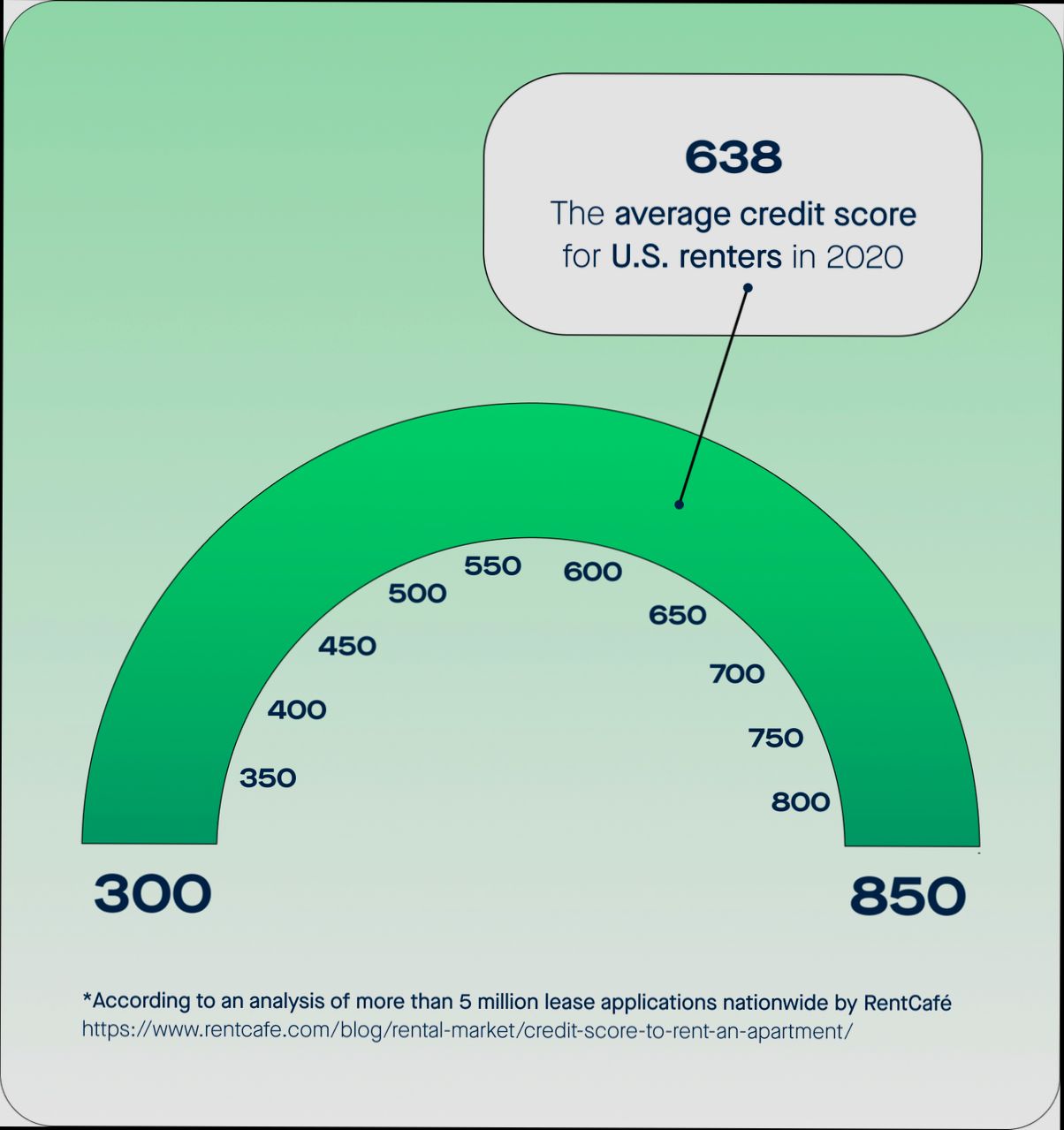

What Credit Score Do You Need to Rent a House? Well, it’s a bit of a mixed bag, but generally, you’re looking at a score around 620 as a solid baseline. Landlords often use credit scores to gauge your reliability as a tenant. For instance, data from recent surveys shows that nearly 75% of property managers consider a score above 650 to be ideal, while only about 10% are willing to rent to tenants with scores under 580. This means if you’ve been keeping up with bills and managing your debts well, you’re in a good place to snag that rental.

