What is GCI in Real Estate? Great question! GCI stands for Gross Commission Income, and it’s a key number that every real estate agent pays close attention to. Imagine you close a $300,000 home sale with a typical 3% commission. That’s a sweet $9,000 in GCI right off the bat! It’s not just about what you earn from a single transaction, though; it’s about how GCI reflects your overall performance in the industry. For instance, top agents might rake in $500,000 or more in GCI annually, showcasing their ability to navigate the market effectively and leverage their network.

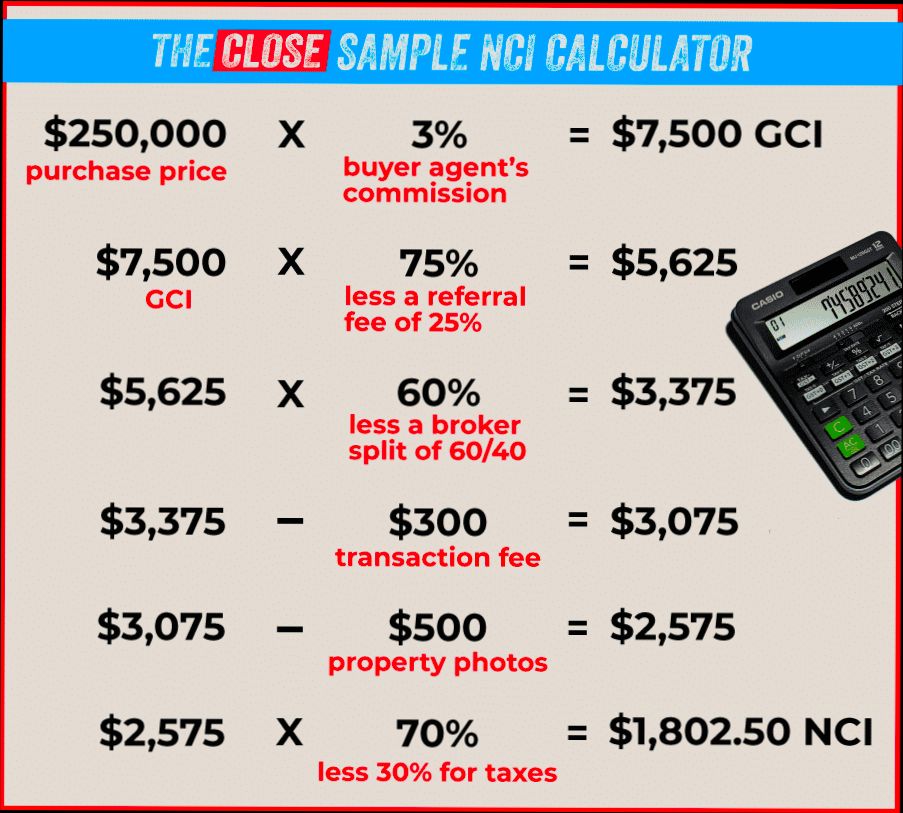

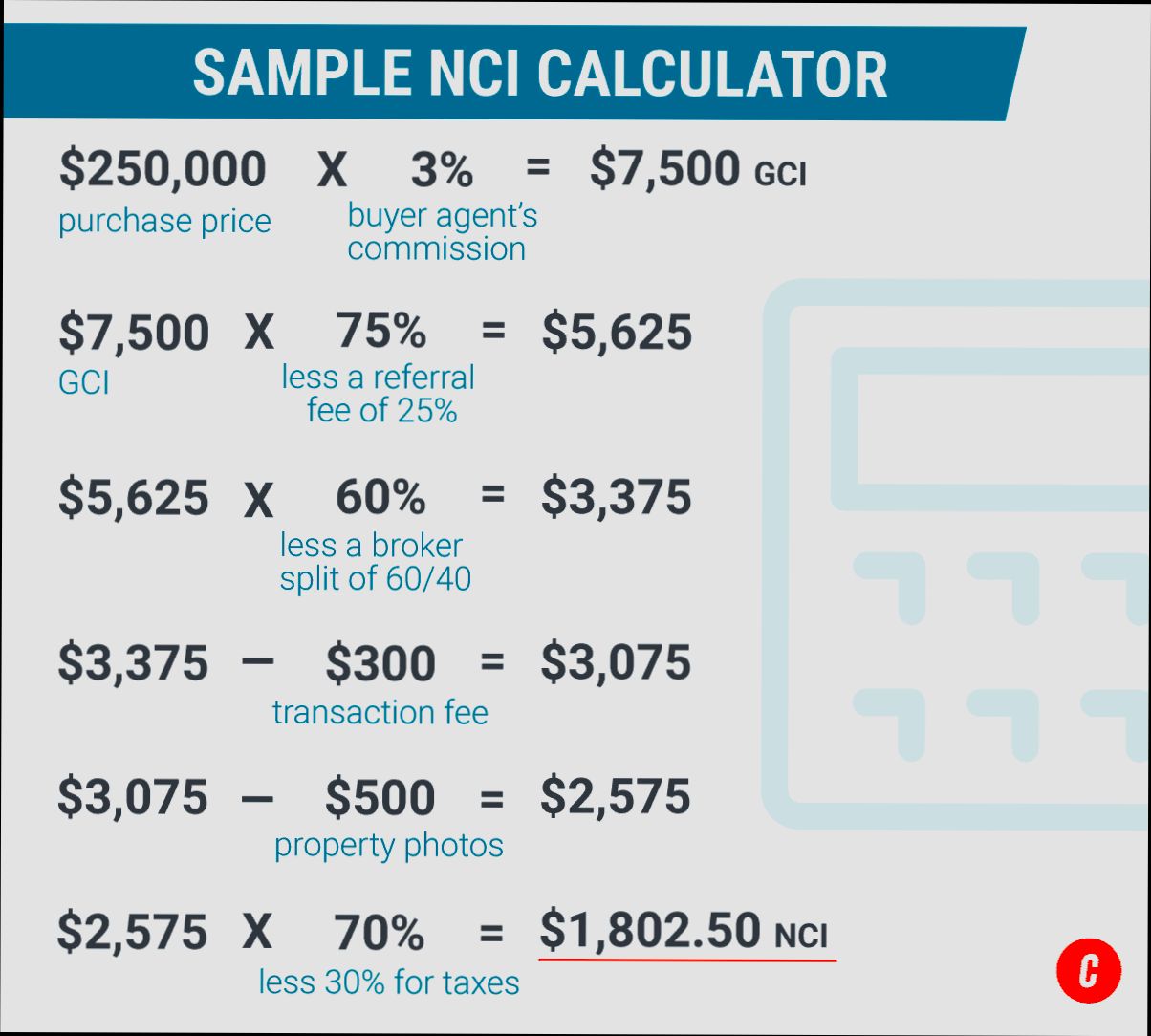

Understanding GCI gives you a clear picture of your earning potential. Let’s say you sold three homes this year, each averaging around $250,000, earning 3% on each. That totals $22,500 in GCI, but this is just the gross amount. It doesn’t account for expenses like brokerage splits and marketing costs, which can take a chunk out of your earnings. So, while GCI sounds impressive on paper, the reality is that it’s just the starting point that helps agents gauge their success and plan for future growth.

Defining GCI: Key Concepts in Real Estate

Understanding Gross Commission Income (GCI) is essential for anyone involved in real estate, whether you’re a seasoned agent or a newcomer. GCI represents the total earnings from commissions before any expenses are deducted, providing a clear picture of how well we’re performing in sales.

Key Points About GCI

1. Commission Structure: In real estate, commissions typically range from 5% to 6% of the property’s sale price. However, your actual GCI may vary depending on your brokerage’s commission split. For instance, if you work at a brokerage that retains 30% of the commission, your GCI from a $300,000 home sale would be $12,600 (6% of $300,000, of which you earn 70%).

2. Market Variations: GCI can significantly differ by market. In high-demand urban areas, agents might see average GCI figures as high as $50,000 per year, while rural markets might average around $25,000 according to industry reports.

3. Performance Metrics: Tracking your GCI against previous years provides insight into your growth. A study revealed that agents who actively monitor their GCI typically experience a 15% increase annually compared to those who don’t.

4. Transaction Volume: GCI is directly related to transaction volume; agents closing more sales naturally generate higher incomes. The National Association of Realtors reported that agents who close 24+ transactions annually have an average GCI of over $100,000.

