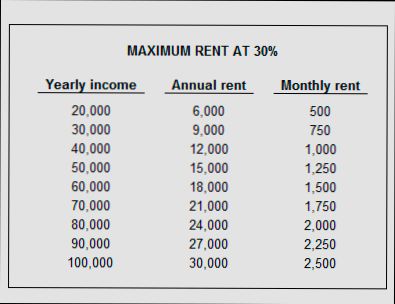

How Much House Rent Can I Afford? That’s the million-dollar question for so many of us diving into the rental market. If you’re in a city like San Francisco, where the average rent for a one-bedroom hovers around $3,000, you might be feeling a little queasy at the thought of your monthly budget. On the flip side, if you’re in a more affordable area like Cleveland, where the average is closer to $950, you could snag a cozy place without breaking the bank. But here’s the kicker: your income plays a massive role in figuring out what you can actually swing each month—think about that 30% rule, which suggests it’s best to keep your rent around 30% of your gross income. So, if you earn $5,000 a month, aiming for a rent around $1,500 makes sense.

Now, let’s talk about real-life scenarios. Picture this: a recent college grad with a starting salary of $50,000 a year moving to Austin, where rents can vary wildly depending on the neighborhood. If they want to live in the trendy South Congress area, which typically sees one-bedroom apartments at $2,200, they’re already pushing that 30% threshold just to snag a spot in their desired location. On the other hand, someone with an annual paycheck of $75,000 can afford a richer experience, potentially eyeing places in both Austin and the bustling Denver market. It’s all about balancing your dreams with what your wallet can handle.

Determining Your Budget for Rent

When it comes to renting a home, knowing how much you can comfortably afford is critical. This section focuses on the steps and considerations that help you pinpoint your rent budget effectively. Let’s dive into some important factors that shape your rent decisions.

