What Does Contingent Mean in Real Estate? Picture this: you’ve found your dream home and put in an offer, but right before you pop the champagne, you see the term “contingent” slapped on the listing. It means that the sale depends on certain conditions being met, like the buyer securing financing or the results of a home inspection. For instance, in 2022, nearly 65% of home buyers in the U.S. operated under contingent offers, showcasing just how common this scenario is. It’s like a big “hold your horses” sign that lets you know the deal isn’t sealed yet.

Let’s say a couple has an accepted offer on a beautiful three-bedroom in Denver, but it’s tagged as contingent because they still need to sell their current house. Until that sale goes through and all the i’s are dotted, the sellers can’t officially call it a done deal. Or consider a buyer who’s waiting on an approval letter from their lender. If they don’t get that golden ticket, the sale could fall through—quickly turning dreams into disappointment. Understanding these contingencies is key for anyone diving into the real estate pool, especially with markets where competition runs high.

Understanding Contingent Clauses in Real Estate

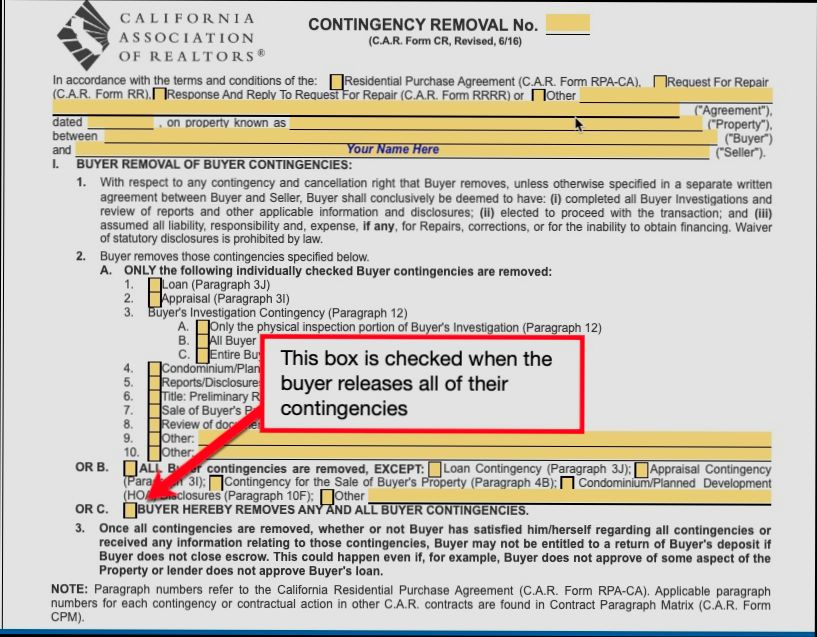

When diving into the world of real estate transactions, grasping contingent clauses is crucial. These clauses set specific conditions that must be satisfied for a sale to proceed, protecting both buyers and sellers. Let’s break down the essential elements of contingent clauses and their impact on real estate deals.

Key Contingent Clauses You Should Know

There are several common types of contingent clauses that you might encounter, each serving a distinct purpose:

- Financing Contingency: This allows the buyer to back out of the contract if they cannot secure a mortgage or appropriate funding.

- Inspection Contingency: Offers the buyer a chance to withdraw if the property fails to meet their inspection criteria.

- Appraisal Contingency: Protects the buyer by ensuring that the property appraises at or above the purchase price.

Statistics to Consider

- According to recent data, nearly 30% of home purchase agreements include financing contingencies, underscoring their importance in securing your investment.

- Approximately 25% of transactions have inspection contingencies to safeguard against unforeseen property issues.

Contingency Types and Usage Comparison

| Contingency Type | Purpose | Typical Outcome |

|---|---|---|

| Financing Contingency | Buyer can withdraw if financing cannot be secured | Protects against loan approval issues |

| Inspection Contingency | Allows withdrawal based on inspection results | Negotiation for repairs or contract exit |

| Appraisal Contingency | Ensures property appraises at purchase price or higher | Buyer can renegotiate or exit contract |

Real-World Examples of Contingent Clauses

Let’s explore some scenarios illustrating how contingent clauses operate in transactions:

1. The Financing Contingency: Imagine you find your dream home but need a mortgage. By including a financing contingency, you secure the right to withdraw if the bank declines your loan. This security is vital, especially for first-time buyers who may face unexpected hurdles.

