How to Get a Mortgage Loan can feel like navigating a maze, especially if it’s your first time. Did you know that as of 2023, the average mortgage rate hovers around 7%? If you’re eyeing a $300,000 home, that sweet spot of monthly payments can be a hefty chunk of change—around $2,000 each month. And let’s not forget about that down payment. If you’re planning to put down the typical 20%, that’s $60,000 upfront—no small feat! To make things more interesting, you’ll need to gather a slew of documents like pay stubs, tax returns, and bank statements to prove you’re a responsible borrower.

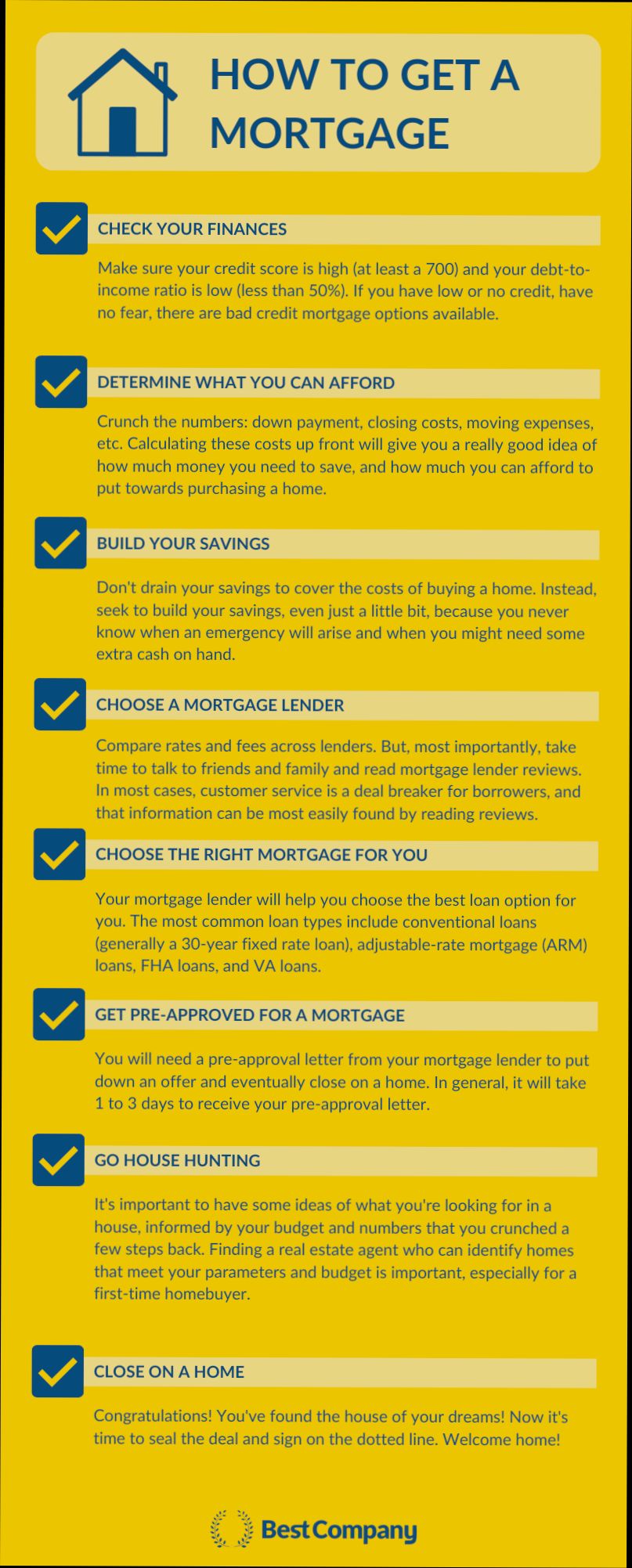

But it’s not just about the numbers; it’s about the whole experience. Imagine walking into a bank, feeling equipped with knowledge about your credit score, which ideally should be above 620 to snag a decent rate. As you probably know, your credit history is like a report card for lenders, influencing both your eligibility and interest rates. You might even bump into folks discussing different loan types—like fixed versus adjustable rates—and weighing the pros and cons based on their personal circumstances. With so many factors at play, getting a mortgage can be as tricky as a game of chess, where every move counts.

Understanding Mortgage Loan Types

When it comes to securing a mortgage, understanding the various types of loans available can significantly impact your financial journey. Each mortgage type is tailored to meet different needs, preferences, and financial situations. Let’s explore these loan types to help you make an informed decision.