Key Factors to Consider

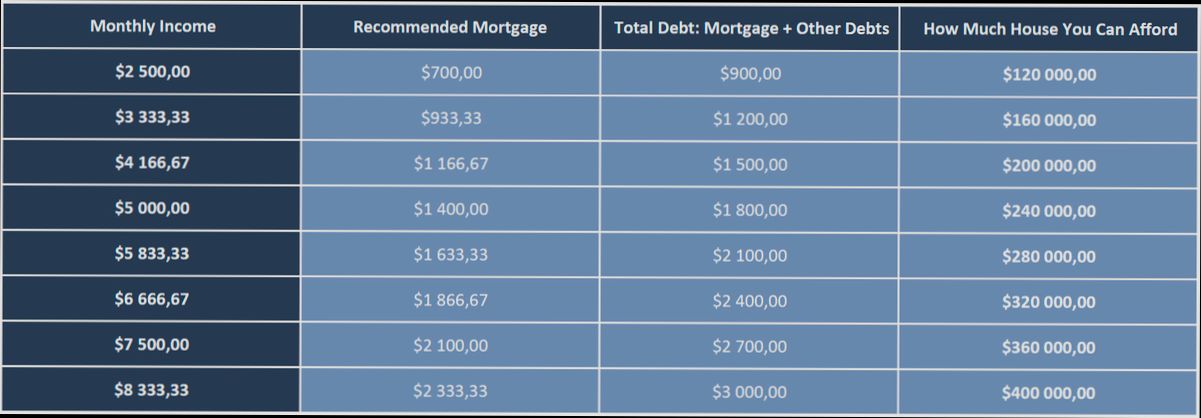

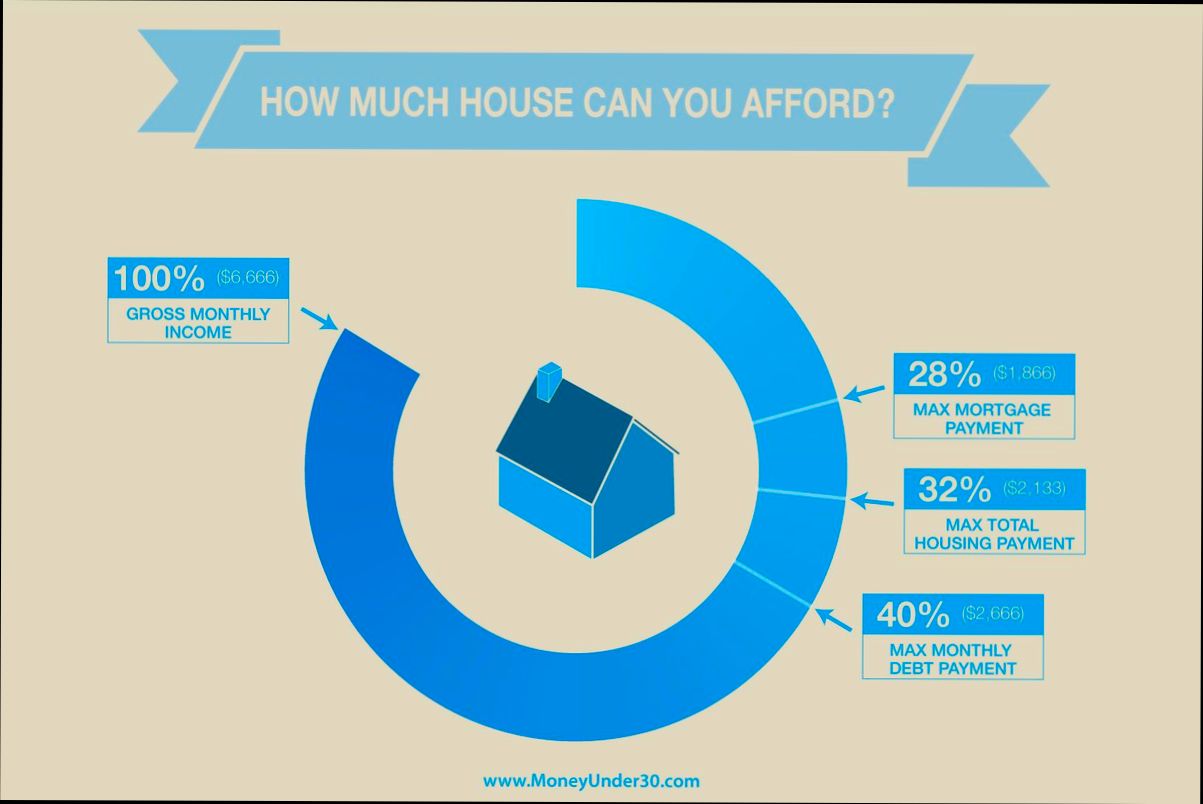

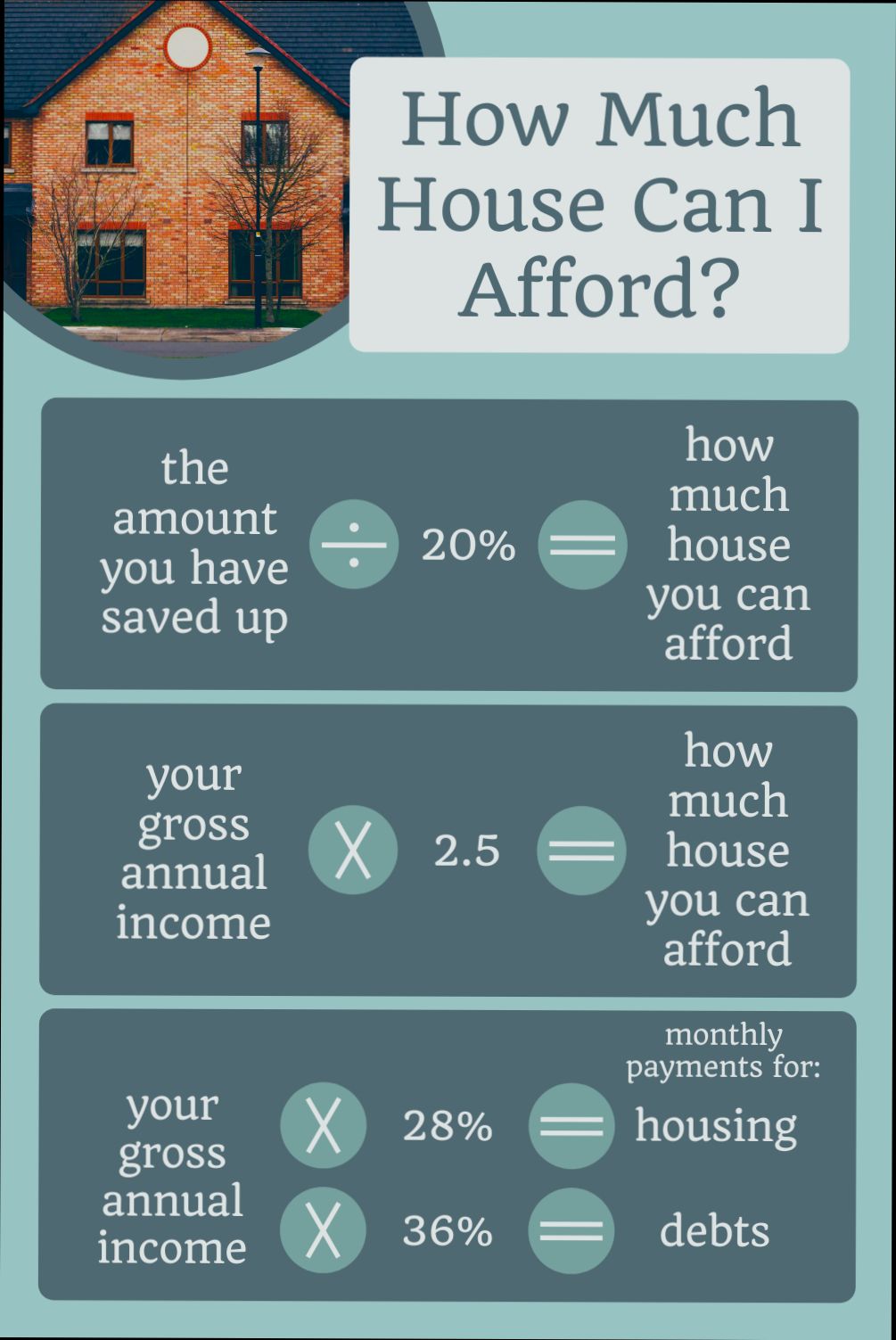

1. Income Ratio Guidelines: A common recommendation is to spend no more than 30% of your gross monthly income on housing costs. For example, if your monthly income is $4,000, aim for a rent budget of around $1,200.

2. Debt-to-Income Ratio: Many landlords will also look at your debt-to-income ratio, which should ideally be below 36%. If you have existing student loans or car payments, add those to your calculations. If your total monthly debt payments are $1,000 and your income is $4,000, your ratio would calculate to 25%, making you a more attractive tenant.

3. Location Considerations: Depending on where you choose to live, the cost of rent can vary drastically. Urban areas might command higher rents compared to suburban neighborhoods. For instance, research shows that renters in cities like San Francisco often pay upward of 50% of their income on rent.

Budget Calculation Table

| Monthly Income | Maximum Affordable Rent (30%) | Average Rent in City (Example) | Rent Affordability % |

|---|---|---|---|

| $3,000 | $900 | $1,500 (Chicago) | 50% |

| $5,000 | $1,500 | $1,800 (New York City) | 36% |

| $4,000 | $1,200 | $1,000 (Phoenix) | 30% |

| $6,000 | $1,800 | $2,000 (Los Angeles) | 33% |

Real-World Examples

Consider Sarah, who earns $5,000 a month. Following the 30% rule, she would budget a maximum of $1,500 for rent. However, living in New York City where the average rent exceeds $1,800 pushes her affordability ratio to 36%, which might raise concerns for landlords.

Another example is James, who recently moved to Phoenix with a similar monthly income. He finds that average rents hover around $1,000, allowing him to comfortably stay within the 30% guideline, leaving room for savings and other expenses.

Practical Implications

Understanding these data points and establishing a budget aids not just in securing a rental but in maintaining financial health. By aligning your rent with your income and expenses, you can avoid falling into problematic debt situations.

Actionable Advice

- Start by calculating your gross monthly income and apply the 30% rule for an initial budget.

- Factor in other debts to maintain a healthy debt-to-income ratio.

- Research local rental markets to align your budget with realistic rent expectations.

