Blog

All You Need to Know About Buying New Build Property

All You Need to Know About Buying New Build Property is a game changer for anyone diving into the vibrant world of real estate. With new builds making up around 30% of all residential property sales in the UK last year, there’s a good chance you’ve considered one as your next home. Picture this: you find that sleek, modern house plastered with clever energy-efficient features, all wrapped up in a shiny warranty. Sounds appealing, right? According to the Home Builders Federation, 91% of new home buyers would recommend their builder, which speaks volumes about the overall satisfaction in this segment.

All You Need to Know About Buying Off Plan Property

All You Need to Know About Buying Off Plan Property revolves around some exciting opportunities and potential pitfalls. Imagine snagging a modern apartment in a bustling downtown area before the construction even starts—sounds dreamy, right? According to the National Association of Realtors, about 32% of new home buyers opt for off-plan properties, which means you’re definitely not alone in this journey. Plus, you could kick things off with a lower entry price; many developers offer sweet deals to entice early investors, sometimes up to 10% below market value.

All You Need to Know About Buying Property in Spain After Brexit

All You Need to Know About Buying Property in Spain After Brexit dives into a world of possibilities that many Brits are eager to explore. Imagine sipping your morning coffee on a sun-soaked terrace, the warm Mediterranean breeze gently nudging your worries away. Since Brexit, the landscape for acquiring property in Spain has shifted significantly, with around 1.3 million British nationals now considering investing in their dream homes. Recent data from Spain's Ministry of Transport, Mobility and Urban Agenda shows that foreign property purchases in Spain rose by 7% in 2022, with British buyers still making up a significant chunk of that market.

Article 28 of the Mortgage Law Cancelled in Spain

Article 28 of the Mortgage Law Cancelled in Spain stirred quite the buzz when it was wiped off the books. This law, which governed mortgage foreclosure processes, had a significant impact on homeowners across the nation. For example, around 2,000 families faced eviction each month in 2020 alone, highlighting the urgency for reform. Homeowners often found themselves helpless, struggling with staggering debts and aggressive lenders. It was a rollercoaster of emotions for many people who thought they could negotiate a fair outcome but suddenly discovered they were trapped in a legally binding framework that felt more like a prison than a safety net.

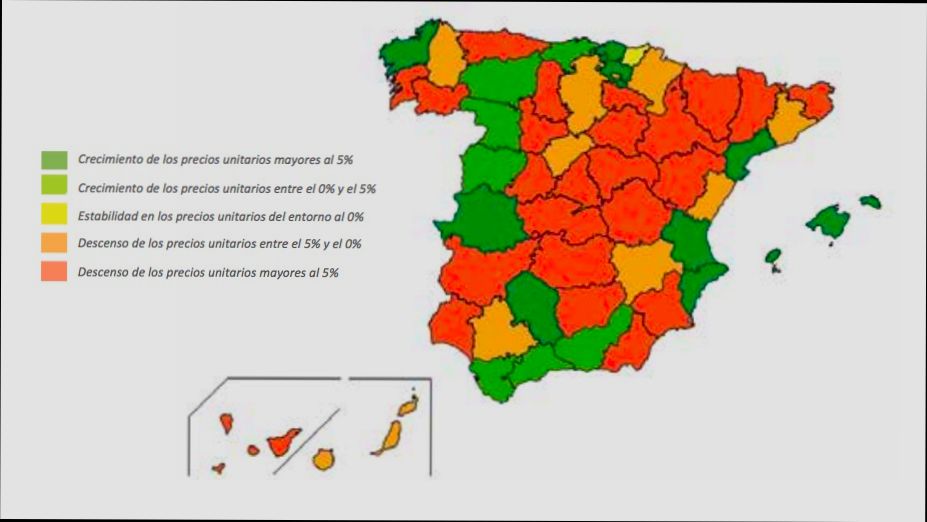

Average Price Houses Spain by Region

Average Price Houses Spain by Region reveals some fascinating trends in the housing market. For instance, in Barcelona, the average cost of a home has soared to around €4,200 per square meter, making it one of the priciest spots in the country. Conversely, if we look towards the southern coast, properties in Andalusia can average a much more budget-friendly €1,600 per square meter. You can practically hear the waves of the Costa del Sol calling, right?

