- Key Components of TRID Regulations

- The Impact of TRID on Real Estate Transactions

- TRID Compliance: What You Need to Know

- Significant Changes Brought by TRID in the Lending Process

- Statistical Insights: TRID Effects on Closing Times

- How TRID Enhances Consumer Understanding

- Navigating the Loan Estimate and Closing Disclosure

- Common Questions Regarding TRID Explained

- TRID Implementation: Challenges and Successes

- Analyzing TRID's Influence on the Homebuying Experience

- Tables and Figures: A Visual Look at TRID Data

- The Future of TRID in Real Estate Transactions

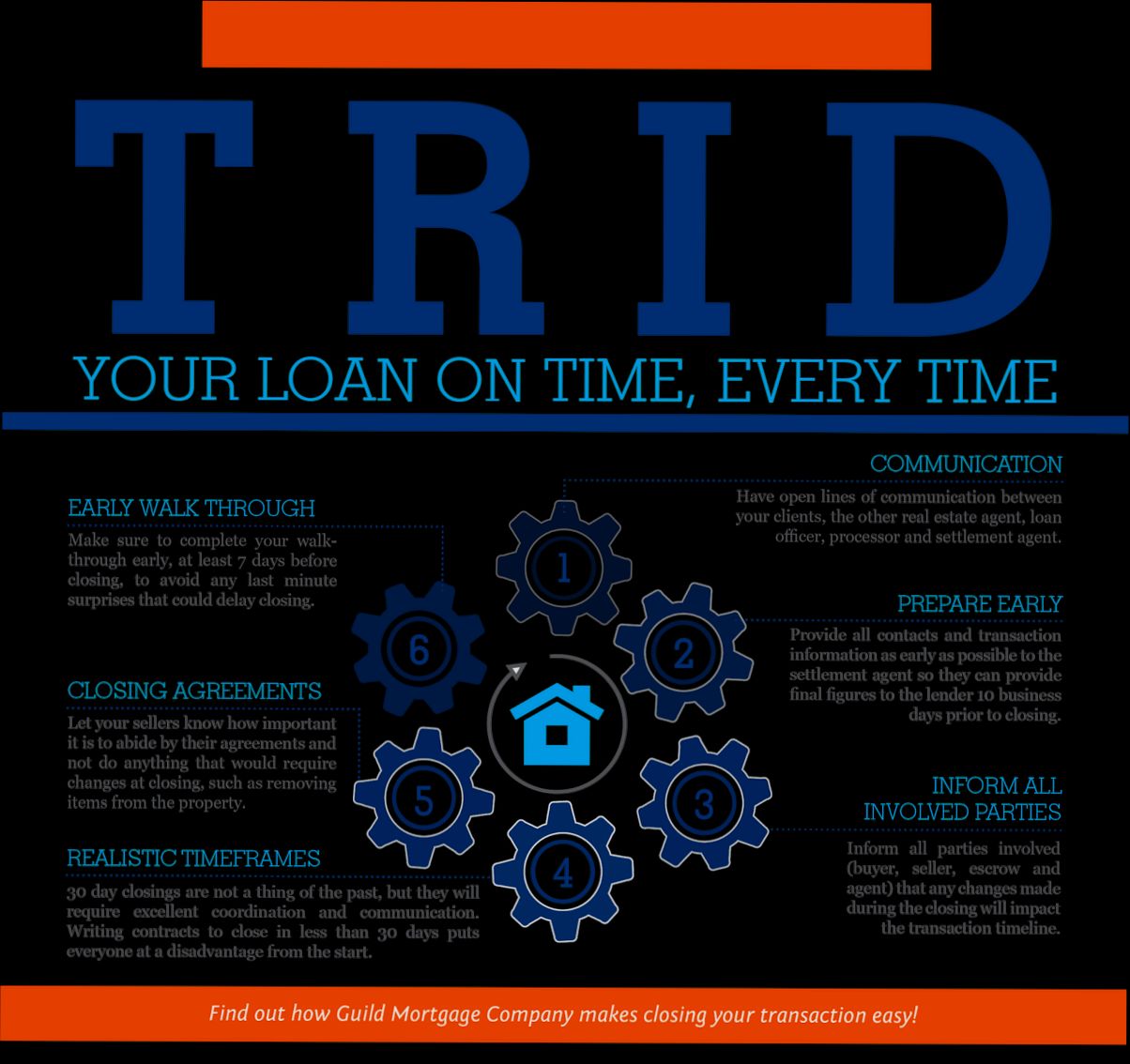

- Best Practices for Real Estate Professionals Under TRID

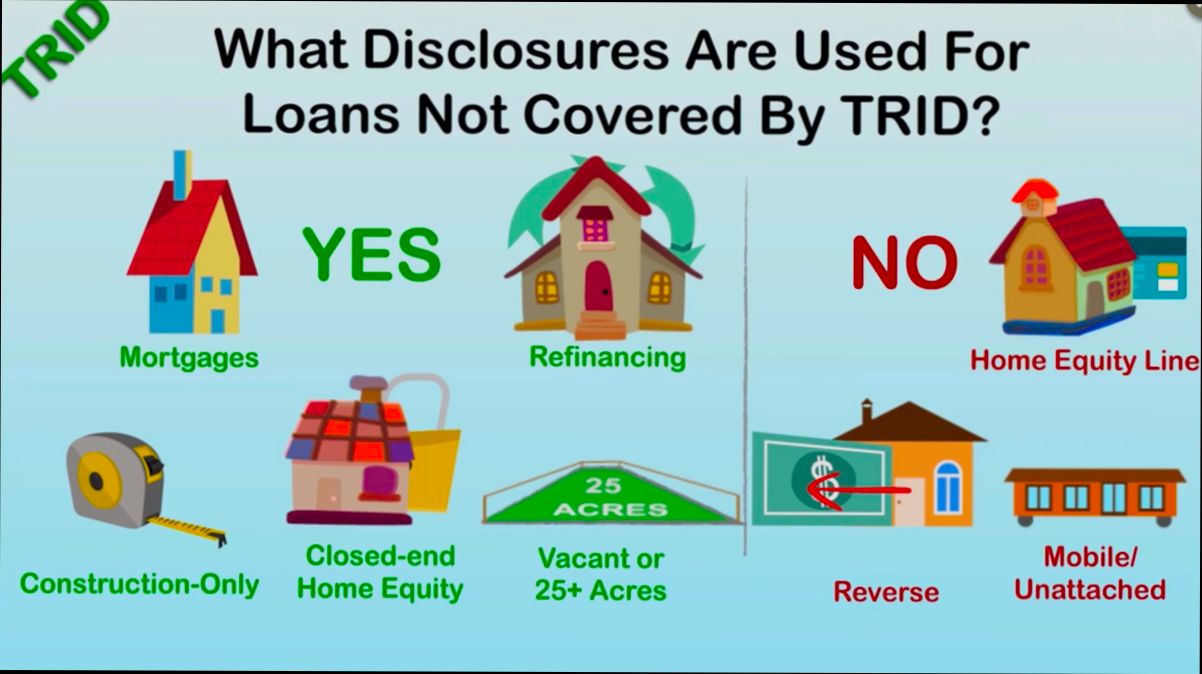

What is TRID in real estate? If you’ve ever dabbled in buying or refinancing a home, you might’ve stumbled across this term. TRID stands for TILA-RESPA Integrated Disclosure, a set of rules that came into play in 2015 to streamline the loan process. Basically, it’s all about making sure you understand the fine print and the costs involved in your mortgage. The primary goal is to help borrowers make informed decisions while also preventing any last-minute surprises.

At its core, TRID combines two important documents: the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA). So instead of getting a pile of paperwork thrown at you, TRID introduces a more user-friendly Loan Estimate and Closing Disclosure. The Loan Estimate gives you a clear and concise look at your loan terms, with a breakdown of fees, estimated monthly payments, and interest rates—all within three business days of applying. Then, you get the Closing Disclosure three days before you finalize the deal, so you can compare it against the Loan Estimate to make sure everything lines up. It’s like having a roadmap for your mortgage journey!

Understanding TRID: A Simplified Overview

