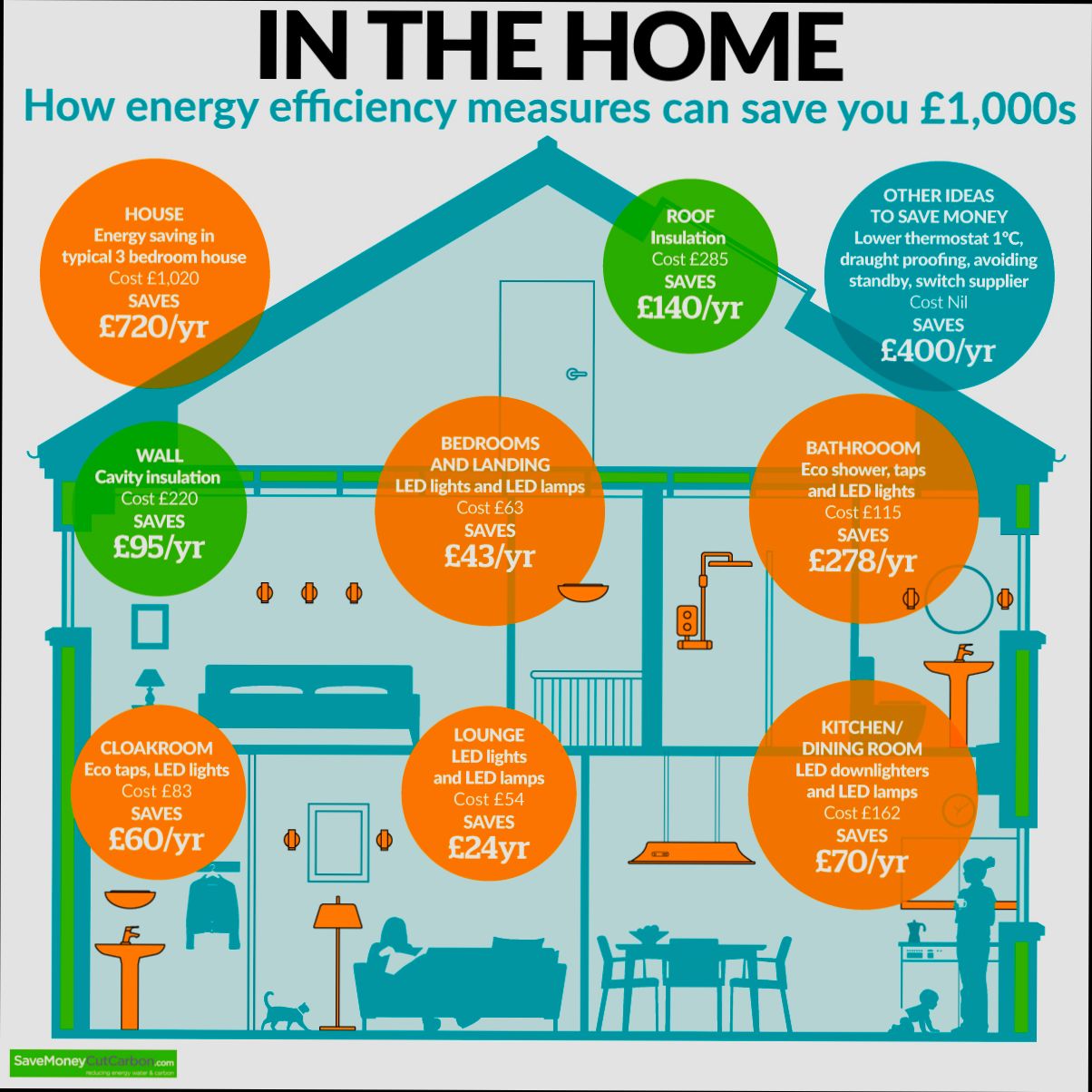

How Saving Energy Really Can Pay for Itself and Save You Money is not just a catchy phrase; it’s a reality backed by numbers. Take a look at your home energy bill—those monthly payments can feel like a black hole for your wallet. Did you know that by simply switching to energy-efficient LED bulbs, you can save about $225 over the lifespan of just one bulb? Or think about those smart thermostats that learn your schedule; they can trim your heating and cooling costs by about 10-20%. That might not sound like a ton at first, but when those savings add up month after month, you’re looking at hundreds of dollars each year staying in your pocket instead of floating away to energy companies.

