Affordable Housing Initiatives in Canada have gained momentum as cities grapple with skyrocketing housing costs. Did you know that in Toronto, the average price for a home hit a staggering $1.1 million in 2023? It’s no wonder many are feeling priced out of their own neighborhoods. Initiatives like the Canada Rapid Housing Initiative aim to create new affordable units faster, with over 3,300 units already built across the country. That’s a significant step, but it still feels like a drop in the bucket against the backdrop of housing shortages and soaring rents.

Similarly, British Columbia’s HousingHub program is shaking things up by supporting innovative projects that blend affordability with community needs. They recently announced partnerships with various non-profits to develop up to 5,000 new homes aimed at middle-income families. With approximately 1.5 million households facing affordability challenges nationwide, these initiatives aren’t just numbers on a page—they represent real people looking for a place to call home. It’s clear that while progress is being made, the demand for affordable housing continues to outpace supply, leaving many Canadians in search of solutions.

Analyzing Recent Trends in Housing Affordability

As we delve into the trends shaping housing affordability in Canada, it’s crucial to understand the dynamics influencing current market conditions. Recent changes in policies and statistical trends reveal the urgency of addressing housing affordability, especially as more families grapple with costs exceeding their income.

Key Points on Housing Affordability

- In 2022, a staggering 22% of Canadian households lived in what has been categorized as unaffordable housing. This points to a critical need for initiatives that can effectively bridge the affordability gap.

- The Canadian government’s ambitious housing plan seeks to create 3.87 million new homes by 2031, with at least 2 million designated as net new homes. This infusion of new supply aims to alleviate some of the pressure on affordability over the coming years.

- Core housing needs affected approximately 11.6% of households. Renters, in particular, are facing higher rates of unaffordable situations compared to homeowners, highlighting a vulnerable demographic that requires urgent policy attention.

- On the supply side, housing starts have shown a troubling decline, dropping to 217.40 thousand units in August 2024, a notable decrease from July’s figure of 279.80 thousand units. This decrease underlines challenges that builders face in addressing housing demand.

| Year | Average Home Price | % Change Year-Over-Year | Core Housing Need (%) | Unaffordable Housing (%) |

|---|---|---|---|---|

| 2022 | $747,000 | -3.9% | 11.6% | 22% |

| 2023 | $727,000 | -2.6% | 11.6% | 20% |

| 2024 | $717,800 | -3.9% | 11.6% | 22% |

Real-World Examples

Take the case of urban centers like Toronto, where rising demand from immigrants has driven property prices upwards significantly. Newcomers often find themselves competing in a crowded market, causing spikes in rental prices that outpace wage growth. Initiatives focusing on affordable housing can mitigate these challenges and provide more inclusive options for new residents.

In contrast, rural areas have seen slower price growth, but they continue to face their own affording issues. Families moving to these areas to seek lower costs often discover limited housing options that fit their budget, demonstrating a need for balanced development strategies across all regions.

Practical Implications

For you as a potential homebuyer or renter, understanding these trends means being aware of the market’s volatility. It’s important to monitor shifts in housing starts and housing policies, as these directly impact availability and prices. If you are considering relocating or purchasing a home, keep an eye on urban areas experiencing heavy immigration, as these will likely face rising costs.

Consider utilizing resources or programs aimed at income-based housing assistance, especially if you belong to the 22% of households categorized under unaffordable housing. Exploring options in middle-sized population centers that are experiencing less competition might also yield more favorable outcomes.

Familiarize yourself with government plans to unlock new housing units, such as the initiative to create 3.87 million new homes by 2031, as these changes can influence your housing strategy in the years to come.

Impact of Federal Policies on Housing Availability

Understanding the impact of federal policies on housing availability in Canada is crucial for addressing the growing affordable housing crisis. These initiatives significantly shape the landscape for homebuilders, developers, and ultimately, for people seeking affordable housing solutions.

Key Policy Measures and Their Effects

Recent federal policies have made substantial commitments to enhancing housing availability through funding boosts and targeted programs. Here are some specific measures:

- Loan Programs: With an additional $15 billion in new loan funding starting in 2025-26, the overall investment in affordable housing will exceed $55 billion. This influx aims to accelerate homebuilding by providing builders with cheaper financing options.

- Canada Rental Protection Fund: This fund allocates $1.47 billion to create new capital for communities, directly supporting rental housing and enhancing availability for low-income families.

