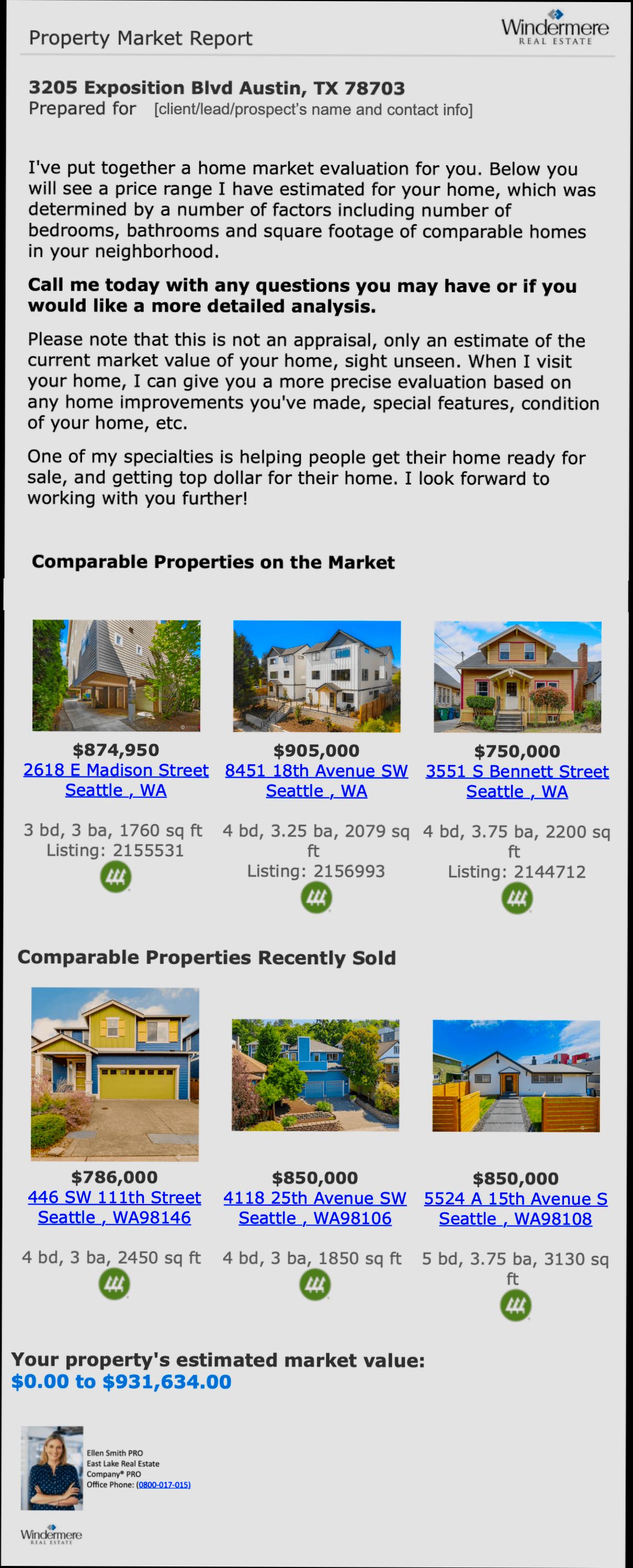

What is a CMA in Real Estate? A Comparative Market Analysis, or CMA, is your secret weapon when it comes to buying or selling a home. Think of it as a snapshot of the current market conditions, helping you understand what similar properties in your neighborhood are selling for. For example, if you’re eyeing a cozy three-bedroom house in Austin, Texas, a well-prepared CMA can show you how much similar homes sold for in the last six months, their pricing trends, and the average days they spent on the market. Knowing that the average sale price for those homes was around $350,000 can make your offer more competitive or prepare you for a potential price negotiation.

