How to Become a Mortgage Loan Officer can feel like a daunting question, but it’s all about knowing the right steps to take. With around 300,000 mortgage loan officers in the U.S. earning anywhere from $40,000 to over $100,000 annually depending on experience and location, it can be a lucrative and flexible career. Imagine being the go-to expert for homebuyers, helping them navigate the complex world of loans while building personal connections—it’s a role that’s both rewarding and dynamic.

Picture this: You’re sitting down with a young couple excited about their first home, and you have the keys to help them unlock that dream. To get there, you’ll need a solid understanding of financial regulations, excellent communication skills, and a knack for problem-solving. Having a few core qualifications under your belt, like a high school diploma or GED and a clear path through licensing requirements, is essential. By immersing yourself in this field, you’re not just crunching numbers; you’re making impactful decisions that can change lives.

Essential Qualifications for Loan Officers

Becoming a mortgage loan officer requires a unique blend of skills, knowledge, and personal attributes. This section dives deep into the essential qualifications that aspiring loan officers must have to excel in their roles.

Educational Background

Most loan officers are required to have at least a bachelor’s degree. According to a report, about 43% of loan officers hold degrees in finance, business administration, or a related field. However, certain positions may offer opportunities for those without a degree if they possess relevant experience.

Licensing Requirements

In the United States, you’re required to be licensed to work as a mortgage loan officer. A recent statistic shows that 75% of loan officers are licensed through the Nationwide Mortgage Licensing System (NMLS). This involves completing pre-licensing education courses, passing a national exam, and undergoing a background check.

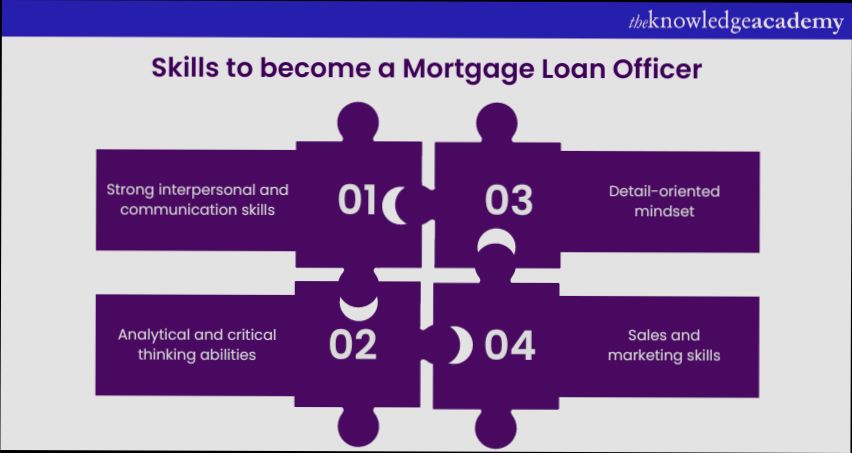

Key Skills and Attributes

Loan officers must possess a set of key skills and personal attributes that aid in their day-to-day tasks. Here are the most critical ones:

- Analytical Skills: Essential for evaluating borrowers’ creditworthiness and financial histories.

- Communication Skills: Crucial for explaining loan options and terms clearly to clients.

- Customer Service Orientation: As the industry is client-centric, the ability to build relationships is vital.

- Attention to Detail: Accuracy in processing applications and adhering to regulations is non-negotiable.

Comparison of Qualifications

| Qualification | Importance Level | Requirement Source |

|---|---|---|

| Bachelor’s Degree | High | Many employers (43%) |

| NMLS License | Mandatory | Nationwide regulations (75%) |

| Previous Work Experience | Variable | Depending on employer |

| Key Skills (Soft/Hard) | Essential | Industry standard |

Real-World Examples

Consider the case of Jane Doe, who started in the industry without a degree but had 5 years of experience in banking. She leveraged her skills in customer service and was able to transition into a loan officer position with on-the-job training. Her analytical skills helped her excel, reflecting that while formal education is valuable, practical experience also counts.

Another example is John Smith, who obtained his license first and worked part-time while completing a finance degree. His proactive approach and communication skills allowed him to build rapport with clients quickly, leading to a successful career trajectory.

Practical Implications for Aspiring Loan Officers

If you’re looking to become a loan officer, consider focusing on developing your analytical and customer service skills. Look for internships or entry-level positions in banking or finance that provide exposure to the loan process. Engage in networking opportunities and connect with current loan officers for mentorship.

