Blog

Hotel License Revoked at Malaga Haunted House

Hotel License Revoked at Malaga Haunted House – talk about a jaw-dropper! This quirky spot, famous for its spooky gimmicks and spine-tingling tours, just lost its hotel license due to a series of safety violations. Local authorities discovered multiple fire code violations, including blocked emergency exits and outdated smoke detectors, during a routine inspection. Seriously, who thought it was a good idea to let guests stay over in a haunted house without proper safety measures? With an average of 500 visitors a month, this place was raking in the cash but neglecting basic safety standards.

How to buy house in Spain for 1 euro

How to buy a house in Spain for 1 euro is one of those eye-catching headlines that makes you stop scrolling and wonder if you’ve stumbled upon the deal of a lifetime. Yes, you read that right—some towns across Spain are actually selling homes for just a single euro! These incredible offers often pop up in rural areas struggling with depopulation. The local governments are eager to attract new residents, which means you can potentially snag a charming fixer-upper in a picturesque village for the price of a coffee.

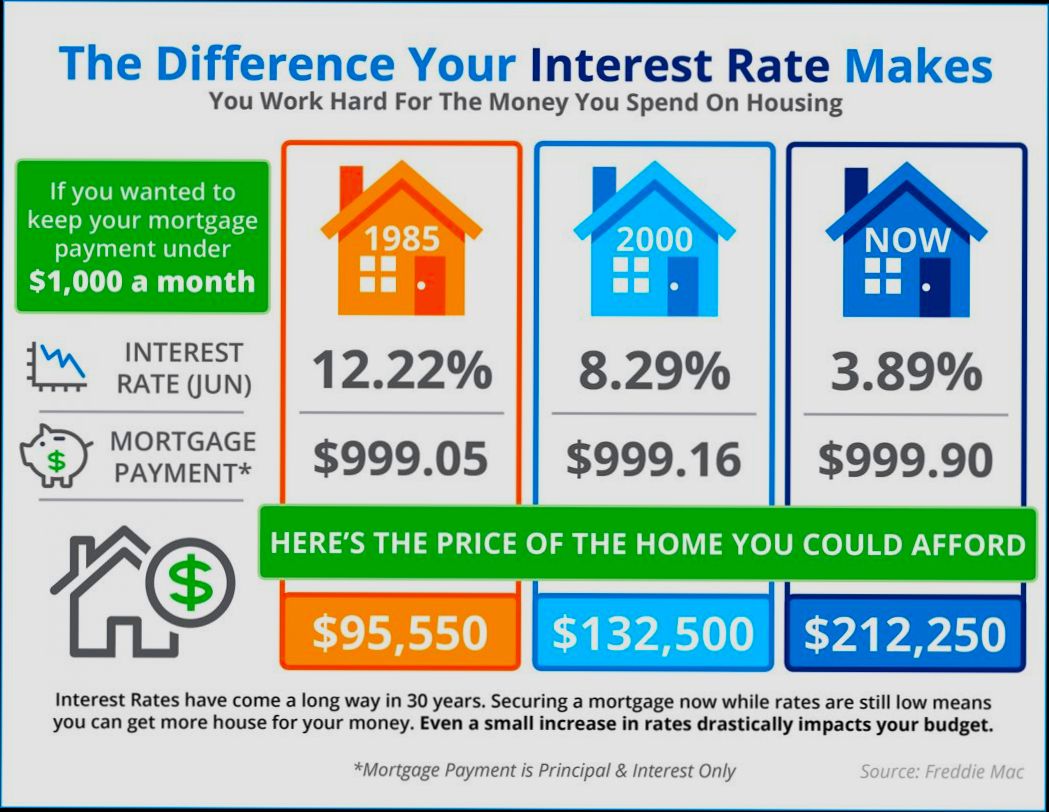

How an Interest Rate Rise Could Impact Your Mortgage Repayments

How an Interest Rate Rise Could Impact Your Mortgage Repayments is something every homeowner should pay attention to, especially in today’s volatile economic climate. Picture this: if the Federal Reserve bumps up interest rates by just 0.25%, the effect could ripple through your monthly payments. For someone with a $300,000 mortgage at a 3% fixed rate, that small increase could push the monthly payment from about $1,265 to around $1,350. Over the life of a 30-year loan, you’re suddenly looking at paying nearly $27,000 more in interest! Yikes, right?

How Can I Get a Mortgage Approval

How Can I Get a Mortgage Approval? That's the million-dollar question for countless first-time homebuyers out there. You might have heard that over 40% of mortgage applications get denied, which is a reality check for many. Imagine finding your dream home only to be turned away by the bank because of a low credit score or insufficient income. In 2022, the average credit score for approved loans was around 751, so if yours isn’t in that ballpark, it’s time to pay attention.

How Can You Encourage People to Buy Your Home

How Can You Encourage People to Buy Your Home? Imagine your listing sitting pretty among countless others, yet it still feels like yours is the only one grabbing attention. With the right strategies, you can create that buzz. Did you know that homes staged effectively sell for an average of 17% more than their unstaged counterparts? That’s real money talking! Consider that homes with high-quality photos receive 70% more views online than those with dark, blurry images. You want potential buyers scrolling through their feeds to stop in their tracks and envision their life in your space.

How Do I Get My Home Ready to Sell

How do I get my home ready to sell? If you’re like most homeowners, you want to maximize your profit while minimizing the time your place sits on the market. Did you know that homes that have been staged can sell for up to 20% more than similar ones that haven't? It's not just about the vibe, either; statistics show that listings with high-quality photos generate 118% more online views. That’s why your first step is to create a captivating environment where potential buyers can envision their future.