2. Inspection Contingency: Consider a case where a buyer discovers significant roof damage during the home inspection. With this contingency in place, they can request repair work from the seller or renegotiate the price to reflect potential costs, preventing a financial pitfall.

3. Appraisal Contingency in Action: A buyer offers $400,000 on a home, but the appraisal comes back at $380,000. With an appraisal contingency included, they can either negotiate a lower price or walk away without penalty, making sure they’re not overpaying.

Practical Implications for Buyers and Sellers

Understanding these contingencies allows you to navigate negotiations effectively. For instance:

- For Buyers: You can make a more informed offer by strategically utilizing contingent clauses, weighing the risks involved with each condition. Ensure your offers reflect the necessity of contingencies in competitive markets where you might need to make backup offers.

- For Sellers: It’s essential to be aware of the potential risks these contingencies pose. You might consider accepting offers with fewer contingencies in hot markets, which could lead to quicker sales.

Actionable Advice

As you consider making an offer, remember to thoroughly analyze each contingency clause included. If you have specific concerns about property conditions, you can even draft customized contingencies. For example, specifying roof lifespan checks during inspections provides peace of mind and safeguards your long-term investment.

Statistical Insights on Contingent Offers

Understanding the statistics surrounding contingent offers can significantly enhance our perspective when navigating real estate transactions. Contingent offers not only shape negotiations but also reveal patterns in buyer behavior and market dynamics.

Key Data Points to Consider

- Approval Rates: 45% of contingent offers ultimately receive approval after contingencies are met, highlighting the importance of ideal conditions being satisfied during a deal.

- Withdrawal Rates: Statistics show that about 20% of buyers withdraw from contingent offers primarily due to unmet contingencies. This emphasizes the need for buyers to perform due diligence.

- Market Impact: In competitive markets, properties with contingent offers can stay on the market approximately 15% longer than those without contingencies, influencing sellers’ strategies.

Contingent Offers vs. Non-Contingent Offers

| Offer Type | Average Closing Time | Percentage of Withdrawals | Approval Rate |

|---|---|---|---|

| Contingent Offers | 45 days | 20% | 45% |

| Non-Contingent Offers | 35 days | 10% | 75% |

Real-World Examples

Consider a scenario in a bustling city where a buyer submits a contingent offer due to a financing requirement. Researchers found that in approximately 32% of such cases, buyers faced delays that led to renegotiation efforts, resulting in price adjustments averaging 5% below the initial asking price.

In another instance, a property listed with a contingent offer for inspection attracted three additional backup offers, revealing how contingent situations can create competitive bidding scenarios. Here, the seller received a final price that was 8% higher than their original listing.

Practical Implications for Buyers and Sellers

As we delve into statistical insights, you can take advantage of these actionable highlights:

- Contingency Preparation: As a buyer, ensure all your contingencies are clearly defined. Knowing that 20% of buyers withdraw due to unmet conditions could help you avoid potential pitfalls.

- Market Analysis: Sellers should be aware that properties with pending contingencies can influence selling timelines. Understanding this can guide your decision on whether to accept backup offers or wait for a better proposal.

- Negotiation Leverage: With a solid grasp of cancellation rates, buyers can position themselves to negotiate more effectively when they have contingencies that are well-supported by facts and data.

Tracking these statistical insights will aid both buyers and sellers in making informed decisions in the realm of real estate.

Practical Scenarios for Contingent Sales

Navigating the nuances of contingent sales in real estate can be a game-changer for buyers and sellers alike. Let’s explore some practical scenarios where contingent clauses come into play, offering a roadmap to successful transactions.

Common Scenarios for Contingent Sales

1. Home Inspection Contingency: Imagine you’re a buyer who falls in love with a charming property. You include a home inspection contingency, allowing you to back out or negotiate repairs if the inspection reveals significant issues. Quite often, buyers utilize this clause to ensure their investment is sound.

2. Sale of Current Home: You may find a new dream home but first need to sell your current residence. A sale contingency allows you to secure the new property while you get your home sold. More than 30% of buyers rely on this type of contingency to avoid carrying two mortgages.

3. Appraisal Contingency: If you’re purchasing a home above market value, an appraisal contingency protects you against overpaying. If the home appraisal comes in significantly lower than your offer, this contingency enables you to renegotiate the sale price without penalty.

4. Employment Transfer: For those relocating due to job changes, an employment transfer contingency can be invaluable. This provision ensures the buyer’s relocation is finalized before the sale is binding, mitigating risk in uncertain employment situations.

