Blog

Advantages of Buying Off Plan Property

Advantages of Buying Off Plan Property include the chance to snag a sweet deal before a property’s value skyrockets. Let’s face it—timing is everything in real estate. For instance, many buyers have scored properties at lower prices, sometimes 10% to 20% less than those completed nearby. Think about a development in a bustling area like London—by the time the building finishes, prices can climb dramatically. It’s not just about the initial cost; you're also stepping into a market where you can customize finishes and layouts to fit your style, giving you that unique feel right from the start.

Affordable Beachfront Property Spain

Affordable Beachfront Property Spain is a hidden gem waiting to be discovered. Picture this: you can find stunning properties along the sun-kissed Costa del Sol or the laid-back beaches of Costa Brava starting around €150,000. Imagine waking up to the sound of waves crashing just steps away from your door, with local tapas bars and charming shops around the corner. The average price per square meter in these areas often falls below the national average, making your dream of living by the sea much more attainable than you might think.

Affordable Housing Initiatives in Austria

Affordable Housing Initiatives in Austria are paving the way for a more inclusive living environment, especially in bustling cities like Vienna. With around 60% of residents in Vienna living in subsidized housing, the city stands out as a model for others. One notable project is the “Smart Housing” initiative, which focuses on eco-friendly designs and communal spaces, making living more affordable while promoting sustainability. By investing over €2 billion annually into public housing, Austria has seen a significant rise in affordable units, reducing financial pressure on families and young professionals alike.

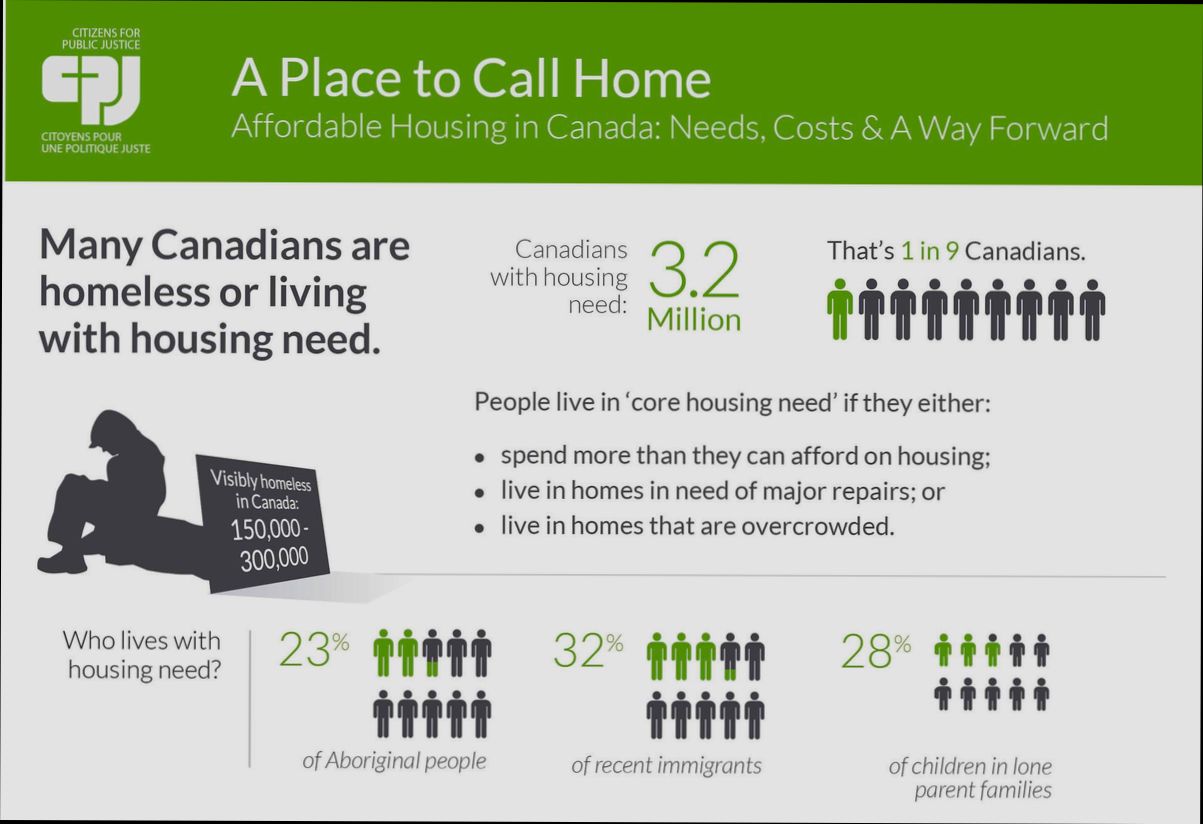

Affordable Housing Initiatives in Canada

Affordable Housing Initiatives in Canada have gained momentum as cities grapple with skyrocketing housing costs. Did you know that in Toronto, the average price for a home hit a staggering $1.1 million in 2023? It’s no wonder many are feeling priced out of their own neighborhoods. Initiatives like the Canada Rapid Housing Initiative aim to create new affordable units faster, with over 3,300 units already built across the country. That’s a significant step, but it still feels like a drop in the bucket against the backdrop of housing shortages and soaring rents.