But it’s not just about the small stuff—big changes can yield even bigger rewards. For instance, homeowners who invest in proper insulation can save anywhere from $200 to $600 a year on their energy bills, depending on their location and current insulation quality. And if you’re thinking of selling your home, consider this: homes with energy-efficient upgrades sell for about 3-5% more than their less efficient counterparts. Picture that extra cash in your pocket when you decide to move! It’s clear: being energy-conscious isn’t just good for the planet; it’s a solid, money-saving strategy that can really pay off in the long run.

Understanding the True Cost of Energy

When we talk about the true cost of energy, it goes beyond just the dollars and cents on your utility bill. It’s about comprehending the various factors that contribute to this expense, helping you make informed decisions about reducing energy consumption. Understanding these aspects can save you money while also benefiting the environment.

Key Points on the True Cost of Energy

- Energy Generation Sources: Renewable energy sources like wind and solar can significantly lower energy costs in the long run. A report found that the levelized cost of solar energy fell by nearly 89% between 2010 and 2020.

- Hidden Costs: A study revealed that for every $1 spent on energy, an additional $0.25 is often associated with societal costs related to environmental degradation, health implications, and climate change.

- Energy Efficiency Investments Yield Returns: Buildings that invest in energy-efficient technologies can realize savings of approximately 25% on their energy costs over time.

Comparative Breakdown of Energy Costs

| Energy Source | Levelized Cost (per MWh) | Environmental Impact (CO2 emissions) | Health Costs (annual estimate) |

|---|---|---|---|

| Coal | $60 | 820 g CO2/kWh | $100 billion |

| Natural Gas | $45 | 450 g CO2/kWh | $50 billion |

| Wind | $30 | 10 g CO2/kWh | $5 billion |

| Solar | $25 | 8 g CO2/kWh | $4 billion |

Real-World Examples

- A small municipality invested in solar panels for public buildings, reporting an annual energy cost reduction of 40%. They found that the initial investment paid for itself in just five years due to the significant drop in energy expenditures.

- A corporation that implemented energy-efficient lighting and HVAC systems noticed a 30% reduction in its energy costs. This move not only cut down their energy spending but also improved employee productivity and comfort.

Practical Implications for You

Understanding the true cost of energy can empower you to make choices that not only save money but also promote sustainability. Consider these actions:

- Evaluate Your Energy Provider: Research alternative suppliers that may offer renewable energy at a competitive rate.

- Invest in Energy Efficiency: Explore grants and tax incentives for home improvements that enhance energy efficiency, such as better insulation or high-efficiency appliances.

- Monitor Usage with Smart Technology: Implement smart thermostats or energy monitoring apps to track and reduce your energy consumption actively.

Actionable Insights

- Investigate local incentives for transitioning to renewable energy sources, as many communities offer financial assistance.

- Aim to reduce peak energy usage, as costs can surge during those times, leading to higher bills.

- Regularly review your energy consumption and adjust accordingly; setting goals, such as reducing energy use by 10% each year, can guide your efforts effectively.

The Financial Benefits of Energy Efficiency

When we discuss financial benefits, energy efficiency stands out as a vital strategy for saving money. By investing in energy-efficient technologies and practices, you not only reduce utility bills but can also enhance the value of your property.

Key Points About Financial Benefits

1. Immediate Savings: Energy-efficient appliances can reduce energy consumption by about 20% to 30%. This means more cash in your pocket every month rather than being spent on unnecessary energy costs.

2. Long-Term Investment: According to recent studies, appliances labeled with ENERGY STAR can save homeowners approximately $300 in energy bills over their lifetime. This upfront investment pays off significantly in the long run.

