- Current Trends in Home Equity: Key Statistics

- Types of Home Equity Financing: Options Available

- Step-by-Step Guide to Accessing Your Home Equity

- Comparing Home Equity Loans vs. Home Equity Lines of Credit

- The Application Process: What to Expect

- Factors Influencing Your Home Equity Value

- Calculating Your Equity: A Simple Formula

- Potential Risks of Cashing Out Home Equity

- Maintaining Financial Health After Leveraging Home Equity

- Tax Implications of Home Equity Withdrawals

- Common Myths About Home Equity Explained

- Frequently Asked Questions About Home Equity

- Resources for Homeowners: Tools and Calculators

How to take equity out of your home is a question many homeowners find themselves asking, especially when they need some extra cash for a big purchase or unexpected expense. Basically, home equity refers to the portion of your home that you actually own, which can increase as property values rise and you pay down your mortgage. So, if you’ve been keeping up with your payments or if home values in your area have shot up, you might have more equity than you think. Some common ways to tap into that equity include refinancing your mortgage, taking out a home equity loan, or applying for a home equity line of credit (HELOC).

Let’s say you’ve been in your home for a while and its value has grown—this could open up opportunities for you. For example, if your home is worth $400,000 and you owe $250,000 on your mortgage, you have $150,000 in equity. That means you might consider refinancing your mortgage to pull out some of that cash for things like home improvements, college tuition, or even starting a business. With options like HELOCs, you can easily access the funds as you need them, making it a flexible choice if you’re not sure how much you’ll need right away.

Understanding Home Equity: What It Is and Why It Matters

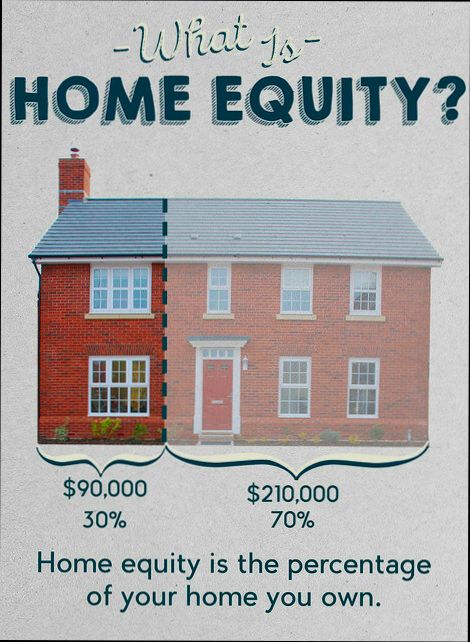

Home equity is basically the portion of your home that you actually own. It’s calculated by taking your home’s current value and subtracting any outstanding mortgage balance. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, your equity amounts to $100,000. Simple, right?

Now, why should you care about home equity? Well, it can be a financial powerhouse. According to the National Association of Realtors, homeowners gained an average of $51,500 in equity over the last year alone. That’s a nice chunk of change that could help you fund significant expenses like home renovations, college tuition, or even a dream vacation.

Here’s the kicker: tapping into that equity isn’t as hard as you might think! You can access it through options like a home equity loan or a home equity line of credit (HELOC). A home equity loan gives you a lump sum at a fixed interest rate, while a HELOC functions more like a credit card—offering a revolving line of credit that you can draw from as needed.

Let’s say you want to remodel your kitchen. If your equity is sitting pretty at $80,000, you could potentially borrow against that to finance the project. Not only do you get to enjoy a new kitchen, but those renovations could also boost your home’s value even further. Stats reveal that kitchen remodels can return about 70% to 80% of their cost when you sell—now that’s a smart investment!

In summary, understanding your home equity can open doors to exciting financial possibilities. Whether it’s tackling high-interest debt or making your home even more fabulous, knowing what your equity can do for you is essential. So, keep an eye on that number—it matters more than you think!

Current Trends in Home Equity: Key Statistics

Home equity is on the rise, and that’s good news for homeowners looking to tap into their property’s value. As of 2023, research shows that homeowners have seen a nationwide increase of about 40% in home equity since 2020. That’s some serious cash!

Let’s break it down with some numbers that really matter:

- Average Home Equity: The average homeowner in the U.S. has around $200,000 in equity. Can you imagine the possibilities?