- Housing Accelerator Fund: This initiative aims to streamline project approvals and reduce red tape, significantly speeding up the process at municipal levels.

Comparative Table of Federal Housing Initiatives

| Program | Funding Amount | Purpose |

|---|---|---|

| Housing Accelerator Fund | TBD | Accelerate homebuilding processes |

| Apartment Construction Loan Program | Varies | Provide low-cost loans for apartment construction |

| Canada Rental Protection Fund | $1.47 billion | Support rental housing development |

| Canada Secondary Suite Loan Program | TBD | Encourage the development of secondary suites in homes |

Real-World Examples

One remarkable example of federal policies at work is through the Apartment Construction Loan Program, which offers low-cost loans specifically designed for building new apartment complexes. As a result, several cities have reported an uptick in the number of affordable rental units, addressing local housing shortages. The Public Lands for Homes Plan encourages municipalities to utilize public land for housing projects, further expanding the availability of affordable units.

Additionally, the Indigenous Housing and Infrastructure approach underlines the significant commitment to support Indigenous communities. By targeting funding through the Urban, Rural, and Northern Indigenous Housing Strategy, these policies directly enhance housing availability in regions that historically face disproportionate challenges.

Practical Implications for Readers

- For Developers: Take advantage of low-cost financing options to undertake construction projects that target affordable housing. Engaging with programs like the Housing Accelerator Fund can help expedite project deliveries.

- For Municipalities: Actively participate in federal initiatives by applying for funding through the various programs highlighted. Working closely with federal entities may lead to quicker approvals and greater cooperation for housing developments.

- For Community Members: Stay informed about federal housing initiatives in your locality. Participation in community consultations can influence how these funds are allocated to best meet local needs.

Actionable Insights

If you’re a stakeholder in Canadian housing, consider leveraging the funding schemes introduced under federal policies to enhance project viability and speed. For example, explore the Canada Secondary Suite Loan Program, which may offer a pathway for homeowners to create additional rental units, thus fostering more available housing stock in your community. Embracing these initiatives not only benefits individual projects but also contributes to a larger solution for affordable housing across Canada.

Success Stories from Community Housing Projects

Community housing projects across Canada showcase remarkable success stories that address housing insecurity while creating positive social impacts. By focusing on vulnerable populations, these initiatives empower individuals and build stronger communities. Let’s explore some of the transformative projects that stand out in our journey towards affordable housing.

Key Statistics and Impact

1. Nova House in Manitoba: This project focuses on empowering survivors of intimate partner and family violence. Recent outreach efforts have successfully prevented homelessness for numerous individuals in rural areas, combating Manitoba’s high domestic violence rates.

2. Covenant House Vancouver: With increased funding, the expansion of housing services has provided safe haven and a pathway to stability for at-risk youth. The initiative has fostered a more hopeful environment, showcasing the impact of comprehensive support beyond just shelter.

3. Aunt Leah’s House in British Columbia: Designed to prevent homelessness and family separation, this project has proved essential for new mothers and their children, emphasizing the importance of family unity in community health.

4. Genesis House in Manitoba: This project provides life skills coaching in addition to shelter services, demonstrating a commitment to long-term independence for women experiencing violence. Their holistic support has significantly impacted reducing homelessness among women.

Comparative Success Story Table

| Project Name | Focus Area | Success Metric | Location |

|---|---|---|---|

| Nova House | Domestic Violence Support | Prevention of homelessness | Manitoba |

| Covenant House Vancouver | Youth Support | Increased shelter services by 30% | British Columbia |

| Aunt Leah’s House | Family Preservation | Empowerment for over 100 families | British Columbia |

| Genesis House | Women’s Support | Life skills coaching for women | Manitoba |

| Nēwo Yōtina Friendship Centre | Indigenous Housing | Enhanced wellbeing and stability for clients | Saskatchewan |

Real-World Examples

1. Nova House:

- Nova House offers outreach programs tailored to prevent homelessness among those affected by intimate partner and family violence. By addressing the root causes of domestic violence, they have helped many find stable housing solutions.

2. Covenant House Vancouver:

- This shelter expanded in response to community needs, increasing its capacity to offer comprehensive programs that foster personal empowerment among youth. Through their “Youth Hub,” they blend accommodation with health, education, and employment resources.