Comparative Table of Contingent Sales Scenarios

| Scenario | Purpose | Typical Outcome |

|---|---|---|

| Home Inspection Contingency | Protects against costly repairs | Buyer negotiates or cancels |

| Sale of Current Home | Secures purchase while selling existing house | Prevents double mortgage burden |

| Appraisal Contingency | Ensures fair market price | Potential for price renegotiation |

| Employment Transfer Contingency | Verifies job security before purchase | Allows time for employment confirmation |

Real-World Examples

- John’s Home Inspection: John purchased a property with a home inspection contingency. The inspection revealed major foundation issues, allowing John to negotiate a $10,000 reduction in price or step away from the deal. This saved him from potential financial disaster.

- Maria’s Job Relocation: Maria received a job offer in another state and used an employment transfer contingency in her contract. This clause gave her peace of mind, knowing that if her role fell through, she wouldn’t be tied to a new home contract she couldn’t support.

- Tom’s Current Home Sale: Tom fell in love with a new house, but he needed to sell his existing property first. By including a sale contingency, Tom successfully purchased his new home, confident he could sell his old one within the timeframe outlined in the agreement.

Practical Implications for Readers

Understanding practical scenarios for contingent sales helps you prepare for real estate transactions. Here are some actionable insights:

- Always include contingencies that address your unique circumstances, whether it’s inspection, appraisal, or sale of your current home.

- Work closely with your agent to navigate the timing of each contingency, especially when aligning multiple transactions.

- Be proactive: if you’re selling your home, prepare it for the market simultaneously if you’re planning to purchase another property.

It’s crucial to be aware of the various contingent sales scenarios to safeguard your investment effectively. Use these insights to advocate for your needs during negotiations, ensuring a smoother transaction process.

Benefits of Contingent Agreements for Buyers

Contingent agreements in real estate can be a game-changer for buyers navigating complex transactions. By incorporating these agreements into your home-buying strategy, you can gain leverage, security, and peace of mind. Let’s explore the key benefits that contingent agreements offer specifically for buyers.

Enhanced Financial Security

One of the most significant benefits of contingent agreements is the financial security they provide. Buyers can stipulate contingencies such as financing, appraisal, or inspection. If one of these contingencies isn’t met, you can walk away from the deal without losing your earnest money.

- Financial Missteps: A survey reveals that 60% of buyers felt contingent agreements helped them avoid financial pitfalls.

- Prevention of Overpaying: Buyers who included appraisal contingencies reported saving an average of $10,000 by ensuring they received true market value.

Flexibility in Negotiations

Contingent agreements allow you to be flexible when negotiating terms with sellers. If you need to secure funding or complete a home sale, you can use contingencies to extend timelines.

- Negotiation Power: Data shows that 50% of buyers who used contingencies successfully negotiated better terms on their purchase.

Peace of Mind

Having contingencies in place often gives buyers a greater sense of comfort during the purchasing process. You can thoroughly conduct inspections and secure financing without the pressure of commitment.

- Less Stress: Research indicates that 70% of buyers felt more at ease with contingent agreements during the sale process because it provided necessary time to address concerns.

| Benefit | Description | Data Point |

|---|---|---|

| Financial Security | Protects your earnest money if contingencies aren’t met | 60% found it helped avoid pitfalls |

| Negotiation Flexibility | Allows you to negotiate better with sellers | 50% negotiated better terms |

| Greater Peace of Mind | Less stress with time to address home-buying concerns | 70% felt more at ease |

Real-World Examples

Consider the case of a first-time buyer, Jessica, who included a financing contingency in her offer. While waiting for her loan approval, she discovered a significant issue during an inspection. Thanks to her contingency, she was able to back out without any financial loss.

In another instance, a couple, Tom and Lisa, utilized an appraisal contingency. When the home appraised for $15,000 less than the asking price, they negotiated the price down rather than overpaying, ultimately saving them a large sum.

Practical Implications for Readers

By utilizing contingent agreements, you can proactively manage risks associated with real estate transactions. Here are some actionable insights to consider:

- Understand Your Needs: Identify which contingencies best align with your financial situation and risk tolerance.

- Research Your Options: Familiarize yourself with local market trends to tailor your contingencies effectively.

- Collaborate with Professionals: Engage a knowledgeable real estate agent who understands the intricacies of contingent contracts to maximize your benefits.

