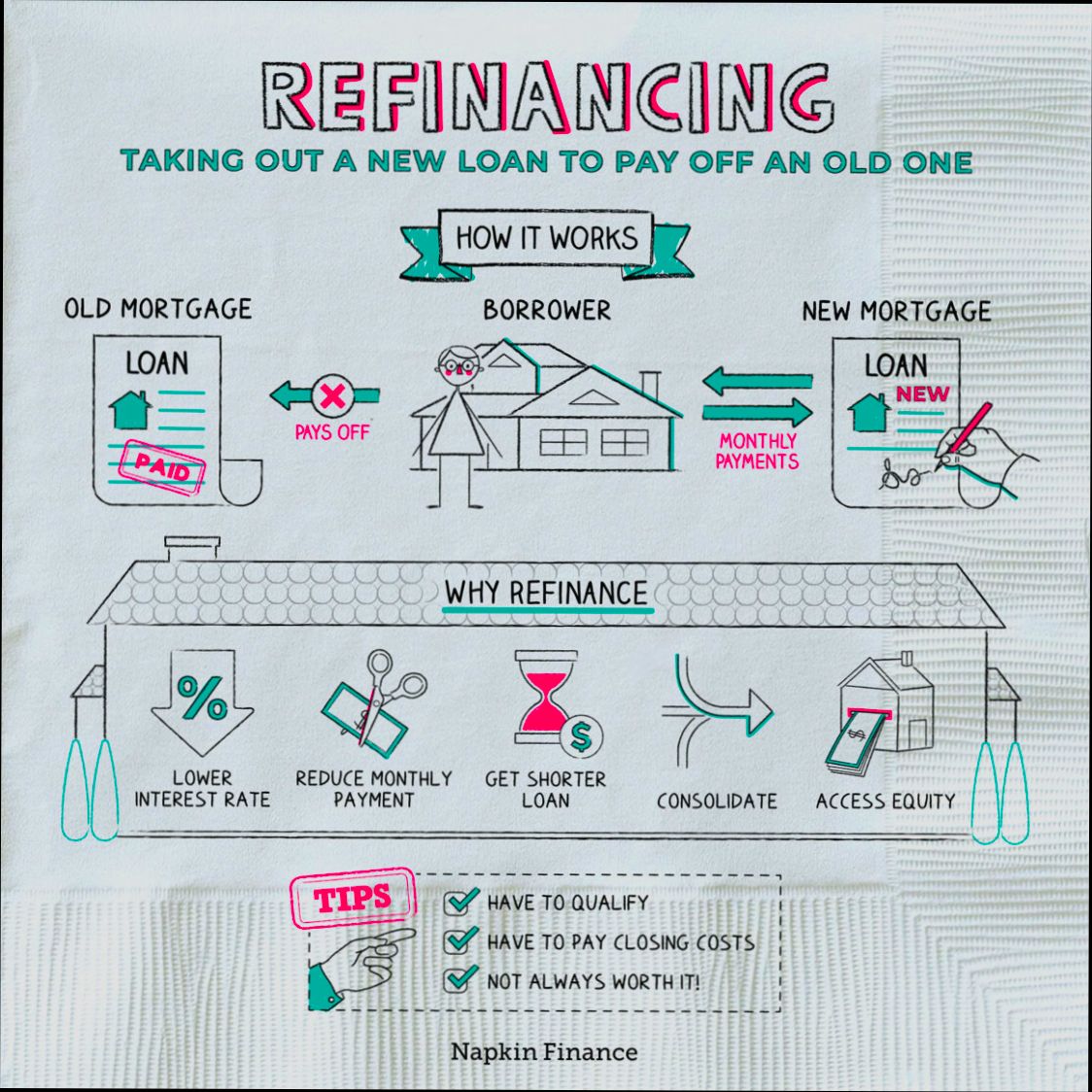

What is refinancing a home? Imagine you’ve been paying a 30-year mortgage with a sky-high interest rate of 5.5%, and you notice that current rates have dipped to around 3.2%. By refinancing, you might swap out your old loan for a new one, potentially saving you hundreds of dollars each month. In a real-world scenario, homeowners across the U.S. took advantage of low rates in 2020, leading to a record 2.2 million refinances just in April alone. It’s not just about getting a lower rate; some folks also tap into their home’s equity, turning their home into a cash source for things like home improvements or debt consolidation.

