Blog

What are the Costs Involved When Renting House in France

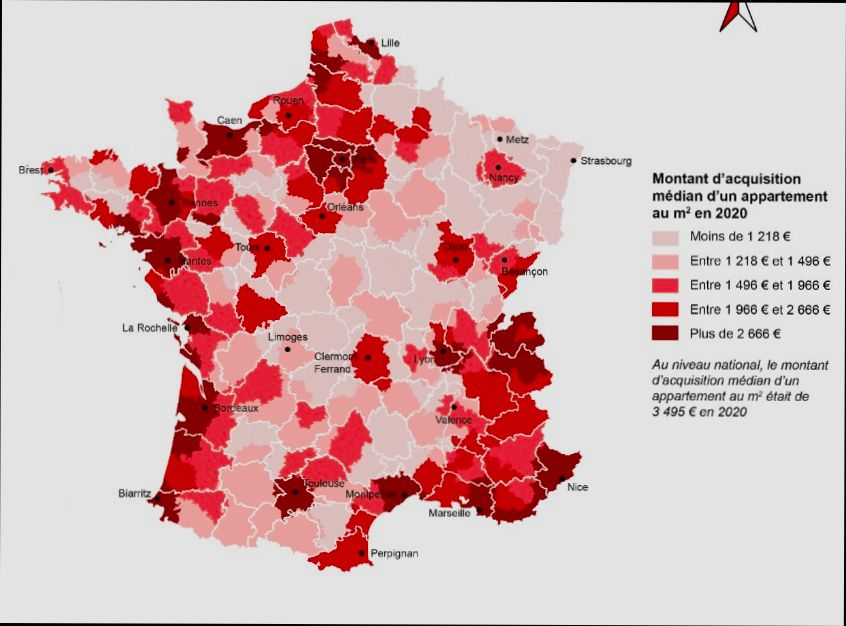

What are the Costs Involved When Renting a House in France? Let’s dive into the nitty-gritty of what to expect. First off, you can’t overlook the rent itself, which can vary wildly depending on where you're looking. For instance, a cozy studio in Paris might run you around €1,000 a month, while a similar space in Lyon could be closer to €600. And don’t forget about the security deposit; it typically equals one month’s rent and can add a hefty chunk to your upfront costs.