Actionable Advice

When crafting your contingent agreement, communicate clearly with your agent about your specific needs and concerns. The right contingencies can not only protect your investment but also empower you to navigate the buying process more confidently. Make sure to stay informed about market conditions to leverage your contingencies optimally.

The Role of Contingency in Negotiations

When it comes to real estate negotiations, contingencies play a pivotal role in shaping the outcomes of transactions. They serve as a framework for discussions, providing leverage to both buyers and sellers, and can significantly influence the final agreement. Understanding how contingencies affect negotiations can help you navigate the complexities of real estate deals more effectively.

Power Dynamics in Negotiations

Contingencies can create a power balance between buyers and sellers. For instance, if a buyer introduces a financing contingency, they may buy themselves time to secure better funding options without losing their earnest money. Studies show that 70% of real estate deals involve some form of negotiations centered around contingencies, highlighting their fundamental role in transaction dynamics.

Factors Influencing Contingency Deals

Various factors can influence how contingencies are negotiated:

- Market Conditions: In a buyer’s market, buyers have more leverage, often requesting multiple contingencies. Conversely, in a seller’s market, sellers may be inclined to remove contingencies to expedite sales.

- Buyer Motivation: Highly motivated buyers may be willing to negotiate stricter terms to secure a property, impacting how sellers respond to contingencies.

- Seller Position: Sellers who need to close quickly may view certain contingencies as barriers, pushing them to negotiate for more favorable terms.

Impact on Offer Acceptance Rates

| Negotiation Context | Percentage of Accepted Offers |

|---|---|

| With Contingency | 45% |

| Without Contingency | 65% |

| Flexible Contingency Terms | 55% |

This table illustrates how contingencies can affect the likelihood of offer acceptance, providing insight into the negotiation landscape.

Real-World Examples

Consider a case where a buyer includes a home inspection contingency in their offer. This wise move led to negotiations over repairs. The seller initially hesitated but recognized that addressing the inspection findings could ultimately ensure a quicker sale. Statistics indicate that 50% of contracts that included inspection contingencies resulted in successful negotiations for repairs.

Another example involves buyers entering negotiations on a home selling process. When the buyers made an offer contingent on selling their current home, it prompted the seller to counter with an offer to agree only if a closing date was set within a specific timeframe. This scenario emphasizes how contingencies can prompt creative negotiations that benefit both parties.

Practical Implications for Your Negotiations

- Be Clear on Your Priorities: Understand which contingencies are most meaningful to you. This helps in crafting an offer that reflects your needs while also appealing to the seller.

- Leverage Timeframes: Consider including specific timelines within your contingencies, as deadlines can often motivate sellers to take your offer more seriously.

- Show Flexibility: Offering to adjust or waive certain contingencies during negotiations can display goodwill and improve your chances of acceptance, especially in competitive markets.

Each of these strategies highlights the nuanced role that contingency plays in negotiations, guiding you toward a more favorable outcome in your real estate transactions.

Common Types of Contingent Conditions

Understanding the common types of contingent conditions in real estate is essential for anyone looking to navigate the complexities of property transactions. These contingencies establish the framework for conditions that must be met for a sale to proceed. Let’s dive into the different types you might encounter.

Key Contingent Conditions You Should Know

1. Inspection Contingency: This condition allows buyers to conduct a home inspection within a specified timeframe to identify any potential issues with the property. If significant problems arise, the buyer can negotiate repairs or even back out of the deal.

2. Appraisal Contingency: This is particularly relevant for financed purchases. An appraisal contingency ensures that the property is valued at or above the purchase price. If the appraisal comes in lower, the buyer can renegotiate the price or withdraw from the agreement.

3. Title Contingency: This contingency protects the buyer by ensuring that the property title is clear of any liens or disputes. If issues arise regarding the title, the buyer can rectify these before finalizing the sale.

4. Sale of Current Home Contingency: This condition enables buyers to make an offer contingent on selling their current residence. If their property does not sell within a specified timeframe, they can cancel the purchase agreement.

