What is the Cost of Living in Spain? If you’ve ever dreamed of sipping sangria by the beach or exploring vibrant local markets, then you’re probably curious about the financial aspect of living the Spanish dream. On average, a single person can expect to spend around €800 to €1,200 per month, depending on the city and lifestyle choices. For instance, renting a cozy one-bedroom apartment in Madrid’s city center might set you back about €1,200, while the same apartment in a smaller city like Valencia would cost you closer to €700.

Food and dining out also factor heavily into the equation. A meal at a mid-range restaurant typically costs around €15, while grabbing a quick bite from a local tapas bar can be less than €10. And don’t forget about the weekly groceries, which can range from €200 to €300 for one person, depending on your shopping habits. So whether you’re savoring fresh seafood along the coast or indulging in churros con chocolate in a bustling plaza, understanding the cost of living in Spain gives you a clearer picture of what to expect.

Understanding Regional Variations in Costs

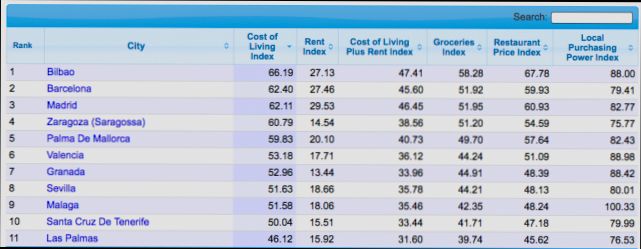

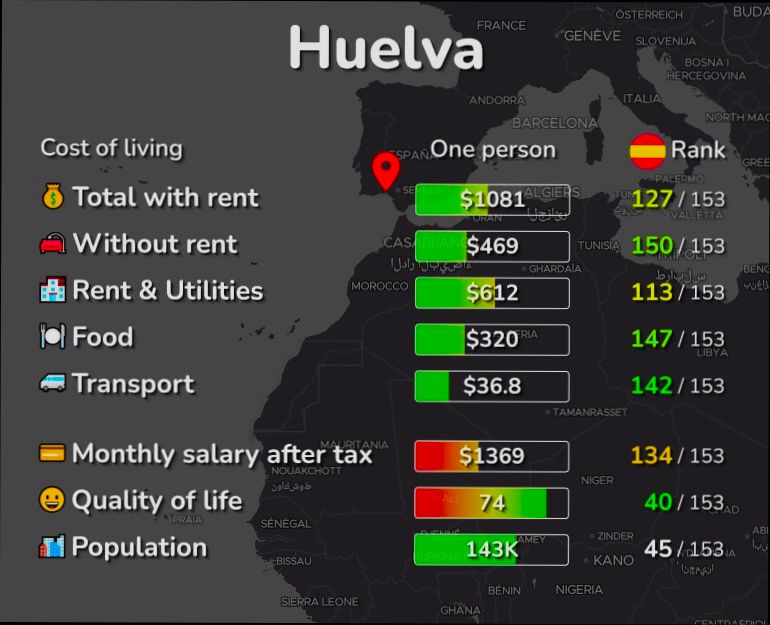

When considering the cost of living in Spain, it’s vital to understand that costs can vary significantly from one region to another. These variations impact everything from housing to groceries, and knowing this can help you make well-informed decisions.