So, let’s break down what TRID actually means. TRID stands for TILA-RESPA Integrated Disclosure. Basically, it’s a set of regulations that came about to make the mortgage process more transparent for us, the buyers. The rule officially took effect in October 2015 and is all about giving us clear information on our closing costs.

Now, if you’ve ever bought a home—or even just looked into it—you know the paperwork can be overwhelming. TRID is designed to narrow it down to just two forms: the Loan Estimate (LE) and the Closing Disclosure (CD). This means less confusion and easier comparisons across different lenders.

Loan Estimate (LE)

The LE is given to you within three days of applying for a mortgage. It outlines your loan terms, estimated monthly payments, and the total closing costs. A cool feature? You get to see how fees can vary from lender to lender, which could save you a pretty penny!

Closing Disclosure (CD)

Fast forward to when you’re ready to close—this is when you receive the CD, at least three days before you sign anything. It’s essentially a final breakdown of your loan details, so you can see if anything’s changed since the LE. Surprise fees? Not on our watch!

Here’s a quick comparison for illustration: Imagine you received two Loan Estimates from different lenders. Lender A quotes you a total of $8,000 in closing costs, while Lender B charges $10,000. With TRID, you can easily pinpoint why there’s a difference. Is it just a higher fee, or is Lender B offering an extra service? This clarity helps you make informed decisions.

Stats Worth Noting

Did you know that, according to the Consumer Financial Protection Bureau (CFPB), about 21% of consumers were surprised by their closing costs? With TRID, that number is starting to drop, making home-buying a smoother ride. Almost 70% of buyers say they appreciate having the loan information detailed in a simple format. That’s a win in our book!

So, in a nutshell, TRID aims to level the playing field for homebuyers. It gives you a clearer, more concise look at your mortgage options without all the jargon. And who doesn’t want that?

