How Is Home Equity Calculated? Understanding this key concept can feel a bit like unraveling a mystery, but it’s actually pretty straightforward. Imagine you bought a cozy little bungalow for $300,000. You put down a 20% down payment—$60,000—so you took out a mortgage for $240,000. Fast forward a few years, and let’s say your home has appreciated to $350,000. To figure out your home equity, you simply subtract that mortgage balance from your home’s current value. So, you’d do $350,000 minus $240,000, leaving you with a neat $110,000 in home equity. Not too shabby, right?

Now, let’s dig deeper into what affects that magic number. If you’ve been making those monthly mortgage payments diligently, you’re slowly chipping away at what you owe. Every payment reduces your mortgage balance, meaning your equity grows. Additionally, if the housing market has been sizzling in your neighborhood and home values keep rising, your equity can balloon even faster. For instance, if your home value jumps to $400,000, your equity immediately jumps to $160,000, simply because the market’s on your side. Can you see how quickly these numbers can shift with just a few changes? It’s a dynamic picture worth keeping an eye on!

Understanding Home Equity Fundamentals

Home equity is a critical concept for any homeowner to grasp, as it represents your financial stake in your property. Understanding the basics of home equity can empower you to make informed decisions about your finances and leverage your home’s value effectively.

Your home equity is essentially the difference between your property’s current market value and the amount you still owe on your mortgage. For example, if your home is valued at $500,000 and you owe $100,000, your total home equity amounts to $400,000. This fundamental understanding is crucial as it guides how you can utilize that equity—whether through borrowing or selling.

Key Points to Understand Home Equity

- Approximately 48.3% of mortgaged homes in the U.S. are considered “equity rich,” indicating that homeowners have less than half of their home’s value still under mortgage.

- The average mortgage-holding homeowner gained about $5,700 in equity within a year, which reflects the overall growth in home values.

- As of recent statistics, homeowners hold an average of $311,000 in equity, out of which around $203,000 is tappable, meaning it can be accessed without compromising necessary equity.

| Metric | Value |

|---|---|

| Percentage of equity-rich homes | 48.3% |

| Average equity gain (2023-2024) | $5,700 |

| Total average equity per homeowner | $311,000 |

| Tappable equity average | $203,000 |

Real-World Examples

To illustrate how home equity functions, consider homeowners in Rhode Island and New Jersey, who saw significant year-over-year gains of $43,000. This sharp increase not only enhances their equity position but also boosts their ability to access loans against this equity, facilitating home improvements or investments.

Conversely, homeowners in states like Hawaii and Colorado experienced declines in equity, with losses of $34,000 and $17,000 respectively. In cases of negative equity, where homeowners owe more than their property’s current value, they may struggle to refinance or sell their homes effectively.

Practical Implications

Understanding home equity is essential for a variety of financial decisions. Knowing how to calculate and monitor your equity gives you insight into your financial health and potential options, such as:

- Accessing funds through home equity loans for renovations or consolidating high-interest debts.

- Planning for retirement by leveraging your home equity, if necessary.

- Evaluating your home financing options if you choose to downsize or relocate.

It’s vital to regularly assess your home’s market value and your outstanding mortgage balance to keep a clear picture of your equity status.

Leveraging home equity can be significant, but it’s crucial to remember that, although gaining equity can feel rewarding, falling into negative equity is a risk that should be avoided.

Key Formulas for Home Equity Calculation

Calculating home equity is not just a numeric exercise—it’s a fundamental way to understand your financial position as a homeowner. Let’s dive into the specific formulas and components you need to calculate your home equity accurately.