Key Points on Regional Cost Variations

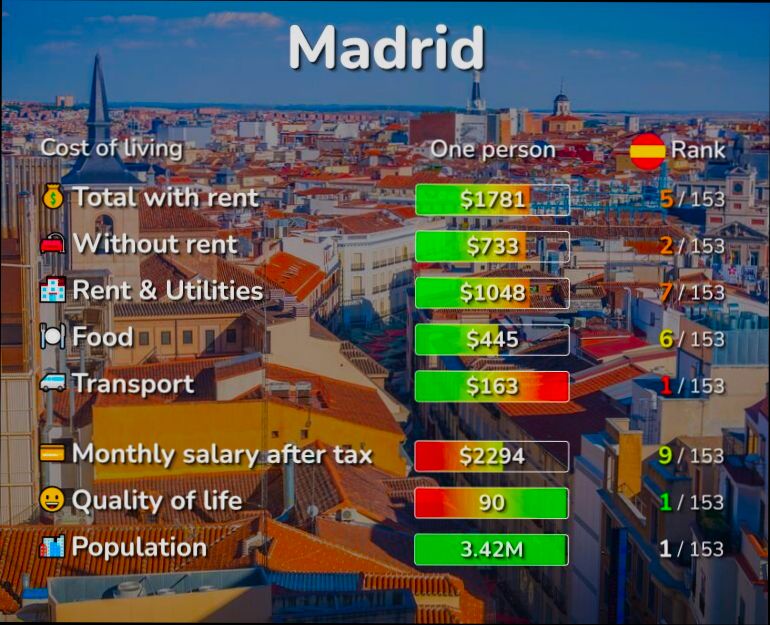

- Cost Disparities: The cost of living in Madrid is approximately 15% higher than in smaller cities like Valencia or Seville. This means if you’re moving from a bustling capital to these cities, you could enjoy a lower lifestyle cost.

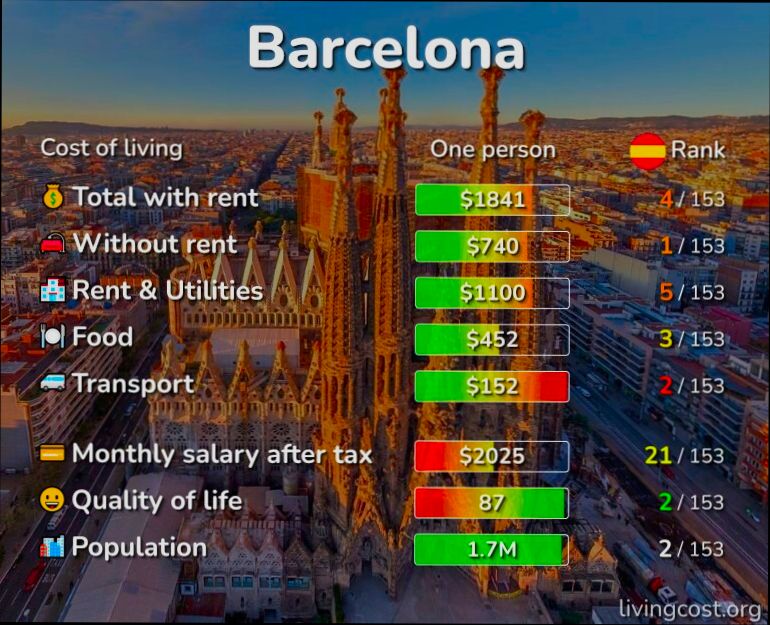

- Housing Costs: For rental prices, Barcelona’s average cost per square meter is around €18, while regions like Andalusia can offer rentals at about €10 per square meter. This disparity can lead to substantial savings if you choose a less urban locale.

- Grocery Prices: In areas like Galicia, essential grocery items can cost up to 20% less compared to the national average. For instance, a liter of milk might be €0.70 in Galicia versus €0.85 in urban centers such as Madrid or Barcelona.

Comparative Costs Table

| Region | Average Rent (€) | Grocery Cost Index (against national average) | Utility Costs (€) |

|---|---|---|---|

| Madrid | 1,200 | 110% | 150 |

| Barcelona | 1,100 | 115% | 140 |

| Valencia | 850 | 95% | 120 |

| Seville | 800 | 90% | 130 |

| Galicia | 700 | 80% | 110 |

Real-World Examples

- Moving from Madrid to Seville could result in a significant reduction of monthly expenses. For example, a couple could save up to €400 monthly on rent alone.

- A family shopping in Galicia might spend around €150 less each month on groceries compared to their counterparts in Barcelona, due to better local prices.

Practical Implications for Readers

As you assess where to live in Spain, pay close attention to these regional costs. If you work remotely or can choose where to settle, consider these factors.

- If affordability is key, regions like Galicia or the smaller towns in Andalusia could provide a comfortable lifestyle at a fraction of the cost you’d incur in cities like Madrid or Barcelona.

- When budgeting, factor in not just housing but also day-to-day expenses. Switching to a region with lower grocery prices alone can have a considerable impact on your overall budget.

