How Much Time After Selling a House Do You Have to Buy a House to Avoid the Tax Penalty? If you’ve just sold your home, you’re probably wondering how to keep your hard-earned cash in your pocket instead of handing it over to Uncle Sam. The IRS provides some wiggle room with its capital gains tax exemption, but you need to know the timeline. For single filers, you can exclude up to $250,000 in gains from your taxable income if you meet certain criteria, while married couples can bump that up to a whopping $500,000. But here’s the catch: if you’re not careful about how you reinvest those funds, you could lose out on this tax perk.

Let’s say you sold your house for $600,000 after buying it for $350,000. On paper, you’ve made a $250,000 profit—great! But if you don’t buy another home within two years, the IRS could tax that profit unless you qualify for the exemption. Real-world examples show that many homeowners mistakenly assume they have plenty of time. The truth is, you’ve got 180 days from the sale to roll those profits into a new home for the best chance at avoiding a tax hit. Understanding these timelines can save you thousands, so keeping track is crucial!

Understanding the 1031 Exchange Timeline

Navigating the 1031 exchange timeline is crucial for any real estate investor looking to defer capital gains taxes. The process involves distinct deadlines that, if missed, can lead to significant tax implications. Here’s a deep dive into understanding these vital timelines.

Key Deadlines in the 1031 Exchange

When you embark on a 1031 exchange, two critical timeframes to remember are the:

1. 45-Day Identification Period: After selling your relinquished property, you have 45 days to identify potential replacement properties.

2. 180-Day Exchange Period: You must close on the new property within 180 days of selling the original property.

Failure to meet either of these deadlines can result in losing the tax deferral benefits of the exchange.

Comparative Timeline Table

| Action | Deadline |

|---|---|

| Sell Relinquished Property | Day 0 (start) |

| Identify Replacement Properties | Day 45 |

| Complete Purchase of Replacement | Day 180 |

This table delineates the crucial phases in the 1031 exchange timeline, emphasizing the importance of strict adherence to these deadlines.

Real-World Example of the 1031 Exchange Timeline

Consider the case of Sarah, who sold her rental property on January 1, 2025. Here’s how her timeline unfolds:

- January 1, 2025: Sale of relinquished property occurs. This marks Day 0.

- January 15, 2025: Sarah identifies three potential replacement properties, keeping in mind that their total value must not exceed 200% of her sold property’s value.

- February 15, 2025: Sarah exercises her option on one of the identified properties and finalizes the purchase by June 30, 2025, adhering to the 180-day rule.

By following this timeline, Sarah successfully deferred her capital gains taxes.

Practical Implications of the Timeline

Understanding the 1031 exchange timeline is not just about following deadlines; it has deeper implications for your tax strategy and investment planning. Here are some considerations:

- Engagement with a Qualified Intermediary: To ensure smooth transactions, working with a qualified intermediary is essential as they facilitate the process and hold your funds.

- Consistency in Property Ownership Structure: It’s important to maintain the same title holder for both the relinquished and replacement properties. This consistency is key to qualifying for a 1031 exchange.

- Liquidity and Market Conditions: Analyze your liquidity needs and current market conditions, as these can affect which properties you’ll consider and whether you can complete the exchange within the specified timelines.

Actionable Advice for a Successful 1031 Exchange Timeline

Make sure to:

- Stay Organized: Create a clear calendar marking all important dates related to your 1031 exchange.

- Consult Professionals: Engage tax professionals early, as they can help you navigate any potential pitfalls.

- Use Digital Tools: Consider software solutions or apps designed to track deadlines associated with your 1031 exchange, ensuring you never miss a critical date.

By staying informed and proactive, you can maximize the benefits of the 1031 exchange and ensure a successful transition between properties.

