What is NOI in Real Estate? Simply put, it’s the Net Operating Income, a key metric that tells you how profitable an income-generating property is. Picture this: you own a small apartment complex with ten units, and each one rents for $1,000 a month. That gives you a solid monthly income of $10,000. But wait! You’ve got to factor in expenses like maintenance, property management, utilities, and property taxes. Say your total expenses come to $4,000 monthly; that means your NOI would be $6,000. This straightforward calculation helps you understand the financial health of your investment.

Now, let’s look at another example. Imagine buying a commercial property, like a retail space, for $500,000. If you bring in $60,000 annually from leases but spend $20,000 on upkeep and management, your NOI would stand at $40,000. This number becomes crucial when assessing your return on investment and deciding whether to hold or sell the property. Whether you’re checking out a cozy duplex or a bustling shopping center, understanding NOI is essential for making informed decisions in real estate.

Understanding the Fundamentals of NOI

When diving into real estate investments, understanding Net Operating Income (NOI) is crucial. It serves as a cornerstone metric that helps you evaluate a property’s profitability. In this section, let’s explore the key elements that make up NOI and how you can apply this knowledge effectively.

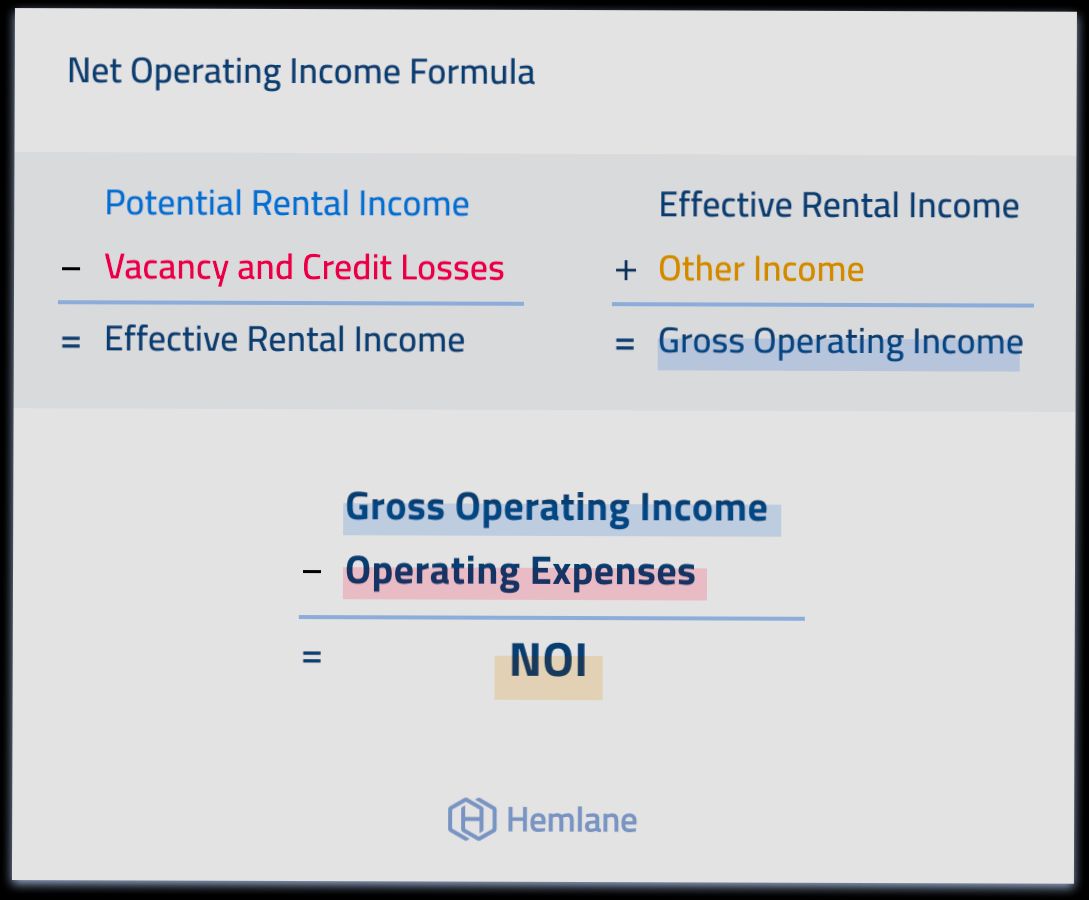

Key Components of NOI

Net Operating Income isn’t just a simple number; it encompasses various factors that influence your revenue and expenses. Here are some critical components to consider:

- Rental Income: This is typically the largest source of income. According to research, on average, rental income constitutes about 85% of total revenue for multi-family properties.