- Delinquency Rates: Only about 1.5% of homeowners are currently delinquent on their mortgages, meaning most folks are in great shape—financially and home-wise!

- Refinancing Trend: Approximately 60% of homeowners with a mortgage are considering refinancing to access that equity, especially with interest rates starting to stabilize.

So, what does that mean for you? If you’re thinking about tapping into your home equity, now might be a prime time. Options like home equity loans or lines of credit (HELOCs) are becoming increasingly popular.

For instance, let’s say you’ve got that equity. You could take out a HELOC of up to 85% of your home’s value, giving you access to a hefty chunk of change without selling your home. Want to renovate your kitchen or pay for that dream vacation? Equity can help make it happen!

In short, home equity is booming, and homeowners are leveraging it like never before. Just remember, with great power comes great responsibility—always weigh your options carefully!

Types of Home Equity Financing: Options Available

When you’re ready to tap into your home’s equity, you’ve got a few main options to consider. Let’s break them down so you can find what fits your needs best!

1. Home Equity Loan

Think of this as a second mortgage. You get a lump sum and repay it in fixed monthly payments at a fixed interest rate. This is great if you need a specific amount for things like home renovations or paying off debt. With average interest rates hovering around 5-7%, it can still save you money compared to credit cards!

2. Home Equity Line of Credit (HELOC)

A HELOC is like having a credit card backed by the equity in your home. You can borrow money as you need it, paying interest only on the amount you use. Plus, you usually have a draw period of 5-10 years, where you can withdraw and pay it back before entering the repayment phase. If you’re unsure exactly how much you need up front, this can be super handy!

3. Cash-Out Refinance

This option replaces your existing mortgage with a new one for more than you owe. You take the difference in cash. For example, if your home is worth $300,000 and you owe $200,000, you might refinance for $250,000. You’d get $50,000 cash! Depending on rates, this can be a viable choice if you’re looking to lower your interest rate along with accessing funds.

4. Reverse Mortgage

If you’re 62 or older, a reverse mortgage can convert part of your home equity into cash without requiring monthly payments. The loan is paid back when you move out, sell, or pass away. Data shows that around 60% of homeowners over 62 are aware of this option, but it’s vital to understand the implications since it reduces the estate passed on to heirs.

Real-Life Example

Let’s say you decide on a HELOC because you want to remodel your kitchen over the next few years. You can set up a line for $30,000. Draw $10,000 now, save some for later, and only pay interest on what you’ve drawn. Sounds flexible, right?

In 2021, around 1.4 million homeowners used their equity for projects, showing just how popular these financing options are!

Whichever route you choose, make sure to assess your financial situation. It’s about what works best for you!

Step-by-Step Guide to Accessing Your Home Equity

Accessing the equity in your home can feel a bit daunting, but it’s pretty straightforward when you break it down. Let’s dive in!

Step 1: Determine Your Home Value

First off, you’ll want to figure out how much your home is worth. You can look at recent sales of similar homes in your area or use an online home value estimator to get a ballpark figure.

Step 2: Calculate Your Equity

Here’s where the math comes in. Your home equity is basically your home’s current value minus what you owe on your mortgage. For example, if your home is worth $300,000 and you owe $200,000, you have $100,000 in equity.

Step 3: Decide How to Access Your Equity

You’ve got a few options here:

- Home Equity Loan: This is a lump sum that you pay back in fixed monthly payments. Think of it like a second mortgage.

- Home Equity Line of Credit (HELOC): This is a bit like a credit card. You can borrow as needed and only pay interest on what you use.

- Cash-Out Refinance: This replaces your current mortgage with a new one for more than you owe, giving you the difference in cash.

Step 4: Check Out Your Credit Score

Your credit score plays a huge role in your ability to access Home Equity. Aim for a score above 620 for the best options. If your score is low, some lenders might hit you with a higher interest rate.

Step 5: Shop Around for Lenders

Don’t just go with the first lender you find. Check out several options and compare their rates, fees, and terms. According to the Consumer Financial Protection Bureau, you could save thousands of dollars by choosing the right lender!

Step 6: Gather Your Documents

You’ll typically need several documents, like pay stubs, tax returns, and any information about your debts. This helps lenders assess your financial situation.