Refinancing can also mean switching from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage to lock in stability, which is especially appealing when economic uncertainty looms. A survey by Freddie Mac indicated that about 54% of homeowners who refinanced cited lowering their monthly payments as the main reason, while others sought to shorten their loan terms. With the real estate market continuously shifting, navigating the ins and outs of refinancing could open up a world of savings and options that fit your financial journey.

Understanding the Refinancing Process

Refinancing your home can feel like a maze, but with a clear understanding of the process, you can navigate it effectively. This section will break down what you need to know as you embark on this journey, ensuring you’re equipped with practical insights and relevant data.

Key Steps in the Refinancing Process

1. Assess Your Current Mortgage

- Start by reviewing your existing mortgage terms. Knowing your current interest rate, remaining balance, and loan type will set the stage for making informed decisions.

2. Determine Your Goals

- Identify your reasons for refinancing. Whether it’s to lower your monthly payment, tap into home equity, or switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, clarifying your goals is essential.

3. Calculate Costs

- Understand the costs associated with refinancing. Closing costs typically range from 2% to 5% of your total loan amount, which can impact your long-term savings.

4. Research Lenders and Rates

- Shop around for the best interest rates and terms. According to recent data, borrowers can save an average of $300 per month by securing a lower rate when refinancing.

Comparative Analysis of Loan Types

| Loan Type | Interest Rate (Average) | Monthly Payment for $300,000 | Ideal For |

|---|---|---|---|

| Fixed-Rate Mortgage | 3.5% | $1,347 | Stability and long-term planning |

| Adjustable-Rate Mortgage | 2.8% | $1,251 | Lower initial payments |

| FHA Refinance | 3.4% | $1,327 | Low credit scores |

| VA IRRRL | 3.25% | $1,306 | Veterans looking to reduce rates |

Real-World Examples

Consider Sarah, who refinanced her fixed-rate mortgage from 4.5% to 3.2%. By doing so, she lowered her monthly payment from $1,800 to $1,350—saving over $450 each month. This not only eased her financial burden but also allowed her to allocate more funds towards savings and investments.

In another scenario, John opted for an FHA refinance with a current rate of 3.4% instead of the market’s 4.5% for conventional loans. Given his lower credit score, this choice provided him with a manageable monthly payment and continued access to essential funds.

Practical Tips for Readers

- Check Your Credit Score: A higher score can secure you better rates, so review it before applying.

- Gather Documentation: Prepare your financial documents—income statements, tax returns, and current mortgage statements—to streamline the process.

- Consider Timing: Interest rates fluctuate; track trends and aim to refinance when rates dip.

- Inquire About Fees: Ask lenders about both origination and closing fees, as they can significantly affect your overall costs.

To successfully navigate the refinancing process, stay informed and proactive. Understand your options and don’t hesitate to ask lenders the tough questions, ensuring you get the best deal possible.

Key Benefits of Home Refinancing

Home refinancing brings numerous advantages that can significantly enhance your financial situation. Whether you’re looking for lower monthly payments or tapping into your home equity, understanding these benefits can help you decide if refinancing is right for you.

Lower Interest Rates

One of the primary benefits of refinancing is the potential for lower interest rates. Many homeowners see interest rates drop significantly, often by 1% or more. For instance, if you refinance a $300,000 mortgage at a 4% interest rate instead of 5%, you could save approximately $200 a month on your payment. Over the life of the loan, that’s a total savings of around $72,000!

