- Types of Loans for Buying Foreclosures

- Key Requirements for Foreclosure Loans

- Financial Considerations and Costs

- Comparative Analysis of Loan Options

- Statistics on Foreclosure Purchases

- Applying for a Foreclosure Loan: Step-by-Step

- What to Expect During the Approval Process

- Potential Risks and Rewards of Buying Foreclosures

- Resources for First-Time Foreclosure Buyers

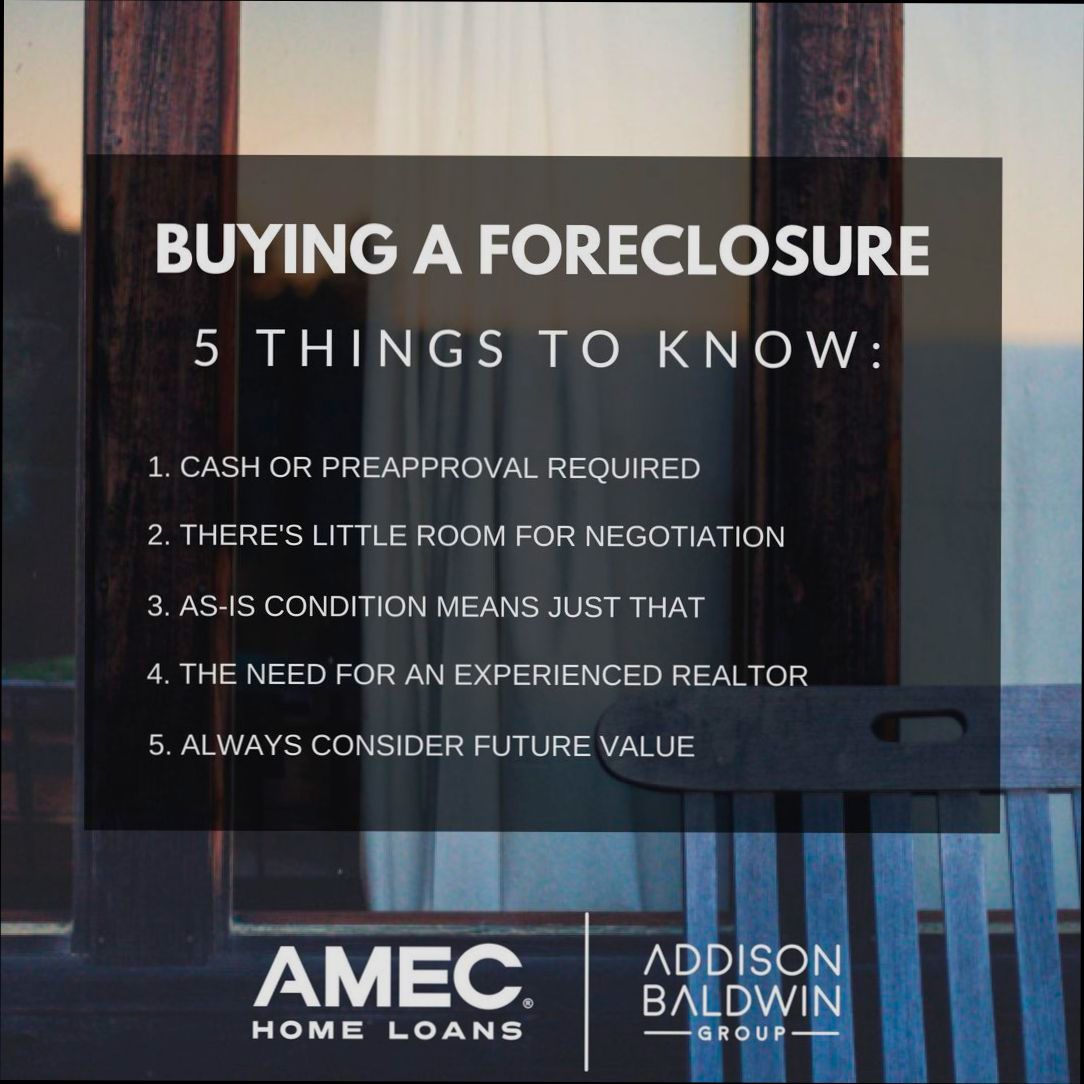

What kind of loan do I need to buy a foreclosure? If you’re eyeing a foreclosure property, you might be wondering about your financing options because not all loans are created equal when it comes to these types of homes. First off, many buyers consider traditional options like a conventional mortgage, but buying a foreclosure can come with unique challenges. You might even have to navigate through the often complex condition issues of properties sold “as-is.” This means some lenders might be hesitant to back your mortgage if they think the house will need more repairs than it’s worth.

Another common choice is an FHA loan, which can actually be a game changer for those looking to buy foreclosures. These loans are government-backed and can help you get into a house with a lower down payment, making them appealing for many buyers. Plus, there’s the 203(k) loan specifically designed for homes that need some TLC. It allows you to finance the purchase and renovation costs in one loan, which is especially handy for foreclosures that might need a little extra love to bring them back to life. Understanding these options is crucial before you jump into the foreclosure market!

Understanding Foreclosure Loans

When you’re eyeing a foreclosure, knowing the right type of loan can make or break your experience. Foreclosure loans are designed specifically for buying properties that have been repossessed by lenders due to the previous owner defaulting on payments. They can either help you snag a great deal or come with risks, so let’s clear this up!

First off, there are different types of loans you might consider:

- FHA Loans: If you don’t have a ton of cash saved up, FHA (Federal Housing Administration) loans could be your best friend. They allow you to put down as little as 3.5% on a home. Plus, you can buy a foreclosure with an FHA loan, making it a popular choice among first-time buyers!

- Conventional Loans: These typically require a larger down payment than FHA loans. They can be a good choice if you have excellent credit and some cash to spare—usually around 20%. Be prepared, though; you might face tougher scrutiny when a foreclosure is on the table.

