How Much Can You Afford as a First Time Buyer? Well, that’s the million-dollar question! The median home price in the U.S. hovers around $400,000, but depending on where you live, that number can skyrocket or dip dramatically. For example, if you’re eyeing a cozy one-bedroom in San Francisco, get ready to shell out closer to $1.4 million. Meanwhile, you might find a charming bungalow in a smaller town for just $250,000. Your budget should also consider how much you can comfortably put down. According to a recent survey, 40% of first-time buyers go for a 3-5% down payment, while 32% aim for the classic 20% to avoid PMI.

But it’s not just about the price tag of the house; it’s also about your financial health. Lenders typically look for a debt-to-income ratio below 43%. So, if you’re bringing in $5,000 a month, you’d want your total monthly debts (including your new mortgage) to stay below $2,150. Plus, consider your savings for closing costs, which typically add another 2-5% of the home’s price. With all these variables in play, the situation varies for each of us, shaping how much house we can truly call home.

Understanding Your Budget Constraints

When stepping into the housing market as a first-time buyer, understanding your budget constraints is key to making sound financial decisions. Let’s dive into what that means for you, so you can enter the market with confidence and clarity.

Key Budget Constraints to Consider

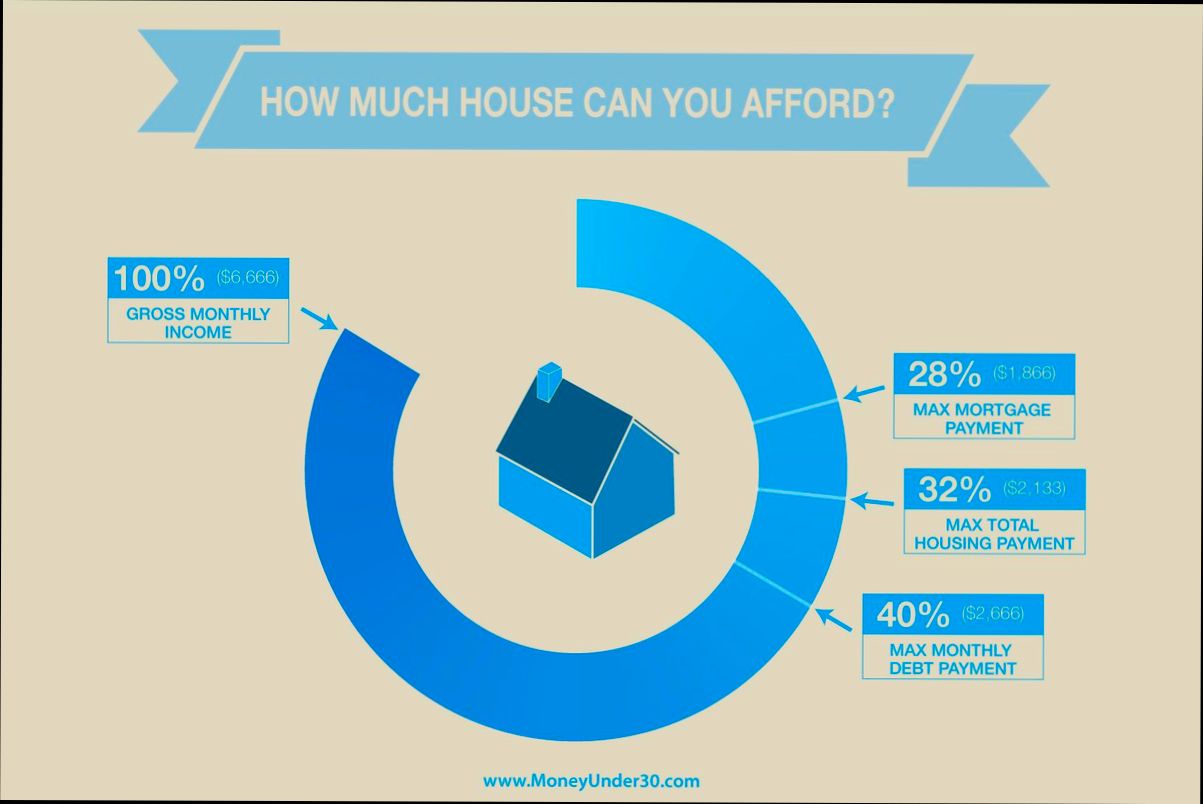

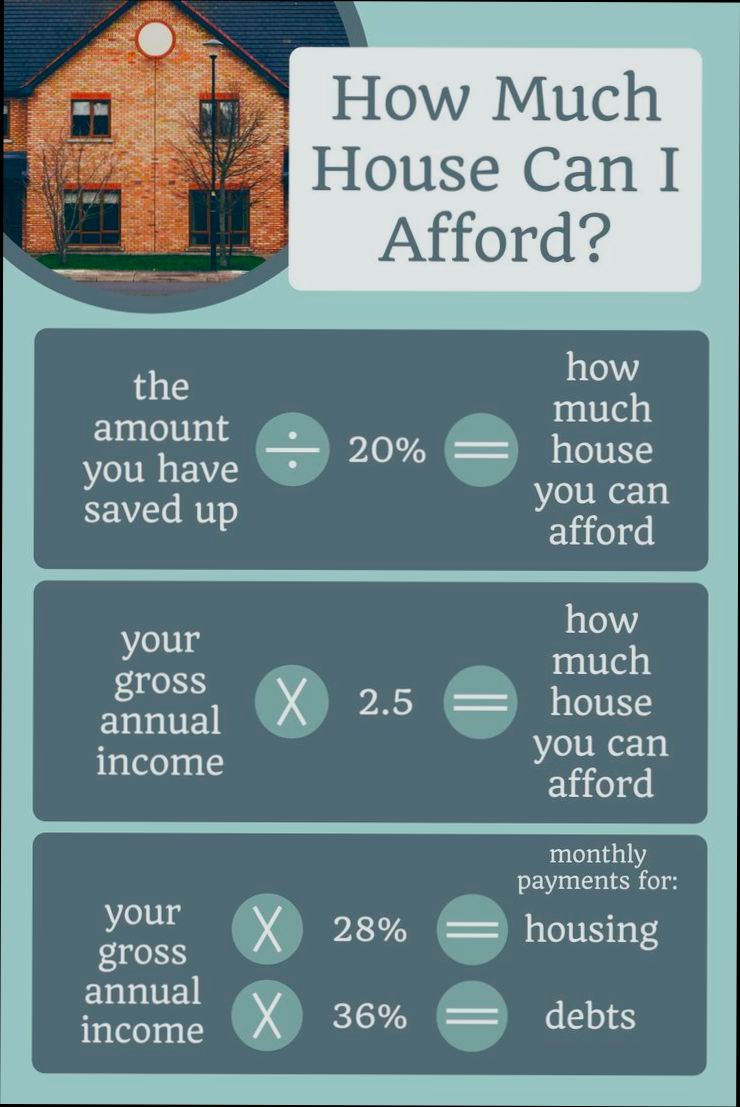