- Vacancy and Credit Loss: It’s essential to account for potential losses due to unoccupied units. Studies show that a prudent estimate for vacancy rates can range from 5% to 10% depending on the property type and location.

- Operating Expenses: These costs include maintenance, property management fees, and utilities. A comprehensive analysis reveals that operating expenses typically account for about 30% to 40% of gross income in many markets.

Expense Breakdown Comparison

| Expense Category | Average Percentage of Gross Income | Best Practices |

|---|---|---|

| Property Management Fees | 8% - 10% | Hire a reputable management company to reduce costs |

| Maintenance Costs | 12% - 15% | Regular inspections can prevent costly repairs |

| Utilities | 5% - 8% | Invest in energy-efficient upgrades to lower bills |

Real-World Examples

Understanding how NOI works is easier through real-world applications:

1. Case Study: Apartment Complex in Texas

- This property generated a gross rental income of $1,200,000 annually. After accounting for a 7% vacancy rate, the effective rental income dropped to $1,116,000. With operating expenses totaling $360,000, the NOI was $756,000.

2. Case Study: Commercial Retail Space in Florida

- A shopping center reported $800,000 in gross rental income. By applying a 5% vacancy rate and with operating expenses of $200,000, the NOI stood at $610,000, demonstrating a healthy operating performance.

Practical Implications of Understanding NOI

Focusing on NOI can empower you as an investor by equipping you with actionable insights, such as:

- Budgeting Better: By knowing your likely income and expenses, you can create more accurate budgets and financial projections.

- Valuation Insights: A solid understanding of NOI helps you evaluate property values based on current and potential income streams.

- Investment Decisions: By contrasting NOI figures across different properties, you can make informed decisions on where to invest.

Specific Facts to Remember

- Understanding that an increase in rental income by just 1% can lead to an estimated 10% boost in NOI can significantly affect your investment approach.

- Familiarize yourself with the local market’s average vacancy rates because they can vary widely. For example, urban areas tend to have lower vacancy rates compared to rural locations.

With these insights, you’re better equipped to navigate the complexities of NOI, ensuring your real estate investments yield the best possible returns.

Key Components of Net Operating Income

When assessing the Net Operating Income (NOI) of a real estate investment, it’s essential to dig deeper into its core components. The interplay of various income streams and expenses gives rise to a comprehensive understanding of your property’s financial health. Let’s unpack some crucial elements that shape the NOI.

Income Sources

Aside from the primary rental income, there are multiple revenue streams that can contribute significantly to NOI:

- Parking Fees: Properties can generate extra income through fees associated with parking spaces. In urban areas, this can add 5-15% to your overall rental revenue.

- Laundry Facilities: Many multifamily units offer laundry services, adding another layer to cash flow. Studies indicate this can enhance income by around 2-4%.

- Selling Utilities: If your property manages utilities and charges back to tenants, this could represent an additional 3-7% of your income.

Operating Expenses

Operating expenses are another crucial component of NOI. Monitoring these costs ensures you can better manage your cash flow. Key operating expenses to consider include:

- Property Management Fees: Typically around 8-12% of gross revenue, this expense is essential for managing tenant relations and maintenance.

- Repairs and Maintenance: Regular upkeep can range from 5-10% of gross income, but don’t overlook seasonal and emergency repairs that may spike expenses.

- Insurance and Taxes: These can often collectively account for 15-20% of the property’s monthly expenses, impacting the final NOI.

| Income/Expense Component | Percentage of NOI Contribution |

|---|---|

| Parking Fees | 5-15% |

| Laundry Facilities | 2-4% |

| Utility Charges | 3-7% |

| Management Fees | 8-12% |

| Repairs and Maintenance | 5-10% |

| Insurance and Taxes | 15-20% |

Real-World Examples

Consider a multifamily property that has several revenue streams:

- A 100-unit apartment complex charges $200 per month for parking. This leads to an annual income of $240,000—an impressive figure when you factor in the overall NOI.

