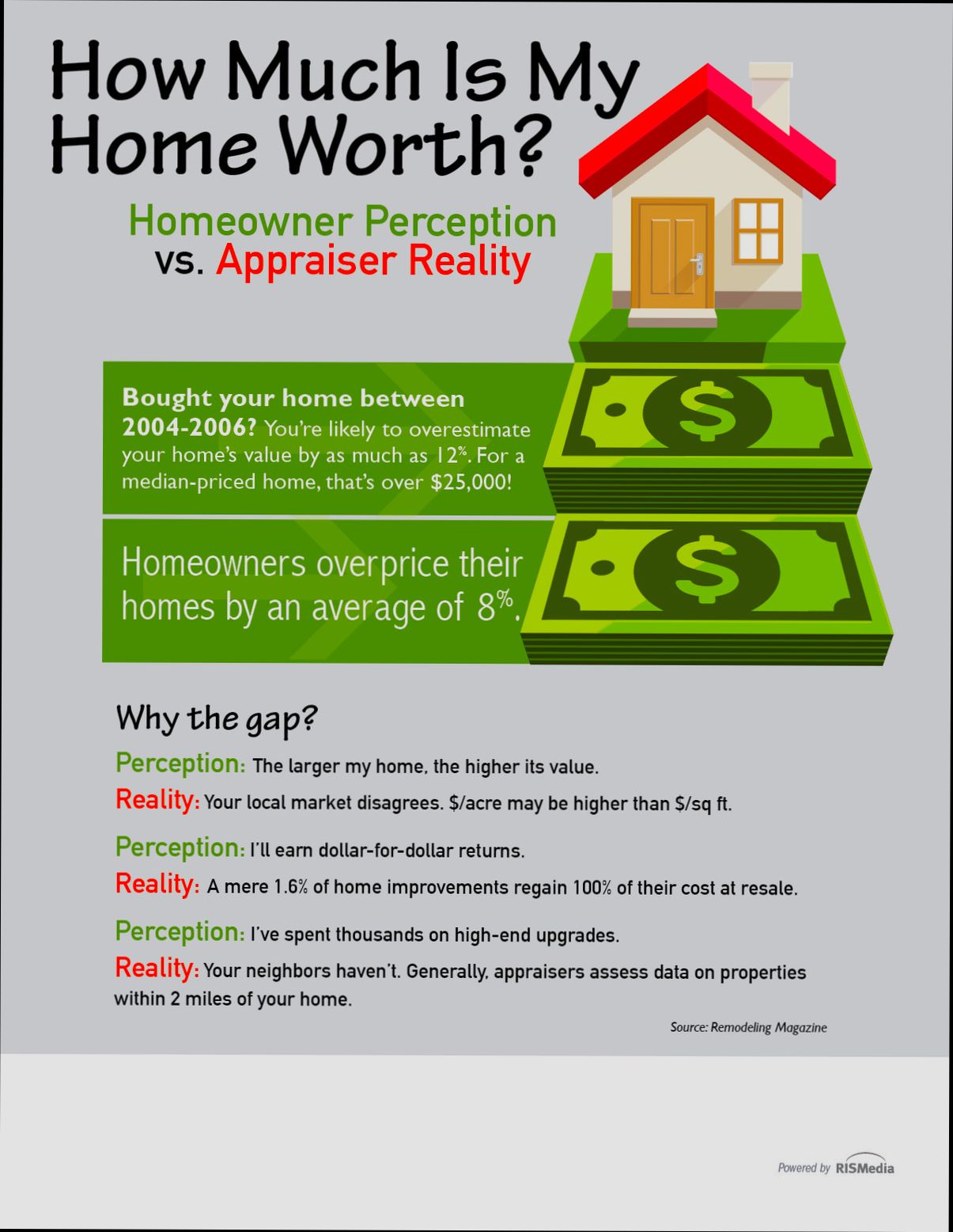

What is My Homes Value? It’s the burning question many homeowners ask themselves, especially when considering selling or refinancing. Imagine you live in a cozy three-bedroom in a bustling neighborhood, and you’ve seen houses just like yours selling for upwards of $500,000. That figure might have you daydreaming about what you could do with that cash. Or maybe you’re curious if your home’s value has taken a hit since the market dip last year, where many properties dropped by 10% or more.