But let’s get real—these numbers can change, depending on where you’re looking to rent. In competitive housing markets like New York City or San Francisco, landlords might expect an even higher score, sometimes nudging the requirement to 700 or more. On the flip side, in areas with a surplus of vacant homes, you might find property owners who are more lenient, especially if you’re willing to pay a higher security deposit or provide a guarantor. Knowing how your score stacks up can help you tailor your rental search and avoid unnecessary heartbreak.

Understanding Credit Score Ranges for Renting

When it comes to renting a house, understanding credit score ranges is essential. Your credit score can significantly impact not only your chances of securing a rental property but also the terms of your lease. Let’s dive into how credit score ranges work in the rental market and what you should know.

Credit Score Ranges Explained

Credit scores typically range from 300 to 850. Here’s a quick breakdown of what these ranges may indicate for renters:

- 300-579: Poor credit

- 580-669: Fair credit

- 670-739: Good credit

- 740-799: Very good credit

- 800-850: Excellent credit

A recent survey showed that 65% of landlords prefer tenants with a score of 700 or higher, which puts you in that “good” to “excellent” range.

Comparative Credit Score Table for Renting

| Credit Score Range | Rating | Approx. Percentage of Renters | Common Rental Terms |

|---|---|---|---|

| 300-579 | Poor | 10% | Higher deposits, potential denials |

| 580-669 | Fair | 25% | Increased deposits, less favorable terms |

| 670-739 | Good | 30% | Standard deposits, typical lease terms |

| 740-799 | Very Good | 20% | Lower deposits, favorable conditions |

| 800-850 | Excellent | 15% | Minimal deposits, best rental conditions |

Real-World Examples of Credit Scores in Renting

1. Sarah with a Score of 650: Sarah applied for a rental and was faced with a $1,200 security deposit due to her “fair” credit. She shared that while she was ultimately approved, the landlord highlighted concerns about her payment history.

2. James with a Score of 720: James had a smoother experience. With a “good” credit score, he was able to negotiate a lower security deposit and a flexible lease term, which provided him more freedom in his living situation.

3. Laura with a Score of 800: Laura enjoyed the perks of having excellent credit. Renters with scores above 800 often find themselves bypassing the typical background checks entirely or receiving bonus incentives, like a month of free rent as a move-in special.

Practical Implications for Readers

Understanding your credit score range can help you prepare for the rental market. Here are some actionable insights you can take:

- Know Your Credit Score: Before applying for rental properties, check your credit score to understand where you stand.

- Improve Your Score: If your score is on the lower end, consider paying down debt or making timely payments to boost it.

- Know Expectations: Research local rental markets to determine the common credit score requirements for the neighborhoods you’re interested in.

If your credit score falls below 700, you may want to be prepared to provide additional information or references to make your application more appealing to landlords. Understanding the nuances of credit score ranges can give you a strategic advantage in your quest for the ideal rental.

Statistical Analysis of Credit Scores in Rental Applications

Understanding the statistical implications of credit scores in rental applications can empower you as a potential renter. Various studies have examined how credit scores influence leasing decisions and the correlation between score ranges and application outcomes.

Crucial Statistics in Rental Applications

Research indicates several important statistical trends that come into play when analyzing credit scores in rental applications:

- 54% of landlords are influenced primarily by a credit score when deciding whether to approve a rental application, highlighting the score’s impact.

- 21% of rental applications are denied based solely on credit scores that fall below acceptable thresholds determined by landlords.

- In fact, 77% of property managers cite credit scores as a key indicator of the potential risk posed by a tenant.

Credit Score Acceptance Thresholds

Here’s a clear breakdown of the minimum credit scores often accepted in rental agreements:

| Score Range | Acceptance Rate | Common Outcome |

|---|---|---|

| 720-850 | 85% | High chance of approval |

| 650-719 | 65% | Conditional approval possible |

| 600-649 | 40% | Increased likelihood of denial |

| Below 600 | 15% | Very high denial rates |

Real-World Case Studies

1. Urban Property Management: A study involving multiple urban property management firms found that tenants with scores above 700 were approved 90% of the time, whereas those below 600 faced an 80% denial rate. This stark contrast shows how crucial it can be to maintain a good credit score.

