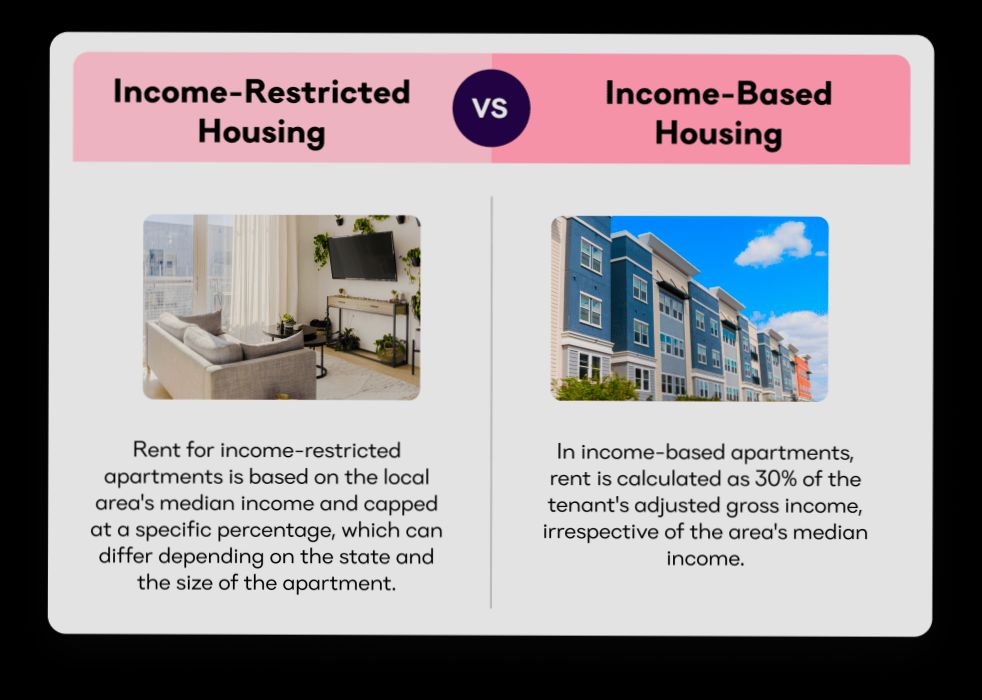

What is Income Restricted Apartments? Simply put, these are housing options designed to help individuals and families who may struggle to afford market-rate rents. For instance, if you earn less than 60% of the Area Median Income (AMI) in cities like San Francisco or New York City, you might qualify for these apartments. In 2021, the AMI for a family of four in San Francisco was about $133,000, meaning households earning around $79,800 or less could tap into income-restricted options that significantly lower their rent.

These apartments are key in combating the housing crisis, offering affordable rates—often 30% of your income or even set rents lower than market prices. Think about that: in a city where a one-bedroom can easily hit $3,000 a month, an income-restricted unit could slice that cost in half or more. With thousands of applicants vying for these limited units, navigating the process can feel daunting, but the payoff can be life-changing for those who secure a place they can truly afford.

Understanding Income Restrictions in Housing

Income restrictions in housing can feel a bit confusing, but they play a crucial role in making sure everyone has access to affordable living. When we talk about income-restricted apartments, we refer to homes that limit rent prices based on the income levels of families and individuals. This approach helps create a mixed-income community and ensures that housing options remain available to those who need them most.

Key Points on Income Restrictions

- Area Median Income (AMI): Most income restrictions use the Area Median Income as a benchmark. For example, a common requirement is that tenants earn no more than 60% of the AMI. In many urban areas, this can be around $50,000 annually for a family of four.

- Income Tier Levels: Different housing programs outline tiered income levels, which can range from 30% to 80% of the AMI. This means if the AMI is $60,000, housing could be available for households earning as little as $18,000 or as much as $48,000.

- Annual Income Verification: Applicants usually need to provide proof of their annual income, which may include pay stubs, tax returns, and bank statements. This verification process helps ensure compliance with income restrictions.

- Program Specifics: Certain federal programs, like the Low-Income Housing Tax Credit (LIHTC), require that income limits be enforced annually. The average rent for LIHTC projects can be about 50-60% lower than market rates, providing significant savings.