Step 7: Complete Your Application

Fill out the application with your chosen lender. Be honest and clear about your needs. The lender will process everything and get back to you with an offer.

Step 8: Close the Deal

If you like the terms, it’s time to close! You’ll sign papers and pay any closing costs. Woah, just like that, you’ve tapped into your home equity!

Wrap Up

In 2022, homeowners in the U.S. collectively gained $1.4 trillion in equity, according to the Federal Reserve. So why not take advantage of what you’ve built? Just remember to use your equity wisely!

Comparing Home Equity Loans vs. Home Equity Lines of Credit

So, you’ve decided to tap into the equity of your home, but now you’re faced with a dilemma: should you go for a home equity loan or a home equity line of credit (HELOC)? Let’s break it down!

Home Equity Loans

A home equity loan is like a one-time cash withdrawal. You borrow a lump sum, typically at a fixed interest rate, and pay it back over a set term, usually 5 to 30 years. This can be great if you have a specific project in mind, like a major renovation or a big purchase.

For example, let’s say you want to remodel your kitchen, and you need $30,000. With a home equity loan, you’d get that full amount upfront and start making monthly payments. Plus, you know exactly how much your payments will be each month, which can make budgeting easier. It’s straightforward!

HELOCs

On the flip side, a Home Equity Line of Credit is more like a credit card. You get a limit based on your equity, and you can draw from it whenever you need. The interesting part? The interest rates are often variable.

Let’s say you have a HELOC with a limit of $50,000. You might withdraw $10,000 for a vacation, then pay it back over time. If you find yourself needing another $20,000 later for, say, a new roof, you can withdraw that as well. This flexibility can be appealing, especially if you’re not sure how much you’ll need.

Choosing What’s Best for You

The choice ultimately comes down to your needs:

- Home Equity Loan: Best if you have a clear purpose and prefer predictable payments.

- HELOC: Ideal if your expenses are variable or you want the flexibility to borrow as needed.

Just to give you some context, as of 2023, the average interest rate for home equity loans was around 7.5%, while HELOCs hovered around 8%. Of course, rates can differ based on credit and lender policies.

In the end, whether you go with a home equity loan or a HELOC, you’re leveraging your home’s value to unlock funds. Just make sure to consider your financial situation and future plans!

The Application Process: What to Expect

Applying to take out equity from your home might sound daunting, but it’s a pretty straightforward process when you break it down. Let’s walk through what you can expect, step by step.

1. Assess Your Home Equity

First things first, you need to know how much equity you actually have. Equity is the difference between what your home is worth and what you owe on your mortgage. For instance, if your home is valued at $300,000 and you owe $200,000, you’ve got $100,000 in equity. Simple, right?

2. Check Your Credit Score

Your credit score plays a crucial role in the application process. Most lenders prefer a score of 620 or higher, but if you’re shooting for the best rates, aim for above 740. Check your credit report for free through sites like AnnualCreditReport.com, and look for any errors you can fix before applying.

3. Shop Around for Lenders

Not all lenders are created equal. Some might offer better terms or lower fees than others. It’s a good idea to get quotes from at least three different lenders. Why? Because rates can vary by thousands of dollars over the life of a loan. For example, let’s say you’re looking to take out a Home Equity Line of Credit (HELOC) for $50,000. At a 5% interest rate, you’d pay around $750 a year; but at a 7% rate, that jumps to $1,050! Trust me, every percentage point counts!

4. Gather Necessary Documents

Before you apply, gather the paperwork you’ll need. Typically, lenders will require:

- Proof of income (like pay stubs or tax returns)

- Information about your debts and monthly expenses

- A list of assets (like bank accounts or other properties)

- Your mortgage statement

5. Application Time!

Now it’s time to fill out the application. Some lenders allow you to do this online, which is super convenient. Be prepared to answer questions about your financial situation and why you want to take out equity. It could be for home improvements, debt consolidation, or even a family trip—whatever your reason, be honest!

6. Wait for the Appraisal

Your lender will likely require a home appraisal to determine its market value. This usually takes a few days, and you might need to pay a fee. A solid appraisal means you could unlock even more equity. If your home is worth more than you thought, that’s a nice bonus!

