What is Title Insurance? It’s that behind-the-scenes superhero that swoops in to protect your investment when you buy a home. Picture this: you’ve found the perfect house, signed the papers, and then you discover an old lien, or worse, a forgotten ownership dispute from decades ago. Title insurance is there to give you peace of mind, covering losses that might arise from these hidden pitfalls. According to the American Land Title Association, nearly one in three homes has some kind of title issue, so you really want this safety net.

Let’s break it down: when you get title insurance, you’re not just buying a policy; you’re also getting a thorough examination of the property’s history. Imagine being able to dive into records that go back generations, finding out if the land was ever owned by someone who didn’t settle their debts. For instance, if a previous owner left behind unpaid property taxes or a lingering divorce claim, you could be in hot water without title insurance guarding your back. This isn’t just a formality; it’s a critical protection that could save you thousands in the long run, letting you focus on making your new house a home instead of fighting legal battles.

Understanding the Role of Title Insurance

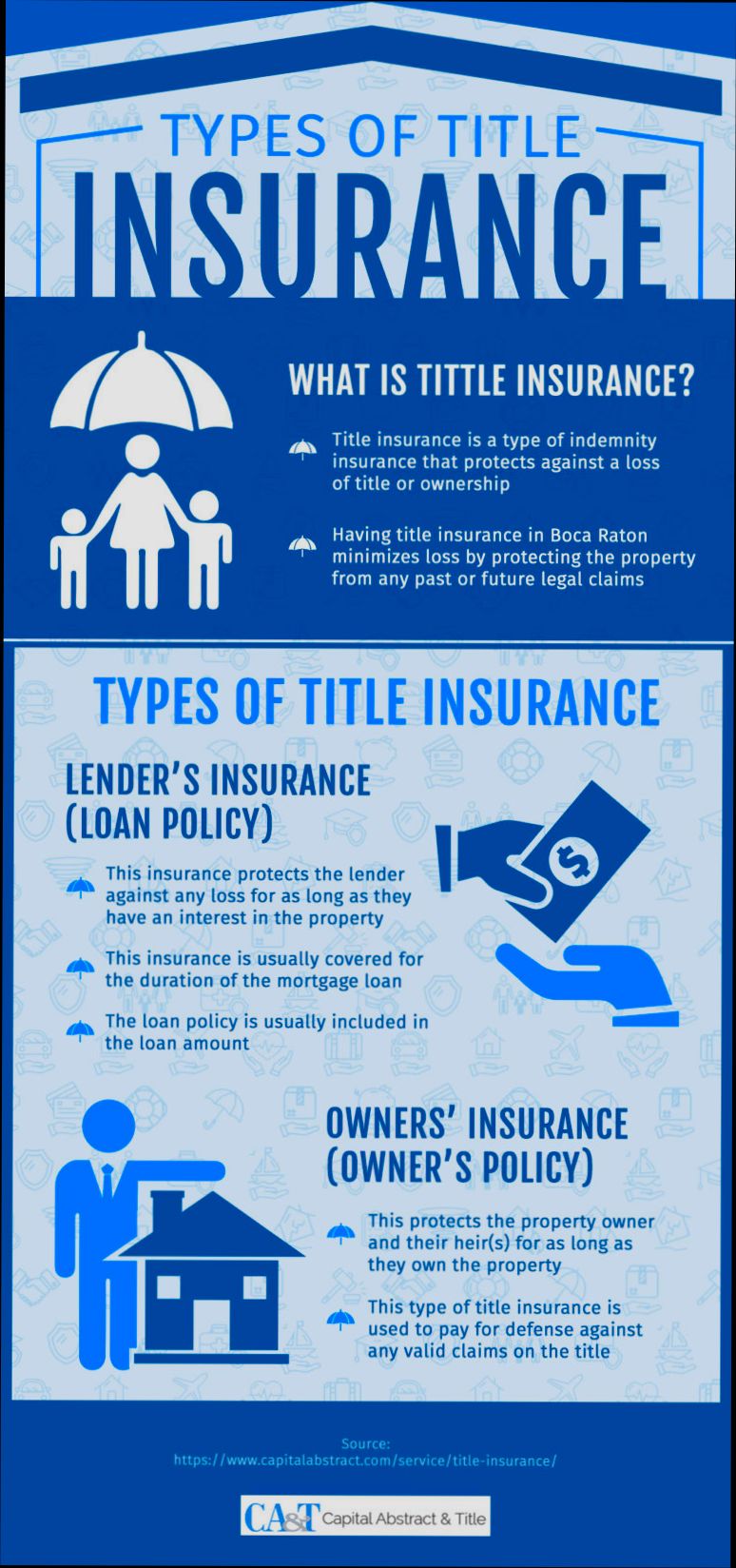

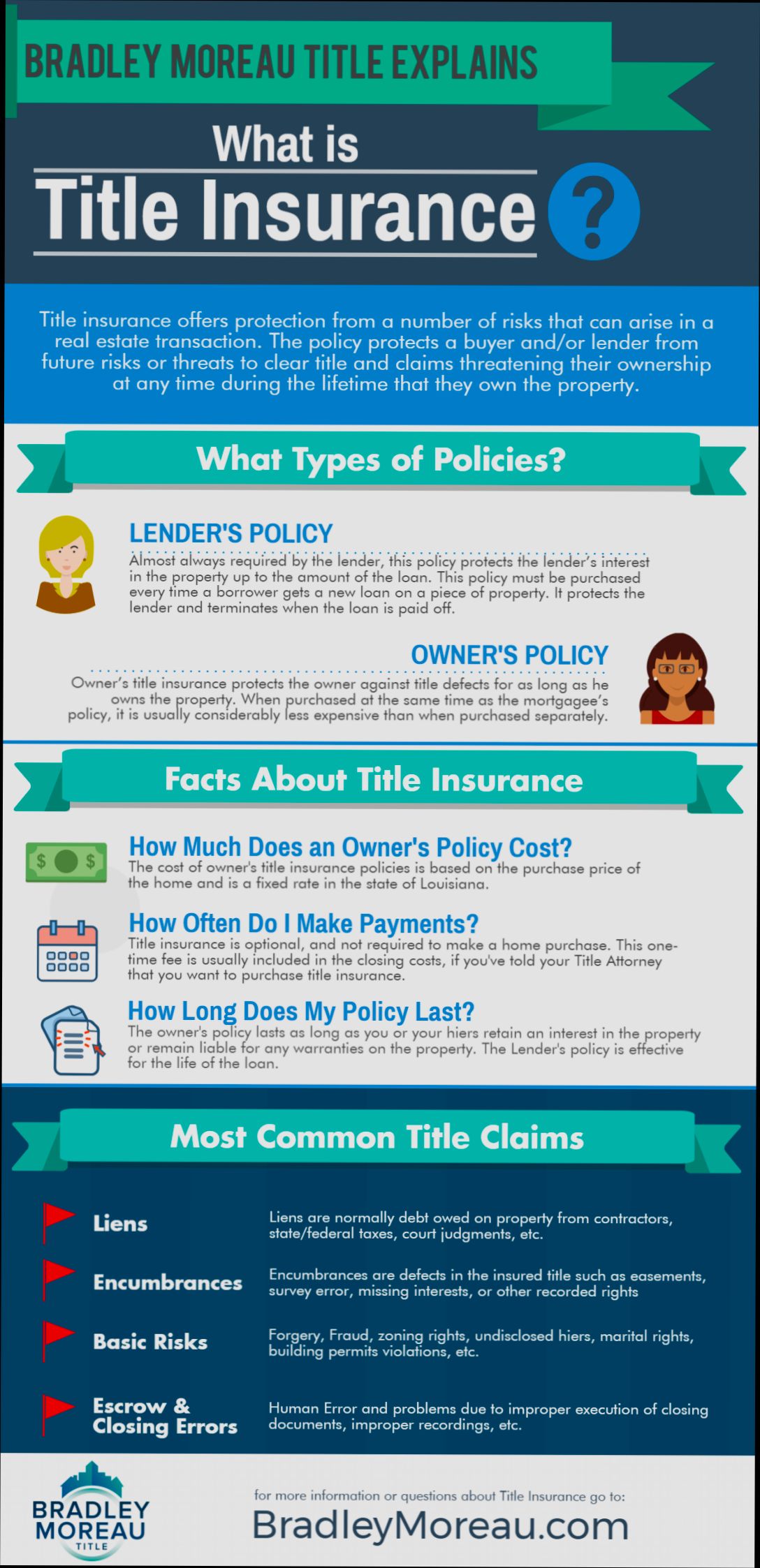

Title insurance plays a crucial role in real estate transactions, safeguarding your investment by offering protection against potential legal claims on a property. By understanding this role, you can navigate the complexities of home buying with confidence.

Importance of Title Insurance in Safeguarding Your Investment

When you purchase a property, you’re not only acquiring a physical structure but also a bundle of rights. Here’s why title insurance matters:

- Protection Against Past Claims: Title insurance protects you from claims, liens, and defects that may arise from previous ownership. For instance, about 30% of title searches reveal at least one issue that could affect ownership rights.