Specific Facts and Actionable Advice

Always research local markets and stay updated with current pricing trends. Each region not only varies in cost but may also offer unique local discounts, which can help you save even more. Make informed decisions based on thorough local research, and you might find your slice of paradise without breaking the bank.

Housing Expenses: Renting vs Buying

Deciding between renting and buying a home is pivotal for many individuals and families in Spain. It’s essential to weigh the financial implications, responsibilities, and lifestyle impacts of both options to make an informed choice.

Key Points

1. Financial Commitment vs. Cost Efficiency:

- Buying a home requires a substantial financial commitment upfront, including down payments, closing costs ranging from 2% to 5% of the home’s price, and ongoing expenses like maintenance. Renting typically involves lower initial payments, including just a security deposit and monthly rent, making it more cost-efficient in the short term.

2. Maintenance Obligations:

- Homeowners should budget roughly 1% of their home’s value annually for maintenance. In contrast, when renting, these maintenance responsibilities are usually managed by the landlord, freeing tenants from unexpected repair bills.

3. Market Condition Dynamics:

- With mortgage rates hovering around 7.03% as of 2025, buying a home might be less appealing compared to renting, which often provides more flexibility in such fluctuating markets. Higher mortgage rates elevate the overall costs of homeownership, making renting a more financially sensible option for many.

Comparative Table

| Housing Aspect | Renting | Buying |

|---|---|---|

| Upfront Costs | Lower (security deposit) | High (down payment + closing fees) |

| Maintenance | Landlord’s responsibility | 1% of home’s value annually |

| Flexibility | High, easy to relocate | Low, complex selling process |

| Equity Growth | No equity building | Builds equity over time |

| Monthly Stability | Potential for rent increases | Fixed-rate mortgage payments |

Real-World Examples

Imagine a young professional considering living in Barcelona. If they choose to rent a one-bedroom apartment at €1,200 monthly, their total annual expenditure on housing would be approximately €14,400, which includes just the rent. On the other hand, if they opt to purchase a similar apartment for €300,000, their immediate financial commitment would involve at least €6,000 to €15,000 in closing costs and an annual maintenance bill of €3,000. Such an investment requires careful financial planning, especially given the current high mortgage rates.

Alternatively, a family in Valencia might prioritize stability for their children. Buying a home could become attractive if they consider the potential for property appreciation, which can secure their financial future. However, they must also plan for ongoing expenses beyond the mortgage, such as property taxes and maintenance.

Practical Implications

When considering your housing options in Spain, take into account your lifestyle and financial landscape:

- If you highly value mobility for career growth, renting may suit you better.

- For those with long-term plans in a specific community, buying might provide not only a home but also a valuable asset.

As you navigate the renting or buying decision, remember to factor in all associated costs, including potential increases in rent, monthly mortgage payments, and upkeep tied to homeownership. Evaluating your situation against current market conditions can significantly impact your financial well-being.

By understanding these nuances around housing expenses, you’ll be better equipped to decide whether renting or buying aligns with your financial goals and lifestyle preferences.

Grocery Prices and Food Affordability

When diving into grocery prices and food affordability in Spain, you’ll discover a landscape that can significantly impact your monthly budget. Understanding what you’ll spend on groceries is crucial for effective financial planning, especially if you’re moving or traveling to Spain.

Understanding Grocery Prices

Grocery prices in Spain can vary based on local markets, brand preferences, and purchasing habits. Here are a few key points to consider:

- Cost of Basic Ingredients: Staple items such as bread, rice, and milk can vary significantly in price. On average, a liter of milk costs around €1.20, while a loaf of bread is typically priced at approximately €1.

- Fresh Produce: Fresh fruits and vegetables are relatively affordable. For example, you might pay around €2 for a kilogram of apples or €1.50 for a kilogram of tomatoes, making a fresh diet quite accessible.

- Meat and Fish: Depending on the type, prices can fluctuate. Chicken breast costs roughly €7 per kilogram, while fresh fish, particularly local catch, can vary between €8 to €12 per kilogram.