7. Closing Process

Once everything checks out, you’ll go through the closing process. This is where you’ll sign a heap of paperwork and pay any closing costs (think about 2-5% of the loan amount). Make sure to read everything carefully before you sign—ask questions if you’re uncertain about any fees!

8. Get Your Funds

After closing, you’ll receive your funds. If it’s a lump sum, it’ll go straight into your account. If you’re opting for a HELOC, you’ll get a line of credit you can tap into as needed. It’s like having a safety net when you need it!

And that’s it! Taking equity out of your home can be a fantastic way to access cash for what matters most to you. Just keep everything organized and don’t hesitate to reach out for help if you hit any snags along the way!

Factors Influencing Your Home Equity Value

Home equity isn’t just a buzzword; it’s a big deal when you’re considering tapping into the value of your home. So, what plays into how much equity you really have? Let’s break it down.

1. Property Value

The first and most significant factor is your home’s current market value. If your neighborhood is thriving and property values are soaring, so is your equity. For instance, according to recent studies, homes in the U.S. saw an average appreciation of about 15% over the last year! Imagine you bought your home for $300,000, and it’s now worth $345,000. That’s a neat $45,000 increase in your equity!

2. Mortgage Balance

Your mortgage balance is the other half of the equation. It’s simple math: Home Value - Mortgage Balance = Equity. Let’s say you still owe $200,000 on that fancy $345,000 home. You now have $145,000 in equity. Easy peasy!

3. Home Improvements

Did you recently renovate your kitchen or add a deck? Home improvements can catapult your home’s value, thereby boosting your equity. A minor kitchen remodel can increase your return on investment (ROI) by about 80% to 90%! So, those upgrades aren’t just pretty; they pay off!

4. Market Trends

Keep an eye on the real estate market. Rising interest rates can slow down buying, impacting home values negatively. In contrast, if the economy is booming and more people are buying houses, your equity might get a lovely bump.

5. Local Factors

Don’t forget to consider local amenities! Great schools, parks, and community centers can hike up demand for your neighborhood, boosting home values. If your area just got a hot new cafe or an exciting shopping district, it could help your equity grow!

To sum it up, keep an eye on these factors: your property value, mortgage balance, home improvements, and the bigger market picture. Doing so can give you a clearer understanding of your home equity and when to make a move!

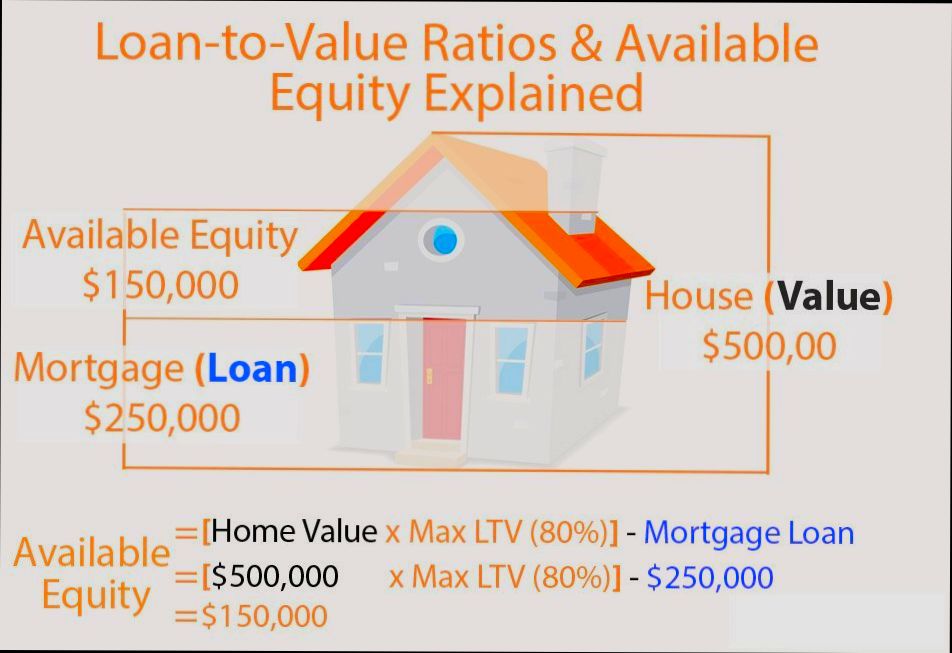

Calculating Your Equity: A Simple Formula

Figuring out how much equity you’ve built up in your home is pretty straightforward. All you need is a simple formula:

Home Equity = Current Market Value of Your Home - Outstanding Mortgage BalanceLet’s break it down:

- Current Market Value: This is how much your home is worth today. You can get a rough estimate by checking online real estate sites or getting a professional appraisal.