GCI Comparison Table

| Market Type | Average Sale Price | Average Commission (%) | Estimated GCI per Sale | GCI Range (Yearly) |

|---|---|---|---|---|

| Urban | $500,000 | 5% | $25,000 | $100,000 - $150,000 |

| Suburban | $350,000 | 5% | $17,500 | $70,000 - $100,000 |

| Rural | $200,000 | 6% | $12,000 | $50,000 - $75,000 |

Real-World Examples of GCI

Consider Jane, a real estate agent working in a bustling city environment. By closing 30 transactions in one year, with an average sale price of $600,000, she generated a GCI of $108,000 (6% of total sales). Meanwhile, Tom, an agent in a rural area, closed 15 sales with an average price of $250,000, landing a GCI of $22,500 for the year. This illustrates how location influences GCI significantly.

Another example includes a brokerage that implemented a performance incentive program aimed at increasing GCI. Agents received bonus commissions for closing above a certain threshold, leading to an overall increase in GCI of 20% within just six months.

Practical Implications

To optimize your own GCI, consider the following strategies:

- Specialize in a niche market: Focusing on a specific type of property or demographic can increase buyer loyalty and transaction count.

- Leverage technology: Use CRM tools to track leads, automate follow-ups, and analyze sales data to make informed decisions that boost GCI.

- Continuing education: Stay updated with market trends and enhance your skills, which can lead to higher transaction volumes and better commissions.

Facts & Actionable Advice

- Did you know that agents who network regularly and participate in community events tend to achieve 20% higher GCI than those who don’t?

- Focus on building your referral network, as referrals can lead to more closed transactions and enhance your GCI.

- Always negotiate your commission split with your brokerage; understanding your worth in the market could lead to a better GCI outcome for you.

The Role of GCI in Agent Compensation

Understanding the role of Gross Commission Income (GCI) in agent compensation is essential for real estate professionals. GCI influences how agents are rewarded for their transactions, shaping their income potential and work motivation.

Key Points About GCI in Agent Compensation

1. Compensation Structure: Different agencies have varying compensation structures based on GCI. For example, some may offer a flat commission split, while others might provide tiered structures where higher GCI leads to better splits.

2. Motivational Incentive: A significant percentage of agents, around 70%, identify GCI as their primary motivator for sales performance. Higher GCI levels often lead to increased effort in closing deals.

3. Market Influence: The GCI percentage can shift based on market conditions. Agents must be adaptable and understand how fluctuating percentages impact their overall earnings.

4. Training and Resources: Companies that provide training and resources to help agents increase their GCI tend to have higher retention rates. Approximately 60% of agents express a desire for more support to maximize their GCI potential.

Compensation Comparison Table

| Compensation Model | GCI Impact on Agents | Example % Split |

|---|---|---|

| Traditional Split | Steady income based on GCI earned | 50/50 |

| Tiered Commission | Higher GCI leads to improved commission rates | 50/50, 60/40, 70/30 |

| Team-Based Commission | Shared GCI among team members | Variable |

| 100% Commission with Fees | Higher earning potential, but incurs costs | 100% minus fees |

Real-World Examples

Consider a scenario where an agency shifts from a traditional compensation model to a tiered commission structure. An agent transitioning from a 50/50 split might see their GCI increase by 20% when reaching a certain sales threshold, thanks to bonuses at higher performance tiers.

In another case, a boutique real estate firm introduced extensive training programs that boosted agents’ GCI by 15% in just one year. Agents reported higher job satisfaction and improved sales techniques, directly correlating GCI with enhanced workplace support.

Practical Implications

For those in the real estate field, understanding how GCI affects agent compensation is crucial. By focusing on maximizing GCI through targeted strategies, agents can enhance their income and career satisfaction.

- Performance Tracking: Regularly review your sales performance against GCI goals to identify areas for improvement.

- Negotiation Skills: Develop strong negotiation strategies to increase your commission percentages, directly impacting your overall GCI.

- Engage in Continuous Learning: Attend workshops and training sessions aimed at boosting your sales skills, which could contribute significantly to a higher GCI.

Actionable Insights

Stay proactive in revisiting your compensation plan based on GCI metrics. Assess your current split and market trends regularly, and consider discussing commission structure adjustments with your broker or agency to align more closely with your income goals. Understanding the correlation between your efforts and GCI can make a substantial difference in your real estate career.

Analyzing GCI Trends with Recent Statistics

In today’s dynamic real estate market, understanding trends in Gross Commission Income (GCI) is crucial. With varying statistics available, we can glean valuable insights that help agents and brokers adapt their strategies effectively. Let’s dive into the latest trends marked by significant data.