Comparative Grocery Prices Table

| Item | Average Price (Spain) | Price Range (€/kg) |

|---|---|---|

| Milk (1 liter) | €1.20 | €1.00 - €1.50 |

| Bread (loaf) | €1.00 | €0.90 - €1.20 |

| Apples (fresh) | €2.00 | €1.50 - €3.00 |

| Chicken Breast | €7.00 | €6.00 - €8.50 |

| Fresh Fish | €10.00 | €8.00 - €12.00 |

Real-World Examples

In urban areas like Barcelona, shopping at local markets can sometimes yield better prices compared to supermarkets. For instance, many local shoppers report that buying fruits directly from markets can save you about 15% compared to grocery store prices.

Conversely, in smaller towns, prices typically decrease further due to lower overhead in local vendors. For example, a resident in a small town could buy fresh vegetables for about €1.20 per kilogram, compared to €1.50 in major cities.

Practical Implications

For anyone considering living in or moving to Spain, here are a few actionable insights:

- Shop Local: Whenever possible, shop at local markets rather than large chains. You’ll often find fresher produce and better prices.

- Seasonal Eating: Embrace seasonal fruits and vegetables. This not only supports local farmers but also helps you save money since these items are usually available at lower prices during peak times.

- Bulk Buying: If you have the storage space, buying staples like rice and pasta in bulk can lead to significant savings. Consider purchasing these items at wholesale stores or larger supermarkets.

Actionable Advice

- Keep an eye on weekly flyers or promotions from local grocery stores, as many offer discounts on certain days.

- Join community groups or forums focused on expat living in Spain to share tips and discover the best local places for grocery shopping.

- Budget around €200-€300 per month for groceries for a single person, adjusting based on dietary preferences and eating habits.

By understanding the landscape of grocery prices in Spain, you can better prepare for how food affordability will impact your overall cost of living.

Utilities and Other Monthly Bills

When planning your living expenses in Spain, utilities and other monthly bills play a significant role. From electricity and water to internet and transportation, understanding these costs is crucial for effective budgeting. Let’s dive into the specific expenses you can expect in your monthly bills while living in Spain.

Key Monthly Bills Overview

Utilities in Spain can vary based on your consumption and the region, but here’s a general idea of what you might encounter:

- Electricity: For a typical household, expect to pay around $150 for electricity. Depending on your usage and the season, this can fluctuate.

- Water: Water bills are generally lower than electricity, coming in at about $50 per month for an average household.

- Gas: If your home uses gas for heating or cooking, budget around $50 monthly.

- Internet: High-speed internet is accessible in most urban areas for approximately $35 per month, making it easy to stay connected.

- Cellphone: Monthly cellphone plans can be quite economical, costing about $15.

Here’s a comparative look at the average utility expenses for two different living scenarios:

| Expense | Scenario 1 (Higher Cost) | Scenario 2 (Lower Cost) |

|---|---|---|

| Electricity | $150 | $80 |

| Water | $50 | $25 |

| Gas | $50 | $30 |

| Internet | $35 | $35 |

| Cellphone | $15 | $15 |

| Cable / Pay TV | $20 | $20 |

| Total | $320 | $205 |

Real-World Examples

Consider two scenarios:

1. Scenario 1: A couple living in a furnished two-bedroom flat in Madrid faces higher utility costs. The combined monthly utility bill amounts to around $320.

2. Scenario 2: In a less expensive area like Valencia, the same couple may only spend approximately $205 on utilities due to lower rates and different consumption habits.

Practical Implications for Budgeting

Understanding these utility costs not only helps you budget more accurately but also allows you to seek out potential savings. If you can minimize your electricity usage, for instance, you can significantly reduce that $150 bill. Additionally:

- Consider Energy Efficiency: Using energy-efficient appliances or being mindful of electricity consumption can lead to lower monthly bills.

- Explore Discounts: Some providers offer discounts for bundled services. For instance, signing up for both internet and cable may reduce your overall costs.

- Monitor Usage: Keep track of your consumption, especially during peak seasons when electricity rates may increase.

Actionable Advice

- Anticipate Changes: Be aware of seasonal fluctuations in utility costs. For instance, air conditioning in summer can spike electricity usage.

- Compare Providers: Regularly review your utility providers and consider switching if you find better rates. Comparison sites can be helpful in identifying the best deals.

By understanding and managing your utilities and monthly bills in Spain, you can ensure a more comfortable and budget-friendly living experience.