- Legal Defense Coverage: If your ownership is challenged, title insurance covers legal fees, which can average around $1,500 to $2,500 for litigation related to title issues.

- Peace of Mind: Buyers can proceed with their investment knowing they have coverage. Approximately 80% of homeowners report feeling more secure with title insurance.

Key Differences in Title Insurance Policies

| Policy Type | Coverage Details | Typical Cost Range (USD) |

|---|---|---|

| Owner’s Policy | Protects homeowners against ownership claims from third parties | $300 - $1,500 |

| Lender’s Policy | Protects lenders’ interests; mandatory for mortgage loans | $100 - $1,000 |

Real-World Examples Demonstrating Title Insurance in Action

1. Case of Inherited Property: A buyer purchased a home previously owned by a family member. After the sale, an unknown heir emerged claiming ownership. Title insurance covered legal fees and ensured the buyer retained their property.

2. Liens Discovered Post-Purchase: A homeowner discovered a mechanic’s lien on their property after moving in. Fortunately, their title insurance policy covered the dispute, allowing them to resolve the issue without significant financial burden.

Practical Implications for Home Buyers

When you’re considering a property purchase, it’s essential to factor in the role of title insurance in your planning. Here are some actionable insights:

- Do Your Research: Before purchasing title insurance, ask about the claims history of the property to understand any prior issues.

- Compare Policies: Look at both owner’s and lender’s policies to see which better suits your needs and consider asking about optional endorsements.

- Request a Title Search: A thorough title search helps identify potential issues that could affect your ownership.

Specific Facts About Title Insurance to Keep in Mind

- About 75% of title insurance claims arise from defects in the title that were not found during the initial title search.

- Errors in public records account for nearly 20% of claim issues, emphasizing the importance of title insurance in protecting homeowners.

By actively engaging with these aspects of title insurance, you can make informed decisions that protect both your investment and your peace of mind.

Key Statistics on Title Insurance Claims

When it comes to title insurance, understanding the statistics surrounding claims can be vital for making informed decisions. These figures not only highlight the importance of title insurance but also give you insights into the potential risks that can arise in real estate transactions.

Eye-Opening Statistics on Claims

- Approximately 1 in 4 property transactions encounter a title issue during the closing process. This statistic underscores the prevalence of existing claims that could affect your ownership.

- Over 90% of title insurance claims are related to issues that arise from defects prior to the closing. These can include unpaid taxes, unrecorded liens, or undisclosed heirs.

- A staggering 80% of all title claims result in at least some form of financial reimbursement to the policyholder. This high percentage illustrates how often claims lead to positive outcomes for insured homeowners.

Comparative Table of Common Title Insurance Claims

| Type of Claim | Percentage of Claims | Average Payout |

|---|---|---|

| Unrecorded Liens | 30% | $20,000 |

| Fraud or Forgery | 25% | $55,000 |

| Missing Heirs | 20% | $40,000 |

| Mistakes in Title Records | 15% | $15,000 |

| Other Legal Issues | 10% | $10,000 |

Real-World Examples of Title Insurance Claims

Consider a scenario where a homeowner discovers an unrecorded lien on their property after purchase. This situation could lead to legal battles, but with title insurance in place, they are able to file a claim. In a recent case, a homeowner received a payout of $25,000 to settle the lien issue, sparing them from financial hardship.

In another example, a property owner faced a claim due to fraudulent documents used in a previous transaction. Thanks to their title insurance policy, they successfully claimed over $50,000 to rectify the matter. Such instances not only highlight the risks involved in property transactions but also illustrate how the right insurance can safeguard against unexpected claims.

Practical Implications for Homeowners

Understanding these key statistics can motivate you to consider title insurance seriously. Knowing that 1 in 4 transactions may face issues empowers you to be proactive. Make sure to ask your title insurance agent about common claims in your state.

Additionally, it’s wise to review your policy details regularly. With over 90% of claims linked to pre-existing issues, continual vigilance can help you address potential risks before they escalate into significant problems.

Being informed about these statistics gives you the power to make smarter decisions regarding your real estate investments, ultimately leading to a more secure ownership experience.

How Title Insurance Protects Property Buyers

Title insurance is essential for property buyers seeking to protect their investment from unforeseen legal complications. It mitigates risks associated with issues that could arise from past claims, ensuring that you have peace of mind throughout your homeownership journey.

