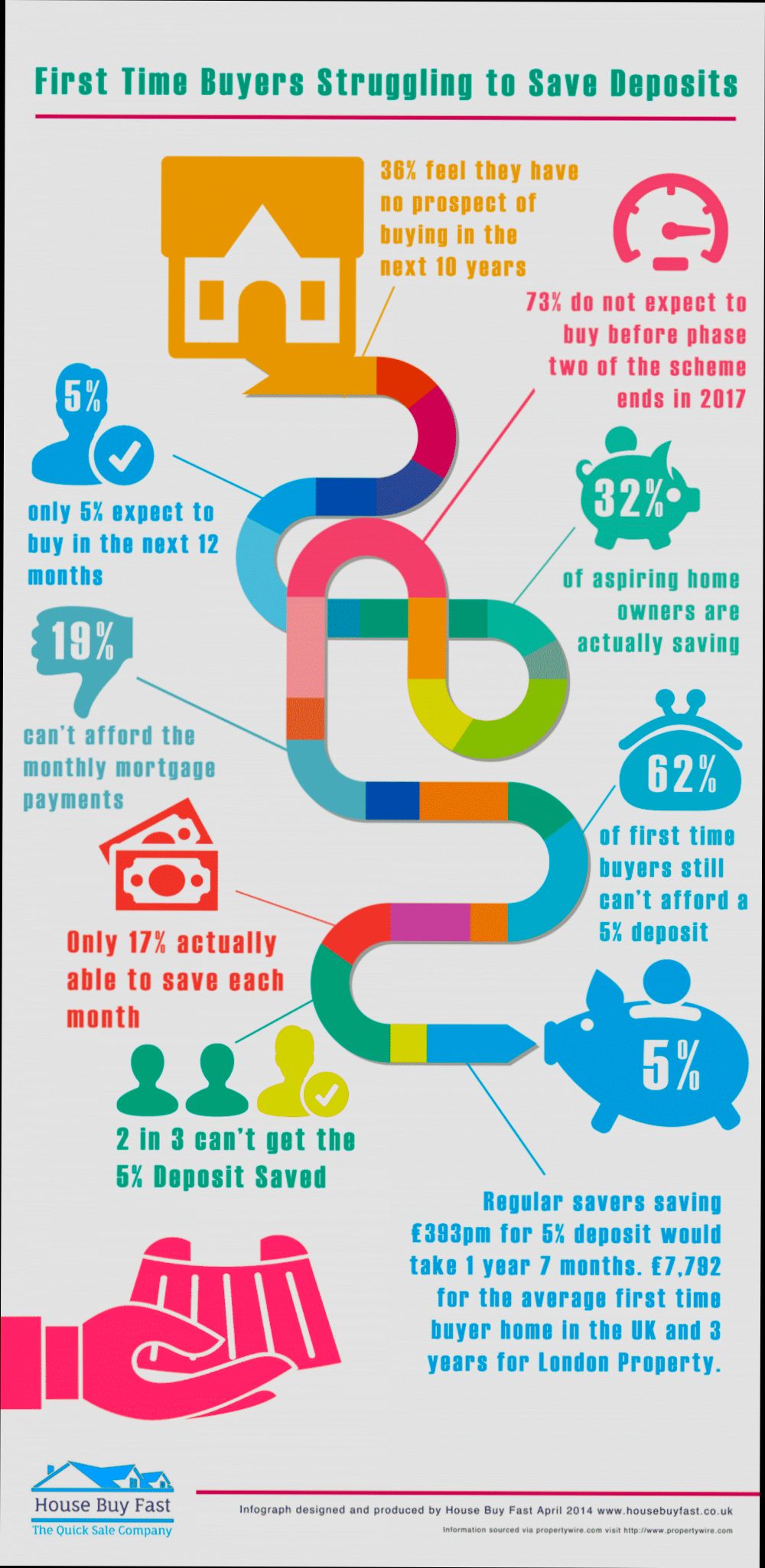

- Key Statistics on First-Time Home Buyers

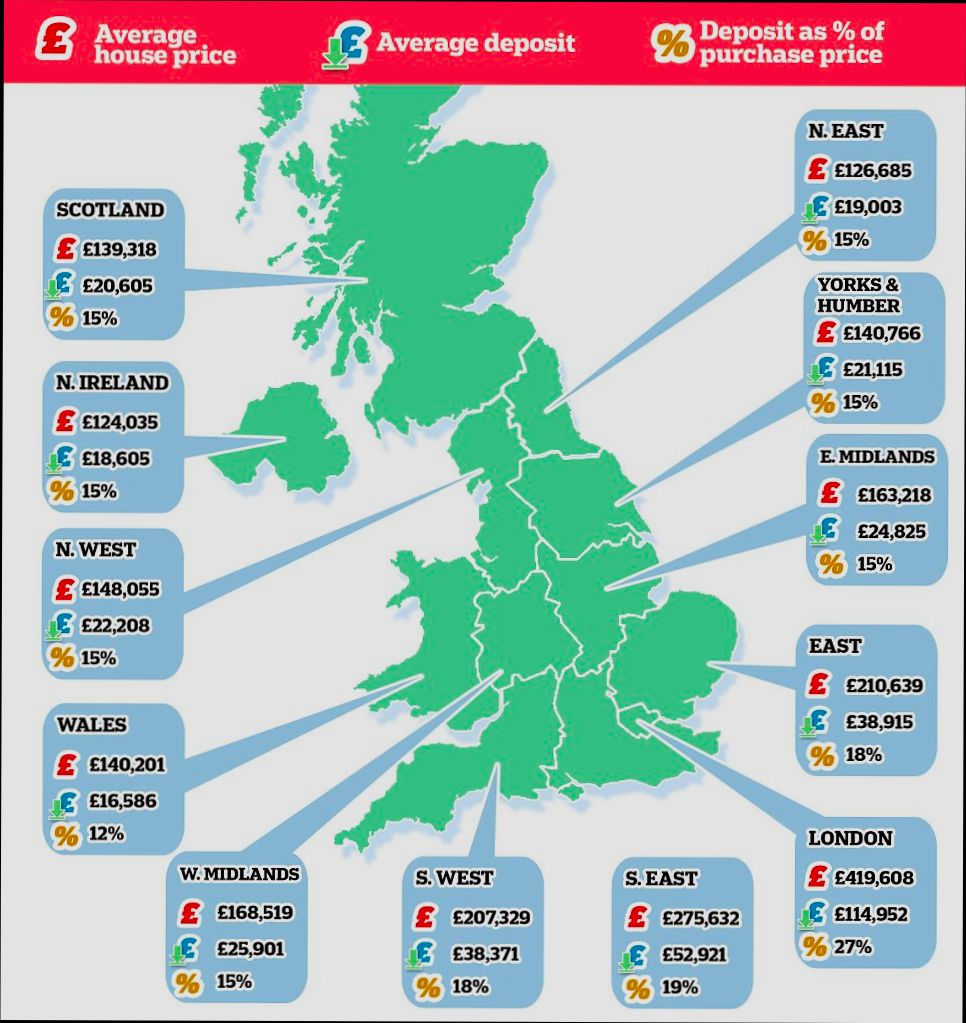

- Regional Price Comparisons: A Closer Look

- Top Cities for Budget-Conscious Buyers

- Cost of Living Impact on Home Purchase Feasibility

- Financing Options for First-Time Buyers in Spain

- Emerging Markets: Areas Showing Growth Potential

- Rental Market Trends for Future Home Buyers

- Government Incentives and Support for First-Time Buyers

- Buying vs Renting: What Makes More Sense in Spain?

- Exploring Financing Challenges for New Buyers

- Market Outlook: Future of Affordable Housing in Spain

Affordable regions for first time buyers in Spain are popping up more and more, making it easier for newcomers to dip their toes into the real estate market. If you’ve dreamt of owning a cozy villa or a charming apartment in a sun-drenched locale, now’s the time to explore your options. Many first-time buyers are finding attractive price points in areas like Valencia, where the vibrant culture and beautiful coastline come together without breaking the bank, or in Granada, renowned for its stunning architecture and rich history.

Another hotspot is Murcia, which boasts a lower cost of living and offers an appealing mix of urban and rural vibes. With its Mediterranean climate and proximity to some stunning beaches, it’s no wonder that first-time buyers are feeling drawn to this region. And let’s not forget about the Canary Islands, where properties can be surprisingly affordable compared to mainland Spain, especially as you head to some of the lesser-known islands. With plenty of options and regions to explore, it’s an exciting time for anyone looking to make their first purchase in Spain.