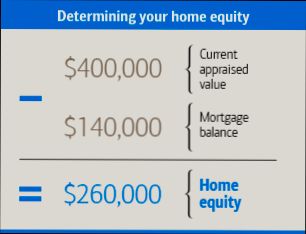

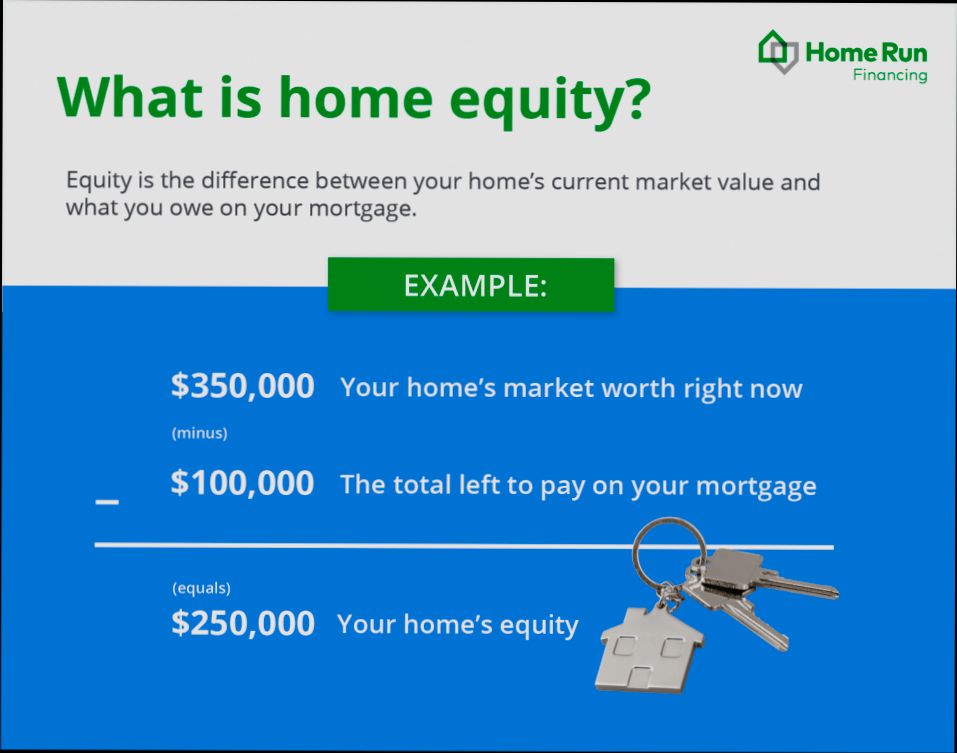

Home Equity Calculation Formula

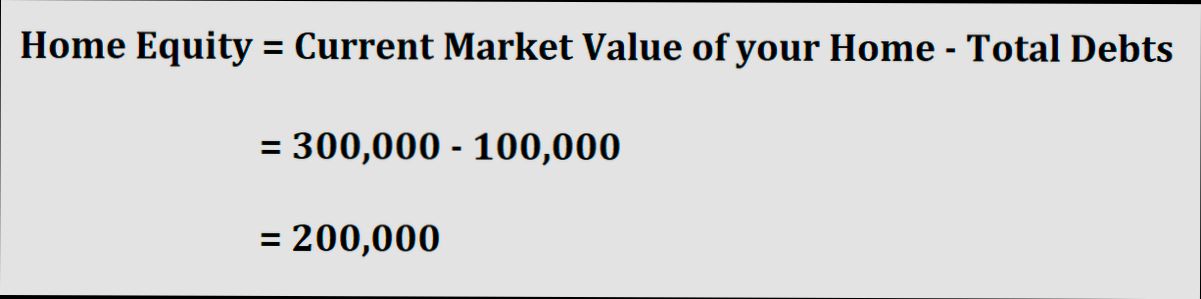

The basic formula for calculating home equity is straightforward:

Home Equity = Current Market Value of Your Home - Total Amount Owed on the Mortgage

1. Current Market Value: Determine how much your home is worth based on various factors, such as recent sales of similar properties and market trends.

