How Much Can a Landlord Raise Rent? Well, that depends on a few factors, but let’s dive into the numbers. For instance, in California, rent can only be increased by a maximum of 5% plus the local rate of inflation, capped at 10% total in any given year under the statewide rent control laws. In contrast, places like Texas don’t have such laws, so landlords can raise the rent as much as they want, as long as they provide proper notice. If you’re living in a city like Seattle, landlords can’t boost your rent by more than 1.9% as of this year, making it crucial to understand how local regulations play into your rent payments.

Imagine you’re living in an apartment in New York City, where the rent stabilization system protects many tenants. In this scenario, a landlord can only raise your rent based on a formula set by the city, which was just around 3% for the most recent year. But, if you’re renting a unit in a deregulated building, prepare yourself for some hefty increases, which could be as much as $300 in one shot. With inflation creeping up and property taxes rising, it’s clear that both tenants and landlords are navigating a tricky landscape. Knowing the specifics of your area can feel like trying to untangle a ball of yarn, but I’m here to help you through it.

Legal Guidelines for Rent Increases

Understanding the legal framework around rent increases is crucial for both landlords and tenants. I’m here to walk you through the specific guidelines that dictate how much a landlord can raise rent, covering the necessary laws, regulations, and best practices.

Key Legal Points to Consider

When it comes to rent increases, many rules vary by state or locality. Here are some key considerations:

- Notice Requirements: Most jurisdictions require landlords to provide a written notice of any rent increase, typically ranging from 30 to 90 days in advance.

- Frequency of Increases: Some areas restrict how often you can increase rent, with most laws stipulating that increases occur no more than once a year.

- Allowed Percentage Increase: Certain regions have limits on the allowable percentage of rent increases. For instance, in California, the cap under the statewide rent control law is typically at 5% plus the local rate of inflation, or 10%, whichever is lower.

Comparative Rent Increase Guidelines

| State / Area | Notice Period | Max Increase | Frequency |

|---|---|---|---|

| California | 30 days | 5% + CPI (10% max) | Once per year |

| New York | 30 days | 5% for 1-year lease | Once every 12 months |

| Texas | 30 days | No limit | Once every 12 months |

| Oregon | 90 days | 7% + CPI | Once every 12 months |

| Florida | 30 days | No limit | Once every 12 months |

Real-World Examples

In San Francisco, landlords must follow strict rent control laws. One landlord attempted to raise rent by 25% without proper notice and faced legal action. The tenant successfully argued the increase was not compliant with the city’s regulations, illustrating the importance of understanding specific local laws.

In Oregon, a landlord attempted to increase rent by 8% while forgetting to consider the state-mandated CPI increase. They quickly learned that the legally allowable amount was just 7% plus CPI, proving the necessity of knowing both state and local laws.

Practical Implications

- Be sure to check your local laws regarding notice periods and allowable increase percentages before implementing a rent hike.

- Keep thorough records of all communications with tenants regarding rent changes to ensure compliance with legal requirements.

- Consider consulting a legal expert familiar with local housing laws to navigate the complexities of rent increases properly.

Specific Legal Facts

- Did you know that approximately 20% of U.S. states have some form of rent control? Understanding these laws can help tailor your rent strategies effectively.

- In places without rent control, landlords can raise rents freely, but be mindful of good tenant relations, as significant increases can lead to turnover and empty units.

Familiarizing yourself with these legal guidelines will empower you to manage your rental properties confidently and lawfully.

Analyzing Recent Rent Hike Statistics

Let’s dive into the recent statistics regarding rent hikes, which have showcased significant trends that both landlords and tenants should be aware of. The data from various sources, particularly the American Community Survey (ACS), provides insights into the conditions renters are facing today.

Key Points from Recent Data

- In 2023, the real median gross cost of renting, which includes rent plus utilities, saw an annual increase of 3.8%. This marks the largest increase since 2011.

- Comparatively, the real median home values only increased by 1.8%, indicating that renters are experiencing more substantial financial pressures than homeowners.

- Notably, low-income renters were particularly affected, spending an even larger share of their income on rent compared to previous years. This trend was especially pronounced between 2019 and 2021.

- Households earning less than $20,000 annually spent nearly 57% of their income on rent and utilities, highlighting the disproportionate impact of rising rental costs on those with limited financial resources.

