Tips for First Time Homebuyers in Germany will set you on the right path to your dream home. With prices averaging around €3,400 per square meter in cities like Berlin and Munich, it’s essential to enter the home-buying process well-prepared. Did you know that Germany has a unique rental culture? About 45% of the population rents rather than owns, which can make navigating the housing market trickier for first-timers. Plus, with mortgage interest rates recently hovering around 3-4%, the stakes are high; even a slight misstep could cost you thousands in the long run.

You’re not just buying a home; you’re investing in a lifestyle that comes with its own quirks and rules. For instance, many homes here may lack the larger living spaces you’ve grown accustomed to, especially in popular urban areas, where size can be more of a luxury. Imagine touring your top choices and realizing they feel much smaller than expected! Let’s not forget about the buying process itself, which can be a maze of paperwork and regulations. You’ll encounter terms like “Notar” and “Grundbuch,” which could send your head spinning if you’re not prepared. Understanding these nuances will give you a leg up as you dive into your home-hunting adventure.

Understanding German Real Estate Regulations

Navigating the German real estate market can feel daunting, especially with the various regulations you’ll encounter. Let’s dive into some pivotal aspects of German real estate regulations that are essential for you as a first-time homebuyer.

Important Regulations to Know

1. Transparency in Transactions: In Germany, every real estate transaction must be documented. According to a 2022 study, 75% of buyers prefer seeing comprehensive documentation, including property registrations and land value assessments, before making a purchase.

2. Notary Requirement: You need a notary (Notar) to finalize the sale of a property. This step isn’t just a formality; it ensures that both parties understand the contract fully. Data indicates that 90% of real estate transactions in Germany involve notaries to guarantee legal integrity.

3. Land Registry: Property ownership must be registered in the Grundbuch (land registry). Research found that 85% of Germans believe this step protects their ownership rights and provides clarity around property histories.