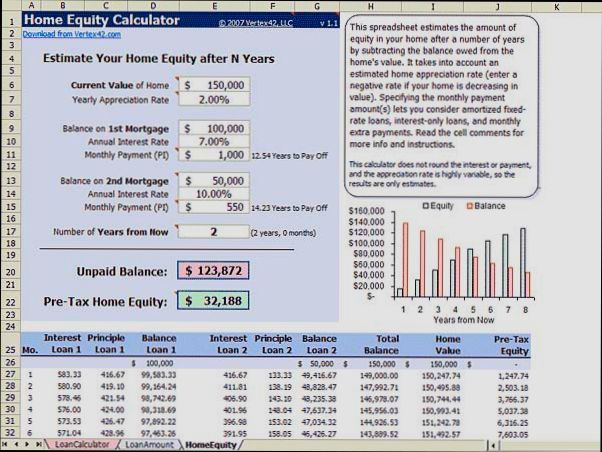

2. Total Amount Owed: This includes your outstanding mortgage balance, plus any second mortgages or home equity loans.

Break Down the Calculation

To calculate your home equity, follow these key steps:

- Assess Your Home’s Current Value: You can use the most recent purchase price, recent selling prices of comparable homes, or online real estate estimates.

- Calculate Total Mortgage Debt: Review your latest mortgage statement for the amount owed. Include any other loans secured by your home to get an accurate total.

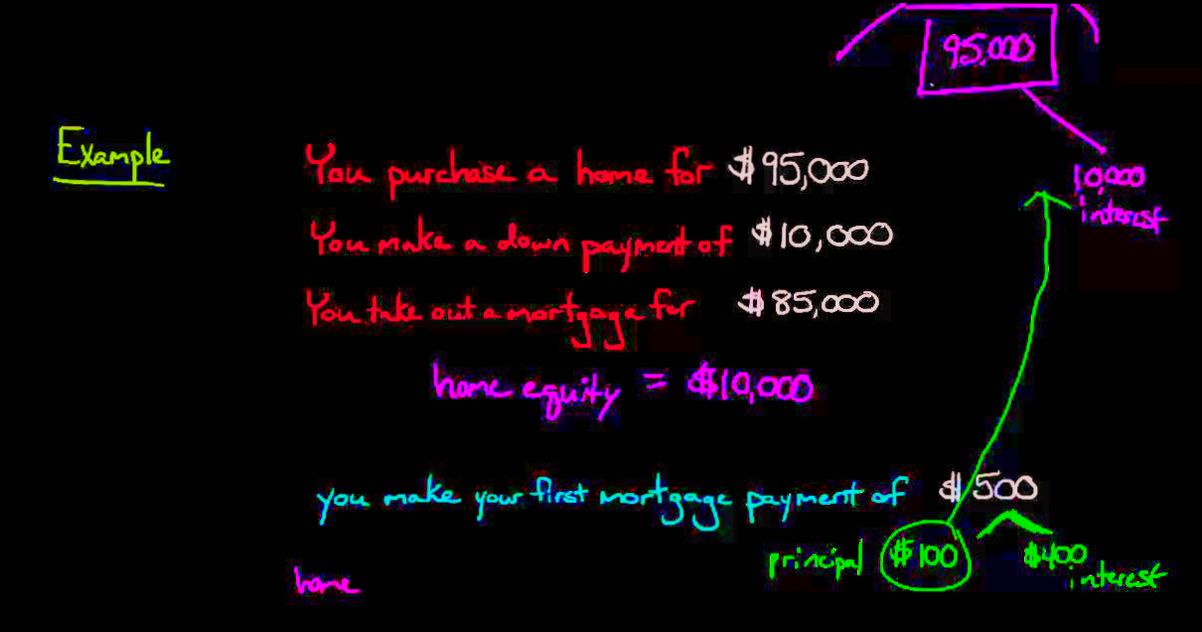

Example Calculation

Let’s say your home has a current market value of $400,000, and you owe $240,000 on your mortgage. Here’s how the calculation would look:

- Home Equity = $400,000 - $240,000 = $160,000

Comparative Table of Home Equity Calculations

| Scenario | Current Market Value | Amount Owed | Home Equity |

|---|---|---|---|

| Scenario A | $400,000 | $240,000 | $160,000 |

| Scenario B | $500,000 | $350,000 | $150,000 |

| Scenario C | $600,000 | $450,000 | $150,000 |

You can see how different values impact your overall home equity.