1. Income vs. Expenses: Lenders typically use the 28/36 rule when determining how much you can afford. This means that your housing costs should not exceed 28% of your gross monthly income, while your total debt (including housing) should not surpass 36%. For instance, if your gross monthly income is $4,000, your housing costs should be limited to $1,120, and your total debt (including student loans, car payments, etc.) should stay below $1,440.

2. Down Payment Requirements: Most conventional mortgages require a down payment of 20% to avoid private mortgage insurance (PMI). However, many first-time buyers leverage loans that allow for as little as 3% down. If you’re buying a $300,000 home, a 3% down payment means you’d need just $9,000, compared to $60,000 for a 20% down payment.

3. Hidden Costs: It’s essential to factor in additional costs beyond the purchase price. Typically, closing costs can range from 2% to 5% of the home’s purchase price. Using the same $300,000 example, closing costs could set you back between $6,000 and $15,000.

| Expense Category | Percentage of Home Price | Estimated Cost on $300,000 Home |

|---|---|---|

| Down Payment (3%) | 3% | $9,000 |

| Closing Costs (3%) | 3% | $9,000 |

| Total Upfront Costs | $18,000 |

Real-World Examples of Budget Constraints

Consider Sarah and Tom, who were first-time buyers looking at a home priced at $250,000. They realized:

- Their combined monthly income was $5,000. At 28%, their housing budget should be around $1,400.

- With their preferred mortgage requiring a 15% down payment, they needed approximately $37,500 upfront. They also estimated closing costs to be around 4%, adding another $10,000.

This brought their total budget constraint to about $47,500 just for the initial purchase, prompting them to reassess whether the home was within feasible limits.