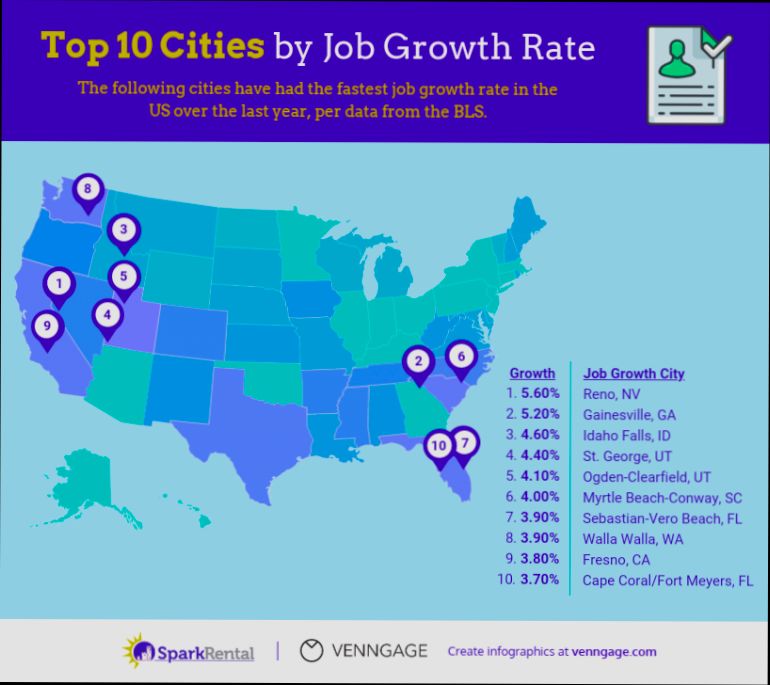

Best Cities for Real Estate Investment in Australia

Best Cities for Real Estate Investment in Australia are exciting spots where opportunities are thriving, and the numbers back it up. Take Brisbane, for instance—its population is set to hit over 3 million by 2025, which is driving up demand for housing. According to CoreLogic, property values in Brisbane have jumped around 25% in just the past year. Then there's Melbourne, known not just for its coffee but also its robust rental market, boasting a rental yield of about 3.5%. With a 15% increase in median rents recently, it’s clear that people are flocking to this vibrant city.

Best Cities for Real Estate Investment in Austria

Best Cities for Real Estate Investment in Austria offer a mix of charm and opportunity that you won’t want to miss. Vienna leads the pack, boasting an impressive annual price growth of around 5% in the residential market. The city's rich culture, stunning architecture, and excellent public transport make it a magnet for both locals and expats. Plus, with an average rental yield of 4.2%, you can see why savvy investors are flocking there. But don’t overlook cities like Graz and Linz. Graz, known for its vibrant student population, has seen rental prices rise significantly, with some properties yielding up to 6%. Meanwhile, Linz is sneaking up with its booming tech scene and rising demand for housing, making it an exciting prospect for future gains.

Best Cities for Real Estate Investment in Belgium

Best Cities for Real Estate Investment in Belgium offer a treasure trove of opportunities for savvy investors ready to dive into the European market. Cities like Brussels and Antwerp are popping with potential, boasting impressive rental yields around 6% and 7% respectively. Picture this: Brussels, the capital city, not only serves as the political heart of Europe but is also experiencing a surge in international tenants seeking vibrant urban living. Meanwhile, Antwerp, known for its fashion and diamond districts, attracts young professionals and families aiming for a blend of culture and convenience.

Tags