Key Points on Protection Through Title Insurance

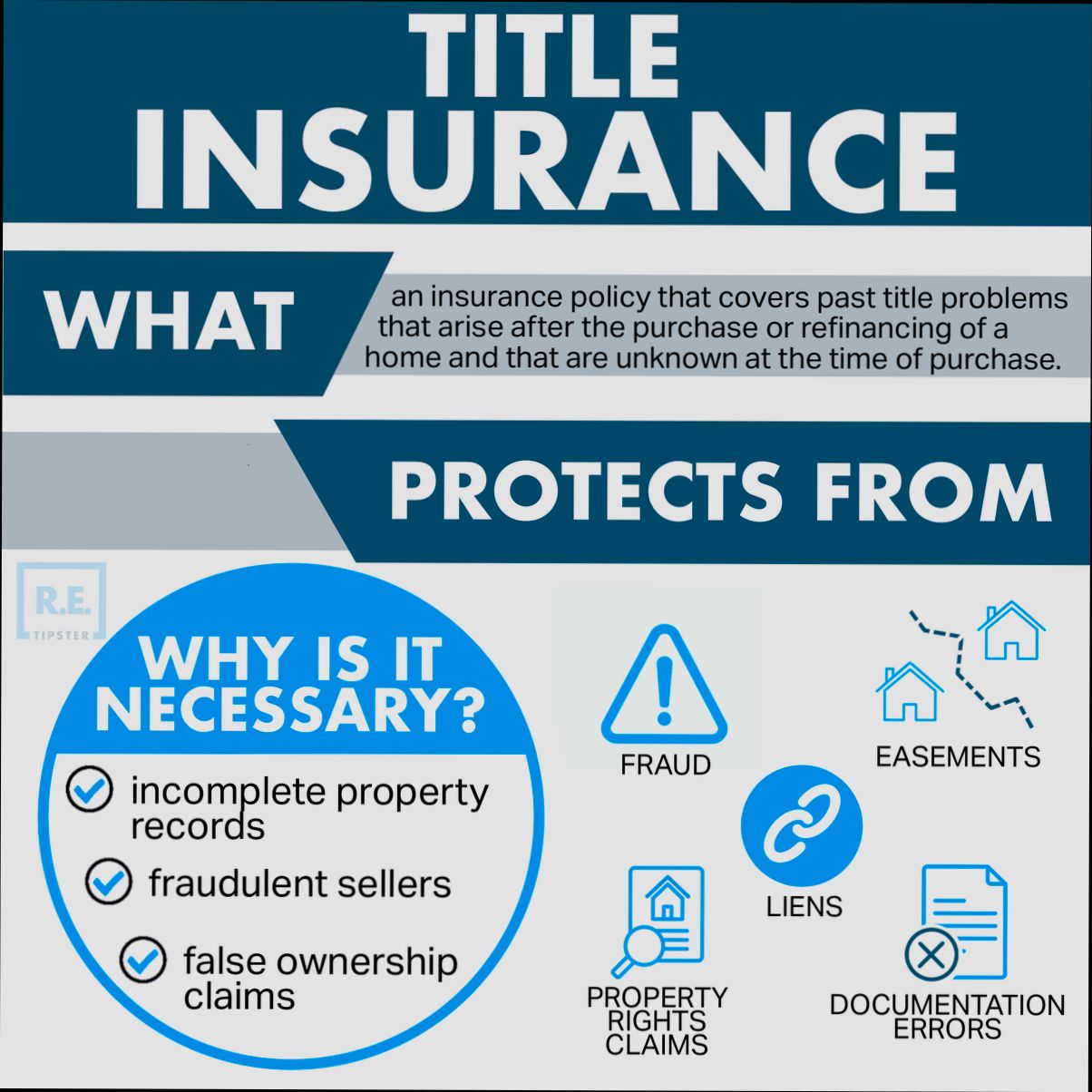

When you obtain title insurance, it safeguards you against various potential challenges, including:

- Lost, forged, or incorrectly filed deeds: These problems can cloud your ownership rights, potentially leaving you vulnerable to claims against the property.

- Fraud prevention: Title insurance helps to identify fraudulent activities, such as falsified documents, which could compromise your ownership status.

- Mechanic’s liens: If previous owners failed to settle debts with contractors, you might face unexpected liens. Title insurance covers these claims, protecting your financial interests.

- Encroachments: Disputes regarding property boundaries can arise, potentially affecting your use of the property. Title insurance helps you navigate these issues before they escalate.

| Title Insurance Coverage | Owner’s Policy | Lender’s Policy |

|---|---|---|

| Coverage Amount | Purchase price + legal costs | Loan amount (decreases as paid off) |

| Duration | As long as you own the property | Ends when mortgage is paid off |

| Protects | Homeowner’s financial interest | Lender’s financial interest |

Real-World Examples

Consider a scenario where a homebuyer discovers a previously unrecorded mechanic’s lien from a contractor who worked on the property years ago. Without title insurance, the buyer could be responsible for paying off the lien, but a policy would cover it, allowing the buyer to focus on their new home rather than unexpected financial burdens.