Practical Implications for Your Financing Strategy

Understanding your budget constraints means you can make educated decisions:

- Assess Your Debt-to-Income Ratio: Sit down and calculate your current debts against your income. This gives you a clearer picture of your financial standing.

- Establish an Emergency Fund: Aim to have 3-6 months’ worth of expenses saved, ensuring you’re not caught off guard by unexpected costs.

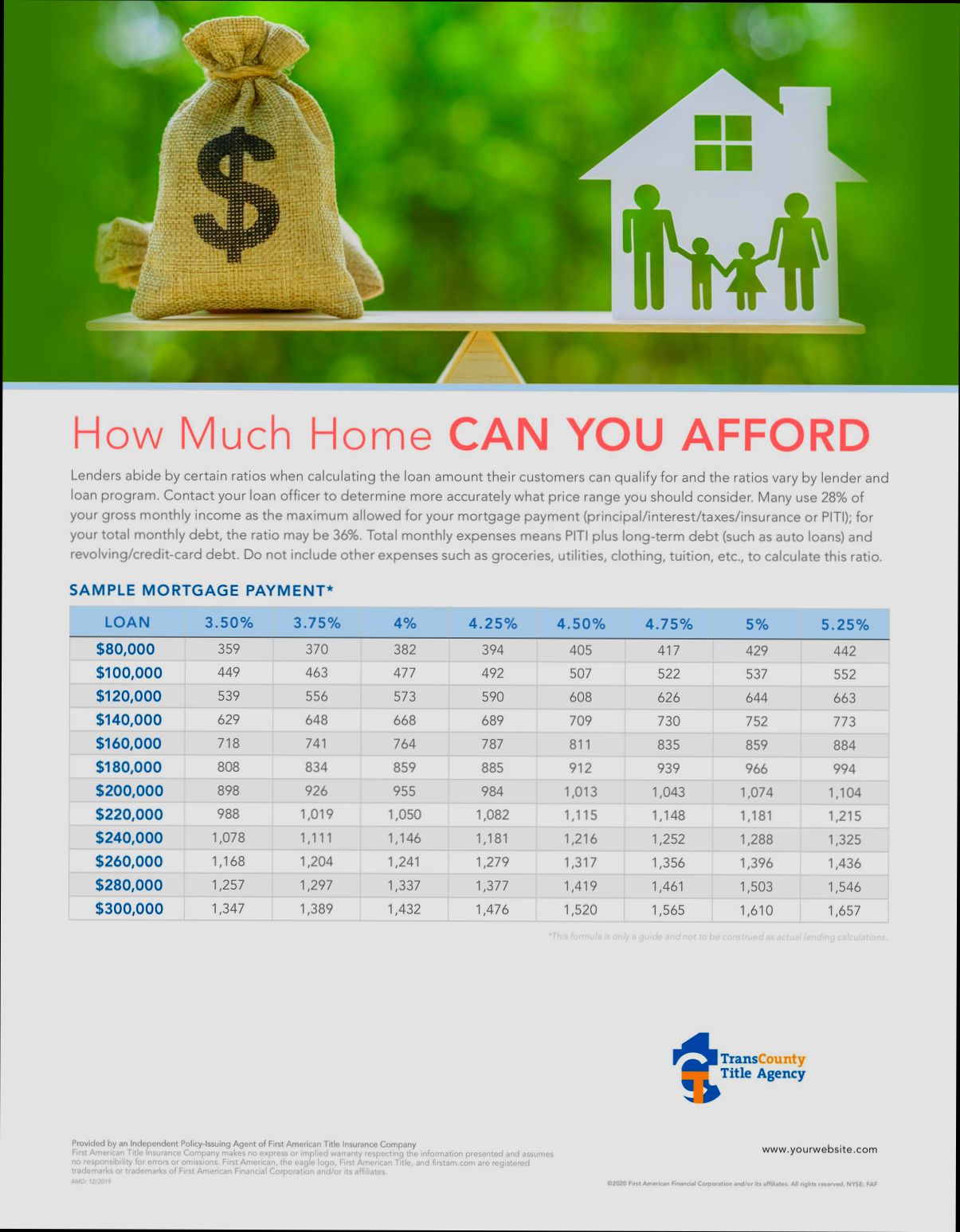

- Account for Interest Rates: A small difference in interest rates can result in a significantly different monthly payment. Even a 1% increase could mean paying hundreds more over the life of the loan.