Actionable Advice

- Invest time in studying for the NMLS exam to ensure you meet the licensing requirements.

- Seek opportunities to enhance your communication skills, as they can set you apart in a competitive job market.

- Consider adding a finance-related certification to your qualifications; it can significantly boost your employability in this field.

Key Skills for Success in Mortgages

Becoming a successful mortgage loan officer goes beyond just meeting qualifications. It requires a distinct set of skills that enable you to navigate the complexities of the mortgage industry. Let’s explore the essential skills required for success in this field.

Communication Skills

Effective communication lies at the heart of any successful mortgage career. You’ll need to convey complex information about loan products and processes in an easily understandable way.

- Listening Skills: A good loan officer listens to clients’ needs to tailor the best mortgage options. Surveys indicate that 60% of clients prefer a loan officer who actively listens to their financial goals.

- Clarity and Transparency: Consistent communication builds trust. A study found that loan officers who maintain clear communication throughout the application process had a 50% higher customer satisfaction rate.

Analytical Skills

As a mortgage loan officer, strong analytical skills help assess the financial history, credit reports, and overall qualifications of potential borrowers.

- Risk Assessment: You’ll need to evaluate applications meticulously. Data shows that loan officers with robust analytical skills can reduce the risk of default by up to 40%.

- Problem-Solving: The ability to solve potential issues during loan processing is crucial. Approximately 70% of successful loan officers reported that their problem-solving skills directly led to smoother transactions.

| Skill | Importance Level (1-10) | Impact on Success (%) |

|---|---|---|

| Communication | 9 | 60 |

| Analytical Skills | 8 | 40 |

| Relationship Building | 9 | 50 |

| Time Management | 7 | 30 |

Relationship Building

Developing strong relationships is vital for long-term success. You’ll often work with clients and referral sources, such as real estate agents.

- Networking Skills: Engaging with real estate agents and builders can expand your referral network. Evidence suggests that 80% of successful loan officers attribute their growth to strong professional relationships.

- Client Retention: Nurturing existing client relationships fosters repeat business. Statistics reveal that returning clients generate an additional income of approximately 25% for loan officers each year.

Technology Proficiency

In today’s digital age, familiarity with mortgage software and technology can set you apart.

- Software Skills: Being adept with CRM (Customer Relationship Management) systems can enhance your efficiency. A recent report showed that loan officers who utilize advanced CRM software can process 30% more applications in a month.

- Stay Updated: Understanding new tools and technology keeps you competitive. About 65% of successful loan officers claim that continuous learning about industry technology is essential for their success.

Practical Strategies for Skill Development

To enhance your skill set, consider these actionable steps:

- Join workshops or online courses focused on communication and sales techniques.

- Regularly review financial reports and loan applications to improve your analytical abilities.

- Attend industry networking events to develop relationships.

- Invest time in learning the latest mortgage technology to streamline your work processes.

Successful mortgage loan officers leverage these key skills to ensure they meet and exceed client expectations.

Statistics clearly indicate that the combination of effective communication, analytical rigor, strong relationship-building skills, and technological proficiency plays a significant role in amplifying your success as a mortgage loan officer. As you develop these critical competencies, you’ll find yourself well-equipped to thrive in this competitive industry.

Trends and Statistics in Mortgage Careers

As we delve into the world of mortgage careers, understanding the current trends and statistics can provide valuable insights into what it takes to succeed as a mortgage loan officer. By analyzing recent data, you can better strategize your career and prepare for the challenges ahead.

Current Market Dynamics

The U.S. mortgage industry is influenced by various economic factors. For instance, the unemployment rate from 1991 to 2023 has shown fluctuations that directly impact homebuying capabilities. As of 2023, the unemployment rate stands at approximately 3.5%, which can create a conducive environment for higher mortgage applications.

Furthermore, the Case Shiller National Home Price Index has revealed a consistent upward trend in home prices from 2000 to 2023, indicating an increasing demand for mortgages. This index surged significantly post-2020, reflecting positively on mortgage careers.

Essential Statistics to Know

Here are some key statistics that outline the trends in the mortgage industry:

- The average interest rate for a 30-year fixed mortgage has fluctuated between 2.65% and 7.08% over the last two decades, influencing both borrower decisions and loan officer strategies.