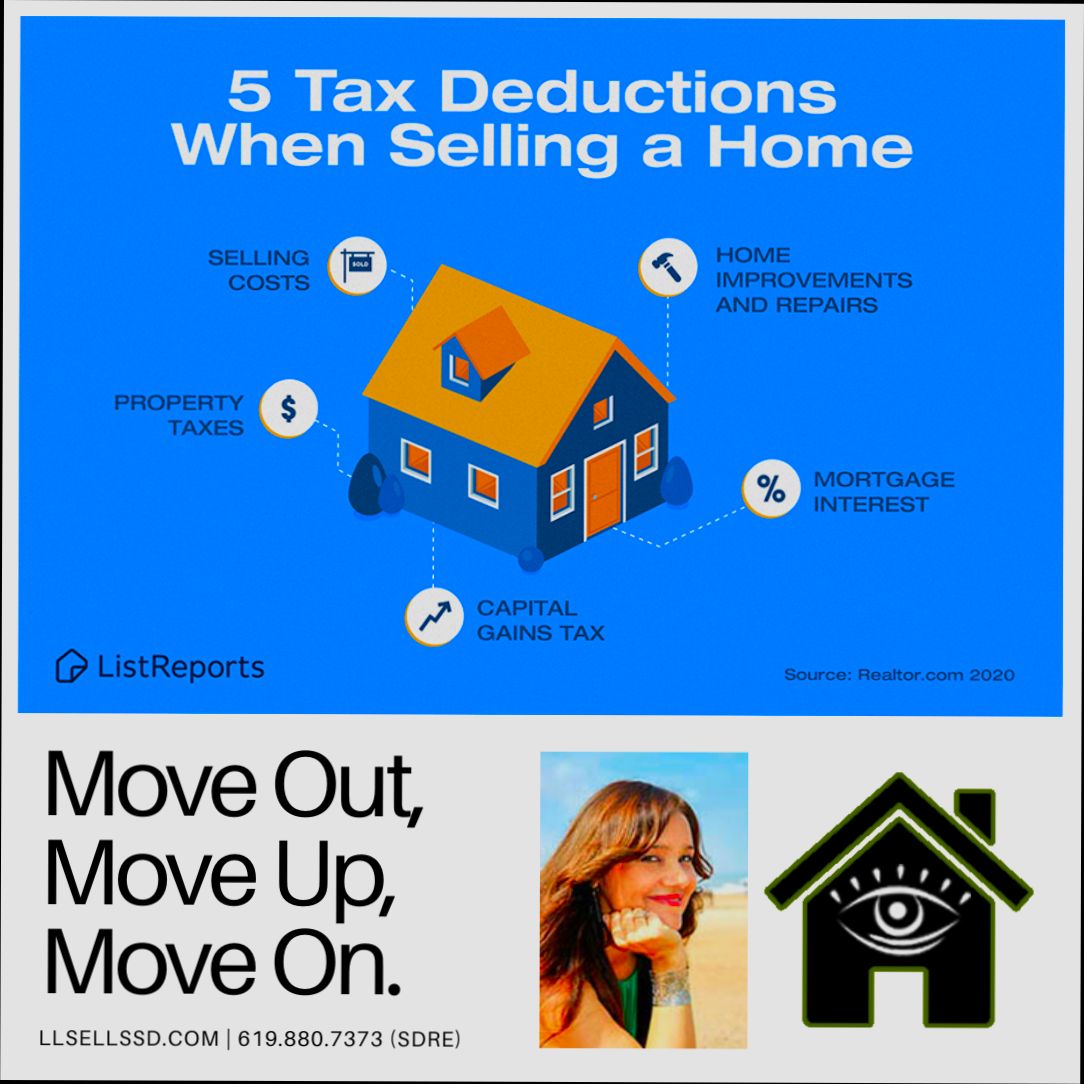

Exploring Capital Gains Tax Implications

Understanding capital gains tax implications when you sell your home is essential for making informed financial decisions. Whether you’re selling your primary residence or an investment property, the tax consequences can significantly impact your net proceeds.

When you sell a home, the profit from the sale may be subject to capital gains tax, which varies depending on factors like your income level and how long you’ve owned the property. Here, we’ll delve into key aspects that influence how capital gains tax works and its implications for homeowners.