Overview of Affordable Regions in Spain

Alright, let’s dive into some of the most wallet-friendly regions for first-time buyers in Spain. You’ll be glad to know you don’t have to break the bank to own a slice of this beautiful country!

First up, Andalusia. This region, famous for its stunning architecture and rich culture, offers some of the best property prices in the country. In cities like Granada, you can find apartments for as little as €60,000, and even in prime spots, prices average around €1,200 per square meter. Plus, you’re surrounded by amazing tapas and vibrant flamenco!

Next, check out the Valencian Community. Areas like Castellón and Valencia present fantastic opportunities for new buyers. Here, you can snag a decent one-bedroom flat for around €80,000. The average price in Valencia hovers around €1,600 per square meter, which is a steal compared to other coastal cities!

Don’t overlook Murcia. This sunny region in Southeast Spain is perfect for those looking for affordable living. The city of Murcia has properties starting at €50,000, making it one of the cheapest options on the market. Plus, you’re just a short drive from beautiful beaches!

Lastly, consider Extremadura. It’s less known, but that’s what makes it an affordable gem. Cities like Plasencia and Cáceres feature homes starting from €40,000. It might not be as flashy, but Extremadura offers a peaceful lifestyle with a rich history and incredible landscapes.

So, if you’re looking to buy your first home in Spain without emptying your savings, these regions are definitely worth a look. Each of them has its own charm and perks, so grab a glass of sangria and start exploring your options!

Key Statistics on First-Time Home Buyers

If you’re a first-time home buyer in Spain, you’ll want to know a few key stats that can really shape your journey. For starters, did you know that around 40% of home purchases in Spain are made by first-time buyers? That’s a huge chunk, showing just how many people are stepping into the property market for the first time.

When it comes to affordability, let’s crunch the numbers. The average price of a home across Spain is about €1,500 per square meter. However, in more affordable regions like Extremadura or Murcia, you can find prices starting as low as €900 per square meter. Imagine the savings!

Now, in terms of financing, almost 80% of first-time buyers rely on mortgages. The average loan amount for first-time buyers is around €130,000, and lenders are generally offering interest rates that hover around 2%, which is pretty good these days.

Also, if you’re looking at property in cities like Valencia or Seville, expect to spend an average of €1,300 per square meter, compared to €2,500+ in hotspots like Barcelona or Madrid. That’s a significant saving, giving you more bang for your buck!

And here’s one more fun fact: first-time buyers typically range from 30 to 40 years old, with many opting for two-bedroom homes. So if you’re in that age group, you’re definitely not alone!

Regional Price Comparisons: A Closer Look

Let’s dive straight into the numbers and see where you can snag a great deal without breaking the bank!

Andalusia

If you have your heart set on sun-soaked beaches, Andalusia is a top contender. Here, you can find charming properties in places like Almería, where prices hover around €1,200 per square meter. Compare that to the coastal cities like Marbella, where prices can skyrocket to €3,000 and beyond! Crazy, right?

Valencia

Next up is Valencia, which offers a vibrant lifestyle at a reasonable cost. In the city center, you’re looking at about €1,800 per square meter. But head a bit further out, say to areas like Albufera, and that drops to around €1,200. You can enjoy beautiful oranges and amazing paellas without paying through the nose.

Murcia

Let’s not forget about Murcia! This region is often overlooked, which is a shame because it has some fantastic deals for first-time buyers. The average price here is around €900 per square meter. Yes, you read that right! With stunning landscapes and a slower pace of life, it’s a hidden gem.

Galicia

If you’re into stunning coastlines and lush green scenery, Galicia is where it’s at. Property prices in certain areas can be as low as €800 per square meter. Plus, the fresh seafood is unbeatable! Just imagine weekend getaways to the beach without the hefty price tag.

Conclusion

There you have it—a quick peek at the regional price tags across Spain. Whether you’re dreaming of a quaint cottage in Galicia or a modern flat in Valencia, Spain has something to suit your budget. It’s all about knowing where to look!

Top Cities for Budget-Conscious Buyers

If you’re a first-time buyer looking to make the leap into property ownership in Spain without breaking the bank, you’re in luck! There are some fantastic cities that won’t leave your wallet gasping for air. Let’s dive into a few of the best options out there!