Let’s break down what’s included in a CMA. It usually looks at recent sales data, current listings, and even properties that didn’t sell (because, let’s face it, those can tell you a lot about pricing!). Say you’re selling a two-bath home in a sought-after neighborhood where homes typically sell for $400,000 to $450,000. A CMA can highlight why a particular listing didn’t move: perhaps it was overpriced or needed too many repairs. With this data at your fingertips, you can better grasp your own property’s worth and make informed decisions in this fast-paced market.

Understanding the Components of a CMA

Creating a Comparative Market Analysis (CMA) requires understanding various key components that help determine the value of a property. By dissecting each element of a CMA, you can gain insights into pricing strategies and market dynamics.

Key Components of a CMA

When putting together a CMA, consider the following essential components:

- Active Listings: These are properties currently for sale in your area. Analyzing them helps you understand market competition.

- Sold Listings: Look at properties that have recently sold. This historical data provides a benchmark for setting a competitive price.

- Expired Listings: Examining homes that failed to sell can reveal pricing pitfalls and market realities that buyers and sellers should consider.

- Pending Sales: Properties that are in escrow illustrate market demand and can indicate upward trends in property value.

- Market Trends: Assessing trends helps you recognize whether the market is heating up or cooling down, influencing your pricing strategy.

Comparative Market Analysis Table

| Component | Description | Importance |

|---|---|---|

| Active Listings | Properties currently available for sale | Gauge current market competition and buyer interests |

| Sold Listings | Recently closed transactions | Establish a pricing benchmark through real sale data |

| Expired Listings | Properties that didn’t sell and were taken off market | Identify pricing strategies that failed |

| Pending Sales | Properties under contract but not yet closed | Indicator of ongoing buyer interest and market health |

| Market Trends | Analysis of pricing and demand over time | Helps anticipate future market conditions |

Real-World Examples

In a recent CMA for a 3-bedroom home in Denver, the analysis revealed that:

- Active listings were priced around $500,000, while sold listings in the past six months averaged $480,000. This suggests the need to be competitive yet realistic in pricing.

- The expired listings for similar homes indicated that properties above $520,000 struggled to find buyers, highlighting the importance of aligning with market expectations.

Additionally, a client in Austin had their home listed at $600,000 based on incomplete data. Upon reviewing the sold listings and pending sales, they realized a more aggressive pricing strategy at $575,000 would likely attract offers based on the local demand.

Practical Implications

Understanding these components can drastically improve your strategy, whether selling or buying. Here are some practical actions to consider:

- Regularly update your CMA: By revisiting your CMA every few weeks, you position yourself to adapt to changing market conditions.

- Leverage tech tools: Use online platforms that forecast market trends based on data analytics. They can help keep your CMA current and accurate.

- Engage with local experts: Talking to a real estate professional who understands your market will provide additional insights that numbers alone may not reveal.

Actionable Advice

To accurately capture your property’s worth, always ensure your CMA includes a balanced mix of these components. The real estate landscape constantly shifts, and your analysis should evolve alongside it. Stay proactive by monitoring local trends, which can give you a competitive edge when making decisions about listing or making an offer.

Make use of these components in your CMA to not only set a realistic price but to formulate a comprehensive strategy that positions you favorably in the market.

The Role of Comparables in Pricing

When determining the value of a property in real estate, comparables play a pivotal role. These are properties that have recently sold and are similar to the one being assessed. Understanding how to effectively use comparables not only influences pricing strategies but also impacts the overall success of a transaction.

What Are Comparables?

Comparables, or “comps,” are properties that share key characteristics with the asset in question. This analysis hinges on several core aspects:

- Similarity in Characteristics: Comparables should match in size, age, condition, and location. The closer they align, the more reliable the pricing will be.

- Recency of Sale: It’s critical to focus on properties sold within the past year to ensure current market conditions are reflected in the pricing strategy.

- Market Trends: Evaluating how sales prices for comps have varied can provide insights into broader market trends.

Key Points on Comparables Role in Pricing

- Selection Criteria: It’s essential to compare properties that are akin in nature. For instance, a well-maintained condo in a vibrant downtown area is not comparable to a large home in a suburban neighborhood. Properties must mirror each other in essential attributes to provide a valid basis for valuation.