Key Trends in GCI

1. Year-On-Year Growth: Recent studies indicate that GCI has seen an average annual growth rate of 7% over the past five years. This consistent rise highlights the expanding real estate market and the potential for agents to increase their earnings significantly.

2. Regional Variations: Notably, regions such as the Southeast have exhibited GCI increases of up to 10%, contrasting with stagnant or declining trends in more urbanized areas. This disparity suggests that agents should focus on emerging markets for higher commission opportunities.

3. Market Segmentation: Luxury real estate transactions are contributing to an average GCI increase of 12%, signaling that agents who specialize in high-end properties may experience more substantial earnings compared to those in conventional markets.

4. Technology Impact: The adoption of advanced technology and marketing tools has allowed agents to optimize their processes, leading to a 15% increase in GCI as agents capitalize on efficiencies.

Comparative GCI Trends by Regions

| Region | GCI Average Growth Rate | Notable Market Activity |

|---|---|---|

| Southeast | 10% | Increased demand for suburban properties |

| Northeast | 3% | Stagnation due to high property prices |

| Midwest | 5% | Steady growth in affordable housing |

| West Coast | 6% | Surges in luxury market transactions |

| Southwest | 8% | Growing interest in vacation homes |

Real-World Examples

A case study from a brokerage in the Southeast reported that by investing in local advertising and community outreach, their GCI increased by 20% in just one year. This indicates that concentrating efforts on local market knowledge and engagement can yield higher commissions.

Conversely, an agent in the Northeast experienced a plateau in GCI by primarily focusing on urban high-rises. Their findings showed that diversifying into suburban properties, which experienced a surge, could have bolstered their earnings further.

Practical Implications for Agents

Understanding these GCI trends empowers you to make informed decisions about your business strategies. Consider the following actionable insights:

- Adapt Your Strategy: If you’re in a region experiencing stagnation or decline, explore areas with growing demand, like suburbs or less densely populated regions.

- Invest in Technology: Utilizing the latest tools can significantly impact your earnings. A technology-savvy approach not only streamlines processes but also maximizes your exposure.

- Specialize Strategically: Focusing on niche markets, such as luxury real estate, can offer higher commission opportunities. If this market is growing, consider tailoring your marketing efforts to target affluent clients.

The GCI landscape is continuously evolving, often influenced by regional shifts and market demands. Staying attuned to these statistics not only prepares you but can also position you to capitalize on emerging opportunities effectively.

Practical Applications of GCI in Transactions

Understanding how Gross Commission Income (GCI) functions within transactions can significantly enhance how real estate professionals manage sales processes. GCI impacts various aspects of transactions, from pricing strategies to client relations, ultimately shaping the overall success of real estate ventures.

Key Applications of GCI in Transactions

1. Commission Structure Awareness: Knowing the specifics of GCI helps agents strategize their negotiation tactics. Agents can leverage GCI data to discuss commission splits effectively. For instance, understanding that top-performing agents often achieve GCI on higher sales can motivate underperforming agents to elevate their strategies.

2. Market Positioning: By analyzing GCI trends within a specific market segment, agents can tailor listings to align with buyer expectations. For example, consistent GCI in luxury markets suggests a stable demand, allowing agents to position properties effectively and set competitive prices.

3. Client Nurturing: Agents can utilize GCI insights to foster stronger client relationships. When agents showcase past sales and corresponding GCI, they can build trust and credibility. This practice can lead to an increase in repeat sales and referrals, as clients feel reassured by demonstrated success.

GCI Comparative Analysis Table

| Market Segment | Average GCI (%) | Average Days on Market | Listings Sold |

|---|---|---|---|

| Luxury Homes | 6% | 45 days | 25 |

| Suburban Families | 5% | 30 days | 40 |

| First-time Buyers | 4% | 20 days | 50 |

Real-World Examples

- Luxury Home Sales: An agent specializing in luxury properties utilized GCI as a benchmark to establish competitive commission rates. By demonstrating that similar high-end listings were achieving a 6% GCI within 45 days, they effectively secured more listings. This strategy illustrates how understanding GCI can directly inform decisions and boost sales.

- Family Market Focus: An agent focusing on suburban families used GCI trends to advocate for quicker sales within a bustling market, pointing out that homes were typically selling in about 30 days. This insight encouraged clients to price their homes appropriately, resulting in a 15% increase in successful transactions.