1. Valencia

Valencia has become a hotspot for budget-conscious buyers. With an average property price around €1,500 per square meter, it’s a steal compared to other big cities like Madrid or Barcelona. Plus, you get stunning beaches, delicious paella, and a lively cultural scene. What more could you want?

2. Alicante

Alicante is another gem. Known for its sunny weather and beautiful coastline, you can find great deals here. Prices hover around €1,200 per square meter! Imagine soaking up the sun on the Costa Blanca while knowing you made a smart investment.

3. Murcia

If you’re seriously budget-minded, check out Murcia. The average property price is just about €1,100 per square meter! It’s less touristy than some other regions, which means you can enjoy a more authentic Spanish lifestyle without the crowds.

4. Granada

Granada is not only famous for its stunning Alhambra palace but also for its affordable housing. You can snag a place for around €1,300 per square meter. Plus, living here means you’re surrounded by breathtaking history and magnificent mountains!

5. Bilbao

While it’s a bit pricier than the others at about €2,000 per square meter, Bilbao is worth mentioning for its incredible quality of life. It’s a cultural hub with a fantastic culinary scene and less hustle and bustle compared to bigger cities.

In short, Spain has plenty to offer for first-time buyers who want great locations without emptying their pockets. From Valencia to Bilbao, there’s a city that matches your budget and lifestyle!

Cost of Living Impact on Home Purchase Feasibility

When it comes to buying your first home in Spain, the cost of living plays a huge role in deciding whether you can actually afford that cozy little spot you’ve been dreaming about. Let’s break it down.

First off, you’ve got to look at the balance between your income and expenses. For example, in areas like Madrid or Barcelona, you might find yourself staring at steep property prices—think around €3,500 per square meter or more! To be honest, that can eat up a big chunk of your monthly paycheck. Meanwhile, smaller cities like Valencia or Seville offer a much better deal. Here, the average price per square meter hovers around €1,500 to €2,200, making it way more manageable for first-time buyers.

Now, let’s chat about monthly expenses. In a city like Barcelona, you might be shelling out between €1,000 and €1,500 just for rent! On the flip side, cities like Alicante often have rents around €700 to €900, leaving you with extra cash for that beach day or salsa class. This lower cost of living can help you save up for that down payment, which typically sits at about 20% of the property price in Spain.

Speaking of savings, in a 2022 study, it was revealed that over 40% of Spaniards felt home affordability was a significant issue, especially in urban centers. But if you’re smart about where you look, regions like Extremadura or Galicia offer both lower property prices and a more relaxed lifestyle, which could be just what you need.

So, what’s the takeaway? The cost of living directly impacts your ability to buy a home. Focus on areas with a more favorable balance between income and expenses, and you’ll find it much easier to snag that first property without sacrificing your lifestyle. Happy house hunting!