Analyzing Cost of Living Statistics

When it comes to understanding the cost of living in Spain, analyzing statistics provides a clearer picture of what you can expect. By diving into the numbers, we gain insights that aid in budgeting, planning, and ultimately making informed decisions about living expenses.

Key Points on Cost of Living Statistics

- Consumer Price Index (CPI): Spain’s CPI shows a year-over-year increase of approximately 2.5%, reflecting the inflationary trends affecting consumer goods and services. This means that prices are gradually rising, impacting daily expenses.

- Transportation Costs: If you’re considering public transport, fares can differ significantly across cities. For instance, a monthly transport pass in Barcelona can cost around €40, while in smaller cities, it can be as low as €25, showcasing the variations in transportation-related expenses.

- Entertainment Spending: Budgeting for leisure is also essential. The average monthly expenditure for entertainment can reach €100 to €150 in urban centers, while smaller towns often see costs as low as €70. Understanding these figures can help you gauge lifestyle choices based on your location.

Comparative Table of Cost of Living Statistics

| Expense Category | Urban Center Average | Smaller Towns Average |

|---|---|---|

| CPI Yearly Increase | 2.5% | 2.5% |

| Monthly Transport Pass | €40 | €25 |

| Entertainment Spending | €100 - €150 | €70 |

| Dining Out (Meal for Two) | €50 | €30 |

Real-world Examples of Analyzing Cost of Living Statistics

In cities like Madrid, the cost of dining out at a mid-range restaurant can average €50 for a meal for two, reflecting higher urban living expenses. In contrast, a similar dining experience in places such as Granada may only cost around €30, emphasizing the significance of location in these statistics.

For transportation, considering a common scenario where an individual has to commute daily, understanding that a monthly pass in Valencia costs €35 against Barcelona’s €40 can influence where one decides to settle based on commuting costs.

Practical Implications for Readers

When analyzing cost of living statistics, it’s vital to factor in the comprehensive picture these numbers portray. Use the CPI to anticipate how cost fluctuations might influence your overall budget. If you’re moving to a city, compare transportation fares and entertainment expenses to predict possible lifestyle changes.

Moreover, consider the disparity in dining costs as a crucial element in budgeting for social outings or dining experiences. Weigh your options, taking into account these statistics to make choices that align with your financial goals.

Actionable Advice on Cost of Living Statistics

Stay informed about monthly shifts in the Consumer Price Index as this impacts what you pay for groceries, utilities, and services. Regularly updating your budget based on transportation and entertainment costs can significantly enhance your financial planning. Be proactive in analyzing local data, as even a few percentages can impact your wallet over time.

The Financial Benefits of Living in Spain

Living in Spain comes with a myriad of financial advantages that can enhance your quality of life while keeping your expenses in check. From an impressive work-life balance to affordable healthcare, Spain offers a unique blend of benefits that make it a favorable place for both expats and locals.

Work-Life Balance and Maternity Leave

- Enjoying a healthy work-life balance is a standout feature of life in Spain. Many companies adopt a horario intensivo, especially during summer, allowing you to finish work earlier and enjoy the beautiful weather.

- Spain also offers equal paternity and maternity leave, which can be a financial advantage, allowing both parents to share childcare responsibilities while retaining income.

Affordable Living Costs

When compared to other Western European countries, Spain often presents a more affordable lifestyle. Here’s a quick glance at housing costs in various regions, which reveal just how accessible living can be in Spain:

| Region | Average House Price (per m²) |

|---|---|

| Balearic Islands | €3,353 |

| Madrid | €2,967 |

| Basque Country | €2,706 |

| Catalonia | €2,317 |

| Andalusia | €1,768 |

| Valencia region | €1,487 |

For instance, if you’re considering buying property in the Valencia region, you could find prices as low as €1,487 per m², considerably less than in major cities like Madrid or Barcelona.

Quality Healthcare

Spain boasts an excellent public healthcare system that offers many services free of charge or at a low cost. According to research, expats often emphasize the financial relief brought by access to quality healthcare without the exorbitant private insurance fees found in other countries. This can save you hundreds of euros annually.

Diverse Culinary Scene

Spain’s rich culinary reputation is not only a treat for your taste buds but also economical. Eating out in Spain is generally more affordable than in many Western European countries. A typical meal in an affordable restaurant can cost around €10-€15, allowing you to enjoy high-quality food without breaking the bank.