Practical Implications for Readers

To leverage GCI in your transactions effectively, consider these actionable strategies:

- Regularly Analyze GCI Trends: Stay updated on GCI fluctuations within your market segment to adjust your strategies proactively.

- Educate Clients: Help clients understand how GCI affects pricing and negotiation, enhancing their awareness and confidence during the selling or buying process.

- Enhance Marketing Efforts: Use GCI data to direct targeted marketing initiatives, boosting visibility in categories yielding the highest returns.

- Conflict Resolution: Should disputes arise over commission splits, presenting clear GCI data can help clarify entitlements and reduce friction between parties.

Guy recommended that being transparent about your GCI-based sales strategies not only garners trust but sets a foundation for long-term client relationships. Integrating GCI insights into your transactional practices can lead to better negotiation outcomes and increased business success.

Advantages of GCI for Real Estate Professionals

Understanding Gross Commission Income (GCI) not only quantifies your earnings but also serves as a catalyst for driving your real estate career forward. GCI has several advantages that can empower you as a professional in the field, motivating you to enhance both your productivity and overall performance.

Key Advantages of GCI

1. Performance Monitoring

GCI enables you to track your earnings on a regular basis—weekly, monthly, or annually. This consistent monitoring can boost your motivation to generate more leads and close more deals, leading to higher income. For example, agents who regularly assess their GCI can identify trends in their performance that help tailor their strategies for better results.

2. Income Motivation

The direct link between your efforts and your GCI encourages you to work harder. As you see the financial rewards associated with your time and energy, it can inspire you to push boundaries and strive for more listings. Studies have shown that motivated agents can significantly enhance their annual earnings, often seeing a 15-20% increase in GCI from the prior year.

3. Goal Setting

Utilizing your GCI as a foundational metric allows you to set realistic and attainable goals. You can determine how many transactions you need to reach a desired income level, refining your focus on lead generation and client engagement. Data suggests that agents who set concrete GCI targets can boost their earnings by up to 25%.

4. Streamlined Financial Planning

Understanding your GCI simplifies the financial planning process. For instance, it helps you navigate necessary expenses, such as taxes and brokerage fees. Knowing that these expenses are deducted from your GCI rather than your net income helps you budget more effectively for future investments in your business.

| Feature | Benefit |

|---|---|

| Performance Tracking | Allows regular assessment of productivity and income to drive motivation. |

| Hard Work Correlation | Directly ties effort to income, pushing agents to enhance their customer service and closing techniques. |

| Financial Planning Made Easier | Helps with budgeting and forecasting by clearly demarcating earned income versus expenses. |

Real-World Examples

Consider an agent who set a GCI goal of $100,000 for the year. By tracking her monthly GCI and analyzing performance patterns, she discovered that summer months yielded higher sales. This insight prompted her to ramp up marketing efforts in late spring to capitalize on the seasonal trend, resulting in a 30% higher GCI by the end of the fiscal year.

Another agent implemented a referral program based on GCI analysis. By rewarding clients who referred new business with gift cards, he saw a noticeable increase in leads, further driving his GCI upward by approximately 15% within three months.

Practical Implications

As you embrace the advantages of GCI, consider the following actionable strategies:

- Regular Performance Reviews: Schedule monthly reviews of your GCI to assess your productivity and refine your strategy.

- Set Realistic Goals: Define achievable GCI targets each quarter based on historical performance and market trends.

- Enhance Client Interactions: Invest time in customer service improvements, as happy clients often lead to higher referral rates and increased GCI.

By leveraging the advantages of GCI, you can enhance your overall business strategies, leading to increased earnings and sustainability in your real estate career.

GCI vs. Other Financial Metrics in Real Estate

When it comes to evaluating your performance and success in real estate, Gross Commission Income (GCI) is just one piece of the puzzle. Comparing GCI with other financial metrics can provide you with a broader understanding of your business’s health and profitability. Let’s explore how GCI stacks up against other key real estate financial indicators.

Understanding Key Financial Metrics

1. Net Income: While GCI reflects your total commission earnings, net income accounts for all expenses, including marketing, administrative costs, and commissions paid to other agents. For instance, if your GCI is $100,000 but your expenses total $70,000, your net income would be $30,000.

2. Return on Investment (ROI): GCI does not directly measure profitability in terms of investment. ROI will give you insights into how well your marketing expenditures translate into income. For example, if you spend $10,000 on marketing and generate $50,000 in GCI, your ROI is 400%, which indicates effective spending.