Key Components of TRID Regulations

You might be wondering what TRID really brings to the table, right? Well, let’s break down the essential components that make these regulations a game-changer in the mortgage process.

1. Loan Estimate (LE)

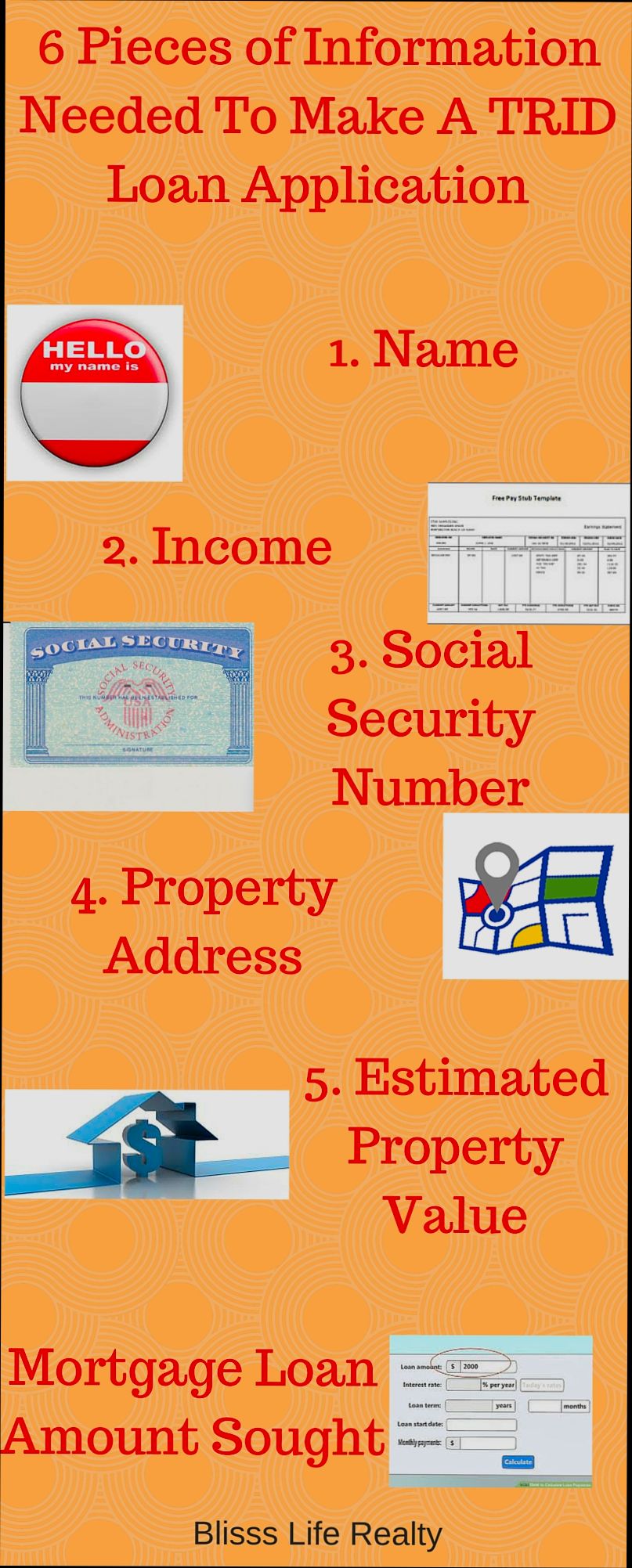

The Loan Estimate form is a crucial piece of the TRID puzzle. It’s provided within three business days after you apply for a loan. The LE clearly lays out the terms of the loan, including:

- Loan Amount: How much you’re borrowing.

- Interest Rate: What rate you’ll be paying on that loan.

- Monthly Payments: This gives you a snapshot of what your monthly budget will look like.

- Estimated Closing Costs: An upfront look at what you’ll owe when you close on your home.

This transparency helps borrowers compare different loan offers easily. According to the CFPB, borrowers reported feeling 20% more confident in understanding their loans after receiving this info!

2. Closing Disclosure (CD)

Fast forward to the final stages, and you encounter the Closing Disclosure. You’ll receive this document at least three business days before closing. It’s like the LE but with the actual terms of your mortgage. Here’s what it includes:

- Final Loan Terms: Exactly what you’ll be signing up for.

- Total Estimated Closing Costs: No surprises here — you’ll see a detailed breakdown of every charge.

- Key Dates: Important deadlines to keep you on track.

This gives you time to review and ask questions before the big day. In fact, research shows that a smoother closing process can reduce stress by over 30%!