3. Tax Incentives: Many governments offer tax credits for energy-efficient home improvements, which can offset initial costs. For example, homeowners can receive tax deductions up to $500 for energy-efficient home upgrades.

4. Increased Property Value: A study has shown that homes with energy-efficient features sell for about 4-5% higher than typical homes. This increase can be appropriate for homebuyers who are increasingly prioritizing sustainability.

5. Job Creation in Energy Efficiency: The energy efficiency sector has been shown to create 1.3 million jobs in the past year alone, boosting the economy. More jobs contribute to a healthier economic environment, indirectly benefiting your financial stability.

Comparative Financial Benefits Table

| Category | Standard Appliance | ENERGY STAR Appliance | Savings Over Lifetime |

|---|---|---|---|

| Energy Consumption (kWh/year) | 1,200 | 800 | $300 |

| Average Annual Cost | $180 | $120 | $60 |

| Repair and Maintenance Cost | $50 | $30 | $20 |

Real-World Examples

- Home Renovation Case Study: A 2020 renovation of a mid-sized household included installing LED lighting, a high-efficiency furnace, and double-glazed windows. This property saw a 40% decrease in energy bills, translating to around $1,200 saved annually.

- Commercial Building Success: A large office building incorporated smart thermostats and upgraded insulation, resulting in energy savings of 30%. This led to approximately $50,000 in reduced energy costs per year, making it a worthwhile investment.

Practical Implications for You

By focusing on energy efficiency, you can start experiencing savings immediately. Consider the long-term benefits of various energy-efficient upgrades, which not only improve your finances but also add to the market value of your property.

Explore local incentive programs for energy-efficient upgrades, which can significantly lower your initial investment. Every small step, whether it’s swapping out a light bulb or investing in full appliance upgrades, adds up to remarkable savings over time.

Choose wisely and consult energy audits to determine the most beneficial upgrades for your unique situation. Engage with local contractors who specialize in energy efficiency to maximize your investments.

Actionable Advice

Evaluate your current energy consumptions. Simple adjustments like using programmable thermostats or sealing gaps can save you upwards of 10-15% on your energy bill annually. Start budgeting for energy-efficient systems and appliances, as investments made today will yield significant financial returns tomorrow.

Real-World Examples of Savings

When it comes to saving energy, seeing is believing. Real-world examples of savings demonstrate how energy conservation can lead to substantial financial benefits for households and businesses alike. From simple home improvements to larger, more strategic implementations, let’s explore some compelling instances of energy savings that could inspire you to take action.

Key Points on Real-World Savings

- Case Study: Office Building Upgrades

A mid-sized office in Seattle upgraded its lighting and HVAC systems, leading to a 40% reduction in energy consumption. This translated to annual savings of $30,000.

- Residential Solar Panels

A family in California installed solar panels, resulting in an average monthly utility bill drop of 60%. Over five years, they saved approximately $15,000, which is a significant return on their initial investment.

- Retail Store Optimization

A grocery store chain in Florida implemented energy-efficient refrigeration units. This change cut their energy costs by 25%, saving the chain $200,000 annually across multiple locations.

Comparative Savings Table

| Implementation Type | Initial Investment | Annual Savings | Estimated Payback Period |

|---|---|---|---|

| Office Lighting Upgrade | $50,000 | $30,000 | 1.67 years |

| Residential Solar Panels | $20,000 | $3,000 | 6.67 years |

| Energy-Efficient HVAC | $100,000 | $40,000 | 2.5 years |

| Grocery Store Refrigeration | $250,000 | $200,000 | 1.25 years |

Real-World Examples from Research

1. Hospital Energy Efficiency Program

A large hospital in Texas enacted an energy efficiency program, incorporating smart building technology. They realized a 35% decrease in energy use, saving the facility over $125,000 annually. This not only reduced operational costs but also improved patient comfort.

2. School District Initiatives

A school district in Ohio launched an energy-saving initiative involving retrofitting schools with energy-efficient lighting and optimizing heating systems. The project led to an overall reduction in energy bills by 20%, saving $1 million over five years.