Real-World Application: Understanding LTV and Equity

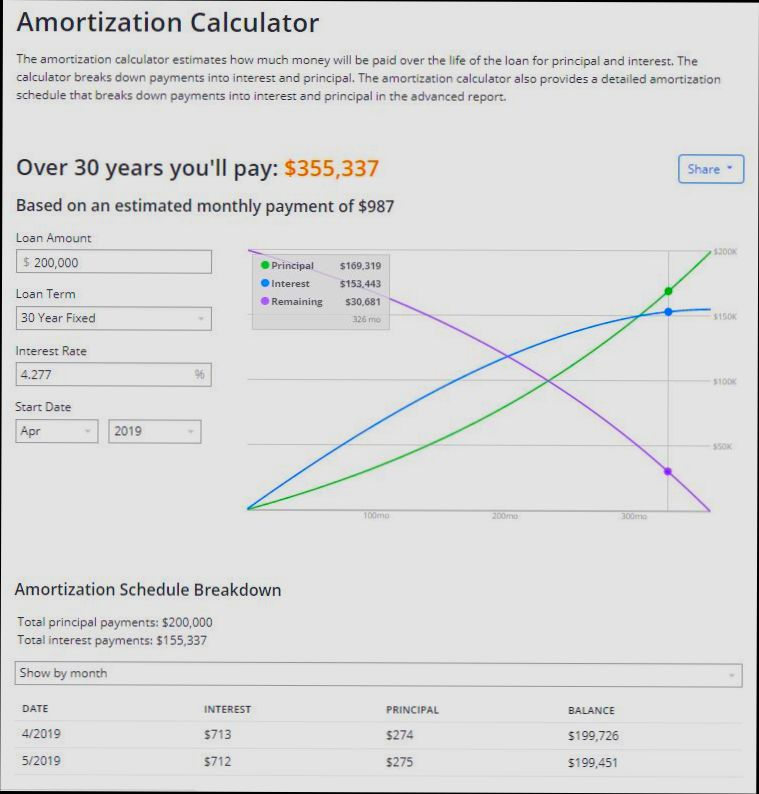

If you have a loan-to-value (LTV) ratio of 60%, as mentioned in previous cases, it implies you have 40% equity in your home. Here’s how it works:

- With a maximum LTV of 80%, a 20% equity margin (or $80,000 on a $400,000 home) remains available for potential borrowing.

This means an equity line of credit or a second mortgage could be easily accessible if your equity exceeds 20%.

Practical Considerations

Lenders typically prefer you to maintain at least 20% equity to eliminate private mortgage insurance (PMI). This not only reduces your monthly payments but significantly enhances your borrowing capability.

Actionable Advice

- Regularly assess your home’s market value and track any home improvements that could increase it.

- Keep an eye on your mortgage balance through monthly statements to pair your home value with what you owe.

- Aim for an LTV that keeps your equity above 20% for better borrowing options.

By following these key formulas and tips, you can effectively manage and leverage your home equity for your financial benefits.

Analyzing Trends in Home Equity Statistics

Understanding trends in home equity statistics can provide you with invaluable insights into the real estate market and your personal financial situation. By examining these trends, we can gauge the overall health of the housing market and predict future movements.

Key Statistics in Home Equity Trends

- Recent studies indicate that home equity levels have surged over the past decade, with more homeowners now enjoying rising property values.

- The average homeowner experienced an approximate $55,000 increase in home equity from 2020 to 2023, reflecting a vibrant real estate market during that period.

- Current projections suggest home equity is expected to grow by 8% annually over the next few years, albeit at a slowing rate compared to the previous years.

- Regions like the West Coast show even greater trends, with reported home equity increases of 15% to 20% in states such as California and Washington over specific timeframes.

Comparative Analysis of Home Equity Growth by Region

| Region | 2020 Average Home Equity | 2023 Average Home Equity | Percentage Increase |

|---|---|---|---|

| West Coast | $275,000 | $330,000 | 20% |

| Midwest | $185,000 | $210,000 | 13.5% |

| South | $210,000 | $250,000 | 19% |

| Northeast | $240,000 | $270,000 | 12.5% |

Real-World Examples: Understanding Home Equity Trends

Looking at specific cities can illustrate these trends vividly. For example:

- San Francisco, CA: Homeowners here saw their equity jump from $600,000 in 2020 to approximately $720,000 in 2023, showcasing a robust 20% growth.