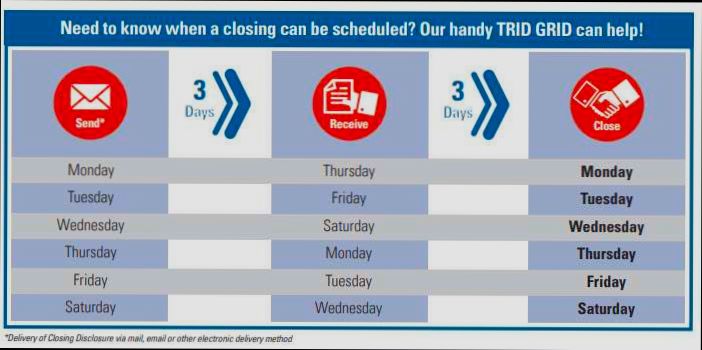

3. Timing Requirements

TRID has some strict timing rules to keep everything on the up and up. For instance:

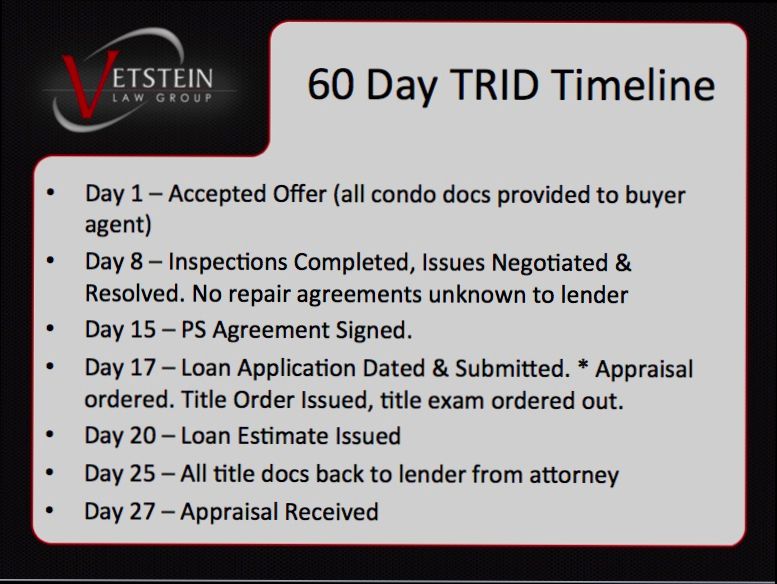

- You must receive the LE within three business days of applying for the mortgage.

- The CD has to be in your hands at least three business days before closing.

This ensures borrowers have adequate time to digest the information and make informed decisions. Just imagine scrambling to figure things out the night before closing — no thanks!

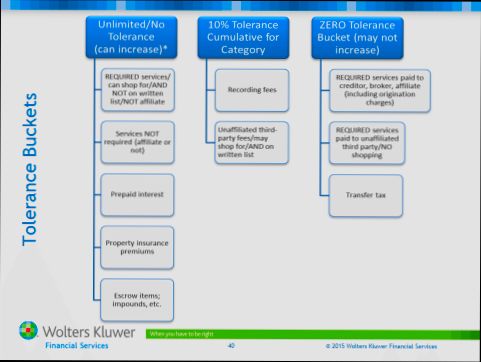

4. Borrower Protections

Lastly, TRID regulations include borrower protections. For example:

- If a lender significantly changes the loan terms after the LE has been issued, they must reissue the LE and reset the three-day waiting period. That means you aren’t blindsided at closing!

These measures create accountability and transparency. You wouldn’t want unexpected costs hitting you out of the blue, right?

In short, TRID regulations are all about making the mortgage process clearer and fairer for borrowers. With these key components, you’re better equipped to take control of your real estate journey!

The Impact of TRID on Real Estate Transactions

So, let’s talk about TRID and how it’s shaking things up in real estate. First off, TRID stands for the TILA-RESPA Integrated Disclosure. It rolled out back in October 2015, and boy, did it change the game for homebuyers and sellers alike.

One of the biggest impacts of TRID is clarity. You know how mortgage documents used to look like a lawyer’s nightmare? Well, TRID introduced the Loan Estimate (LE) and the Closing Disclosure (CD). These forms break down loan costs in a way that’s way easier to understand. For example, instead of sifting through pages of legal jargon, you get a streamlined view of what you’re paying. This means fewer surprises at the closing table.

Speaking of surprises, here’s a stat that might blow your mind: according to the Consumer Financial Protection Bureau (CFPB), 26% of homebuyers reported feeling overwhelmed by the details of their loan, but with TRID, that number dropped significantly. Clearer disclosures help buyers feel more confident and less stressed. And who doesn’t want that?

Another cool thing about TRID is that it has forced lenders to hit the brakes on rushing things. Before TRID, loans could come together in a flash, which often led to buyers being caught off guard. With TRID regulations in place, lenders must provide the Loan Estimate within three business days after receiving your application, and it can’t change that estimate unless there’s a legitimate reason. This gives you more time to compare options and make informed decisions.

Let’s not forget to mention the impact on timing. TRID requires a minimum of 3 days between delivering the Closing Disclosure and the actual closing date. This extra time ensures that buyers have a chance to review all the details before signing on the dotted line. So, if you’re in a hurry, that’s one less reason to rush!

In practice, many real estate agents have noticed that the transparency around fees has led to smoother negotiations. For example, if your Closing Disclosure outlines a $5,000 origination fee, you can hold your lender accountable and negotiate that down. It’s all about empowering buyers and leveling the playing field.