3. Manufacturing Facility Improvements

A manufacturing plant in Michigan replaced old machinery with energy-efficient alternatives, resulting in a remarkable 50% decrease in energy usage. This switch saved the facility nearly $500,000 per year.

Practical Implications for Readers

Understanding these examples shows that energy savings are achievable and can lead to significant financial benefits. Whether you’re a homeowner looking to invest in solar panels or a business leader considering a comprehensive energy audit, the numbers speak for themselves. Each dollar saved can be reinvested into improving your home or business.

Consider actions you can take today:

- Evaluate your current energy usage and identify areas for improvement.

- Explore grants and incentives for energy-efficient upgrades in your local area.

- Collaborate with energy consultants to devise a savings plan tailored to your specific needs.

Specific Facts or Actionable Advice

- Did you know that even small changes, such as switching to LED bulbs, can save you around $75 a year? Multiply that across an entire business or community, and the savings skyrocket.

- Investing in more efficient appliances can yield energy savings of 10-50%, depending on the appliance and usage.

- Actionable steps like regular maintenance of HVAC systems can enhance efficiency and lead to approximately 15% annual savings.

Dive into energy-saving strategies, and you may find that your smart investments today bring significant financial returns in the future!

Analyzing Energy Consumption Statistics

Understanding energy consumption statistics is crucial to making informed decisions about energy savings and cost reduction. By analyzing various datasets, you can pinpoint where energy is being used most and identify opportunities for improvement. Let’s dive into some relevant statistics that provide insights into energy consumption patterns across different sectors.

Key Energy Consumption Statistics

• Residential Energy Use: According to data from the U.S. Energy Information Administration (EIA), residential households in the U.S. consumed approximately 20% of total U.S. energy in 2020. This sector is significant because it reveals patterns of energy consumption that directly affect monthly utility bills.

• Air Conditioning Usage: Nearly 90% of U.S. households relied on air conditioning in 2020. This high percentage indicates potential for substantial savings through energy-efficient upgrades or alternative cooling methods during warmer months.

• Energy Expenditure: The average U.S. household spent about $2,060 on energy in 2020, according to the Residential Energy Consumption Survey. Understanding such expenditures can help you evaluate the effectiveness of energy-saving measures.

• Commercial Sector Trends: Commercial buildings accounted for approximately 18% of total U.S. energy consumption in 2020. By analyzing this data, businesses can implement energy-saving initiatives that directly reduce operational costs.

Comparative Table of Energy Consumption

| Sector | Percentage of Total Energy Consumption | Average Energy Expenditure |

|---|---|---|

| Residential | 20% | $2,060 |

| Commercial Buildings | 18% | N/A |

| Manufacturing | 29% | N/A |

Real-World Examples

A recent survey on energy consumption patterns revealed that households using energy-efficient appliances reduced their energy consumption by 30% compared to those using standard appliances. This demonstrates the direct impact of initial investments in energy-efficient technology on long-term savings. Additionally, a case study revealed that businesses adopting smart building technology could reduce energy consumption by up to 25%, leading to significant financial benefits.

Practical Implications for Readers

By analyzing energy consumption statistics, you can identify areas where changes can be made to save money effectively. Here are some actionable insights:

- Monitor Your Usage: Use tools or apps that monitor household energy consumption in real time. This can help you spot trends and identify peak usage times.

- Invest in Energy-Efficient Systems: According to the data, energy-efficient appliances can lead to substantial savings. Investing upfront can pay off in lower utility bills over time.

- Explore Smart Technology: For commercial spaces, integrating smart technology to control lighting and heating can lead to measurable reductions in energy consumption.

Specific Facts and Advice

- Consider exploring the various datasets provided by the EIA for insights specific to your region and energy consumption patterns.

- With nearly 90% of U.S. households using air conditioning, you might analyze your cooling strategy, potentially opting for smarter control systems or alternative cooling solutions.

