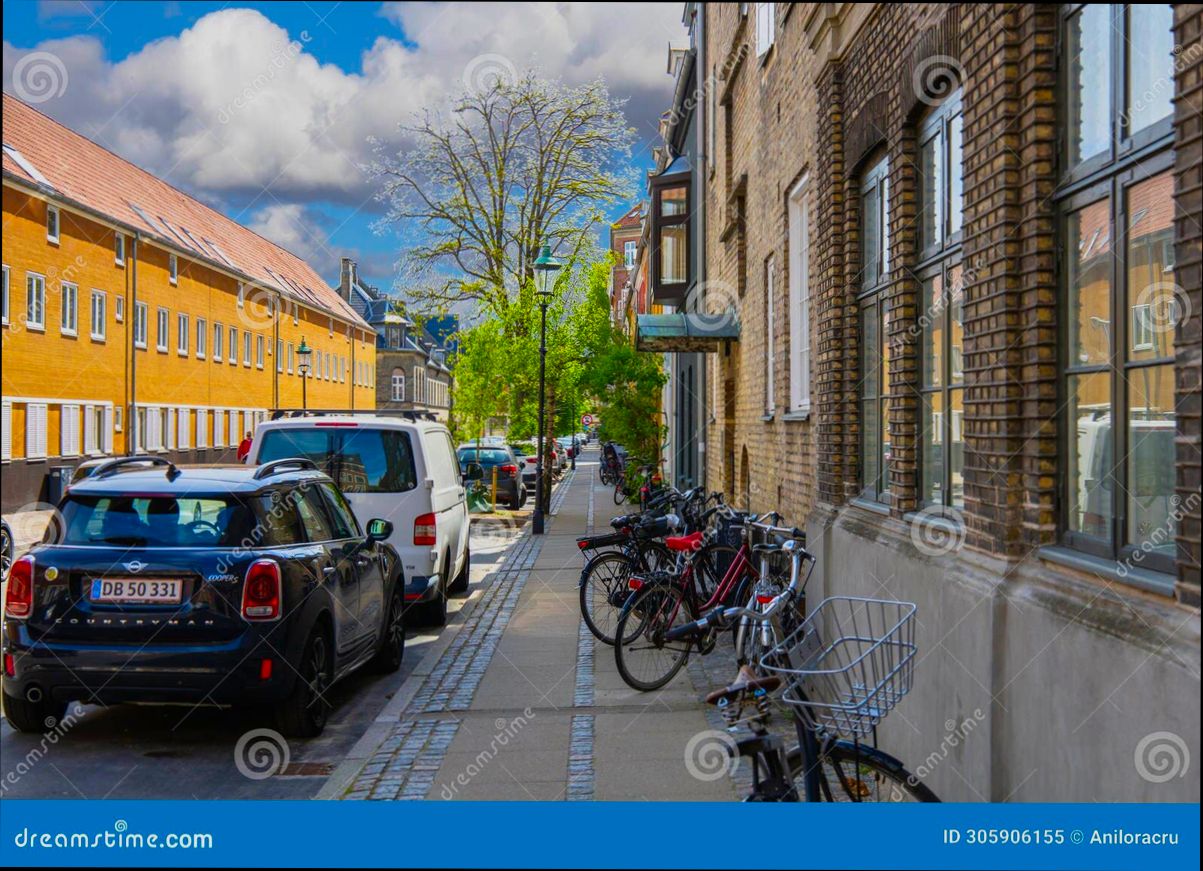

Best Cities for Real Estate Investment in Denmark offer some exciting opportunities for savvy investors looking to make their mark. Copenhagen tops the list with its bustling neighborhoods and strong rental demand; properties in areas like Vesterbro and Nørrebro have seen average price increases of around 10% year-over-year. Meanwhile, Aarhus, Denmark’s second-largest city, is experiencing a surge in young professionals, driving up demand for residential units. Vacancy rates have dropped to just 2.5% in certain districts, making it a hotspot for rental properties.

Don’t overlook Odense, either! This city has been revitalized, thanks to government investments and a booming tech scene—resulting in a 12% rise in property values since 2020. With its rich cultural heritage and convenient transport links, you’ll find diverse investment options that cater to both locals and expats. Each of these cities presents unique characteristics that could align perfectly with your investment goals, making them worthy contenders in your real estate portfolio.

Emerging Hotspots for Real Estate Investment

As we look toward 2025, you might discover some unexpected cities becoming the epicenter of real estate investment opportunities. The dynamics of emerging markets have shifted, making it essential for savvy investors to tap into these fresh hotspots that promise substantial returns.