- Another property includes a coin-operated laundry facility, generating an additional $24,000 annually. This extra income can significantly boost NOI and improve investment metrics.

When evaluating these examples, notice how diversifying your income sources and keeping tabs on operating expenses can enhance your overall NOI.

Practical Implications

Understanding the key components of NOI equips you with actionable insights to optimize your real estate strategy. By identifying and maximizing additional income streams, you can better buffer against rising operational costs. Regularly auditing your expenses will ensure they stay within manageable limits, preserving your NOI’s health.

There’s much to gain from prioritizing these elements in your investments. It allows you to focus not just on immediate revenues, but also on sustaining long-term financial viability. By doing so, you’ll enhance both your property’s value and your investment returns.

Real-World Applications of NOI in Property Investment

When you’re knee-deep in property investment, understanding how to apply Net Operating Income (NOI) can significantly impact your decisions. NOI isn’t just a number on a spreadsheet; it’s a powerful tool that guides real-world investment strategies and helps you maximize profitability.

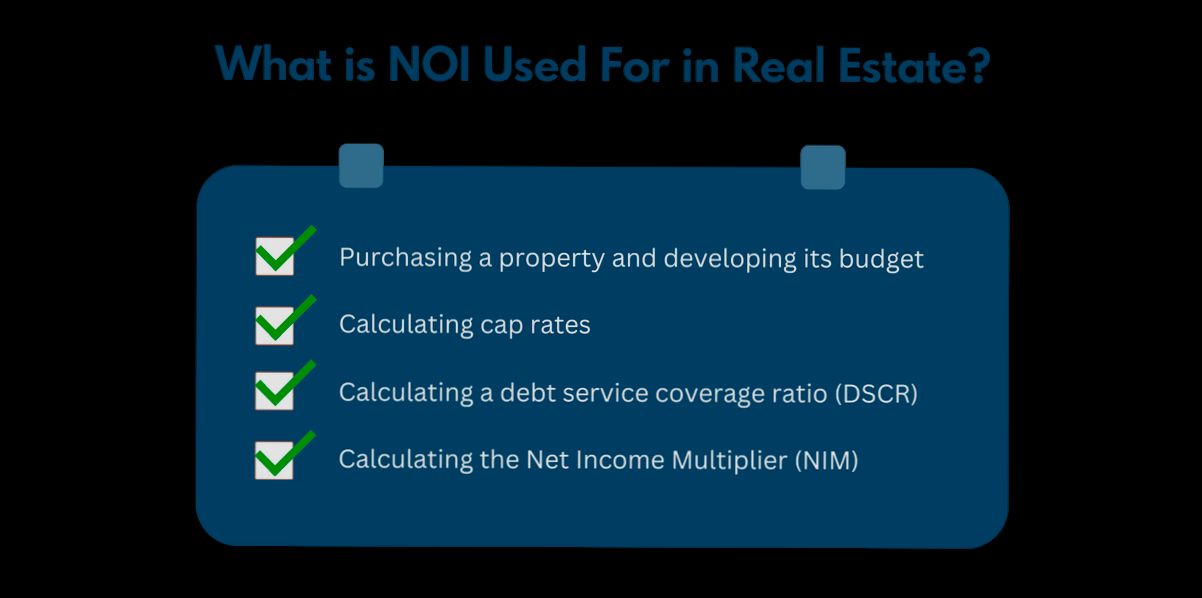

Key Applications of NOI

1. Investment Analysis and Decision-Making

- Investors use NOI to assess the viability of property investments.

- A study indicated that properties with an NOI growth of just 5% can lead to a value increase of about 20% over five years.

2. Financing and Loan Approval

- Lenders often require NOI calculations to evaluate an investor’s ability to make timely mortgage payments.

- A solid NOI can improve the chances of securing favorable loan terms.

3. Portfolio Management and Capital Expenditure Planning

- Investors leverage NOI to identify underperforming properties needing management changes or capital improvements.

- Properties showing a decline in NOI by 10% may warrant immediate attention to investigate operational inefficiencies.

