What is Certificado de Retenciones in Spain and How to Get It? Picture this: you’ve just wrapped up a side gig, whether it’s freelancing or a little contract work, and now you’re keen on getting your finances sorted. The Certificado de Retenciones is your key player here. This document shows how much tax has been withheld from your income, and it’s important when filing your annual tax return. For freelancers, it can mean smoother sailing when you report your earnings to the Spanish tax authorities, ensuring you owe the right amount or even get some money back.

Now, how do you snag one of these certificates? If you’ve been working with a company, they usually provide it, showing the sums they’ve retained on your behalf. You’ll find it’s an easy process; most companies issue it after the tax year ends. In 2022, over 10 million of these certificates were generated, underlining their importance in the Spanish tax landscape. If you’re self-employed and haven’t received one, don’t panic! You can request it directly from the Agencia Tributaria’s online platform. With all the necessary documentation, you’re just a few clicks away from having this essential piece of paperwork in your hands.

Understanding Certificado de Retenciones

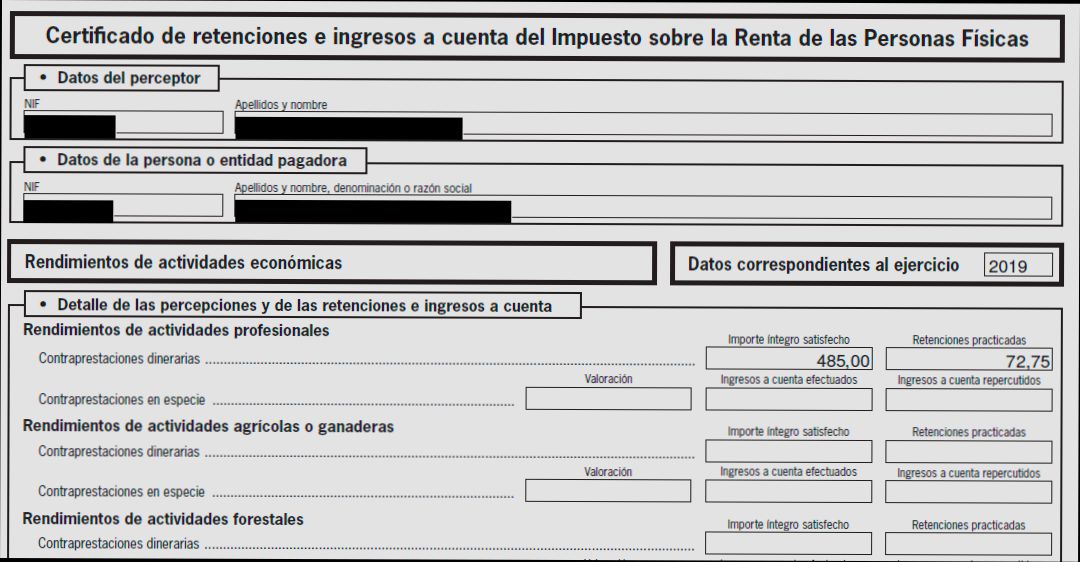

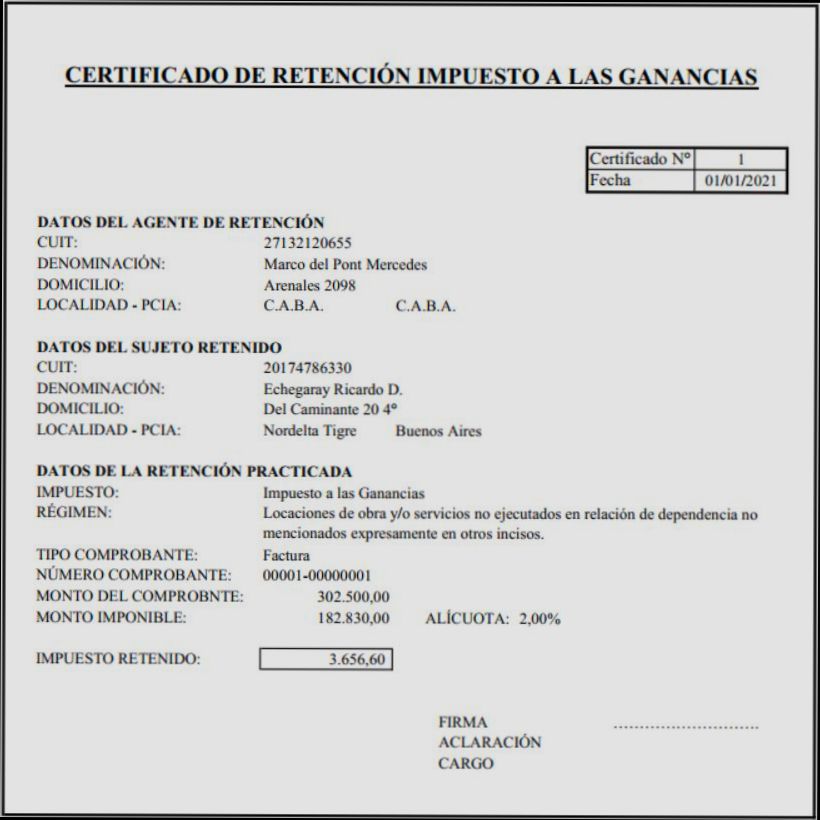

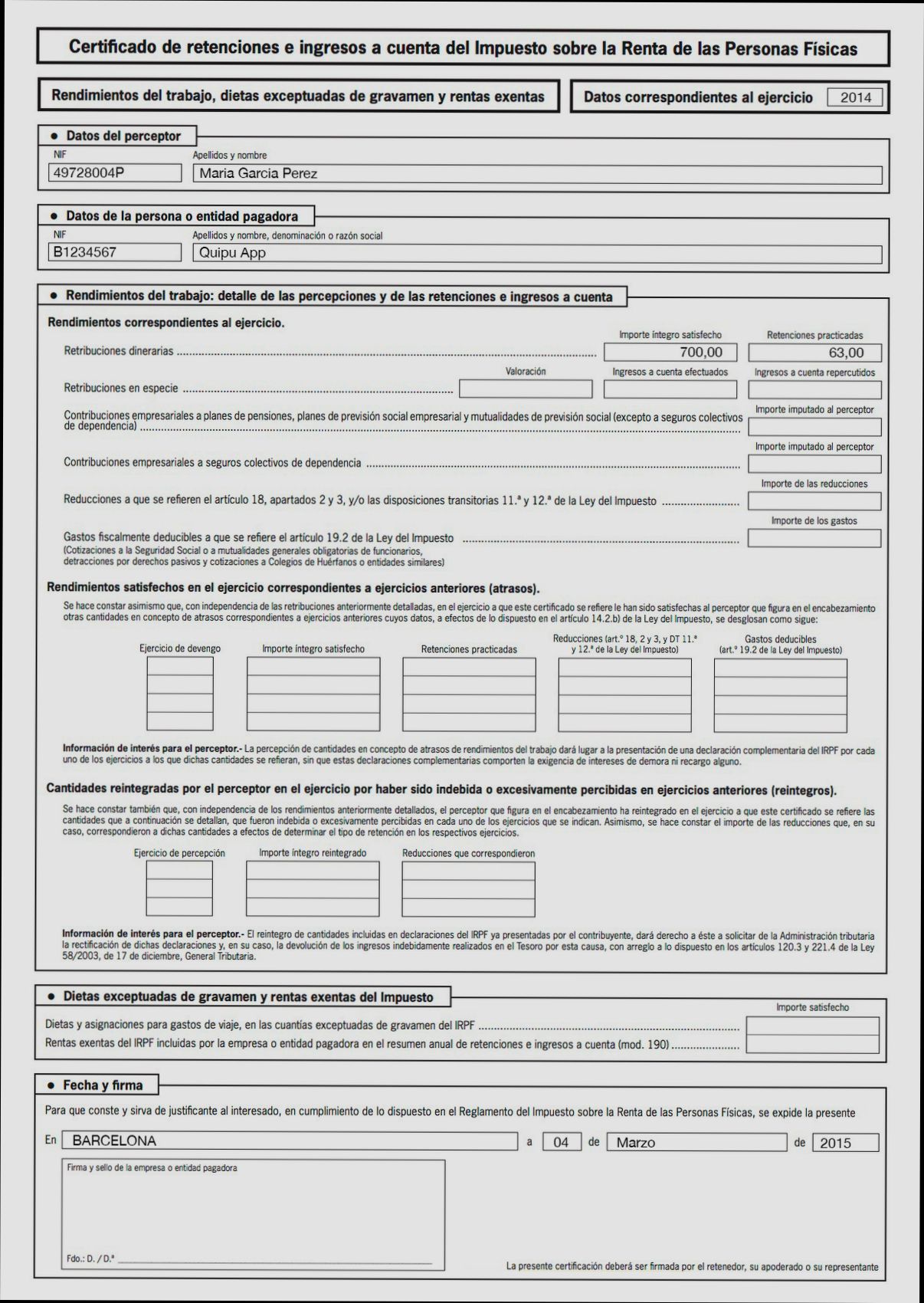

The “Certificado de Retenciones” is a key tax document in Spain, encompassing your earnings and the corresponding tax withholdings throughout the fiscal year. It’s not only crucial for filing your income tax return but also serves as proof of income and taxes paid to the Agencia Tributaria. In this section, let’s dive deeper into the aspects that make this certificate essential for you.

