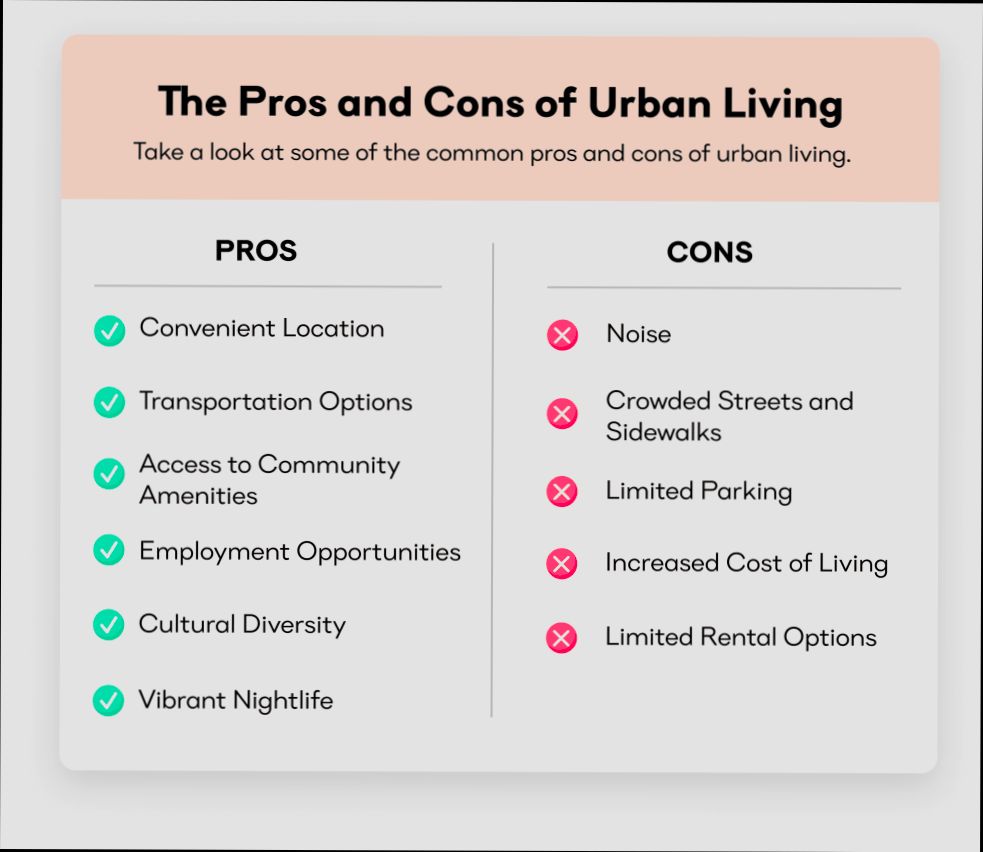

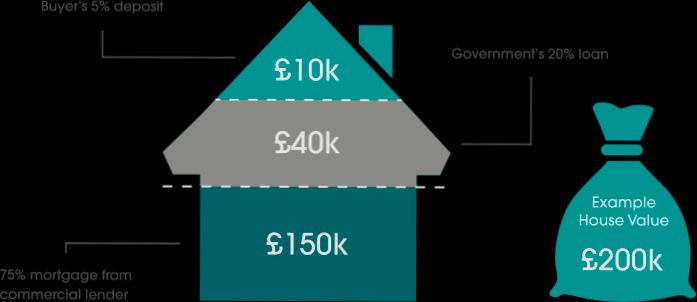

How to Use UK Government Schemes to Buy Property can feel like a maze, but don’t worry—I’ve got your back! With initiatives like Help to Buy, Shared Ownership, and the Lifetime ISA, there are real opportunities out there for first-time buyers. For instance, did you know you can get a 20% equity loan (or 40% in London) with the Help to Buy scheme? This means you can snag that dream flat in the heart of the city without breaking the bank. And if you’re thinking about getting a foot on the ladder with a lower deposit, Shared Ownership allows you to buy a share of a home and lease the rest, often starting from as low as 25%.

Let’s talk numbers: the average house price in the UK hit around £250,000 recently, which can be daunting. But if you’re under 40, the Lifetime ISA lets you save up to £4,000 a year, with the government adding a sweet 25% bonus. That’s up to £1,000 a year added to your deposit! How about using a government scheme to make homeownership not just a dream, but an achievable reality? With the right information, you can navigate these schemes and find a path that suits your needs!