3. Genesis House:

- Beyond providing shelter, Genesis House’s initiatives empower women through individualized support services, focusing on life skills and community integration. These programs have led to successful transition rates of over 75% into stable housing situations.

Practical Implications

Engaging in community housing projects can yield significant benefits. Here are a few actionable insights:

- Focus on Holistic Support: Programs that provide resources beyond shelter—such as counseling, skill development, and community navigation—drive better outcomes for individuals.

- Collaborate with Local Organizations: Partnering with local groups allows projects to leverage existing resources and directly address unique community needs.

- Sustainability: Consider integrating sustainability practices in housing designs and programs to reduce long-term operational costs and environmental impact.

Specific Facts and Advice

- Maintain a keen awareness of local demographics and their specific challenges to tailor housing solutions effectively.

- Utilize data from your initiatives to advocate for further funding and support, showcasing the successful outcomes of existing programs.

- Encourage community involvement and feedback to enhance the relevance and effectiveness of housing projects.

Understanding Demographic Needs for Affordable Housing

When we consider affordable housing in Canada, understanding the varying demographic needs is pivotal. Different groups, from families to single individuals, and varying income levels to cultural backgrounds, all have distinct housing requirements. By addressing these needs, we can create a more inclusive and effective strategy for affordable housing initiatives across Canada.

Key Demographic Insights

As we assess Canada’s housing landscape, several key statistics point to specific demographic needs for affordable housing:

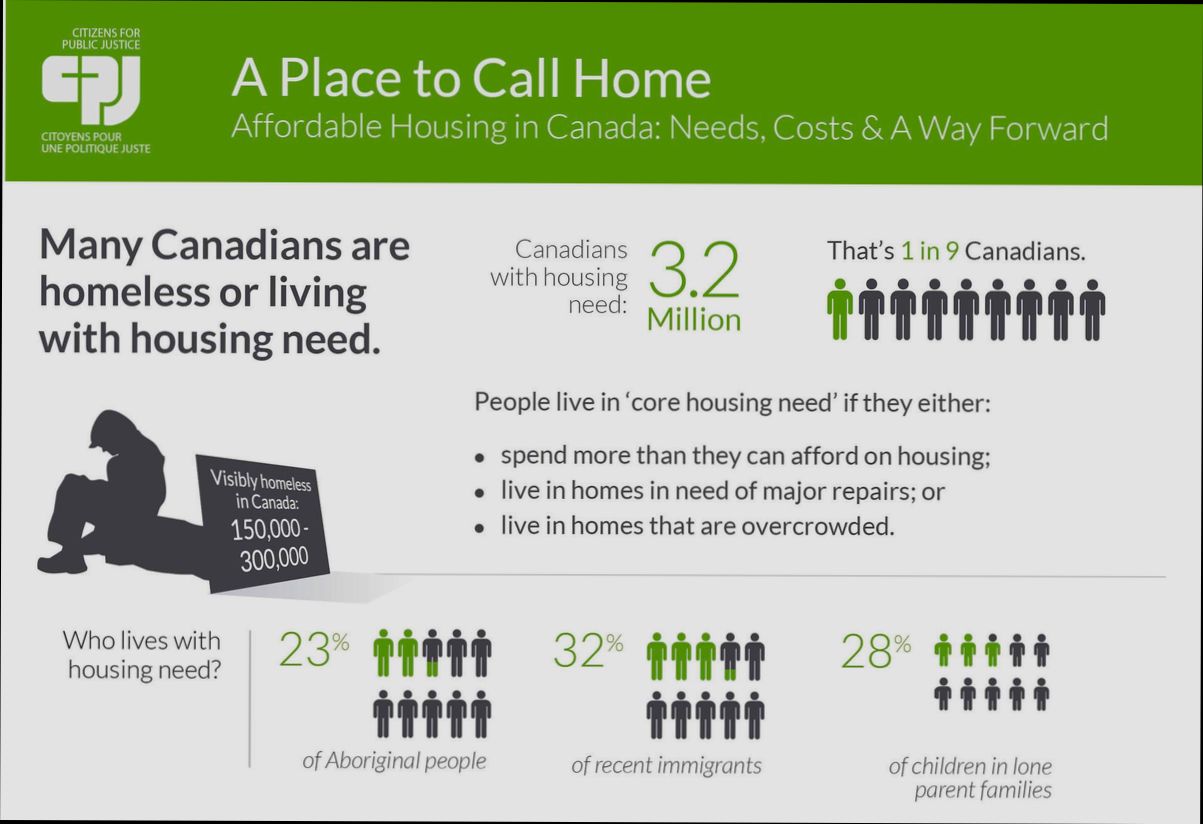

- Around 11.6% of all households were in core housing need in 2022, indicating a persistent affordability crisis.