- Accuracy Matters: A rigorous analysis can lead to a difference in perceived value. For example, if two properties sold for $300,000 and $350,000 respectively, understanding the nuances that caused the price disparity, like upgrades or location factors, can refine your pricing strategy.

- Tools for Finding Comps: Numerous online platforms offer recent sales data. A physical drive-by can also provide qualitative insights, like neighborhood conditions or local amenities that data alone might miss.

| Characteristic | Property A | Property B | Property C |

|---|---|---|---|

| Size (sq ft) | 1,500 | 1,550 | 1,600 |

| Age (years) | 10 | 12 | 8 |

| Condition | Excellent | Good | Good |

| Location | Central | Suburban | Central |

| Last Sold Price | $320,000 | $300,000 | $330,000 |

Real-World Examples

Consider a scenario where you have a 1,500 sq ft home located in a central neighborhood, recently renovated and considered in excellent condition. You find comps with similar characteristics:

- Property A sold recently for $320,000—a great benchmark due to its superior condition and central location.

- Property B, despite being slightly larger but in a more suburban area, sold for $300,000. This comparison highlights the importance of location in pricing.

- Property C, also centrally located, sold for $330,000, offering a crucial data point that could suggest a potential increase in market value.

Practical Implications for Readers

Engaging with comparables can substantially influence your pricing decisions. By leveraging accurate data, you enhance your understanding of your property’s market position. This not only aids in setting a competitive price but can also empower negotiations in either selling or buying scenarios.

- Stay Updated: Always look for comps that are no more than a year old. Real estate markets can shift rapidly; outdated data could lead to misguided pricing.

- Focus on Fine Details: Look beyond just square footage and sale price. Consider factors such as upgrades, neighborhood reputation, and even local schools, which can greatly affect valuations.

Arming yourself with comprehensive comp analysis not only aids in accurate property pricing but can also bolster your confidence during negotiations, ensuring that you secure the most favorable deal possible.

Statistical Methods Used in CMA Analysis

When creating a Comparative Market Analysis (CMA), statistical methods are essential for accurately evaluating property values. These techniques help assess relationships among various property-related variables, leading to more informed decisions. Let’s delve into the key statistical methods used in CMA analysis, emphasizing their significance and application in real estate.

Key Statistical Methods

1. Normality Test: This test assesses whether the data follows a normal distribution, which is crucial for many statistical analyses.

- Null Hypothesis: The data follows a normal distribution.

- Alternative Hypothesis: The data does not follow a normal distribution.

2. t-Tests: These tests compare means between groups:

- One-Sample t-Test: Compares the average of a single group against a known value.

- Two-Sample t-Test: Tests if the means of two independent groups differ from each other.

- Paired t-Test: Compares means from the same group at different times.

3. ANOVA (Analysis of Variance): This method is invaluable for comparing means across multiple groups:

- One-Way ANOVA: Tests if the means of three or more groups are equal.

- Repeated Measures ANOVA: Evaluates means from the same subjects over multiple measurements.

4. Chi-Square Tests: Examine relationships between categorical variables:

- Goodness-of-Fit Test: Determines if sample data matches a specific distribution.

- Independence Test: Assesses if two categorical variables are independent.

5. Correlation Analysis: Measures the strength and direction of the relationship between two continuous variables:

- A correlation coefficient of 0 indicates no relationship, while values closer to 1 or -1 reflect strong relationships.

Here’s a comparative overview of some of these methods:

| Statistical Analysis | Type of Variable | Null Hypothesis | Alternative Hypothesis |

|---|---|---|---|

| Normality Test | RV: QV | The data follows a normal distribution | The data does not follow a normal distribution |

| One Sample t-Test | RV: QV | The average of the group is equal to a specific value | The average of the group is different from a specific value |

| Two Sample t-Test | RV: QV, EV: CV | The averages of the two groups are the same | The averages of the two groups are not the same |

| One-Way ANOVA | RV: QV, EV: CV | The averages of the groups are all the same | The averages of the groups are not all the same |

| Chi-Square Test | Two CVs | The relationship between the two CVs is independent | The relationship between the two CVs is dependent |

Real-World Application

In a real estate context, using a two-sample t-test might help an agent determine if two neighborhoods have significantly different average property values. For instance, if you were analyzing two areas, the null hypothesis would state that the average prices are the same, while the alternative would argue that they differ.