- Outstanding Mortgage Balance: This is the remaining amount you owe on your mortgage. You can find this in your monthly statement or by checking with your lender.

For instance, let’s say your home is currently valued at $350,000 and you still owe $200,000 on your mortgage. Here’s how it works:

Home Equity = $350,000 - $200,000 = $150,000Boom! You’ve got $150,000 in equity. Pretty sweet, right?

Now, let’s tackle a quick example to show how equity can change over time. If the market value of your home increases by 10% over a few years (because, let’s be honest, who doesn’t want a stronger market?), your home would now be worth:

$350,000 + ($350,000 * 0.10) = $385,000Now, your equity calculation looks like this:

Home Equity = $385,000 - $200,000 = $185,000Just like that, your equity jumped to $185,000!

According to recent stats, homeowners usually see their home value appreciate about 3-5% per year on average. So keeping tabs on your home’s market value is key—it not only lets you know how much equity you’ve accumulated but also helps you plan your finances better. Let’s be honest, that extra cash can be a game changer for making renovations, paying off debt, or funding education!

Potential Risks of Cashing Out Home Equity

So, you’ve got some equity built up in your home and you’re thinking about cashing it out—sounds like a solid plan, right? Not so fast! Before you jump in with both feet, let’s chat about some risks you might want to consider.

1. Increased Debt Burden

When you cash out home equity, you’re essentially taking on more debt. Just like that, your mortgage balance goes up. If you’re already stretching your budget, this could be a slippery slope. According to a recent study, homeowners who tapped into their equity often increased their mortgage balance by an average of 30-40%. That’s a big jump!

2. Risk of Foreclosure

If budgeting becomes tricky and you struggle to make those larger payments, you might face foreclosure. Yep, that’s a real risk. With the rising interest rates, homeowners could be even more vulnerable. A 2023 survey revealed that about 7% of homeowners who tapped into their home equity reported worrying about missing payments. Nobody wants to lose their home!

3. Market Fluctuations

The housing market can be a wild ride. If you cash out and the market takes a nosedive, you could end up owing more than your home is worth. Imagine pouring cash into a new car or vacation only to find your home’s value dropped by 10-15%. Ouch!

4. Constant Financial Pressure

Taking out a home equity loan or a line of credit can put constant pressure on your wallet. You might feel like you’re always chasing that payment, especially if unexpected expenses pop up. This could affect your quality of life, as you might have to cut back on vacations or fun outings just to stay afloat.

5. Fees and Closing Costs

Don’t forget about the fees! Cashing out home equity often comes with closing costs that can set you back a few thousand bucks. These costs can eat into the money you thought you were gaining. Be sure to read the fine print!

Before you decide to take the plunge, weigh these risks and consider if the benefits truly outweigh them. It might just save you a ton of stress down the line!

Maintaining Financial Health After Leveraging Home Equity

So, you’ve tapped into your home equity—awesome! But now, it’s all about keeping your finances in check. The last thing you want is to dig yourself into a deeper hole. Here are some real-world tips to help you handle that cash wisely.

Make a Budget and Stick to It

First things first: create a budget. You don’t need to overthink it—just jot down your income, expenses, and that beautiful new home equity cash that’s sitting pretty in your bank account. For instance, if you took out $50,000, how will you allocate this? Maybe 10% for home improvements, 20% for paying off debt, and the rest for emergencies or investments.

Emergency Fund is Key

Speaking of emergencies, did you know that 40% of Americans can’t cover a $400 unexpected expense? Yikes! Aim to save 3-6 months’ worth of living expenses. If your monthly costs are $3,000, that’s $9,000 to $18,000 put aside. This fund can save a ton of stress when life throws you a curveball.