Another example involves a title being forged by a con artist who sells a property that doesn’t belong to them. This kind of fraud can leave a legitimate buyer in a difficult situation. Title insurance protects the buyer by covering legal costs associated with proving rightful ownership and reclaiming the title.

Practical Implications for Property Buyers

Buying title insurance isn’t just a safeguard; it’s an intelligent decision. By purchasing an owner’s policy, you ensure that you are protected against future title issues, which can save you significant legal costs down the line. It’s important to shop around for coverage, as prices can vary significantly, even if recommended by your agent or lender.

When communicating transaction details, always prioritize cybersecurity. It’s crucial to verify payment transfer details directly with your closing agent or lender over the phone to prevent fraud.

Actionable Advice

As a property buyer, consider getting an owner’s policy in addition to any lender’s policy you might require. This way, you’ll have comprehensive protection tailored to your financial interests. Remember to conduct thorough research when selecting a title insurance provider to ensure that you get the best coverage for your needs.

Real-World Scenarios Requiring Title Insurance

When navigating the complexities of real estate transactions, understanding real-world scenarios that necessitate title insurance can significantly impact your ownership experience. Title insurance acts as a safety net, protecting you from unexpected legal challenges that might arise from your property’s history.

Key Scenarios Where Title Insurance is Essential

1. Estate Claims: Imagine purchasing a home, only to discover later that a distant relative of the previous owner has come forward, claiming rights to the property. According to the National Association of Insurance Commissioners, nearly 25% of all property purchases involve some form of claim from an unknown heir.

2. Unforeseen Liens: If a previous owner had debts that remained unpaid, creditors could place liens on the property even after it’s sold. Reports indicate that around 15% of title insurance claims are tied to undisclosed liens that the new owner had no knowledge of.

3. Fraudulent Activities: In some unfortunate situations, properties change hands through forged documents. Research shows that almost 10% of title insurance claims stem from fraud, underscoring the need for protection against potential scams.

4. Misfiled Information: Sometimes, property records contain clerical errors, leading to disputes over ownership. A staggering 20% of claims are due to inaccuracies in public records, making title insurance crucial for safeguarding your rights.

Comparative Table of Common Title Challenges and Coverage

| Scenario | Percentage of Claims | Importance of Title Insurance |

|---|---|---|

| Unknown Heirs | 25% | Protects against claims from distant relatives |

| Unpaid Debts and Liens | 15% | Shields homeowners from unexpected financial burdens |

| Fraudulent Transfers | 10% | Provides recourse in cases of forgery |

| Record Inaccuracies | 20% | Ensures your ownership rights are protected |

Real-World Examples Showcasing Title Insurance Needs

One notable case involved a homebuyer in Florida who discovered that the previous owner had failed to disclose a $50,000 lien due to unpaid contractor fees. Without title insurance, the new homeowner would have faced the financial burden of settling this debt before gaining clear ownership.

In another instance, a Virginia couple purchased a historic property, only to learn six months later that an unknown heir claimed ownership based on a long-lost will. The title insurance they had secured covered their legal fees and argued their case, ultimately preserving their investment and peace of mind.

Practical Implications for Property Buyers

Understanding these scenarios can shape how you approach purchasing properties. Always consider requesting a title search as part of your buying process, and don’t underestimate the importance of title insurance in mitigating potential legal disputes. Knowing the figures—like the 25% related to claims from unknown heirs—underscores the risks that exist without this crucial coverage.

Actionable Facts About Title Insurance Scenarios

- If you’re buying a property, request a full title report from your insurance provider to uncover any existing claims or liens.

- Consider investing in title insurance as soon as you make an offer, especially in areas with a history of disputed properties.

- Educate yourself on common signs of potential title issues, such as unresponsive sellers, ambiguous property lines, or inconsistencies in the deed description. These insights will help you make a well-informed decision.

The Advantages of Title Insurance Coverage

Title insurance offers unique advantages that can safeguard property owners against costly legal disputes and financial pitfalls. Understanding these benefits can empower you as a homeowner, ensuring that you make informed decisions about your property investment.

Key Benefits of Title Insurance Coverage

1. Protection Against Financial Liabilities: Title insurance can cover you from liens that may have been overlooked during the title search. This means if a contractor, tax authority, or previous lender hasn’t been paid and has placed a lien on your property, title insurance can protect you from taking on these unwelcome financial responsibilities. You wouldn’t want to inherit someone else’s unpaid bills, right?