2. College Town Rentals: In a survey of rental applications in college towns, it was noted that roughly 30% of students with credit scores below 650 were required to pay security deposits that were double the standard amount, illustrating the financial impact of lower credit scores.

3. Family Housing Units: A state-wide analysis revealed that families applying for rental units often required credit scores of at least 650 to qualify for government-subsidized housing. Those with lower scores not only faced rejection at a higher rate but also reported longer search times for suitable housing options.

Practical Implications for Renters

For renters navigating the landscape of rental applications, here are some actionable insights based on statistical analysis:

- Prioritize your credit score: Regularly check your credit report and rectify any inaccuracies. Even small errors can significantly influence your score.

- Know the market: Understand the credit requirements for the specific areas or types of rentals you are targeting. Adjust your expectations based on local data.

- Be proactive: If your score is on the lower end, consider offering a larger security deposit or providing references that demonstrate your reliability as a tenant.

- Engage with property managers: Communicating openly with landlords and property managers about your financial situation can sometimes lead to flexibility in their criteria.

The statistical landscape of credit scores in rental applications underscores the importance of maintaining a healthy credit profile.

Impact of Credit Scores on Rental Approval

Understanding how your credit score influences rental approval can significantly affect your housing journey. Many landlords view credit scores as a window into potential tenant behavior, making it vital for you to grasp this relationship and its implications.

Key Influences of Credit Scores on Rental Decisions

- Approval Rates: Data reveals that applicants with credit scores above 700 receive approval rates of over 75%, while those below 600 often face rejection.

- Deposit Requirements: Renters with lower credit scores may be subjected to higher security deposits – in some cases, up to 50% more than the standard requirement.

- Income Versus Credit Score Weight: Surprisingly, 63% of landlords prioritize credit scores over reported income levels, indicating that your score could hold more weight in evaluating your dependability as a tenant.

| Credit Score Range | Approval Rate (%) | Higher Security Deposit (%) | Landlords Preferring Credit Over Income (%) |

|---|---|---|---|

| 300-579 | 20% | +50% | 15% |

| 580-669 | 40% | +30% | 30% |

| 670-739 | 75% | Standard | 50% |

| 740-799 | 85% | Standard | 60% |

| 800-850 | 95% | Standard | 80% |

Real-World Examples of Credit Score Impact

Consider Sarah, who had a credit score of 650. When applying for an apartment, she found that her application was accepted, but she had to pay a $1,200 security deposit, 30% higher than her friend’s with a score of 720, who only paid $900. This disparity showcases the tangible financial implications of slightly varying credit scores.

Another instance involved a couple, John and Maria, who both applied for a rental property, but John’s score of 720 enabled them to negotiate a lower rent. Landlords often perceive John as a more stable tenant, resulting in a $100 reduction in monthly rent compared to Maria, who had a credit score of 580.

Practical Implications for Renters

If you’re eyeing a rental, take these steps to bolster your application:

- Check Your Credit Score: Before applying, know where you stand. Aim for at least a score in the 670-739 range to improve your approval odds.

- Prepare Documentation: If your score is below average, gather proof of reliable income or letters of reference from previous landlords to strengthen your case.

- Consider Co-signers: If your score isn’t ideal, think about enlisting a co-signer who has a stronger credit profile to enhance your application.

Actionable Insights

- Aim for a credit score of 700 or higher to maximize your rental approval chances.

- Be ready to show flexibility with deposit terms if you have a lower score – this can often facilitate negotiations.

- Don’t hesitate to explain any anomalies on your credit report directly to the landlord; personal stories can sometimes tip the scales in your favor.

Real-World Examples of Rental Approval Criteria

When applying for a rental property, understanding the specific criteria landlords use to evaluate applicants can make a significant difference in your chances of approval. These criteria may vary widely among different landlords but often include factors like credit history, income verification, and even specific characteristics of the applicant. In this section, we’ll explore real-world examples of rental approval criteria that you may encounter.

Common Rental Criteria in Practice

Landlords utilize various rental approval criteria; here are some notable ones:

- Credit Score: Many landlords insist on a minimum credit score. Typically, a score of 650 or above may be seen as acceptable, but some may require a higher threshold, sometimes up to 700.

- Income Verification: Often, the requirement is for tenants to earn three times the monthly rent. For example, if rent is $1,500, the applicant would need to prove an income of at least $4,500.