Common Mortgage Loan Types

Several mortgage loan types cater to varying financial circumstances. Below are some key types to consider:

- Fixed-Rate Mortgages: These loans offer a consistent interest rate over the life of the loan. Approximately 70% of homeowners opt for fixed-rate mortgages for their predictability, often ensuring stability in monthly payments.

- Adjustable-Rate Mortgages (ARMs): With ARMs, the interest rate is fixed for an initial period (typically 5, 7, or 10 years) and then adjusts annually. About 30% of mortgage holders choose ARMs, often enticing borrowers with lower initial rates.

- FHA Loans: Insured by the Federal Housing Administration, these loans are designed for low-to-moderate-income borrowers. A significant benefit is the low down payment requirement—sometimes as low as 3.5%. About 20% of first-time homebuyers utilize FHA loans.

- VA Loans: Available to veterans, active-duty service members, and certain members of the National Guard and Reserves, VA loans allow eligible borrowers to purchase homes without a down payment. Statistics show that over 15% of U.S. mortgages are VA loans, underscoring their popularity among military families.

- USDA Loans: For rural and suburban homebuyers, USDA loans offer 100% financing with no down payment required for eligible homes. This type accounts for around 2% of the mortgage market and is an excellent option for those in less populated areas.

| Loan Type | Typical Down Payment | Interest Rate Stability | Who is it For |

|---|---|---|---|

| Fixed-Rate Mortgage | 3% - 20% | Stable for the whole term | Long-term homeowners |

| Adjustable-Rate Mortgage | 3% - 20% | Initially fixed, then adjustable | Those expecting to move or refinance |

| FHA Loans | As low as 3.5% | Stable for the whole term | First-time homebuyers |

| VA Loans | 0% | Stable for the whole term | Veterans and military families |

| USDA Loans | 0% | Stable for the whole term | Rural homebuyers |

Real-World Examples

Consider Sarah, who recently purchased her first home using an FHA loan. With a down payment of just 3.5%, she comfortably managed her finances while securing a stable loan. Meanwhile, John, a veteran, chose a VA loan. By forgoing a down payment, he effectively saved thousands while still purchasing a home that met his needs.

In another scenario, Emily opted for an ARM when purchasing her home. By capitalizing on the lower initial rate, she reduced her monthly payments, planning to refinance before the rate adjusted.

Practical Implications

It’s crucial to assess your financial situation and future plans when choosing a mortgage loan type. Ask yourself:

- How long do I intend to stay in this home?

- Am I comfortable with the potential fluctuation of interest rates?

- What is my current financial situation regarding income and savings?

By answering these questions, you can better determine which mortgage loan type aligns with your goals and stability preferences.

Finally, remember that the type of mortgage you choose can significantly influence your long-term financial health. Make sure to conduct thorough research and consult with mortgage professionals to find the best fit for your situation.

Key Factors Influencing Mortgage Approval

When you’re navigating the mortgage approval process, several critical factors come into play that can significantly impact your chances of securing a loan. Understanding these factors can empower you to make informed financial decisions as you embark on your home-buying journey.

Credit Score

Your credit score is one of the most pivotal factors influencing mortgage approval. Typically, most lenders prefer a minimum credit score of 620 for conventional loans, while government-backed loans like FHA might accept scores as low as 500. Each point in your score can affect your approval chances and interest rates.

Debt-to-Income Ratio (DTI)

Another essential factor is your debt-to-income ratio, which measures how much of your income goes towards paying your debts. Many lenders look for a DTI ratio of 43% or lower. For instance, if your monthly gross income is $5,000, your monthly debt payments (including the proposed mortgage) should not exceed $2,150.

Employment History

Stable employment is critical for lenders. They typically appreciate at least two years of continuous employment in the same field. For example, if you switched jobs for a higher salary but remained in the same industry, most lenders will view this positively.

| Factor | Ideal Benchmark | Minimum Acceptable Level |

|---|---|---|

| Credit Score | 740+ | 620 |

| Debt-to-Income Ratio | 36% or lower | 43% |

| Employment Duration | 2+ years in same field | 6 months |

Real-World Examples

Consider two individuals applying for a mortgage.

- Jane has a credit score of 700, a DTI of 35%, and has been at her job for five years. She gets approved easily with favorable terms.

- Mike, on the other hand, has a credit score of 580, a DTI of 45%, and a job change every year. He faces a more complex approval process and is likely to incur higher rates or be declined altogether.