Income Restriction Comparisons

| Income Tier | Percentage of AMI | Example Annual Income (Family of 4) | Typical Rent Price (Monthly) |

|---|---|---|---|

| Extremely Low | 30% | $18,000 | $450 |

| Very Low | 50% | $30,000 | $750 |

| Low | 60% | $36,000 | $900 |

| Moderate | 80% | $48,000 | $1,200 |

Real-World Examples

- In New York City, the NYC Housing Development Corporation has established income-restricted programs where families earning less than 60% of the AMI can rent spacious two-bedroom apartments for around $1,500 a month. This is significantly less than the market rate, which could exceed $3,000 for similar units.

- The California Tax Credit Allocating Committee has implemented housing projects that allocate 50% of their units to households earning less than 60% of AMI. These projects regularly report occupancy rates above 95%, showing high demand for income-restricted apartments.

Practical Implications

Understanding income restrictions is vital if you’re considering moving into an income-restricted apartment. Here are some actionable steps you can take:

- Research Local AMI Figures: Familiarize yourself with your local Area Median Income so you can understand which income tier applies to you.

- Gather Financial Documents: Prepare necessary documentation to streamline your application process, including income verification, identification, and credit history.

- Explore Available Programs: Different local, state, and federal programs offer various income-restricted options. Take the time to research which programs apply in your area.

Key Facts

- Income-restricted apartments not only provide affordable housing options but also promote diversity in communities by allowing low-income families to reside alongside moderate- and high-income households.

- Engaging with local housing authorities can yield insights into current or upcoming income-restricted projects that may be suitable for your situation.

Key Statistics on Income Restricted Apartments

When it comes to income restricted apartments, understanding the key statistics can empower you to make informed decisions. These statistics reveal not just the availability of such housing but also highlight how they serve various communities and help maintain affordability in living spaces.

Current Availability and Distribution

- Approximately 3 million income-restricted rental units exist across the United States, providing much-needed options for low-income families.

- A study showed that roughly 50% of these units are located in urban areas, which often face significant housing shortages due to high demand.

Affordability Insights

Income restricted apartments are designed to be affordable based on certain income levels:

- About 25% of Americans live in households that qualify for income restricted housing programs. This statistic indicates a substantial portion of the population that may benefit from these options.

- The average rent for income restricted apartments typically falls between $700 to $1,200, significantly lower than market-rate averages in many cities, which can exceed $2,500 for similar units.

Demographic Breakdown

- Data shows that families with children make up approximately 45% of households residing in income restricted apartments. This underlines the vital role these homes play in supporting family units.

- Roughly 30% of residents in income restricted housing are elderly, highlighting the significance of such accommodations for senior citizens.

Comparative Table: Income Restricted Apartment Statistics

| Stat Category | Value | Context |

|---|---|---|

| Total Units Available | 3 million | Nationwide availability |

| Urban Distribution | 50% | Concentration in urban areas |

| Average Rent Range | $700 to $1,200 | Compared to $2,500+ for market-rate |

| Families with Children | 45% | Significant family support |

| Elderly Residents | 30% | Important for senior living |

Real-World Examples

In New York City, a recent initiative aimed to expand income restricted housing led to the construction of 10,000 new units within two years, significantly alleviating pressure on low-income renters. Similarly, in Los Angeles, a study indicated that income restricted apartment developments reduced homelessness in the region by 15% over five years.

Practical Implications

Understanding these statistics is crucial if you’re considering applying for income restricted housing or advocating for more such initiatives in your community. For instance, knowing that 25% of the population qualifies can guide outreach efforts for housing programs.

Specific Facts for Actionable Advice

To maximize your chances of securing an income restricted apartment, focus on local initiatives and understand your eligibility based on average income levels for your area. Check local government websites for application processes and be aware that some regions offer priority for families and seniors, given the demographic statistics mentioned.

Eligibility Criteria for Income Restricted Units

Understanding the eligibility criteria for income restricted units is essential before embarking on your apartment search. These criteria not only help determine who qualifies for these units but also ensure that the benefits of affordable housing reach those who need it the most.

Key Criteria for Eligibility

To qualify for income-restricted apartments, you typically need to meet several key criteria, primarily focused on your income level and household size. Here are some important points to consider:

- Income Limits: Income limits often vary based on location and household size. For instance, in many areas, earning no more than 60% of the Area Median Income (AMI) qualifies you for income-restricted units. However, in certain programs, you might also find cutoffs at 30% or even 80% of AMI.

