Blog

How Hard Is a Real Estate Exam

How hard is a real estate exam? Well, let’s break it down together. Depending on the state you’re in, you might be staring down the barrel of anywhere from 60 to 150 questions, and the passing rate often hovers around 60-75%. For instance, in California, the exam has a reputation for being particularly tough, with about 50% of first-time test-takers not making the cut. That’s a lot of brainpower on the line! You’ll need to know everything from property laws to finance methods and must ace tough concepts like agency relationships and contract law.

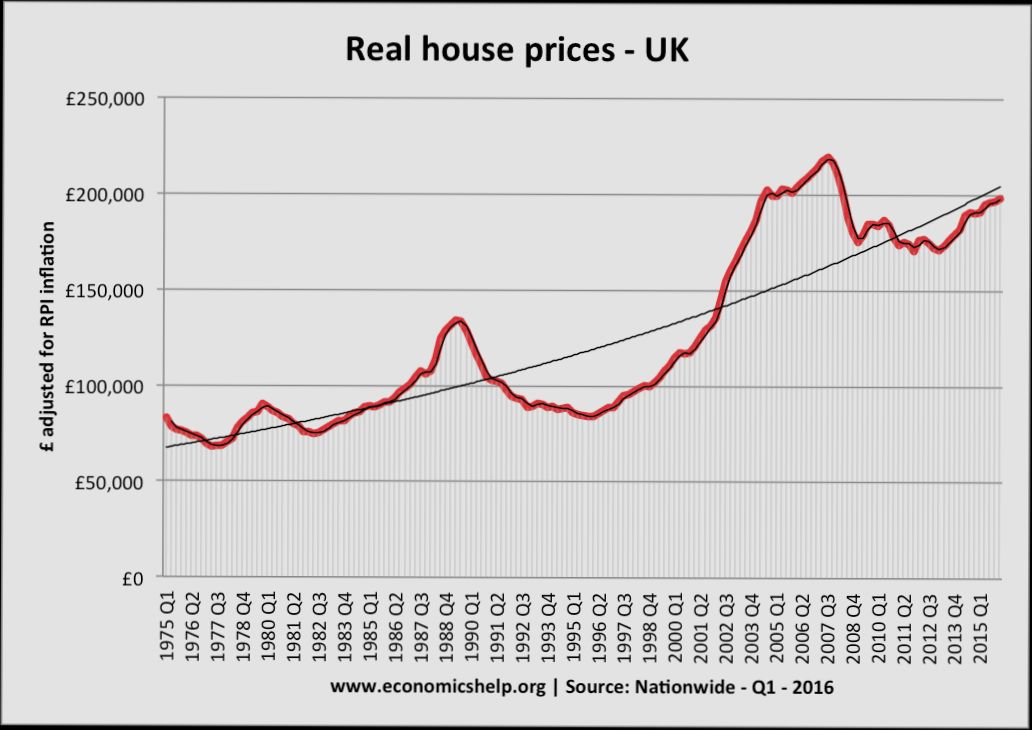

How Interest Rates Affect United Kingdom Housing Market

How Interest Rates Affect United Kingdom Housing Market isn’t just a dry topic—it’s a nuanced dance that can determine whether you’re scoring a sweet deal on your first home or watching prices soar beyond your reach. Take 2021, for instance. With the Bank of England keeping interest rates at a historic low of 0.1%, buyers flocked to the market, and house prices surged by nearly 10% over the year. Suddenly, brick-and-mortar dreams turned into reality for many, but as rates began to creep back up to 2% in early 2022, the landscape shifted dramatically. A slight hike can make monthly mortgage payments feel heavier, pushing that dream home just outside of many buyers' budgets.

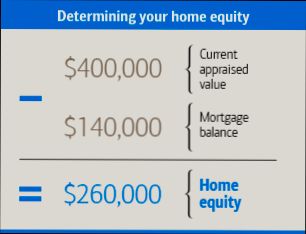

How Is Home Equity Calculated

How Is Home Equity Calculated? Understanding this key concept can feel a bit like unraveling a mystery, but it’s actually pretty straightforward. Imagine you bought a cozy little bungalow for $300,000. You put down a 20% down payment—$60,000—so you took out a mortgage for $240,000. Fast forward a few years, and let’s say your home has appreciated to $350,000. To figure out your home equity, you simply subtract that mortgage balance from your home’s current value. So, you’d do $350,000 minus $240,000, leaving you with a neat $110,000 in home equity. Not too shabby, right?