Practical Implications

If you’re looking to improve your chances of mortgage approval, start by checking and enhancing your credit score. This could mean paying off outstanding debts, ensuring timely bill payments, and keeping credit utilization low. Further, endeavor to maintain a stable income and reduce your existing liabilities to lower your DTI.

Actionable Advice

If you’re close to the ideal benchmarks mentioned, focus on small adjustments. For example, if your credit score is just under 700, consider strategies like paying off a credit card balance to improve it. Similarly, if your DTI is slightly above 43%, you might look into paying down some smaller debts before applying for the mortgage, as this can significantly enhance your approval odds.

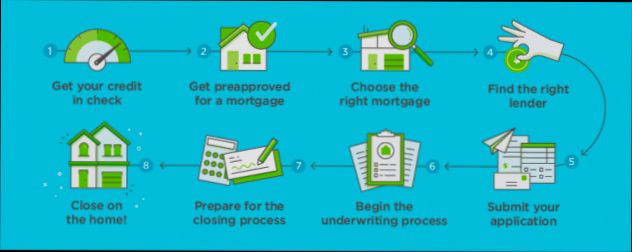

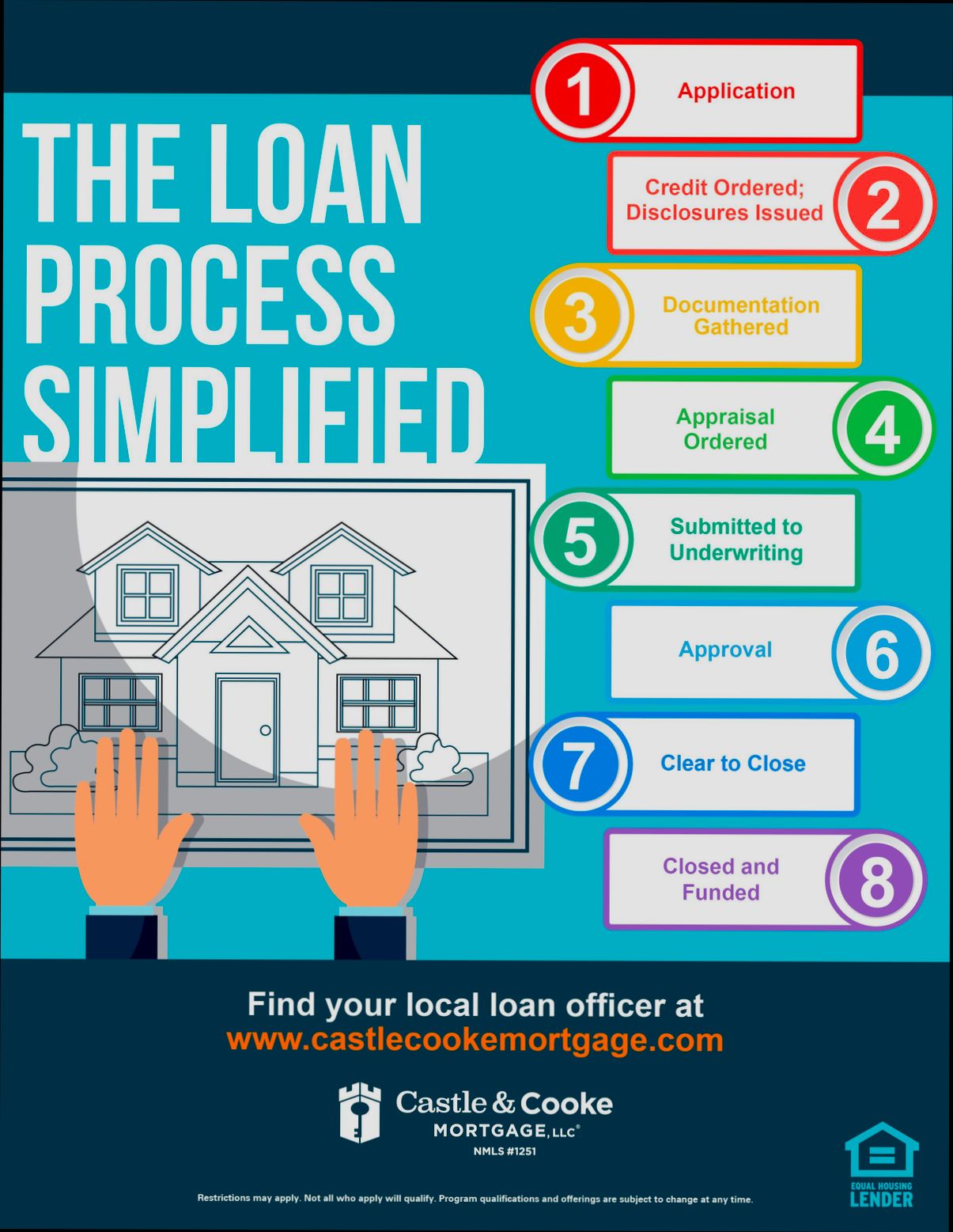

Navigating the Application Process Successfully