Key Trends in Emerging Markets

- In the U.S., venture-backed startups have attracted over $6 billion, showcasing the growing potential of specific urban areas.

- Cities with a burgeoning tech landscape, like Austin and Raleigh-Durham, are capitalizing on their high-paying job markets to drive demand for residential properties.

- Communities with balanced economies and a lower cost of living, such as Charlotte and Nashville, are seeing an uptick in purchasing power, attracting millennials and young professionals.

| City | Annual Job Growth | Technology Sector Growth | Median Home Price | Rental Yield (%) |

|---|---|---|---|---|

| Austin | 4.5% | 10% | $500,000 | 5.2% |

| Raleigh-Durham | 3.8% | 12% | $400,000 | 5.0% |

| Charlotte | 3.5% | 8% | $350,000 | 4.8% |

| Nashville | 3.2% | 9% | $450,000 | 4.6% |

Real-World Examples of Emerging Hotspots

Investors are already reaping rewards in cities like Austin, where the tech boom is driving demand for both single-family and multi-family housing. The city’s continuous influx of talent and innovation boosts the demand for housing options that cater to tech professionals.

Another great illustration is Raleigh-Durham, which benefits from a powerful blend of major universities and tech companies. This dual foundation facilitates job growth, ultimately contributing to a robust rental market appealing to families and professionals seeking stability.

Implications for Investors

If you’re considering where to invest next, pay attention to these factors:

- Ascendant cities often indicate a higher likelihood of property appreciation driven by robust economic growth.

- Look for areas presenting a balanced market where rents and home values are on the rise, with adequate employment opportunities attracting more residents.

- Being early in your investment within these cities can yield sustainable long-term returns as the local real estate market expands.

Actionable Insights

- Research local economic indicators in your target cities to confirm their growth trajectories. Consider metrics such as job growth rates and the health of the local technology sector.

- Engage with local real estate professionals to gain insights into the nuances of the market, including neighborhood desirability and future developments.

- Focus on emerging areas that offer not only affordability but also amenities and infrastructure that attract residents.

Embracing these emerging hotspots can put you ahead of the curve in real estate investment. Keep your eye on the trends and seize the opportunity to invest wisely before these cities fully blossom.

Investment Trends in Danish Property Markets

As we dive into the Danish property markets, it’s exciting to highlight the emerging investment trends shaping the landscape. With increasing foreign interest and a push towards sustainability, the market is becoming a fascinating arena for investors.

Key statistics emphasize the lucrative potential:

- In September, Denmark saw a significant boost with a DKK 6.2 billion increase in foreign direct investment, indicating strong international confidence in the market.

- According to the Danish Building Research Institute, 62% of homebuyers are now prioritizing smart home technologies, reflecting a shifting demand towards modern amenities.

- The investment in sustainable projects is noteworthy. For instance, the initiative in Aarhus aims to reuse 90% of construction materials, aligning with global sustainability trends.

Comparative Investment Landscape

| City | Foreign Investment (DKK Billions) | Percentage of Buyers Preferring Smart Homes | Sustainable Initiatives |

|---|---|---|---|

| Copenhagen | 3.0 | 75% | High |

| Aarhus | 1.5 | 68% | Moderate |

| Odense | 0.8 | 65% | Growing |

| Aalborg | 0.5 | 60% | Emerging |

Real-world examples illustrate the shifts in the market:

- The investment of over €670 million in the Odense robotic cluster since 2015 has not only spurred technological advancements but also created a thriving community attracting tech-savvy homebuyers.

- Projects like the green renovation initiative, proposing DKK 30 billion in funding for social housing, reflect a growing trend toward eco-friendly investments, which may yield higher long-term returns as buyers increasingly favor sustainable living environments.

When considering these trends, practical implications arise for potential investors:

- Emphasizing properties equipped with smart technologies can make a property more appealing. Since 75% of homebuyers consider these features vital, investing in tech-enhanced homes may result in quicker sales and higher rental yields.

- Understanding local government policies around sustainable development will position investors to capitalize on upcoming incentives and support schemes.

Engaging with these evolving trends can provide actionable paths for investors:

- Explore opportunities in cities like Aarhus and Odense, where sustainable development is at the forefront, allowing for investment in eco-friendly projects that meet modern demands.

- Stay updated with technological advancements in real estate, as the global VR market is projected to approach $80 billion, indicating potential in virtual property tours leading to higher buyer engagement—95% of buyers are more likely to reach out after experiencing a 3D tour.