Comparative Rent Increase Statistics

| Year | Median Gross Rental Cost Increase | Median Home Value Increase | Notes |

|---|---|---|---|

| 2011 | N/A | N/A | Baseline year |

| 2021 | 2.5% | 3.5% | Significant increase in rental burden |

| 2022 | 3.0% | 4.0% | Continued upward trend for rentals |

| 2023 | 3.8% | 1.8% | Largest increase since 2011 |

Real-World Examples

The ACS revealed that in cities like Seattle and Los Angeles, some areas experienced rental increases upwards of 10% in just one year. This stark rise puts those cities among the most challenging rental markets in the U.S. These statistics reflect a broader trend where urban centers are facing acute housing shortages, leading to upstream pressure on rental prices.

In contrast, states like Ohio and Pennsylvania showed more moderate increases ranging from 1% to 3%, making them relatively more affordable for renters. Such discrepancies highlight the importance of location in understanding rental hikes.

Practical Implications for Renters and Landlords

For landlords, understanding these statistics can help gauge the appropriate range for future rent increases while remaining compliant with regional regulations. Being informed about the local housing market dynamics allows landlords to make educated decisions on adjustments that can maximize revenue without alienating tenants.

For renters, being aware of the trends can empower you to negotiate better lease terms. If you find your renewal rate exceeds these trends or seems disproportionate, you can use this data as leverage in discussions with your landlord.

Actionable Advice

Stay informed about local rental market conditions by regularly checking resources like the ACS or state-specific housing reports. If you’re facing significant rent increases, consider calculating your rent-to-income ratio to better understand your financial situation. If the cost burden grows too high, exploring neighboring areas or negotiating your lease terms could be viable options.

Market Trends Influencing Rent Prices

Understanding the market trends that influence rent prices is vital for both renters and landlords in navigating rental agreements effectively. Several factors contribute to these trends, impacting how much rent can be raised and how quickly.

Key Market Influencers

1. Supply and Demand Dynamics: One of the most significant factors affecting rent is the balance of housing supply and demand. In cities where housing demand exceeds supply, rents typically see a substantial increase. For example, areas with growing job sectors often experience a spike in demand.

2. Economic Indicators: Factors like the unemployment rate and wage growth can heavily influence rent prices. A lower unemployment rate often correlates with increased wages, leading to more spending power and potentially higher rent.

3. Inflation Rates: As inflation rises, the cost of living increases, including housing costs. In 2023, inflation has notably affected rental prices, leading to a year-over-year increase observed in various markets.

Comparative Rent Trends by Region

| City | Year-over-Year Rent Increase | Supply Availability | Economic Growth Rate |

|---|---|---|---|

| San Francisco | 5.1% | Low | 4.2% |

| Austin | 4.5% | Moderate | 6.0% |

| New York City | 3.7% | High | 3.0% |

Real-World Examples

- San Francisco: Known for its tech job boom, San Francisco experienced a rent increase by 5.1% last year due to a significantly low housing supply. The attractiveness of the job market in technology has continued to draw new residents, driving up demand.

- Austin: In Austin, the rent prices have surged by 4.5% as the city’s growth rate reaches 6.0%. As more companies relocate to this vibrant city, the housing demand has sharply increased, showcasing how successful economic sectors can lead to higher rental prices.

Practical Implications for Readers

If you’re a landlord, staying attuned to these market trends can help you make informed decisions about rent adjustments. Keep your ear to the ground regarding new developments in your area, as they might signal changes in demand and allow you to adjust rent strategically.

For renters, understanding the local economy and job market can give you insights into why your current rent may seem high or is likely to increase. You might also want to compare your rent against regional averages to gauge where you stand.

Actionable Advice

- Monitor local economic reports regularly and be aware of new job openings in your area to understand where rental prices may go.

- Consider diversifying your investments to include rental properties in booming markets with low supply, maximizing your potential returns as demand continues to rise.

- Track inflation trends and consider this when negotiating rental agreements, as these will impact purchasing power and ultimately, rental prices in the future.

Real-World Examples of Rent Adjustments

Understanding how rent adjustments work in the real world can help both tenants and landlords navigate their agreements more effectively. Instances of rent adjustments illustrate the practical application of legal guidelines and market trends, offering insights into what you might expect in various situations.

Examples of Rent Adjustments

1. Annual Increases Based on CPI:

- Many landlords adjust rents based on the Consumer Price Index (CPI). For example, if the CPI increases by 2.5% over the year, a landlord might raise the rent accordingly. A specific case observed this adjustment in a San Francisco apartment complex, where a rise from $2,000 to $2,050 was tied directly to CPI increases.

2. Market Comparison:

- Suppose a two-bedroom apartment in a growing neighborhood previously rented for $1,800 per month. After assessing comparable properties, the landlord decided to raise the rent to $1,950 to align with the market rate — reflecting a 8.3% increase. This adjustment was largely influenced by newer lower vacancy rates due to higher demand in that area.