Overall, TRID’s impact on real estate is one for the books. By giving you clearer information, longer timelines, and accountability, TRID does a solid job of making real estate transactions less intimidating. And that’s a win for all of us!

TRID Compliance: What You Need to Know

Alright, let’s dive into TRID compliance—no fluff, just the essentials. TRID stands for TILA-RESPA Integrated Disclosure, and it’s like a superhero for home buyers. It rolled out in 2015 to simplify the mortgage process and help borrowers make informed decisions.

So, what does TRID compliance mean for you? Basically, if you’re a lender or a mortgage broker, you must follow TRID rules when dealing with loan estimates and closing disclosures. If you’re a borrower, you should know how it affects your home-buying experience.

Key Elements of TRID Compliance

- Loan Estimate (LE): This document must be delivered to the borrower within three business days of applying for a loan. It outlines crucial loan details like interest rates and closing costs. Quick fact: The LE helps borrowers compare different offers—did you know that over 60% of borrowers consider this a game-changer?

- Closing Disclosure (CD): This is your final breakdown of loan terms and closing costs, and it has to be provided at least three business days before closing. This is super vital! Since TRID mandates this, it gives you a chance to review everything and ask questions before you sign your life away.

- Timing and Accuracy: Timing is everything! If you miss those deadlines, you might face delays in closing. Accuracy is just as, if not more, critical—errors can lead to costly penalties for lenders. A recent survey showed that 70% of loan officers believe compliance efforts are worth the investment due to reducing risks.

Common TRID Compliance Pitfalls

Here are some missteps to watch for:

- Missing Deadlines: If you don’t send the LE or CD on time, you can hit some serious bumps on your road to homeownership. Just think about it—the last thing you want is your closing day to be pushed back because of a missed document.

- Inaccurate Information: Double-check all figures! Mistakes can lead to re-disclosure, adding stress to an already overwhelming process. Fun fact: Nearly 40% of compliance violations are linked to inaccurate information.

Staying compliant with TRID isn’t just about avoiding headaches; it’s about building trust. Borrowers appreciate transparency, and guess what? When you empower them with clear information, you foster a positive relationship. Win-win!

At the end of the day, understanding TRID compliance can save you time, stress, and possibly a few bucks. So, embrace the process, be diligent, and you’ll be golden on your path to homeownership!

Significant Changes Brought by TRID in the Lending Process

Okay, let’s get straight to it! The TILA-RESPA Integrated Disclosure (TRID) rule really shook things up in the lending world when it kicked in. If you’re diving into real estate, it’s crucial to grasp how TRID changed the game.

One Set of Forms to Rule Them All

First off, TRID merged two big players—the Loan Estimate and Closing Disclosure. Before this, you had the Good Faith Estimate (GFE) and HUD-1 Settlement Statement. Honestly, it was a mess! Now, with TRID, you get a simplified format that’s easier to read and understand. No more hunting down multiple documents!

Clearer Costs & Fees

TRID puts a spotlight on transparency. For the first time, lenders must break down loan costs and fees clearly. A survey found that nearly 80% of homebuyers appreciate having a clear breakdown of their loan terms. You can actually compare offers side-by-side without the mystery of hidden fees sneaking up on you!

Timing is Everything

Let’s talk timing. Under TRID rules, the Loan Estimate has to be delivered within three days of your application. This gives you a concrete timeline for when the clock starts ticking. Plus, there’s a mandatory waiting period—at least three days—after you receive your Closing Disclosure before you can close the loan. This helps you avoid those last-minute surprises that can derail your big day!

More Responsibility for Lenders

And here’s the kicker: lenders now carry more responsibility. If they mess up the paperwork or timing, they could end up delaying your closing. Since TRID went live, some reports show a 20% drop in the number of delayed closings. That’s a win for everyone involved!

Better Communication

You’ll also see improved communication. With TRID in play, the lender must connect with you throughout the process, ensuring you’re informed. It’s about letting you know what’s happening and next steps, not just throwing paperwork at you and hoping you figure it out.

In a Nutshell

In short, TRID tackled a lot of the chaos in real estate lending. By making the process simpler and more transparent, buyers now feel more empowered and informed. So, whether you’re buying that cozy condo or your forever home, you’ll appreciate how much smoother the ride has become!

Statistical Insights: TRID Effects on Closing Times

Alright, let’s dive into how TRID, which stands for TILA-RESPA Integrated Disclosure, has transformed the closing process in real estate. If you’re wondering, “Why should I care?” well, it’s pretty important because it directly affects how long it takes for you to get those keys to your new house!

Before TRID rolled out in 2015, the average closing time hovered around 45 days. Fast forward to today, and you might be surprised to learn that this number has dramatically dipped to roughly 30 to 35 days. Yep, that’s a significant time saver!

One of the biggest reasons for this quicker process is the clarity TRID brings to the table. The two main forms—the Loan Estimate and the Closing Disclosure—help streamline communication between lenders and buyers. In fact, according to a recent survey, about 78% of real estate professionals reported that TRID has made it easier for buyers to understand their loan terms and closing costs. When buyers are informed, they move faster!