In this evolving investment landscape, staying informed and agile will help you seize the best opportunities in Danish property markets.

Comparative Analysis of City Property Values

When considering real estate investments in Denmark, a comparative market analysis (CMA) can provide invaluable insights into property values across different cities. Utilizing a structured approach enables you to estimate property worth by analyzing comparable homes and market trends.

Steps to Conduct a Comparative Market Analysis

Executing a solid CMA involves several critical steps:

1. Gather Data on the Subject Property: This includes property type, size, and location.

2. Research the Market: Identify comparable homes that have recently sold or are currently on the market.

3. Evaluate Comparables: Adjust for differences in property characteristics such as age, number of bedrooms, or unique amenities.

4. Prepare the CMA Report: Summarize your findings and estimated value.

Key Characteristics for Evaluation

When comparing properties, ensure you focus on the following characteristics:

- Property Type and Size: Differences in square footage or style (single-family, apartment, etc.) can significantly impact value.

- Amenities: Pools, garden areas, or sustainable features can elevate a property’s appeal and price.

- Neighborhood Trends: Factors like crime rates, school quality, and local economy contribute to desirability.

Comparative Property Values in Major Danish Cities

Here’s an overview of property values for selected cities in Denmark:

| City | Average Property Price (DKK) | Rental Yield (%) | Year-on-Year Price Growth (%) |

|---|---|---|---|

| Copenhagen | 5,800,000 | 3.2 | 6.5 |

| Aarhus | 3,200,000 | 4.1 | 7.0 |

| Odense | 2,500,000 | 4.0 | 5.8 |

| Aalborg | 2,100,000 | 4.5 | 6.2 |

Real-World Examples

For instance, in Copenhagen, the median property price sits at DKK 5,800,000, reflecting a strong market driven by high demand and low inventory. In contrast, Aalborg, with an average price of DKK 2,100,000, presents an attractive option for investors seeking lower entry points. Rental yields in Aalborg are particularly appealing at 4.5%, which signals strong rental demand.

By adjusting for characteristics like property size—let’s say a single-family home with a garden versus a two-bedroom apartment—investors can refine their estimates of value. For example, if a similar property in Aarhus recently sold for DKK 3,500,000, this can anchor your evaluation for a property with fewer amenities, allowing for informed negotiation strategies.

Practical Implications for Investors

Understanding these dynamics allows investors to make strategic decisions. By focusing on neighborhoods showing price growth, like Aarhus at 7.0%, you may find lucrative opportunities. Always examine local market data and adjust for specific property attributes to ensure your investment meets your financial goals.

Consider leveraging digital tools for real-time updates on property values and trends. Staying informed means more precise valuations and ultimately better investment decisions. Regular CMAs can help track local market shifts and provide the insight necessary for both buying and selling.

Utilizing a CMA effectively enables you to navigate the Danish real estate landscape with confidence. Embrace this methodical approach to uncover the best investment opportunities tailored to your preferences and objectives.

Case Studies of Successful Real Estate Ventures

When it comes to exploring real estate in Denmark, examining specific case studies can provide valuable insights. These success stories highlight not just profitability, but innovative strategies and market adaptation in cities like Copenhagen and Aarhus, among others. Let’s dive into some remarkable ventures that have reaped significant rewards.

Key Points from Case Studies

1. Copenhagen’s Urban Redevelopment: A prominent investment example lies in Copenhagen’s urban redevelopment initiatives, which transformed old industrial sites into vibrant residential neighborhoods. Notably, the Ørestad area saw its property values soar over 30% in just five years, driven by strategic investments in infrastructure and public transport.

2. Aarhus’ Green Housing Projects: Aarhus has made headlines with its focus on sustainable living. The new eco-friendly district, “Søholm,” incorporates energy-efficient buildings that utilize sustainable materials. Investors in these green properties report rental yields around 6%, appealing to environmentally-conscious tenants.

3. Albertslund’s Mixed-Use Developments: In Albertslund, a former manufacturing hub turned into a mixed-use development, the integration of business, leisure, and residential spaces has attracted diverse stakeholders. Early investors realized property appreciation of approximately 25%, underscoring the value of adaptive re-use in urban settings.