3. Unit Improvements:

- If a tenant lives in a unit that undergoes significant renovations, such as modern appliances or upgraded amenities, a landlord may increase the rent post-renovation. For instance, a landlord in Chicago raised the rent from $1,400 to $1,600 after installing new fixtures and updating the kitchen and bathroom, marking a 14.3% increase based on enhancements made.

Comparative Rent Adjustments Table

| Location | Previous Rent | New Rent | Percentage Increase | Reason |

|---|---|---|---|---|

| San Francisco | $2,000 | $2,050 | 2.5% | CPI Adjustment |

| New York City | $2,800 | $3,024 | 8.0% | Market Comparison |

| Chicago | $1,400 | $1,600 | 14.3% | Unit Improvements |

| Austin | $1,500 | $1,575 | 5.0% | Inflation Rate |

| Los Angeles | $2,300 | $2,450 | 6.5% | Increased Demand in Rental Market |

Case Studies of Rent Adjustments

- Seattle’s Rent Control Situation:

A study illustrated that a property owner raised rent by 4% annually due to Seattle’s housing market pressures. They provided tenants with a 60-day notice as required, demonstrating adherence to legal guidelines while reflecting on market conditions.

- Portland’s Historic Buildings:

A landlord managing a historic building in Portland opted to raise rent by 10%. This decision was tied to extensive renovation and upgrading efforts aimed at attracting higher-paying tenants, highlighting the influence of property improvement on rental price adjustments.

Practical Implications for Rent Adjustments

Understanding these real-world examples equips you with knowledge about when and why landlords might adjust rent. For tenants, knowing how to anticipate adjustments based on market conditions or improvements can help in budgeting and planning for future expenses. Landlords should be aware of the importance of transparency and communication with tenants to maintain a positive rental relationship.

- Be Proactive:

If you sense an impending rent increase, start researching comparable rental prices in your area to understand what is reasonable.

- Stay Informed:

Familiarize yourself with local guidelines regarding rent adjustments, including required notice periods and permissible percentage increases.

- Document Enhancements:

If you’re a landlord making improvements to a unit, keep a detailed record of expenses and the expected value-added as justification for future rent increases.

Real examples highlight the nuances of rent adjustments and offer actionable insights for anyone involved in a rental agreement.

Cost-Benefit Analysis for Landlords

When considering a rent increase, conducting a cost-benefit analysis is essential for landlords. This analysis helps you weigh the potential monetary gains against the possible repercussions—both financially and relationally—with your tenants. Let’s break down this critical process.

Assessing the Financial Gains

Financial gain is one of the most apparent benefits of increasing rent. You might be tempted to raise rent to keep pace with market changes or inflation. However, it’s crucial to estimate the actual financial impact:

- Income Increase: A rent increase of even 5% on a $1,200 monthly rent yields an additional $60 per month, equating to $720 annually.

- Vacancy Rates: On average, a slight increase could lead to a 2% increase in vacancy rates. If your unit remains vacant for one month, this could cost you $1,200, negating your rental income increase for that period.

Evaluating Potential Costs

While raising rent can boost income, you must also consider potential costs:

- Marketing Costs: If current tenants decide to leave, attracting new ones often requires marketing. Average advertising costs in your area may range from $100 to $500.

- Tenant Turnover: Tenant turnover can lead to unexpected expenses. For instance, if it costs approximately $1,000 to prepare a unit for a new tenant (cleaning, repairs), you might find the costs outweigh the benefits of a small rent increase.

Comparative Analysis Table

| Factor | Expected Increase (%) | Financial Gain/Cost (Annual) |

|---|---|---|

| Monthly Rent | 5% | + $720 (additional income) |

| Vacancy Impact | 2% | - $1,200 (lost income if vacant) |

| Marketing Costs | N/A | - $300 (average advertising cost) |

| Tenant Turnover Costs | N/A | - $1,000 (unit preparation cost) |

Real-World Examples

Let’s look at real-world scenarios demonstrating the costs and benefits associated with rent increases:

1. Case Study: Urban Apartment Complex

- A landlord decided to raise rents by 7%, anticipating an annual increase of $1,440 per unit. However, after a few months, the unit sat vacant for two months, resulting in a loss of $2,400—showing how quickly costs can erase benefits.

2. Case Study: Suburban Single-Family Rental

- A landlord opted for a conservative 3% increase, resulting in an additional $360 annually but retained the tenant for three years. The cost of vacancy and turnover was minimized, showcasing the long-term benefits of stability.

Practical Implications

As a landlord, it’s vital to effectively balance the desire for increased income with the long-term implications of tenant relationships. Consider adopting a gradual approach to rent increases:

- Incremental Increases: Instead of a steep hike, small, consistent increases can preserve goodwill and lower turnover rates.