Actionable Advice for First-Time Buyers

1. Create a Detailed Budget: List all your monthly expenses including utilities, groceries, and debt payments to understand how much you can safely allocate to your mortgage.

2. Get Pre-Approved: Before house hunting, get pre-approved for a mortgage to know exactly what your budget looks like from a lender’s perspective.

3. Explore Assistance Programs: Many states offer financial assistance or grants for first-time homebuyers which could alleviate some upfront costs.

Keep these budget constraints in mind as you embark on your home-buying journey to ensure that you make a well-informed and financially responsible choice.

Analyzing Local Real Estate Markets

When diving into the real estate market, especially as a first-time buyer, understanding local trends becomes your guiding star. Analyzing these markets involves not just looking at home prices but understanding the economic ecology around them. Let’s explore key elements that can shape your purchasing decisions.

Key Factors Influencing Local Real Estate Markets

- Current Interest Rates: Depending on your region, interest rates can significantly influence how much you can afford. Keep an eye on national trends, but also check local shifts.

- Median Home Prices: Identifying the median home price in your desired area gives you a clear benchmark. For instance, in many suburban markets, median home prices have stabilized around $350,000, while urban areas may hover around $550,000.

- Median Income Levels: A crucial factor for measuring affordability is the local median income, which often influences how far your budget can stretch. For example, if the median family income in your area is $75,000, your home purchase would be more reasonable compared to locales where it is only $50,000.

- Economic Forecasts: Watch how local economic trends might affect housing prices. A growing job market could increase demand, resulting in higher property values over time.

- Market Saturation: The level of inventory available impacts how competitive your offers may need to be. If new constructions are outpacing sales, you might benefit from lower prices.

Local Market Comparison Table

| Area | Median Home Price | Median Income | Current Interest Rate | Market Saturation Level |

|---|---|---|---|---|

| Urban Area | $550,000 | $80,000 | 6.5% | High |

| Suburban Area | $350,000 | $75,000 | 6.0% | Moderate |

| Rural Area | $200,000 | $50,000 | 5.5% | Low |

Real-World Examples

- Urban Area Trends: In cities like San Francisco, where the median price is approximately $1.5 million, many first-time buyers are looking towards more suburban areas where prices are comparatively accessible.

- Case Study – Suburban Development: Recently, a suburban development project in Austin noted a price increase of about 5% year-over-year, influenced by an influx of tech jobs. This illustrates the importance of understanding local economic health when analyzing home values.

Practical Implications for Buyers

To effectively assess localized real estate markets, I recommend:

1. Conducting Ongoing Research: Regularly check local listings and economic reports to understand market sentiment.

2. Engaging with Real Estate Professionals: Find agents who are deeply familiar with local properties and market dynamics.

3. Analyzing Comparable Sales (Comps): Look at recently sold homes in your targeted neighborhood to gauge competitive pricing.

Actionable Insights

- Leverage Local Data: Use local resources, such as city planning websites or local chambers of commerce, to get the latest economic insights.

- Monitor Inventory Levels: Regularly assess how many homes are available in your desired area; this affects your negotiating power.

Keep diligent tabs on these aspects to navigate the complexities of local real estate markets effectively. Understanding these dynamics will not only help you make informed decisions but it will also empower you as a first-time buyer to find a home that fits both your budget and lifestyle.

Evaluating Debt-to-Income Ratios

When it comes to applying for a mortgage as a first-time buyer, one critical factor to evaluate is your debt-to-income (DTI) ratio. This percentage not only affects your approval chances but also determines the kind of loan terms you can secure. Understanding how to calculate and analyze your DTI can make a significant difference in your home-buying journey.

What is Debt-to-Income Ratio?

The debt-to-income ratio reveals how much of your gross monthly income goes toward servicing your debt. It’s calculated using the formula:

(Monthly Debt Payments / Gross Monthly Income) x 100 = DTI Percentage

Lenders generally look favorably on a lower DTI, indicating that you’re not overly burdened by debt.

Key DTI Statistics

- The ideal front-end DTI ratio, which encompasses housing costs including mortgage and insurance, should ideally be no more than 28%.

- The back-end DTI ratio, capturing all monthly debt payments, should not exceed 36%.

- However, depending on the lender, some are now willing to accept a high DTI ratio up to 50% for certain financing options.

Understanding Front-End and Back-End Ratios

It’s essential to differentiate between front-end and back-end ratios:

- Front-End Ratio: This indicates what portion of your income goes toward housing costs. For example, if your housing expenses (e.g., mortgage, property taxes) total $2,100 and your gross monthly income is $10,000, your front-end ratio is 21%.