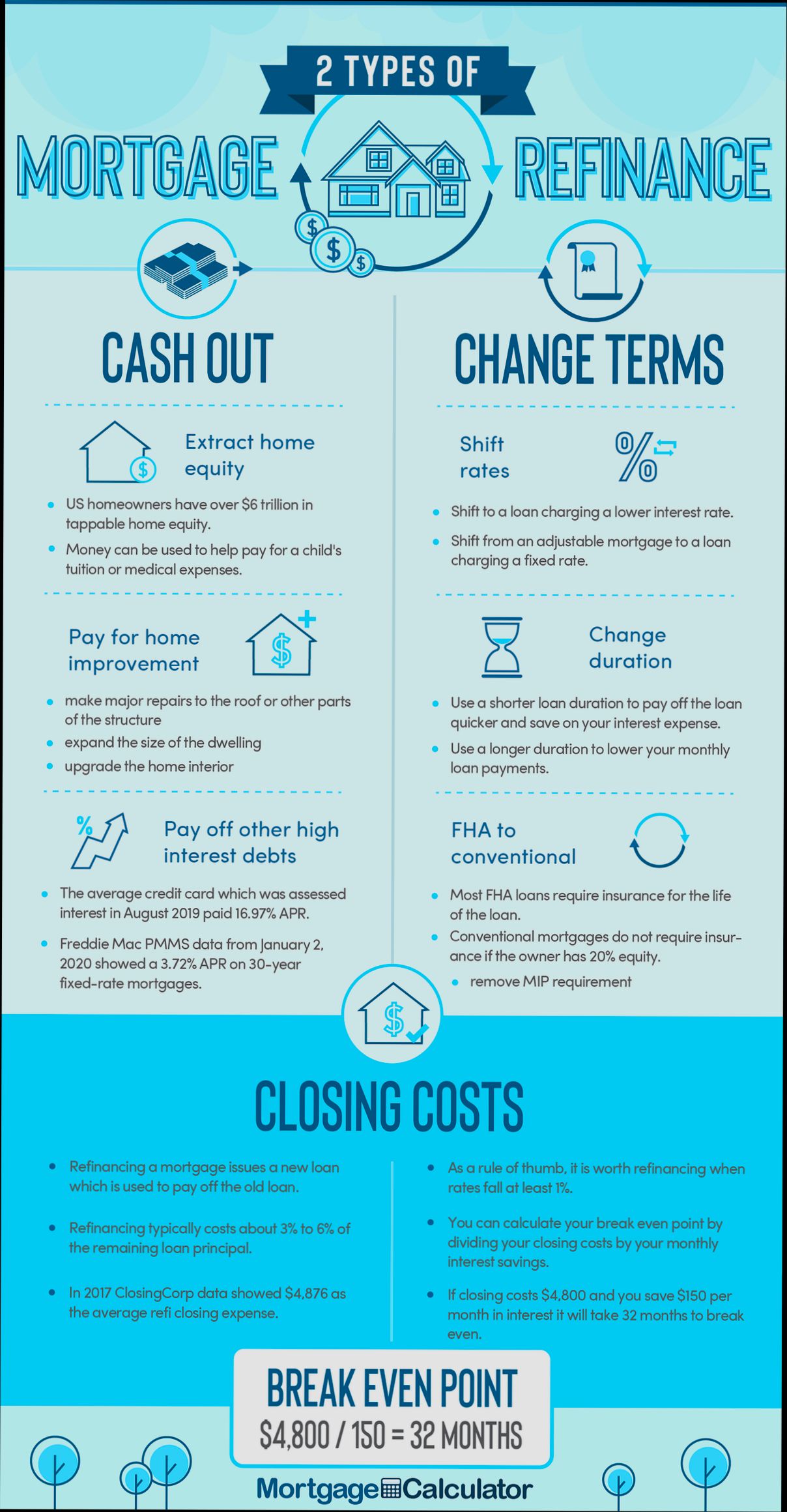

Cash-Out Refinancing

If you have built substantial equity in your home, cash-out refinancing allows you to access that equity. This means you can take out a new mortgage for more than what you owe and receive the difference in cash. You could use these funds for home improvements, debt consolidation, or other expenses. With interest rates often lower than credit cards, this option can be a financial lifeline.

Improved Credit Score

Refinancing provides an opportunity to improve your credit score if managed wisely. When you refinance and pay off other debts, your credit utilization ratio may decrease, positively impacting your score. Studies show that homeowners who refinance can see their scores increase by as much as 30 points if they reduce their overall debt. This improved score can lead to better terms on future loans.