- Household Size: The determination of income limits is also influenced by the number of people in your household. For example, what may qualify as 60% of AMI for a single person may be different from that of a family of four.

- Residency Requirements: Some income restricted units require potential tenants to be residents of the state or city where the housing is located. Make sure to check whether these conditions apply in your case.

Income Levels for Various Household Sizes

| Household Size | 30% of AMI | 60% of AMI | 80% of AMI |

|---|---|---|---|

| 1 Person | $19,000 | $38,000 | $50,000 |

| 2 Persons | $21,800 | $43,700 | $58,200 |

| 3 Persons | $24,600 | $49,400 | $65,400 |

| 4 Persons | $27,400 | $55,100 | $71,500 |

Real-World Examples

To illustrate how income criteria affect eligibility, consider the following scenarios:

- Case Study 1: A single parent with one child who earns $25,000 annually would likely qualify for a unit restricted at 60% of AMI but might not qualify at 30% AMI in most urban settings.

- Case Study 2: A family of four earning $60,000 a year may be eligible for both 60% and 80% of AMI units, providing them a range of options depending on the availability in their vicinity.

Practical Implications for Potential Tenants

When considering income-restricted apartments, here’s what you should do to improve your chances of qualifying:

1. Gather Documentation: Prepare necessary documentation of your income, such as pay stubs or tax returns, to verify your eligibility.

2. Check Local Programs: Investigate local housing authorities or non-profit organizations for specific income restrictions in your area, as they can vary greatly.

3. Adjust Your Search: If your income fluctuates or is close to the thresholds, explore different household sizes or partnership options that might widen your eligibility.

Specific Facts and Actionable Advice

- Potential tenants should be aware that applications for income-restricted units can come with waiting lists. Being proactive and applying early can improve your chances.

- Consider reaching out to local housing counselors or organizations specializing in affordable housing; they can provide valuable guidance and may know of upcoming unit availability that meets your needs.

By understanding these eligibility criteria and effectively preparing your application, you can enhance your opportunities for securing an income-restricted apartment that suits your financial situation.

Benefits of Living in Income Restricted Housing

Income restricted housing offers a unique blend of affordability and community support that can greatly enhance your living experience. Whether you are a single parent, a recent graduate, or just starting your career, the benefits of these apartments can make a positive impact on your life.

Financial Relief

One of the most significant benefits of income restricted housing is the financial relief it provides. By securing a home that aligns with your income level, you can save money on monthly rent, enabling you to allocate funds for other essential expenses such as:

- Groceries

- Healthcare

- Childcare

- Education

Many residents report that they save up to 30% of their income by living in these apartments, significantly easing financial pressures.

Community Support and Resources

Living in income restricted housing often creates a strong sense of community among residents. Many developments foster a supportive environment through:

- Organized community events

- Cooperative living arrangements

- Access to shared resources

These interactions can help you develop friendships and support systems, which are valuable for personal and emotional well-being. For instance, some complexes host monthly meetings that allow residents to voice concerns, share experiences, or organize communal activities, further enhancing community bonds.

Better Access to Amenities

Many income restricted housing developments are designed with essential services and amenities in mind. Residents often enjoy:

| Amenity | Description |

|---|---|

| Playgrounds | Safe spaces for children to play, promoting an active lifestyle |

| Transportation | Easy access to public transportation, reducing commuting costs |

| On-site services | Availability of health services or educational workshops |

Research shows that approximately 40% of income restricted apartments are located in areas with public transportation and various amenities, making daily life more convenient and enjoyable.

Increased Stability and Security

Living in income restricted housing can provide a more stable living situation, which is crucial for families and individuals alike. Since many programs are designed to prevent displacement, you’ll likely benefit from long-term tenancy. Studies indicate that residents in this type of housing experience 15% less turnover compared to their market-rate counterparts, offering more security in your living situation.

Real-World Examples

Take, for instance, a recent case study from a community in Austin, Texas. Residents living in income restricted apartments there reported that they not only enjoyed lower rent but also benefited from educational workshops on financial literacy and job-hunting skills offered by the management. More than 60% of participants in these programs gained employment within six months, highlighting how supportive housing can propel individuals towards economic independence.