- Back-End Ratio: This includes all your debts, not just housing. In the same example, if your total monthly debts amount to $3,200, your back-end ratio would be 32%.

DTI Requirements by Loan Type

Let’s take a closer look at how different types of loans evaluate DTI with this table:

| Loan Type | DTI Requirements |

|---|---|

| Personal Loan | 45% to 50% |

| Conventional Mortgage | Typically 36% – 50% |

| FHA Loan | Typically 43%; up to 57% |

| USDA Loan | Typically 41% |

| VA Loan | Typically 41% |

| Home Equity Loan | Typically 43%; 40% for PenFed |

| Auto Loan | Typically 36%; up to 50% |

| Private Student Loans | Typically 36% |

| Student Loan Refinance | Typically 50% |

Real-World Examples

Consider this scenario for a first-time buyer evaluating their DTI:

- Monthly Rent: $1,550

- Car Loan: $400

- Student Loan: $425

Calculating the back-end ratio:

- Total Debt Payments: $1,550 + $400 + $425 = $2,375

- Gross Monthly Income: Assume $10,000

Thus, the DTI calculation would be:

- Back-End DTI = ($2,375 / $10,000) x 100 = 23.75%

This individual is well below the ideal back-end DTI of 36%, making them a strong candidate for mortgage approval.

Practical Implications for Evaluating DTI

Understanding your DTI ratios can help you make informed choices about your mortgage options. Before you apply for a loan, consider:

- Clearing Existing Debts: Lowering your DTI can improve your chances of getting a better rate.

- Increasing Income: Explore avenues to boost your earnings, whether through overtime, side gigs, or other income sources.

- Credit Utilization: Ideally maintain your credit utilization ratio below 30% when preparing for a mortgage.

Actionable Advice on Evaluating DTI

- Track your monthly debts meticulously and keep our DTI formulas handy for quick calculations.

- Regularly analyze your DTI in relation to your income as market conditions change, so you can adjust your financial strategies accordingly.

- Be proactive in discussing your DTI with lenders to fully understand what financing options may be available based on your current financial standing.

Benefits of Homeownership for First Timers

Stepping into the world of homeownership as a first-time buyer brings numerous advantages that go beyond the walls of a new home. Not only can you build equity, but you also gain access to financial security and a greater sense of community. Let’s explore the specific benefits that come with owning your first home.

Building Wealth Through Home Equity

One of the most compelling benefits of homeownership is the opportunity to build wealth. U.S. homeowners typically enjoy an average net wealth that is 400% higher than renters with similar demographics and earnings. Each year you own your home can add approximately $9,500 to your net wealth, leading to significant long-term financial advantages.

- Home equity represents the largest portion of wealth for U.S. households, accounting for 34.5% of total wealth.

- For first-time buyers, this equity can serve as a foundation for financial growth, helping to secure loans or finance education.

Enhanced Civic and Social Engagement

Owning a home often leads to increased civic participation. Homeowners are 1.3 times more likely to engage in neighborhood groups and civic associations compared to renters. This engagement isn’t just beneficial for individual homeowners; it can also uplift the community as a whole.

- Voting Rate: Homeowners are generally more likely to vote in local elections, particularly in neighborhoods with socio-economic disadvantages.

- Community Connection: As you settle into your new home, you’ll likely form lasting bonds with neighbors, creating a network of support and shared responsibility.

Educational Benefits for Families

Homeownership can significantly impact the educational success of children in low-income households. Research indicates that children of low-income homeowners are 11% more likely to graduate from high school and have a 4.5% higher chance of enrolling in post-secondary education compared to children of renters.

| Outcome | Low-Income Homeowners | Low-Income Renters |

|---|---|---|

| High School Graduation Rate | 11% Higher | - |

| College Attendance Probability | 14% Increase per $10,000 in Housing Wealth | - |

By owning a home, first-time buyers can create a stable environment that promotes educational attainment for their children.

Financial Stability and Long-Term Benefits

As a first-time buyer, the financial stability afforded by homeownership can’t be underestimated. Homeownership can lead to lower housing costs in the long run, especially when factoring in potential benefits like weatherization for older homes, which can decrease energy costs by an average of 12.4% within the first year. This is particularly vital for low-income households, who often spend a significantly larger share of their income on energy.