Navigating the mortgage application process can feel overwhelming, but understanding key steps can significantly ease your journey. This section focuses on actionable strategies and insights to help you move through the application process smoothly and effectively.

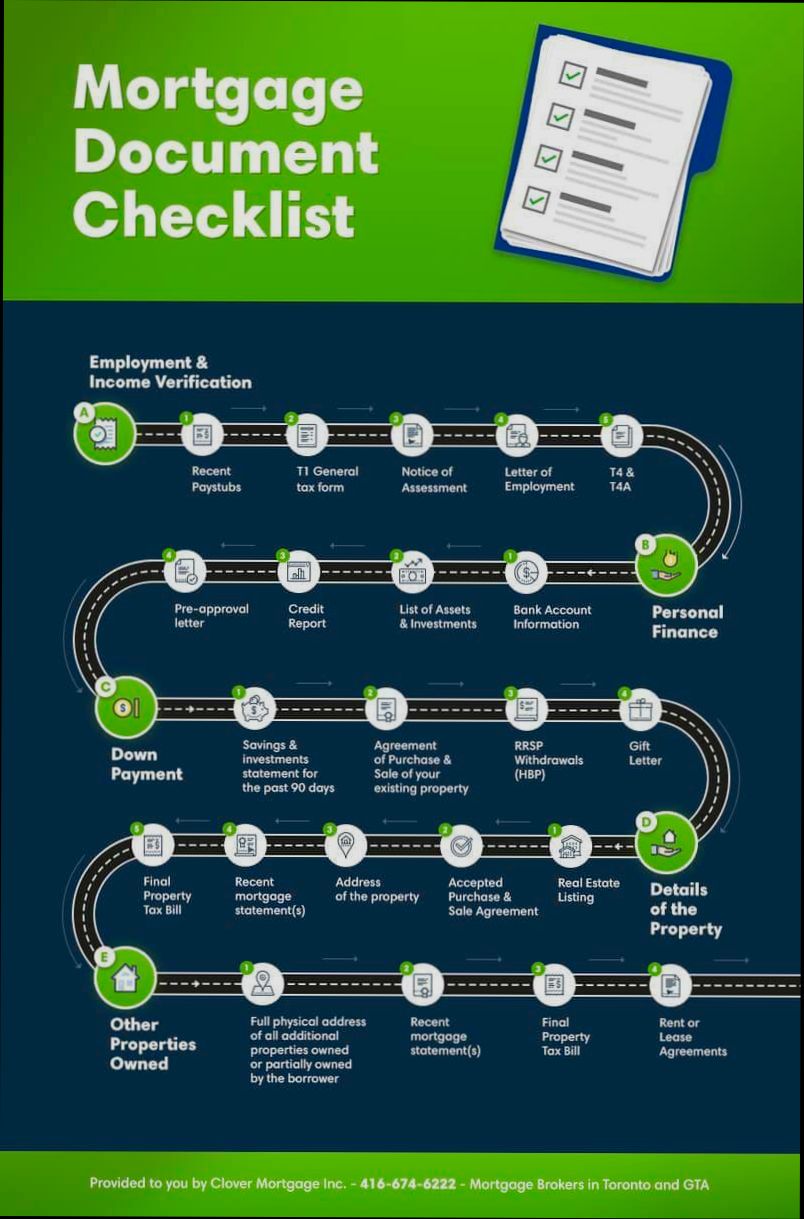

Prepare Your Documentation

One of the first steps in the application process is gathering your necessary documentation. You should be ready with key documents such as:

- Bank statements for the last two to three months

- Recent pay stubs or proof of income

- Tax returns for the past two years

- Identification, like a driver’s license or passport

Research shows that 40% of applicants experience delays due to incomplete paperwork. Avoid this by organizing your documents early.

Utilize a Mortgage Pre-Approval

Securing a mortgage pre-approval can greatly enhance your application process. Having pre-approval signifies to lenders that you’re a serious buyer and can expedite the underwriting process. According to data, pre-approved applicants are 57% more likely to get their mortgage approved than those who are not.