- Chicago, IL: In contrast, while home prices there appreciated, the equity gain was steadier, rising from $200,000 in 2020 to about $230,000 by 2023, a solid 15% increase but much less volatile than coastal markets.

Practical Implications of Home Equity Trends

As you analyze these trends, consider:

- Timing for Selling or Refinancing: High equity levels might present the perfect opportunity for homeowners to sell or refinance, allowing them to leverage good market conditions.

- Investment Opportunities: Understanding heightened equity trends can guide you in deciding whether to invest in property or to tap into existing equity through home equity lines of credit (HELOCs).

- Risk Assessment: Recognizing that equity can fluctuate helps you better prepare for potential downturns in the housing market, allowing for more informed decisions.

- Stay Informed: Continue to track how market trends shape local equity statistics, as they can directly impact your financial choices and housing strategies.

Monitoring these statistics, interpreting the data accurately, and making optimized decisions will help you harness the benefits of your home equity to its fullest potential.

Real-Life Scenarios for Home Equity Use

Home equity can be a powerful financial tool for homeowners, offering creative ways to access cash or finance important life changes. In this section, we’ll explore various real-life scenarios where tapping into home equity can make a significant difference in your financial journey.

Key Scenarios to Consider

1. Home Renovations

- Homeowners often use equity to fund renovations and upgrades, boosting property value. A study found that 75% of homeowners who engaged in major renovations financed them through home equity.

2. Debt Consolidation

- Utilizing home equity for consolidating high-interest debts can be strategic. Data shows that about 60% of equity borrowers used funds to pay off credit card debts and personal loans, saving them substantial amounts in interest payments.

3. Education Expenses

- Many families also tap into home equity to fund educational expenses. Around 45% of equity users reported using the money for tuition, making it a practical option for securing a better future for their children.

Equity Use Cases Comparison Table

| Use Case | Percentage of Homeowners Using It | Average Amount Accessed |

|---|---|---|

| Home Renovations | 75% | $45,000 |

| Debt Consolidation | 60% | $32,000 |

| Education Expenses | 45% | $25,000 |

| Emergency Funds | 30% | $20,000 |

| Investment Opportunities | 20% | $50,000 |

Real-World Examples

- Home Renovation: Jessica, a homeowner in California, used $60,000 of her home equity to renovate her kitchen. After the upgrades, the property value increased by 15%, making her investment worthwhile.

- Debt Consolidation: Tom consolidated his student loans and credit card debts using a $40,000 equity loan. This move reduced his monthly payments by 25%, allowing him to regain financial stability.

- Education Funding: Sarah accessed $30,000 from her home equity to pay for her daughter’s college tuition. This decision meant her daughter could graduate without student loans, which contributed to her financial peace of mind.

Practical Implications for Homeowners

Using home equity wisely can significantly enhance your financial situation. When considering pulling from your home’s value, ask yourself:

- What is my goal for this cash?

- Can I comfortably manage the added monthly payments?

- How will this financial decision impact my long-term equity growth?

Actionable Advice

- Before drawing on home equity, seek professional advice to understand all potential costs involved.

- Shop around for the best refinancing options to lower interest rates on any home equity loans.

- Stay aware of your local real estate market trends, as they can greatly affect how much equity you can access in the future.

Advantages of Knowing Your Home Equity

Understanding your home equity can be a game changer for homeowners. By being aware of the equity you have in your property, you empower yourself to make informed financial decisions that can significantly impact your financial future.

Key Advantages of Knowing Your Home Equity

1. Informed Decision-Making:

Knowing your home equity allows you to make better choices about refinancing, selling, or investing in home improvements. For instance, if you know your equity is substantial, you might choose to borrow against it to fund a renovation that can further increase your home’s value.

2. Financial Leverage:

A recent survey indicated that about 60% of homeowners with higher equity utilized it for significant purchases or investments, highlighting the potential of home equity as a financial lever. This leverage can provide you with avenues for growth that you might not have considered otherwise.

3. Enhanced Negotiating Power:

Homeowners with a solid grasp of their home equity often find themselves in a stronger position when negotiating mortgage terms or selling their property. Understanding your equity gives you a clearer perspective on your financial standing, which can be an asset in discussions with lenders.