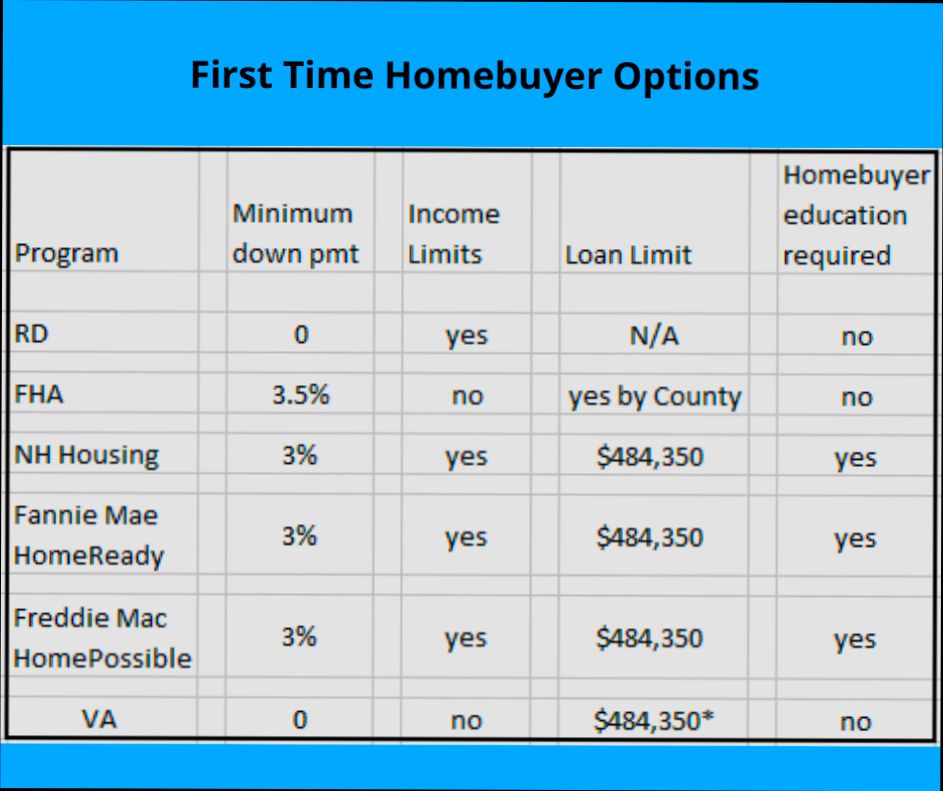

Financing Options for First-Time Buyers in Spain

So, you’re ready to take the leap into homeownership in Spain? That’s awesome! But you might be wondering how on earth you’re going to finance your new place. Let’s break it down!

1. Mortgage Loans

The most common route for first-time buyers is a mortgage. In Spain, banks typically offer mortgages up to 80% of the home’s value for residents and around 70% for non-residents. If you’re eyeing a cozy apartment for €150,000 in, say, Valencia, you’d need to come up with roughly €30,000 for the down payment. Sounds doable, right?

2. Government Aid and Subsidies

Spain has some sweet government programs to help first-timers. The Help for Young Buyers initiative is a gem, offering financial assistance for people under 35. You could snag up to €10,800 to help with your purchase. It’s definitely worth checking out!

3. The ‘Hipoteca Joven’

Another option is the Hipoteca Joven (Young Mortgage). This specifically targets buyers under the age of 36—if you qualify, you might score a lower interest rate and a smaller down payment requirement. It’s designed to make buying a home easier for younger people!

4. Personal Savings and Family Loans

Good old-fashioned savings can also save the day. A lot of first-time buyers tap into their savings or secure loans from family. This can be particularly helpful for those short on funds for that pesky down payment.

5. Check Out Local Credit Unions

Don’t forget about local credit unions! They often have lower fees and more flexible terms compared to traditional banks. Plus, they tend to know the local market better, which is a bonus for first-time buyers.

In conclusion, financing your first home in Spain doesn’t have to be a nightmare. With various options tailored for first-timers, you can find the best fit for your situation. Do your homework, and don’t be afraid to ask for help from financial advisors—they’re there for a reason!

Emerging Markets: Areas Showing Growth Potential

When it comes to finding affordable regions in Spain for first-time buyers, some emerging markets are really catching the eye. If you’re considering buying a home, it’s worth looking at these up-and-coming areas that offer both great value and potential for appreciation.

One standout region is Valencia. With its stunning beaches, vibrant culture, and growing job market, it’s no wonder more and more folks are flocking here. House prices are still much lower than in big cities like Madrid or Barcelona, with average prices around €1,500 per square meter. Plus, Valencia has seen a 10% rise in property values in the last year alone!

Another area to keep on your radar is Murcia. This region is often overlooked but packs a punch when it comes to affordability. You can snag a decent apartment for around €1,200 per square meter. And, with new developments popping up, the region is slowly gaining popularity among locals and expats alike.

Don’t forget about Andalusia. While some parts can be pricey, areas like Almería and Cádiz offer some fantastic deals. Property in Almería averages around €1,350 per square meter. With beautiful coastlines and a rich cultural heritage, it’s an appealing option for first-time buyers looking for a slice of paradise.

Lastly, check out Granada. With its stunning views of the Sierra Nevada and a strong student population, the demand for rental properties is on the rise. Average prices are around €1,600 per square meter, but given the city’s charm and vibrancy, investing here could pay off big time.

So, if you’re a first-time buyer, don’t just stick to the well-trodden paths. Look into these emerging markets where you can find great value and a brighter future for your investment!