Communication is Key

Establish clear communication with your lender or mortgage advisor. Regular check-ins can keep you informed about your application’s status and any additional information they may require. Proper communication also reflects your commitment and readiness to provide necessary updates swiftly.

Stay Aware of Timelines

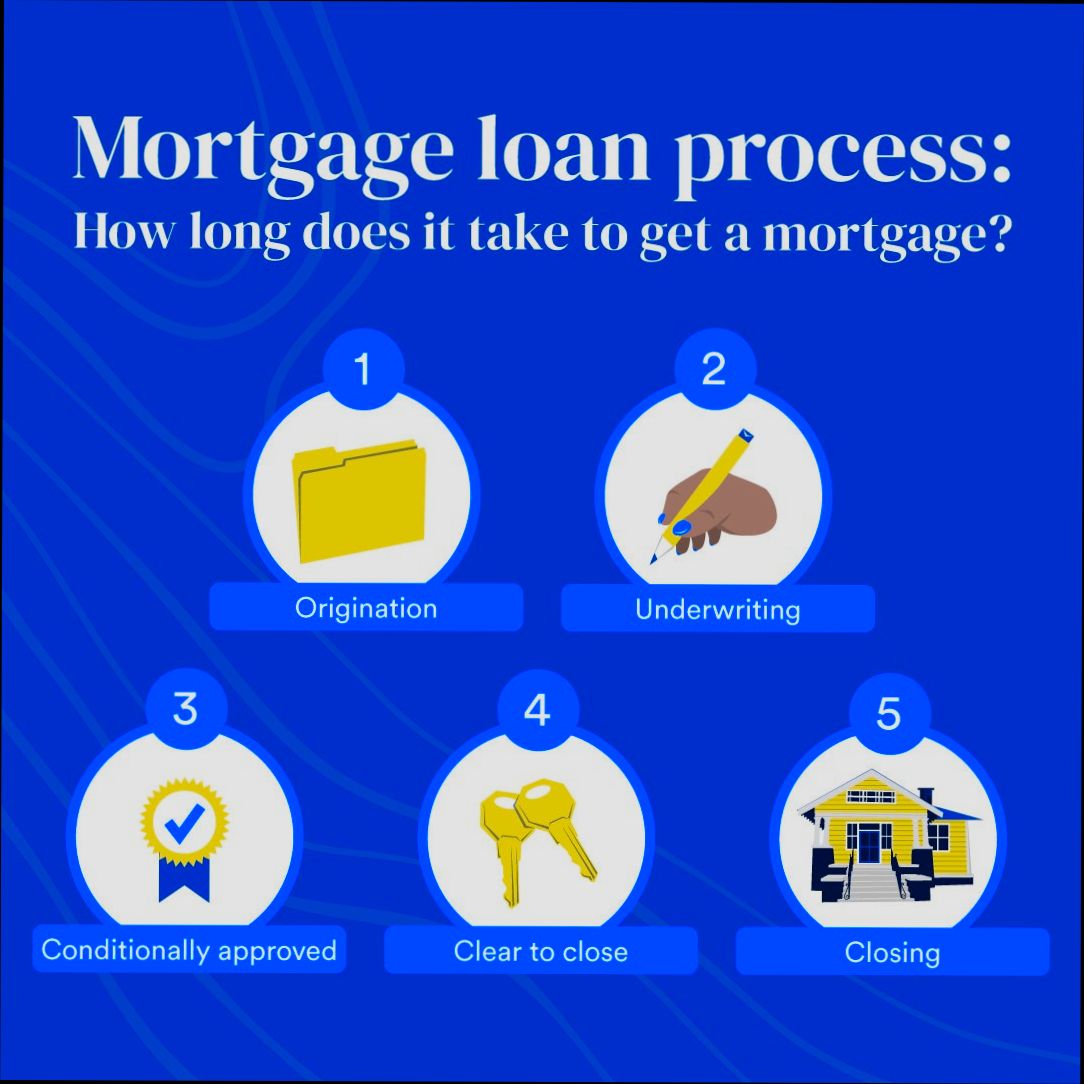

Understanding the typical timelines associated with mortgage processing can help set your expectations. The various stages involve:

1. Application submission (1-3 weeks)

2. Underwriting (2-4 weeks)

3. Closing (1 week)

Being aware of these timelines can keep you on track and help avoid unnecessary stress.