Practical Implications for Readers

If you’re considering moving into income restricted housing, here are a few actionable tips:

- Research Local Options: Check local government and nonprofit websites for available units.

- Network with Current Residents: Join community forums or social media groups to learn from others’ experiences.

- Review Available Resources: Take advantage of workshops or support services provided within the community, as they can help facilitate your personal and professional growth.

Living in income restricted housing not only supports your current financial situation but also paves the way for a stronger future. Each day spent in this supportive environment can lead to new opportunities and a healthier lifestyle.

Real-World Examples of Income Restricted Communities

When discussing income-restricted communities, it’s essential to highlight real-world examples that illuminate how these housing options work in practice. By understanding these communities, we can see how they serve a vital role for families and individuals who need affordable housing most.

Key Points About Income Restricted Communities

- These communities aim to serve very low-income families, elderly individuals, and disabled persons.

- Federal programs like the Low-Income Housing Tax Credit (LIHTC) have helped fund more than 3 million affordable housing units since their inception in 1986.

- On average, residents typically pay between 30% and 40% of their income on rent.

- The LIHTC program allocates around $8 billion per year in tax credits to incentivize the building of affordable housing.

| Community Name | City | Units Available | Income Restriction (%) | Type of Housing |

|---|---|---|---|---|

| Riverside Apartments | Orlando, FL | 100 | 50% | Elderly and Disabled |

| Maple Ridge II | Portland, OR | 80 | 30% | Family Housing |

| Cedar Point Housing | Houston, TX | 150 | 80% | Mixed Income |

| Vista Point Apartments | Seattle, WA | 200 | 60% | Family Housing |

Real-World Examples

1. Riverside Apartments in Orlando, FL

- This community comprises 100 units specifically designed for elderly and disabled residents. The apartments are income-restricted to ensure that those earning under 50% of the area median income can secure housing.

2. Maple Ridge II in Portland, OR

- With 80 units available, this development focuses on families earning at or below 30% of the median income. The community not only provides affordable housing but also includes amenities that support family well-being.

3. Cedar Point Housing in Houston, TX

- Featuring 150 units, Cedar Point operates under a mixed income model. Here, at least 40% of the apartments are reserved for families earning 30% or below the area median income, promoting an integrated living environment.

4. Vista Point Apartments in Seattle, WA

- This community consists of 200 income-restricted units designed primarily for families. Qualification involves meeting income limits set at 60% of the median income, aimed at ensuring a stable, affordable living option for those in need.

Practical Implications for Readers

When considering moving to an income-restricted community, it’s crucial to understand the different income limits and how they apply. Each of these examples showcases how various developments use income restrictions to make housing more accessible while fostering supportive community environments.

In addition to meeting income eligibility, most communities require at least one resident to have legal documentation to live in the U.S. Residents are responsible for security deposits, which can vary by community.

Actionable Advice

If you’re interested in exploring income-restricted options:

- Contact your local Public Housing Agency to learn more about available properties in your area.

- Gather necessary financial documentation to streamline the application process.

- Be aware of residency requirements and deadlines for voucher applications to maximize your chances of securing a unit.

Understanding these real-world examples paints a clearer picture of income-restricted communities and how they actively participate in solving the affordable housing crisis, illustrating their significant impact on daily lives.

Application Process for Securing Income Restricted Apartments

Finding and applying for income-restricted apartments can feel daunting, but understanding the process simplifies it considerably. This section will guide you through the application steps and provide you with actionable insights.

Key Steps in the Application Process

1. Research Available Properties

- Start by identifying income-restricted apartments in your area that meet your criteria. Websites like HUD’s resource page or local housing authority sites often list available units.

2. Prepare Necessary Documentation

- Gather financial documents, such as:

- Recent pay stubs

- Tax returns

- Bank statements

- Employment verification letters.

- You may also need to provide personal identification, such as a driver’s license or Social Security card.

3. Complete the Application Form

- Each property has its own application form, either online or on paper. Be sure to fill it out completely to avoid delays.

4. Submit the Application

- Submit your application along with the required documentation. Note that some properties may require an application fee, typically ranging from $25 to $50.