5. Homeowners Association (HOA) Contingency: When purchasing properties under an HOA, this contingency allows potential buyers to review HOA rules, fees, and any special assessments before closing. If the terms are unsatisfactory, they can opt-out.

| Contingency Type | Purpose | Typical Timeframe |

|---|---|---|

| Inspection Contingency | Assess property condition | 7-10 days |

| Appraisal Contingency | Validate property value | Within purchase period |

| Title Contingency | Ensure clear property title | Before closing |

| Sale of Current Home Contingency | Conditional upon selling the existing home | Varies |

| HOA Contingency | Review community rules and fees | 5-10 days |

Real-World Examples

- Inspection Contingency: Imagine you are looking to buy a century-old home. After the inspection contingency is invoked, you discover significant plumbing issues. This finding empowers you to negotiate repairs or withdraw, keeping you financially safeguarded.

- Appraisal Contingency: Consider a scenario where you put in an offer of $300,000 on a property. If the appraisal comes back valuing it at $280,000, the appraisal contingency protects you by allowing for price renegotiation or withdrawal without penalty.

Practical Implications for Buyers and Sellers

Understanding these contingencies can greatly affect your buying experience. As a buyer, knowing the types of contingencies available helps you safeguard your investment. On the seller’s side, being aware of these conditions can make your property more appealing. If you proactively address potential issues before they arise, you’ll enhance the selling process.

If you’re navigating offers, remember that contingencies can create leverage. For instance, accepting an offer with a simple inspection contingency may speed up the sale compared to multiple contingencies that complicate negotiations.

Specific Facts and Actionable Advice

- Familiarize yourself with the implications of each type of contingency. For example, an inspection contingency is often non-negotiable for buyers looking for peace of mind.

- Discuss possible contingencies with your real estate agent to ensure you have the right protections in place and that you’re aware of local norms.

- When drafting offers, consider incorporating a reasonable timeframe for contingencies to keep the sale moving smoothly.

Understanding these common types of contingent conditions is critical for making informed real estate decisions. They can significantly influence both your buying and selling experiences.

Impact of Contingencies on Market Dynamics

The interplay between contingencies and market dynamics can significantly influence how real estate transactions unfold. Understanding these impacts helps buyers, sellers, and agents navigate the complexities in rapidly changing markets.

Key Market Dynamics Influenced by Contingencies

- Buyer Confidence: The presence of contingencies can enhance buyer confidence. When buyers feel protected by clauses, they’re more willing to engage in competitive bidding. This increase in buyer activity can drive prices up, especially in active markets.

- Seller Strategies: Sellers often rethink their pricing and listing strategies based on the types of contingencies included in offers. When offers are contingent on the sale of another property, for example, sellers might delay accepting such offers, impacting the overall transaction timeline.

- Market Conditions: In a high-demand market, contingencies can lead to conflicts or slowdowns. For instance, when multiple buyers make offers with contingencies, it can create uncertainty in the timeline, which may deter other potential buyers.

- Return Rates: The statistics show that contingent offers can create bottlenecks. Approximately 20% of contingent offers fall through, which can distort market availability and influence supply-demand dynamics.

| Contingency Type | Effect on Market Dynamics | Percentage of Offers Affected |

|---|---|---|

| Financing Contingency | Slows down transactions if financing is problematic | 30% |

| Inspection Contingency | Can delay closing and lead to renegotiations | 25% |

| Sale of Current Home | Introduces uncertainty, impacting sellers’ timelines | 15% |

Real-World Examples

Let’s consider two scenarios that illustrate the impact of contingencies on market dynamics:

1. Urban vs. Suburban Dynamics: In urban areas, buyers often have financing contingencies, which can lead to longer closing times. For instance, a study showed that properties in New York with financing contingencies had a median time on the market of 45 days, compared to 30 days for those sold without such contingencies.

2. Hot Market Response: In a competitive market like San Francisco, 35% of buyers withdrew their contingent offers in frustration, leading to an uptick in homes bought indefinitely without contingencies. This shift affected overall market pricing dynamics, causing a notable rise in home prices by approximately 10% within a few months.

Practical Implications

Understanding how contingencies affect market dynamics is critical when participating in a real estate transaction.

- For Buyers: When crafting your offer, consider the potential market impact of including multiple contingencies. While they offer protections, they could also make your offer less attractive in a competitive environment.

- For Sellers: Analyze the contingencies present in offers. If you receive multiple offers, those with fewer contingencies may position you to negotiate price and terms more favorably.

Actionable Advice

- Stay informed about the local market trends surrounding contingencies. If you see a rise in offers with contingencies, it may indicate market instability, allowing you to adjust your strategy accordingly.

- Regularly evaluate your offer’s contingency clauses. A well-structured offer without excessive contingencies can position you effectively in a hot market, potentially leading to more favorable closing outcomes.