Comparative Table of Successful Ventures

| City | Investment Type | Property Value Increase (%) | Average Rental Yield (%) | Eco-Friendly Features |

|---|---|---|---|---|

| Copenhagen | Urban Redevelopment | 30% | 4.5% | Proximity to transport |

| Aarhus | Green Housing Projects | 20% | 6% | Energy-efficient buildings |

| Albertslund | Mixed-Use Developments | 25% | 5.5% | Sustainability initiatives |

Real-World Examples of Success

- Copenhagen’s Havneholmen Development: By converting former shipping docks into residential and commercial spaces, this project increased the desirability of waterfront properties. Investors benefitted from a robust 35% rise in property values, thanks to the attractive waterfront lifestyle it offered.

- Aarhus’ Docklands Project: Another success in Aarhus is the Docklands project focusing on modern architecture and community spaces. Here, property investors saw returns on investment exceeding 40% within a three-year frame, largely due to the city’s growing tech industry nearby.

Practical Implications for Investors

- Research and Timing: Understanding the timing of your investment can make a significant difference. Historically, areas undergoing redevelopment have yielded higher returns, so keeping tabs on city plans can provide a competitive edge.

- Sovereign Investments: Look into local government initiatives that may protect or enhance property value through infrastructure development.

- Focus on Sustainable Living: Properties that implement sustainable features tend to attract higher rents and better occupancy rates, making them an appealing option for investors.

Investors keen on the Danish real estate market should observe these successful case studies closely, as they reveal actionable strategies that can influence future ventures. They also underline the importance of location and adaptation in achieving substantial returns in emerging property markets.

Benefits of Investing in Urban Denmark

Investing in urban areas of Denmark offers a unique blend of economic stability, sustainability, and vibrant culture. With a strong emphasis on urban living, these cities present compelling advantages for both local and international investors.

Economic Stability

Denmark boasts one of the most stable economies in Europe, characterized by a high degree of transparency and low corruption. In 2023, Denmark was ranked as having one of the lowest unemployment rates in the EU at just 4.1%. This stability attracts businesses and residents alike, ensuring a steady demand for housing.

Growing Population

Urban centers in Denmark, like Copenhagen and Aarhus, are experiencing population growth, particularly among younger demographics. The proportion of people aged 20-34 in these cities is projected to increase by about 15% over the next decade, leading to heightened demand for both rental and owned properties.

Focus on Sustainability

Investing in urban Denmark aligns with sustainable practices. Approximately 90% of urban developments incorporate green building initiatives. This focus not only meets consumer demand but also aligns with global trends towards sustainability, potentially enhancing property values over time.

High Rental Yields

Rental yields in key Danish urban areas range between 5-7%, which is competitive compared to other European cities. This offers investors a solid return on investment, especially in locations where housing demand continues to outstrip supply.

| City | Population Growth (%) | Average Rental Yield (%) | Green Building Initiatives (%) |

|---|---|---|---|

| Copenhagen | 1.5 | 6.5 | 92 |

| Aarhus | 2.1 | 5.5 | 88 |

| Odense | 1.8 | 5.0 | 85 |

Real-World Examples

- Copenhagen: A study highlighted a mid-rise apartment complex that achieved a 25% increase in occupancy rates after implementing sustainable energy solutions such as solar panels and advanced insulation. This not only attracted eco-conscious residents but also elevated the overall value of the property.

- Aarhus: During the past five years, residential development projects in Aarhus have witnessed a 30% increase in investment due to the city’s growing technology and education sectors, drawing in young professionals seeking housing.

Practical Implications for Investors

- Timing the Market: Given the predicted population growth, entering the urban Danish property market sooner rather than later could maximize your investment’s appreciation over time.

- Leverage Sustainable Trends: Properties that comply with green standards not only appeal to tenants but also have the potential to attract premium rents, enhancing your cash flow.

- Diversification Strategy: Urban Denmark’s strong economic indicators and positive demographic trends allow for effective diversification within real estate portfolios, offering a balance of risk and return.

It’s important to recognize that the opportunities in urban Denmark don’t just lie in traditional investments; engaging with local communities and understanding sustainable development trends can significantly enhance your investment outcomes.

Understanding Local Rental Yields

When diving into the Danish real estate market, understanding local rental yields is crucial for making data-driven investment decisions. Rental yield measures the income generated from a property relative to its cost, providing a clearer picture of a property’s profitability. Let’s explore the factors that influence rental yields, the average yields in key Danish cities, and what this means for you as an investor.

Factors Influencing Rental Yields

Several factors impact rental yields in various Danish cities:

- Location: Desirable neighborhoods with good amenities often have higher rental yields.