- Hard Money Loans: If you’re diving into the investment side of foreclosures, hard money loans can offer quick funding, often in less than a week. But hold up—these aren’t cheap! Interest rates can be sky-high, so make sure you’re ready for the risk!

- Renovation Loans: Many foreclosures come with issues. That’s where renovation loans, like the FHA 203(k), shine. They let you finance both the purchase and the renovation costs into one loan. Just remember, the property generally needs to be livable for this type of financing.

Now, let’s talk money. According to the National Association of Realtors, around 10% of homes sold in the U.S. were foreclosures in recent years. This offers a huge opportunity, but keep an eye on those numbers and understand the local market. It could save you some serious cash!

In summary, not every loan is a perfect fit for buying a foreclosure. Make sure to consider your financial situation and the condition of the property. Reach out to a mortgage professional to find out what works best for your unique scenario. Stay smart, and you’ll be one step closer to owning that dream home!

Types of Loans for Buying Foreclosures

When it comes to buying foreclosures, not all loans are created equal. You’ll want to consider a few specific types of financing tailored for these unique situations. Here’s a quick breakdown:

1. Conventional Loans

Conventional loans are great if you have strong credit and enough cash for a down payment, usually 20%. They don’t require any special programs or certifications, making them a straightforward choice. However, be aware that many lenders might shy away from properties that need extensive repairs, which is often the case with foreclosures.

2. FHA Loans

If you’re looking for a bit more flexibility, FHA loans might be your best bet. The Federal Housing Administration backs these loans, allowing you to put down as little as 3.5% if your credit score is 580 or higher. Plus, they’re often okay with purchasing homes that need repairs, which is a common scenario with foreclosures. Just remember, the property will need to meet certain safety standards.

3. 203(k) Loans

Now, let’s get more specific with the FHA 203(k) Loan. This one’s a game-changer for buying fixer-uppers. It combines the cost of the purchase and renovations into one loan. Got a foreclosure that’s seen better days? The 203(k) allows you to finance up to $35,000 for repairs. This is perfect if you’re confident in your renovation skills!