- Be proactive in seeking energy efficiency retrofits; even moderate changes can lead to notable savings, as demonstrated in case studies across residential and commercial sectors.

Investing in Energy-Saving Technology

Investing in energy-saving technology can be a smart move for your wallet and the environment. With the advent of innovative solutions, households and businesses alike can significantly cut down on energy consumption while saving money over time. Let’s explore how these investments can pay off in tangible ways.

Key Points on Energy-Saving Technology

1. Enhanced Appliance Standards: Recent updates to appliance standards will lead to energy savings and lower utility bills. As energy intensity in residential buildings is projected to decline by 16-18% from 2020 to 2035, upgrading to compliant appliances can help you benefit from these efficiencies.

2. Increased Clean Electricity Generation: The share of clean electricity generation is set to rise dramatically, reaching about 71-79% by 2030 and 79-88% by 2035. Investing in technologies that harness this clean energy can reduce overall energy costs.

3. Future-Proofing Investments: The anticipated adoption of clean vehicles, particularly in freight where sales are expected to surge by 33-39 times by 2035, indicates a shift toward sustainable practices. Investing now in renewable energy technologies can yield long-term financial benefits as fossil fuel alternatives become more mainstream.

4. Industrial Sector Reductions: Energy-related CO2 emissions in the industrial sector are projected to decline by 28-41% below 2005 levels by 2035. Investing in energy-efficient industrial technologies not only supports this trend but also enhances operational efficiencies and reduces costs.

| Energy-Saving Technology | Projected Savings/Reductions |

|---|---|

| Residential Appliance Upgrades | 16-18% decline in energy intensity |

| Clean Electricity Generation | 71-88% by 2035 |

| Clean Freight Vehicles Sales | 33-39x increase by 2035 |

| Industrial CO2 Emission Reductions | 28-41% reduction by 2035 |

Real-World Examples

- Residential Impact: Homeowners retrofitting their properties with energy-efficient appliances can expect to save money on utility bills, with many reporting reductions of 20-30%. This change not only enhances comfort but also aligns with the projected drop in residential energy intensity.

- Commercial Applications: Businesses adopting clean energy solutions, like solar panels or energy-efficient HVAC systems, have reported energy savings between 30-60%. The shift towards clean energy can lead to reductions in operational costs that directly impact the bottom line.

Practical Implications for You

- As you consider investing in energy-saving technologies, remember that the initial cost may be offset by long-term savings. Look for rebates and incentives offered through local or federal programs designed to promote energy efficiency.

- Stay informed about emerging trends in energy technologies. By proactively investing in systems and appliances that align with projected clean energy standards, you position yourself to save significantly over time.

- Monitor your energy use consistently after upgrading or implementing new technologies. This way, you can see firsthand the tangible benefits of your investments, making it easier to justify and plan for future energy-saving upgrades.

Investing in energy-saving technology is not just an environmental choice—it’s a financial strategy that can yield significant returns. Keep an eye on advancements, assess your needs, and make informed choices that align with both your financial goals and environmental responsibilities.

Long-Term Advantages of Reduced Utility Bills

Saving energy not only lowers your immediate expenses but also provides remarkable long-term advantages, especially in terms of utility bills. A significant reduction in these costs can accumulate over the years, freeing up funds for other essential areas of your life.

Key Financial Benefits of Lower Utility Bills

1. Higher Property Value: Homeowners who implement energy-efficient upgrades frequently see an increase in their property value. Homes with lower utility bills are appealing to buyers, which can elevate resale prices.

2. Long-term Savings: For Americans, the 2008 data showed that efforts to save energy resulted in approximately $19 billion in reduced utility bills. This translates to an average household saving around $1,500 over several years simply by adhering to energy-saving practices.

3. Offset Costs of Improvements: The upfront costs of energy-efficient upgrades, like installing solar panels or energy-efficient windows, may reflect in significantly lower utility bills over time. You may recover these costs within a few years through ongoing savings.

4. Stability Against Rising Energy Costs: Energy prices tend to fluctuate. By reducing your consumption and establishing energy efficiency, you insulate yourself from these unpredictable spikes in utility costs over the years.