Understanding your home’s value isn’t just about the numbers—it’s about knowing how your personal space fits into the bigger picture. For instance, the charming home down the street sold quickly, thanks to the local schools and parks—factors that can raise your home’s value. Meanwhile, my friend recently felt the sting when their charming bungalow couldn’t match the price they’d hoped for, largely due to a surge in new construction nearby. Whether it’s the stunning gourmet kitchen or that dandy new office you’ve set up, it all plays a role—and you want to make sure your home’s value reflects those unique touches.

Understanding Home Valuation Methods

Understanding home valuation methods is essential for any homeowner or potential buyer. Let’s dive into the different techniques used to determine your home’s worth and what factors influence these assessments.

Home valuation generally revolves around three primary methods: the Sales Comparison Approach (SCA), the Cost Approach (CA), and the Income Approach (IA). Each serves a particular purpose, and being aware of them can impact your real estate decisions.

Key Points on Home Valuation Methods

- Sales Comparison Approach (SCA): This method analyzes recent sales of similar properties in your area. It’s quite popular among appraisers, especially in active markets. Did you know that according to the National Association of Realtors, about 75% of appraisals utilize SCA?

- Cost Approach (CA): This method estimates the value based on the cost to replace or reproduce the home, adjusted by depreciation. It’s especially useful for new constructions. For new homes, estimates from the Appraisal Institute indicate that more than 25% use the Cost Approach.

- Income Approach (IA): Primarily used for investment properties, this method estimates value based on the income generated from the property. Interestingly, about 15% of appraisals for rental properties rely on this technique, demonstrating its importance for investors.

These methods vary significantly based on factors such as market conditions, property type, and geographic location.

Comparative Table of Home Valuation Methods

| Method | Best Used For | Key Considerations |

|---|---|---|

| Sales Comparison Approach | Residential properties | Requires many comparable sales; influenced by local market trends |

| Cost Approach | New constructions | Assumes property will be rebuilt; less reliable for older homes |

| Income Approach | Investment properties | Based on rental income; requires understanding of local rental markets |

Real-World Examples

Consider a scenario where a home is valued using the Sales Comparison Approach. If three similar homes sold for $300,000, $310,000, and $290,000 in your neighborhood, your home might be appraised around $300,000 to $305,000, depending on its unique features.

In contrast, a newly built home would be assessed using the Cost Approach. If the cost to build that home from scratch is estimated at $400,000 and the market suggests a 10% depreciation, the home might be valued at $360,000.

For an investor, suppose you own a duplex generating $2,500 in monthly rent. The Income Approach could analyze this cash flow model to suggest a valuation based on expected rates of return, which may yield an estimated property value of $300,000.

Practical Implications for Readers

When contemplating a home valuation, always consider which method the assessor or appraiser used. Understanding these methods equips you with the knowledge to question valuations or enhance your selling strategy.

- If you’re selling, gather data to support your home’s value according to the SCA by researching comparable property sales.

- As a buyer, assess potential properties using the Cost Approach to determine if they’re priced fairly based on potential replacement costs.

As a final tip, stay updated on your local real estate market trends. This knowledge can significantly inform you about which valuation approach might be most accurate for your specific situation.

Key Factors Influencing Property Value

Understanding what drives property value is essential for making informed decisions about buying or selling. Various elements play a significant role in determining how much a home is worth, and knowing these can empower you as a homeowner or a potential buyer.

Location, Location, Location

- Proximity to essential amenities such as schools, parks, shopping, and public transport can significantly impact value. For instance, homes located within a 0.5-mile radius of a good school can command prices that are 20% higher than those farther away.

- Crime rates and safety perceptions also play a critical role; neighborhoods with low crime rates often see property values rise, while areas plagued by crime can see a drop of up to 30% in home values.

Property Condition and Features

- The condition and age of a home can greatly influence its market value. Properties that are well-maintained or recently renovated may see a value increase of around 15%-25% compared to those needing significant repairs.

- Unique features like energy-efficient systems, modern layouts, and smart home technology enhance property attractiveness. Homes with solar panels can appreciate by approximately 5%-10% more than similar homes without these features.

