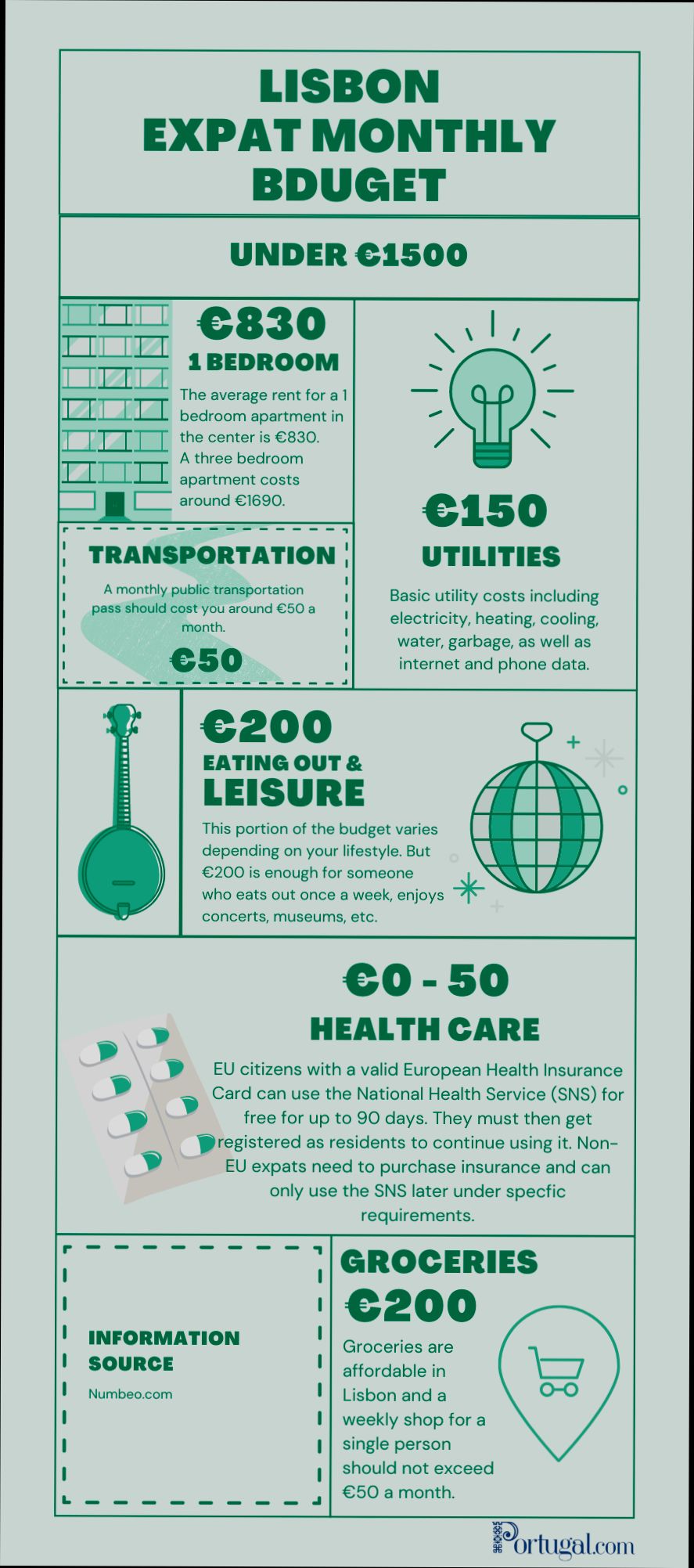

What is the Cost of Living in Portugal? Well, it can be surprisingly affordable, especially when you compare it to other European hotspots. For instance, the average monthly rent for a one-bedroom apartment in Lisbon sits around €1,200, but if you venture out to places like Porto or the Algarve, you might find the same for just €600. Groceries can be a steal too; a meal at a local restaurant might only set you back about €12, and a cappuccino often costs around €1.50.

But it’s not all sunshine and cheap wine—there are some quirks to consider. Utility bills can range from €100 to €150 monthly on average, depending on the season. If you’re a transportation buff, you’ll appreciate that a monthly metro pass in Lisbon runs about €42, while a ticket for the scenic trains can be a fun day trip. So, whether you’re lured by the beautiful coastline or the vibrant culture, the numbers tell a vivid story about living in Portugal.