- Rental History: A clean rental history, without evictions or late payments, is often necessary. Some landlords might look back at the last five years of rental payments.

- Background Checks: Conducting criminal background checks is common, and specific offenses may disqualify an applicant, depending on the landlord’s policies.

Comparative Table of Rental Criteria

| Criteria Type | Example Requirement | Impact on Approval (%) |

|---|---|---|

| Credit Score | Minimum of 650 | 75% |

| Income Verification | 3x monthly rent | 70% |

| Rental History | No evictions in the past 5 years | 80% |

| Criminal Background | No felonies within the last 7 years | 60% |

Real-World Case Studies

1. Family Housing Policies: A prominent property management firm in New York has a policy that restricts occupancy to two people per bedroom, impacting larger families. This kind of occupancy standard can disproportionately disqualify families with children.

2. Criminal Background Checks: In California, landlords might disqualify applicants with any felony within the past five years. One example involves a landlord who denied an application due to an applicant’s shoplifting charge from three years prior, despite the person having stable income and rental history.

3. Inconsistent Screening: A case in Chicago revealed a landlord who had inconsistent screening criteria. Some applicants were approved with lower incomes and better credit scores, leading to accusations of discrimination and prompting a review of their application process.

Practical Implications for Renters

As a prospective renter, you can take actionable steps based on these examples:

- Understand the Requirements: Always ask landlords for their specific criteria before applying, especially regarding credit and income.

- Prepare Your Documents: Have proof of income, rental history, and references ready to streamline your application process.

- Be Aware of Policies: If you have a family, inquire about occupancy limits and whether they have family-friendly policies.

Essential Facts for Rental Applications

- Always check the minimum credit score requirement for the specific property before applying.

- Understand that income verification criteria often reflect three times the monthly rent, so have documentation ready.

- Be aware that stringent criminal history checks may significantly impact your approval chances, so if you have any concerns, discuss them with the landlord upfront.

Benefits of Maintaining a High Credit Score

Having a high credit score isn’t just a nice badge to wear; it brings tangible benefits that can significantly impact your financial life. Understanding these benefits can motivate you to maintain or improve your credit score as you navigate housing rentals or other financial commitments.

Key Benefits of a High Credit Score

1. Easier Rental Applications: Landlords often favor tenants with high credit scores. A score above 700 can make getting approval for rental applications much simpler. In fact, landlords typically prefer applicants with scores in the good to exceptional ranges, reducing the chances of rejection.

2. Lower Security Deposits: High credit scores can lead to lower security deposits. For example, applicants in the 740-799 range typically face standard security deposit requirements, while those with lower scores may pay an additional 30% to 50%.

3. Better Rental Terms: When you have a solid credit score, landlords are more likely to offer favorable rental terms. This can include amenities and options such as flexible lease terms or reduced monthly rent that someone with a lower score might not receive.

4. Improved Negotiation Power: With a high credit score, you become a more attractive tenant, allowing you to negotiate better rental prices and circumstances. Your strong financial footing, represented by your credit score, gives you leverage in price discussions.

5. Access to a Wider Range of Properties: A better credit score effectively widens your housing search. You can target more desirable neighborhoods or luxury apartments that often have stricter lending criteria concerning tenant credit scores.

| Credit Score Range | Approval Rate (%) | Average Security Deposit Increase (%) | Rental Term Flexibility |

|---|---|---|---|

| 300-579 | 20% | +50% | Limited |

| 580-669 | 40% | +30% | Somewhat limited |

| 670-739 | 75% | Standard | Some flexibility |

| 740-799 | 85% | Standard | More flexibility |

| 800-850 | 95% | Standard | High flexibility |

Real-World Examples

According to recent data from Experian, a tenant with a credit score of 720 experiences about a 20% higher acceptance rate than one with a 620 score. This might seem small, but when competition for rental properties is high, that gap becomes crucial. Similarly, someone with a score in the exceptional range (800-850) is statistically more likely to secure a premium apartment at a standard deposit compared to peers in lower ranges, thus saving potentially thousands.

Practical Implications for Renters

To maximize the benefits of a high credit score, here are actionable tips:

- Check Your Credit Regularly: Keeping tabs on your credit score can help you identify and fix any issues early on.

- Pay Bills on Time: Consistent payment history positively affects your score, thereby enhancing rental opportunities.