- Tenant Communication: Communicating openly with tenants about the rationale behind rent increases can foster understanding and reduce the chance of them moving out.

Actionable Advice

Before you implement new rent prices, always analyze:

- The local market to ensure your rates are competitive while still profitable.

- The potential financial ramifications of a vacancy due to rent increases.

- The relational aspect of tenant retention, which may offer more significant long-term benefits than short-term profit.

By rigorously analyzing costs and benefits, you can make informed decisions that align with your financial goals while maintaining positive tenant relationships.

Tenant Rights During Rent Increases

Navigating rent increases can be tricky, but understanding your rights as a tenant will empower you to advocate for yourself. Rent increases don’t just affect your budget; they also come with a set of legal implications and protections. Let’s explore what you need to know about your rights during rent increases.

When Your Landlord Can Increase Rent

Landlords have specific legal guidelines for when they can raise your rent. Generally, they must provide a written notice, which often ranges from 30 to 90 days, depending on local laws. It’s essential to know that:

- If you’re under a lease, your landlord typically cannot increase your rent until the lease is up unless the lease allows for mid-term increases.

- Even if you’re in a month-to-month rental agreement, your landlord must adhere to local regulations regarding notice periods for rent increases.

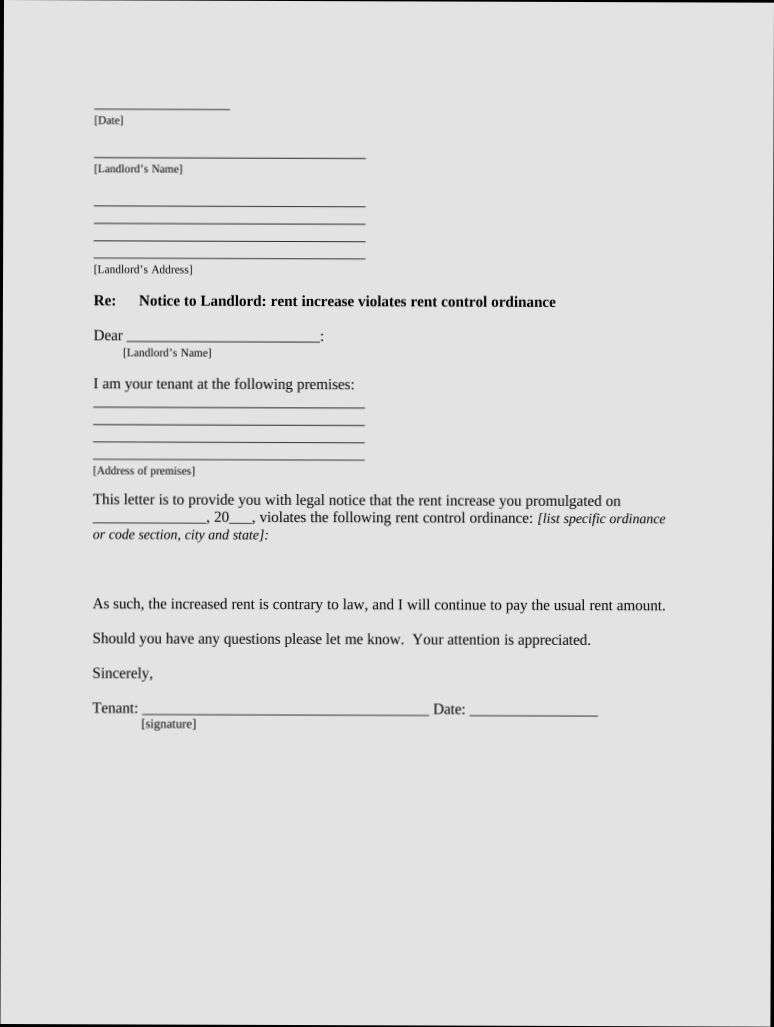

What to Do When Your Landlord Wrongfully Raises Rent

If you believe your landlord has increased your rent unlawfully, there are steps you can take:

1. Document Everything: Keep records of your current rent, any communication you’ve had about rent increases, and your lease agreement.

2. Consult the Law: Research local rent control laws or tenant rights organizations in your area. Many states have specific protections against retaliatory rent increases.

3. Consider Mediation: Sometimes, a face-to-face discussion can resolve misunderstandings about rent increases.

4. Legal Resources: Depending on the situation, you might need to reach out to a tenant rights attorney for guidance.

How Rent Increases Affect Security Deposits

It’s important to know that your security deposit may also be impacted by a rent increase. For example, some states require that the deposit not exceed a specific multiple of your monthly rent. You should ensure that:

- Your security deposit aligns with the new rent amount, or your landlord may need to adjust it accordingly.