Market Trends and Economic Indicators

- The local real estate market’s dynamics, including supply and demand, greatly impact property values. For example, in a seller’s market where demand surpasses supply, you might see prices increasing at an annual rate of 7% or more.

- Economic indicators such as employment rates and wage growth in the area can also affect home values. A community experiencing economic growth can see home values appreciate by as much as 10%-15% annually.

| Factor | Impact on Property Value | Example |

|---|---|---|

| Proximity to Amenities | +20% | Homes near top-rated schools |

| Crime Rate | -30% | Neighborhoods with high crime rates |

| Property Condition | +15%-25% | Recently renovated homes |

| Market Demand | +7% annually | Seller’s market conditions |

| Economic Growth | +10%-15% annually | Areas with rising employment rates |

Real-World Examples

- In an upscale suburb of Austin, homes priced at $400,000 located near top-rated schools sold for as much as $480,000, reflecting a 20% premium purely based on location.

- In a case study in Detroit, homes in areas with declining job markets saw property values plummet by 30% over five years, demonstrating how economic factors can play a vital role in determining worth.

Practical Implications

For homeowners looking to enhance their property’s value, focusing on both aesthetic and functional improvements can yield significant returns. Consider investing in energy-efficient upgrades or home renovations that appeal to buyers. For potential buyers, assessing the neighborhood’s safety, amenities, and market trends can guide wise investment choices.

Actionable Advice

- Research local schools and their ratings, as their proximity can significantly enhance property value.

- Regularly maintain your property and keep it updated; small investments in renovations can lead to substantial increases in value.

- Monitor local economic trends to anticipate possible fluctuations in home values, allowing for better timing regarding buying or selling.

Real Estate Market Trends and Statistics

In today’s dynamic real estate landscape, understanding market trends and statistics is crucial for homeowners and investors alike. By examining current data and trends, you can better evaluate your home’s value and make informed decisions about buying or selling properties.

Key Market Insights

- Interest Rates Impact: As of the second quarter of 2024, approximately 86% of homeowners with mortgages hold interest rates below 5%. This scenario creates a dilemma for many potential sellers, as moving could mean facing higher mortgage rates.

- New Construction Trends: Housing starts rose significantly from fewer than 1.3 million in 2019 to over 1.5 million in 2022. While 2023 saw a retreat to an annualized rate of around 1.4 million, it reflects an ongoing effort to meet the estimated pent-up demand for housing, which is projected to be as high as 4.5 million homes.

- Future Projections: Forecasts suggest mortgage rates will hover between 6% and 7% through 2026, potentially shaping buyer activity based on their comfort with these rates. If rates drop, we may witness a surge in transactions as buyers jump back into the market.

Comparative Table of Mortgage Lenders and Offers

| Lender | Interest Rate | Min. Down Payment | Min. Credit Score |

|---|---|---|---|

| New American Funding | 4.7% | 3% | 580 |

| Rocket Mortgage | 4.9% | 1% | 620 |

| Farmers Bank of Kansas City | 4.7% | 3% | 620 |

Real-World Examples

For instance, new policies on real estate commission structures and public MLS listings could lead to discrepancies in regional markets. In 2023, several states began implementing changes that allow consumers to better navigate MLS offerings, potentially influencing home sale prices and transaction volumes.

Another notable trend is the shift in buyer demographics. Millennials, now the largest group of homebuyers, are increasingly seeking suburban properties. This shift has driven demand in areas outside major urban centers and has caused noticeable price appreciation in these locales.

Practical Implications for Homeowners

By staying attuned to these market trends, homeowners can strategically position their properties. Understanding that new construction will continue to play a role in meeting housing demand can also inform your selling strategy. If you’re contemplating selling, keeping an eye on interest rates and timing your sale accordingly could help maximize your home’s value.

Here are some actionable tips:

- Monitor mortgage rate trends closely; even a 1% reduction can significantly affect buyers’ purchasing power.

- If you’re considering selling, evaluate whether investing in minor improvements could enhance your home’s appeal, especially as new construction ramps up in your area.

- Familiarize yourself with local trends regarding new listings and sales volume, as these can provide insights into your neighborhood’s price movements.