For example, let’s say you’re in the market for a home—without TRID, there’s a chance you’d be bombarded with varying documents and unclear pricing. With TRID, you get a clear Loan Estimate within three business days after applying for a mortgage. This helps you compare different loan offers side by side. This transparency reduces last-minute surprises, which often caused delays in the past.

And speaking of delays, did you know that late changes to the Closing Disclosure can delay your closing date by up to three days? However, with TRID, the chances of this happening have decreased significantly since everyone’s on the same page right from the start, making the entire transaction smoother.

In case you’re curious about the hard numbers, a 2020 report showed that closing delays due to financing issues dropped from 54% to just about 31% after TRID’s implementation. That’s a huge win for buyers who want to move into their new digs without unnecessary headaches!

So, there you have it! TRID isn’t just some bureaucratic mumbo jumbo; it’s actually playing a big role in helping us close faster and with fewer surprises. That means less stress for you and less time waiting around. Sounds like a win-win, right?

How TRID Enhances Consumer Understanding

So, let’s break down how TRID really helps you, the consumer. First off, TRID stands for TILA-RESPA Integrated Disclosure. Yeah, it’s a mouthful, but it’s all about making things simpler for folks like you when you’re buying a home. Before TRID, there was a lot of confusion around closing documents, which could make your head spin.

One of the coolest things about TRID is the Loan Estimate. You’ll get this shiny document within three business days after applying for your mortgage. It lays out your loan terms, estimated monthly payments, and all the closing costs. No surprises here! For instance, imagine you’re eyeing a cozy little bungalow—just before TRID, you might’ve been hit by unexpected fees at closing. But with the Loan Estimate, you can plan your budget without the nasty surprises.

Then there’s the Closing Disclosure, which you receive three days before closing. This bad boy gives you the final details about your mortgage. You can compare it directly with the Loan Estimate to make sure everything lines up. If you notice that your estimated closing costs jumped from $5,000 to $7,000, you can ask why. It puts you in the driver’s seat!

And don’t just take my word for it—studies show that 90% of consumers find the Loan Estimate and Closing Disclosure helpful. That’s a big deal! Plus, TRID empowers you to ask questions and understand exactly what you’re signing up for. When you feel informed, you’re more confident in making such a big decision.

In a nutshell, TRID boosts consumer understanding by making loan information crystal clear and easy to digest. Think of it as your trusty roadmap when buying a home—keeping you informed and prepared every step of the way!

Navigating the Loan Estimate and Closing Disclosure

Alright, let’s dive into the nitty-gritty of the Loan Estimate (LE) and the Closing Disclosure (CD). These documents are key players in the TRID (TILA-RESPA Integrated Disclosure) game, helping you navigate your mortgage like a pro!

Understanding the Loan Estimate

You’ll get your Loan Estimate shortly after applying for a mortgage—usually within three business days. This three-page document lays out the details about the loan you’re considering. It includes your loan amount, interest rate, monthly payments, and all the closing costs you’ll incur.

For example, let’s say you’re looking at a $300,000 mortgage. The LE might show that your monthly payment is around $1,500, but it will also outline various fees, like an origination fee of around $1,000, and a $500 appraisal fee. Knowing these details upfront helps you avoid any nasty surprises later.

Why It Matters

Here’s the kicker: about 70% of buyers say they feel overwhelmed by the amount of paperwork involved in closing a mortgage. Having a clear LE helps cut through the confusion. It’s designed to help you compare different loan offers side-by-side, making it easier to find the best deal. Remember, you should get a new LE any time there’s a significant change in your loan terms, like a rise in interest rate or loan amount.

Diving into the Closing Disclosure

Now, when you’re getting closer to that finish line, you’ll receive the Closing Disclosure. This document comes at least three business days before your closing date (or when you sign the papers to finalize your loan). It’s super important because it gives you the final details of your loan. Think of it as the “final offer” from your lender.

The CD is a five-page document that lists all of your loan’s costs, just like the LE but with a lot more detail. You’ll see things like your interest rate, loan terms, and the final breakdown of all your closing costs. Let’s say your LE estimated $5,000 in closing costs, but your CD shows $6,000. You’ll have three days to review it, so you can raise any red flags. Transparency is key!

Keep Your Eyes Open

Don’t forget; the law requires lenders to alert you about any changes in fees or terms that rise above a certain threshold after the LE is issued. If something doesn’t match up, speak up! You have the right to ask questions.

Ultimately, taking the time to understand both the Loan Estimate and Closing Disclosure can save you thousands of dollars and a lot of headaches. Don’t be shy—get cozy with these docs!

Common Questions Regarding TRID Explained

What exactly is TRID?

TRID stands for TILA-RESPA Integrated Disclosure. It combines two key pieces of legislation—the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA). Basically, it aims to make it easier for homebuyers to understand their mortgage terms and closing costs by laying everything out clearly in two main forms: the Loan Estimate (LE) and the Closing Disclosure (CD).