Rental Market Trends for Future Home Buyers

If you’re eyeing a home in Spain but still juggling rent, it’s good to keep an eye on the rental market trends. They can provide some valuable insights into where the best opportunities might lie for buying in the future.

First off, rents have been on the rise in many popular regions. According to recent data, rental prices in cities like Madrid and Barcelona increased by about 4-6% in the last year alone. This spike can make it tough for renters to save up for a down payment on a home. So, if you’re renting here, it might be time to explore more affordable spots.

Now, let’s talk locations. If you’re thinking about trading your rent for a mortgage, areas like Valencia or Malaga are looking really appealing. Here’s a fun fact: while rent in Madrid can average around €1,900 for a three-bedroom apartment, you can find similar spaces in Valencia for about €1,200. That difference can help you rack up savings quicker!

Additionally, the rental market is experiencing a shift towards more flexible living. Many young professionals are opting for co-living spaces or shared apartments, making them more open to areas further from city centers. This trend could lead to price drops in those prime locations, and potentially, affordable purchases for hungry buyers.

Let’s not forget the rising interest in outer suburbs or smaller cities, like Alicante. Recent surveys show a growing interest in these regions, with rent prices being significantly lower—around €900 for a three-bedroom—encouraging first-time buyers to consider their options here.

In summary, staying alert to these rental trends can really position you to make a smart home-buying move down the line. By keeping an eye on price changes and growing areas, you can choose a location that fits your budget and lifestyle.

Government Incentives and Support for First-Time Buyers

If you’re dreaming of owning your first home in Spain, you’ll be glad to know the government has your back! There are some neat incentives and support programs out there specifically for first-time buyers that can make a huge difference in your journey.

Tax Benefits

One of the most attractive perks is the tax deduction on property purchases. In many regions, first-time buyers can deduct up to 7.5% from their personal income tax for the purchase of their first home—this can save you a pretty penny! If you’re moving to affordable areas like Valencia or Alicante, this incentive becomes even more crucial as property prices are relatively lower.

Reduced Stamp Duty

The Spanish government also offers a reduction in stamp duty, which can be a major expense. In regions like Catalonia, first-time buyers can benefit from reduced rates, where the stamps can be as low as 1%-2% of the property value. This can add up to significant savings, particularly on homes priced between €100,000 and €200,000.

Help with Mortgages

Another fantastic support option comes from banks. Many Spanish banks offer preferential mortgage conditions for first-time buyers, like lower interest rates or reduced down payments. For example, some lenders only require as little as 10% down instead of the typical 20%, allowing you to enter the property market without breaking the bank.

State-sponsored Programs

On a broader scale, programs like the Social Housing Plan target first-time buyers looking for affordable options. This initiative provides financial assistance and aims to make housing more accessible. In 2021, the Spanish government allocated about €3 billion to this plan, which helps thousands of young adults find their sweet spot in the housing market.

Mortgage Grants

And let’s not overlook the regional grants! Some areas, such as Andalusia, offer direct grants or subsidies for first-time homebuyers. These can mean thousands of euros in assistance that you could put towards your home purchase, making that dream more achievable.

So, if you’re seriously considering a home in Spain, take advantage of these government incentives. They’re designed to ease the journey for first-timers like you. With the right knowledge and planning, you’ll be unlocking the door to your new home in no time!

Buying vs Renting: What Makes More Sense in Spain?

So, you’ve got your eye on Spain, and you’re wondering whether to buy a home or rent. Let’s break it down in a way that actually makes sense.

First off, let’s look at the numbers. In cities like Barcelona and Madrid, the average rent for a one-bedroom apartment can set you back about €1,200-€1,500 per month. That’s a whopping €14,400-€18,000 a year! Over time, this money doesn’t build any equity. Poof! It’s gone. On the flip side, if you buy a small apartment costing around €200,000, with a mortgage rate of about 2.5% over 25 years, your monthly payments could be in the ballpark of €900. You’d be investing in something that appreciates over time, and you’d eventually own it outright!

Now, I know what you’re thinking—“But I’m not ready to tie myself down!” That’s a valid point! Renting gives you the flexibility to move around without a huge commitment. If you’re planning to stay in Spain for only a couple of years, renting might make more sense. Plus, lesser responsibilities come with renting—no hefty maintenance costs or property taxes to worry about!