4. VA Loans

If you’re a veteran or active-duty service member, the VA loan can be a fantastic option. There’s no down payment requirement and no mortgage insurance, which is pretty sweet. However, similar to FHA loans, the home must pass certain inspections—and lenders might be hesitant to finance homes in bad shape.

5. Hard Money Loans

For those looking to jump on a foreclosure quickly, hard money loans can be a fast solution. These are typically short-term loans from private lenders, allowing you to close quickly. The downside? Expect high interest rates and fees. But, if you see a property with high potential, it might be worth the risk.

Conclusion

Shopping for a loan to buy a foreclosure? Don’t forget to assess your financial situation and future plans. Statistics show that about 10-20% of home sales in the U.S. involve foreclosures, so it’s a busy market. Do your research, consult with a financial advisor, and pick the loan that best fits your needs!

Key Requirements for Foreclosure Loans

So, you’ve decided to dive into the world of foreclosure properties. Cool! But before you start daydreaming about that sweet deal you’re going to score, let’s chat about the requirements for getting a foreclosure loan. It’s super important to know what to expect!

1. Credit Score

First up, your credit score matters a lot! Most lenders prefer a score of at least 620. If yours is lower, don’t sweat it—there are still options. Just be prepared for higher interest rates or perhaps a larger down payment. For example, if your score is around 580, some FHA loans might still be open to you!

2. Down Payment

Speaking of down payments, be ready to cough up some cash. For conventional loans, you’re typically looking at around 20%. However, FHA loans can work with as little as 3.5%. If you find a great foreclosure but don’t have a fat stack of cash, don’t freak out—options are out there!

3. Documentation

You’ll need to gather a bunch of documents to show you’re legit. Think pay stubs, tax returns, and bank statements. Lenders need to see you can actually afford the house on top of the repairs that might come with a foreclosure!

4. Property Condition

Most lenders will want a professional appraisal to gauge the property’s condition. Foreclosures often need repairs (think plumbing and electrical issues). If the place is a real fixer-upper, your lender might actually require a renovation loan, like the FHA 203(k), so be ready to show you can handle the work!

5. Pre-Approval

Getting pre-approved for a loan is a smart move! This shows sellers you mean business and gives you a clear idea of how much you can afford. In a foreclosure market where properties can fly off the shelves, this is a total game changer!

Remember, about 32% of foreclosures sell for less than their estimated market value. That’s pretty tempting, right? So make sure you’re prepared and know what’s required to secure your loan. Happy house hunting!

Financial Considerations and Costs

When you’re diving into the world of foreclosure purchases, it’s crucial to wrap your head around the financial side of things. First off, foreclosures often come with the opportunity for a great deal, but that doesn’t mean you’re off the hook when it comes to costs.

Start by considering your loan options. Most buyers turn to either conventional loans or government-backed options like FHA loans. If you’re looking at properties that need a bit of TLC, an FHA 203(k) loan might be your best friend. This loan not only covers the purchase price but also lets you finance renovations, which can be a lifesaver if the home isn’t move-in ready.

For example, let’s say you find a foreclosure listed at $150,000. You might be able to snag it for $120,000. If the roof needs replacing, you could add around $20,000 more with an FHA 203(k). In the end, you’re looking at a total loan amount of $140,000. Sounds good, right?

Now, let’s talk about costs. Be prepared for more than just the sticker price of the home. On top of your down payment (which can be as low as 3.5% for FHA loans), you’ll need to think about closing costs, property taxes, and possibly homeowners’ insurance. Closing costs typically range from 2% to 5% of the loan amount. So, on a $140,000 loan, that could mean anywhere from $2,800 to $7,000 just for closing!