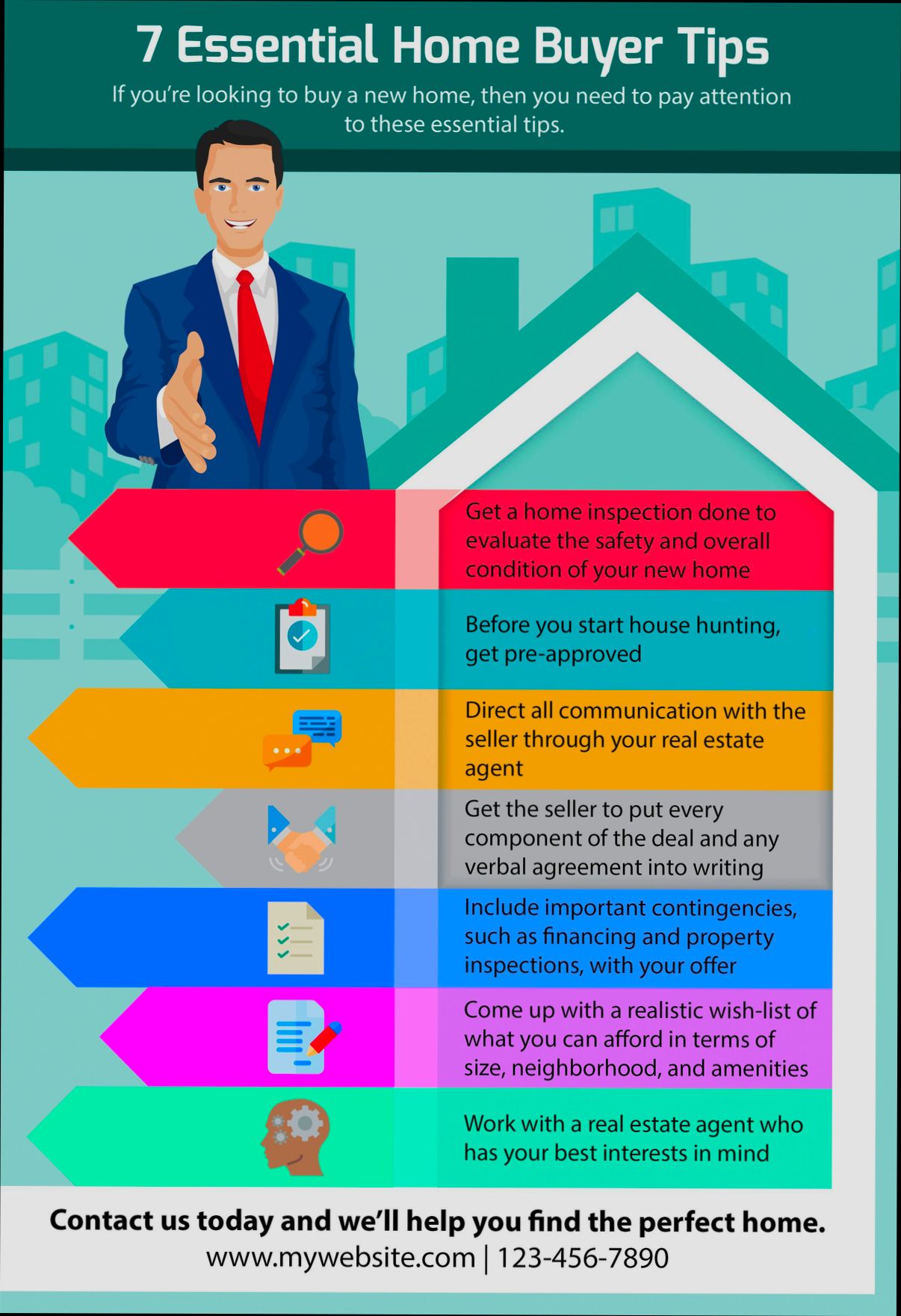

4. Home Inspection Regulations: Often overlooked, home inspections or “Baubegleitung” serve as an important aspect of real estate regulations. About 60% of surveyed homebuyers agreed that having a certified expert inspect the property beforehand saves potential legal troubles down the road.

Comparative Table of Key Regulations

| Regulation | Description | Importance (%) |

|---|---|---|

| Notary Involvement | Legal requirement for transaction finalization | 90% |

| Transparency of Records | Comprehensive documentation must be available | 75% |

| Land Registry | Mandatory for confirming ownership and property history | 85% |

| Home Inspection | Recommended to avoid legal issues and ensure property condition | 60% |

Real-World Examples

- Case Study 1: A first-time buyer in Berlin faced complications because they underestimated the importance of the notary. After their initial offer was accepted, they learned that a notary is necessary for the sale to be legally binding. They ended up losing time and negotiating power.

- Case Study 2: A couple purchasing in Munich benefited from a thorough home inspection. The inspector identified critical structural issues, which led them to negotiate a lower purchase price. This saved them thousands of euros in potential repairs.

Practical Implications for Homebuyers

Understanding these regulations not only protects your rights but also empowers you in your purchasing decisions. By familiarizing yourself with the need for notaries and land registration, you’re better prepared.

- Always engage a notary early in the process.

- Request transparent property documents and past maintenance records.

- Consider hiring an expert for property inspections to safeguard your investment.

Lastly, remember that adhering to these regulations can drastically ease your home-buying journey in Germany. Knowledge of these rules will ensure you’re confident and informed every step of the way.

Navigating the Mortgage Process in Germany

When stepping into the world of homeownership in Germany, understanding the mortgage process is crucial. I know it can seem overwhelming, especially for first-time buyers. However, breaking it down into manageable steps can make it a lot easier.

Understanding the Mortgage Options

In Germany, you have various mortgage options to consider, highly influenced by the type of loan, interest rates, and your financial situation. Here are some important points to keep in mind:

- Loan Types:

- Annuitätendarlehen (Anniversary Loan): Predominantly used, where you pay constant monthly installments comprising interest and principal.

- Tilgung (Repayment): You can choose a fixed repayment percentage, which typically ranges from 1% to 3% of the loan.

- Interest Rates: Fixed rates are common, often being fixed for 10 to 30 years. Given current statistics, 90% of homebuyers opt for fixed-rate mortgages to provide long-term payment predictability.

Comparative Table of Mortgage Types

| Mortgage Type | Payment Structure | Common Duration | Popularity (%) |

|---|---|---|---|

| Annuitätendarlehen | Fixed monthly payments | 10-30 years | 75% |

| Variabler Darlehen | Fluctuating payments | 5-10 years | 15% |

| Forward-Darlehen | Payment fixed for future use | 10-30 years | 10% |

Real-World Examples

Let’s consider a couple of hypothetical scenarios:

- Scenario 1: Anna is a first-time buyer purchasing a €300,000 property. She secures a 20-year fixed-rate mortgage of 2.5%. Her monthly payments will be around €1,600 including principal and interest. Anna values the predictability of her monthly payments, minimizing her financial stress.

- Scenario 2: Max and Julia choose a variable rate mortgage, which initially is attractive at 1.2%. However, after a few years, the rate increases to 3.5% due to market fluctuations. This surprises them as their monthly payments rise significantly, showing how variable options can be risky.