5. Increased Use of Renewable Energy: Adopting renewable energy sources minimizes reliance on the traditional grid, leading to dramatic decreases in utility bills. For instance, a solar panel system can eventually save homeowners upwards of $20,000 over its lifetime.

Comparative Analysis of Energy Savings

| Energy Efficiency Measure | Average Annual Savings | Estimated Payback Period |

|---|---|---|

| LED Lighting Upgrades | $150 | 1-2 years |

| Smart Thermostats | $100 | 1-3 years |

| High-Efficiency Appliances | $200 | 3-5 years |

| Solar Panel Installation | $1,500 | 5-7 years |

Real-World Examples of Long-Term Savings

- Case Study of a Family in Florida: A family installed energy-efficient windows and doors, realizing a reduction of nearly 30% in their energy bills. Over ten years, they saved approximately $15,000, highlighting how targeted improvements can lead to large-scale savings.

- Community-wide Solar Initiative: In a mid-sized town in California, a group of homeowners switched to solar energy. After a collective setup cost, they noticed monthly bills dipping by 60%, leading to an average household saving of $3,000 annually compared to traditional energy sources.

Practical Implications for Reducing Utility Bills

1. Invest in Energy Audits: Begin by scheduling an energy audit to identify potential areas for savings in your home. This assessment can yield insights on where to focus upgrades.

2. Consider Long-Term Financing Options: If upfront costs for energy efficiency upgrades seem daunting, look into financing options that are designed to help homeowners spread out costs and begin saving immediately.

3. Education and Resources: Utilize available resources on energy-saving techniques, which often provide DIY solutions that can result in significant savings without large expenditures.

4. Stay Proactive with Maintenance: Regularly maintain heating and cooling systems to ensure efficiency. Small actions, like replacing filters and sealing leaks, can amplify long-term savings.

5. Market and Resale Considerations: If you plan to sell, emphasize your energy-efficient upgrades to potential buyers. The long-term savings you’ve enjoyed are marketable benefits, making your property more attractive.

By adopting energy-efficient measures and remaining vigilant about your utility expenses, you can capitalize on substantial long-term savings that go beyond just immediate cost cuts.