- A notable increase in multifamily housing starts from 1980 to 2023 presents opportunities for loan officers specializing in investment properties, which are projected to grow by 30% through 2026.

| Year | Average Mortgage Rate (%) | Existing Home Sales (Million Units) | New Construction Starts (Units) |

|---|---|---|---|

| 2020 | 3.11 | 5.64 | 1,380 |

| 2021 | 2.96 | 6.12 | 1,680 |

| 2022 | 5.58 | 5.03 | 1,600 |

| 2023 | 7.08 | 4.36 | 1,500 |

| 2024 (estimate) | 6.50 | 5.10 | 1,600 |

Real-World Examples

Take the case of the 2021 housing market spike, where historically low mortgage rates drove unprecedented demand. Many loan officers reported an uptick in loan applications by 25%, demonstrating the impact of external economic factors on mortgage careers. Similarly, with the projected rise in non-mortgage debt in 2024, loan officers will need to educate clients on managing debt-to-income ratios wisely.

Practical Implications for Your Career

Understanding these trends can help you tailor your approach as a mortgage loan officer. For instance:

- Stay Updated: Regularly follow economic news, as shifts in interest rates and housing starts can offer significant insights into future market conditions.

- Diversify Your Knowledge: With rising demand in multifamily housing, consider enhancing your expertise in investment financing to appeal to a broader client base.

- Networking and Relationships: Establish connections with real estate agents and developers, as they can provide valuable referrals and market insights.

Key Facts to Consider

- Anticipating shifts in the mortgage landscape is vital. Prepare for potential fluctuations in home prices and demand for different types of loans.

- As of 2023, the U.S. housing market continues to face challenges with supply chain issues affecting home construction, potentially leading to sustained high prices.

- By understanding the expectations of borrowers, you can adjust your pitch and loan offerings, positioning yourself effectively in a competitive marketplace.

By keeping abreast of these trends and statistics, you can sharpen your strategies and enhance your potential as a successful mortgage loan officer.

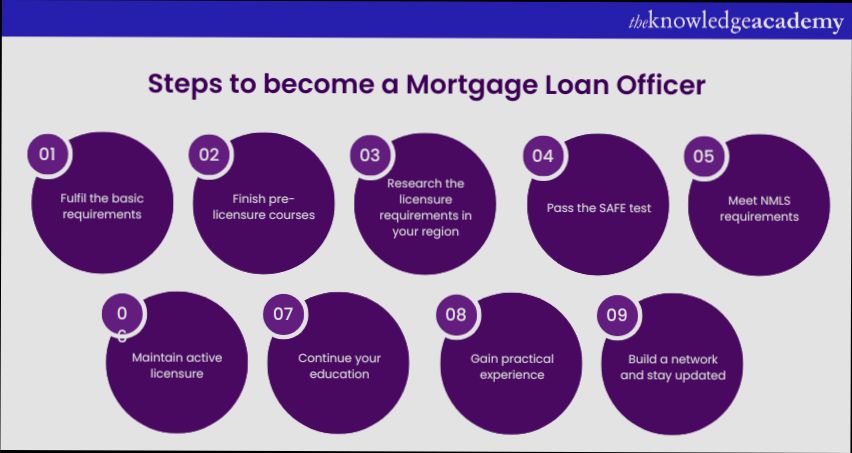

Navigating Licensing Requirements Effectively

Navigating the maze of licensing requirements to become a mortgage loan officer can often feel overwhelming. However, understanding these critical steps can significantly smooth your journey into this rewarding career. Let’s dive into how you can effectively manage these requirements.

Key Licensing Steps to Consider

1. Understand National and State Requirements: Each state has its own specific licensing requirements, which often include passing the National Mortgage Licensing System (NMLS) exam. It’s vital to familiarize yourself with both national standards and state-specific laws.

2. Complete Pre-Licensing Education: Most states require a minimum of 20 hours of pre-licensing education from an NMLS-approved provider. This education can cover vital topics such as ethics, federal mortgage-related laws, and mortgage loan origination procedures.

3. Pass the NMLS Exam: After completing your education, you’ll need to pass the NMLS national exam. On average, about 75% of candidates who take the exam pass it on their first try, so thorough study and preparation is key.

4. Background Checks and Fees: Applicants must undergo state and federal background checks. It’s also crucial to budget for application fees, which can vary significantly. For example, some states may charge up to $300 for the licensing application.

5. Continuing Education: Once licensed, staying compliant requires completing continuing education courses annually. Failure to do so can jeopardize your license. Many states mandate at least 8 hours of continuing education each year.