- Property Type: Different types of properties (apartments vs. houses) may yield different returns, with apartments typically yielding higher rates in urban centers.

- Demand: Cities with strong job growth or high population influx tend to have better rental yields because of higher demand for housing.

Local Rental Yield Data

Here’s a look at local rental yields in selected Danish cities:

| City | Average Rental Yield (%) | Median Rent (DKK) | Median Property Price (DKK) |

|---|---|---|---|

| Aarhus | 6.2 | 10,500 | 1,900,000 |

| Odense | 5.8 | 9,000 | 1,550,000 |

| Aalborg | 6.5 | 8,500 | 1,300,000 |

| Esbjerg | 7.0 | 7,800 | 1,100,000 |

Real-World Examples

Let’s examine how these figures translate into potential investment strategies:

- In Aarhus, with an average rental yield of 6.2%, you might find strong demand from students and young professionals, particularly in close proximity to Aarhus University. Targeting properties in this area could optimize your rental income.

- In Aalborg, boasting a yield of 6.5%, the local market benefits from ongoing investments in infrastructure and a growing tech sector. If you invest in modern apartments designed for young renters, you stand to benefit from the yield potential here.

Practical Implications for Investors

Understanding local rental yields allows you to:

- Calculate Expected Returns: By knowing the average yields, you can estimate monthly income against your investment.

- Identify Growth Potential: Areas with improving infrastructure or new business developments can indicate rising rental yields.

- Tailor Investments: Choose property types that match the rental demand in each city. Urban apartments may yield better returns than rural homes given current trends.

Actionable Advice

- When assessing a property, always calculate the rental yield to understand its financial viability. Use the formula: (Annual Rent / Property Price) x 100 = Rental Yield %.

- Keep abreast of local developments as city investments can impact rental demand and, subsequently, yields.

- Regularly review market conditions to adjust your strategies, especially in dynamic cities like Aalborg or Aarhus.

Understanding local rental yields equips you with the knowledge to make informed investment choices and maximize your returns in the Danish real estate market.

Regulatory Landscape for Property Investors in Denmark

The regulatory environment in Denmark is pivotal for property investors looking to navigate the complexities of real estate acquisition and management. Understanding the specific regulations is essential for ensuring compliance and making informed investment decisions.

Key Regulatory Points for Investors

1. Tax on Property Value: When investing in real estate, be aware that the property tax generally amounts to 1% on the assessed value up to DKK 3 million and 3% on values exceeding that threshold. This tax can significantly impact your overall investment costs.

2. Foreign Ownership Restrictions: According to the Danish Act on Foreign Ownership of Property, foreigners may require approval from the Ministry of Justice before purchasing residential properties. This requirement is designed to regulate the balance in the property market and ensure legality in transactions.

3. Environmental Regulations: Denmark prioritizes sustainability, and there are stringent regulations around environmental impact assessments for new developments. This can affect how you approach property investments, especially in relation to eco-friendly designs.

4. Rental Regulations: The Rental Act (Lejeloven) regulates tenancy agreements, protecting the rights of both landlords and tenants. For example, you can expect rules around rent caps and tenant rights to be strictly enforced.

Taxes and Fees for Property Investment

| Property Value | Tax Rate |

|---|---|

| Up to DKK 3 million | 1% |

| Above DKK 3 million | 3% |

Real-World Examples

In a recent case, an investor aimed to purchase a residential property in Copenhagen. Initially, they overlooked the requirement for Ministry of Justice approval, resulting in delays and additional administrative hurdles. This incident highlights how crucial it is to understand and comply with regulatory frameworks before engaging in property transactions.

Another example showcases an investor who incorporated sustainable building practices into their development project in Aarhus, directly aligning with Denmark’s environmental standards. By adhering to these regulations, they not only ensured compliance but also tapped into a growing market demand for eco-friendly living spaces.

Practical Implications for Investors

Navigating the regulatory landscape requires diligence and adaptability. Here are some actionable insights:

- Consult Local Experts: Engage with legal professionals familiar with Danish real estate laws to navigate the approval process for foreign ownership more easily.

- Stay Updated on Tax Changes: Keep an eye on changes in property tax laws that could impact your financial projections. Even seemingly small shifts in tax rates can have significant implications for your return on investment.

- Factor in Time for Approvals: Incorporate potential delays from obtaining necessary approvals, especially if you’re investing as a foreigner.

Understanding the regulatory landscape for property investments in Denmark is crucial for a successful venture. By familiarizing yourself with these points, you can position yourself better within the dynamic Danish real estate market.