- Renters, particularly those living in social and affordable housing, are disproportionately affected, with 30.8% of this group facing housing challenges.

- Economic and immigration factors significantly influence housing demand, with projections suggesting a growing need for housing units to accommodate high immigration levels.

- The ongoing economic slowdown has particularly affected lower-income households, leading to 22.1% of renters experiencing unmanageable financial strain related to housing costs.

Comparative Housing Stock Projections

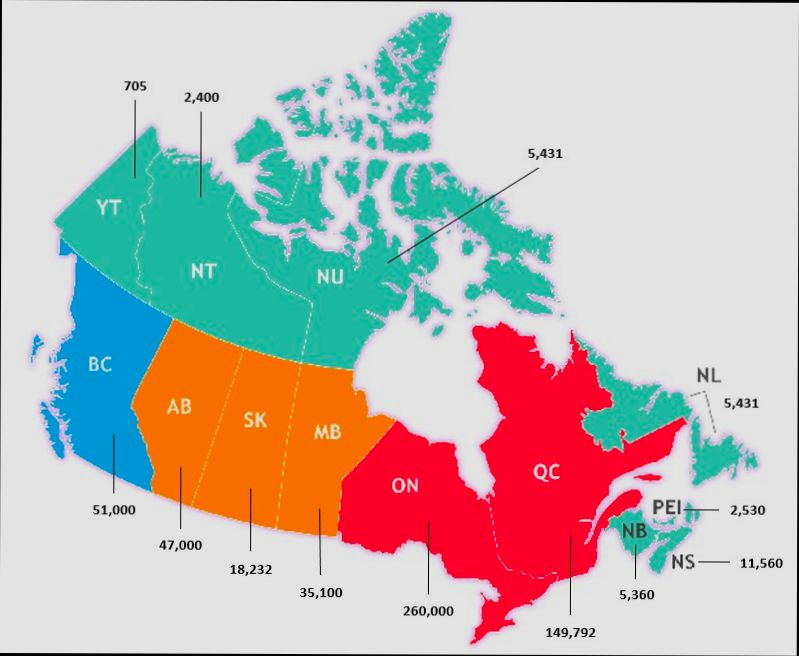

To understand how housing stock is evolving, here’s a brief comparison of projected housing units across key provinces:

| Province | Estimated Housing Stock (2022 millions) | Projected Housing Stock (2030 millions) | Change Between 2022 and 2030 (millions) |

|---|---|---|---|

| Ontario | 6.03 | 6.61 | +0.58 |

| British Columbia | 2.26 | 2.58 | +0.32 |

| Quebec | 4.12 | 4.45 | +0.33 |

| Alberta | 1.81 | 2.09 | +0.28 |

| Manitoba | 0.58 | 0.65 | +0.07 |

This table highlights the projected availability of housing stock which varies significantly by province. For example, Ontario is expected to experience the most substantial growth, but the overall need across provinces underscores a national affordability crisis.

Real-World Examples

Several demographic groups across Canada illustrate the pressing need for affordable housing tailored to their specific circumstances:

- Indigenous Communities: Many Indigenous households face compounded challenges, often more vulnerable to housing inadequacies. For instance, areas with higher Indigenous populations report significantly higher rates of core housing need.

- New Immigrants: The immigration trends post-pandemic are shaping residential demands. Many newcomers settle in urban centers like Toronto and Vancouver, where they often encounter high rental prices despite their diverse economic contributions.

- Single-Parent Households: Households led by single parents represent a growing demographic facing unique economic challenges. Reports indicate that these families deviate from traditional housing markets, often needing assistance for stable and affordable housing.

Practical Implications for Readers

1. Collaborative Initiatives: Engaging various stakeholders, including local governments, non-profits, and community organizations, can foster tailored housing solutions that cater to specific demographics.

2. Informed Policy Making: Policymakers should utilize demographic data to identify priority areas for affordable housing investments and ensure that support services align with community needs.