Actionable Insights for First-Time Buyers

Understanding these benefits can empower you as a first-time buyer:

- Focus on building equity: Choose a home that you can improve over time, increasing its value and your wealth.

- Engagement is key: Attend local meetings or neighborhood events after moving in; it enhances your community connection.

- Leverage educational opportunities: Use your home equity for educational purposes, ensuring a brighter future for your children.

Owning a home goes beyond mere financial transactions; it builds a foundation for wealth, community, and educational advantages. Embracing homeownership can deeply impact you and your family’s future.

Practical Steps to Determine Affordability

Determining how much you can afford as a first-time homebuyer involves examining various factors, from your savings to market conditions. This process can feel daunting, but breaking it down into actionable steps can make it much simpler.

Steps to Calculate Your Maximum Affordable Price

1. Assess Your Savings: Start by taking stock of your savings. Beyond your down payment, ensure you have funds for closing costs, home inspections, and potential renovations. The average closing cost ranges between 2% and 5% of the home’s purchase price.

2. Calculate Your Monthly Budget: Track your monthly income and expenses to understand how much you can allocate to housing. This budget will help you determine a comfortable mortgage payment without straining your finances.

3. Use the 28/36 Rule: This classic guideline suggests that your housing costs should not exceed 28% of your gross monthly income and total debt payments should remain under 36%. If you earn $5,000 per month, for instance, you should aim for a mortgage payment of around $1,400.

4. Evaluate Your Credit Score: A higher credit score can yield better mortgage rates. Make sure you know your score and the range of rates that apply to it, as even a small percentage difference can significantly impact your payment and overall cost.

Home Affordability Estimate Table

| Income Level | 28% Monthly House Payment | 36% Total Monthly Debt |

|---|---|---|

| $3,000 | $840 | $1,080 |

| $5,000 | $1,400 | $1,800 |

| $7,000 | $1,960 | $2,520 |

Real-World Example of Affordability Calculation

Consider a scenario where you are a single professional earning $60,000 annually. With this income level, your gross monthly income is $5,000.

1. 28% of Monthly Income: $5,000 * 0.28 = $1,400 can be your maximum monthly housing cost.

2. 36% of Monthly Income: $5,000 * 0.36 = $1,800 is your total monthly debt limit, including other financial obligations.

Based on this analysis, the maximum affordable home price needs to take into account current mortgage rates, down payment size, and any existing debts you have, ensuring you stay within comfortable limits.

Practical Considerations for Your Affordability Check

- Use Online Calculators: Numerous online mortgage calculators allow you to input your income, down payment, and interest rates to estimate what you can afford.

- Consult a Financial Advisor: If you’re unsure about your financial status, a consultation with a financial advisor can help clarify your situation and formulate a plan tailored to your needs.

- Examine Additional Costs: Don’t forget about ongoing costs such as property taxes, homeowner’s insurance, utilities, and maintenance. These expenses can add significantly to your monthly outgoings, and they should be factored into your affordability calculations.

Specific Facts to Consider

- Aim to save at least 20% for a down payment to avoid private mortgage insurance (PMI), which can add to your monthly payments.

- Research local property tax rates, which can vary widely by area, affecting your overall housing costs.

- It’s essential to re-evaluate your budget periodically, especially if your income changes or if you reassess your lifestyle needs.

These practical steps and insights will empower you to determine a realistic price range for your first home, ensuring you step into homeownership with confidence and clarity.

Navigating Mortgage Options for New Buyers

When stepping into the realm of home purchasing, understanding mortgage options is as crucial as knowing your budget. As a first-time buyer, you might feel overwhelmed by the variety of choices available. Don’t worry; let’s break it down together and explore the different mortgage types and what might work best for you.

Types of Mortgages to Consider

There are several mortgage options you can choose from, each tailored to meet different financial situations and goals. Here are some common categories:

- Fixed-Rate Mortgages: These provide stability with a fixed interest rate, making your monthly payments predictable. They are ideal if you plan to stay in your home long-term.

- Adjustable-Rate Mortgages (ARMs): With ARMs, your interest rate may change after an initial fixed period. They often start lower than fixed rates but can increase significantly, impacting your future payments.

- FHA Loans: Backed by the Federal Housing Administration, these loans are designed for low-to-moderate-income buyers and allow for a lower down payment—sometimes as low as 3.5%.

- VA Loans: If you or a spouse are a veteran, you might qualify for a VA loan, which can offer competitive rates, no down payment, and no private mortgage insurance (PMI).