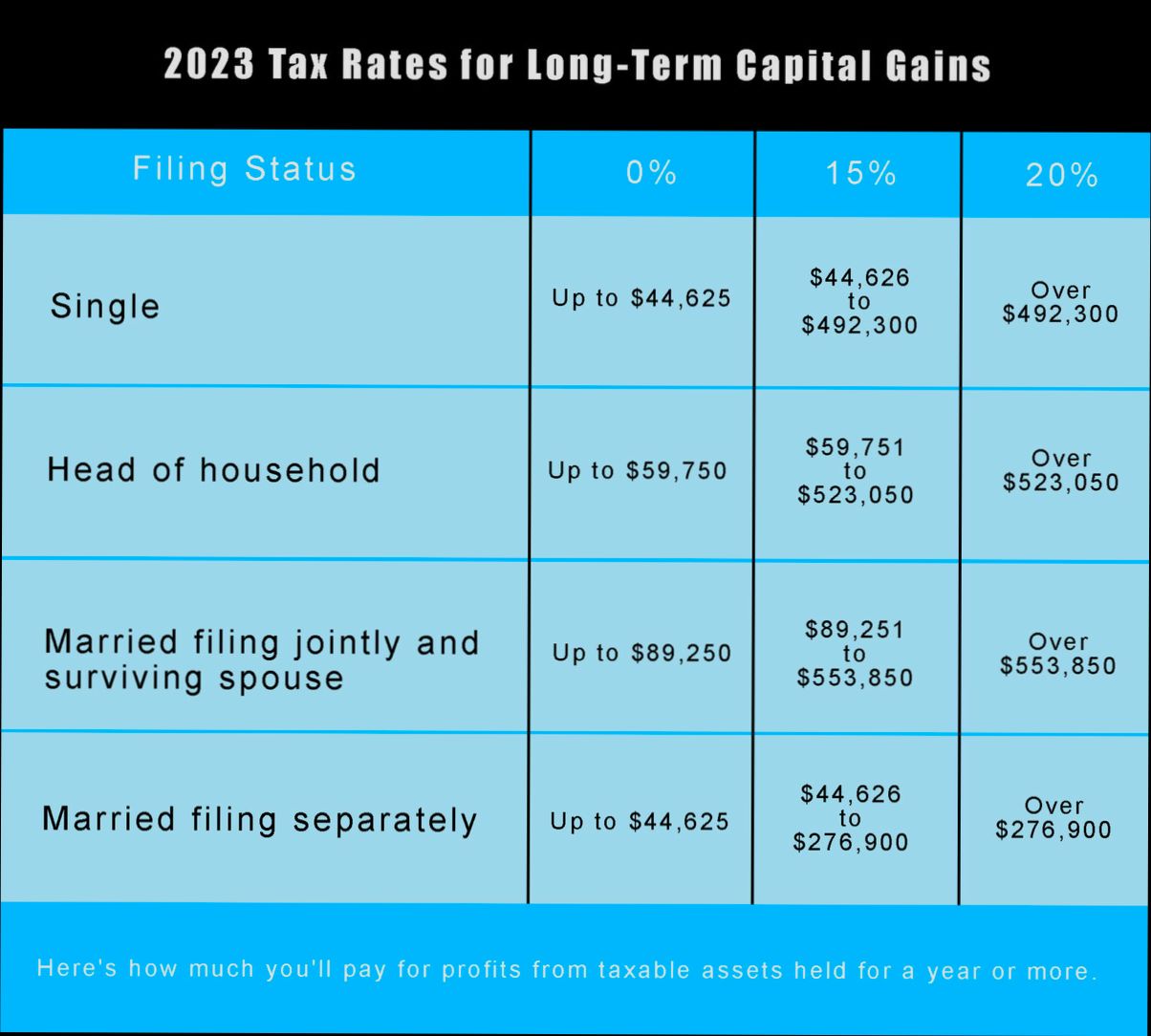

Key Tax Rates and Implications

- Short-term Capital Gains: If you sell the property within a year of ownership, you’re looking at short-term capital gains, which are taxed at your ordinary income tax rate. This could be as high as 37% for high-income earners.

- Long-term Capital Gains: For properties owned for more than a year, the more favorable long-term capital gains tax rates apply, ranging from 0% to 20%, depending on your taxable income. Approximately 37% of taxpayers can potentially benefit from these rates.

Capital Gains Exemption for Home Sales

For a primary residence, the IRS allows homeowners to exclude up to $250,000 of capital gains from taxable income, or $500,000 for married couples filing jointly. This means if you sell your home at a profit under these thresholds, you won’t owe any capital gains tax on that profit, making it crucial to be aware of your eligibility:

- Single homeowners can exclude gains up to $250,000.

- Married couples filing jointly can exclude gains up to $500,000.

Comparative Tax Tables

Here’s a summary of capital gains tax rates for different filing statuses:

| Tax Rate | 0% | 15% | 20% |

|---|---|---|---|

| Filing Status | Up to $47,025 | $47,026 to $518,900 | Over $518,900 |

| Single | |||

| Head of Household | Up to $63,000 | $63,001 to $551,350 | Over $551,350 |

| Married Filing Jointly | Up to $94,050 | $94,051 to $583,750 | Over $583,750 |

Real-World Examples

Consider a couple who sold their long-term primary residence for a profit of $600,000 after owning it for over two years. Because they are married and filing jointly, they can exclude $500,000 of that gain. This means they will only be taxed on the remaining $100,000, potentially at a lower long-term capital gains rate of 15%, saving thousands compared to higher rates.

In another scenario, an investor purchases a rental property, holding it for only eight months before selling it at a profit of $200,000. Since this sale is considered short-term, the investor’s gain will be taxed based on their ordinary income level, which could be as high as 37%. Understanding this difference can effectively influence the timing of your property sale.