2. Coverage for Unforeseen Claims: Title insurance covers you against third-party claims that might arise unexpectedly, sometimes years after the sale. For instance, if a conflicting will surfaces or an heir from a previous owner makes a claim to the property, having title insurance in place can shield you from the potential costs associated with these disputes.

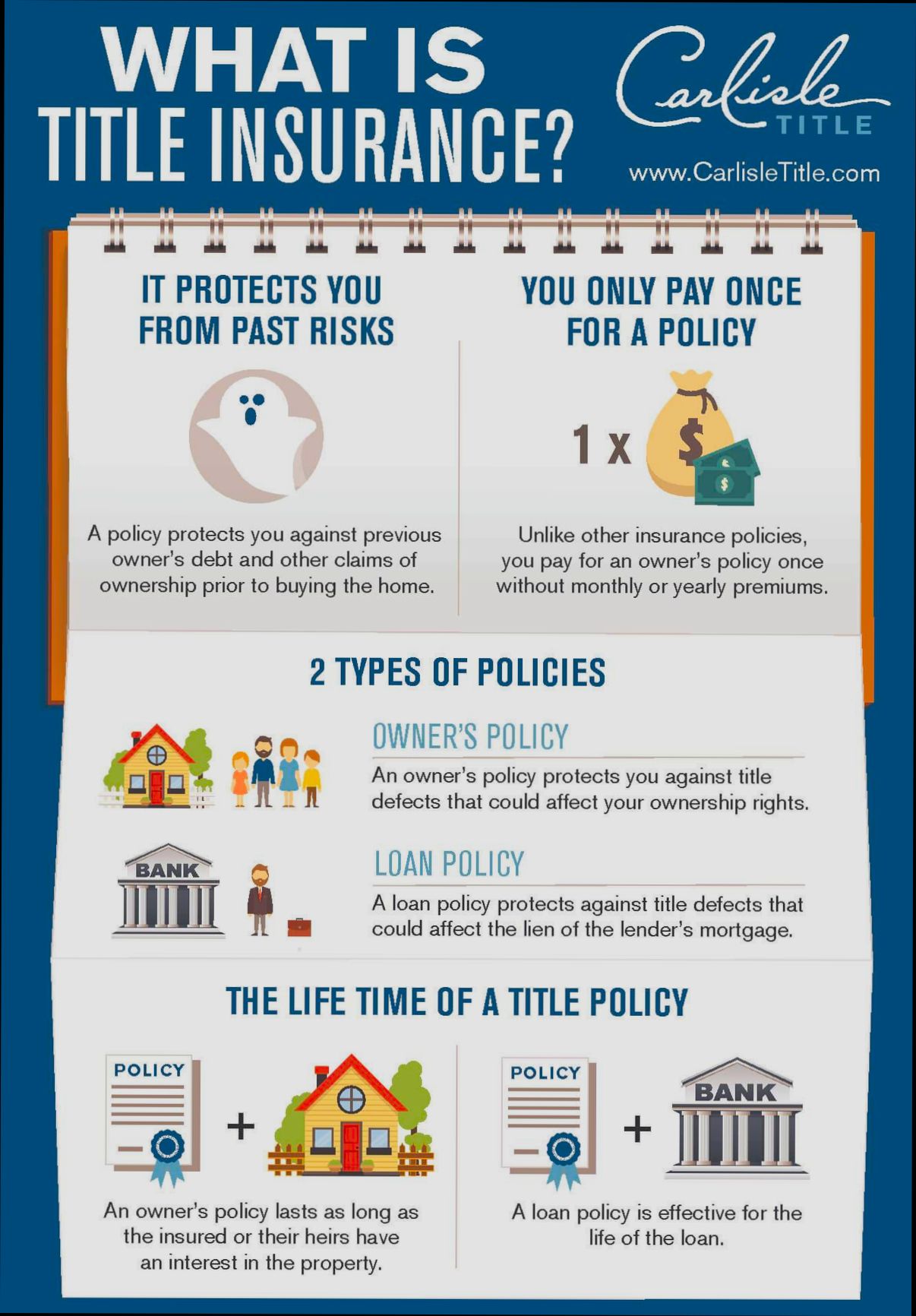

3. One-Time Premium for Ongoing Peace of Mind: The average cost for title insurance ranges from 0.5% to 1.0% of the home’s purchase price, translating to about $1,500 to $3,000 for most transactions. This one-time payment provides long-lasting security, which is relatively inexpensive compared to the potential costs of legal battles resulting from uncovered title defects.