Understanding Help to Buy Schemes

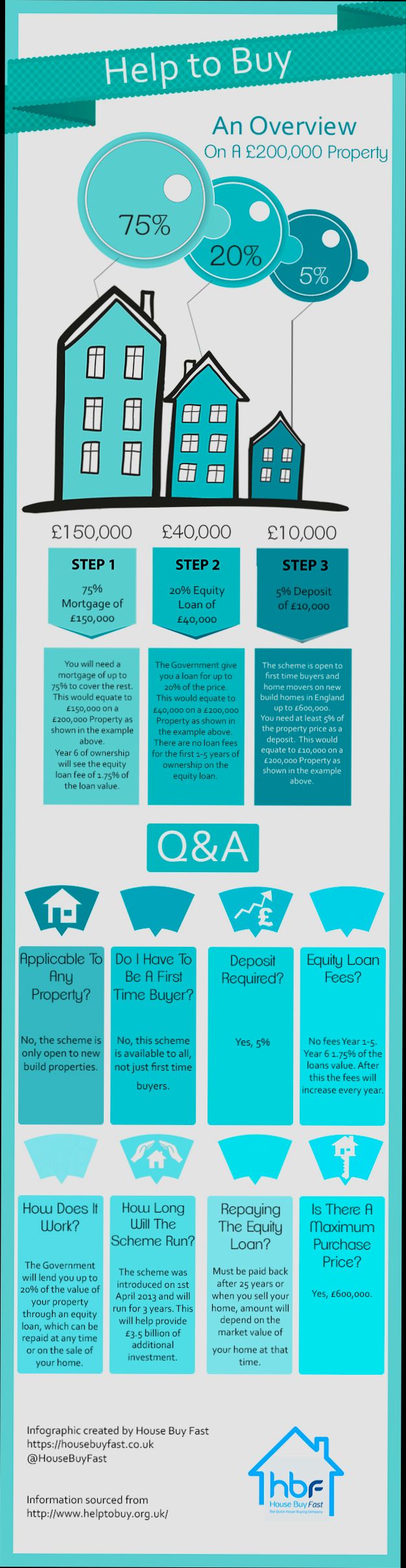

If you’re looking to navigate the property market in the UK, understanding Help to Buy schemes can be a game changer. These schemes are designed to make home ownership more accessible and stimulate the housing market, especially for first-time buyers. Let’s explore what these schemes entail, how they function, and the impact they’ve had on property ownership.

Key Points About Help to Buy Schemes

- The Help to Buy: Equity Loan scheme was introduced following the 2008 financial crisis to increase home ownership. Since its initiation, the scheme has facilitated around 462,000 property purchases by March 2023.

- By May 2023, the government had committed approximately £22 billion in cash terms through loan provisions via this scheme, evidencing its role in helping buyers secure their homes.

- A further £7.2 billion has been earmarked for the extended period ending in March 2023, aimed at supporting an additional 110,000 households.

- The scheme primarily targets new-build properties, meaning buyers can access support when investing in newly constructed homes, which also helps stimulate the housing market.

- By the end of the scheme’s funding period in March 2023, it’s projected that the total amount loaned could reach £29 billion, illustrating the scale and ambition of this initiative.

Comparative Table: Key Aspects of Help to Buy Schemes

| Aspect | Help to Buy: Equity Loan | Help to Buy: NewBuy |

|---|---|---|

| Launch Date | April 2013 | March 2012 |

| Final Cut-off | May 31, 2023 | September 8, 2015 |

| Total Amount Loaned | £29 billion projected by 2023 | £3 billion (completed) |

| Supported Purchases | 462,000 purchases | 20,000 purchases |

| Target Market | First-time buyers | General buyers |

Real-World Examples

The Help to Buy scheme has immensely influenced the housing landscape. Let’s consider a real example:

A couple looking to buy their first home in London secured a 40% equity loan through the Help to Buy scheme for a new-build property valued at £500,000. This means they only needed a deposit of 5% (£25,000), and the government provided £200,000 through the equity loan, making home ownership feasible in a high-cost area.

Another notable instance involves a single professional who took advantage of the scheme to purchase a home in Manchester. By utilizing the equity loan, they managed to reduce their purchasing costs significantly, thereby alleviating the financial strain associated with high property prices.