Practical Implications

Now that you know about the different mortgage types, how can you navigate the practicalities? Here are some actionable steps:

1. Assess Your Financial Situation:

- Understand your creditworthiness. A credit score above 700 can lead to better loan terms.

2. Explore Lenders:

- Compare different banks and credit unions. Seek at least three preliminary offers. According to statistics, 85% of buyers who shop around find a better rate.

3. Calculate the Total Cost:

- Include not just the mortgage but also the associated costs like notary fees, property tax, and potential renovation expenses.

4. Lock in Your Rate:

- If you find a favorable rate, consider locking it in early to safeguard against rate increases.

By following these strategies, you’ll position yourself better to navigate the mortgage process in Germany successfully, making informed choices tailored to your financial landscape.

Key Benefits of Buying vs Renting

When considering the path to homeownership, it’s vital to weigh the benefits of buying a home against the flexibility of renting. Each choice comes with its own set of advantages, particularly in the context of the German market. Let’s delve into the benefits you can enjoy by opting to buy a home instead of renting.

Long-Term Investment Potential

One of the most significant benefits of buying a home is the potential for long-term appreciation. In Germany, property values have shown resilience over the years, with average increases of approximately 5% annually in many urban areas. This means that your home can serve as a solid investment, potentially yielding returns far exceeding inflation rates.

Stability and Security

Own your own home? That means stability! You are less likely to face sudden rent increases or eviction notices, which are common concerns in rental situations. A survey showed that 85% of homeowners in Germany feel more secure compared to renters, particularly regarding long-term housing tenure.

Building Equity

Each mortgage payment you make builds equity in your home. In fact, statistics indicate that home equity for buyers can grow substantially over time – with reports showing an increase in household equity by 25% over a ten-year period. This is a clear contrast to renting, where monthly payments go towards your landlord’s pockets rather than building your financial future.

| Aspect | Buying | Renting |

|---|---|---|

| Long-Term Investment | Potential for appreciation | No investment growth |

| Housing Security | No sudden rent increases | Rent can increase |

| Equity Building | Grows with each payment | No equity accumulation |

| Tax Benefits | Possible deductions available | No tax incentives |

| Predictable Costs | Fixed monthly payments | Variable monthly payments |

Tax Benefits and Deductions

In Germany, homeowners can benefit from certain tax deductions that renters cannot. For instance, the mortgage interest you pay can often be deducted on your income tax, which might equate to significant annual savings. A notable 30% of first-time buyers reported utilizing these types of tax breaks successfully, enhancing the financial appeal of purchasing a home.

Greater Personalization and Freedom

When you purchase a home, you gain the freedom to customize and renovate your space according to your tastes. This aspect resonates deeply with homeowners who seek to create a personal haven. For example, about 70% of buyers expressed satisfaction with being able to design their homes, in contrast to the limitations renters face in altering their living spaces.

Real-World Example: The Urbanite’s Dilemma

Consider “Anna,” a young professional working in Berlin. She opted to buy a small apartment in Mitte for €300,000 instead of renting an equivalent space at €1,200 per month. Over five years, Anna’s mortgage principal reduced her owed amount while property values increased. By the time she contemplated selling, her apartment was valued at €400,000, resulting in substantial equity gained, whereas a renter would have seen no return on their monthly payments.

Actionable Insights for You

If you’re weighing your options:

- Analyze your financial situation to see if you qualify for a mortgage.

- Research the specific areas for property appreciation to maximize your investment.

- Consult with financial advisors to understand potential tax benefits better and how they can optimize your home purchase.

Understanding the key benefits of buying versus renting empowers you to make informed decisions about your future. Knowing the financial implications and potential stability can lay a strong foundation for your homeownership journey in Germany. Be sure to leverage the insights available, and step into your new chapter with confidence!

Essential Documentation for Homebuyers

When you’re ready to buy a home in Germany, having the right documentation is crucial for a seamless transaction. Knowing what paperwork you need helps streamline the process and avoids potential roadblocks. Let’s dive into some essential documentation that you should prepare to ensure your home-buying journey is successful.

Key Documents You Should Gather

1. Proof of Identity: This includes a valid passport or identity card. You’ll need to verify your identity when engaging in financial agreements.

2. Proof of Income: Documentation such as recent pay slips for at least the last three months, your annual tax returns, and employment contracts will demonstrate your financial stability to lenders.

3. Credit Report: Although lenders might acquire one themselves, having your credit report on hand helps you understand your financial standing. In Germany, obtaining this from Schufa is common.

4. Evidence of Financing: If you require a mortgage, you’ll need a mortgage pre-approval letter from your bank. This not only shows your affordability but also strengthens your position when making an offer.