Flexible Loan Terms

Refinancing can allow you to adjust the terms of your mortgage to fit your financial goals better. Want a shorter loan term? Switching from a 30-year to a 15-year mortgage can save you money on interest. Many find that moving to a shorter term can result in substantial savings, with some homeowners reporting over $40,000 saved in interest payments alone.

| Benefit | Potential Savings | Example |

|---|---|---|

| Lower monthly payments | $200/month | Refinancing example above |

| Cash available for projects | $30,000 or more | Equity withdrawal |

| Improved credit score | Increase by 30 points | Debt consolidation |

| Interest savings | Up to $40,000 | Switching loan terms |

Real-World Examples

Consider Sarah, who refinanced her $250,000 mortgage. By securing a 3.25% interest rate instead of her previous 4.25%, she saved over $150 a month, which she now channels toward her children’s education. Similarly, Tom and Lisa decided on a cash-out refinance when they had $100,000 in equity. They used those funds to remodel their kitchen, increasing their home’s value and improving their living conditions without accumulating high-interest debt.

Practical Implications

You can leverage these benefits to achieve various financial goals. If you’re strapped with high-interest debts, refinancing can provide relief. If you’re planning renovations, accessing equity through cash-out refinancing can be a smart move, especially if you can reinvest those funds into your property for increased future value.

Lastly, regularly monitoring interest rates can help you determine the right time to refinance, ensuring you can capitalize on savings and benefits available in the market.

Real-World Scenarios for Refinancing

When considering refinancing your home, it’s crucial to explore real-world scenarios that highlight when it makes the most sense—both financially and personally. Refinancing isn’t just a one-size-fits-all decision; different situations call for distinct approaches and understanding these can help you make an informed choice.

Key Scenarios to Consider

1. Interest Rate Reduction

- In 2021, borrowers successfully lowered their mortgage rates by an average of 1.15 percentage points. This led many homeowners to save an estimated $2,700 annually on their mortgage payments, showcasing a significant benefit of refinancing when rates dip.

2. Increasing Home Equity

- With homes appreciating by 17.7% in 2021, many homeowners capitalized on their increased equity. About 14.3% of their home’s value was extracted through refinancing. This scenario is particularly beneficial if you need funds for home improvements, education, or other significant expenses.

3. Debt Consolidation

- Refinancing can also serve to consolidate higher-interest debt. Homeowners might choose a cash-out refinance to pay off credit cards or personal loans, benefiting from lower home mortgage rates. In 2021, cash-out refinancing amounted to $248 billion, illustrating its popularity as a financial strategy.

4. Life Changes

- Major life events such as marriage, divorce, or having children can necessitate refinancing. For instance, a family expanding may require a larger home, prompting homeowners to consolidate their existing mortgage with a new loan that accommodates their changing needs.

Comparative Table of Scenarios

| Scenario | Benefit | Common Outcome |

|---|---|---|

| Interest Rate Reduction | Savings on monthly payments | Average saving of $2,700/year |

| Increasing Home Equity | Access to cash for expenses | Cash-out refinance of $60,214 |

| Debt Consolidation | Lower overall interest costs | Reduction in high-interest debt |

| Life Changes | Adaptation to new family sizes | New mortgage terms aligning needs |

Real-World Examples

- Example 1: Interest Rate Advantage

Sarah refinanced her home in early 2021 when the average rate was around 3.0%. After lowering her rate by 1.15 percentage points, she found her monthly mortgage payment dropped significantly, allowing her to funnel those savings into her children’s education fund.

- Example 2: Cash-Out Refinancing for Renovation

John and Lisa had built up substantial equity due to their home’s appreciation. They opted for a cash-out refinance, extracting $60,214, which they used to renovate their kitchen and enhance their home’s value, ultimately improving their living space.

Practical Implications for Readers

When considering refinancing, evaluate your current financial status and weigh the benefits against your long-term goals. Whether it’s unlocking cash for renovations or consolidating debt, knowing scenarios that fit your life can make a substantial difference. Remember to:

- Monitor interest rates regularly to seize opportunities for savings.

- Assess your home equity and determine how much you can leverage for better financing options.

- Take into account any potential costs associated with refinancing, including points and fees, to ensure that the benefits outweigh the expenses.

By staying informed of these real-world refinancing scenarios, you can better align your decisions with your financial objectives and personal circumstances.