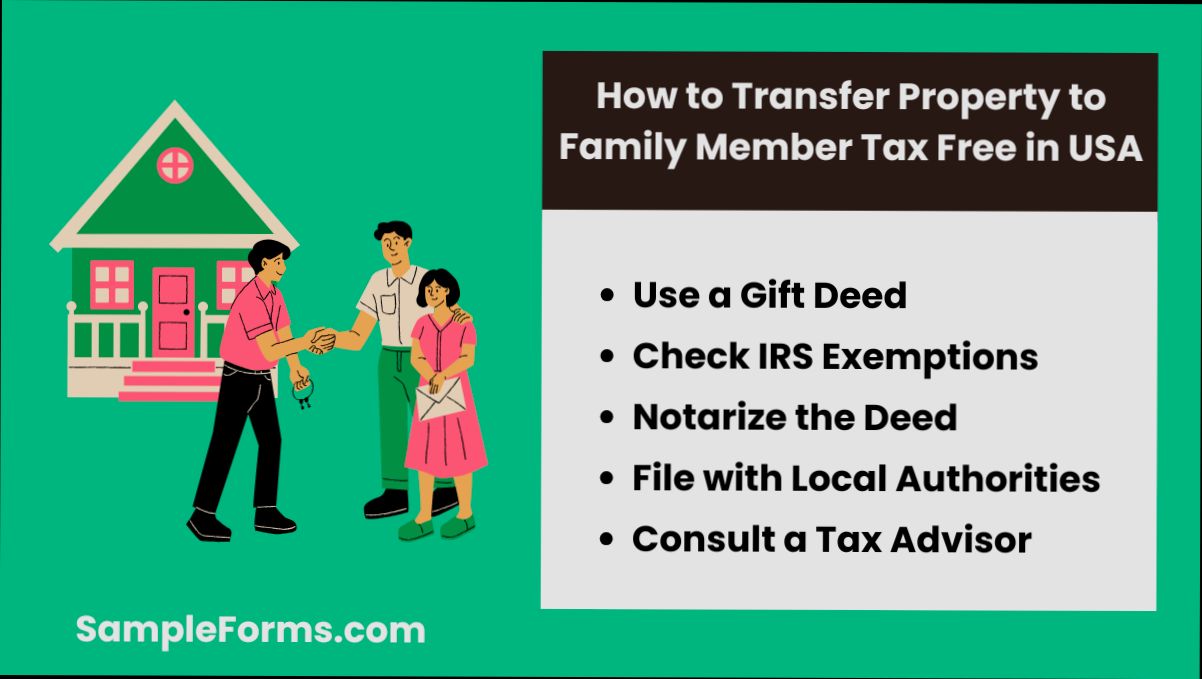

How Do I Transfer Property to a Family Member Tax Free

How Do I Transfer Property to a Family Member Tax Free? If you're looking to pass on your family home or a rental property without the IRS taking a big bite, you're in the right place. Let’s say you own a cozy bungalow worth $300,000 and want to gift it to your child. Depending on how you go about it, you could potentially avoid capital gains tax, which can eat up around 15% to 20% of your profits if you were to sell it outright. That’s a hefty chunk of change you’d rather see in your family’s pocket, right?

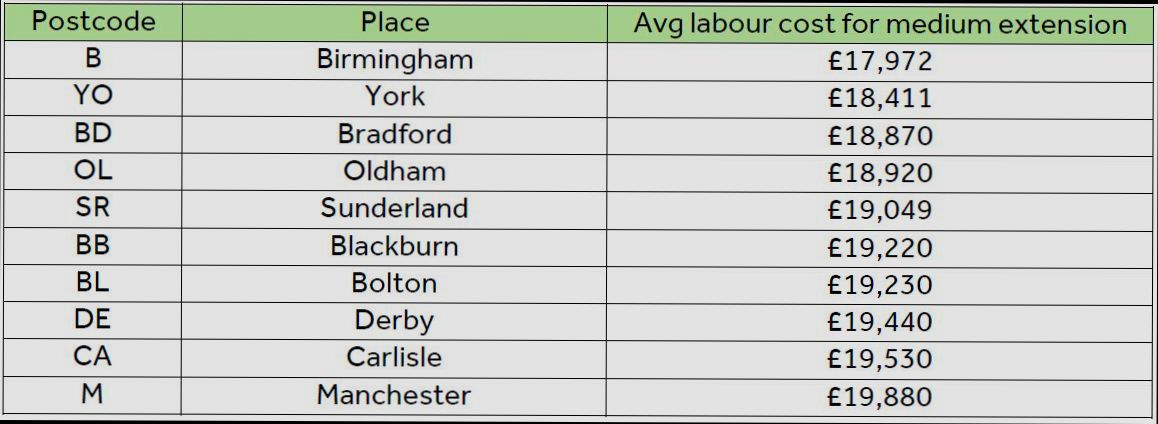

How Do Labour Costs for Extensions Vary and What Do I Need to Know

How Do Labour Costs for Extensions Vary and What Do I Need to Know? It's a burning question for anyone looking to add that extra room or spacious open-plan living area. If you've glanced at quotes from builders, you know the numbers can bounce around like a rubber ball. For instance, a simple single-story extension could cost you anywhere from £1,200 to £2,500 per square meter, while a two-story project might push that to between £1,500 and £3,000. Why the difference? Factors like location, materials, and even the complexity of your design come into play, drastically shifting those labour costs.

Tags