4. Market Comparisons and Valuation

- NOI allows for straightforward comparisons between similar properties in the market.

- Using the Cap Rate formula, investors can quickly evaluate if a property is over- or under-priced relative to its NOI.

| Metric | Property A | Property B |

|---|---|---|

| Gross Rental Income | $200,000 | $250,000 |

| Operating Expenses | $60,000 | $80,000 |

| NOI | $140,000 | $170,000 |

Real-World Examples of NOI Applications

- Case Study: Multifamily Housing Investment

An investor purchased a multifamily building with a projected NOI of $200,000. By implementing a strategic marketing campaign to reduce vacancy rates and raising rents by 5%, the NOI increased to $230,000 in just one year, amplifying the property’s value.

- Case Study: Commercial Retail Space

A retail strip center had an NOI of $500,000. After investing in improvements that cost $50,000, the NOI rose to $600,000 within two years. This increase not only provided a better return but also attracted higher-quality tenants.

Practical Implications for Investors

- Budgeting and Forecasting

- Utilize NOI data for budgeting annual operating expenses and predicting future profits.

- By analyzing historical NOI trends, you can project potential increases or setbacks in revenue.

- Performance Benchmarking

- Regularly compare NOI against similar properties. This benchmark helps determine if your property is performing as expected.

- For instance, if your property’s NOI lags behind the average of 7% growth for similar buildings, it may be time to explore operational adjustments.

Actionable Advice

- Keep a close eye on all components influencing your NOI. Small changes can lead to significant effects on overall operating income.

- Consider digital tools for tracking NOI regularly, which allows for responsive management practices.

- Engage with property management professionals to continuously optimize expenses and enhance income streams, ensuring your NOI remains robust over time.

Analyzing NOI Through Market Statistics

When grappling with Net Operating Income (NOI), understanding market statistics can offer invaluable insight. By examining these statistics, you can evaluate how your property performs within its market context. Let’s delve into the essential data that informs your analysis of NOI, ensuring your decisions are backed by solid numbers.

Key Market Statistics to Consider

To accurately analyze NOI through market statistics, keep in mind the following data points:

- Occupancy Rates: An average occupancy rate in a healthy market might hover around 90%. Knowing your property’s rate in comparison can indicate its performance relative to local demand.

- Average Rent Growth: Research shows that rental rates grow by about 3% annually on average in most urban areas. Tracking historical trends can help predict future revenue contributions to NOI.

- Expense Ratios: The operating expense ratio (OER) typically ranges from 30% to 50% for many property types. Examining your property’s OER against market norms can highlight areas where you can improve efficiency.

Comparative Market Analysis Table

| Property Type | Average Occupancy Rate | Average Rent Growth | Operating Expense Ratio |

|---|---|---|---|

| Multi-Family | 92% | 4% | 35% |

| Retail | 89% | 3% | 40% |

| Industrial | 95% | 5% | 30% |

Real-World Examples

Consider a multi-family unit in an urban area with a reported occupancy rate of 87%. The market average is 92%, indicating a potential need for targeted marketing or enhancements to attract tenants. Additionally, if the average rent growth in that area is 3% and your rents have stagnated, it might signal a need for upgrades or price adjustments to align with market trends.

In another case, a retail property running at an operating expense ratio of 50% significantly exceeds the average of 40%. Assessing the specifics—such as maintenance costs and property management fees—may reveal opportunities to streamline and enhance NOI.

Practical Implications for Investors

When analyzing NOI through market statistics, you can gain actionable insights:

- Track your property’s occupancy versus local averages to assess potential upturns.

- Use comparative data on rent growth to optimize your pricing strategy, ensuring you capitalize on market trends.

- Regularly evaluate your operating expense ratio against other properties to identify areas for cost-containment.

By leveraging market statistics, you empower yourself to make informed decisions that directly enhance your NOI. Knowing the averages and trends in your area equips you to adjust your strategies effectively, ensuring better income performance over time.

Benefits of Using NOI for Valuation

When it comes to valuing real estate investments, focusing on Net Operating Income (NOI) offers several crucial benefits. Understanding these advantages can enhance your valuation strategies and bolster your decision-making processes in real estate.