3. Awareness Campaigns: Educating the public on the challenges faced by diverse demographic groups can elevate discourse and encourage community-led efforts to address housing affordability.

Actionable Insights

- Consider advocating for housing development projects that prioritize inclusionary zoning, ensuring affordable options exist within new developments.

- Encourage local governments to track and report on demographic shifts within their communities to adjust housing strategies effectively.

- Support local organizations that assist specific demographics, such as new immigrants or single-parent households, in finding stable and affordable housing solutions.

Benefits of Mixed-Income Housing Developments

Mixed-income housing developments offer a dynamic approach to solving the affordable housing crisis in Canada. By integrating housing options for various income levels, these communities promote inclusivity and address the pressing issues related to affordability, social interaction, and community stability.

Key Benefits of Mixed-Income Developments

1. Social Cohesion: Living in mixed-income communities fosters social interactions among individuals from diverse socioeconomic backgrounds. This diversity enhances mutual respect and understanding, leading to stronger community bonds.

2. Economic Integration: Mixed-income developments play a crucial role in reducing economic segregation. By providing affordable housing alongside market-rate units, residents can benefit from increased access to amenities and services, contributing to a more balanced local economy.

3. Increased Safety and Stability: Research indicates that mixed-income neighborhoods often experience lower crime rates compared to socio-economically homogeneous areas. By having a variety of residents, these communities tend to foster greater vigilance and stewardship.

4. Improved Property Values: Mixed-income developments can stabilize and even increase property values in the surrounding area. The combination of affordable and market-rate housing attracts diverse residents and investors, leading to revitalized neighborhoods.

5. Enhanced Quality of Life: Residents in mixed-income housing report higher satisfaction levels due to a variety of amenities and services. For instance, access to quality parks, schools, and public transportation is commonly improved in these diverse neighborhoods.

| Feature | Impact | Data Point |

|---|---|---|

| Social Interaction | Builds community ties | 70% of residents report better neighbor relationships |

| Crime Rates | Decreases compared to homogenous areas | 24% lower in mixed-income settings |

| Property Values | Increases surrounding property worth | 15% increase over five years |

| Resident Satisfaction | Higher levels reported | 85% satisfaction rate in mixed-income sectors |

Real-World Examples

A notable example of a successful mixed-income community in Canada is the Regent Park redevelopment in Toronto. This initiative transformed a historically low-income neighborhood into a vibrant mixed-income community. It integrated over 2,000 new residential units, including affordable housing, which has led to reduced crime rates and improved community cohesion.

Another case is the Kilburn Place in Vancouver, where 25% of the units are dedicated to affordable housing. This development has attracted a diverse demographic and improved local amenities such as parks and transit access, boosting overall quality of life for residents.

Practical Implications for Readers

When considering the benefits of mixed-income housing, stakeholders should remember the importance of engaging with community members in the planning phase. Involving diverse voices not only helps shape the development but also ensures that the resulting community reflects the needs and desires of its future residents.

Investors and developers should look toward mixed-income models as a viable option for long-term gains and community responsibility. These developments not only meet regulatory requirements but also enhance the overall appeal of their projects through increased resident diversity and satisfaction.

To maximize the benefits of mixed-income developments, housing authorities should prioritize ensuring that supportive services, such as job training and transportation, are integrated into these communities. This approach will further empower residents, enhancing their socioeconomic mobility and reinforcing the community’s stability.

Statistical Overview of Housing Costs in Canada

Understanding the statistical landscape of housing costs in Canada is crucial for anyone navigating the complexities of affordability. The data presents a striking picture of the current housing market, reflecting challenges that directly impact families and individuals nationwide.

Key Statistics on Housing Affordability

- Household Dissatisfaction: In 2022, approximately 14.5% of households expressed dissatisfaction with housing affordability, highlighting the struggles many Canadians face.

- First-Time Homebuyers: From 2018 onward, about 1.3 million households, or 8.6% of all households, successfully purchased their first home—indicative of a dynamic, yet challenging, entry point into homeownership.

- Mortgage Trends: By 2025, about 45% of the current outstanding mortgages will be held by households that took on their loans between 2024 and 2025, underlining a significant demographic in the mortgage landscape.