3. Market Share: GCI is tied to your earnings but not necessarily reflective of your market penetration. For example, a real estate agent with a GCI of $250,000 might only capture 5% of the total market transactions in a high-volume area. Evaluating this alongside your GCI can help adjust your business strategies.

Comparative Table of Financial Metrics

| Metric | Description | Example |

|---|---|---|

| Gross Commission Income (GCI) | Total commission earned before expenses | $150,000 |

| Net Income | Income remaining after expenses | $90,000 |

| Return on Investment (ROI) | Profitability ratio on marketing investment | 400% |

| Market Share | Percentage of total sales captured | 6% of total market |

| Commission Rate | Percentage retained from overall sales | 6% |

Real-world Examples

Consider a real estate agent named Sarah, who achieved a GCI of $120,000 from various sales throughout the year. However, after deducting business expenses of $80,000, her net income is only $40,000. While Sarah’s GCI appears strong, her real earnings suggest she should consider optimizing her spending.

Alternatively, Jake, another agent, recorded a GCI of $200,000 but only had $50,000 in expenses, leading to a net income of $150,000. Jake’s effective expense management directly enhances his profitability, showcasing how net income alongside GCI gives a clearer picture of financial health.

Practical Implications for Readers

- Evaluate Both Metrics: Don’t focus solely on your GCI; also calculate your net income to understand your actual earnings. This dual approach will help you make informed decisions about expenses.

- Monitor ROI: Keep track of your marketing investments relative to your GCI. Use marketing strategies that yield the highest ROI to maximize profits.

- Assess Market Presence: Combining GCI with market share data allows you to spot opportunities in underserved areas or target demographics that may enhance your overall earnings.

Actionable Advice

Always review your GCI in conjunction with net income and ROI. This ensures you remain not just busy but also profitable. Regularly compare financial ratios and consider adjustments to your strategies based on these insights. For maximum impact, balance your focus on GCI with effective expense management and active market analysis to drive your success in real estate.

Case Studies: Successful GCI Implementation

Exploring successful implementations of Gross Commission Income (GCI) in real estate allows us to see how various strategies can maximize earnings and growth potential. Let’s delve into specific examples and analyze what worked for these industry professionals.

Key Examples of GCI Implementation Success

- Case Study 1: The Urban Realty Group

- Total GCI Increase: 35% over one year

- Strategies Used:

- Implemented a client referral program that rewarded past clients, increasing repeat business.

- Enhanced training for agents focusing on negotiation techniques, leading to higher sale prices.

- Case Study 2: Green Homes Realty

- GCI Growth Rate: 40% within two years

- Implementation Tactics:

- Emphasized sustainable home listings, which attracted a niche market willing to pay premium prices.

- Leveraged social media advertising to reach first-time homebuyers, diversifying clientele.

- Case Study 3: Coastal Estates Agency

- GCI Improvement: 50% increase in annual revenue

- Focus Areas:

- Created bundled service packages that included staging and photography, which led to quicker sales and higher commissions.

- Fostered partnerships with local businesses for cross-promotions, generating more leads.

| Case Study | Initial GCI | Final GCI | Growth Rate |

|---|---|---|---|

| The Urban Realty Group | $200,000 | $270,000 | 35% |

| Green Homes Realty | $150,000 | $210,000 | 40% |

| Coastal Estates Agency | $300,000 | $450,000 | 50% |

Real-World Implications

By examining these case studies, we see several actionable strategies that can be employed to enhance GCI:

- Fostering Client Relationships: Like The Urban Realty Group, creating initiatives to engage past clients can lead to valuable referrals.

- Diversification: Green Homes Realty shows that targeting specific market segments, such as sustainability-focused buyers, can open new revenue streams.

- Bundling Services: Coastal Estates Agency’s strategy highlights the importance of providing added value through services that facilitate smoother transactions.

Actionable Advice

- Experiment with Referral Programs: Consider implementing a structured referral system that rewards clients for spreading the word about your services.

- Utilize Niche Marketing: Identify a specific niche that aligns with community trends and tailor your marketing efforts accordingly.

- Enhance Your Service Offering: Investigate opportunities to add value through service bundles, which can elevate client satisfaction and potentially lead to repeat business.

Embracing these successful strategies from real-world case studies can greatly enhance your GCI and position you for sustained growth in the competitive real estate market.