Key Points on NOI Benefits

1. Objective Assessment: NOI provides a clear picture of a property’s profitability by focusing solely on its income and operating expenses. This removes ambiguities often associated with financing or tax considerations, allowing you to analyze properties strictly from an operational standpoint.

2. Standardized Metric: Since NOI excludes financing costs, taxes, and depreciation, it serves as a standardized metric across various properties. This uniformity allows for easier comparisons between different investments, helping you evaluate options more effectively.

3. Capitalization Rate Calculation: Utilizing NOI is essential in calculating the capitalization (cap) rate, a critical formula for determining a property’s value. Cap rates derived from NOI calculations help you assess potential returns quickly and accurately.

4. Investment Feasibility: By knowing the NOI, investors can estimate the viability of new projects. A property generating $200,000 in NOI could justify a higher capital investment, suggesting that serious consideration should be given to options, like Option A valued at $5 million versus Option B at $3 million.

5. Enhanced Decision-Making: With a firm grasp of NOI, you can make informed decisions about property improvements and operational efficiencies. This metric enables you to pinpoint areas for cost reduction or revenue enhancement, essential for increasing property value.

Comparative Table of NOI Benefits

| Benefit | Description | Impact on Valuation |

|---|---|---|

| Objective Assessment | Focuses purely on income generated and expenses incurred | Improves accuracy in valuation |

| Standardized Metric | Offers uniformity for comparisons across varied investments | Facilitates decision-making |

| Cap Rate Calculation | Provides basis for calculating the cap rate | Enhances investment analysis |

| Investment Feasibility | Helps evaluate potential project viability | Informs investment strategies |

| Enhanced Decision-Making | Allows identification of opportunities for improvements | Increases potential property value |

Real-World Examples

Consider two investment options with the same NOI of $200,000.

- Option A, valued at $5 million, may reflect a more desirable location with lower management costs, suggesting stability and lower risk.

- Conversely, Option B, valued at $3 million, might need $1 million in improvements. Despite a similar NOI, the additional costs may deter investment unless renovations can substantially increase the property’s value.

This apples-to-apples comparison allows investors like you to assess investment worthiness efficiently, bolstering the decision-making process.

Practical Implications for Readers

Understanding the benefits of NOI empowers you to evaluate properties beyond their face value. You can:

- Benchmark Properties: Compare various investments using NOI as a common denominator.

- Strategy Development: Formulate actionable strategies to enhance property performance, such as adjusting rent or reducing operational costs.

- Focus on Cash Flow: Prioritize investments based on their potential to generate and sustain cash flow through effective NOI management.

Here are some actionable takeaways about leveraging NOI for property valuation:

- Regularly review and analyze your properties’ NOI to identify trends.

- Utilize NOI calculations as a tool for negotiations with potential investors or lenders.

- Aim for operational efficiencies that can lead to a consistent or growing NOI, ensuring better valuation outcomes down the line.

Common Misconceptions About NOI

When it comes to understanding Net Operating Income (NOI) in real estate, several misconceptions can cloud your judgment. These misunderstandings can lead to poor decision-making and can significantly affect your investment strategy. Let’s clarify some of the most common myths surrounding NOI to enhance your real estate acumen.

Myth 1: NOI is the Same as Cash Flow

One prevalent misconception is that NOI equals cash flow. While both are financial metrics crucial in evaluating real estate investments, they represent different things. NOI is a measure of income generated from property operations, excluding financing costs like mortgage payments. On the other hand, cash flow accounts for all outgoing payments, including debt service and personal taxes.

- Data Insight: According to research, many new investors fail to account for this distinction, believing that high NOI directly translates to high cash flow.

Myth 2: NOI Only Accounts for Direct Income and Expenses

Another common misconception is that NOI only incorporates direct income (like rent) and expenses (like maintenance). In reality, it can include various revenue streams and operational costs, such as:

- Utilities and maintenance expenses

- Management fees

- Insurance

- Property taxes

Overlooking these factors can lead to inflated expectations about your property’s profitability.

Myth 3: Increasing Rent Always Increases NOI

While it’s intuitive to think that raising rental rates will improve your NOI, it isn’t always that simple. Higher rents can lead to higher vacancy rates if they’re not supported by market conditions.