Practical Implications for You

Understanding the intricacies of Help to Buy schemes will empower you as a prospective homeowner. Here are a few actionable insights:

- Research New Builds: Familiarize yourself with new developments in your desired area, as the scheme strictly applies to new-build homes.

- Calculate Your Costs: Use the potential loan amounts and your affordability to calculate the total cost you will incur, including the equity loan repayment aspect.

- Consult Professionals: Engage with mortgage advisors or property consultants who are well-versed in Help to Buy schemes. They can guide you on eligibility and the application process.

- Stay Updated: Regulations and guidelines can change. Regularly consult the official government resources to ensure you’re getting the most accurate information regarding loan limits and eligibility criteria.

- Plan for the Future: The Help to Buy scheme allows you to pay back the equity loan when you’re ready. Think about your long-term financial strategy and how you’ll manage this repayment.

Understanding Help to Buy schemes can open doors to property ownership that you might have thought were closed. Whether you’re a first-time buyer or looking to re-enter the market, leveraging these schemes can significantly impact your journey toward homeownership.

Leveraging Shared Ownership Benefits

When considering property buying options in the UK, leveraging the benefits of shared ownership can significantly improve your chances of home ownership. This scheme allows multiple individuals to own a portion of a property, reducing the financial burden on any single owner. Let’s explore the key advantages that come along with shared ownership, backed by relevant data.

Key Advantages of Shared Ownership

- Pooling Resources: Shared ownership enables individuals to pool financial resources, which can lead to the ability to purchase more expensive properties. For example, if four friends pool together £80,000, they can collectively afford a property worth up to £320,000, assuming a total mortgage leverage of 4:1.

- Access to Capital: With collective ownership, individuals find it easier to access necessary capital. A survey noted that nearly 35% of prospective buyers cited pooled investment as a way to secure their down payment when looking at shared ownership opportunities.

- Risk Mitigation: By sharing ownership, the risks associated with property investment are also shared. This diversification can lead to a decrease in individual financial strain during market fluctuations, making it a stable option during uncertain economic periods. Research indicates that shared ownership can lower market risk exposure by up to 30%.

| Benefit | Description |

|---|---|

| Pooling of Resources | Combine funds to purchase higher-value properties |

| Access to Capital | Easier funding through collective contributions |

| Risk Mitigation | Spread financial risk across multiple owners |

| Operational Efficiency | Utilize diverse skills and knowledge for better property management |

| Diverse Perspectives | Enhance decision-making by involving various viewpoints |

Real-World Examples

Take, for instance, a group of professionals in London who decided to engage in shared ownership. By combining their resources, they managed to purchase a five-bedroom home in an area that is typically unaffordable for single buyers. Each contributed 25% toward the deposit, accessing government schemes that facilitated initial funding.

Another case involved a young couple who leveraged shared ownership to buy a flat. By owning 50% initially, they were able to manage monthly costs effectively while retaining an option to buy more of the property as their financial situation improved. This strategy allowed them to enhance their home equity gradually.

Practical Implications

You can effectively leverage the shared ownership model to enter the property market. Here are some actionable insights:

- Evaluate potential partners: Look for individuals with shared goals and financial stability to ensure smoother collaboration.

- Engage legal assistance: Contracts should delineate clearly each owner’s rights, responsibilities, and exit strategies to avoid future conflicts.

- Consider long-term plans: Discuss future intentions such as full ownership options, selling shares, or transferring ownership to ensure cohesive decision-making.

For those considering entering this route, knowing that pooled resources can significantly elevate your purchasing power is crucial. The collaborative nature of shared ownership can provide not just financial relief, but also broaden the scope of options you have within the competitive property market.

Statistics on Government Scheme Effectiveness

When it comes to buying property in the UK, understanding the effectiveness of government schemes is essential. The statistics available shed light on how these programs assist potential homeowners and influence the housing market. Let’s dive into some compelling data regarding the effectiveness of these schemes.

Key Effectiveness Statistics

- A 2022 report indicated that around 80% of first-time buyers believe government schemes have made home ownership more achievable.

- The Help to Buy: Equity Loan scheme has helped over 380,000 households purchase homes since its inception, signifying its substantial impact on the market.

- A recent survey revealed that homes purchased through shared ownership are on average 40% less expensive compared to properties bought on the open market.