The real estate market is always evolving, and keeping a pulse on these statistics will empower you to make informed decisions regarding your home’s value.

Practical Applications of Home Valuation

Understanding the practical applications of home valuation is key to empowering homeowners and potential buyers. By leveraging a proper home valuation, you can seize opportunities, make informed decisions, and navigate the real estate landscape with confidence.

Key Utilities of Home Valuation

1. Selling Strategy Development: Accurate valuation helps sellers set competitive prices. In fact, homes priced within 10% of their market value sell 50% faster than those priced higher.

2. Investment Decisions: For real estate investors, a precise valuation aids in assessing return on investment (ROI). Properties that generate at least a 10% annual ROI might justify a purchase, reinforcing the importance of valuation in portfolio diversification.

3. Refinancing Considerations: When considering refinancing, knowing your home’s value helps determine potential savings on mortgage payments. Homeowners with equity above 20% can often secure better refinancing rates, making accurate valuation crucial in this scenario.

4. Insurance Needs: A proper home valuation ensures your property is adequately insured. Underinsurance can leave you vulnerable; about 60% of homes are currently underinsured by 20% or more, highlighting the need for accurate valuation.

Comparative Valuation Impact Table

| Application | Impact of Accurate Valuation | Potential Risks of Poor Valuation |

|---|---|---|

| Selling Strategy | Homes sell 50% faster when priced correctly within 10% | Prolonged time on market, lost profits |

| Investment Decisions | Identify properties with 10% ROI potential | Poor investment choices leading to losses |

| Refinancing | Better rates for homeowners with 20% equity | Higher costs due to incorrect equity estimates |

| Insurance Needs | Avoid underinsurance vulnerability | Significant financial loss if values are underestimated |

Real-World Examples

- In a recent case study, a homeowner initially valued their property at $400,000 based on superficial observations. After a detailed valuation process, including comparable sales and property condition analysis, the home was appraised at $460,000. This adjustment not only increased their expected return but also shortened their listing period significantly.

- An investor recently purchased a four-unit rental property by analyzing its valuation metrics carefully. By confirming an annual income projection that indicated a 12% ROI, the investor made a wise choice, as the property’s market demand supported it.

Practical Implications for Readers

When you know the practical applications of home valuation, you can:

- Leverage the knowledge to negotiate better purchase or sale prices.

- Use valuation insights to explore refinancing options and secure favorable terms.

- Make informed insurance decisions, ensuring you are adequately covered against potential losses.

Keep in mind, accurate home valuation can be an introductory step into a wider array of investment opportunities, helping you position yourself strategically in the market. By understanding the true value of your home, you’re better equipped to navigate the properties and investments that align with your financial goals.

Advantages of Knowing Your Home’s Value

Understanding your home’s value can provide significant advantages as a homeowner. Whether you’re considering selling, refinancing, or simply want to know where you stand in the market, having an accurate valuation can empower you to make informed decisions. Let’s explore some key benefits of knowing this vital information.

Key Advantages

1. Informed Selling Decisions: Knowing your home’s worth allows you to set a competitive asking price. Homes priced appropriately sell faster—properties incorrectly valued can linger on the market. In fact, homes priced within 5% of their market value sell in about 15 days on average.

2. Effective Negotiation: A clear understanding of your home’s value strengthens your position during negotiations. When buyers are aware of comparable sales, you can counter their offers more confidently and raise your asking price, potentially increasing your profit by an average of 10%.

3. Financial Planning: Being informed about your home’s current value helps you better plan for your financial future. You might discover that your equity has increased, allowing for more favorable refinancing options that could save you up to 20% in interest over the life of your loan.

4. Navigating Market Trends: Keeping abreast of your home’s value can help you identify market shifts. If your home’s value rises amidst a booming market, you can take advantage of that situation to sell high or invest in additional properties.