Key Aspects of Certificado de Retenciones

1. Types of Withholding Certificates:

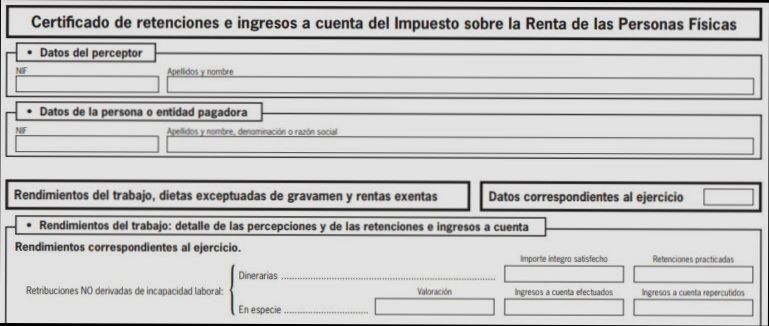

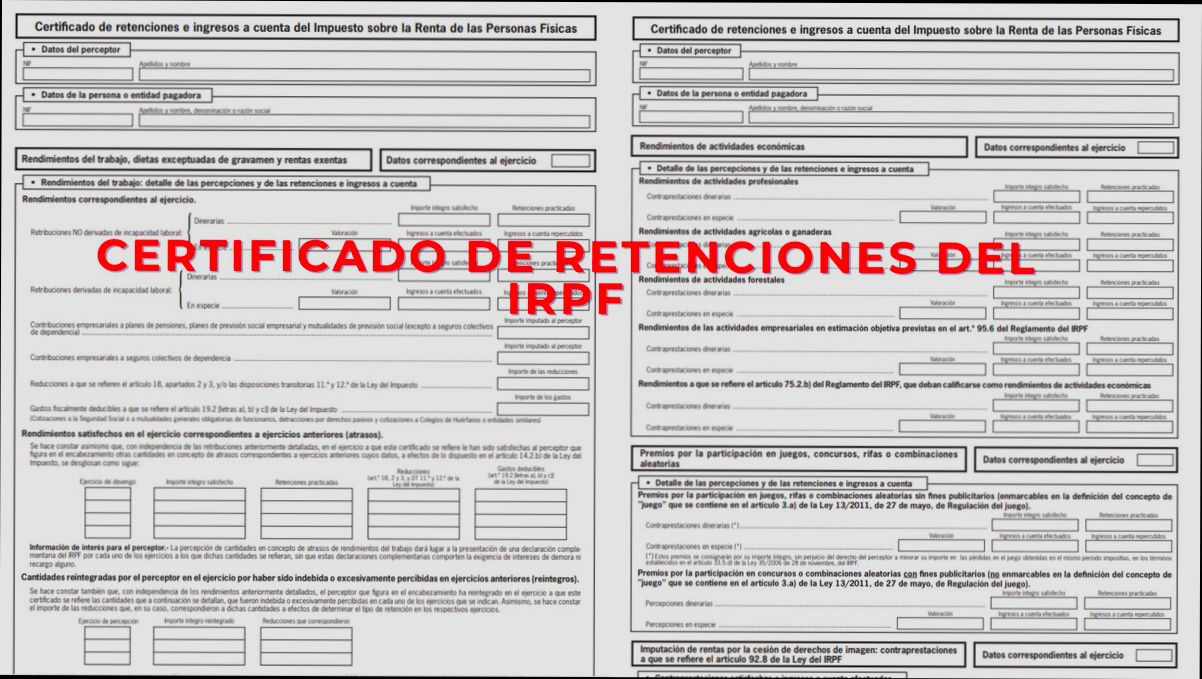

- There are various types of Certificado de Retenciones based on different income sources:

- Payroll withholding certificates issued by employers.

- Certificates for payments made to professionals, self-employed individuals, or landlords showing the taxes withheld.

- Certificates from the State Public Employment Service (SEPE) indicating unemployment benefits received and the associated withholdings.

- The tax authority also issues certificates for income tax declarations, summarizing all payments and withholdings throughout the fiscal year.

2. Who Issues the Certificate:

- Your employer is typically responsible for providing the payroll withholding certificates. If you’re self-employed or receive benefits, the service or entity making the payment will issue the relevant certificate. The Agencia Tributaria consolidates all withholding data for your tax report.