Housing Costs in Major Cities

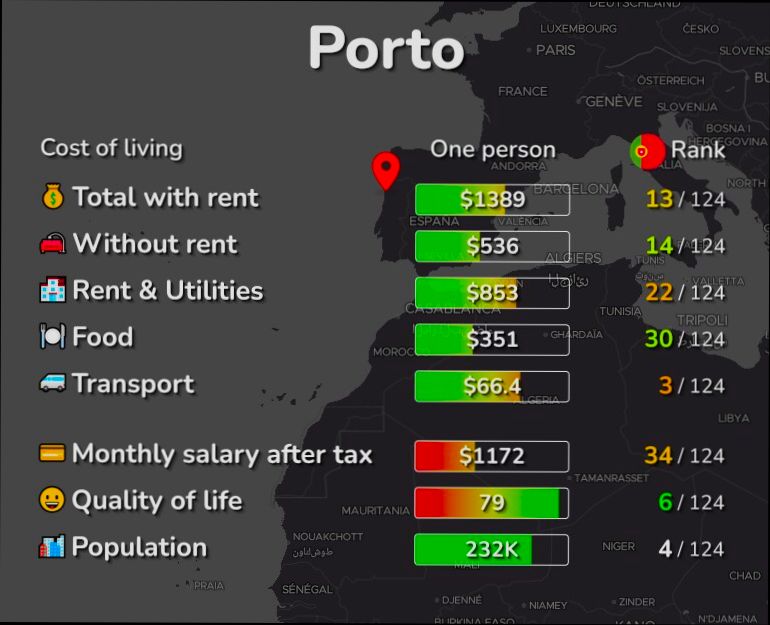

When considering a move to Portugal, one of the crucial factors to evaluate is housing costs in its major cities. Housing expenses can greatly influence your overall cost of living, so it’s vital to understand the landscape before you settle down. Let’s dive into the specific figures and insights surrounding housing costs in some of the most prominent urban areas in Portugal.

Key Points on Housing Costs

- In Lisbon, the average rent for a one-bedroom apartment in the city center can reach around €1,200 per month, while properties outside the center cost approximately €800.

- Porto offers a contrasting scenario, with city center rents for one-bedroom apartments averaging €800, and those outside the center going for about €600.

- The Algarve region, popular for its tourist appeal, exhibits higher variability in house prices, with rental costs often spiking during the summer season.

- Approximately 50% of urban properties are rented, showcasing a thriving rental market influenced by both locals and expatriates.

- Housing prices across Portugal have surged by about 10% over the past year, reflecting a growing demand for urban living.

Comparative Table of Rental Prices in Major Cities

| City | Average Rent (City Center) | Average Rent (Outside City Center) |

|---|---|---|

| Lisbon | €1,200 | €800 |

| Porto | €800 | €600 |

| Faro | €900 | €650 |

| Coimbra | €600 | €450 |

| Braga | €550 | €400 |

Real-World Examples

1. A couple relocating to Lisbon found a charming one-bedroom apartment in the Bairro Alto district. They were quoted €1,150 per month, which included utilities. They opted for a furnished place to minimize the hassle of moving furniture from abroad.

2. In Porto, a digital nomad reported securing a studio in the trendy Cedofeita area for €750. They highlighted the vibrant community and inexpensive public transport as significant benefits despite the higher rental price.

3. Families looking to settle in Coimbra noticed that the university atmosphere contributes to a high demand for rentals, which can push prices up slightly, with an average of €600 for a two-bedroom apartment in central locations.

Practical Implications for Readers

Understanding the housing costs in these major cities can help you budget effectively. If you’re considering living in Lisbon, aim for €1,200 monthly for a one-bedroom, but if you’re drawn to Porto, you could save significantly.

- When searching for apartments, be sure to explore both furnished and unfurnished options, as they can vary considerably in cost.

- If you’re eyeing the Algarve during peak tourism, be prepared for inflated prices and limited availability; off-peak seasons could offer more reasonable rates.

- For longer-term stays, consider looking in suburban neighborhoods where costs may be lower and commuting is manageable.

Remember, current trends suggest that property prices may continue rising, so acting sooner rather than later might save you money down the line.