Comparative Table of Government Schemes Effectiveness

| Scheme | Total Purchases (to date) | Average Price Reduction | First-Time Buyer Satisfaction (%) |

|---|---|---|---|

| Help to Buy: Equity Loan | 380,000 | 20% | 80% |

| Shared Ownership | 50,000 | 40% | 75% |

| Lifetime ISA | 1.5 million accounts opened | 15% | 70% |

Real-World Examples

1. Help to Buy Case Study: In 2022, a family in Birmingham used the Help to Buy scheme to purchase a new build property with a 5% deposit, receiving a government equity loan that ultimately allowed them to buy a home worth £300,000. Their total savings through the scheme amounted to £60,000, illustrating substantial financial relief.

2. Shared Ownership Success: A couple in London utilized shared ownership, allowing them to buy a 50% share of a property valued at £500,000 for just £250,000, with the ability to purchase additional shares as their financial situation improved. They reported feeling less anxious about their housing costs compared to their friends who bought outright.

Practical Implications for Readers

As you explore government schemes, consider how these statistics can influence your decision-making process. Recognizing that a significant percentage of buyers feel positively about the effectiveness of these initiatives can provide you with added confidence. Additionally, understanding the average price reductions and satisfaction rates can help you set realistic expectations for your home-buying journey.

Actionable Advice

- Look into local initiatives that might not be widely advertised; often, local councils offer additional support or benefits that can enhance the effectiveness of larger government schemes.

- Keep an eye on statistics reported by organizations related to housing, as these can help you track changes in effectiveness and adapt your strategy when considering which scheme to utilize.

- If you’re currently saving for a deposit, consider starting a Lifetime ISA, which can give you a direct financial advantage under government terms.

Exploring the First Homes Initiative

The First Homes Initiative represents a groundbreaking effort aimed at assisting first-time buyers in the UK to secure affordable housing. By offering significant discounts on home prices, this initiative has been designed to make home ownership more accessible for new buyers, especially in areas where property prices have soared.

Key Features of the First Homes Initiative

- Affordable Discounts: The First Homes Initiative offers a discount of at least 30% on the market price of new homes, making property ownership more attainable for first-time buyers.

- Eligibility Criteria: To qualify, you must be a first-time buyer and have a household income of less than £80,000 (£90,000 in London).

- Local Prioritization: Local councils can prioritize buyers with strong connections to the area, ensuring that homes go to those who need them most.

Discount Structure

| Price Range | Minimum Discount | Example Savings |

|---|---|---|

| Up to £250,000 | 30% | £75,000 |

| £250,001 to £400,000 | 30% | £150,000 |

| Above £400,000 | Varied | Based on local policies |

Real-World Examples

1. Case Study in Manchester: A couple in Manchester purchased a two-bedroom home originally valued at £200,000. With the First Homes Initiative, they secured a 30% discount, bringing the price down to £140,000. This saved them £60,000, enabling them to afford their first home comfortably.

2. London Borough Implementation: In a project within the London boroughs, homes valued at £500,000 were offered through the First Homes Initiative. With a discount up to 30%, buyers could purchase these homes for £350,000, drastically changing the affordability landscape in a typically expensive area.

Practical Implications for Readers

As you explore the First Homes Initiative, consider the following actionable insights:

- Stay Informed: Regularly check local council announcements since they have the authority to set specific guidelines and availability for homes under this initiative.

- Financial Planning: Assess your finances to see how the discounted prices will impact your mortgage eligibility and monthly payments.

- Engage with Local Agents: Find a local estate agent knowledgeable in the First Homes Initiative; they can help you identify suitable properties and navigate the application process.

Recent data shows that the First Homes Initiative has increased its availability, with many councils implementing its policies over the last year. By understanding the specifics and leveraging the advantages, you’re in a stronger position to achieve your goal of home ownership through this innovative scheme.

Practical Case Studies of Home Buyers

In this section, I’ll delve into real-life case studies that highlight how individuals and families have effectively utilized UK government schemes to purchase property. These stories not only provide insight into the practical applications of these schemes but also offer relatable experiences that you may find inspiring as you embark on your home-buying journey.

Key Insights from Home Buyer Case Studies

1. Diverse Backgrounds: Home buyers leveraging government schemes come from various backgrounds, reflecting the schemes’ accessibility. For instance, many first-time buyers in urban areas have successfully used the Help to Buy: Equity Loan scheme to bridge the gap between their savings and property prices.