Let’s consider some regions where buying might be the smarter choice. In places like Valencia or Málaga, the real estate market is much more affordable compared to Madrid. You can find lovely two-bedroom apartments under €150,000, making it easier for first-time buyers. While the average cost of renting can still hover around €800-€1,000, investing in a place could be a game-changer.

Another thing to keep in mind is that the rental market in Spain is heating up. Prices are rising—up nearly 5% year-on-year in many areas! This trend might make purchasing more appealing if you want to avoid paying more in rent down the line.

In the end, it all boils down to your personal situation. If you crave stability and have a longer-term plan (let’s say 5-10 years), buying could be a no-brainer. But if you love the freedom that comes with renting, then go for it! Just keep an eye on the market, because what works today might change tomorrow.

Exploring Financing Challenges for New Buyers

So, you’ve found your dream home in sunny Spain—maybe a quaint little flat in Valencia or a cozy bungalow in Malaga. But then reality hits: how are you actually going to pay for it?

Let’s break it down. First off, getting a mortgage can be a bit of a maze for new buyers, especially if you’re not a resident of Spain. Many banks will only lend to non-residents if you can put down a hefty deposit of around 30% of the property’s value. That’s a big chunk of change! For example, if you’re eyeing a €150,000 property, you’ll need to fork over €45,000 upfront. Ouch!

Another kicker? Interest rates. As of recent reports, mortgage rates in Spain range from 2% to over 4%, depending on the bank and your financial history. Compare that to other countries in Europe where rates could be even lower. It’s crucial to shop around and see what suits your budget best.

Don’t forget about fees, either. You’ve got to factor in notary fees, property tax, and registration costs. On average, these can add about 10% to the purchase price. Surprise! Budgeting for these can feel like navigating through a financial jungle.

If finances seem daunting, there are some positives to note. Some regions, particularly the rural areas, offer lower prices and potentially lower deposits. In places like Extremadura or parts of Murcia, you might find charming homes for under €100,000. Less stress, more sun, right?

Finally, consider government programs aimed at helping first-time buyers. While the options might not be as abundant as you’d hope, there are sometimes incentives for young buyers or families. Keep your eyes peeled for local initiatives that might help lighten the financial load.

In short, while buying in Spain may come with its set of challenges, being informed and prepared can make your dream of owning a home in the sun a reality.

Market Outlook: Future of Affordable Housing in Spain

As we look ahead, the future of affordable housing in Spain looks like it’s got its ups and downs. With rising property prices in major cities like Madrid and Barcelona—where a small apartment can easily set you back over €250,000—it’s clear that first-time buyers are feeling the pinch. But don’t fret! Some regions are bucking the trend and offering more wallet-friendly options.

Take places like Valencia and Alicante. These coastal gems not only offer beautiful beaches but also have seen property prices increase at a slower rate. In fact, average apartment prices in Valencia hover around €150,000, making it a hotspot for those just starting out. Plus, with the city’s ongoing improvements in infrastructure and living conditions, it’s becoming increasingly attractive.

And let’s not overlook Andalusia! Towns like Seville and Málaga present affordable options compared to the pricier urban centers. You can snag a decent apartment in Seville for around €120,000. It’s not just about the price; these areas boast a rich culture, vibrant lifestyles, and, of course, that famous Spanish sun. Did you know? The Andalusia government has also been rolling out initiatives aimed at boosting affordable housing projects, which can only help first-time buyers.

Moving east, the Balearic Islands are traditionally known for being pricey, but places like Menorca or even parts of Mallorca are seeing cheaper listings. Around €200,000 can get you a cozy little spot there—perfect for that dream vacation home that doubles as an investment.

One trend that’s catching on is the rise in sustainable housing. With a growing number of eco-friendly developments, buyers are not just looking for a home, but also for one that aligns with their values. Imagine living in a solar-powered apartment community in a city like Bilbao, where prices average around €175,000. Not only do you get a place to call your own, but you also contribute to a greener planet.

In conclusion, while the overall trend might seem daunting, there are plenty of avenues for first-time buyers to explore. Areas like Valencia, Seville, and even hidden gems in the Balearics offer hope for many looking to take that first step into home ownership. Keep your eyes peeled, stay informed, and you might just find your affordable dream home in sunny Spain!