Pay Down High-Interest Debt

Consider using some of your equity to tackle high-interest debts. Credit card debt can feel like a weight on your shoulders, with some rates soaring above 20%. If you take $10,000 from your equity to pay off a credit card, you’re effectively saving yourself hundreds—if not thousands—over time in interest payments. Trust me, your future self will thank you!

Invest Wisely

Why not put some of that cash to work? Investing can be a smart move, especially if you’re thinking long-term. Whether it’s in stocks, bonds, or even a small business, be sure to do your research. Historically, the S&P 500 has returned about 10% annually, so consider keeping your money growing rather than letting it sit idle.

Monitor Your Home’s Value

Your home’s value can fluctuate, so keep an eye on the market. If the value of your home drops, you could be at risk of owing more than it’s worth. Regularly check sites like Zillow or Redfin to gauge how things are going.

Know Your Limits

Finally, don’t overextend yourself. Just because you can borrow money, doesn’t mean you should. Aim for a loan-to-value (LTV) ratio below 80%. If your home is worth $300,000, that means you should limit your total debt (including the first mortgage) to no more than $240,000. Keep some cushion; it’s crucial for your peace of mind.

Remember, utilizing your equity can be a fantastic financial tool, but managing it wisely is key to maintaining your overall financial health. You’ve got this!

Tax Implications of Home Equity Withdrawals

So, you’ve decided to tap into your home’s equity. Great choice! But before you start spending that cash, let’s talk about the tax implications.

When you withdraw equity from your home, it’s important to understand that while you get this money, it’s not free money—at least, not totally. The interest you might pay on your home equity loan or home equity line of credit (HELOC) may be tax-deductible, but only if you use the funds for certain purposes.

According to the IRS, you can deduct interest on home equity debt if you use the money to “buy, build, or substantially improve” your home. For example, if you pull out $20,000 to renovate your kitchen, you could potentially deduct the interest. But if you use that same $20,000 for a vacation or to pay off credit card debt, unfortunately, that interest won’t qualify for a deduction.

Here’s a quick rundown:

- Home Equity Loans: If you’re using the money to improve your home, you can typically deduct the interest, provided your total mortgage debt (including first and second mortgages) stays below $750,000 (or $1 million if you got the loan before December 15, 2017).

- HELOCs: Same deal here—if you’re using the funds for important home improvements, you might snag that deduction!

- Personal Use: If you’re just pulling out cash for other expenses, don’t expect any tax breaks. That’s a bummer, right?

One more thing to consider: if your home appreciates a lot over the years and you sell it, you could be in for some capital gains taxes, especially if your profit crosses the IRS exclusion limits of $250,000 for single filers or $500,000 for married couples filing jointly. Make sure to have a plan, or talk to a tax pro!

Overall, wise withdrawals from your home will not only put cash in your pocket but could also lead to some really awesome tax perks if done right. So keep your future plans in mind, and maybe stash a few bucks for the tax man!

Common Myths About Home Equity Explained

Okay, let’s clear the air on some popular misconceptions about home equity. Trust me, you’ll want to keep these in mind before diving into the equity game.

Myth 1: You Can Only Access Equity When You Sell Your Home

False! You don’t have to cash out by selling your place. You can tap into your home equity through methods like a home equity loan or a cash-out refinance. This means you can access that money while still living in your cozy abode. For example, if your home is worth $300,000 and you have $200,000 left on your mortgage, you can potentially access $100,000 in equity for things like home improvements, debt consolidation, or even a vacation!

Myth 2: Taking Out Equity Puts You at Risk of Losing Your Home

Here’s the thing: as long as you can manage your payments, you’re in the clear! Taking out equity isn’t inherently risky, but mismanaging it can be. According to a 2021 report, nearly 63% of homeowners feel uneasy about this. The key is to only borrow what you can afford to repay and use that equity wisely.

Myth 3: Home Equity Loans Are All the Same

Not even close. There are different types of home equity loans and lines of credit (HELOCs). A home equity loan gives you a lump sum with a fixed interest rate, while a HELOC works more like a credit card with a variable rate. If you’re planning to buy new furniture with a loan, a HELOC might give you the flexibility you need—drawing from your equity as you go instead of grabbing a lump sum all at once. Choose what fits your needs!