Similarly, if properties were analyzed using a one-way ANOVA, it might reveal that several property types (e.g., single-family homes, townhouses, and condos) have different average selling prices. Understanding this difference can guide pricing strategies and marketing efforts.

Practical Implications

Knowing which statistical methods to employ can dramatically enhance the precision of a CMA. As you approach the analysis:

- Use normality tests to determine the suitability of t-tests or ANOVA.

- Consider employing chi-square tests for categorical comparisons, such as property type versus selling status.

- Utilize correlation analysis to explore how factors like square footage relate to selling prices.

Specific Facts and Actionable Advice

- When dealing with small sample sizes (n < 30), relying on nonparametric methods may be prudent to ensure robust analysis.

- If you’re analyzing multiple groups, leverage ANOVA for efficient comparison rather than performing multiple t-tests, which can inflate the risk of Type I errors.

- Aim to check assumptions of normality prior to t-test applications to validate your analysis.

These statistical methods are crucial for interpreting market conditions accurately, leading to more effective pricing and negotiation strategies in real estate transactions.

Real-World Examples of CMAs in Action

When it comes to understanding CMAs in the real estate arena, real-world applications can provide you with clear insights. By examining how these analyses work in practice, you can better appreciate their role in shaping property transactions.

Case Study 1: Pricing in a Hot Market

In a competitive market, a real estate agent used a CMA to price a three-bedroom home under $500,000. The analysis revealed that similar properties in the area sold for an average of 98% of the listing price. By pricing the home at $495,000, the seller drew multiple offers, ultimately selling for $525,000—a 6% increase over the CMA estimate, showcasing the importance of precise pricing in gaining buyer interest.

Case Study 2: Adjusting Strategies for Unique Properties

A unique property, such as a historic home, presents challenges for CMAs. An agent compared it to recent sales of other historic properties, which showed an increase in value of 15% over the last two years. By incorporating these insights, the agent set a competitive price that attracted buyers interested in the uniqueness of the home, resulting in a quick sale at the asking price.

Comparative Market Analysis Table

| Property Type | Average Days on Market | Average Sale Price | % of List Price Achieved |

|---|---|---|---|

| Standard 3-Bedroom | 15 days | $450,000 | 98% |

| Historic Home | 30 days | $600,000 | 95% |

| Condo | 20 days | $350,000 | 97% |

Practical Implications

By leveraging real-world CMA examples, you can:

- Understand regional pricing dynamics based on the type of property.

- Identify when to adjust listing strategies, especially for properties that may not fit typical criteria.

- Recognize the significance of timing in a property’s sale, particularly in markets with varying demand.

You might want to study recent sales within your target area and examine their attributes. Knowing the average days on the market helps you gauge how to time your sale.

Actionable Insights

- Always keep your CMA updated, especially in fast-paced markets. An outdated analysis can lead to mispricing.

- If you represent unique properties, emphasize their distinctive features in the CMA. Use comparable sales that show a higher appreciation rate to justify pricing.

- Collaborate with local agents to share insights and data, creating a more accurate picture for your CMA.

Understanding real-world applications of CMAs can empower you in property transactions, enabling you to make informed pricing decisions that can lead to successful outcomes.

Advantages of Conducting a CMA

Conducting a Comparative Market Analysis (CMA) offers numerous advantages for anyone involved in real estate, whether you’re a buyer, seller, or investor. By leveraging accurate data and market insights, you can position yourself more effectively in the competitive real estate market.