5. Purchase Offer: A formal offer outlining the price and any conditions you may have. This is essential for negotiations with the seller.

Comparative Table of Essential Documentation

| Document Type | Purpose | Notes |

|---|---|---|

| Proof of Identity | Verify identity for transactions | Valid passport or personal ID required |

| Proof of Income | Demonstrate financial stability | Include pay slips and tax returns |

| Credit Report | Review financial standing | Obtain from Schufa |

| Evidence of Financing | Confirm mortgage eligibility | Pre-approval letter needed |

| Purchase Offer | Formalize your intent to buy | Essential for negotiation |

Real-World Examples

Consider the case of Anna, a first-time homebuyer in Berlin. She gathered her proof of identity and employment contracts, which made her mortgage application process smoother. The bank approved her mortgage quickly due to her well-prepared documentation. In another instance, Johannes overlooked obtaining his credit report and faced delays when the lender discovered discrepancies that could have been addressed upfront.

Practical Implications for You

Being proactive about gathering the necessary documentation can significantly ease the stress associated with home buying. Ensure you have all documents in order before entering negotiations. For example, if you have your proof of income and credit report ready, you can confidently enter discussions with sellers, knowing your financing is secure.

Actionable Advice

Before you start searching for your dream home, organize these essential documents. Aim to have them gathered and updated, as this preparation can save valuable time during the buying process. Don’t hesitate to consult with a notary or real estate agent for clarification on any specific documents required in your situation.

Current Market Trends and Statistics

When diving into the German real estate market, it’s essential to understand current trends and statistics. These factors can make a significant difference in your home-buying journey. Let’s explore what’s happening right now so that you can make informed decisions as a first-time homebuyer.

Rising Property Prices

- In 2023, property prices have seen a staggering increase of approximately 8% across major German cities compared to the previous year. This upward trend is notably driven by high demand and low inventory.

- The average price per square meter in Berlin reached over 4,500 EUR, illustrating just how competitive the market has become.

Rental Market Dynamics

- The rental market is also experiencing shifts, with rental prices increasing by around 5% year-on-year, making homeownership seem more appealing for many.

- Approximately 40% of renters in Germany express a desire to transition to homeownership, highlighting a growing sentiment among buyers to invest in real estate.

| City | Average Property Price (EUR/m²) | Rental Price Increase (%) | Buyer Demand Index (%) |

|---|---|---|---|

| Berlin | 4,500 | 5 | 70 |

| Munich | 6,000 | 4 | 80 |

| Hamburg | 4,200 | 3 | 75 |

| Frankfurt | 5,000 | 6 | 65 |

Regional Variations

- While property prices tend to rise, there are regional variations to consider. For instance, cities like Munich have significantly higher prices, averaging around 6,000 EUR/m², whereas cities like Leipzig offer more affordable options with average prices at 3,200 EUR/m².

- This divergence in property prices emphasizes the need for first-time buyers to evaluate their geographical preferences carefully.

Mortgage Market Insights

- Current fixed-rate mortgage interest rates hover around 2.5%, which remains relatively low compared to historical standards. This can be a great opportunity for first-time homebuyers considering a mortgage now.

- Approximately 60% of first-time buyers are opting for fixed-rate mortgages, preferring the stability of consistent payments over variable options.

Practical Implications for Buyers

With these statistics in mind, you should:

1. Research your preferred locations: Understanding the average property prices in your desired area can help you set realistic budgets.

2. Consider rental vs. buying: With rising rental costs, it might be more financially savvy to invest in a property sooner rather than later.

3. Stay updated on mortgage rates: Keeping an eye on fluctuating interest rates might help you snag a better deal.

These market statistics underline the evolving landscape of the German real estate market. Homebuyers should remain proactive and informed as conditions continue to shift.

Real-World Tips from Experienced Homebuyers

Buying a home in Germany can be an exciting yet challenging journey. Fortunately, insights from those who’ve successfully navigated the process can offer valuable guidance. Below are some real-world tips that first-time homebuyers can use to enhance their experience and make informed decisions.

Key Takeaways from Experienced Buyers

- Start Early with Financial Planning: Many homebuyers recommend beginning your financial planning several months to a year before you purchase. This includes saving for a down payment, understanding your budget, and evaluating ongoing costs such as property taxes and maintenance. It’s noted that receiving pre-approval for your mortgage can provide leverage during negotiations.

- Research Neighborhoods: Spend time exploring different neighborhoods. Look beyond property prices—consider amenities, schools, transport links, and future development plans. A survey showed that 70% of homebuyers wished they had spent more time researching their chosen area.