And don’t forget about the potential hidden costs. Foreclosures often come “as-is,” so you might run into surprises. A roof in dire need of repair or old plumbing can drill a hole in your budget. Make sure to budget for inspections and any contingencies while keeping a little financial wiggle room for those unexpected expenses.

Lastly, here’s something important to remember: if you’re using an investor-friendly lending option, interest rates might be a bit higher, typically between 0.25% to 0.5% more than traditional loans. Explain to your lender what you’re doing and see what options they suggest that can work for your situation.

In short, while buying a foreclosure can be a financially savvy move, don’t let the excitement blind you to the costs. Do your homework, crunch those numbers, and make sure you’re ready for the financial rollercoaster!

Comparative Analysis of Loan Options

When you’re thinking about snagging a foreclosure, understanding your loan options is crucial. Not all loans are created equal, and picking the right one can make all the difference in your budget and your stress levels. Let’s dive into the main types of loans you might consider.

1. FHA Loans

First up, FHA loans. These are Government-backed loans, which means they’re a bit more forgiving on your credit score and require a minimum down payment of just 3.5%. But there’s a catch: the home usually needs to meet certain safety standards. If you’re buying a fixer-upper foreclosure, you might have to pump in some extra funds to get it up to code.

Pro Tip: The FHA 203(k) loan is perfect if you plan to renovate your foreclosure. You can finance both the purchase and the repair costs, which can sum up to a maximum of about $35,000 for minor improvements.

2. Conventional Loans

Next up are conventional loans. These are not backed by the government, so they tend to be a little stricter. You’ll typically need a credit score of at least 620 and a down payment of around 5-20%. The upside? If you have good credit, you could snag a lower interest rate than with FHA loans.

Statistics Alert: According to the latest data, about 65% of homebuyers with excellent credit opt for conventional loans, as it helps them save money over the loan term.

3. VA Loans

For our veterans and active military folks, VA loans are a fantastic option. No down payment and no private mortgage insurance (PMI) – yes, please! These loans are one of the best deals out there, but they do require that you’re eligible under VA guidelines. Foreclosures? No problem; just ensure you’re meeting the necessary conditions.

4. Hard Money Loans

Now, if you’re looking for something a bit quicker and aren’t too worried about high-interest rates, hard money loans might be the way to go. These are short-term loans provided by private lenders and are often based on the property’s value rather than your credit score. But, be ready for rates that can hit anywhere from 8% to 15%.

Hard money loans can be an excellent option for flipping homes or quick sales, but they can drain your wallet if you’re holding onto the property longer than planned.

5. USDA Loans

If you’re eyeing a foreclosure in a rural area, don’t overlook USDA loans. These loans offer zero-down payment options for eligible rural and suburban homes, making them a great choice if you meet the area and income requirements. Plus, they usually come with competitive interest rates!

In summary, when buying a foreclosure, weigh your options carefully. Consider your credit situation, how much cash you can put down, and what your future plans are. Remember, the right loan can really lighten the load as you move into your new (albeit slightly rough-around-the-edges) home.

Statistics on Foreclosure Purchases

When it comes to buying foreclosures, it’s essential to understand the numbers behind the deals. Did you know that in 2022, around 300,000 properties across the U.S. were foreclosed? That’s a lot of homes up for grabs!

According to RealtyTrac, you can often snag a foreclosure for about 30% below market value. Imagine scoring a $300,000 house for just $210,000! It’s like finding a hidden treasure, right?

Let’s break it down a bit. In Q1 2023, the average purchase price for a foreclosed home was around $200,000. In comparison, regular home sales averaged about $300,000. That’s a significant difference! It’s no wonder many buyers are diving into foreclosure purchases.

Plus, the competition’s a bit different. In a standard market, there might be 10 buyers for every house. For foreclosures, you could be looking at just 2 or 3. Fewer buyers often lead to better deals!

However, it’s not all sunshine and rainbows. Many foreclosures need repairs, so factor in extra costs. In a recent survey, 57% of foreclosure buyers said they spent over $10,000 on repairs!