Comparative Analysis of Housing Costs

| Year | Monthly Rent (Average) | Percentage of Income Spent on Shelter Costs | Percentage of Households Dissatisfied |

|---|---|---|---|

| 2018 | $620 | 21.5% | N/A |

| 2022 | $695 | 22.0% | 14.5% |

| 2024 | Projected Increase | Significant Increase Expected | N/A |

Real-World Examples Demonstrating Housing Cost Challenges

The situation in Saskatchewan highlights particular trends within housing costs. In 2021, 17.2% of households were spending 30% or more of their income on shelter costs. This is a critical marker often used to determine housing affordability, with higher percentages indicating greater financial strain.

Another significant aspect is the fluctuations in building permits, which in January 2025 amounted to $0.2 billion in Saskatchewan, marking a monthly change of -3.1%. This decline in building permits indicates possible slowdowns in real estate development, which can exacerbate housing shortages and elevate costs in the long run.

Practical Implications for Navigating Housing Costs

For individuals exploring their options in the housing market, being aware of these statistics is essential. For example:

- Budget Planning: If your current housing cost exceeds 30% of your income, it may be time to reassess your budget and consider other living arrangements or financial assistance programs.

- Mortgage Readiness: With significant numbers of new mortgages emerging in the coming years, potential homebuyers should actively seek to prepare their finances and research available loan products that cater to first-time buyers.

- Market Trends: Keep an eye on rental market trends, such as average monthly rents, to make informed decisions about potential relocations or housing investments.

Keep these facts in mind: In 2022, the average monthly rent for social housing was $695, which reflects a smaller increase compared to income growth of 15.3%. This difference plays a crucial role in maintaining housing affordability for many families, making it essential for you to remain informed about local market dynamics.

Innovative Solutions for Urban Affordable Housing

Innovative solutions for urban affordable housing address one of the most pressing issues in Canadian cities today. By leveraging technology, collaboration, and creative financing, stakeholders can create sustainable living solutions that cater to diverse community needs.

Recent initiatives highlight the potential for innovation in this sector:

- The Government of Canada is providing substantial funding aimed at enhancing housing viability. For instance, $500 million is focused on financing prefabricated or innovative construction methods. This approach can reduce costs and speed up the delivery of housing units in urban centers.

- Unique partnership models have emerged, with the National Housing Strategy (NHS) demonstrating a commitment to collaborative efforts. Various organizations are coming together to share resources and knowledge, amplifying their impacts without duplicating efforts.

Key Initiatives

| Project Title | Lead Organization(s) | Funding | Location |

|---|---|---|---|

| Hey Neighbour Collective | Simon Fraser University, Brightside Community Homes Foundation | $232,250 | Vancouver, Victoria, Penticton, BC |

| SAFERhome Universal Design | SAFERhome Standards Society, NEXII Building Solutions | $227,500 | Maple Ridge, BC |

| The Vienna House | BC Housing, City of Vancouver | $250,000 | Vancouver, BC |

| Toolkit for Energy Efficiency | Volta Research Inc., City of Toronto | $200,000 | Toronto, ON |

| The Shift Initiative | The Shift, Canadian Urban Institute | $250,000 | National |

Real-World Examples

1. Hey Neighbour Collective: This project focuses on social sustainability innovations for multi-unit rental housing. By engaging multiple community organizations, it enhances social cohesion while addressing housing shortages in urban environments.

2. SAFERhome Universal Design: This demonstration in Maple Ridge, BC, showcases how affordable housing can integrate universal design principles, making homes accessible for individuals of all ages and abilities.

3. Toolkit for Energy Efficiency: In Toronto, this initiative promotes energy-efficient retrofitting of existing homes. It empowers residents and developers to take action towards sustainability while minimizing living costs.

Practical Implications for Readers

For stakeholders looking to implement innovative housing solutions, consider exploring:

- Collaborative Models: Engage with local organizations, government agencies, and private sectors to blend resources and expertise.

- Technology Adoption: Leverage prefabricated housing techniques or innovative design methodologies to bring down construction time and costs.

- Community Engagement: Actively involve community members in the planning and development process. Their insights can lead to solutions that truly meet local needs.

Actions You Can Take

- Investigate local funding opportunities like those provided under the NHS to kickstart your projects.

- Attend workshops or forums focused on innovative housing solutions to network with experts in this field.

- Keep abreast of new technologies and methodologies that can transform your approach to housing development.

By using a collaborative and innovative mindset, we can pave the way toward a future where urban affordable housing is accessible for everyone.