4. Ability to Manage Debt:

Around 45% of equity-knowledgeable homeowners reported using their equity to pay off high-interest debts. This strategy can lead to significant savings, allowing you to manage your financial obligations more effectively.

5. Greater Financial Security:

Having knowledge about your home equity contributes to a heightened sense of financial security. In times of economic uncertainty, accessed equity can act as a safety net, providing you with liquidity when you need it most.

| Advantage | Description | Percentage/Value |

|---|---|---|

| Informed Decision-Making | Better choices on refinancing or improving property | - |

| Financial Leverage | Used for significant investments | 60% of homeowners |

| Enhanced Negotiating Power | Stronger position in mortgage or sale negotiations | - |

| Ability to Manage Debt | Pay off high-interest debts using equity | 45% of equity-aware homeowners |

| Greater Financial Security | Acts as a safety net during economic uncertainty | - |

Real-World Examples

- Case Study 1: Meet Sarah. She discovered her home equity had grown significantly over the last few years. By leveraging this equity, she remodelled her kitchen, resulting in a home value increase of 20%. Sarah not only enhanced her living space but also boosted her investment.

- Case Study 2: Tom, who understood his home equity, opted to use it to consolidate debt. With 45% of homeowners reporting similar actions, Tom was able to lower his interest payments substantially, allowing him more financial flexibility going forward.

Practical Implications for Readers

By recognizing the advantages of knowing your home equity, you can strategically manage your finances. This knowledge enables you to plan for major expenditures, prioritize home improvements, and even prepare for retirement.

If you want to utilize your home equity effectively, regularly assess its value and your mortgage balance. This practice will keep you informed and ready to make decisions that benefit your financial health, creating opportunities for wealth-building and security.

Stay proactive in tracking your home’s market value, and don’t hesitate to consult a real estate professional for insights. This approach can help you realize the full potential of your home equity, turning it into a valuable financial resource.

Factors Influencing Home Equity Values

Understanding the factors that influence home equity values is crucial for homeowners like you who want to leverage their property’s worth effectively. Various elements play a significant role in determining both your home’s market value and the equity that you can access.

Key Factors Affecting Home Equity Values

1. Market Trends: Local real estate market conditions can significantly affect home values. For instance, areas experiencing a housing boom can see property values increase by up to 20% year-over-year, leading to a proportional increase in home equity.

2. Home Improvements: Investing in renovations can enhance your home’s value considerably. Studies show well-planned renovations can yield returns of 70% to 80% of the original investment, directly impacting the increase in home equity.

3. Location: The geographical location of your home is a major determinant of its market value. Properties in neighborhoods with reputable schools and low crime rates are often valued higher, thus increasing equity. Areas designated as “up-and-coming” can also see sharp value increases, sometimes by 10% to 15% within a few years.

4. Economic Conditions: Broader economic factors, such as employment rates and interest rates, also influence home equity values. For example, when unemployment is low, consumers are more likely to invest in homes, potentially raising values across the board and increasing equity.

5. Property Maintenance: The upkeep of your home affects its market attractiveness. Neglected properties can lose value over time; maintaining a home can prevent a decline and may enhance equity. Properties that are well-kept can experience value retention better than poorly maintained ones, sometimes by as much as 25% during economic downturns.

| Factor | Impact on Home Value | Description |

|---|---|---|

| Market Trends | +20% | Rising demand in local markets drives property values. |

| Home Improvements | +70%-80% | Renovations can significantly boost home equity. |

| Location | +10%-15% | Desirable neighborhoods enhance property market value. |

| Economic Conditions | Varies | Employment and interest rates influence home buying. |

| Property Maintenance | +25% (during downturns) | Better-kept homes retain their value over time. |

Real-World Examples

A family in a bustling suburb upgraded their kitchen and added a deck, investing about $30,000. Following the renovations, they appraised their home’s value at $500,000, a $50,000 increase. This scenario illustrates how effective home improvements can enhance equity significantly.

In another case, a homeowner in a transitional neighborhood watched their property’s value increase by 15% over three years due to the influx of new businesses and amenities. This neighborhood shift not only improved their home’s market value but also their home equity, offering access to additional financing options.