- Data shows that, on average, properties that increase rents by more than 10% often experience a decrease in occupancy by about 20%. You need to consider market dynamics thoroughly before adjusting rent.

Comparative Table: NOI vs. Other Terms

| Term | Definition | Common Misconception |

|---|---|---|

| Net Operating Income | Income from property operations minus operating expenses | NOI equals cash flow |

| Cash Flow | Total income minus all expenses, including financing | NOI accurately predicts cash flow |

| Gross Revenue | Total income without deducting expenses | Higher gross revenue means higher NOI |

Real-World Examples

Consider a landlord who believes that a raised rent will directly increase NOI. They increase the rent by 15%, only to find that their vacancy rates rise sharply. This exemplifies the disconnect between increasing revenue and actual profitability.

Additionally, a property manager might assume that excluding management fees will boost NOI figures. However, by not accounting for these fees, they create an unrealistic portrayal of the investment’s financial health, ultimately hindering their ability to make informed decisions.

Practical Implications

To guard against these misconceptions, it’s essential to:

- Break down your calculation of NOI to include all relevant income streams and expenses.

- Conduct thorough market research before making rent adjustments.

- Educate yourself on the broader financial definitions related to property, especially distinguishing between NOI and cash flow.

Understanding and addressing these misconceptions about NOI can fortify your investment strategies, enabling you to make more informed financial decisions that lead to successful real estate outcomes.

Impact of NOI on Investment Decisions

When it comes to making investment decisions in real estate, understanding the impact of Net Operating Income (NOI) is crucial. NOI serves as a vital financial metric that can significantly influence your choices, from purchasing properties to determining their value and performance.

Key Points on the Impact of NOI

- Property Comparisons: NOI provides a clear and standardized way to compare the profitability of different properties or Real Estate Investment Trusts (REITs). For instance, if UrbanCore REIT generates $6.8 million in NOI, investors can easily juxtapose this income against other investment opportunities to gauge relative performance.

- Valuation and Lending: NOI is instrumental in property valuation and can sway commercial lending decisions. Lenders often evaluate a property’s NOI to assess its cash flow potential, determining how much they would be willing to finance.

- Cap Rate Calculations: NOI directly feeds into the calculation of the capitalization rate (cap rate). A higher NOI generally translates to a lower cap rate, suggesting a more valuable investment. This relationship helps investors evaluate potential returns and risks effectively.

Comparative Table of NOI Impact

| Investment Metric | Raw Data | Decision Implication |

|---|---|---|

| NOI (UrbanCore REIT) | $6.8 million | High profitability signal |

| Property Tax Expenses | $1.5 million | Affecting bottom-line profitability |

| Management Fees | $600,000 | Costs that can be optimized for better NOI |

| Cap Rate | Based on NOI | Determines the attractiveness of the investment |

Real-World Examples

To illustrate the impact of NOI on investment decisions, let’s consider a scenario where two different properties are evaluated based on NOI. Property A has an NOI of $4 million, while Property B has an NOI of $2 million.

- Informed Decisions: Investors would be inclined to focus on Property A due to its higher profitability, assuming all other factors remain constant. This highlights how NOI can steer investors toward more lucrative opportunities.

- Lending Influence: A lender reviewing Property A’s higher NOI is more likely to offer favorable financing terms compared to Property B, which can influence an investor’s ultimate decision on whether to acquire a particular property.

Practical Implications for Readers

Understanding the impact of NOI on investment decisions can sharpen your decision-making approach. Here are some actionable insights you might consider:

- Always calculate the NOI before making investment decisions. It gives you a clear snapshot of a property’s operational efficiency.

- Compare NOI against your investment benchmarks. Knowing what constitutes a “good” NOI in your target market can narrow your choices effectively.

- Factor in how external variables, such as market trends and occupancy rates, may affect future NOI when evaluating potential investments.

Specific Facts or Actionable Advice

- Keep a close eye on expense management. Reducing operational costs without compromising service can lead to a higher NOI, making your property more attractive to investors and lenders.

- Use NOI as a cornerstone metric for your property investments, as it’s a critical determinant of both current value and future growth potential.

By recognizing the strong influence of NOI on investment decisions, you as an investor can enhance your strategic approach and ultimately your success in the real estate market.