So, if you’re considering a foreclosure, just keep these stats in mind. They could mean the difference between finding a great investment or getting stuck with a money pit!

Applying for a Foreclosure Loan: Step-by-Step

So, you’ve decided to jump into the world of foreclosures! Exciting, right? But before you dive in, you need to know how to apply for a foreclosure loan. Here’s a straightforward guide to help you through it.

Step 1: Check Your Credit Score

First things first—check your credit score! A score above 620 is generally needed to qualify for most loans. If you’re sitting below that, consider boosting your score a bit before applying. Even a few points can make a difference!

Step 2: Choose the Right Loan Type

You have a few options here:

- Conventional Loans: These are not backed by the government but often offer competitive lower rates. Best for buyers with solid credit.

- FHA Loans: If you have a lower credit score (as low as 580), an FHA loan might be your ticket. They only require a 3.5% down payment!

- VA Loans: If you’re a veteran, don’t forget this option. No down payment is required, plus no private mortgage insurance (PMI).

Step 3: Get Pre-Approved

Next, get pre-approved! This step shows sellers you’re serious. During this process, lenders will evaluate your finances—so be ready to share your income documents, bank statements, and tax returns. Pre-approval can also speed up the closing process, which is great when you’re eyeing that foreclosure!

Step 4: Find a Lender Experienced in Foreclosures

Not all lenders are created equal. Some specialize in foreclosure loans and can guide you through the unique aspects of these purchases. Look for someone who understands the risks and rewards associated with buying distressed properties.

Step 5: Gather Necessary Documentation

Time to dig out some paperwork! You’ll likely need:

- Proof of Income (W-2s or pay stubs)

- Tax Returns from the past two years

- Bank Statements

- Identification (Driver’s License or passport)

Step 6: Submit Your Application

Now, it’s go time! Fill out your application with all the required details. Double-check everything to make sure it’s accurate—no one likes a bunch of follow-up questions from the lender!

Step 7: Wait for Approval

This is the nail-biting phase! Usually, it takes a few days to a couple of weeks to get approval. Keep in mind that lenders may schedule an appraisal to gauge the property’s value since foreclosures can be tricky.

Step 8: Close the Deal

Once you’re approved, you’ll go through a closing process where you’ll sign a bunch of documents and officially take ownership. Make sure you review everything carefully, and don’t hesitate to ask questions!

Final Thoughts

Applying for a foreclosure loan might seem daunting, but by breaking it down into these simple steps, you’ll be ready to snag that property of your dreams. Remember, foreclosures can come at a cost—on average, foreclosed homes can sell for about 30% less than their market value. Happy house hunting!

What to Expect During the Approval Process

So you’ve found your dream foreclosure property, and now it’s time to get that loan approved! Here’s what you can expect during this process:

- Pre-Approval Comes First: Before you dive in, you should get pre-approved. This is where a lender looks at your financial situation and gives you a specific loan amount. According to the HUD, pre-approved buyers are more likely to have their offers taken seriously, especially in hot markets.

- Gather Your Documents: You’ll need to provide a bunch of paperwork like tax returns, pay stubs, and bank statements. It’s a headache, but it proves you can pay the mortgage. Keep everything tidy and organized!

- Home Inspection and Appraisal: Expect your lender to ask for a home inspection and appraisal. They need to ensure the property is worth what you’re planning to pay. For foreclosures, things can get tricky—often the property isn’t in the best shape. Be prepared for surprises!

- Where’s the Money Coming From? If you’re eyeing a government-backed loan like an FHA or VA loan, your lender will want to go through their specific guidelines. For instance, with an FHA loan, you might only need a down payment as low as 3.5%, but it must be your primary residence. Keep in mind—these loans can take a bit longer to process due to extra red tape.

- Stay in Touch: Communicate with your lender regularly. The approval process can feel like watching paint dry, but being proactive can speed things up. If they ask for anything extra, get it to them ASAP!