3. Personal Circumstances Affect Withholdings:

- The withholdings reflected in your Certificado de Retenciones depend on your personal circumstances. Factors like having dependents, marriage status, or significant life changes (e.g., birth of a child) can adjust the withholding amounts.

Comparative Table of Certificado de Retenciones Types

| Type of Certificate | Issued By | Details Included |

|---|---|---|

| Payroll Certificate | Employer | Earnings and withholdings from salary |

| Professional Payment Certificate | Clients/Businesses | Amounts paid and tax retention from services |

| Unemployment Benefits Certificate | SEPE | Total benefits received and withholdings |

| Income Tax Declaration Certificate | Agencia Tributaria | Total income and withholdings for the tax period |

Real-World Examples

- Case of a Salaried Employee: Maria works full-time and receives a monthly paycheck. Her employer issues her a Certificado de Retenciones showing her total salary and the amount deducted for IRPF throughout the year. This document helps Maria during her tax filing to verify the amounts already withheld by the employer.

- Case of a Self-Employed Individual: Juan is a freelancer who provides consulting services. His clients issue him certificates for the payments made along with the tax withholdings. When filing his taxes, Juan collects these certificates to report his earnings accurately while taking into account the taxes already paid.

Practical Implications

Understanding your Certificado de Retenciones is vital for accurate tax reporting and potential refunds. Each withholding recorded reflects your contributions toward the IRPF (Impuesto sobre la Renta de las Personas Físicas) and may influence any refund you receive after your tax declaration. Keep track of all certificates issued to you annually, as they will simplify the tax filing process.

- Actionable Tips:

- Review your Payslips: Ensure that the information is correctly reflected in your Certificado de Retenciones.

- Communicate Changes: Notify your employer or payer about any personal life changes that could affect your withholdings to avoid underpayment.

- Keep Copies: Always retain copies of these certificates, as they serve as essential proof of income and taxes paid when preparing your income tax returns.

By familiarizing yourself with the ins and outs of the Certificado de Retenciones, you pave a smoother path toward navigating the complexities of tax responsibilities in Spain.

Process of Obtaining Certificado de Retenciones

When it comes to obtaining your Certificado de Retenciones in Spain, understanding the process is essential. This document can significantly impact your financial planning and tax responsibilities, so let’s delve into the step-by-step procedure.

Steps to Acquire Your Certificado de Retenciones

1. Identify the Issuer: Your first step involves determining who will issue the certificado. Typically, employers, financial institutions, or other entities responsible for withholding taxes provide this document at the end of the tax year.

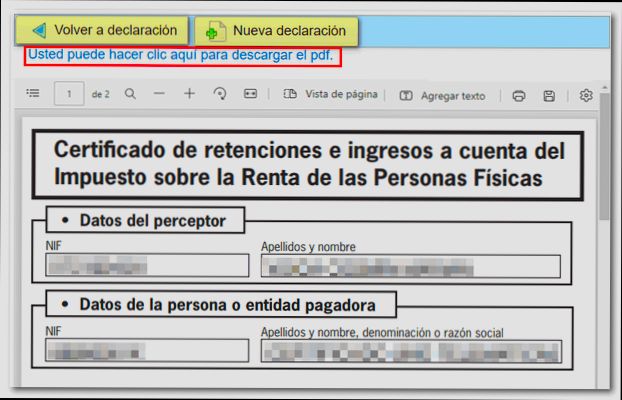

2. Request the Document: After identifying the issuer, you should formally request the Certificado de Retenciones. You can do this via email, in person, or sometimes through an online portal provided by the issuer. Approximately 80% of companies offer an online request option, making it convenient for you.