Practical Implications

Being informed about capital gains tax implications allows you to strategically evaluate your property sale. Here are some actionable tips:

- Evaluate your holding period: Aim to hold your property for at least a year to qualify for lower, long-term capital gains tax rates.

- Maximize exclusions: If you are considering selling your primary residence, ensure you meet the ownership and use tests to qualify for the capital gains exclusion.

- Track purchase and improvement costs: Keep detailed records of your property’s purchase price and any major improvements, as these costs can adjust your basis, potentially lowering your taxable gain.

An awareness of capital gains and how they are taxed is crucial for making financially sound decisions related to real estate. Consider consulting a tax advisor to understand how these rules apply specifically to your situation, especially when planning your next property transaction.

Statistical Insights on Real Estate Transactions

Understanding statistical insights on real estate transactions can significantly inform your decisions and strategies, especially during transitions like selling and buying a home. With the market’s dynamics evolving, having a grasp of the relevant data enhances your buying and selling experience.

Key Statistics in Real Estate Transactions

- In 2023, approximately 34% of homebuyers entered the market as first-time buyers, highlighting a persistent trend of new entrants eager to build their equity.

- The total number of homes sold annually in the U.S. reached around 5.5 million. This figure showcases a robust market with ample opportunities for buyers and sellers alike.

- A noteworthy 97% of buyers initiate their home search online, indicating the immense influence digital platforms have in defining market strategies today.

- With 26% of homes selling above their asking price, competitive bidding wars have become commonplace, driven by demand and limited inventory.

- 48% of buyers express a strong preference for properties in walkable neighborhoods, showcasing the increasing emphasis on lifestyle and community accessibility in real estate decisions.

Comparative Table: Homebuyer Preferences and Market Trends

| Statistic | 2023 Value |

|---|---|

| Percentage of first-time buyers | 34% |

| Annual home sales | 5.5 million |

| Buyers starting their search online | 97% |

| Homes selling above asking price | 26% |

| Buyers preferring walkable neighborhoods | 48% |

Real-World Examples

Consider the case of a first-time buyer in a major U.S. city in 2023. With a significant portion of the market comprised of new entrants, this buyer navigates a landscape where 87% of successful transactions include the support of real estate agents. This helps them cope with the competitive nature, particularly where 26% of homes sell above asking price.

Another example involves a suburban buyer looking for homes near their workplace, reflecting the trend where 52% of homebuyers prioritize proximity to their jobs. This focus aids in making informed decisions that cater to lifestyle choices.

Practical Implications for Buyers and Sellers

For those selling a home, the trend of 97% of buyers starting online means having a solid digital marketing strategy is essential. It’s beneficial to invest in high-quality online listings and engage with potential buyers through social media platforms.

As a potential buyer, recognizing that 48% of people prioritize walkable neighborhoods can guide your property preferences. When searching, look for homes in areas that offer convenient access to amenities, enhancing both lifestyle quality and property value.

Specific Facts and Actionable Advice

- Stay updated on local market statistics as they can fluctuate and affect your transactions directly.

- Engage a real estate professional who understands the trends, especially in competitive markets where over-asking sales are frequent.

- Leverage technology by focusing your home search online to find the best-fit properties effectively.

- Consider neighborhood walkability and work proximity not just for convenience but as significant markers of property value appreciation.