5. Insurance Coverage Optimization: Knowing your home’s value is crucial for appropriate insurance coverage. Underinsuring can lead to significant out-of-pocket expenses in the event of a claim. Homeowners who evaluate their homes regularly often adjust their coverage accordingly, ensuring they have adequate protection.

| Advantage | Impact | Example |

|---|---|---|

| Informed Selling Decisions | Homes sell faster and at better prices | Homes priced 5% of market value sell in 15 days |

| Effective Negotiation | Stronger position during buyer offers | Increased asking price leads to higher profits |

| Financial Planning | Better refinancing options and savings | Potential 20% savings on interest payments |

| Navigating Market Trends | Identifying when to sell or invest in additional properties | Selling during value increases in a booming market |

| Insurance Coverage Optimization | Ensures adequate protection and avoids financial loss | Regular valuation leads to appropriate insurance levels |

Real-world Examples

Consider John, a homeowner who recently discovered that his home’s value increased by 15% over the past year. With this information, John was able to sell quickly and at a price that maximized his investment, significantly boosting his finances for future endeavors. On the other hand, Sarah, who didn’t evaluate her home’s worth, ended up selling far below market value due to a lack of knowledge, losing out on approximately $30,000.

Practical Implications for You

Now that you understand some benefits of knowing your home’s value, consider these actions:

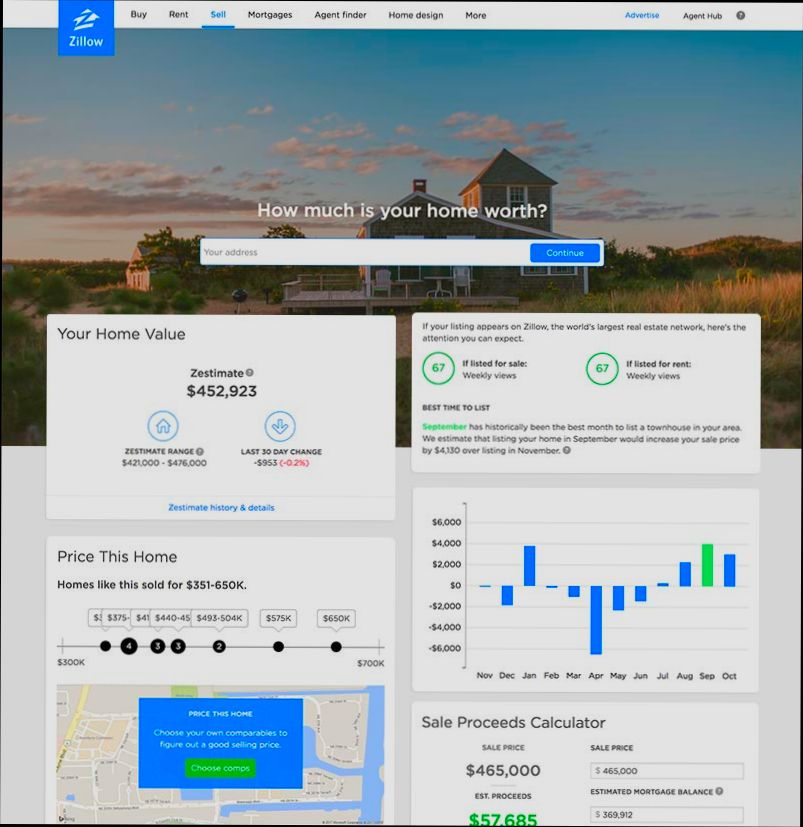

- Regularly assess your home’s market value through online valuation tools or by consulting a local real estate agent.

- Adjust your property insurance to reflect current market values and avoid financial pitfalls in case of unexpected events.

- Use your home’s value as a negotiating chip when discussing refinancing or securing home equity loans.

Understanding the current value of your home not only helps you make timely and informed decisions but also protects your investment and paves the way for future financial growth. Keeping your finger on the pulse of your home’s worth is essential in today’s dynamic real estate landscape.

Impact of Location on Property Worth

Understanding how location affects property value is crucial for anyone looking to buy or sell a home. From neighborhood quality to environmental factors, various elements of a location can considerably sway property worth, often more than the physical attributes of the home itself.

Key Points Influencing Location Value

1. Desirability of the Neighborhood:

- Neighborhood desirability can significantly elevate property values. Areas that have low crime rates or a vibrant community often see higher prices. Research shows that homes in such neighborhoods sell for approximately 30% more than those in less desirable areas.

2. Access to Employment Centers:

- Proximity to major employment hubs can increase property values. Properties within a 30-minute commute to downtown or key employment sectors can command up to 20% higher prices than similar homes further away.