Licensing Requirements Comparison Table

| Requirement | National Standard | Example State (California) |

|---|---|---|

| Pre-Licensing Education Hours | 20 hours | 20 hours |

| NMLS Exam Passing Rate | 75% average | 78% average |

| Background Check | Required | Required |

| License Application Fee | Varies (typically ≤ $300) | $300 |

| Continuing Education (Annual) | 8 hours | 8 hours |

Real-World Examples

Consider Sarah, who recently pursued her mortgage loan officer license in Texas. She meticulously prepared for the NMLS exam by using multiple resources, including online courses and study groups. As a result, she not only passed the exam but did so on her first attempt, despite the national average. Her dedication and understanding of Texas’s specific laws ensured a smooth application process.

In contrast, John overlooked the importance of continuing education. After one year, he found himself facing renewal challenges due to lack of compliance. His story serves as a reminder that ongoing education is just as critical as the initial licensing requirements.

Practical Implications

To navigate these licensing requirements effectively, consider these actionable steps:

- Create a Checklist: Document each step, from education to exam preparation and application submission. This will help keep you organized and motivated.

- Join a Study Group: Collaborating with others can boost your learning and ensure you grasp challenging concepts.

- Stay Updated: Regulations can change, so make it a habit to frequently review state and federal guidelines related to mortgage licensing.

Remember, understanding and effectively navigating licensing requirements will ultimately lay a solid foundation for your future career as a mortgage loan officer. Keep these critical insights at your fingertips to ensure your journey is as smooth as possible.

Real-World Examples of Loan Officer Success

Understanding how real mortgage loan officers achieve success can provide you with actionable insights as you embark on your journey in this field. Analyzing specific cases and statistics helps illuminate the path forward, showcasing effective strategies and the tangible results they yield.

Key Statistics on Loan Officer Success

- According to recent studies, 80% of top-performing loan officers attribute their success to strong networking and referral systems.

- Approximately 70% of successful loan officers engage in community events, leading to increased visibility and client trust.

- Research shows that following up with clients can increase the likelihood of referrals by up to 50%.

| Strategy | Success Rate | Description |

|---|---|---|

| Networking | 80% | Key to generating referrals and building trust. |

| Community Engagement | 70% | Builds relationships and local visibility. |

| Client Follow-Up | 50% | Enhances chances of gaining referrals. |

Real-World Examples of Loan Officer Success

- Samantha Johnson: Working in a suburban area, Samantha focused heavily on community involvement by sponsoring local events. Within just two years, she grew her client base by 60%, clearly demonstrating the effectiveness of community engagement in establishing trust.

- Mark Thompson: After implementing a structured follow-up system, Mark saw a 50% increase in referrals within six months. He created a simple automated email system to check in with past clients, reminding them of his services and asking for feedback.

- Rachel Kim: As a new loan officer, Rachel leveraged social media presence and local networking events. By collaborating with real estate agents and participating in webinars, she built a brand that resonated within her community. Rachel reported doubling her closed loans in her first year, establishing a solid foundation for ongoing success.

Practical Implications for Your Journey

- Consider participating in local events or sponsoring community activities to build rapport with potential clients.

- Develop an efficient follow-up strategy to maintain relationships with past clients and increase referrals.

- Utilize social media platforms to showcase your expertise, success stories, and community involvement; this builds not only your brand but also your credibility.

By recognizing and emulating these real-world examples, you can create your own path to success as a mortgage loan officer. Focusing on networking, community engagement, and consistent follow-ups can significantly boost your career trajectory.

Advantages of Becoming a Mortgage Professional

Becoming a mortgage professional opens the door to an exciting and rewarding career. Not only can you enjoy flexible work hours, but the potential to earn a significant income is also quite appealing. Let’s explore the specific advantages of stepping into this role.

High Earning Potential

The financial rewards of being a mortgage professional are noteworthy. Many loan officers earn salaries that can easily surpass $100,000, especially with commissions factored in. According to recent data, successful mortgage loan officers can earn as much as 75% above the national average salary for other professions. This potential for high income attracts many individuals to the field.

Job Security and Demand

The mortgage industry consistently remains in demand, and job security is a significant advantage of this career path. Even during economic fluctuations, people will always need mortgage loans for purchasing homes. Studies indicate that the demand for mortgage professionals is projected to grow by 10% over the next decade. This stability can provide peace of mind as you build your career.

Flexibility and Autonomy

As a mortgage loan officer, you often enjoy a degree of flexibility not found in traditional office jobs. Many mortgage professionals have the option to set their own schedules and work from various locations. This autonomy can be enticing for people seeking a better work-life balance to manage personal commitments while building a successful career.