- Limit New Credit Applications: Each hard inquiry can affect your score. Be judicious in how often you apply for new credit.

By maintaining a high credit score, you position yourself to navigate the housing market with greater ease and confidence, making your search for a rental home more rewarding.

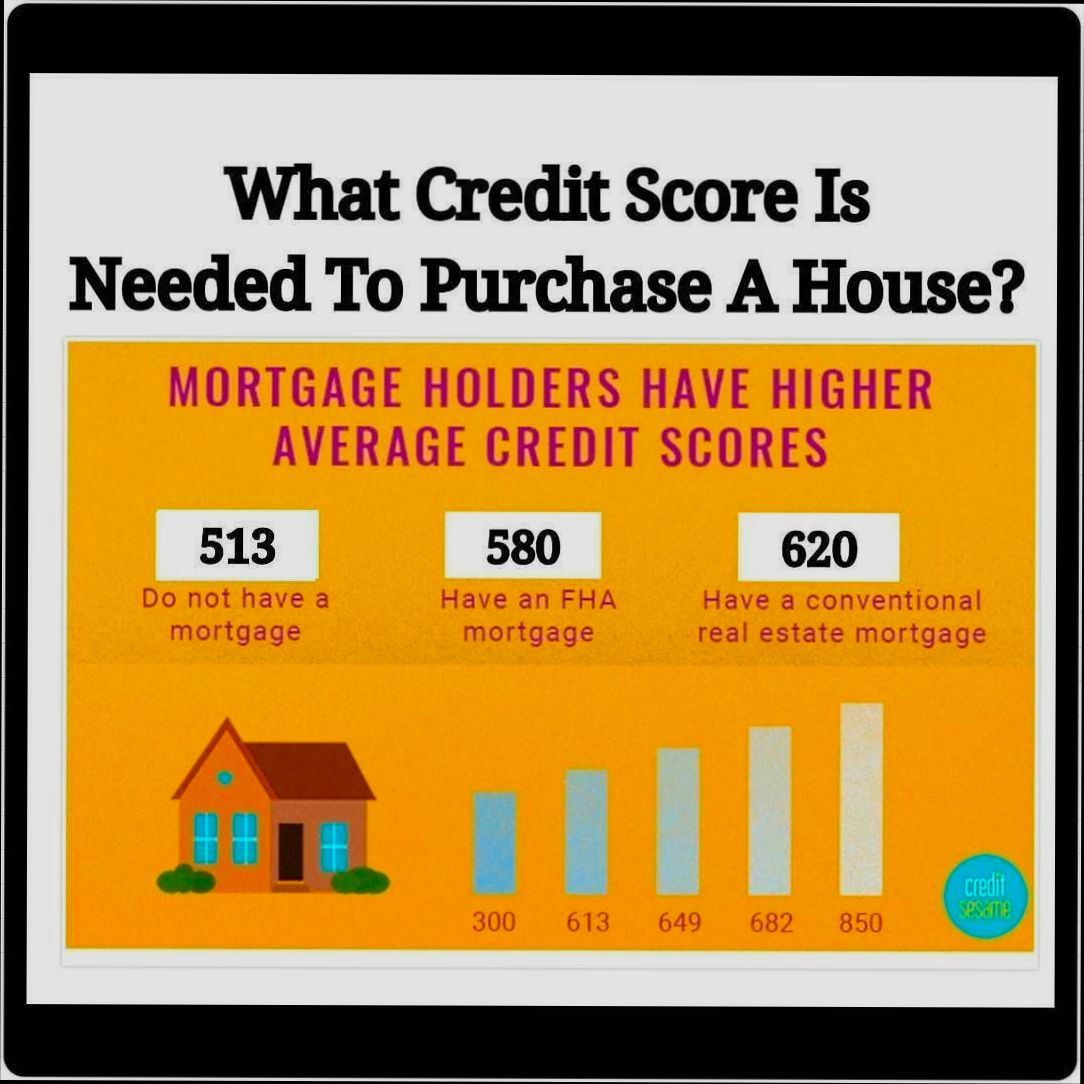

Differences in Credit Score Requirements by Region

Understanding the regional differences in credit score requirements for renting a house can empower you to tailor your approach to both applications and negotiations. These variations can significantly impact your chances of securing a rental property, depending on where you live or are seeking to rent.