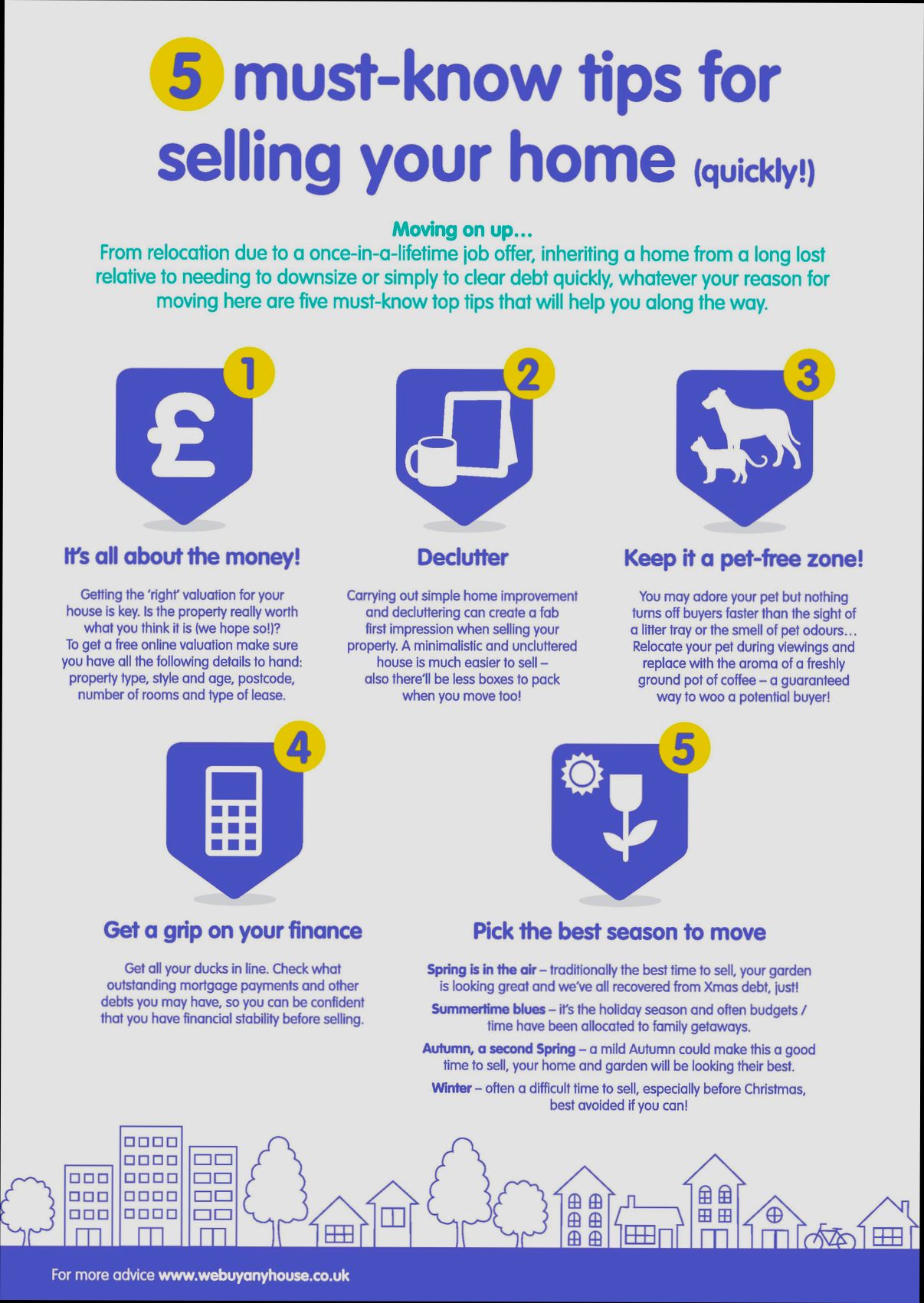

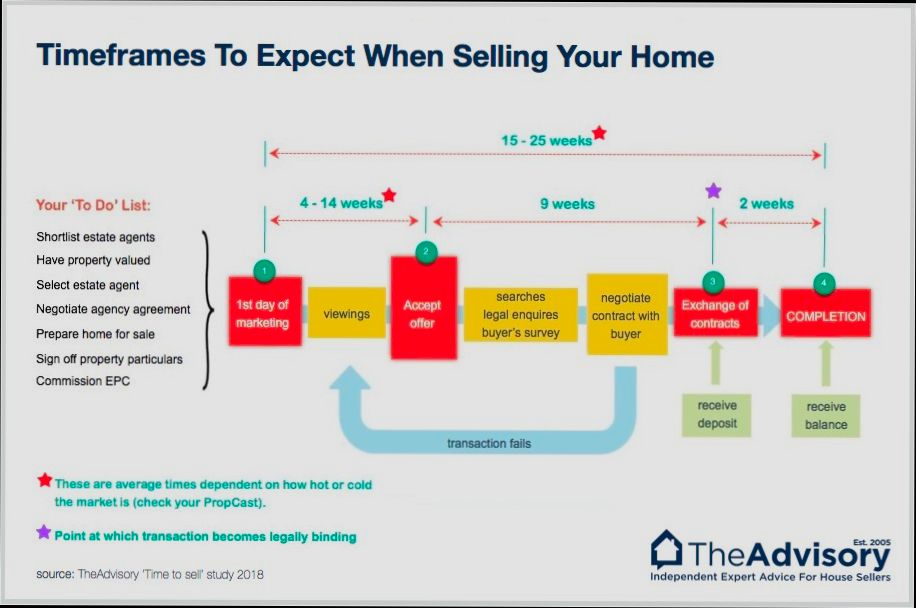

Practical Strategies for Smooth Transitions

When selling and buying a home, managing the transition smoothly is key. You not only want to maximize your financial advantage but also ensure that your move is stress-free. Here, I’ll share some practical strategies to help you navigate your transition effectively.