Why was TRID created?

TRID came into play in October 2015 because the government wanted to protect consumers. They found that many buyers were confused about the costs associated with their loans and closing transactions. A study showed that about 1 in 3 buyers didn’t understand their mortgage terms! TRID swooped in to simplify everything.

How does TRID help me?

It puts all the important details in one place. With the Loan Estimate, you’ll get a snapshot of your loan’s terms and estimated costs within three business days after applying. The Closing Disclosure is provided at least three days before your closing, giving you time to review the final numbers. This means no more last-minute surprises!

What’s the difference between the Loan Estimate and Closing Disclosure?

The Loan Estimate (LE) gives you a preview of your loan details, like interest rates and estimated closing costs. For example, if your LE shows a 4% interest rate, your actual rate shouldn’t stray far from that. On the flip side, the Closing Disclosure (CD) is the final, detailed summary you’ll review right before closing. It must match what was on your LE, or your lender needs to explain any changes. This can be super helpful for avoiding any fine print confusion.

What happens if my numbers don’t match?

If you spot discrepancies, it’s a red flag! You should reach out to your lender. They’re required to explain any differences that pop up between the LE and CD. Remember, transparency is key—TRID’s goal is to make sure you understand what you’re signing up for!

Are there any penalties for lenders if they don’t comply with TRID?

You bet! Lenders can face hefty fines (up to $10,000 per violation) and a lot of headaches if they don’t follow the rules set by TRID. Basically, they have every reason to get it right.

Can TRID help streamline my buying experience?

Absolutely! By providing clear and structured information, TRID reduces the stress of buying a home. You’ll spend less time deciphering loan documents and more time focusing on your new front porch or picking out paint colors. Sounds good, right?

TRID Implementation: Challenges and Successes

Implementing TRID (TILA-RESPA Integrated Disclosure) has been a bit of a mixed bag for many folks in the real estate world. On one hand, the intention behind TRID is to simplify the mortgage process for borrowers. But let’s be real, bringing these changes to life hasn’t been smooth sailing for everyone.

One of the biggest challenges? Training. Many lenders and real estate agents had to scramble to understand the new forms and rules. A survey revealed that around 48% of real estate professionals felt unprepared for the TRID rollout back in 2015. Imagine trying to explain these new disclosures to a homebuyer who’s already feeling overwhelmed!

Then there’s the issue with timing. The TRID rules require that the Loan Estimate (LE) and Closing Disclosure (CD) be delivered within strict timelines. For example, the LE must be given at least 3 business days before closing. Missing these deadlines can delay the entire process, and, oh boy, does that frustrate buyers and sellers. Some lenders have reported an increase in closing delays by up to 20% in the first year after TRID was implemented.

But not everything has been doom and gloom. On the success side, TRID does make it easier for consumers to compare loan offers. With clear, straightforward forms, buyers can actually see the differences in costs and terms side by side. It’s like laying out your options on a table instead of digging through piles of paperwork. According to a study, 60% of consumers said that the new forms improved their understanding of the mortgage process.

Take Jane, for example. She was a first-time homebuyer who felt lost in the sea of jargon and fine print. After TRID, she found the Loan Estimate incredibly helpful. It laid out her loan terms and estimated monthly payments in a way that made sense. “For the first time, I really felt like I knew what I was signing up for,” she said.

So, while TRID implementation had its bumps along the way—like training headaches and compliance challenges—it’s clear that it also brought some positive changes to the way we handle mortgages. It’s all about learning and adapting, right?

Analyzing TRID’s Influence on the Homebuying Experience

So, let’s dive right in! TRID, which stands for TILA-RESPA Integrated Disclosure, seriously changed the game for homebuyers. Implemented back in October 2015, TRID was designed to simplify the mortgage process and help buyers understand all those fine print details that usually get lost in the shuffle.

But how exactly has TRID made a difference? For starters, the old Good Faith Estimate (GFE) and the Truth in Lending (TIL) forms were replaced with a pair of new disclosures: the Loan Estimate (LE) and the Closing Disclosure (CD). This means that instead of drowning in paperwork, buyers now have a streamlined set of documents that gives them clear info about loan terms and closing costs.

Here’s where it gets interesting. A study by the Consumer Financial Protection Bureau found that 80% of homebuyers appreciated receiving the Loan Estimate three days after applying for a mortgage. This means more time to ask questions or shop around for the best deal without feeling the pressure. Plus, the Closing Disclosure arrives three days before closing, allowing buyers to double-check everything without last-minute surprises. It’s all about that peace of mind.

You might wonder if this transparency has any real impact on buyer behavior. Well, statistics show that buyers who received the Loan Estimate were 50% more likely to understand their loan terms. Talk about a confidence boost when you’re making one of the biggest purchases of your life!

Let’s not forget the unintended consequences, though. Some lenders have reported increased processing times due to the new rules. This might sound like a bummer, but the aim is to protect you, the buyer, from any unexpected fees or changes at the last minute. Imagine closing day rolling around only to find out your final costs are way different from what you expected!