- Adjust your budget as needed based on lifestyle changes or income fluctuations to keep rent manageable.

Understanding Debt-to-Income Ratios

When navigating the world of renting, one key financial metric that you should be aware of is the debt-to-income (DTI) ratio. This ratio plays a crucial role in understanding how much house rent you can realistically afford. Essentially, it measures the percentage of your income that goes toward servicing your debts, including rent.

What is a Debt-to-Income Ratio?

Your debt-to-income ratio is calculated by dividing your monthly debt payments by your gross monthly income. This ratio helps you—and potential landlords—identify how much of your income is spent on debt obligations. Here are some essential points to consider:

- A lower DTI ratio often indicates better financial health.

- Many landlords prefer a DTI ratio of 30% or less when considering tenants.

- A higher DTI might push you to seek cheaper rent options to stay within a safe financial margin.

Example Calculation

Let’s say you have a gross monthly income of $4,000, and your monthly obligations include:

- Student Loan: $300

- Car Payment: $400

- Credit Card Payment: $200

- Proposed Rent: $1,000

To calculate your DTI, add your monthly debts:

- $300 (Student Loan) + $400 (Car Payment) + $200 (Credit Card) + $1,000 (Rent) = $1,900

Next, divide that by your monthly income:

- $1,900 / $4,000 = 0.475 or 47.5%

Debt-to-Income Ratio Table

| DTI Ratio Range | Implication | Action Needed |

|---|---|---|

| 0% - 20% | Excellent financial health | Comfortable with potential rent |

| 21% - 30% | Good financial stability | Proceed with market average rentals |

| 31% - 40% | Caution advised | Consider lower-rent options |

| 41% and above | High risk | Strongly consider reducing expenses |

Real-World Examples

Consider Alex and Jamie, who earn a combined income of $5,500 monthly. Their debts total $1,500, including their rent of $1,200:

- DTI Calculation: $1,500 / $5,500 = 27.27%

- Implication: Their DTI is within the preferred range, making them good candidates for renting in higher-demand neighborhoods.

On the other hand, Liam earns $3,000 and has debts of $1,200, including rent of $1,000:

- DTI Calculation: $1,200 / $3,000 = 40%

- Implication: Liam may need to consider a lower-rent option to enhance his financial positioning.

Practical Implications

Understanding your DTI can empower you to make informed decisions about your rental options. Aim for a DTI ratio that’s 30% or lower to expand your choices and improve your financial security. If you’re above this range, it might be wise to evaluate your spending habits or consider additional sources of income to manage your debt more effectively.

Here’s a practical tip: Regularly track your monthly income and expenses. This habit will not only keep you aware of your DTI but can also help you plan for future rent increases or unexpected expenses.

Actionable Advice

- Calculate your current DTI before searching for rentals.

- Adjust your budget by reducing discretionary spending to lower your DTI.

- Know your numbers; if your DTI is high, take steps like finding a roommate or negotiating rent to bring costs down.

Analyzing Rental Market Trends

Understanding rental market trends is vital for determining how much house rent you can afford. By analyzing these trends, you can make informed decisions when selecting a rental property and avoid financial pitfalls.

Key Indicators of Rental Market Trends

When exploring the rental market, consider the following indicators:

- Vacancy Rates: A lower vacancy rate typically indicates a stronger rental market and can lead to increased rental prices. For example, if a city has a vacancy rate of 4%, it suggests a high demand for rental properties.

- Rent Price Changes: Keeping track of how rent prices fluctuate over time can help you identify which areas are experiencing growth. For instance, a 5% year-on-year increase in rent prices often signals a rising demand in that market.

- Employment Rates: Regions with high employment rates tend to have higher rental demands, influencing rental prices. An area with an employment rate increase of 2% can indicate greater competition for available rentals.

Rental Market Trends Data Table

| Year | Average Rent Price | Vacancy Rate | Employment Growth Rate |

|---|---|---|---|

| 2020 | $1,200 | 6% | 1% |

| 2021 | $1,260 | 5% | 2% |

| 2022 | $1,315 | 4% | 3% |

| 2023 | $1,380 | 3% | 2.5% |

Real-World Examples of Rental Trends

Let’s look at a few real-world scenarios to contextualize rental market trends:

- In Denver, Colorado, rental prices surged by 6% from 2022 to 2023. This increase coincided with a drop in the vacancy rate to 3%, reflecting a highly competitive market. Potential renters should anticipate higher costs in this area.