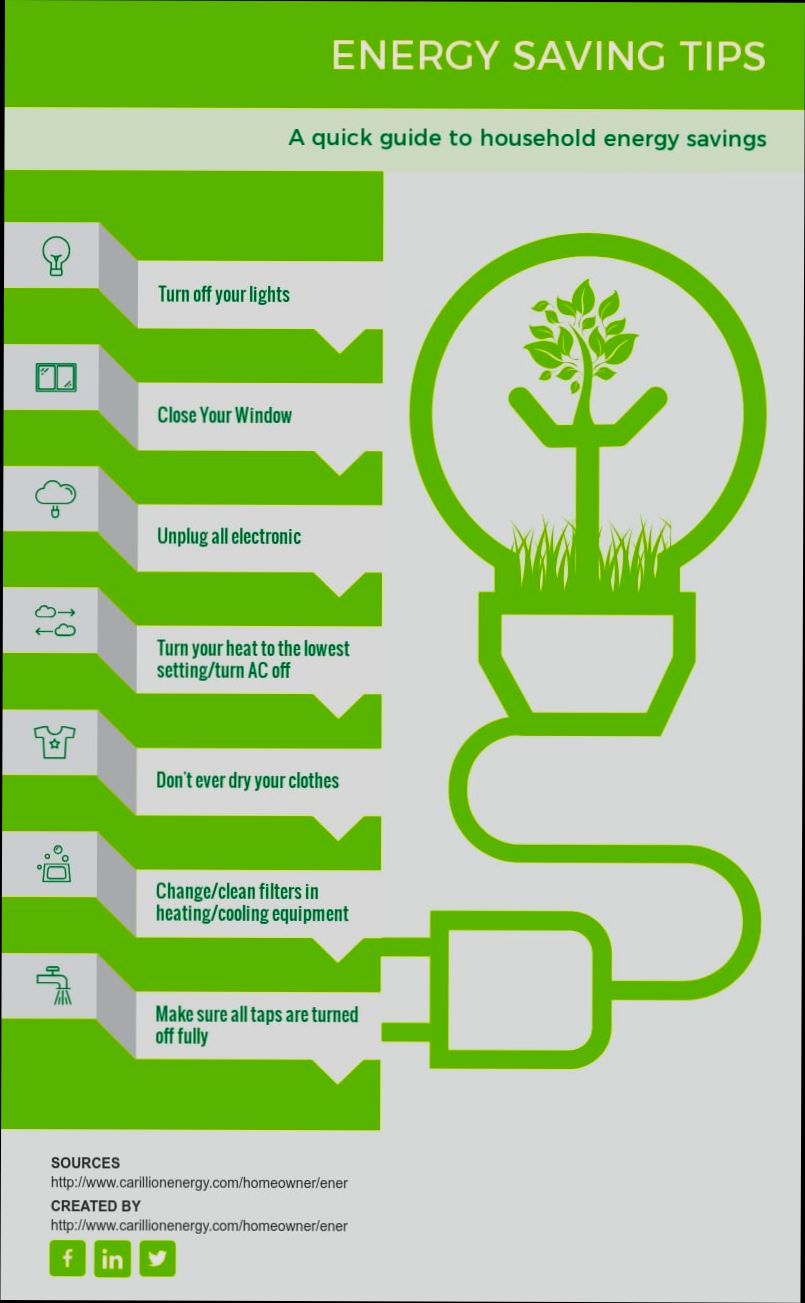

Behavioral Changes That Contribute to Savings

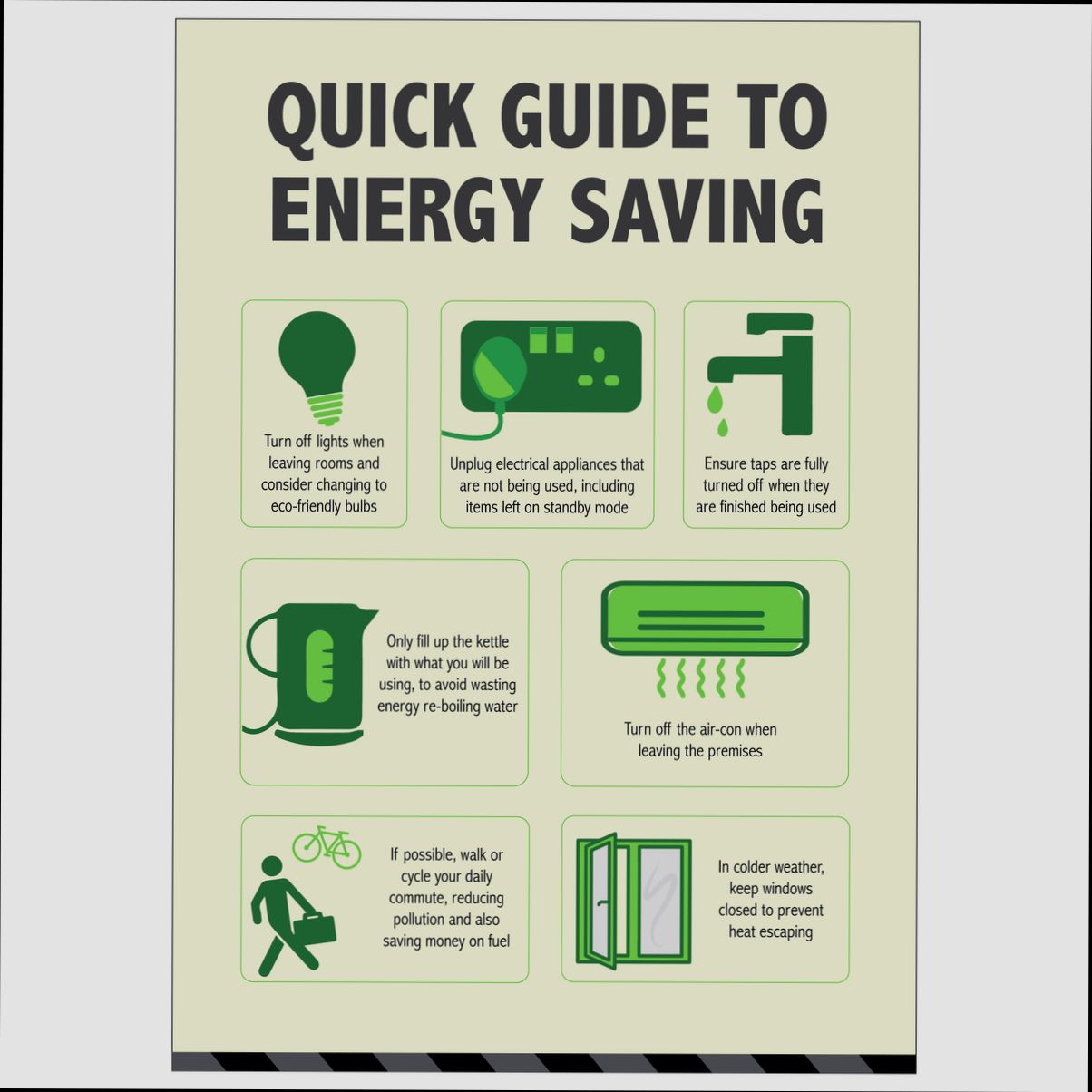

Changing our daily habits can significantly impact our energy consumption and overall savings. By adopting specific behaviors, we can reduce energy waste and lower our utility bills effectively. Let’s explore some key behavioral changes that can lead to noticeable savings.

Key Behavioral Changes

1. Raising Awareness: Simply being mindful of energy usage can lead to savings. Studies indicate that people who track their energy consumption can reduce usage by up to 10%.

2. Setting Timers: Using timers for lights and appliances can help minimize unnecessary usage. Setting a timer to switch off your lights or appliances 30 minutes before you usually do can result in about 15% less energy use.

3. Powering Down: Forming the habit of unplugging devices when they are not in use—like chargers, TVs, and computers—can save families an average of $100 annually. This behavior reduces what is known as “phantom load” or energy that appliances draw even when turned off.

4. Involving the Family: Engaging family members in energy-saving practices boosts overall efforts. Households that have family discussions about energy usage report up to 20% lower energy bills.

5. Using Natural Light: Maximizing natural daylight instead of relying on artificial lighting can reduce lighting costs by 15-20%. This simple change requires no investment but can make a significant difference.

| Behavior Change | Potential Savings (%) | Annual Savings ($) |

|---|---|---|