4. Safeguarding Property Usage: Title insurance protects against easements and encumbrances that may restrict how you can use your property. For example, if easements are in place granting access to utility companies, your title policy ensures that you won’t face disputes regarding boundaries or usage rights later.

5. Protection Against Title Errors: Mistakes can happen with property surveys, deed filings, or zoning laws. Title insurance can defend you against the implications of these errors, ensuring that no adverse legal consequences arise due to someone else’s mistakes.

| Advantage | Description | Potential Cost Savings |

|---|---|---|

| Financial Liability Protection | Shields you from liens placed by contractors or previous homeowners. | Avoids costs associated with settling unpaid debts. |

| Coverage for Unforeseen Claims | Protects against third-party claims that may arise years later. | Saves legal fees in unexpected disputes. |

| One-Time Premium | Simple and straightforward payment that secures your investment. | Long-term security at a fraction of potential legal costs. |

| Safeguarding Property Usage | Limits disputes over easements and encumbrances that affect property use. | Preserves the value and utility of your property. |

| Protection Against Title Errors | Guards against mistakes in property records that could impact ownership. | Prevents costly legal battles over ownership disputes. |

Real-World Examples of Title Insurance Advantages

- Case of the Unpaid Contractor: A homeowner purchased a property only to find out later that a contractor had placed a lien due to unpaid renovation costs from the previous owner. Because they had owner’s title insurance, they were able to resolve the issue without incurring additional costs.

- Surprise Heir Claim: An individual thought they secured a beautiful old property, only to have an unexpected heir present a claim to ownership based on an old will. Their title insurance policy helped cover legal fees and resolved the claim in their favor.

Practical Implications of Title Insurance Coverage

For homeowners, the advantages of title insurance go beyond the initial purchase process. It provides critical protection against potential claims that can arise long after the transaction is complete. This security fortifies your investment and allows you to live in your home without the shadow of past ownership issues looming overhead.

Actionable Insights About Title Insurance Coverage

When purchasing title insurance, make sure to:

- Discuss policy options thoroughly with your insurer to understand what is covered.

- Consider the long-term value of having owner’s title insurance, as it remains valid for your lifetime or that of your heirs.

- Factor in title insurance costs as a part of your closing expenses, knowing that it can save you from major financial headaches down the line.

By exploring title insurance options and understanding its advantages, you can make informed choices that significantly enhance your property ownership experience.

Common Misconceptions About Title Insurance

When it comes to title insurance, there are several common misconceptions that can lead to confusion and potentially significant financial implications. Many people misunderstand what title insurance actually covers and how it functions in real estate transactions.

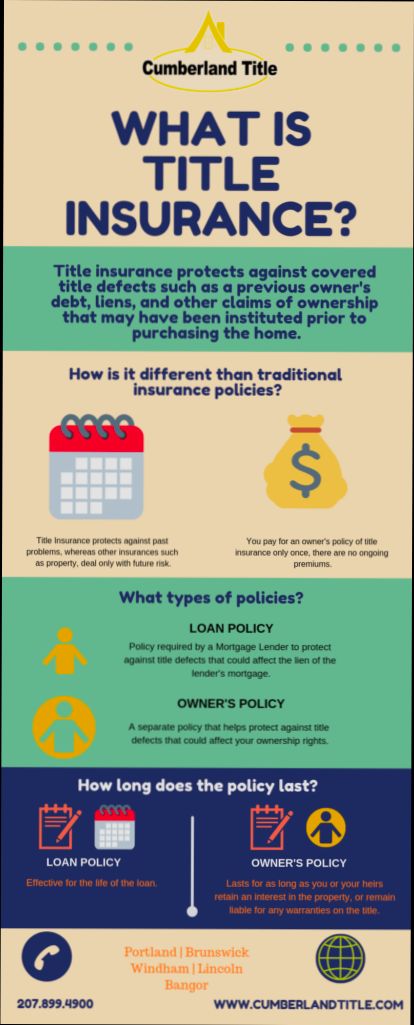

Misconception #1: Title Insurance is Only Necessary for Lenders

Many purchasers believe that title insurance serves only the lender’s interests. In reality, while lenders often require a lender’s policy, an owner’s policy is equally important for protecting your investment. Without it, you are at risk of financial loss from claims against your title. It’s essential to know that approximately 25% of properties encounter title issues that could affect you, the owner.

Misconception #2: Title Insurance is a One-Time Expense

Some individuals think that title insurance is just a one-time payment and that it covers them indefinitely. However, title insurance only provides coverage for issues that existed before you purchased the property. The moment you sell or transfer your property, your policy often expires. With claims related to past ownership affecting roughly 30% of transactions, it is vital to understand the timeline of your coverage.