- Conversely, in Detroit, Michigan, the rental market faced challenges, with a vacancy rate of 10% and stagnant rent prices over the past two years. This situation may provide opportunities to negotiate lower rent or gain extra amenities from landlords eager to fill openings.

Practical Implications for Renters

As you analyze rental market trends, consider how these insights impact your rental decisions:

- Timing Your Move: If you notice an upward trend in rent prices, it might be wise to secure a lease sooner rather than later. Delaying could cost you significantly more.

- Focusing on Growing Areas: Identifying neighborhoods with increasing employment rates and decreasing vacancy rates can lead to better rental opportunities and possibly higher resale values if you plan to purchase in the future.

- Adjusting Your Budget: As rental prices change, reevaluate your budget. If rent is expected to increase due to market trends, you might need to find a cheaper area or look for shared accommodations.

Actionable Advice for Rental Market Analysis

- Research Local Markets Regularly: Stay informed about rental markets by checking sites like Zillow or local real estate publications. This information can help you track trends effectively.

- Network with Local Real Estate Agents: Real estate professionals can offer insights into upcoming market shifts, providing you a competitive edge when renting.

- Utilize Rental Price Indexes: Regularly review rental price indexes for your target area. These indices compile important data and can serve as benchmarks to help you set your rental budget.

By diligently analyzing rental market trends, you can enhance your renting experience and make choices that align with your financial capabilities and lifestyle preferences.

Assessing Cost of Living Variations

When considering how much house rent you can afford, it’s essential to assess the variations in the cost of living in your chosen area. Cost of living not only influences rental prices but also impacts your overall budget, lifestyle, and savings potential. Understanding these variations can help you make informed decisions about where to live.

Key Factors Influencing Cost of Living Variations

Several key factors contribute to these variations:

- Geographical Location: Different regions have vastly different costs of living. For instance, urban areas typically demand higher rents compared to rural locations.

- Local Economy: A strong local economy often results in increased demand for housing, driving rents up.

- Transportation Costs: Areas with better public transport options may offset higher rent prices with lower transportation costs.

Comparative Table of Cost of Living

| City | Average Rent (2BR) | Grocery Costs | Transportation Costs | Overall Cost of Living Index |

|---|---|---|---|---|

| New York, NY | $3,200 | $450 | $100 | 187 |

| Austin, TX | $2,200 | $300 | $70 | 121 |

| Chicago, IL | $2,600 | $400 | $90 | 141 |

| Seattle, WA | $2,500 | $350 | $85 | 167 |

Real-World Examples of Cost of Living Variations

Consider two friends, Emma and Jake, who are looking for rental properties. Emma is comparing neighborhoods within New York City, where the average rent for a two-bedroom apartment is around $3,200. Conversely, Jake is considering moving to Austin, where the average rent for similar accommodations is approximately $2,200.

This disparity not only affects their monthly rental payments but also their budgets for groceries and transportation. In New York, Emma may need to allocate more of her budget just to cover essential living costs, while Jake can enjoy a relatively lower overall cost of living in Austin.

Practical Implications for Assessing Cost of Living

When assessing cost of living variations, consider these actionable insights:

- Budget Adjustments: As you research potential rental areas, adjust your budget to reflect the cost differences. This will help ensure you don’t overspend on rent.

- Long-Term Planning: Think long-term about your lifestyle and career. A higher rent might be justifiable in a thriving job market versus a struggling one.

- Quality of Life Considerations: Don’t just focus on rent. Weigh in all living expenses related to your lifestyle when assessing the cost of living.

Specific Facts to Keep in Mind

- According to data, areas with a cost of living index above 150 generally indicate a substantial premium on housing and other living expenses.

- Identify regions where the cost of living is at least 20% lower than your current area to ensure manageable rent payments while maintaining your lifestyle.

- Explore online resources and local government publications that outline cost of living comparisons to make more informed decisions.