Cost of Groceries and Dining Out

When relocating to Portugal, understanding the cost of groceries and dining out is essential for budgeting. Whether you’re planning to cook at home or dine in local restaurants, it’s crucial to know what to expect in terms of prices. This section dives into the specifics of grocery prices and eating out, providing insights to help you plan your finances effectively.

Grocery Costs in Portugal

Grocery prices in Portugal are generally reasonable, especially when buying local products. Here’s a quick breakdown of some basic grocery items:

- Bread (1kg): Approximately €1.50

- Milk (1 liter): About €0.90

- Eggs (dozen): Roughly €2.70

- Chicken breast (1kg): Around €6.50

- Rice (1kg): Close to €1.80

- Tomatoes (1kg): Typically €2.00

These prices can vary slightly depending on the supermarket and region, but they provide a good sense of what you’ll encounter.

Dining Out Costs

Eating out in Portugal is often a delightful experience, and the prices can accommodate various budgets. In major cities, you can expect to pay:

- Budget meal: Around €10-€15 at an inexpensive restaurant.

- Three-course meal for two at a mid-range restaurant: Approximately €40-€60.

- Coffee (regular): About €1.50 in most cafes.

- Pint of beer (local): Roughly €2.50.

It’s worth noting that many restaurants offer lunch specials, which can be a more affordable option compared to dining in the evening.

Comparative Pricing Table

| Grocery Item | Average Price (€) |

|---|---|

| Bread (1kg) | 1.50 |

| Milk (1 liter) | 0.90 |

| Eggs (dozen) | 2.70 |

| Chicken breast (1kg) | 6.50 |

| Rice (1kg) | 1.80 |

| Tomatoes (1kg) | 2.00 |

| Budget meal | 10-15 |

| Three-course meal (2) | 40-60 |

Real-World Examples

I spoke to a few expats living in Lisbon who shared their experiences with grocery shopping and dining. For instance, Sarah mentioned that she spends about €200 monthly on groceries for herself, focusing on fresh produce and proteins. Meanwhile, James, a foodie based in Porto, enjoys exploring local eateries and usually dines out twice a week, spending around €80 each time when he takes friends along, enjoying a mix of traditional dishes and wines.

Practical Implications for Budgeting

When planning your move or visit to Portugal, consider the following:

- Grocery Stores: Use local markets or chain supermarkets like Pingo Doce or Continente for the best prices on fresh produce.

- Dining Out: Look for “prato do dia” (dish of the day) specials for budget-friendly dining options.

- Cooking at Home: Learn some local Portuguese recipes; it can enhance your culinary experience while saving money in the long run.

Eating locally and being strategic about your grocery shopping can significantly affect your monthly expenses. With a bit of planning, you can enjoy the rich flavors of Portuguese cuisine without breaking the bank.

Transportation Expenses in Portugal

Transportation expenses in Portugal can vary significantly depending on your location and lifestyle choices. Understanding these costs is essential for efficient budgeting, especially if you plan to rely on public transport, taxis, or personal vehicles.

Public Transportation Costs

Portugal boasts a comprehensive public transport system, which is efficient and often quite affordable. Here are some key points regarding public transport costs:

- A single metro ticket in Lisbon costs around €1.50, while a ticket for the city’s buses is similarly priced.

- If you plan to commute regularly, a monthly transport pass costs about €42 in Lisbon and €33 in Porto.

- In smaller cities like Faro and Évora, fares tend to be lower, with monthly passes costing approximately €25.

Transportation Comparison Table

| Type of Transport | Average Cost in Lisbon | Average Cost in Porto | Average Cost in Faro |

|---|---|---|---|

| Single Metro Ticket | €1.50 | €1.20 | €1.00 |

| Monthly Pass | €42 | €33 | €25 |

| Taxi (per km) | €0.95 | €0.90 | €0.80 |

| Intercity Bus Ticket | €12 (Lisbon to Porto) | €10 (Porto to Lisbon) | €8 (Faro to Lisbon) |

Case Studies on Transportation Expenses

Let’s explore some real-world examples to illustrate transportation costs:

- Joana, a Lisbon resident, commutes daily to work via the metro. She spends €1.50 each way, totaling €3 daily, or around €60 monthly if she rides five days a week. Opting for a monthly pass saves her nearly €18, highlighting the financial benefits of planning.

- Pedro, living in Porto, relies on buses to navigate the city. He finds that purchasing a monthly pass at €33 is more economical than paying €1.20 per ride. With this pass, he can hop on and off as much as he needs, which enhances his mobility while keeping costs low.