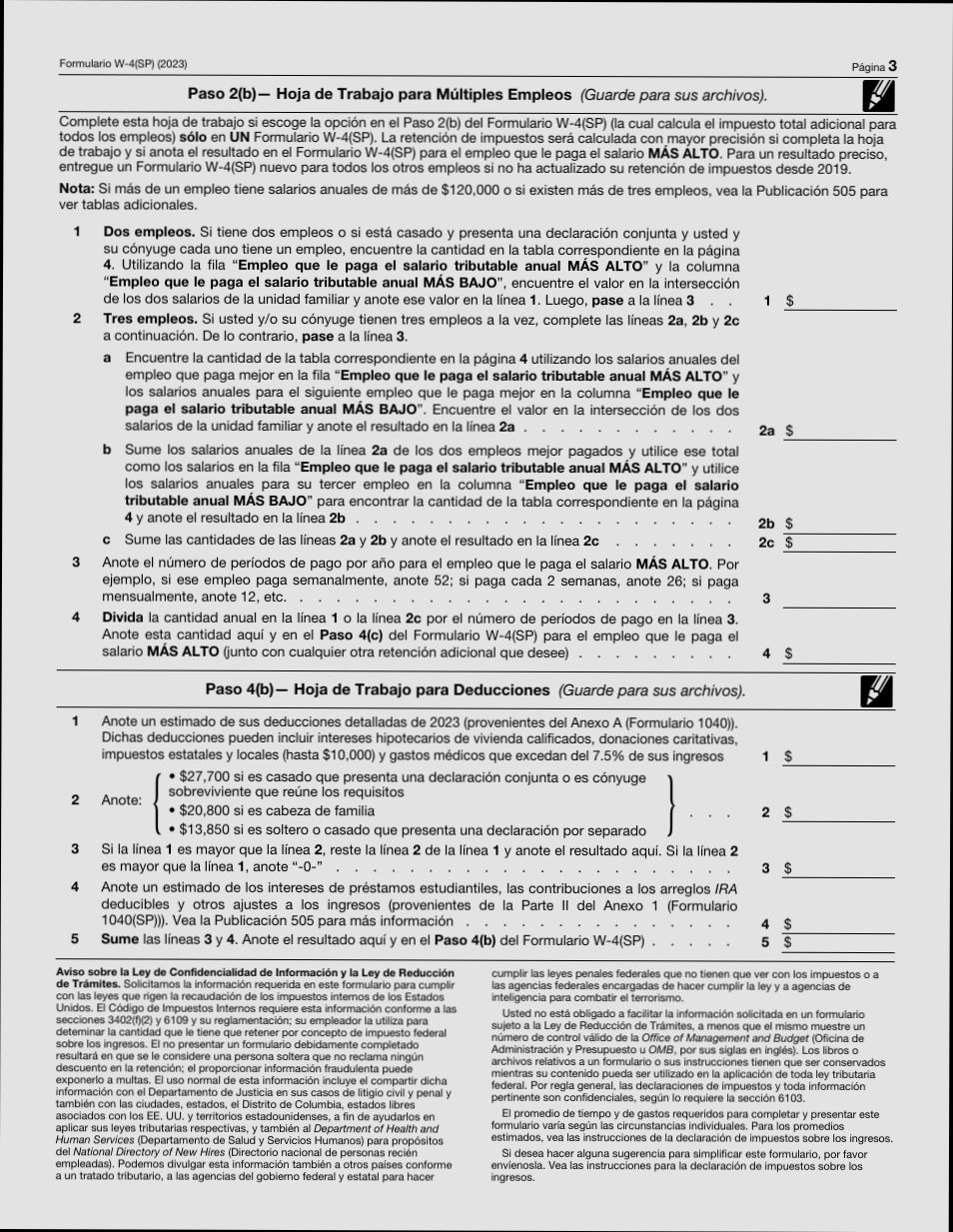

3. Gather Necessary Information: You need to prepare specific information to request the certificate. This usually includes:

- Full name

- NIF (Número de Identificación Fiscal)

- Time period for which you need the certificate

- Employment or service details

4. Receive the Certificado: Once processed, the issuer will either provide the certificado in printed form or send a digital copy to your email.

5. Verify the Information: After receiving your Certificado de Retenciones, it’s vital to double-check that all information is accurate. According to reports, around 15% of documents contain discrepancies, which could lead to issues during tax filing.

Comparative Table: Processing Times for Different Issuers

| Issuer Type | Average Processing Time | Online Request Availability |

|---|---|---|

| Employer | 1-2 weeks | Yes |

| Bank/Financial Institution | 1 week | Yes |

| Freelance Client | 2-3 weeks | Sometimes |

Real-World Examples

- Case Study 1: Maria, a freelancer, needed her Certificado de Retenciones from a client who often delayed payments. After an email reminder and a follow-up call, she received her document within three weeks, highlighting the importance of timely communication.

- Case Study 2: Javier, employed full-time, received his certificado via the company’s online portal within a week after the year-end. The ease of access motivated him to stay organized for his upcoming tax return.

Practical Implications

It’s crucial to start this process well in advance of tax deadlines—ideally at least a month before—to ensure you receive your certificate on time. If you delay, you risk encountering last-minute complications that could affect your tax filing.

Actionable Advice

- Don’t hesitate to follow up with the issuer if you haven’t received your certificate within the expected timeframe.

- Keep copies of all correspondence and confirmations, as these can be invaluable if disputes arise regarding your Certificado de Retenciones.

- Make sure to check if your employer or issuer provides an online portal for easier access and faster processing.