| Tracking Energy Consumption | 10% | $120 |

| Setting Timers for Appliances | 15% | $180 |

| Unplugging Devices | 10% | $100 |

| Family Discussions About Usage | 20% | $240 |

| Utilizing Natural Light | 20% | $240 |

Real-World Examples

- In a community initiative, a group of families in a small town began tracking their energy consumption together. By sharing tips and encouraging each other, they collectively achieved a 15% reduction in their energy bills over six months. This change was largely attributed to increased awareness and shared commitment.

- A family in Florida implemented a timer system for their outdoor lights based on sunset timings. This small adjustment resulted in a 12% reduction in their monthly bill, demonstrating that even minor changes can yield noteworthy savings.

Practical Implications

You can start implementing these behavioral changes today to reap the benefits of energy savings. Track your energy use by checking your utility bills or using monitoring tools. Set timers for your everyday appliances, and involve your household in discussions about energy efficiency. By making these conscious changes, not only do you lower your expenses, but you also contribute to a more sustainable environment.

- Consider investing in a power strip that can easily be turned off to eliminate phantom loads.

- Create a family energy challenge to encourage everyone to adopt sustainable behaviors and share successes.

By being proactive about energy-saving habits, you position yourself to enjoy financial benefits alongside a reduced environmental footprint.