In short, TRID is all about empowering you. With clearer disclosures and more time to review your options, it shifts the balance of power back to you, the homebuyer. It’s about making informed decisions, and that’s something we can all get behind, right?

Tables and Figures: A Visual Look at TRID Data

Alright, let’s dive into some good ol’ charts and numbers that help us get a grip on TRID data!

Understanding the Basics

First off, TRID stands for TILA-RESPA Integrated Disclosure. It’s all about streamlining the information given to homebuyers when they’re getting a mortgage. This means you get a clearer picture of the loan terms and costs right from the start.

Key Figures You Should Know

| Component | Average Time Reduction | Notes |

|---|---|---|

| Loan Estimate Form | 3 days | Helps buyers understand costs before committing. |

| Closing Disclosure | 1 day | Provides final loan terms 3 days before closing. |

| Overall Time Savings | 6 days | Speedy closings mean less waiting around! |

A Quick Example

Let’s say you’re buying a $300,000 home with a 30-year mortgage at a 3.5% interest rate. With TRID, you can expect:

- Loan Estimate (LE): A breakdown of monthly payments, interest, and closing costs, customized to your exact situation.

- Closing Disclosure (CD): A final account of what you’ll pay at closing, so there are no surprises!

Having these clear documents can save you stress (and money!) in the long run.

Wrapping It Up

Data like this makes it clear—TRID is simplifying the mortgage process, and that’s a win for us all! So, keep these numbers and visuals in mind the next time you’re diving into real estate.

The Future of TRID in Real Estate Transactions

As we look ahead, the implementation of TRID (TILA-RESPA Integrated Disclosure) is poised to evolve even further. TRID has already streamlined the way we handle mortgages by combining the old forms into two clear documents: the Loan Estimate and the Closing Disclosure. This shift is a game changer! It’s not just about meeting compliance; it’s about making real estate transactions smoother and more transparent.

Did you know that since TRID rolled out in 2015, over 83% of mortgage lenders report that it has improved their workflow efficiencies? Less confusion means faster closings, which is a win-win for buyers and lenders alike. Imagine a first-time homebuyer confidently navigating the process because everything is laid out in simple, digestible terms. That’s the future we’re aiming for!

Looking down the line, we might see even more tech integration. Tools like AI and chatbots could enhance the TRID experience by providing real-time answers to buyers’ questions. Homebuyers could have a personalized assistant guiding them through each step, ensuring they understand their Loan Estimate and Closing Disclosure. Say goodbye to information overload and hello to clarity!

Furthermore, lenders are likely to enhance their digital platforms. Reports suggest that up to 70% of borrowers prefer digital tools for their mortgage journeys. With TRID paving the way, lenders can create user-friendly portals that allow borrowers to review disclosures, compare options, and even e-sign documents. It’s like having a home-buying companion right at your fingertips!

Ultimately, the future of TRID in real estate looks bright. As the landscape of real estate transactions continues to shift, we can expect TRID to adapt, ensuring buyers are informed and empowered. So, whether you’re gearing up to buy your first home or you’re a seasoned investor, rest easy knowing that TRID is there to make the ride a little smoother!

Best Practices for Real Estate Professionals Under TRID

So, you’re a real estate pro navigating the TRID waters? Great! While it can feel a bit overwhelming, sticking to some best practices can make your life a whole lot easier—and keep your clients happy.

1. Be Transparent about Costs

TRID requires clear disclosures, so make sure to provide a full understanding of all potential costs upfront. This means itemizing fees in the Loan Estimate (LE). Did you know that buyers today are more than twice as likely to walk away from a deal if they feel they were not informed about fees? (Source: National Association of Realtors)

2. Embrace Technology

Use tech tools like CRM software that integrate TRID requirements. This helps you manage timelines and ensures everyone gets the right disclosures on time. Automated reminders for the 3-day LE and Closing Disclosure (CD) timelines can save you headaches later!

3. Communicate, Communicate, Communicate

Never underestimate the power of good communication. Make it a habit to check in with your clients regularly throughout the process. Explain the LE and CD in simple terms—this isn’t the time for jargon! If they understand what they’re seeing, they’re less likely to feel anxious.

4. Train Your Team

If you’ve got a team, ensure everyone is up to date with TRID processes. Regular training sessions can keep everyone aligned on best practices. A well-informed team can reduce errors and cut down on closing delays. Statistics show that teams with regular training have a 20% faster transaction times (Source: Real Trends).

5. Pre-Review Disclosures

Before you send over the LE or CD, take a moment to review them yourself. Check for any discrepancies or possible errors. A second pair of eyes—yours—can make a huge difference! Missing deadlines or incorrect figures can lead to serious delays.

6. Set Expectations

Educate your clients about what to expect during the TRID process. For example, explain that they should expect to receive the LE within three business days of applying for a loan and that the closing can’t happen until at least three days after they receive the CD. Clarity here reduces stress!

Conclusion

By following these straightforward practices, you can streamline your transactions under TRID and ensure that everything flows smoothly. Remember, happy clients mean repeat business!