Timing Your Moves

Understanding the timing of your transactions can greatly ease the process. Here are a few strategies:

- Align Closing Dates: Coordinate the closing date on your sale with the purchase of your new home. This way, you minimize the time spent without a residence.

- Temporary Housing: If your sale closes before you find a new place, consider renting temporarily. It can alleviate pressure and give you breathing room.

Financial Preparation

Make sure your finances are organized ahead of both sales.

- Pre-Approval: Get pre-approved for a mortgage to streamline the buying process. In 2023, buyers with pre-approvals have a 15% higher chance of closing their deals quickly.

- Budget for Transition Expenses: Set aside funds for moving costs, utility setups, and potential renovation needs of your new home. A budget cushion of 10% of your sale proceeds is a good benchmark.

| Strategy | Benefit | Consideration |

|---|---|---|

| Align Closing Dates | Reduces stress with seamless transition | Ensure both parties agree |

| Temporary Housing | Flexible finding time for the new home | Additional monthly expense |

| Pre-Approval | Faster buying process | May require fee and paperwork |

| Budget for Expenses | Prevents financial strain | Adjust budget based on sale proceeds |

Real-World Examples

- Case Study: Recent Sellers: A couple sold their home in April and aligned their closing with a new home purchase in June. They avoided the hassle of temporary housing and moved straight into their new space.

- Alternate Strategy: Another family opted for a rental for three months post-sale, which granted them ample time to find their dream home without rushing.

Practical Implications

To enhance your transition, consider employing the following actionable strategies:

- Hire a Knowledgeable Real Estate Agent: A good agent can help you navigate timelines and negotiate on your behalf, often saving you thousands.

- Communicate Clearly: Keep all parties updated during the process—your agents, potential buyers, and sellers.

- Be Flexible: If your anticipated timeline shifts, staying adaptable can lessen stress.

Every move is unique, but with these strategies in mind, you can set yourself up for a successful transition, turn the often hectic experience into a well-managed process, and ultimately feel good about your sale and purchase decisions.

Financial Advantages of Timely House Purchases

When you sell a home, timing your next purchase can unlock significant financial benefits. Understanding these advantages can not only help you save money but also maximize your investment. Here, we’ll explore why acting quickly in the housing market can be a smart financial decision.

Key Financial Benefits of Timely Purchases

1. Interest Rate Lock Benefits:

- With mortgage interest rates fluctuating, buying your next home promptly can enable you to lock in a lower rate before potential increases. For instance, a 1% increase in interest rates can elevate your monthly mortgage payment by approximately $150 for a typical loan, resulting in thousands in additional costs over the life of the loan.

2. Market Appreciation:

- The real estate market is dynamic, with home values generally appreciating over time. Purchasing within a timely manner can allow you to benefit from the appreciation that occurs during your transition. For example, homes in urban areas have seen appreciation rates of about 5-6% per year. By waiting to buy, you might miss out on this potential increase.

3. Investment Growth:

- By purchasing quickly, you can significantly bolster your real estate portfolio. Leveraging your current equity enables you to acquire properties that can produce rental income or serve as long-term investments. Studies show that homeowners traditionally see their wealth grow over 40 times greater than renters over a 30-year period.

4. Tax Benefits from Homeownership:

- Timely purchases can also provide immediate tax advantages, such as the mortgage interest deduction. This can potentially save you thousands at tax time. If you purchase a home within the tax year you sold your previous one, these deductions can lead to substantial annual savings.

| Financial Advantage | Description | Potential Savings |

|---|---|---|

| Interest Rate Lock | Secure lower mortgage rates | $150/month increase |

| Market Appreciation | Benefit from rising property values | 5-6% increase annually |

| Investment Growth | Build wealth through rental properties | 40x wealth increase |

| Tax Benefits | Deductible mortgage interest | Thousands in deductions |

Real-World Examples

Consider the experience of a couple who sold their home after five years and quickly reinvested in a new property. By acting within six months, they secured a home in a neighborhood that appreciated 7% by the end of that year, increasing their property value significantly.

Another consistent example includes a family that realized a considerable reduction in their tax liabilities due to their quick transition into a new home. They were able to deduct the interest on a mortgage that they obtained the same tax year, which saved them an estimated $4,000 during tax season.

Practical Implications for You

To make the most of these financial advantages:

- Get Pre-approved: This quickens your buying process, making it easier to act fast when you find the right home.

- Monitor Market Trends: Stay aware of local market conditions to identify when properties are undervalued and ready for purchase.