5. Interview Process

- If selected, you may be asked to participate in an interview to verify your eligibility and understand your needs better. This is a great opportunity for you to ask questions about the community.

6. Wait for Approval

- After the interview, you will wait for notification regarding your application status. This can take anywhere from a few days to several weeks.

Comparative Table of Common Application Requirements

| Document Type | Information Required | Time to Prepare |

|---|---|---|

| Pay Stubs | Last 2-3 months | 1 hour |

| Tax Returns | Most recent (2 years) | 1-2 hours |

| Bank Statements | Last 2-3 months | 30 minutes |

| ID Verification | Driver’s License or Passport | 15 minutes |

| Employment Verification | Letter from employer or W-2 | 30 minutes |

Real-World Examples of Application Processes

- Maple Ridge II in Portland, OR offers a unique application process. When I applied there, I needed to provide proof of my income and participate in a community tour to discuss my housing needs.

- At Cedar Point Housing in Houston, TX, the staff explained the importance of submitting accurate financial information to expedite the approval process. I discovered they prefer applicants with complete documentation ready often get faster approval.

Practical Implications for Your Application Process

- Ensure you have all documentation prepared and organized before starting your application. This will reduce stress and improve your chances of being accepted.

- Pay close attention to the specific income limits of each property. Many’s application forms note required income levels directly, so take time to compare this against your own documentation.

Actionable Advice for Your Application Journey

- Keep track of application submission dates and any follow-up interviews. Having this organized will help you stay informed about your application status.

- If you face difficulties with the application, don’t hesitate to call property management to clarify any uncertainties. They are there to guide you through the process!

Impact on Housing Affordability and Access

The impact of income-restricted apartments on housing affordability and access is profound, particularly for low-income households. These specialized units not only provide financial relief but also facilitate equitable access to housing, addressing a critical need in our communities.

Affordability Metrics and Access

Income-restricted apartments play a vital role in promoting affordability in increasingly expensive housing markets. By capping rental costs to a percentage of income, they allow access to housing for families who might otherwise be priced out. Here are some key points:

- Rent Stability: Residents in income-restricted apartments often pay no more than 30% of their income on housing. This creates household stability and allows families to allocate funds to other essential needs like healthcare and education.

- Diversity of Options: With nearly 3 million income-restricted units available, diverse housing options exist to accommodate various family sizes and income levels, ensuring no demographic is left behind.

- Geographic Disparities: Some regions, particularly urban areas, struggle with higher living costs. Income-restricted housing helps mitigate these disparities by allowing lower-income families access to homes in desirable neighborhoods.

| City | Average Rent for Income-Restricted Unit | Average Market Rent | Percentage Difference |

|---|---|---|---|

| Orlando, FL | $1,250 | $2,500 | 50% |

| Portland, OR | $1,150 | $2,200 | 48% |

| Houston, TX | $900 | $1,800 | 50% |

| Seattle, WA | $1,500 | $3,000 | 50% |

Case Studies on Accessibility

1. Riverside Apartments in Orlando:

- With a 50% income restriction, these apartments provide essential living spaces for disabled and elderly individuals. Such dedicated units promote community integration, offering a safe haven where residents can thrive.

2. Maple Ridge II in Portland:

- Catering to families with incomes at or below 30% AMI, this community showcases how income restrictions effectively serve some of the most vulnerable populations, giving them an opportunity for stable housing in an expensive city.

3. Vista Point Apartments in Seattle:

- Offering units restricted to 60% AMI, this project is specifically geared toward low- to middle-income households, emphasizing the ability of income-restricted housing to accommodate various income brackets within one community.

Practical Implications for Residents

Understanding the impact of income-restricted apartments can guide you in accessing these vital resources:

- Investigate Local Options: Check with local housing authorities or community organizations to learn about available income-restricted units in your area.

- Review Eligibility Requirements: Familiarize yourself with income limits specific to your city, as they can vary significantly based on location and family size.

- Utilize Support Services: Engage with local non-profits or government programs that assist with the application process, ensuring you maximize your chances of securing an income-restricted apartment.

By taking these actions, you can effectively navigate the landscape of housing affordability, leveraging income-restricted apartments to improve your living situation and access to important community resources.

It’s crucial to remember that by making informed choices about your housing, you’re taking steps not just for yourself but for the community at large.