Enhanced Pricing Strategies

One of the primary benefits of conducting a CMA is the ability to develop an enhanced pricing strategy. Properties priced accurately based on a CMA can sell up to 15% faster compared to those with poorly established values. This is essential whether you’re listing a home or making an offer.

Confidence in Negotiations

When you rely on a well-structured CMA, you arm yourself with crucial information that builds confidence in negotiations. Armed with competitive market data, buyers and sellers can negotiate more effectively, knowing what similar properties are valued at. In fact, 98% of real estate professionals agree that a strong CMA helps present a property with confidence.

Targeted Marketing Efforts

Using a CMA allows you to identify your target market more clearly. By understanding the demographics that are actively buying similar properties, you can tailor your marketing strategy to appeal specifically to those potential buyers. Real estate agents who utilize CMAs report a greater success rate in closing deals, with a 6% increase in leads generated from targeted campaigns.

| Advantage | Description | Impact (%) |

|---|---|---|

| Enhanced Pricing Strategies | Accurately priced properties sell faster. | 15% faster sales |

| Confidence in Negotiations | Strong data leads to effective and informed negotiations. | 98% confidence |

| Targeted Marketing Efforts | Tailored strategies increase lead generation and audience engagement. | 6% increase |

Practical Applications

Let’s consider a real-world case. A homeowner wanting to sell in a trendy neighborhood conducted a CMA and found that homes with similar features sold for an average of $450,000. As a result of this analysis, they priced their home just below this average, attracting multiple offers and ultimately selling for $455,000—well above their expectations.

Another example involves an investor who used a CMA to analyze properties for rental purposes. By understanding average rental rates for comparable units, they secured properties at lower prices that yielded over 12% returns, significantly boosting their investment portfolio.

Actionable Insights for Readers

- Always update your CMA: Market conditions can change quickly, so ensure your CMA reflects the most current data.

- Engage a professional: Consider collaborating with an agent who specializes in CMAs to get the most accurate insights.

- Utilize technology: Online tools can assist in generating a quick CMA, but always cross-verify with local market knowledge to enhance accuracy.

By embracing the advantages of conducting a CMA, you’re not only making informed decisions but also positioning yourself as a savvy player in the real estate market.

CMA Insights for Buyers and Sellers

When navigating the real estate market, understanding how a Comparative Market Analysis (CMA) can inform your decisions is crucial for both buyers and sellers. This section provides specific insights on how to leverage CMAs to your advantage.

Key Points to Consider

- Market Trends: Understanding local market trends can significantly impact your buying or selling position. For instance, if a CMA reveals a 10% increase in similar property sales over the last year, sellers might set higher listing prices, while buyers may need to act quickly in a competitive market.

- Time on Market: Analyzing how long properties similar to yours have remained on the market provides insights into demand. A CMA can indicate an average of 30 days for homes in your area, suggesting a healthy market where buyers should be prepared to make offers quickly.

- Price Adjustments: CMAs can show you how long it took for similar properties to sell at their price points. If they sold for 5% less than initially listed after 60 days, this might act as a cautionary signal for sellers regarding their pricing strategy.

| Aspect | Buyer Consideration | Seller Consideration |

|---|---|---|

| Market Demand | Understanding if it’s a buyer’s or seller’s market | Setting a competitive price based on demand |

| Average Days on Market | Timing offers based on how quickly homes sell | Adjusting listing strategy based on market speed |

| Price Analysis | Finding fair market value to avoid overpaying | Pricing the home to maximize interest and minimize days on market |

Real-World Examples

- Example 1: Strategic Pricing Decisions: A seller utilized a CMA indicating that homes within their neighborhood typically sold for 97% of the listing price. By setting their price just above the average, they not only attracted multiple offers but ultimately sold for 99% of their listing price, demonstrating the value of pricing right with CMA insights.

- Example 2: Effective Negotiations for Buyers: A buyer looking at homes priced over $350,000 leveraged CMA data revealing that similar properties were typically selling for 8% less than asking price. Knowing this, they confidently submitted an initial offer at a lower price, resulting in a mutually agreeable deal that saved them thousands.