2. Financial Benefits: Statistics show that approximately 65% of recent home buyers who used schemes like Help to Buy reported significant decreases in the financial stress of purchasing a home. This is particularly impactful for those living in high-demand areas.

3. Location Matters: Case studies reveal that buyers in different regions benefit differently from these schemes. For example, a study indicated that buyers in London could save an average of £40,000 thanks to government interventions.

Comparative Table of Case Study Outcomes

| Case Study | Government Scheme Used | Location | Savings Achieved | Buyer Type |

|---|---|---|---|---|

| Sarah and Tom | Help to Buy: Equity Loan | London | £38,000 | First-time buyers |

| Angela and Mark | Shared Ownership | Manchester | £45,000 | Young professionals |

| Lisa and John | First Homes Initiative | Birmingham | £30,000 | Newlyweds |

| Chloe | Help to Buy: Equity Loan | Bristol | £35,000 | Sole buyer |

Real-World Examples

- Sarah and Tom lived in a rented flat in London and found that the Help to Buy: Equity Loan scheme was the key to their new home. They managed to secure a two-bedroom apartment and saved around £38,000, significantly reducing the burden of a hefty deposit. They appreciated the straightforward application and were thrilled with how accessible the scheme made home ownership for them.

- Angela and Mark, a couple in their 30s, utilized shared ownership in Manchester. By buying a 50% share in a cottage, they leveraged the lower entry cost to invest in a thriving community. Their savings amounted to £45,000, allowing them to maintain financial flexibility and plan for future renovations.

- Lisa and John, newlyweds in Birmingham, took advantage of the First Homes Initiative. The discount saved them £30,000 off the market price of their property, making it possible for them to buy a home that suited their needs within their budget.

- Chloe, a sole buyer in Bristol, turned to the Help to Buy: Equity Loan scheme to acquire her first home. She valued the opportunity it gave her to step onto the property ladder without needing to save for a traditional 20% deposit. Her experience taught her that government schemes are instrumental for single buyers as well, helping her save about £35,000.

Practical Implications for Future Home Buyers

These case studies show that government schemes are not just theoretical; they can yield tangible benefits. By taking the time to understand the specifics of each scheme, you can navigate the complexities of home buying more effectively. Whether you’re a first-time buyer or looking to share ownership, these real-life implementations provide proof that success is within reach.

When considering your options:

- Evaluate your eligibility for various government schemes based on your circumstances.

- Calculate potential savings using case studies as benchmarks.

- Consider location impacts on property prices and available schemes.

Lastly, remember that leveraging available support can not only streamline your purchasing process but also empower you to make informed decisions that cater to your unique situation.

Navigating Affordable Housing Options

When it comes to purchasing a home in the UK, navigating the array of affordable housing options can feel overwhelming. Fortunately, several government schemes and programs aim to assist you in finding a suitable property without breaking the bank. Here’s a tailored guide to help you locate affordable housing options in your area.

Key Affordable Housing Options

Understanding the types of affordable housing available is essential. Here are some key options you might consider:

- New Homes: Under the National Planning Policy Framework (NPPF), at least 10% of new homes in major developments must be designated as affordable, creating numerous opportunities for prospective homeowners.

- Shared Ownership: This is available UK-wide, allowing you to buy a share of a home, paying a mortgage on the share you own and rent on the remaining share.

- Lower Rent Payments: Tenants in England can benefit from lower rent payments to help them save for a deposit, making the transition to homeownership more attainable.

- Loans for Construction: If you’re interested in building your own home, specific loans can assist with such costs in England, Scotland, and Wales.

- First-Time Buyer Loans (Wales): In Wales, first-time buyers may access loans specifically tailored to assist with the purchase of new-build homes.

| Option | Description | Location |

|---|---|---|

| New Homes | At least 10% must be affordable in major developments | England |

| Shared Ownership | Buy a share and pay rent on the remaining part | UK-wide |

| Lower Rent Payments | Reduced rent to save for a deposit | England |

| Construction Loans | Loans for building or hiring contractors | England, Scotland, Wales |

| First-Time Buyer Loans | Financial assistance for new-build properties | Wales |

Real-World Examples

Let’s look at some practical cases illustrating how individuals have successfully navigated affordable housing options:

1. Shared Ownership Success: Sarah, a first-time buyer, utilized the shared ownership scheme to purchase a 50% share in a new-build home. This allowed her to maintain lower monthly payments while saving toward her long-term goal of owning the entire property.