Practical Implications

1. Regular Assessment: Keep a pulse on your local real estate market. Regularly assessing market conditions can help you understand when to buy, sell, or upgrade your property.

2. Smart Renovations: Focus on renovations that provide high returns, such as kitchen upgrades or energy-efficient installations. These can make a considerable difference in property value and, thus, equity.

3. Maintain Property: Never underestimate the value of good maintenance. Regular upkeep not only preserves your equity but also makes your home more appealing to potential buyers, should you decide to sell.

4. Stay Informed on Economic Changes: Economic fluctuations can impact your home’s value quickly. Stay informed about changes in interest and employment rates to make smarter financial decisions regarding your home equity.

5. Understand Neighborhood Dynamics: Monitor trends within your neighborhood to anticipate potential increases in value and equity. Engage with community development plans that might enhance property values in the future, ensuring you stay ahead.

How Home Equity Impacts Financial Decisions

Understanding how home equity influences your financial choices is vital for every homeowner. Your home equity can shape decisions regarding borrowing, investment, and even retirement planning. By leveraging this asset, you can create financial opportunities or navigate potential pitfalls.

Key Points on Financial Impacts of Home Equity

1. Borrowing Power Enhancement: Your home equity can increase your borrowing capacity. Homeowners often use equity to secure loans, as many lenders view it as collateral. For instance, approximately 70% of homeowners utilize their equity to fund renovations or consolidate debt.

2. Investment Opportunities: Accessing your home equity can allow you to take advantage of investment opportunities. By leveraging your equity, you can invest in rental properties or start a business. Roughly 45% of homeowners consider equity withdrawal for such investments, seeing it as a chance to generate passive income.

3. Emergency Fund: Equity acts as a financial safety net. In case of unexpected expenses, such as job loss or medical emergencies, having equity translates to immediate liquidity. Research indicates that around 60% of homeowners access their equity as a buffer for emergencies.

4. Retirement Funding: Many homeowners view their home equity as a critical component of their retirement planning. You can downsize or tap into your equity through various means, such as a reverse mortgage, to support lifestyle choices in retirement. Surveys show that 20% of seniors rely on home equity to fund retirement.

Comparative Table: Home Equity and Financial Decision Categories

| Financial Decision | Percentage of Homeowners Utilizing Home Equity | Average Equity Accessed |

|---|---|---|

| Renovations | 70% | $30,000 |

| Investment Opportunities | 45% | $25,000 |

| Emergency Funds | 60% | $20,000 |

| Retirement Funding | 20% | $50,000 |

Real-World Examples

- Home Renovation: Lisa and Mark decided to remodel their kitchen using a home equity loan. They accessed $40,000, which increased their property value significantly, allowing them to sell the home for a $70,000 return on their investment just a few years later.

- Starting a Business: Alex used his home equity to launch a landscaping company. He took out a $50,000 equity line of credit, which turned into a profitable venture, generating an average annual revenue of $100,000.

- Emergency Expenses: Jamie faced unexpected medical bills totaling $15,000. By tapping into her home equity, she secured a quick loan that alleviated her financial stress without depleting her savings.

Practical Implications

Understanding your home equity can dramatically influence your financial decisions. Here are some practical steps you can take:

- Stay Informed: Regularly assess your home’s market value and discover how it affects your equity. This knowledge empowers you to make informed borrowing decisions.

- Budget for Equity Use: When considering home equity loans or lines of credit, budget carefully to ensure you can manage additional payments comfortably.

- Plan for the Future: Think about long-term goals. For instance, if retirement funding is a priority, consider how and when you might want to tap into your equity.

Actionable Advice

- Monitor Market Trends: Stay updated on housing market trends to maximize your home equity utilization. If your home’s value increases, it might be a strategic time to leverage that equity.

- Consult Financial Experts: Before making significant financial decisions based on equity, consult with a financial advisor to explore the best options tailored to your circumstances.

- Use Equity Wisely: Focus on using home equity for productive investments that will generate a return rather than for depreciating assets. This strategic approach can significantly enhance your overall financial health.