Comparing Mortgage Options

To help visualize how these mortgage types stack up, consider the following comparison based on typical percentages and rates:

| Mortgage Type | Average Interest Rate | Required Down Payment | PMI Requirement |

|---|---|---|---|

| Fixed-Rate | 6.5% | 20% | Yes |

| Adjustable-Rate | 5.5% (first 5 years) | 10% | Yes, after 80% LTV |

| FHA | 5.8% | 3.5% | Yes |

| VA | 5.4% | 0% | No |

Real-World Examples

Consider Sarah, a first-time buyer looking for her first home. After evaluating her options, she chose an FHA loan due to her limited savings and was able to capitalize on a low down payment requirement. This decision allowed her to buy a house and start building equity without breaking the bank.

On the other hand, Mike, a veteran, took advantage of a VA loan. He bought a home with zero down payment and avoided PMI, significantly lowering his monthly mortgage costs, making his home more affordable in the long run.

Practical Implications for You

As a new buyer, understanding the different mortgage options helps you determine what aligns best with your financial situation:

- Take time to shop around; different lenders may offer varied rates and products.

- Know your credit score: better scores often yield better interest rates, saving you thousands over time.

- Calculate total costs, including principal, interest, PMI, and homeowner’s insurance, to ensure you can comfortably afford your payments.

Always remember that evaluating your personal needs alongside available mortgage options empowers you as a buyer. Get advice from a trusted lender who can help you navigate this process, ensuring you make informed decisions about your future home.

Exploring First-Time Buyer Assistance Programs

Navigating the world of homeownership can be daunting, especially as a first-time buyer. Fortunately, there are various assistance programs designed to lend a helping hand, making purchasing a home more accessible and affordable. Let’s dive into some key aspects of these programs that can make a significant difference in your home-buying journey.

Types of First-Time Buyer Assistance Programs

First-time buyers have a variety of programs available that can help reduce the burden of upfront costs. Here are some notable types:

- Down Payment Assistance: Many state and local governments offer grants or zero-interest loans that can cover a portion of the down payment. For instance, buyers in certain areas can receive up to 5% of the home purchase price as a grant.

- Federal Housing Administration (FHA) Loans: FHA-insured loans allow buyers to secure financing with as little as 3.5% down, depending on their credit score.

- HomePath Ready Buyer Program: If you’re interested in buying a Fannie Mae-owned property, you might qualify for up to 3% in closing cost assistance if you complete a homebuyer education course.

Comparative Table of Assistance Programs

| Program Type | Assistance Amount | Eligibility Requirements |

|---|---|---|

| Down Payment Assistance | Up to 5% of purchase price | Varies by state, typically first-time buyers |

| FHA Loans | 3.5% down payment | Minimum credit score of 580 |

| HomePath Ready Buyer | Up to 3% in closing costs | Must purchase a Fannie Mae property |

| USDA Rural Development Loans | 100% financing available | Must purchase in eligible rural areas |

| VA Loans | 0% down payment possible | Must be a qualifying veteran or active-duty service member |

Real-World Examples of Assistance Programs

Consider Sarah, a first-time homebuyer in Texas, who was able to take advantage of a down payment assistance program. She received a $10,000 grant that covered her down payment, allowing her to purchase her first home at $200,000 without the stress of saving for years.

Another example is John, a veteran, who utilized a VA loan to buy his home with no down payment required. This not only saved him thousands upfront but also secured him a competitive interest rate that lowered his monthly payments.

Practical Implications for Your Homeownership Journey

Understanding and utilizing first-time buyer assistance programs can significantly impact your affordability. Here are some practical steps you can take:

1. Research Available Programs: Start by checking local government and nonprofit organizations that offer assistance. There may be options that are specific to your state or locality.

2. Get Pre-Qualified for Loans: Knowing your financing options can help you feel confident when applying for assistance programs. Reach out to lenders who are familiar with first-time buyer programs.

3. Attend Workshops: Some programs require homebuyer education workshops. These not only educate you on financing but can qualify you for additional assistance.

4. Calculate the Total Cost: Factor in the assistance amount to get a clear picture of what you can realistically afford and how much you may need to borrow.

Your eligibility for these programs can hinge on several factors, so it’s crucial to gather all pertinent information before making decisions. Consider this as your stepping stone towards homeownership—research diligently, ask questions, and explore every avenue available to you.