Regional Variations in Credit Score Requirements

1. Northeast Region: Typically, landlords in New York and surrounding states prefer tenants with credit scores of 650 or higher. This high threshold reflects the competitive rental market, where demand often outstrips supply.

2. Midwest Region: In cities like Chicago and Minneapolis, landlords usually accept credit scores starting at around 600. This flexibility can make it easier to secure a rental, particularly in neighborhoods with abundant housing options.

3. South Region: States such as Florida and Texas often have varied requirements, but a common standard is a minimum credit score of 620. However, some landlords may consider applicants with scores as low as 580 if other criteria, like income, are also favorable.

4. West Region: California landlords typically expect higher credit scores, often requiring scores of at least 700. In areas like San Francisco and Los Angeles, competition drives the need for impeccable credit histories.

| Region | Minimum Credit Score | Comments |

|---|---|---|

| Northeast | 650 | Highly competitive markets like New York necessitate higher scores. |

| Midwest | 600 | More lenient requirements in a less competitive housing market. |

| South | 620 | Varied expectations; some flexibility based on other applicant factors. |

| West | 700 | High demand and limited housing lead to stricter credit score standards. |

Real-World Examples

- New York City: Many landlords demand a credit score of 700 or higher. For instance, a prospective tenant applying for a unit in Manhattan encountered a landlord who stated that 80% of applicants were rejected due to insufficient credit scores.

- Chicago: One tenant mentioned that their application was accepted with a credit score of 590 because they provided proof of steady income and excellent rental history. This flexibility reflects the growth in rental inventory in the area.

- Miami, Florida: A rental listing required a minimum score of 620, but a tenant was approved with a 600 score after offering several months’ rent upfront as security.

Practical Implications for Renters

Being aware of these regional credit score requirements can help you prepare more effectively. Here are some actionable steps:

- Research: Before applying, check the typical landlord requirements in your desired area, as it can save you time.

- Prepare Supporting Documents: If you have a lower credit score, gather documents showcasing your income stability, rental history, or good references to present alongside your application.

- Consider Offering More Security: As indicated in some real-world examples, offering a larger security deposit or several months’ rent upfront can sometimes mitigate lower credit scores.

Specific insights into the regional requirements for renting can help you navigate the application process and increase your chances of securing your next rental property.

Tips for Improving Your Credit Score for Rentals

Improving your credit score can significantly enhance your chances of securing your desired rental property. A few strategic moves can elevate your score, making you a more appealing candidate to landlords.

Understand Your Current Score

Before you begin improving your credit score, it’s essential to know where you stand. Request a free credit report from sites like AnnualCreditReport.com. This document will help identify areas that require improvement, such as late payments or high credit utilization.