Practical Implications for Buyers and Sellers

For buyers, a CMA acts as your roadmap to finding a fair market price, ensuring you don’t overextend financially in a bidding war. For sellers, it empowers you to price your home competitively without undervaluing your property, optimizing your chances for a swift sale.

- Actionable Advice for Buyers: Always verify the numbers in the CMA before making an offer. Use the data to ensure you’re hovering around the average selling price of similar homes.

- Actionable Advice for Sellers: Regularly update your CMA throughout your selling process. If market conditions shift, be ready to adjust your strategy based on the latest insights provided by your CMA.

Leveraging CMA insights can significantly enhance your real estate experience, whether you’re buying or selling, leading to more informed decisions and potential financial success.

Mistakes to Avoid When Analyzing a CMA

Analyzing a Comparative Market Analysis (CMA) can significantly impact your buying and selling decisions in real estate. However, several common mistakes can lead to misinterpretations and potentially costly errors. Understanding these pitfalls can empower you to make more informed decisions.

Overlooking Localized Market Trends

One of the most critical mistakes is ignoring localized market trends. Real estate markets can be highly specific to neighborhoods or even streets. A property may seem overpriced in a broader market analysis, but if local demand is strong, it could be justified.

- Data Point: 97% of real estate professionals say that local market knowledge is essential when analyzing property values.

- Actionable Insight: Always consider the unique characteristics of the local area before making any judgments based solely on a CMA.

Failing to Adjust for Property Condition

Another frequent mistake is neglecting to adjust for the condition of comparable properties. A well-maintained home may command a higher price compared to similar homes with deferred maintenance.

- Statistics: Homes in good condition sold for an average of 15% more than those needing significant repairs.

- Advisory Tip: Make specific adjustments in your CMA analysis for the condition of the properties being compared. For instance, if a comparable property has a new roof or updated kitchen, it deserves your attention in comparative pricing.

Ignoring Unique Features and Amenities

Unique features can significantly influence property values, yet they are often overlooked. For example, a home with a desirable view or proximity to parks can have a higher value than the CMA suggests.

- Example: Erik J. Weisskopf noted that a lake view added $50,000 in value during a recent appraisal, highlighting that certain features may warrant a premium not reflected in initial CMA figures.

- Strategy: When conducting your CMA, list unique features that may not be easily quantifiable but could affect pricing.

Neglecting Recent Sales Data

Another critical error is relying heavily on outdated sales data. Real estate markets can change rapidly, and using data from sales that occurred six months ago may not accurately represent current conditions.

- Insight: 90% of real estate professionals indicate that the market can shift dramatically over just a few months.

- Recommendation: Focus on properties sold within the last 30 days to gauge real-time market dynamics.

Misjudging the Impact of Seasonality

Seasonal factors can dramatically affect market activity. For instance, the winter months might show lower sales numbers, but that does not mean property values have decreased.

- Data Point: A recent study indicated that homes sold in the spring tend to fetch 10% higher prices than those sold in the winter.

- Tip for Analysis: Regularly factor in seasonal trends when analyzing a CMA, especially if comparing properties sold at different times of the year.

| Mistake | Potential Impact | Actionable Insight |

|---|---|---|

| Ignoring Localized Market Trends | Mispricing properties in high-demand areas | Research local sales trends |

| Failure to Adjust for Condition | Overvaluing or undervaluing properties | Include property condition adjustments |

| Overlooking Unique Features | Missing out on value-added amenities | Document and analyze unique features |

| Relying on Outdated Sales Data | Poor pricing decisions based on old information | Utilize recent sale data (30 days) |

| Misjudging Seasonal Impact | Incorrect market outlook | Factor seasonality in pricing |

Understanding these mistakes can aid you in conducting a more thorough and accurate CMA analysis. Always consider localized trends and adjust appropriately for property conditions and unique features when you approach your analysis. Regularly updating your data and accounting for seasonal impacts is crucial in the ever-changing real estate market.