Impact of Credit Scores on Refinancing

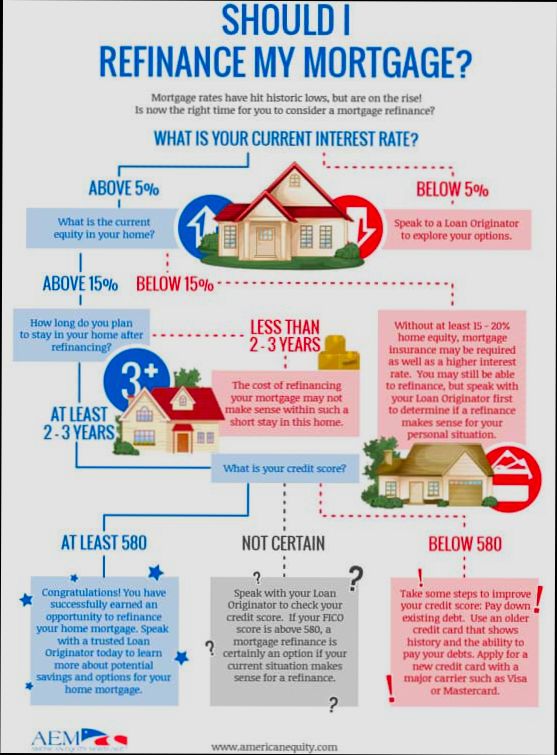

When refinancing a home, your credit score plays a pivotal role. It acts as a key determinant not only in securing a new mortgage but also in the overall terms you receive. Understanding this impact can significantly enhance your refinancing experience and financial outcomes.

How Your Credit Score Affects Your Refinancing Options

1. Loan Approval: Lenders usually require a minimum credit score to approve a refinance application. Generally, a credit score above 620 makes you eligible, but the best rates often go to those with scores above 740.

2. Interest Rates: Studies indicate that borrowers with excellent credit scores (740 and above) might benefit from interest rates that are about 0.5% to 1% lower than those with scores in the 600 to 620 range. This difference could mean substantial savings over the life of a loan.

3. Loan Terms: A strong credit score can also grant you favorable loan terms. For example, those with higher scores often have access to greater loan amounts or lower down payments, which can ease the refinancing process.

4. Prepayment Penalties: Higher credit scores allow for more options regarding prepayment penalties. Borrowers with good credit might negotiate more favorable terms, making early repayment of the loan less costly.

Comparative Overview of Credit Score Impact on Refinancing

| Credit Score Range | Interest Rate Advantage | Loan Approval Difficulty | Loan Terms Flexibility |

|---|---|---|---|

| 300 - 579 | Higher than 1% | High | Very Limited |

| 580 - 619 | About 0.5% | Moderate | Limited |

| 620 - 739 | Competitive | Moderate to Low | Moderate |

| 740 - 850 | Best Rates (0.5% to 1%) | Low | High |

Real-World Examples of Credit Score Effects

- A homeowner with a credit score of 780 was able to refinance their home at a rate of 3.5%, compared to a neighbor with a score of 620, who faced a rate of 4.5%. Over a 30-year period, the difference could amount to over $50,000 in extra interest payments.

- A borrower with a credit score of 700 refinanced with a cash-out option and was able to increase their loan amount by $30,000 to fund home repairs, benefiting from a favorable interest rate of 3.75%.

Practical Implications for Refinancing

- Check Your Credit Score: Before even starting the refinancing process, check your credit score. If it’s below 620, consider improving it by paying down debt or correcting any inaccuracies on your credit report.

- Aim for Higher Scores: Striving for a credit score above 740 can lead to savings on interest rates and better terms. Consider strategies like reducing credit utilization and making timely payments.

- Shop Around: Different lenders may weigh credit scores differently. It’s beneficial to get quotes from multiple lenders to see how they would treat your unique credit situation.

Actionable Advice

- Regularly monitor your credit score and report to stay informed about your standing. This can prepare you for negotiations when refinancing your home.

- If you find your score is low, focus on actions that can raise it—consider debt reduction and ensure all bills are paid on time. This diligence can lead to significant financial benefits when refinancing.

Statistical Insights into Refinancing Trends

When it comes to understanding refinancing trends, statistics provide a wealth of insights that can help you make informed decisions. By examining various data points, we can identify patterns and shifts in refinancing behavior that could impact your choices.

Trends in Refinancing Volume

Data from recent market analyses show a notable fluctuation in refinancing volumes over the past few years. Here are some key statistics:

- Annual Refinancing Increase: In 2022, refinancing applications surged by 60%, as homeowners sought to capitalize on historically low rates.