Cost-Effective Public Transport

Spain’s extensive public transport network makes getting around affordable and convenient. If you intend to travel frequently within cities or regions, consider a transport pass. For example, in Madrid, a monthly public transport pass costs about €54, significantly lower than transport costs in many major cities worldwide.

Real-Life Example

Consider Maria, who moved from Germany to Barcelona. She found her monthly rent for a one-bedroom apartment in the city center to be around €1,200, which is comparable to what she paid back home. However, with Spain’s lower grocery and dining out costs, she reported savings of up to €300 each month, allowing her to allocate money towards her travel adventures in Europe.

Practical Implications

If you’re mapping out a budget, consider these financial benefits:

- Leverage Spain’s diverse landscapes and climates to find a location that suits your lifestyle, possibly saving more on utilities or housing.

- Factor in the lower dining and grocery costs as part of your living budget, allowing for a more enjoyable lifestyle without financial strain.

Eating out, public transport, and affordable housing are just a few aspects of financial life in Spain that can enhance your overall experience while keeping expenses manageable. By understanding these benefits, you can make the most out of your move or stay in this vibrant country.

Real-Life Experiences of Expatriates

Living as an expatriate in Spain offers a mix of exciting experiences and challenges, shaped by cultural nuances and economic realities. Understanding these real-life experiences helps you grasp what life will be like in this vibrant country.

Key Aspects of Expat Life

1. Community and Integration: Expatriates often find the process of integrating into Spanish society rewarding. Many expats join local clubs or organizations, fostering friendships with locals and other foreigners, which can ease the transition.

2. Language Matters: While English is commonly spoken in tourist areas, knowing even basic Spanish significantly enriches your experience and helps in daily interactions, whether shopping or asking for directions. Many expats recommend enrolling in language classes to accelerate your fluency.

3. Healthcare Access: Even though Spain has a robust healthcare system, expatriates sometimes face difficulties navigating the bureaucracy, which can require some patience. Having private health insurance can ease your access to quicker treatment options.

4. Transport and Accessibility: Most expats praise Spain’s well-developed transportation network, particularly the high-speed train. You can easily explore both local spots and neighboring countries, enhancing your travel experiences.

Comparative Costs for Expatriates by Region

| Region | Average Property Price (€/m2) | Rental Price (1-bedroom, city center) | Monthly Transport Pass |

|---|---|---|---|

| Balearic Islands | €3,353 | €1,000 | €40 |

| Madrid | €2,967 | €1,200 | €54 |

| Catalonia | €2,317 | €950 | €40 |

| Basque Country | €2,706 | €850 | €45 |

| Andalusia | €1,768 | €650 | €30 |

| Valencia region | €1,487 | €700 | €37 |

Real-World Examples

- Sarah’s Journey in Madrid: Sarah, an expatriate from Canada, settled in Madrid and shared her initial experiences with the local rental market. She found that while prices in the center can be steep, neighborhoods on the outskirts offered good deals. She paid €1,300 for a modern apartment with easy access to public transportation, allowing her to explore the city without relying on a car.

- Mark in Valencia: After moving to Valencia, Mark discovered the culinary delights and cultural richness. He noted that dining out was affordable, with an average meal costing around €12 at local restaurants. This openness to enjoyment made life rewarding and sociable for him.

- Emily’s Health Experience: Emily, a healthcare worker from Australia, found the Spanish healthcare system to be efficient but noted that navigating the administrative side could be tricky, especially when trying to find a family doctor. She recommended fellow expatriates familiarize themselves with local hospitals early on.

Practical Implications for Expatriates

- Network Building: Engage with your local expat community through social media or meet-up events that cater to expatriates. This can provide a support system and valuable local tips.

- Language Classes: Invest time in Spanish language courses. They not only improve communication but also help you feel more connected to the culture and community.

- Explore Beyond Tourism: Utilize Spain’s efficient transport system to visit lesser-known cities and regions, broadening your understanding of Spanish culture and lifestyle.

Overall, navigating real-life experiences as an expatriate in Spain requires flexibility, cultural sensitivity, and a willingness to learn. Embrace each opportunity as a step towards a fulfilling life abroad.