What are the Costs Involved When Renting House in Italy

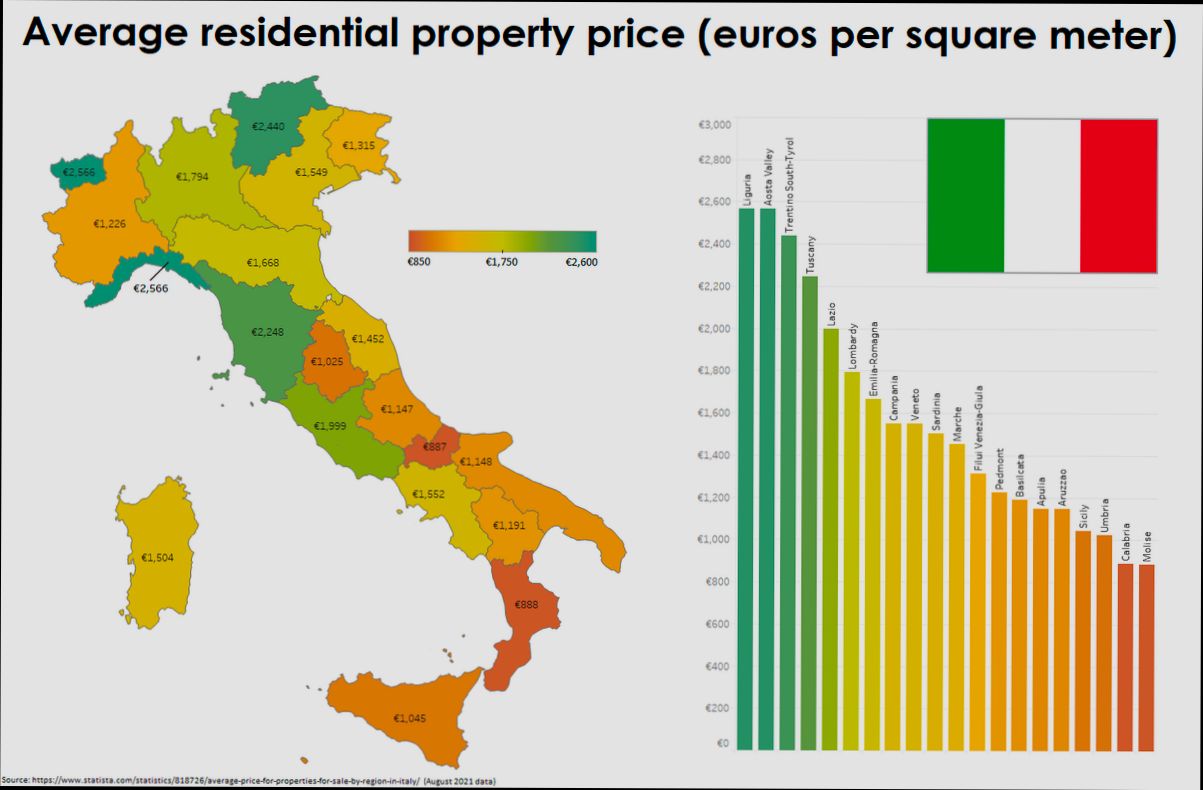

What are the Costs Involved When Renting House in Italy? Well, if you’re daydreaming about sipping espresso on a sunlit balcony, you might want to take a closer look at your budget. Rent prices can vary wildly depending on the city and neighborhood. For instance, while a cozy one-bedroom in Milan might set you back around €1,200 a month, the same space in a smaller town like Lecce could be as low as €400. And don’t forget that local hotspots often come with a heftier price tag—Florence and Rome can be especially pricey, sometimes nearing €1,500 for central locations.

What are the Costs Involved When Renting House in Portugal

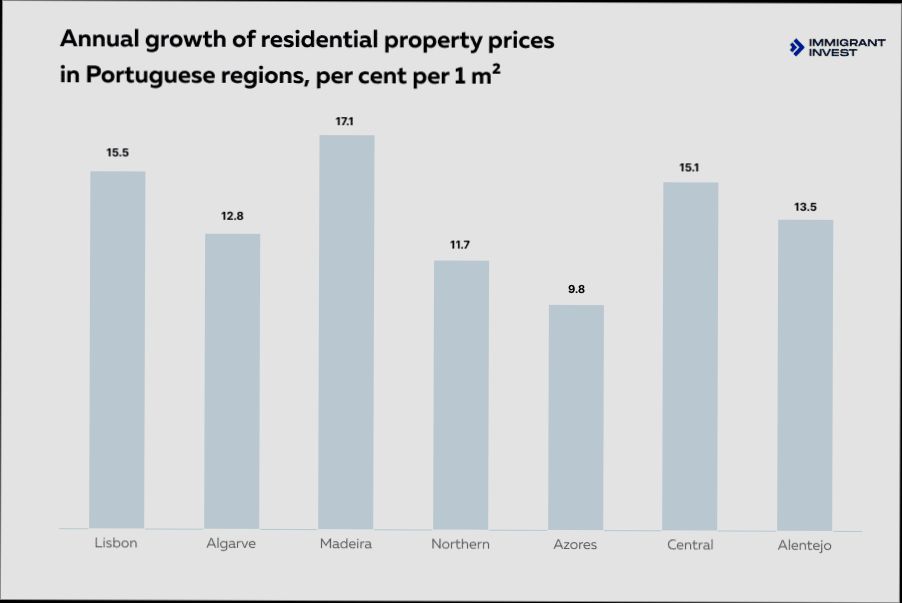

What are the Costs Involved When Renting a House in Portugal? If you're thinking about making a move to this beautiful country, it's essential to know that renting isn't just about the monthly rent itself. For instance, in Lisbon, you might find a cozy one-bedroom apartment in a central area for around €1,200, but that’s just the tip of the iceberg. Beyond the rent, you’ll be looking at additional costs like property taxes, which can add another 5-25% of your monthly expenses depending on the property value and local regulations.

What are the Costs Involved When Renting House in Spain

What are the costs involved when renting a house in Spain? Well, it can be a bit of a rollercoaster ride, especially if you're new to the game. First off, you should brace yourself for the rent itself, which typically averages around €700 to €1,200 per month depending on the region. Places like Madrid and Barcelona will hit that high end, while coastal spots like Valencia or Málaga might offer a bit more bang for your buck. And don’t forget the deposit! Landlords usually expect a month’s rent upfront, plus you might need another month for agency fees if you're renting through a property management company.