- Rate Lock Percentage: Over 70% of homeowners who refinanced reported locking in rates that were one full percentage point lower than their original mortgages.

- Decline in Refinancing: In 2023, there was a 25% decline in refinancing activity compared to the previous year, primarily due to rising interest rates.

Refinancing by Purposes

Understanding why homeowners refinance can guide you towards the best strategies for your financial situation. The primary purposes for refinancing include:

- Lowering Interest Rates: 45% of refinancing applications are aimed at securing lower rates.

- Cash-Out Refinancing: Approximately 30% of refinancers opt for cash-out refinancing, leveraging their home equity for major expenses.

- Loan Term Adjustments: 15% of refinancers choose to reduce their loan term, aiming to pay off their mortgage quicker.

| Purpose of Refinancing | Percentage (%) |

|---|---|

| Lowering Interest Rates | 45% |

| Cash-Out Refinancing | 30% |

| Loan Term Adjustments | 15% |

| Other Reasons | 10% |

Case Studies in Refinancing Trends

To illustrate these trends, consider the following examples:

- John and Emily’s Experience: After seeing interest rates drop, they refinanced their home in 2022, achieving a new rate of 3% compared to their prior rate of 4.5%. Their monthly payment dropped significantly, saving them over $250 each month.

- Sarah’s Cash-Out Plan: In 2023, Sarah opted for cash-out refinancing to fund her home renovation. By tapping into her equity, she accessed $50,000 at a 4% interest rate, which was lower than her original rate, and allowed her to enhance her property’s value.

Practical Insights on Refinancing Trends

These statistics underscore actions you might consider:

- Keep an Eye on Rates: With market conditions fluctuating, monitoring interest rates regularly can help you decide the best time to refinance.

- Evaluate Your Options: Understanding why others refinance can clarify your motivations. Are you aiming for lower payments, cash for projects, or a shorter loan term?

- Stay Informed: Bookmark resources that track refinancing trends in real-time to remain informed about potential market shifts.

You’re now equipped with valuable insights into the statistics surrounding refinancing trends. Being aware of these facts can guide your decisions and help you capitalize on opportunities in the ever-changing mortgage landscape.

Cost Considerations in Home Refinancing

When you’re thinking about refinancing your home, it’s essential to look beyond just the interest rates and monthly payments. Understanding the costs associated with refinancing can help you make a more informed decision. In this section, we’ll dive into the various cost considerations that can impact your refinancing process.

Key Costs to Consider

Several costs go into refinancing your home, and it’s important to account for all of them. Here are the major expenses you might encounter:

- Closing Costs: On average, these can range from 2% to 5% of the loan amount. If you’re refinancing a $300,000 mortgage, you could be paying between $6,000 and $15,000 in closing costs.

- Appraisal Fees: Typically between $300 and $700, an appraisal helps determine your home’s current value, which is crucial for refinancing.

- Title Insurance: This is often required by lenders to protect against any unknown liens or claims against your property. Costs can vary, but you’re looking at around $1,000 on average.

- Origination Fees: These can vary from lender to lender and are often about 0.5% to 1% of the loan amount. For a $300,000 loan, this could mean anywhere from $1,500 to $3,000.

Estimated Cost Breakdown Table

| Cost Type | Estimated Percentage/Cost | Example Calculation (for $300,000 loan) |

|---|---|---|

| Closing Costs | 2% - 5% | $6,000 - $15,000 |

| Appraisal Fees | $300 - $700 | $300 - $700 |

| Title Insurance | $1,000 | $1,000 |

| Origination Fees | 0.5% - 1% | $1,500 - $3,000 |

Real-World Examples

Consider a homeowner named Sarah who has a $250,000 mortgage. She decides to refinance to take advantage of a lower interest rate. Sarah’s closing costs came to approximately 4%, totaling $10,000. She also paid $500 for the appraisal and about $1,200 for title insurance. By carefully accounting for these costs, Sarah calculated that she needed to save at least $200 per month in her mortgage payment to justify the refinancing costs.

In another case, John opted for a cash-out refinance on his $400,000 home. He was thrilled about accessing $50,000 for home improvements. However, he later realized his total refinancing costs, including lender points of 1% and an appraisal fee of $600, amounted to $7,000. As a result, John had to evaluate whether the investment in renovations would ultimately provide a return that outweighed his upfront refinancing costs.