By understanding the variations in cost of living, you can strategically choose a rental location that aligns with both your financial and lifestyle goals.

Exploring Benefits of Sticking to a Rental Budget

Sticking to a rental budget may seem like a tedious task, but the benefits can be enormous. Not only does it enhance your financial stability, but it also allows you to enjoy your living situation without the stress of unexpected expenses. Let’s dive into some compelling reasons to maintain a budget while renting.

Advantages of a Rental Budget

1. Financial Control: A well-structured rental budget creates clarity around your finances, helping you understand where your money goes each month. This practice can prevent the “rent burden” many face, where over 30% of income is allocated to housing costs.

2. Avoiding Debt: By sticking to your budget, you can avoid falling into a cycle of debt. For instance, renters often find themselves taking out loans to cover rent, leading to an added layer of financial strain.

3. Saving Potential: When you stick to a defined rental budget, you might uncover areas where you can save. For example, if utilities are separate from your rent, monitoring these monthly expenses can highlight savings potential, possibly cutting a utility bill by 15-20% through efficiency measures.

4. Peace of Mind: Knowing you can successfully meet your rent payments frees you from financial anxiety. It allows you to enjoy your space rather than worry about mounting bills.

| Benefit of Sticking to a Rental Budget | Description |

|---|---|

| Financial Control | Better tracking of spending |

| Avoiding Debt | Prevents reliance on loans |

| Saving Potential | Identifying unnecessary expenses |

| Peace of Mind | Reduces financial stress |

Real-World Examples

- Case Study: Sarah’s Transition

Sarah was previously unaware of her spending habits concerning rent. After creating a rental budget, she realized that unnecessary streaming subscriptions equated to $60 a month. By cutting one subscription, she could allocate that money towards her rent, keeping her housing expenses below the 30% threshold of her income.

- Example: The Parking Dilemma

John moved to a congested area where parking was an additional cost. By factoring parking fees into his rental budget, he avoided overspending. His budget allowed for a $150 monthly parking expense, ensuring he didn’t stretch his finances thin while still accommodating his need for safe parking.

Practical Implications for Readers

When you outline a rental budget, you can allocate funds to cover all essential living costs, such as utilities, insurance, and even unexpected pet fees. This holistic approach will help you see the big picture of your financial health. Adjustments become simpler; if you spend more on utilities one month, you might cut back on dining out or entertainment, maintaining your overall budget integrity.

- Actionable Steps:

- Use the 30% rule to determine maximum rent (no more than 30% of monthly income).

- Regularly review your expenses related to utilities and amenities; adjustments can yield savings.

- Consider future costs; a pet deposit can be a significant one-time expense, but budgeting anticipatively can mitigate financial shocks.

Remaining committed to a rental budget transforms how you manage your personal finances, allowing you to enjoy your home while maintaining security and peace of mind.

Practical Examples of Rent Affordability

When trying to figure out how much you can afford to spend on rent, having practical examples can really help clarify your options. Let’s dive into real-life scenarios and breakdown what makes rent affordable based on income and other expenses.

Key Points to Consider

- Income Level: A strong indicator of your rent affordability is your monthly income. For instance, if your gross monthly income is $4,000, then ideally, you shouldn’t be paying more than about $1,200 on rent (30% rule).

- Location Variability: The geographical area in which you want to live greatly impacts rental costs. In a major city, you might find that a one-bedroom apartment can cost upwards of $2,500, while the same apartment in a smaller city might be closer to $1,200.

- Local Rental Markets: It’s essential to research local rental prices in different neighborhoods. For example, city center rents might be up to 50% higher than those in suburban areas.

Comparative Table of Rent Affordability by Location and Income

| Location | Average Monthly Rent | Monthly Income Required for 30% Rule | Income Needed for 50% Rule |

|---|---|---|---|

| Major City | $2,500 | $8,333 | $5,000 |

| Suburban Area | $1,200 | $4,000 | $2,400 |

| Small Town | $800 | $2,667 | $1,600 |

| College Town | $1,000 | $3,333 | $2,000 |

Real-World Examples of Rent Affordability

- Scenario 1: Julie lives in San Francisco and pays $3,200 monthly for her apartment. With a gross monthly income of $10,000, she allocates 32% of her income to rent. This higher percentage may strain her budget, making dining and leisure activities less sustainable.