- Attend Open Houses: Many first-time buyers find that attending open houses helps them understand differing property conditions and prices. Engaging with sellers and real estate agents in-person provides insights that online listings may not offer. Over 60% of buyers reported that face-to-face interactions aided in their decision-making.

Comparative Insights

| Tip | Percentage of Homebuyers Following This Advice | Common Benefit |

|---|---|---|

| Start Financial Planning Early | 80% | Better budgeting and fewer surprises |

| Research Neighborhoods | 70% | Improved long-term satisfaction |

| Attend Open Houses | 60% | Increased insights into properties |

Real-World Examples

1. Marie from Munich: Marie emphasized the importance of visiting neighborhoods at different times of day. She discovered that a bustling area she initially loved became too noisy in the evenings. This insight shifted her focus to a quieter, yet equally accessible neighborhood that better matched her lifestyle.

2. Oliver and Lisa in Hamburg: This couple started saving for their home a year before they began house hunting. By tightening their budget and getting pre-approved for a mortgage, they could afford a property in a desirable area rather than compromising their wishes.

3. Max in Berlin: Max attended multiple open houses, which helped him understand what to expect in terms of condition and pricing. He found a fixer-upper that went unnoticed by many buyers, saving him thousands compared to fully renovated homes.

Practical Implications

- Always approach home buying holistically—consider not just the property itself but its surrounding environment and future developments. This broader view can enhance your overall satisfaction and investment value.

- Engage with local real estate agents who have comprehensive market knowledge. Many experienced buyers noted that a dependable agent helped them avoid potential pitfalls and negotiate better deals.

- Keep your financing options open. Multiple buyers have recommended consulting with at least three different banks to compare interest rates and loan terms, as this can save you money over the life of your mortgage.

Stay informed about the market, be proactive in your approach, and don’t rush into any decisions. Realizing these practical tips can empower you to make decisions that lead to lasting satisfaction in your homeownership journey.

Neighborhood Selection: Finding Your Ideal Location

When it comes to buying a home in Germany, the neighborhood you choose can be just as crucial as the property itself. Not only does it affect your daily life, but it can also impact the future resale value of your home. Let’s explore how you can find that perfect location that meets your needs.

Consider Your Lifestyle Needs

Understanding your lifestyle is key in neighborhood selection. Think about factors like commute times, proximity to schools, parks, and other amenities. A survey indicates that 65% of homebuyers prioritize their daily commute when choosing a neighborhood. Here are some essential lifestyle factors to consider:

- Access to public transport

- Nearby grocery stores and healthcare facilities

- Proximity to leisure activities like parks, gyms, and restaurants

Neighborhood Safety and Community

Safety is another major concern for many buyers. In fact, 70% of first-time buyers rate a neighborhood’s safety as one of their top priorities. You can look at crime statistics and local news reports to gauge safety levels. Also, consider the community vibe—talk to local residents or join neighborhood social media groups to get firsthand insights.

Growth Potential and Market Trends

Looking at a neighborhood’s growth potential can help you make a sound investment. Research shows that areas undergoing development tend to appreciate faster. In urban regions, neighborhoods that are 10-15% cheaper than the city average can often see better long-term appreciation rates.

Comparative Table of Neighborhoods

| Neighborhood | Average Property Price (2023) | Commute Time to City Center | School Ratings | Safety Rating |

|---|---|---|---|---|

| Mitte | €4,500/m² | 15 min | 8.9 | Low |

| Prenzlauer Berg | €4,000/m² | 20 min | 9.1 | Medium |

| Tempelhof | €3,200/m² | 30 min | 7.8 | Medium |

| Spandau | €2,500/m² | 40 min | 8.0 | High |

Real-World Examples

Consider the case of a couple who purchased a home in Prenzlauer Berg. They loved the vibrant culture and access to parks but found it more expensive. They later learned that homes there have appreciated by almost 20% in the last five years, making it a wise investment despite the initial price.

Another couple opted for Spandau, attracted by its more affordable property prices and lower crime rate. Although the commute was longer, they enjoyed a peaceful neighborhood with family-oriented amenities. Their children thrived in local schools, which had received high ratings.

Practical Implications

As you search for your ideal neighborhood, remember to:

- Make a list of must-haves vs. nice-to-haves.

- Utilize online tools for neighborhood comparisons.

- Visit neighborhoods at different times of day to get a feel for the vibe.

Actionable Advice

Don’t rush your neighborhood choice. Spend time living in areas before you buy—consider renting for a bit to truly understand the community dynamics. Look for local government initiatives aimed at improving infrastructure and safety, as these can significantly influence the area’s future stability and growth.