What are the Costs Involved When Renting House in United Kingdom

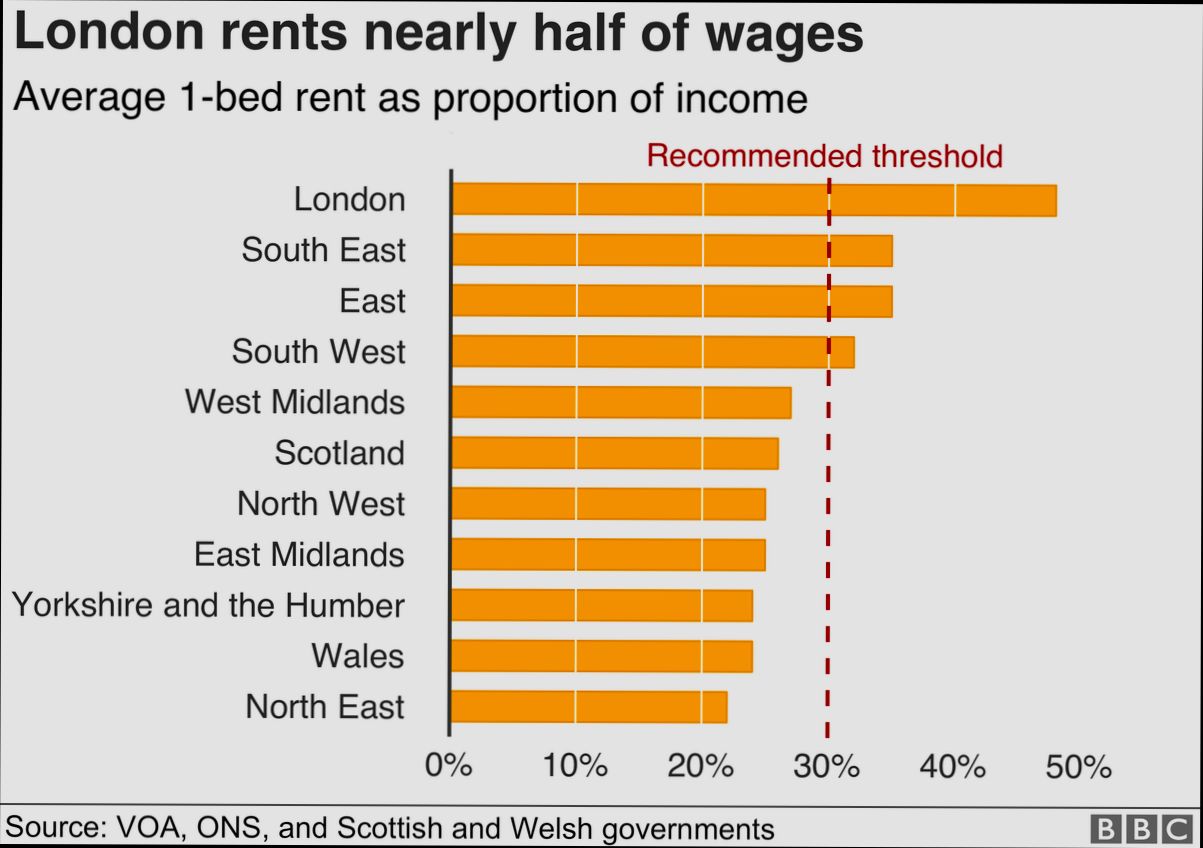

What are the Costs Involved When Renting House in United Kingdom? If you’re eyeing that trendy flat in London or a cozy cottage in the Cotswolds, brace yourself for more than just the monthly rent. On average, you might face a hefty upfront cost equivalent to around five weeks' rent as a deposit, not to mention the first month’s rent hitched right behind it. If you’re looking in London, where the average rent for a one-bedroom apartment can soar to £2,000 per month, that’s a jaw-dropping £4,000 just to get settled in! And don’t forget about fees—yes, they're back in some places. Let’s say you land a property that charges admin fees; those can range anywhere from £150 to £500 or more.

What are the Costs of Moving to Bali

What are the costs of moving to Bali? If you’re dreaming of swapping your 9-to-5 grind for beach sunsets and coconut trees, it’s crucial to crunch some numbers first. On average, the cost of living in Bali can be surprisingly low; you might find one-bedroom apartments in popular areas like Canggu or Ubud for around $400 to $800 a month. But don’t forget about the little things—groceries can run you about $200 to $300 a month if you enjoy fresh local produce, and dining out at local warungs can cost as little as $2 for a meal.

What are the Costs of Moving to France

What are the Costs of Moving to France? Picture this: you’ve packed your bags, ready to swap your 9-to-5 grind for croissants and café au lait in a charming Parisian café. But before you dive into the world of French cinema and stunning countryside, you first need to tackle the reality check of moving expenses. Research shows that relocating to France can set you back anywhere from €5,000 to over €15,000, depending on your location and the size of your household. If you're eyeing a three-bedroom apartment in central Lyon, be prepared for rent prices that can soar to around €1,200 monthly, not to mention utilities that average around €150 a month.

What are the Costs of Moving to Germany

What are the Costs of Moving to Germany? If you’re dreaming of trading your current view for the charming streets of Berlin or the picturesque scenery of Bavaria, you’ll want to crunch some numbers first. For starters, the average cost of renting a one-bedroom apartment in cities like Munich can hit around €1,200 per month, while even in less pricey cities like Leipzig, you might still fork out about €750. Don’t forget about the one-time moving expenses—shipping your belongings from your home country can start anywhere from €1,000 and go up from there, depending on where you’re coming from.

Tags