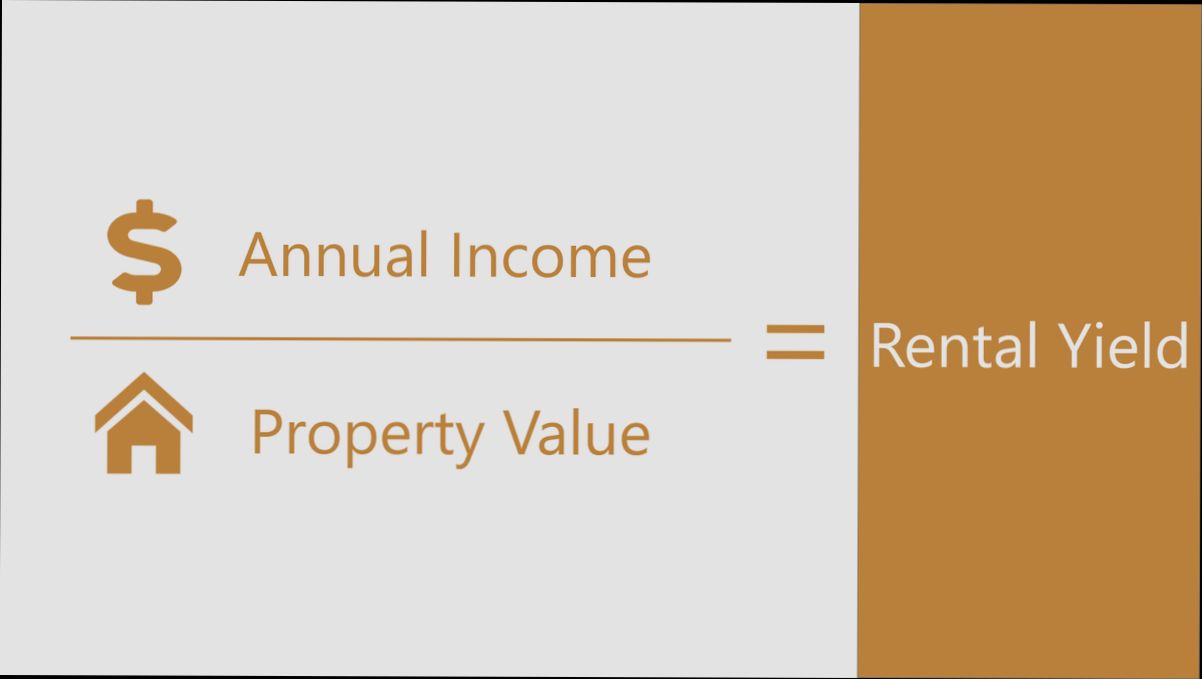

How Is Rental Yield Calculated

How Is Rental Yield Calculated? Let’s break it down simply. Imagine you’ve just invested in a cozy two-bedroom apartment in downtown Austin. You bought it for $300,000, and you plan to rent it out for $2,500 a month. Sounds great, right? To figure out your rental yield, you’ll want to first calculate your annual rental income, which in this case is $2,500 multiplied by 12 months, giving you a solid $30,000 a year. Next, it's all about putting that income against your investment cost, so you’ll take that $30,000 and divide it by the property purchase price of $300,000.

How Long Can I Buy a House After Chapter 7

How Long Can I Buy a House After Chapter 7? That’s a question many people find themselves asking after they’ve gone through the bankruptcy process. The short answer often surprises folks: it can be as little as two years if you’re on top of your financial recovery. For instance, if you filed for Chapter 7 and received your discharge in March 2021, you might be eligible for a mortgage as early as March 2023. However, this timeline can vary based on a few key factors, like the type of mortgage you’re targeting and how you handle your finances post-bankruptcy.

How Long Do I Pay Escrow on My Mortgage

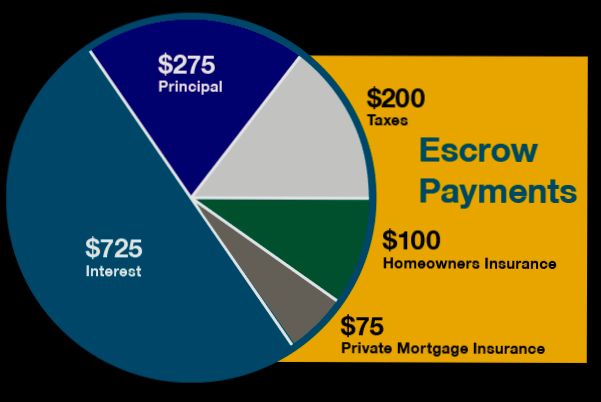

How long do I pay escrow on my mortgage? It’s a question many homeowners grapple with, and the answer often isn’t as straightforward as you'd think. Typically, escrow accounts are set up to cover property taxes and homeowners insurance, which means you might find yourself making those monthly payments for the life of your loan—often 15 to 30 years, depending on your mortgage terms. Imagine that first year when you're digging into your bills only to discover you’re putting away a few hundred bucks each month, just to cover those big expenses when they come due. According to the National Association of Realtors, around 90% of homebuyers choose escrow accounts to help manage these payments, so you’re definitely not alone.

How Long Does a Home Appraisal Take

How long does a home appraisal take? It’s a great question, especially if you’re knee-deep in the buying or refinancing process. Typically, you can expect an appraisal to last anywhere from 30 minutes to a couple of hours. For example, if you live in a bustling city like Chicago, where homes are stacked closely together, the appraiser might zip through much quicker than in a sprawling suburb like Phoenix, where they could take their time examining more land. On average, the entire turnaround time from the appointment to receiving the report usually spans about five to ten business days, but keep in mind that this can vary significantly based on factors like the appraiser’s workload or the complexity of the property.

How Long Does a Home Inspection Take

How long does a home inspection take? If you’re buying a house, this is a question that’s likely lingered in your mind. On average, a standard home inspection can take anywhere from 2 to 4 hours, depending on the size and condition of the property. For instance, a cozy 1,200-square-foot bungalow might zip through in about two hours, while a sprawling 4,000-square-foot home could stretch the process closer to four hours or even longer. Factors like the number of bathrooms, the age of the house, and any accessibility issues can all play a role in how long your inspector will need to thoroughly assess the property.

Tags