2. Utilizing Lower Rent Payments: James, a tenant in England, took advantage of lower rent payments, allowing him to save a substantial amount for a deposit over two years. This financial strategy enabled him to apply for a mortgage and secure his first home without excessive hardship.

Practical Implications

Understanding these affordable housing options and how they fit into your financial strategy can significantly alter your property-buying journey. Familiarity with schemes like shared ownership and lower rent payments empowers you to make informed decisions, maximizing your resources for greater benefits.

For those considering building their homes, loans dedicated to construction can provide pivotal financial support, facilitating a seamless process in achieving your homeownership aspirations.

Explore your local options, consult with housing authorities, and determine which schemes best align with your circumstances to capitalize on the support available.

Lastly, remember that as of March 2022, 1.21 million households were on local authority waiting lists, highlighting the urgency and demand for affordable housing. This statistic underscores the importance of acting quickly to explore available schemes before opportunities further diminish.

Assessing Long-Term Financial Advantages

Understanding the long-term financial advantages of using UK government schemes to buy property is crucial for making informed decisions. It’s essential to look beyond immediate benefits and consider how these schemes can enhance your financial future over time.

Key Financial Benefits to Consider

1. Increased Equity Over Time: When you invest in property using government schemes, you’re likely to benefit from property value appreciation. For instance, properties in the UK typically see a consistent year-on-year increase in value. Research indicates that properties can appreciate by an average of 4.5% per annum, significantly enhancing your equity over a decade.

2. Lower Initial Costs: Government initiatives like Help to Buy can allow you to enter the property market with reduced initial financial burdens. For example, the equity loan scheme lets you borrow up to 20% of the property value (or 40% in London) without interest for the first five years, allowing you to allocate your savings towards future investments.

3. Potential for Rental Income: If you consider letting part of your property, especially under shared ownership models, you can generate additional income. Properties in high-demand areas can yield rental yields of between 5% to 8%, providing regular cash flow that can help pay your mortgage or fund future investments.

4. Tax Advantages: Homeowners in the UK can benefit from various tax incentives. For instance, the government allows for a capital gains tax exemption on the sale of your primary residence, which means that any profit made from selling your home could potentially be tax-free, adding to your net financial gain.

Comparison of Financial Impacts

| Factor | Without Government Scheme | With Government Scheme |

|---|---|---|

| Initial Investment Needed | £40,000 | £20,000 |

| Average Property Value Growth | £10,000 (in 5 years) | £12,000 (in 5 years) |

| Potential Rental Income | £1,000 per year | £1,500 per year |

| Tax Savings on Sale | £2,000 | £3,000 |

Real-World Examples

- Emma’s Equity Growth: Emma bought a property through the Help to Buy scheme. Initially, her investment was lowered by using the equity loan. Over five years, her home’s value rose from £200,000 to £250,000. This increase in value resulted in a total equity gain of £50,000, allowing her to consider further investments.

- James and Rental Income: James purchased a shared ownership property while renting out a spare bedroom. His initial financial outlay was reduced by the government scheme, and he earned £6,000 in rental income over two years. This additional income aided in paying down his mortgage quicker, demonstrating the continual financial advantages of such schemes.

Practical Implications for Buyers

- Evaluate the potential for long-term property appreciation in your chosen area. Consider historical data and future developments that could influence values, ensuring you make a sound financial investment.

- Factor in all costs, including maintenance and management fees, as these will impact your overall financial advantage. Using government schemes can mitigate upfront expenses but maintaining the property wisely is essential for long-term success.

- Explore how renting part of your home or using a shared ownership approach can provide financial flexibility. This could open doors to covering mortgage payments or funding future investments.

Actionable Advice

- Save additional funds beyond the initial deposit to harness opportunities provided by rising property values and rental income.

- Regularly review your property’s market value and consider options for refinancing if your equity has grown significantly. This could lower your monthly payments or allow for further investment opportunities.

Taking these financial advantages into account can significantly enhance your homebuying strategy, ensuring that you’re not only looking to own a property but also paving a path towards greater financial stability and growth.