Myth 4: You Need a Perfect Credit Score

This one is a bit misleading. While good credit can help you secure better rates, it’s not the end of the world if you don’t have a top-notch score. Many lenders will consider other factors, such as your income and debt-to-income ratio. So, if you’re just slightly below the magic number, don’t stress too much.

Myth 5: Using Home Equity Means Losing Your Tax Benefits

Not necessarily! Tax benefits aren’t gone; they just depend on how you use the money. If you use a home equity loan to make home improvements, you may still qualify for deductions on the interest. But consult a tax professional before making assumptions—tax laws can be a real maze.

So there you have it! Busting these myths can help you navigate the home equity landscape a whole lot easier. Remember, knowledge is power when it comes to making the most of your home’s value.

Frequently Asked Questions About Home Equity

1. What exactly is home equity?

Home equity is basically the part of your home that you actually own. It’s calculated by taking your home’s current market value and subtracting any outstanding mortgage or loans. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, your equity is $100,000. Simple, right?

2. Why should I consider tapping into my home equity?

Using your home equity can help you fund big projects like home renovations, pay for college tuition, or even consolidate high-interest debt. Did you know that nearly 50% of homeowners tap into their home equity for renovations? It can be a smart way to enhance your living space while potentially increasing your home’s value.

3. What are my options for accessing home equity?

You’ve got a few options: a Home Equity Loan, a Home Equity Line of Credit (HELOC), or a Cash-Out Refinance. With a Home Equity Loan, you get a lump sum at a fixed interest rate. A HELOC works more like a credit card — you can borrow as needed and only pay interest on what you use. A Cash-Out Refinance means refinancing your existing mortgage for more than you owe, taking the difference in cash.

4. Are there any risks involved?

Absolutely, there are risks! If you can’t keep up with payments, you could lose your home. That’s why it’s crucial to borrow only what you can comfortably pay back. Remember, a study shows that nearly 20% of HELOC borrowers can’t make their payments on time. Yikes!

5. How much equity can I actually tap into?

Most lenders allow homeowners to borrow up to 80% of their home’s equity. So if your equity is $100,000, you might be able to access up to $80,000. But keep in mind, the more you take out, the more at risk you are if property values drop!

6. How do I know if tapping into my home equity is a good idea?

It really depends on your financial situation and goals. Consider if the funds will really benefit you, like investing in home improvements that will increase your home’s value or paying off expensive debt. Before you dive in, it’s wise to talk to a financial advisor to see if it fits your plans.

Resources for Homeowners: Tools and Calculators

Want to take equity out of your home but feeling a bit overwhelmed? No worries! There are plenty of handy tools and calculators out there to help you figure things out. Let’s break down some of the best resources you can use.

1. Home Equity Loan Calculators

These calculators let you input your home’s value, current mortgage balance, and the rate you can get. You’ll see how much cash you can snag. For instance, if your home is worth $300,000 and you owe $200,000, many lenders will let you borrow up to 80% of your equity — that’s $80,000 in this case! Just search for “home equity loan calculator” and find one that suits you.

2. HELOC Calculators

If you’re thinking of a Home Equity Line of Credit (HELOC), these calculators are great too. They help determine what your monthly payments might look like based on interest rates. Remember, your payments will vary, so it’s good to see estimates. You might find an online tool that shows you how much you can draw and what the resulting payments will be based on current interest rates.

3. Amortization Schedulers

After getting your loan or HELOC, you might want to know how long it’ll take to pay it off. Amortization schedulers can give you a clear picture of your monthly payments and interest over time. This is super handy for budgeting! A simple Google search for “amortization calculator” will lead you to several options.

4. Mortgage Rate Comparison Sites

Before signing anything, do a little digging to find the best rates. Sites like Bankrate or NerdWallet can show you different mortgage and HELOC rates side-by-side. According to a recent study, homeowners can save an average of $3,500 just by shopping around for better rates. So, don’t skip over this step!

5. Equity Management Tools

If you’re the tech-savvy type, consider using apps designed to help you track your home’s value and equity growth. They typically send you alerts about market changes that can impact your property’s worth. Keeping an eye on these changes can help you decide the best time to access your equity.

With these resources at your fingertips, taking equity out of your home doesn’t have to turn into a complicated headache. Dive into those calculators, do some comparisons, and make informed decisions to get the most out of your home’s value!