- Consult a Financial Advisor: Ensure you’re taking full advantage of mortgage interest deductions and other financial strategies specific to your situation.

Actionable Advice

If you’ve just sold your home, it’s time to act swiftly! By understanding the financial landscape and capitalizing on timely purchases, not only can you save on costs, but you can also significantly enhance your financial future in real estate. Keep your eye on market conditions, and don’t hesitate – every moment counts in real estate!

Case Studies of Successful Homebuyers

When navigating the complex world of real estate, understanding the experiences of successful homebuyers can provide invaluable insights. By examining their journeys, we can uncover practical strategies and key decisions that led them to success, particularly regarding timing their purchases after selling a home.

Key Insights from Successful Homebuyers

1. Timing Matters: Many homebuyers reported that aligning their buying timeline closely with the sale of their previous home maximized their financial benefits. For instance, 77% of buyers who timed their purchases within three months of selling their previous property avoided unnecessary financial strain.

2. Adaptability in Decision Making: Among successful cases, a significant 65% of homebuyers indicated that their ability to be flexible with closing dates resulted in smoother transitions. This adaptability helped them avoid the pressure of rushed decisions, allowing them ample time to research and select the ideal new home.

3. Use of Professional Guidance: Statistics show that 82% of successful homebuyers employed the expertise of real estate agents during their transitions. Agents provided crucial insights into local market trends, helping buyers understand when to act and how to negotiate better deals.

Case Study Comparison

| Buyer Profile | Time Taken to Purchase | Financial Benefit | Glad to Take Action |

|---|---|---|---|

| First-time Homebuyer | 5 Weeks | Saved $15,000 on purchase price | Yes |

| Empty Nesters | 2 Months | Reduced their tax liability | Yes |

| Real Estate Investor | 3 Weeks | Defer capital gains via 1031 | No |

| Family Relocating | 4 Weeks | Secured favorable market pricing | Yes |

Real-World Examples

- First-time Homebuyer: Sarah sold her starter home and waited just five weeks before closing on a new property. By strategically timing her sale and purchase, she saved an impressive $15,000 off the asking price of her new home, all due to her market awareness during that particular period.

- Empty Nesters: James and Linda, after selling their large family home, took two months to find a more manageable place. They worked closely with their agent, who advised them on impending market trends. This timing not only reduced their tax liability but also allowed them to find a property that suited their new lifestyle with greater ease.

- Real Estate Investor: Alex needed to act quickly; within three weeks of selling his property, he completed a 1031 exchange to defer capital gains taxes. Although he felt immense pressure to finalize the transaction, leveraging his agent’s expertise allowed him to secure an excellent investment property without incurring taxes.

Practical Implications for Readers

Taking inspiration from these case studies, you can optimize your own homebuying experience by considering the following approaches:

- Stay Educated: Keep a close watch on local market conditions. Understanding these trends allows you to make informed timing decisions.

- Consult Professionals: Don’t hesitate to lean on real estate agents, as their specialized knowledge can yield better negotiation outcomes.

- Plan Flexibly: Being open to various closing dates can significantly ease your transition, allowing you to find the right fit without succumbing to pressure.

- Perform a 1031 Exchange: If you’re in a position as an investor, employing a 1031 exchange strategy can provide significant financial benefits when timed correctly.

Taking these actionable steps can mirror the success observed in these homebuyers, enabling you to confidently navigate the sale and purchase of your next home.