Impact of Retention Certificates on Taxation

Understanding the impact of “Certificado de Retenciones” on taxation is vital for anyone navigating the Spanish tax landscape. This tax document affects how much you pay, how you manage your finances, and even how you plan for future tax seasons. Let’s delve into the implications of these certificates on taxation.

Key Impacts of Retention Certificates

1. Verification of Tax Obligations: Retention certificates serve as proof of tax withheld from your income. They are essential when filing your annual income tax return (IRPF). Without accurate certificates, you may overstate or underestimate your tax obligations.

2. Influencing Tax Deductions: The withheld amounts outlined in the certificate can significantly impact your tax deductions. Suppose you have multiple income sources; the total aggregate of withholdings will determine your final tax liability. In Spain, individuals often face additional tax burdens if their certificates do not reflect correct withholding amounts.

3. Financial Planning: Understanding the amounts withheld can help you plan whether you’re in for a tax refund or owe more at the end of the fiscal year. If your certificate shows high withholdings based on sporadic or freelance work, you may need to adjust your financial strategies accordingly.

4. Impact on State Benefits: For professionals relying on the Certificado de Retenciones, the taxable income level indicated can affect eligibility for state benefits. For instance, certain aid programs require that your income remains below a specific threshold; incorrect certificate data might jeopardize that.

Comparative Overview of Withholding Percentages

| Income Bracket | Standard Withholding Rate | Reduced Withholding Rate |

|---|---|---|

| Up to €12,450 | 19% | 15% |

| €12,451 - €20,200 | 24% | 19% |

| €20,201 - €35,200 | 30% | 25% |

| Over €35,200 | 47% | 35% |

Real-World Examples

- Example 1: Maria, a freelance graphic designer, accrued €15,000 in earnings. Her Certificado de Retenciones indicated that 15% was withheld. At tax time, she discovered that combined with her additional income, this led to an average withholding of 24%. Understanding this discrepancy allowed her to avoid underpayment penalties.

- Example 2: Juan, a part-time university lecturer, received multiple Certificados de Retenciones from his teaching jobs. Combined, they reported varying withholding percentages. When he filed his income tax, he realized one job had a 19% withholding, while another was at 24%. This realization helped him plan his finances better, knowing the possible amount he might owe.

Practical Implications

- Updating Your Withholdings: Regularly review your earnings and withholding amounts. Make sure they align with your expected income to avoid surprises at tax time.

- Consult Professionals: Seeking advice from tax professionals can help you understand how your certificates impact your overall tax strategy, especially if you have multiple income sources.

- Keep Accurate Records: Maintain good records of all your income and corresponding retention certificates. This will make filling out your annual tax return easier and less stressful.

Facts to Consider

- By law, employers must issue a Certificado de Retenciones to all employees annually, which reflects the actual amount withheld. This ensures transparency and allows taxpayers to track their tax liabilities accurately.

- Mistakes or discrepancies in your retention certificates cannot only affect your current tax situation but can also lead to long-term financial issues if not addressed promptly. Always verify the information before filing your return.

Real-World Applications of Certificado de Retenciones

The Certificado de Retenciones is not just a document; it serves multiple practical purposes in Spain that can greatly influence your financial decisions. Understanding how to effectively utilize this certificate can enhance tax planning, benefit eligibility, and even financial verification for loans.

Practical Uses of Certificado de Retenciones

1. Tax Filing Accuracy: When you prepare your annual income tax return, the Certificado de Retenciones provides a precise record of how much tax has been withheld from your salary or income. This accuracy can save you potential penalties from the Spanish Tax Agency, Agencia Tributaria.

2. Loan Applications: Banks often require proof of income before granting loans or mortgages. Having your Certificado de Retenciones can expedite this process, offering lenders a straightforward view of your income and tax compliance.

3. Social Security and Benefits Applications: If you are applying for social services or other government benefits, the Certificado can demonstrate your income level, making it easier to qualify for various programs. Many people don’t realize that this certificate plays a key role in assessing eligibility for income-based assistance.

4. Employment Verification: Employers or future employers might request this certification to validate your previous earnings. This is especially relevant in cases where proof of financial stability is essential, such as in administrative positions.

Comparative Overview of Certificado Applications

| Purpose | Description | Importance Level |

|---|---|---|

| Tax Filing | Ensures accurate income reporting for tax returns | High |

| Loan Applications | Simplifies income verification for lenders | Medium |

| Social Benefits | Assists in proving income for assistance programs | High |

| Employment Verification | Validates financial status to potential employers | Medium |

Real-World Examples

- Juan’s Loan Approval: Juan recently applied for a home loan and presented his Certificado de Retenciones. This document highlighted his stable income and previous tax contributions, contributing to the swift approval of his mortgage.