Affordable Housing Initiatives in France

Affordable Housing Initiatives in France tackle one of the country's most pressing issues: the growing need for accessible living spaces. With cities like Paris facing skyrocketing rents—averaging around €35 per square meter—it’s no wonder that the French government is stepping up. Programs like “Habiter Mieux” and “Louer Abordable” are designed to help low-income families secure stable housing. These initiatives aim to renovate older buildings and provide subsidized rents, bringing relief to those who are struggling. Even in 2022, the French government allocated €1.3 billion specifically for housing projects, showing that they’re serious about making a difference.

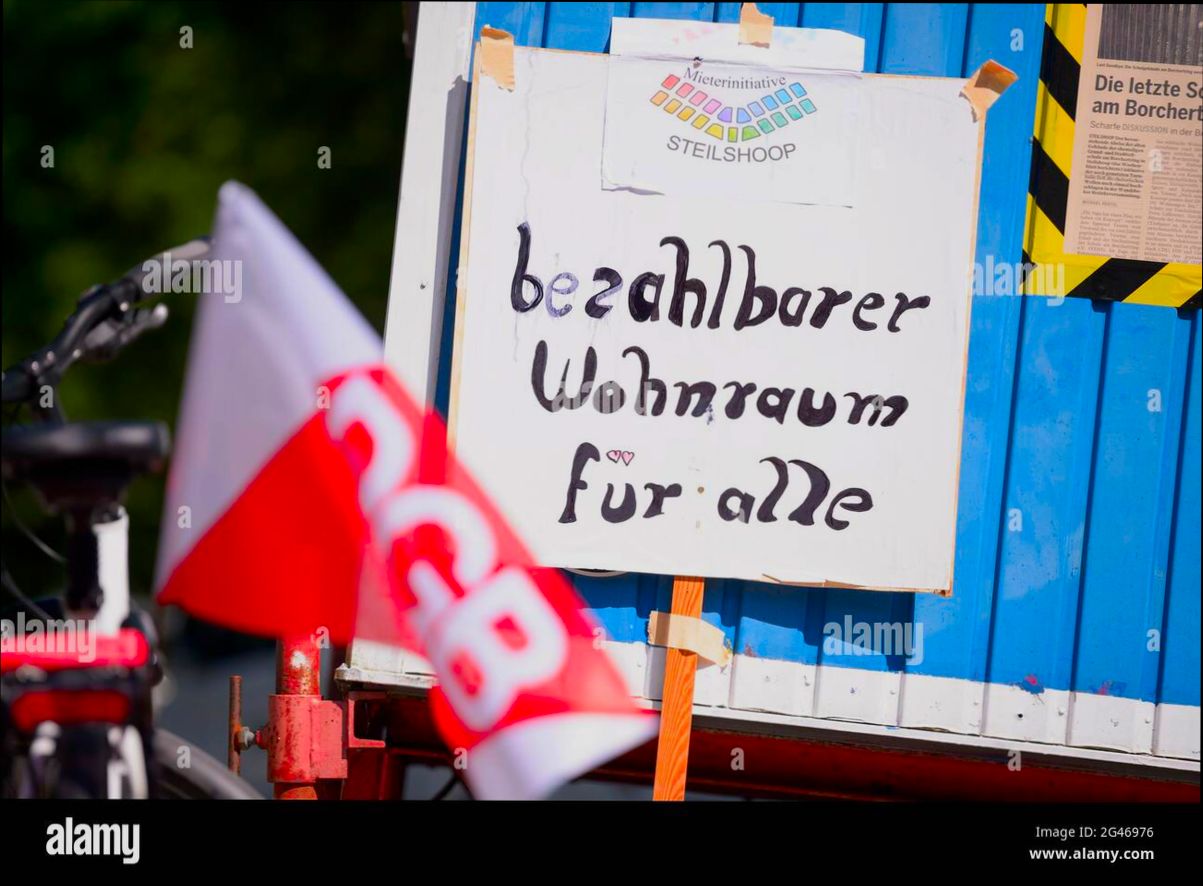

Affordable Housing Initiatives in Germany

Affordable Housing Initiatives in Germany are shaking up the way we think about urban living. With a growing population and increasing rental prices, cities like Berlin have become battlegrounds for affordable living. Did you know that in the past decade, rent in Berlin has skyrocketed by more than 50%? To tackle this crisis, the German government has rolled out ambitious plans, like the €5 billion investment in social housing projects aimed at creating around 100,000 new homes by 2023. That’s a serious commitment to ensuring that everyone can find a spot to call home.

Affordable Housing Initiatives in Spain

Affordable Housing Initiatives in Spain are shaping the way people live, especially in urban areas where skyrocketing prices have made owning a home feel like a distant dream. For instance, in cities like Madrid and Barcelona, housing costs have surged over 40% in the past decade. To combat this, the Spanish government rolled out programs like the “30% Act,” which mandates that a third of new developments must be allocated for affordable housing. Local governments are also taking strides; Barcelona's “Housing Plan” aims to create over 7,000 affordable homes by 2023. It’s exciting to see how these initiatives are trying to make the dream of homeownership a reality, even amid the rising costs.

Affordable Housing Initiatives in Switzerland

Affordable Housing Initiatives in Switzerland are shaping a more inclusive living environment in a country often perceived as prohibitively expensive. With cities like Zurich and Geneva boasting some of the highest living costs globally, the Swiss government and various non-profits have stepped up to tackle this pressing issue. For instance, the Swiss Federal Housing Office (BFH) reported that around 40% of the population resides in rental properties, and initiatives like the construction of cooperative housing projects have made a real difference. These co-ops allow residents to help manage housing together, ensuring lower rent prices while building a sense of community.

Tags