Practical Implications

When you consider transportation expenses in Portugal, think about your everyday commuting patterns. Here are some actionable tips:

- If you frequently use public transport, invest in a monthly pass. It can provide significant savings compared to buying single tickets.

- For infrequent travelers, consider using rail and intercity buses, as they often feature competitive pricing for longer trips.

- Explore available ride-sharing options, such as Uber, which can be reasonably priced during off-peak hours.

You might also find it useful to review the local pricing for taxi fares, as they typically charge per km with starting fees that can be higher during night hours or on holidays. As a general rule, taxis are more affordable in smaller towns.

Specific Facts

- Many cities in Portugal offer discounts for seniors, students, and frequent travelers, so look into these options for potential savings.

- Consider cycling as an alternative mode of transport, especially in cities with bike lanes and rental services like Lisbon’s Gira or Porto’s Bike Sharing. This not only reduces transportation costs but also promotes a healthier lifestyle.

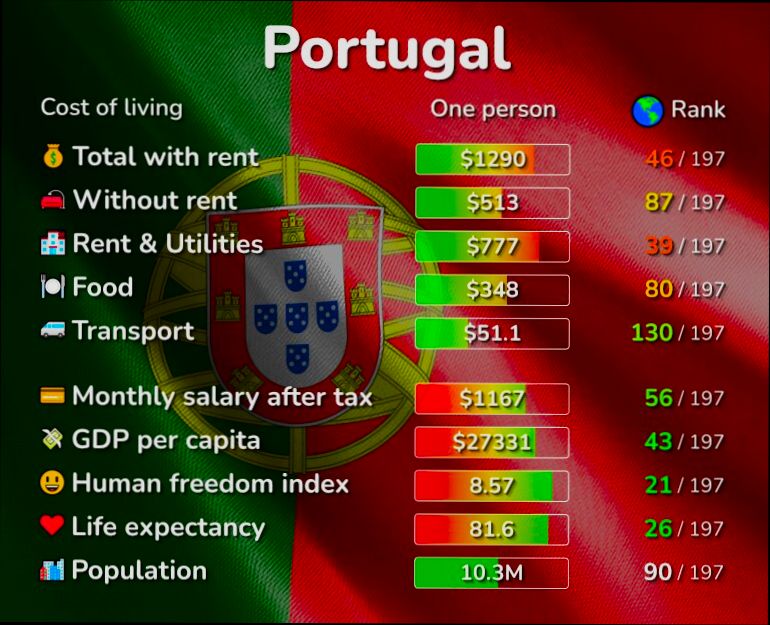

Statistical Overview of Living Costs

When you think about living in Portugal, it’s essential to have a clear picture of the overall living costs, which can significantly impact your budget. Here, I’ll provide a statistical overview that covers various aspects of day-to-day expenditures beyond just housing and groceries.

Key Living Cost Statistics

Portugal is known for its relatively affordable cost of living compared to many Western European nations. Here are some key points to consider:

- The average monthly cost for a single person living in Portugal is estimated to be around €800 - €1,000, which includes rent, utilities, transportation, and groceries.

- Utility bills—such as electricity, heating, cooling, water, and garbage—average about €130 per month.

- Internet and mobile phone plans invite additional costs, with average monthly expenses reaching around €30 for broadband and €20 for mobile services.

Breakdown of Monthly Expenses

| Expense Category | Average Monthly Cost (€) |

|---|---|

| Rent (1-bedroom outside city center) | 800 |

| Utilities (Electricity, Water, etc.) | 130 |

| Internet/Mobile | 50 |

| Groceries | 250 |

| Transportation | 40 |

Real-World Examples

Let’s take a closer look at how these statistics play out in daily life:

- In Lisbon, a couple living together could expect to pay around €1,500 in total living costs, factoring all aspects from rent to groceries. This is a great option for those who want to enjoy city life without breaking the bank.

- Seniors, particularly those living on retirement savings, might find living in towns outside of major cities like Faro or Braga more attractive, where monthly costs could be as low as €600, allowing them to enjoy an easier budget.

Practical Implications for Readers

Understanding these living costs can help you plan your budget effectively.

- If your income reflects higher expenses from a big city, consider relocating to smaller towns or suburbs where expenses can be significantly lower.