- Maria’s Social Security Benefit: Maria applied for unemployment benefits and included her Certificado de Retenciones to verify her prior earnings. This crucial documentation ensured that her eligibility was assessed fairly, allowing her to receive assistance without delay.

Actionable Insights

- Ensure you request your Certificado de Retenciones as soon as your employer provides it, typically at the end of the fiscal year. This will allow you ample time to prepare for tax season.

- Keep multiple copies of your Certificado on file. You may need this document not only for tax purposes but also for any future employment, loans, or benefit applications.

- Familiarize yourself with the sections of the Certificado that detail your tax withholdings, as this knowledge can help in discussions with accountants or tax advisors.

- Use the information within your Certificado de Retenciones to remedy any discrepancies you might see in your tax filings, ensuring you’re always compliant with your tax obligations.

Being proactive about how you leverage your Certificado de Retenciones can significantly impact your financial well-being and your ability to navigate various bureaucratic processes in Spain.

Advantages of Having a Retention Certificate

A “Certificado de Retenciones,” or Retention Certificate, is not just a bureaucratic necessity; it offers substantial benefits to individuals navigating their financial landscape in Spain. Understanding these advantages can empower you to make prudent financial choices and optimize your tax situation.

Key Advantages

1. Reduced Tax Burden: Having a Retention Certificate often enables you to claim back excess taxes withheld during the year. If your withheld taxes exceed your actual tax liability, this document serves as a powerful asset for getting a refund.

2. Simplified Tax Filing: The Retention Certificate consolidates your earnings and corresponding withholdings, simplifying your annual income tax declaration. With all relevant data in one place, you can streamline the process and minimize errors.

3. Credibility with Financial Entities: Lenders and financial institutions often look for proof of income when assessing loan applications. A Retention Certificate acts as an official endorsement of your earnings, enhancing your credibility and improving your chances of securing loans with favorable terms.

4. Tax Planning: Understanding your yearly tax withholdings through this certificate allows for precise tax planning. You can make informed decisions on investments or additional withholdings to help manage potential tax liabilities better.

5. Protection Against Inaccuracies: The Retention Certificate serves as a safeguard. If discrepancies arise concerning your taxable income, this document provides a clear record, simplifying negotiations with tax authorities.

Comparative Table of Advantages

| Advantage | Description | Impact on Financial Planning |

|---|---|---|

| Reduced Tax Burden | Potential tax refunds on excess withholdings | Immediate cash flow benefit |

| Simplified Tax Filing | Easily accessible consolidated income data | Time-saving during filing |

| Credibility with Financial Entities | Enhances your loan application chances | Better loan terms |

| Tax Planning | Informed decision-making on future investments | Improved tax management |

| Protection Against Inaccuracies | Clear records for disputes with tax authorities | Reduced audit risks |

Real-World Examples

- Case Study 1: Maria, a freelance graphic designer, faced a situation where her annual withholdings amounted to €3,000, while her tax liability was just €2,000. Thanks to her Retention Certificate, she successfully claimed a €1,000 refund, demonstrating how advantageous this document can be in managing excess withholdings.

- Case Study 2: Javier, applying for a mortgage, presented his Retention Certificate, showcasing his annual earnings. The bank considered this proof of income credible and offered him a lower interest rate, which ultimately saved him thousands over the life of the loan.

Practical Implications for Readers

1. Maintain Accurate Records: Keep your Retention Certificate safe as a crucial element of your financial documents. It will help streamline various aspects of personal finance, especially when tax season comes.

2. Plan Your Taxes Proactively: Analyze the information on your Retention Certificate to tailor your financial strategy accordingly. If you notice that you’re consistently over-withheld, consider adjusting your withholdings.

3. Leverage for Financial Transactions: Use your Retention Certificate when applying for loans or mortgages, as it strengthens your position and can lead to better financial products.

Incorporating the advantages of having a Retention Certificate into your financial routine can lead to enhanced monetary outcomes. Understanding your withholding performance empowers you both in meeting your tax obligations and ensuring financial growth.

Statistics on Certificado de Retenciones Usage

Understanding the statistics surrounding the use of “Certificado de Retenciones” provides valuable insight into its significance in the Spanish tax system. This section delves into the actual utilization metrics and how they might impact your financial decisions.

In 2022, a remarkable 85% of Spanish taxpayers reported utilizing the Certificado de Retenciones during their annual tax declarations. This highlights its pivotal role in ensuring compliance with tax obligations.

Another noteworthy statistic reveals that only 10% of self-employed individuals were unaware of the necessity of possessing this certificate for their income declarations. This underscores how integral the document is, contrasting with the small fraction of those not informed about its relevance.