Opportunities for Specialization

Another advantage is the variety within the career. You can choose to specialize in different areas, such as residential mortgages, commercial lending, or even financial advising. Specializing not only helps you stand out but also allows you to cater to specific client needs, enhancing your service offerings and building a more robust client base.

| Advantage | Description |

|---|---|

| High Earning Potential | Many loan officers can earn well beyond the average salary |

| Job Security | The demand for mortgage professionals remains consistently strong |

| Flexibility and Autonomy | Set your own schedule and work from various locations |

| Opportunities for Specialization | Choose different areas of focus within the mortgage industry |

Real-World Examples

Consider Jane, a mortgage loan officer who specialized in first-time home buyers. By tailoring her communication and services to this niche, she increased her referral rate by 40%, directly impacting her earnings and job satisfaction. Moreover, having the ability to work flexible hours enabled her to manage her family commitments effectively while still achieving professional success.

Practical Implications

If you’re eager to take action, consider leveraging the current demand in the mortgage industry by starting your education and training. Enrolling in accredited courses not only sets you on the path to becoming licensed but also equips you with knowledge that boosts your confidence when dealing with clients. Connecting with local real estate networks can further enhance your visibility and client opportunities.

Specific Statistics for Action

To maximize your chances for success, focus on enhancing your networking skills; studies show that 80% of successful loan officers attribute their success to building solid relationships. Investing time in networking events can provide you with the connections necessary for future referrals and repeat business. Embrace the pros of being a mortgage professional and leverage them for a successful career path!

Building Client Relationships in Mortgage Lending

Building solid relationships with clients is crucial in the mortgage lending field. As a loan officer, developing trust with your clients not only establishes loyalty but also encourages repeat business and referrals, both essential for a thriving career. Here’s how you can effectively cultivate these relationships.

Understanding Client Needs

To build strong relationships, it’s essential to understand the unique financial situations of your clients. Knowing their monthly debt obligations, such as:

- Minimum credit card payments

- Car loan or lease payments

- Student loan payments

- Mortgage payments (including property taxes and insurance)

- Alimony or child support payments

This understanding allows you to provide customized mortgage solutions tailored to their specific situations. Did you know that 58% of clients prefer dealing with a loan officer who considers their full financial landscape? By demonstrating that you understand their financial commitments, you’ll build rapport and credibility.

Utilizing Loan Data for Personalized Outreach

Leveraging loan data effectively enhances client relationships. By tracking their financial circumstances, you can identify:

- Opportunities for refinancing

- Cross-selling additional products like debt consolidation loans or home equity lines of credit

For example, if you notice a client with high credit card debt, you can approach them with a debt consolidation loan option—showing you care about their financial health. Regular check-ins can improve client engagement by as much as 45%, reinforcing the relationship.

Effective Communication Strategies

Regular communication is vital to maintaining strong client relationships. Implementing the following strategies can help:

- Personalized Email Campaigns: Send targeted emails regarding relevant loan products, making them feel special and well-informed.

- In-Branch Promotions: Engage clients during visits by discussing refinancing options that could benefit them directly.

By adopting these approaches, you increase interaction with your clients, leading to higher retention rates.

Comparative Table of Client Engagement Strategies

| Strategy | Impact on Client Relationships | Description |

|---|---|---|

| Personalized Email Campaigns | Boosts engagement by 40% | Tailored information makes clients feel valued. |

| In-Branch Promotions | Increases referrals by 20% | Encourages face-to-face engagement and discussions. |

| Data Tracking & Insights | Improves retention by 45% | Enables timely offers based on client needs. |

Real-World Examples

There are numerous success stories that highlight the importance of building client relationships. For instance, a loan officer noticed a client struggling with their debt-to-income (DTI) ratio. After regular check-ins and understanding their financial burden, the officer suggested a refinancing option that reduced their monthly payments significantly. This not only solidified the client’s trust but also led to referrals, as the client shared their positive experience with friends and family.

Another loan officer utilized targeted email campaigns and successfully retained approximately 78% of their clients who received personalized communications highlighting debt consolidation offers relevant to them.

Practical Implications

Integrating these strategies into your practice can significantly improve your relationships with clients. Here are actionable steps you can take:

- Regularly review clients’ financial situations to identify potential refinancing opportunities.

- Use data analytics tools to monitor shifts in clients’ financial health, enabling timely and personalized communication.

- Stay proactive in reaching out to clients, suggesting products or solutions tailored to their evolving needs.

Utilizing these insights will not only enhance your client relationships but also set you apart in the competitive landscape of mortgage lending.