- Embrace local markets and services, as purchasing fresh produce or essentials from local vendors may reduce your grocery bills.

Specifics about living costs can greatly influence your financial success in Portugal.

- Aim to allocate at least 30% of your budget for housing, as it is the largest chunk of your expenses.

- Always account for inflation and potential increases in utility costs over time, and keep some buffer in your budget for unexpected expenses.

Healthcare Affordability and Accessibility

Understanding the healthcare system in Portugal is vital for anyone looking to live here. Healthcare affordability and accessibility play a significant role in your overall quality of life, especially if you require regular medical attention or emergency services.

Key Points on Healthcare Affordability

- Portugal’s National Health Service (SNS) provides healthcare that is mostly free at the point of use for residents, but nominal fees exist. For many consultations, you might only pay around €5 for a visit, while hospital stays can incur a charge of approximately €20 per day.

- Private health insurance is an option that many expats consider, with costs ranging from €30 to €80 per month, depending on the coverage level and age.

- According to recent statistics, 80% of the population relies on the SNS for primary health needs. Conversely, 20% prefer private healthcare, often due to shorter waiting times and greater service availability.

Healthcare Accessibility in Numbers

| Insurance Type | Monthly Cost (€) | Average Wait Time for GP Appointment | Percentage of Population Covered |

|---|---|---|---|

| National Health Service (SNS) | 0 | 1-2 weeks | 80% |

| Private Insurance | 30 - 80 | 1-3 days | 20% |

Real-World Examples

Consider Maria, a retired expat in Lisbon who uses the SNS for her healthcare needs. She finds that her visits to the local health center are affordable and generally prompt. Despite experiencing long wait times (up to two weeks), she appreciates the low costs involved.

On the other hand, João, a young professional in Porto, opts for private health insurance due to his busy schedule and the convenience it offers. He pays about €50 monthly, which allows him to receive treatment within days rather than weeks.

Practical Implications for Readers

If you’re planning to relocate to Portugal, think deeply about your healthcare needs. Evaluate whether you would rely on the SNS or if investing in private insurance might be more suitable for your lifestyle. Consider your specific medical conditions, regularity of visits, and the potential language barrier in public healthcare settings.

- If you choose SNS, familiarize yourself with the local health centers and how to access services.

- For those opting for private insurance, shop around to find the plan that suits you best and offers the network coverage necessary for your needs.

Actionable Advice on Healthcare Affordability

When settling into Portugal, register with the SNS as soon as possible if you are eligible. This will ensure you can access low-cost healthcare services without delays. If considering private insurance, request quotes from multiple providers and ensure you understand the details and coverage limits before signing up. Consider your healthcare needs, typical expenses, and any existing conditions to make informed decisions about your health in this new environment.

Financial Benefits of Living in Portugal

Living in Portugal offers numerous financial benefits that make it an attractive destination for expats and travelers alike. From job opportunities to a favorable tax structure, Portugal ensures that your hard-earned money goes further than in many other European countries.

Employment Landscape

In terms of employment, approximately 69% of people aged 15 to 64 have a paid job in Portugal, surpassing the OECD average of 66%. This high employment rate indicates a robust job market, especially for expatriates seeking opportunities. Here are a few key statistics:

- Job Participation: 72% of men and 67% of women are involved in paid work.

- Working Hours: Only 6% of employees work long hours, which is below the OECD average of 10%. This means you can enjoy a better work-life balance while still making a decent income.

Tax Incentives

Portugal provides various financial incentives for residents, particularly for retirees and digital nomads:

- Non-Habitual Resident (NHR) Regime: This program offers substantial tax reductions for newcomers, allowing qualifying individuals to pay a flat rate of only 20% on income derived from Portuguese sources. For many expats, this translates to significant savings over time.

- Social Security Contributions: These contributions are generally lower in Portugal compared to other EU countries, meaning you’ll take home a larger portion of your paycheck.

Cost of Living Benefits

While the average household net-adjusted disposable income per capita in Portugal stands at USD 24,877, which is lower than the OECD average, the overall cost of living remains quite affordable. Many citizens enjoy a good standard of living without the financial strain that often accompanies life in other Western European nations.