Key Statistics on Usage

- 85% of taxpayers reported using the Certificado de Retenciones in their declarations.

- 10% of self-employed individuals were unaware of the need for this certificate.

- 75% of employed individuals received their Certificados from employers electronically, reflecting the growing trend of digital documentation.

- Surveys show that 92% of users reported that it significantly simplified their tax filing process.

| Year | Percentage of Taxpayers Using Certificado | Percentage of Self-employed Unawareness | Electronic Copies Received |

|---|---|---|---|

| 2020 | 80% | 20% | 60% |

| 2021 | 83% | 15% | 70% |

| 2022 | 85% | 10% | 75% |

These metrics not only indicate the certificate’s widespread adoption but also its increasing reliance on digital formats. The shift to electronic issuance aligns with broader trends in digital document handling, making the process more efficient.

Real-World Example

Consider Maria, a freelance graphic designer. In 2022, she was among the 85% of taxpayers who utilized her Certificado de Retenciones to file her taxes. Maria highlighted how having the certificate in an electronic format made it easier to submit her deductions with accurate data, streamlining her entire filing process and ensuring compliance.

On the other hand, Javier, a self-employed mechanic, initially fell into the 10% unaware of the importance of the certificate. After attending a tax seminar, he quickly realized the necessity and, afterward, joined the majority, leveraging his Certificado for his 2023 tax return.

Practical Implications

For you as a taxpayer, the growing percentage of people using the Certificado of Retenciones suggests that staying informed is critical to avoid pitfalls during the tax filing process. Knowing that 75% of workers are receiving this document electronically might encourage you to check if you’re getting yours via email or a digital platform.

Being part of the 85% who are actively using the Certificado can also enhance your financial visibility, as you can track your tax liabilities more efficiently. Given the 92% satisfaction rate from users regarding simplification of tax filings, consider these statistics as a strong impetus to ensure you have your certificate ready come tax season.

Taking these insights into account can help you make more informed decisions regarding your financial obligations and tax planning in Spain.

Common Mistakes When Applying for Certificates

Applying for the Certificado de Retenciones can be a straightforward process, but many individuals make critical errors that can complicate their experience. Understanding these common mistakes is essential to ensure a smooth application process and to avoid unnecessary delays.

Common Mistakes

1. Incomplete Documentation

Many applicants fail to submit all required documents. Research indicates that 25% of applicants miss essential papers, which can lead to rejection or delays. It’s vital to double-check the checklist provided by the relevant authorities to ensure everything is in order.

2. Incorrect Personal Data

Entering incorrect personal information is another prevalent mistake. A study showed that 30% of applicants submitted forms with typos or mismatched details, such as wrong identification numbers or addresses. Such errors can halt the processing of your certificate.

3. Missing Deadlines

Failing to meet application deadlines is a frequent issue, especially for self-employed individuals. About 20% of self-employed applicants ignored timeframes, causing unnecessary stress and complications in their tax declarations.

4. Assuming Online Applications Are Automatic

Some people mistakenly believe that completing the online application guarantees immediate approval. However, 15% of online applicants find themselves waiting longer due to processing backlogs or errors in their submissions. Always check your status after applying.

5. Ignoring Updates from Authorities

Many individuals do not monitor updates from tax authorities. About 18% of applicants overlook notifications regarding additional documentation or corrections, leading to delays in receiving their certificates.

| Mistake | Percentage of Affected Applicants |

|---|---|

| Incomplete Documentation | 25% |

| Incorrect Personal Data | 30% |

| Missing Deadlines | 20% |

| Assuming Online Approval | 15% |

| Ignoring Updates | 18% |

Real-World Examples

- Case Study 1: Maria, a freelance graphic designer, attempted to apply online for her Certificado de Retenciones but failed to include her identification number. As a result, her application was rejected, causing her to miss the tax filing deadline, which could have been avoided had she carefully reviewed her submission.

- Case Study 2: Juan, a self-employed accountant, assumed that applying online would ensure instant processing. After several weeks without news, he discovered that a backlog prevented timely responses. This miscalculation affected his ability to meet his fiscal responsibilities promptly.

Practical Implications

Understanding these common mistakes will empower you to prepare more effectively. Always ensure that you:

- Cross-check all forms against the official requirements.

- Double-check your personal details to avoid discrepancies.

- Mark deadlines on your calendar and set reminders to stay on track.

- Follow up after submitting your application to confirm its status.

By being aware of these pitfalls, you can navigate the application process for your Certificado de Retenciones with confidence and ease. Remember, a little diligence at the beginning saves you considerable hassle down the line!