Remember, on average, it takes about 30-45 days to get loan approval, but it could stretch longer for foreclosures due to their unique situations. Just keep your cool and stay organized, and you’ll get through it!

Potential Risks and Rewards of Buying Foreclosures

Buying a foreclosure can be a rollercoaster ride—exciting, yes, but filled with ups and downs. Let’s break down the risks and rewards so you can navigate the waters a little easier.

Rewards: Why It Might Be Worth It

- Lower Purchase Price: You could snag a property for 10% to 30% below market value. In many markets, that can mean a substantial savings, making it an attractive option.

- Potential for Profit: If you’re eyeing a fixer-upper, you might turn that investment into a pretty profit. Homes in good neighborhoods could double in value after a little renovation. Think about it—if you bought a foreclosed home for $150,000 and dumped $50,000 into it, that same property could easily be worth $250,000 after some love!

- First-Time Homebuyer Programs: Depending on where you live, there may be grants or loans specifically aimed at buyers of foreclosures. It’s a good idea to check with local housing authorities about potential assistance.

Risks: What You Need to Watch Out For

- Condition of the Property: Often, foreclosures are sold “as-is.” This means you could end up with unexpected repair costs. On average, homeowners spend about $15,000 on repairs after buying a foreclosure, but that number can swing wildly depending on the property’s condition.

- Hidden Liens: You might find unexpected debts attached to your new home—think unpaid taxes or utility bills. Always do your homework! Hiring a title company can help uncover any liens.

- Limited Financing Options: Not all lenders are on board with financing foreclosures, especially if they’re in rough shape. You might need to stick with FHA 203(k) loans or cash offers, which could limit your options if you’re not prepared.

In the end, buying a foreclosure can be a great opportunity, but it requires careful consideration and a bit of legwork. Make sure to weigh both the pros and cons before diving in!

Resources for First-Time Foreclosure Buyers

So you’ve decided to dive into the world of foreclosures, huh? Smart move! But let’s not sugarcoat it: it’s a bit of a maze out there. Here are some resources that can help you navigate the murky waters of buying a foreclosure.

1. Real Estate Agents Specializing in Foreclosures

First off, consider teaming up with a real estate agent who has experience with foreclosure properties. They come packed with knowledge about the local market, so they can help you find the best deals. A pro can make a stressful experience way smoother!

2. Online Listing Sites

Websites like Realtor.com, Zillow, or Auction.com are gold mines for finding foreclosures. You can filter your search based on criteria like price and location. Around 9% of all homes in the U.S. were in some stage of foreclosure as of last year, so there’s plenty out there!

3. Local Government Resources

Don’t overlook local government websites! They often list foreclosures and tax lien properties, which can be a bit of a hidden treasure. Check sites for your city or county to snag some good deals right from the source.

4. Financial Assistance Programs

If you’re a first-time buyer, look into programs that offer down payment assistance or special loan options. The Federal Housing Administration (FHA) has loans specifically for first-timers, and many banks offer special rates for foreclosures. You could get a fixed-rate mortgage as low as 3.5% if you qualify!

5. Foreclosure Auctions

Thinking about attending a foreclosure auction? Be prepared! It’s crucial to have your financing lined up beforehand and do your homework on the property. Websites like Bid4Assets can help you get a feel for what to expect at these events.

6. Home Inspection Services

Don’t skip the home inspection. Foreclosures might have hidden issues. Some properties are sold “as-is,” meaning you could inherit a load of problems. Do your due diligence—spending a few hundred bucks on a home inspection can save you thousands down the line.

7. Community Workshops and Webinars

Finally, don’t underestimate the power of knowledge. Many non-profits and housing agencies offer free workshops and webinars to guide first-time buyers through the foreclosure process. Look for events in your area or even online; they’re a great way to stay informed!

Buying a foreclosure doesn’t have to be an intimidating adventure if you arm yourself with the right knowledge and resources. Happy hunting!