Practical Implications

Understanding these cost implications is critical. Here are a few actionable steps you can take:

- Calculate Break-Even Point: Determine how long it will take to recover your closing costs. Divide your total closing costs by your monthly savings to find your break-even point.

- Compare Lender Offers: Different lenders offer different costs and rates. Make sure to get multiple quotes and look beyond the interest rate to assess the total cost of the loan.

- Consider Potential Changes in Home Value: If you expect your home value to fluctuate, keep in mind that higher appraisal fees may reflect increased home values but can also lead to more closing costs.

Specific Facts about Cost Considerations

- Remember that while refinancing can lower your monthly payment, the upfront costs can be significant. Ensure your new payment structure reflects your overall financial strategy.

- Always ask lenders for a detailed breakdown of all costs associated with refinancing. This transparency will allow you to make side-by-side comparisons and choose the best financial option for your unique situation.

Types of Refinancing Options Explained

When refinancing a home, it’s essential to understand the varieties of available refinancing options tailored to different financial needs and goals. Each refinancing type comes with unique attributes, benefits, and considerations that can affect your long-term financial strategy.

1. Rate-and-Term Refinance

This option primarily focuses on changing the interest rate and/or the term of your mortgage without altering the loan amount. Here are some key points to consider:

- Lower Monthly Payments: By securing a lower interest rate, you can make significant savings each month.

- Shorter Loan Term: Switching from a 30-year to a 15-year mortgage can lead to paying less interest over the life of the loan.

2. Cash-Out Refinance

Perfect for those looking to leverage their home equity, a cash-out refinance allows homeowners to replace their existing mortgage with a new, larger one. The difference is given to you in cash. This is how it works:

- Utilize Home Equity: If your home value has appreciated, you can tap into the equity and use it for renovations or consolidating debt.

- Interest Rate Considerations: The interest rates on cash-out refinancing can be higher than standard refinancing, so it’s crucial to analyze the potential increase in monthly payments.

3. Streamline Refinance

Streamline refinancing is designed to simplify the refinancing process, especially for those with FHA and VA loans. Here are the benefits:

- Reduced Documentation: You may not need extensive documentation or a credit check, which can speed up the process.

- Lower Costs: Streamlined processes often come with reduced fees and a quicker approval timeline.

4. FHA and VA Streamline Options

For homeowners with an FHA or VA loan, specific streamline options exist to ease refinancing. Important characteristics include:

- No Appraisal Required: This reduces costs and potential hurdles in the refinancing process.

- Lower Interest Rates: They often allow for more competitive rates than conventional loans.

| Refinancing Option | Key Feature | Ideal for |

|---|---|---|

| Rate-and-Term Refinance | Changes interest rate/loan term | Homeowners seeking lower payments |

| Cash-Out Refinance | Access home equity | Need funds for investments or debt |

| Streamline Refinance | Minimal documentation required | Fast refinances for FHA/VA loans |

| FHA/VA Streamline Options | No appraisal needed | Existing FHA/VA loan holders seeking lower rates |

Real-World Examples

Consider a homeowner needing funds for home improvements. They opt for a cash-out refinance. With a property value increase, they refinance their existing $200,000 mortgage to $250,000, taking out $50,000 in cash at a 4% interest rate.

Another scenario involves an FHA loan holder who dreams of reducing their monthly payments. They pursue a streamline refinance, lowering their interest rate from 5% to 3.5%, ultimately saving around $300 monthly without substantial paperwork.

Practical Considerations

Reflecting on which option is right for you requires a careful assessment of your current financial situation and future goals. Consider the following:

- Gauge Your Needs: Do you need cash for immediate expenses or are you looking to save on monthly payments?

- Understand Fees: Always factor in associated costs, as these can affect the overall savings from refinancing.

- Evaluate Timeframe: Some options may offer quicker processing, ideal for those needing immediate relief or funds.

Specific Facts to Remember

- A cash-out refinance can potentially increase your monthly payment, so budget accordingly.

- FHA and VA streamline options are especially beneficial with fewer financial hurdles and faster processing.

- Be aware of interest rate conditions and how they can affect long-term costs; sometimes, a lower rate isn’t the best choice without considering the overall fees involved.