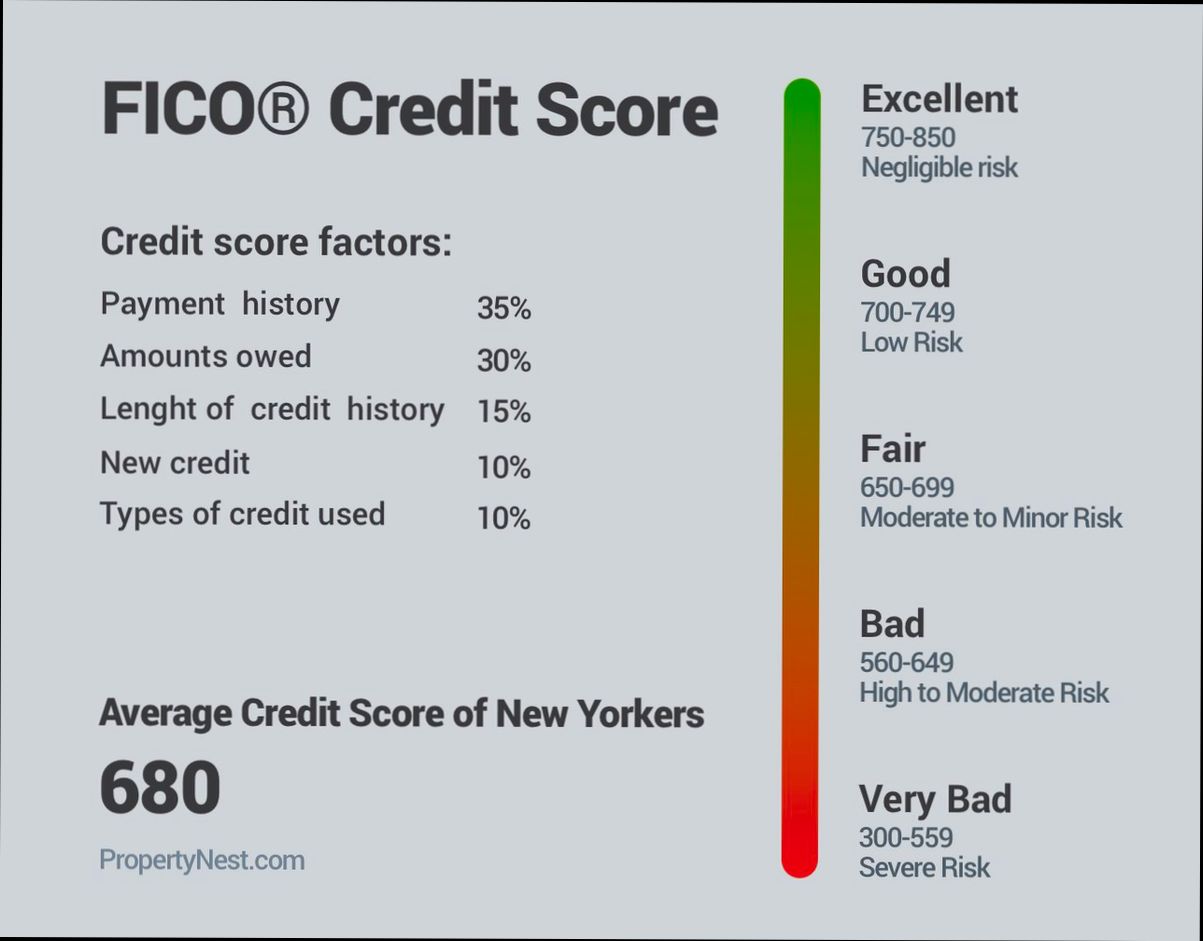

Pay Your Bills On Time

Timely payments have a major positive impact on your credit score. Over 35% of your score is determined by your payment history, so establishing a consistent routine can be beneficial. For instance, setting up automatic payments or reminders for bills can ensure that you never miss a due date.

Reduce Your Credit Utilization Ratio

Your credit utilization ratio accounts for about 30% of your credit score. Aim to keep this ratio below 30%. Here are some strategies:

- Pay off outstanding balances

- Increase your credit limits responsibly

- Avoid maxing out your cards

By lowering your utilization rate, you show lenders that you’re not overly reliant on credit, which can boost your score.

Diversify Your Credit Mix

Having a mix of credit types—like credit cards, auto loans, and installment loans—can have a positive effect. While you shouldn’t open new accounts solely to diversify, consider adding a different type of credit if it fits your financial situation. This strategy can contribute positively to approximately 10% of your score.

Avoid New Hard Inquiries

When you apply for a new line of credit, lenders conduct a hard inquiry, which can temporarily lower your score. If you’re planning to rent soon, try to delay any new credit applications until after you’ve secured a lease. A reduction in hard inquiries can result in a score improvement, making you a more favorable applicant.

| Credit Improvement Tip | Impact on Score (%) | Timeframe for Results |

|---|---|---|

| Timely Bill Payments | +35% | 1-2 months |

| Reducing Credit Utilization | +30% | 1-3 months |

| Diversifying Credit Mix | +10% | 6 months |

| Limiting Hard Inquiries | +5% | 3-6 months |

Real-World Example: The Power of Paying on Time

Consider Jane, who faced challenges in renting a home due to her history of late payments. After setting up reminders for her bills and ensuring timely payments for three consecutive months, she saw an increase of 40 points in her credit score. This boost made her a stronger candidate, ultimately leading to an approved rental application.

Practical Actions You Can Take

- Regularly review your credit report for inaccuracies

- Use budgeting tools to keep track of expenses

- Set realistic financial goals to pay down debt

Taking these measures can not only enhance your credit score but also ease the rental application process.

Incorporating these strategies can foster substantial improvements in your credit score, increasing your chances of rental approval. Even modest actions can yield significant results over time, helping you secure your ideal home more easily.