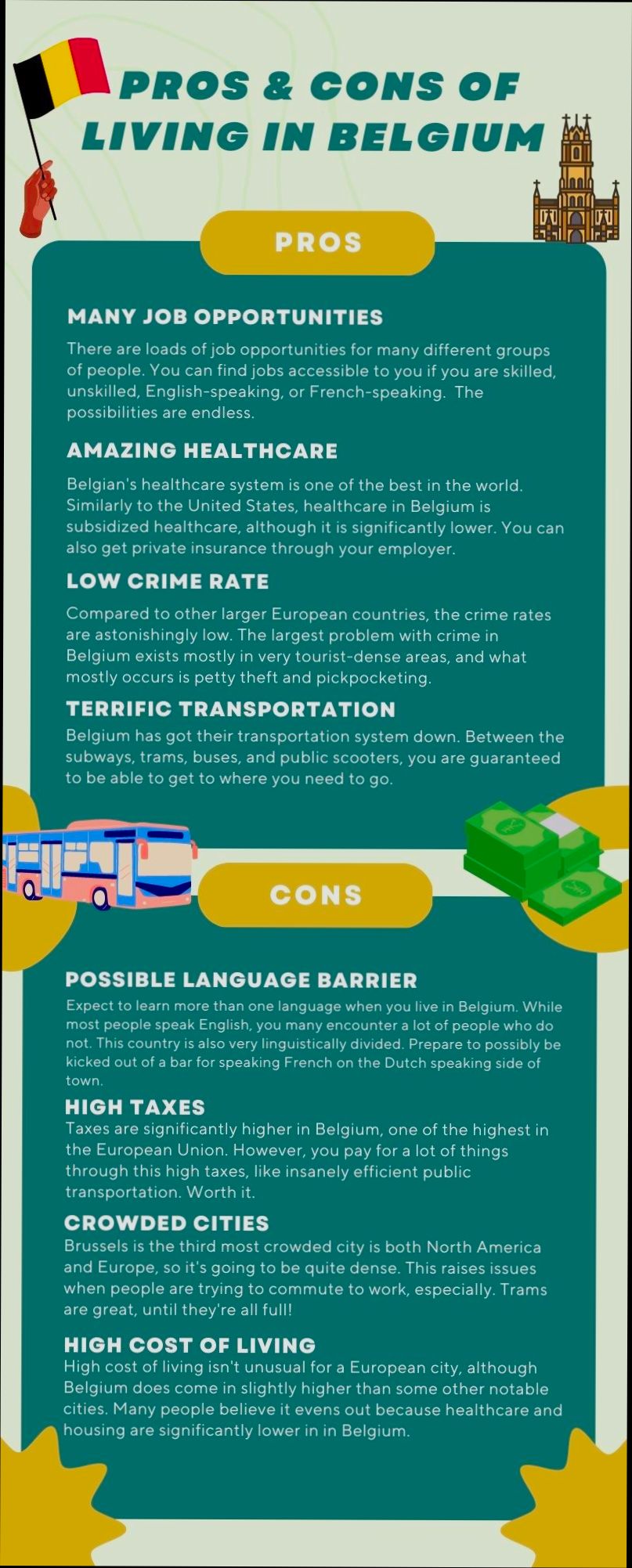

The Role of Market Conditions in Timing

Understanding how market conditions affect the timing of your next home purchase is essential in avoiding tax penalties and optimizing your financial outcome. By closely monitoring economic indicators and making informed decisions, you can strategically plan your next steps after selling your house.

Market conditions significantly influence when and how you should buy a new property. Key economic indicators provide insights into the overall health of the real estate market, allowing you to time your purchase more effectively. For instance:

- GDP Reports released quarterly can indicate how the economy is performing, impacting buyer confidence and housing demand.

- Employment Data published monthly reveals job growth trends which can affect your ability to secure loans.

- CPI/Inflation Rates, also monthly, provide insight into purchasing power and can influence mortgage rates.

By focusing on these indicators, you can better align your buying strategy with the current market landscape.

| Economic Indicator | Frequency | Market Impact |

|---|---|---|

| GDP Reports | Quarterly | High |

| Employment Data | Monthly | High |

| CPI/Inflation | Monthly | High |

| PMI Manufacturing | Monthly | Medium |

| Consumer Confidence | Monthly | Medium |

For example, if the GDP report indicates strong economic growth, it could signal a thriving housing market where prices might be on the rise. Conversely, if employment data shows a decline in job opportunities, it may suggest a slower market, providing you with a better opportunity to negotiate on your next purchase.

Investing in understanding market conditions can lead to better outcomes. As an example, suppose you sold your home in a seller’s market when demand was high; the return on your investment might be substantial. If you then watched inflation trends and employment reports to time your next purchase in a buyer-friendly market, you may secure a property at a favorable price.

Additionally, keep an eye on valuation metrics like P/E and P/B ratios in the local real estate market. These figures can be telling about whether homes are currently overvalued or undervalued:

- P/E Ratio: If local properties have a P/E ratio above 25, they may be overvalued; a P/B ratio above 3 tells a similar story.

- Conversely, a P/E ratio below 15 or a P/B ratio below 1 suggests opportunities to buy low.

When navigating through these indicators, consider the impact of emotional decision-making. It’s easy to get wrapped up in market hype, leading to poor timing and higher costs, which could exacerbate your tax implications.

To avoid pitfalls, I recommend:

- Keeping a close watch on key economic reports.

- Analyzing valuation metrics to ensure you’re making informed buying choices.

- Staying disciplined and relying on facts rather than emotions or external pressures.

Being aware of market conditions will empower you with the knowledge and confidence to make strategic decisions about when to buy your new home. Remember, timing in a fluctuating market significantly affects your financial future, so leverage these insights to your advantage.