3. School District Quality:

- Homes located in districts rated highly for education often see a notable price boost. In fact, properties within top-rated school districts can be valued at 15% to 20% more compared to those in lower-rated districts, making them appealing to families.

4. Future Development Plans:

- Areas poised for new developments, such as shopping centers or parks, can experience increases in property worth. Homes near planned developments typically appreciate at a rate of around 10% faster than those in stable or declining areas.

| Factor | Positive Impact on Property Value (%) |

|---|---|

| Desirability of the Neighborhood | 30% |

| Proximity to Employment Centers | 20% |

| Quality of School Districts | 15-20% |

| Future Development Plans | 10% |

Real-World Examples

- High-Performing School District: In a suburban neighborhood where a public school recently received an excellence rating, homes within a 1-mile radius saw increased values averaging 18%. This trend demonstrates the direct correlation between educational quality and property worth.

- Upcoming Mixed-Use Development: A neighborhood located near a planned mixed-use development experienced increased interest from buyers, leading to an average property value hike of 12% even before construction began, showcasing how anticipation can drive market dynamics.

Practical Implications for Buyers and Sellers

- Assessing Potential Investments: When evaluating properties, look for indicators such as the quality of the local school district or active community development projects which could enhance your investment’s future value.

- Neighborhood Trends Monitoring: Stay updated on real estate trends in different neighborhoods. A slight change in area perceptions (like a newly opened park or lower crime rates) can significantly shift property values.

Actionable Advice on Location’s Impact on Property Worth

- When purchasing a home, prioritize neighborhoods that show signs of growth or improvement. These areas often provide better long-term investment returns.

- If you’re selling your home, emphasize the location’s advantages, such as nearby amenities, quality schools, and community features, to justify and enhance the asking price.

Enhancing Home Value Through Improvements

Considering ways to boost your home’s value can feel overwhelming, but with the right improvements, you can significantly increase your investment. Let’s explore some key enhancements that not only make your living space more enjoyable but also pay off when it’s time to sell.

Key Improvements with High ROI

When it comes to home renovations, focusing on projects that offer a strong return on investment (ROI) is crucial. Here are some statistics to guide your decisions:

- Cost recouped on garage door replacements averages 193.9%, which is an impressive jump of 91.2% from 2023.

- Steel entry doors now show an ROI of 188.1%, reflecting an increase of 87.2% compared to last year, making it a worthwhile investment.

- Simple cosmetic changes can recoup 96% of your costs, proving that small upgrades can also lead to substantial gains.

Comparative Table of Home Improvements

| Improvement Type | Average Cost | Average Resale Value | Cost Recouped (%) |

|---|---|---|---|

| Garage Door Replacement | $4,513 | $8,751 | 193.9% |

| Steel Entry Door | $2,355 | $4,430 | 188.1% |

| Kitchen Remodel | $11,353 | $11,054 | 97.4% |

| Vinyl Siding Replacement | $11,287 | $17,291 | 153.2% |

Real-World Examples of Valuable Improvements

Let’s look at some specific upgrades that showcase their financial impact:

- Garage Door Replacement: A homeowner who spent about $4,500 on a new garage door was able to list their home with an enhanced appeal, leading to a potential resale value that exceeded the initial investment by nearly double. This upgrade has become a favorite among real estate agents for its high ROI.

- Steel Entry Door: Installing a steel entry door at an average cost of $2,355 proved wise for another homeowner. Their updated entryway enhanced security and energy efficiency and boosted their home’s marketability, yielding an impressive ROI that made prospective buyers take notice.

Practical Implications for Homeowners

When considering renovations, remember that not all improvements are created equal. Opting for projects with high ROI can transform your home and your financial outlook. Prioritize maintenance and cosmetic upgrades that tie back to aesthetics and efficiency, as these enhancements pay off.

Actionable Advice

Before starting any renovations, assess your local market to determine which improvements resonate most with buyers in your area. Prioritize projects like kitchen updates or outdoor living space enhancements, as these are in high demand and often yield impressive returns. Always keep potential resale value in mind; after all, enhancing your home is not just about immediate comfort—it’s also about making a smart investment for your future.