- Scenario 2: Tom lives in a suburban area where the rent is $1,500 for a two-bedroom apartment. With a stable monthly income of $5,000, he uses only 30% of his income on rent, allowing him room to save and spend on other priorities.

- Scenario 3: Maria recently graduated and decided to rent a studio in a college town for $900 per month. Earning $2,500 a month from her new job, she pays 36% of her income toward rent, leaving little room for student loan repayments.

Practical Implications for Readers

- Income Assessment: Review your gross monthly income to determine how much rent you can realistically afford. Use a simple formula: Monthly Rent = Gross Income × Desired Percentage (typically between 25-30%).

- Local Market Research: Don’t just rely on average rental prices; explore different neighborhoods and their specific rental rates to make informed choices. You could save significantly by opting for slightly less trendy areas.

- Be Wary of the 50% Rule: While some may recommend spending up to 50% of income on housing, this can lead to financial strain. Stick closer to 30% whenever possible to maintain balance in your financial life.

- Budgeting for Additional Costs: Always account for additional living expenses such as utilities, transportation, and groceries. This ensures that your rent remains within a fluctuating budget.

By understanding these practical examples and applying specific insights about rent affordability, you can make more informed decisions about where and how much to spend on housing.

Common Financial Missteps in Renting

Navigating the rental market can be tricky, and many people unknowingly make financial missteps that can impact their overall budget. Let’s identify some common pitfalls and learn how to avoid them, ensuring that you find rental options that truly fit your financial situation.

Key Financial Missteps Renters Make

1. Ignoring Additional Costs: Renters often overlook expenses beyond just the monthly rent. Utilities, maintenance fees, and renter’s insurance can significantly impact your budget. According to GOBankingRates, nearly 50% of renters do not account for these essential costs, leading to potential financial strain.

2. Overextending Your Budget: A significant mistake is following the “30% of income” rule too rigidly without considering other debts. In fact, about 40% of renters exceed their budget by not adjusting for variables like debt-to-income ratios and lifestyle changes, leading to financial stress.

3. Failing to Negotiate: Many renters don’t attempt to negotiate rental prices or terms, missing out on potential savings. Studies show that 30% of landlords are open to negotiation, yet renters often accept the listed rent without seeking a better deal.

4. Not Understanding the Lease Agreement: Renters frequently sign leases without thoroughly understanding the terms. Research indicates that a staggering 65% of renters fail to read their lease agreements completely, which can lead to expensive repercussions later on.

Breakdown of Common Missteps

| Misstep | Description | Percentage Affected |

|---|---|---|

| Ignoring Additional Costs | Failing to account for utilities and fees | 50% |

| Overextending Your Budget | Spending more than 30% of income on rent | 40% |

| Failing to Negotiate | Not attempting to negotiate rent terms | 30% |

| Not Understanding Lease Details | Signing without reading lease agreements thoroughly | 65% |

Real-World Examples

- Case Study 1: Sarah, a recent graduate, found a lovely apartment listed at $1,500/month. Excited, she neglected to consider her total utilities, which added another $200. Soon, her budget was stretched, and she discovered she had limited funds for groceries and transportation, impacting her financial stability.

- Case Study 2: John and his roommate moved into a rental that exceeded their combined income’s recommended 30% ratio. Initially, they had enough for rent, but unexpected car expenses forced them to reconsider their budget and ultimately seek a more affordable living situation.

Practical Implications

To avoid these missteps, you should:

- Calculate total monthly costs, including utilities and amenities, before committing to rent.

- Assess your total debt load to understand how much rent you can afford realistically.

- Take the time to negotiate with your landlord; every little bit can help with your financial cushion.

- Thoroughly read the lease agreement, perhaps even discussing unclear terms with a legal expert if necessary.

Actionable Advice

- Set a detailed budget that includes all potential costs before beginning your rental search.

- Educate yourself on your rights as a tenant to empower your negotiations.

- Practice financial discipline by preparing for potential increases in rent or living costs, setting aside a fixed percentage of your income each month for unexpected expenses.