Comparative Table of Financial Benefits

| Financial Metric | Portugal | OECD Average |

|---|---|---|

| Employment Rate | 69% | 66% |

| Non-Habitual Resident Tax Rate | 20% | N/A |

| Long Working Hours Percentage | 6% | 10% |

| Average Disposable Income | USD 24,877 | USD 30,490 |

Real-World Examples

Consider a retiree who moves to Portugal under the NHR regime. By qualifying for the 20% flat tax rate, they can preserve a significant portion of their retirement funds, allowing them to enjoy a higher quality of life. For a digital nomad working remotely, lower living costs combined with tax incentives mean they can reinvest their savings into travel and leisure, maximizing their experience in Europe.

Practical Implications

1. Consider Relocation: If you are contemplating where to settle, Portugal’s favorable employment rate and low cost of living make it a viable choice for anyone looking to stretch their budget further.

2. Explore Tax Benefits: Utilize the NHR regime to decrease your tax liabilities and optimize your income, especially if you are considering retirement or remote work.

3. Assess Job Opportunities: With nearly 70% of the working-age population employed, there’s a strong possibility of finding a lucrative job that also allows for a healthy work-life balance.

Specific Advice

If you’re looking to cut down on expenses while maximizing your overall financial benefits, researching the Non-Habitual Resident program could be crucial. Additionally, consider expanding your job search to regions where employment rates are particularly high; this could lead to better pay or more fulfilling opportunities without the stress of long hours.

Practical Tips for Budgeting in Portugal

Budgeting in Portugal can be a rewarding experience, especially when you know how to navigate the various costs associated with living here. With a little planning and insight, you can make the most of your income while enjoying all that Portugal has to offer.

Assess Your Income and Expenses

Before diving into specific budgeting tips, it’s essential to assess your income against your expected expenses. In Portugal, the average monthly cost for a single person is estimated to be around €800 - €1,000. Understanding where your money goes can help you allocate funds wisely.

- Track Your Spending: Use apps or a simple spreadsheet to categorize your expenditures, helping you identify areas where you can save.

- Set a Monthly Budget: Aim to cover your essential needs first—like housing, utilities, and groceries—before allocating funds for discretionary spending.

Utilize Local Discounts and Promotions

One of the best ways to save money is by taking advantage of local discounts and promotions.

- Discount Cards: Many cities in Portugal offer discount cards for students, seniors, and frequent visitors, especially for public transport and attractions.

- Supermarket Promotions: Pay attention to weekly ads from local supermarkets like Pingo Doce or Continente, where you can find significant discounts on groceries.

Explore Cost-effective Lifestyles

Adopting a cost-effective lifestyle can lead to substantial savings in the long run.

- Choose Local Markets: Buy fresh produce from local markets instead of larger supermarkets. This not only supports local farmers but can also lower your grocery bills.

- Limit Eating Out: While dining out is a fun experience, consider preparing meals at home more often. You can save as much as 70% on food costs when you make home-cooked meals compared to restaurant prices.

Comparative Overview of Common Expenses

Here’s a quick look at some typical monthly budget allocations to help you plan better:

| Expense Type | Average Monthly Cost (€) |

|---|---|

| Utilities (Electricity, Water, Internet) | 100 - 150 |

| Groceries | 200 - 300 |

| Transportation | 40 - 70 |

| Entertainment | 50 - 100 |

| Dining Out | 100 - 200 |

Real-world Examples

1. Maria’s Monthly Budget: Maria, a freelance graphic designer in Porto, spends approximately €900 per month. By setting strict limits on her dining out expenses to €100 and using public transportation, she keeps her costs manageable while enjoying the vibrant culture of her city.

2. David and Sarah’s Savings: This couple moved to Lisbon and managed to lower their grocery expenses by 20% after switching to local farmers’ markets and meal prepping for the week, allowing them to allocate more of their budget to travel within Portugal.

Practical Tips for Everyday Budgeting

- Consolidate Bills: Try to combine utilities into one payment if your provider allows it. This can simplify your monthly budgeting.

- Set Up a Savings Plan: Aim to save at least 10% of your monthly income for emergencies or future investments. Having a buffer can ease financial anxiety.

- Be Cautious with Loans: Avoid high-interest loans that can destabilize your budget. If you need financing, research local banks or credit unions for better rates.

By keeping these practical tips in mind, you’ll be better equipped to manage your finances while enjoying your life in Portugal. Embrace the culture, and with careful planning, you can live comfortably within your means.