- Any changes are documented and communicated properly to avoid confusion later.

Talking the Landlord Out of a Rent Increase

Sometimes, you might find a way to negotiate with your landlord. Here are some strategies to consider:

- Show Your Reliability: Provide a history of on-time payments and positive renting behavior, showcasing your value as a tenant.

- Highlight Local Market Trends: If the rental market in your area is softening, use that data to negotiate.

- Offer Compromises: If your landlord is set on increasing rent, suggest alternatives such as a smaller hike or a delayed increase.

Comparative Table of Tenant Rights

| Aspect | Right/Requirement |

|---|---|

| Written Notice Period | 30 to 90 days (varies by state) |

| Mid-Term Rent Increase | Only if stated in the lease |

| Retaliatory Increases | Illegal in most states |

| Security Deposit Adjustment | Must comply with local rental laws |

| Lease Renewal Terms | Must be honored before any rent increase applies |

Real-World Examples of Tenant Rights in Action

Consider the case of Sarah, who learned that her landlord raised her rent by 20% without proper notice. After verifying local laws, she discovered she was entitled to a 60-day notice. By documenting her payment history and understanding her rights, she negotiated the increase down to a more manageable 5%.

Another example is Mike, who faced an unlawful rent increase shortly after reporting code violations. Knowing that retaliatory increases are illegal, he contacted a local tenant rights organization. They helped him draft a letter to the landlord, effectively freezing the increase until proper dialogue could occur.

Practical Implications for Tenants

Understanding your rights during rent increases not only aids in financial planning but also strengthens your position as a tenant. Familiarize yourself with local ordinances regarding rent increases, and consider joining a tenant’s association for support and information.

Actionable Advice on Tenant Rights

If you find yourself facing a rent increase, take immediate steps to assess your lease and local laws. Don’t hesitate to negotiate or seek legal counsel if you feel your rights are being compromised. Always keep all documentation organized; it can be pivotal in resolving disputes effectively. Be proactive in understanding your rights to navigate rental increases confidently.

Impact of Renovations on Rent Valuation

When it comes to determining how much you can raise rent, renovations play a crucial role. Upgrades can not only enhance a property’s appeal but can also significantly impact its rental value. By understanding the influence of renovations, you can make data-driven decisions about rent increases.

Key Points on Renovations and Rent Impact

- Rate of Return on Renovations: Studies indicate that landlords can expect to recover approximately 70-80% of their renovation costs when increasing the rent.

- Type of Renovation Matters: High-demand renovations such as kitchen and bathroom upgrades can lead to rent increases of 15-25% compared to properties without these improvements.

- Long-Term Impact: Properties that undergo extensive renovations can see enhanced tenant retention rates, with studies showing a decrease in tenant turnover by 30% for newly renovated units.

Comparative Renovation Effects on Rent Valuation

| Type of Renovation | Average Rent Increase (%) | Average Cost Recovery (%) |

|---|---|---|

| Kitchen Remodel | 20% | 75% |

| Bathroom Addition | 15% | 80% |

| Energy-Efficient Upgrades | 18% | 70% |

| Cosmetic Improvements | 10% | 60% |

Real-World Examples

1. Luxury Bathroom Remodel: A landlord invested $15,000 in a complete bathroom renovation. As a result, they raised rent by 20%, leading to an additional $300 monthly income. Over a year, that added up to $3,600, far surpassing the initial investment.

2. Kitchen Upgrade: After spending $10,000 on a modern kitchen renovation, the property owner increased rent by 25%. The payback period was just over three years, making it a profitable long-term investment.

3. Sustainable Features: A rental property installed solar panels at a cost of $20,000, allowing for a 15% rent increase. The sustainability feature attracted eco-conscious tenants, improving overall occupancy rates.

Practical Implications

- Invest in high-demand renovations, focusing on areas that yield the highest return, such as kitchens and bathrooms.

- Keep detailed records of renovation expenses and corresponding rent increases to justify the higher rent to tenants.

- Consider the target tenant demographic when planning renovations; premium upgrades may command higher rent in affluent areas but might not be as effective in lower-income neighborhoods.

Specific Facts and Actionable Advice

- Determine your local market’s average rent for similar renovated properties to position your unit competitively.

- Leverage renovations to reduce vacancy times; a well-upgraded property is more likely to attract tenants quickly.

- Communicate the value of upgrades to potential tenants, highlighting energy efficiency and modern amenities to justify rent increases effectively.