Misconception #3: I Don’t Need Title Insurance if My Home is New

A prevalent misunderstanding is that new homes come with a clean title, and therefore, title insurance isn’t necessary. This assumption is misleading because even new constructions can have latent defects or claims that arise from previous owners or land records. Studies indicate that title claims can arise from issues that occurred decades before your purchase—so having title insurance is essential regardless of the property’s age.

| Misconception | Explanation | Impact on Buyers |

|---|---|---|

| Only for lenders | Both lenders and buyers can benefit from title insurance. | Risk of financial loss |

| One-time payment | Coverage is effective only pre-purchase; it does not last indefinitely. | Unexpected costs upon sale |

| Not necessary for new homes | Title issues can arise even with new constructions. | Vulnerability to title claims |

Real-World Examples

Consider the case of a homebuyer who assumed title insurance was unnecessary for his newly built home. Shortly after purchasing, he discovered a historical easement that significantly limited how he could use his property. Without title insurance, he faced legal fees and restrictions worth thousands in unexpected renovation costs.

Another example involves a buyer who believed a one-time premium covered all potential claims. After selling her home, she was hit with a title claim from a neighbor asserting a right-of-way that had been overlooked. The buyer had to foot the bill for her legal defense, which could have been avoided had she understood the longevity limitations of her policy.

Practical Implications for Readers

To safeguard your investment effectively, consider these actionable steps:

- Always obtain an owner’s title insurance policy in addition to any required lender’s policy.

- Understand the limitations and duration of your title insurance coverage, and take proactive measures as you plan to sell or rent your property.

- Don’t assume that newly constructed properties are immune to title issues. Always perform due diligence and consider title insurance as a staple of your home-buying process.

Being aware of these common misconceptions empowers you to make better-informed decisions when navigating real estate investments.

Navigating the Title Insurance Process

Navigating the title insurance process can feel overwhelming, but understanding its steps and requirements will empower you to protect your real estate investment effectively. Engaging with the process proactively will enhance your confidence as a buyer and mitigate potential complications before they arise.

Steps to Navigate the Title Insurance Process

1. Identify Your Needs: Determine whether you want an owner’s title insurance policy, a lender’s policy, or both. Around 30% of buyers still believe these policies are solely for lenders, but knowing your options helps you make informed choices.

2. Choose a Reliable Title Company: Research and select a reputable title insurance company. It’s crucial to read reviews, seek recommendations, and get quotes from multiple companies. A local company familiar with state-specific regulations can make a significant difference.

3. Request a Preliminary Title Report: Before closing, request a preliminary title report from your chosen title company. This report provides a comprehensive overview of any existing title issues and outstanding liens. Be sure to review it carefully and raise any flags with your agent.

4. Understand Closing Costs: Title insurance is just one part of the closing costs. Generally, title insurance can constitute 0.5% to 1.0% of the purchase price of the home. This cost can vary based on your location and the property’s value.

5. Address Title Issues Promptly: If the preliminary report reveals any title issues, address them immediately. Issues can range from unpaid liens to claim disputes, and resolving them quickly can prevent delays in your closing timeline.

Title Insurance Process Comparative Table

| Action Item | Description | Estimated Timeframe |

|---|---|---|

| Identify your needs | Determine if you need owner’s and/or lender’s policy | 1-2 days |

| Choose a title company | Select and finalize your title insurance provider | 2-5 days |

| Request preliminary title report | Get a detailed report on title status | 3-7 days |

| Review and address title issues | Discuss any concerns with your agent | Ongoing (as needed) |

| Finalize insurance and closing | Complete the purchase with insurance in place | At closing |

Real-World Examples

Imagine you’re purchasing a charming home that seems perfect. However, the preliminary title report reveals a lien from a previous owner for unpaid property taxes. By addressing this issue early, you avoid the potential for a third party to claim your house later on, which could lead to costly legal battles.

Another case involved a buyer who neglected to understand the implications of a prior owner’s divorce decree, which affected ownership rights. By engaging actively with the title company early, the buyer ensured that these rights were clarified before the final purchase, removing any ambiguity.

Practical Implications

You have the power to influence the outcome of the title insurance process. Here are some actionable steps:

- Ask Questions: Never hesitate to ask your title agent about any terms or reports that are unclear. They are there to guide you.

- Stay Organized: Keep all documents and communication records in one place for easy reference.

- Set Deadlines: Manage your own timeline by setting dates for when you want to resolve title issues to stay on track for closing.

Statistically, ensuring you follow these steps diligently can significantly reduce the chance of encountering unexpected title issues later. Being proactive in the title insurance process ultimately protects your interests and contributes to a smoother real estate transaction.