Comparative Table: Document Preparation Timeline

| Document Type | Preparation Timeframe | Key Tips |

|---|---|---|

| Bank Statements | 1 week | Download statements directly from your bank |

| Pay Stubs | 1 week | Ensure you have most recent pay stubs |

| Tax Returns | 2 weeks | Gather both federal and state returns |

| Identification | 1 day | Make sure it’s current and valid |

Real-World Examples

Let’s look at Sarah, who streamlined her application by organizing documents ahead of time and obtaining pre-approval. She completed her application in 4 weeks instead of the usual 7 weeks, allowing her to make an offer on a home quicker than other buyers.

Contrast this with David, who neglected to communicate with his lender, leading to a 2-week delay due to missing documentation. He ultimately lost his dream home to another buyer who was pre-approved and ready to close.

Practical Implications

- Be proactive: Anticipate lenders’ document requests to prevent delays.

- Communicate regularly: Keep an open line with your lender; this creates a smoother process.

- Stay organized: Create a checklist of all necessary documents with their preparation timelines.

Key Takeaways

- Start gathering your documentation well in advance.

- Consider getting pre-approved to enhance your bargaining power.

- Stay informed about the timelines, and regularly communicate with your lender to ensure a smooth application experience.

Statistics on Mortgage Loan Trends

Understanding the latest statistics on mortgage loan trends is vital for anyone looking to secure a mortgage. These insights can inform your decisions, especially in a fluctuating market. Here’s a closer look at the trends shaping mortgage loans today.

Current Mortgage Rate Trends

- As of 2023, the average mortgage interest rate has increased significantly, averaging around 7.5%, compared to just 3% two years prior.

- A recent survey indicates that over 60% of prospective homebuyers are considering variable-rate mortgages, reflecting a shift in preference as rates rise.

- In the last year, refinancing applications have dropped by 70%, indicating homeowners are reluctant to refinance at higher rates.

Mortgage Loan Origination Statistics

- The total mortgage loan origination volume reached approximately $2.5 trillion in 2022 but is projected to decrease to around $1.8 trillion in 2023 due to higher interest rates.

- The Federal Housing Finance Agency reported that the number of first-time homebuyers obtaining mortgages decreased by 18% in 2023, highlighting the impact of rising rates on affordability.

Comparative Table of Mortgage Rates Over the Years

| Year | Average Fixed-Rate Mortgage (%)* | Number of New Borrowers | Refinancing Rate (%) |

|---|---|---|---|

| 2021 | 3.0 | 1,200,000 | 75% |

| 2022 | 5.0 | 1,000,000 | 50% |

| 2023 | 7.5 | 800,000 | 30% |

*Source: Freddie Mac & National Association of Realtors

Real-World Examples and Case Studies

In 2022, many homebuyers turned to Federal Housing Administration (FHA) loans, with around 50% of all loans originated being FHA loans. This indicates that when conventional loans become too costly due to high-interest rates, buyers often seek more accessible options.

Another case involves a couple who bought their first home in 2021 with a 3.5% interest rate. They intended to refinance in 2023 to lower their monthly payments but decided against it when rates escalated to around 7.5%. This behavior showcases the real-time impact of fluctuating rates on homeownership plans.

Practical Implications for You

As you consider a mortgage, stay informed about the changing rates and the shift in borrower behaviors. Lower home loan origination volumes signal a more competitive market, which could lead lenders to offer better terms to attract the remaining buyers.

Familiarize yourself with government-backed loans that may offer relief amidst rising standard rates. You might also want to keep an eye out for market forecasts to time your home purchase strategically.

Be proactive in investigating different loan types and consider consulting with a mortgage advisor to understand how current trends can affect your mortgage application. Staying informed is your best tool as you navigate this changing landscape.

Real-World Examples of Successful Financing

When we consider successful financing, it’s inspiring to look at real-world examples that showcase how businesses have transformed their dreams into reality through strategic use of loans and financial investments. Let’s dive into some cases that highlight the power of borrowing effectively.

Key Examples of Successful Financing

1. Amazon’s $1 Billion Loan for Expansion

- Amazon leveraged a monumental $1 billion loan to fund its growth initiatives. This financial boost enabled the company to expand its operational capabilities while enhancing its logistics and technology infrastructure, allowing it to maintain its competitive edge in the e-commerce market.

2. Tesla’s $465 Million Loan from the U.S. Department of Energy

- Tesla utilized a $465 million loan to pioneer advancements in electric vehicle technology. This financing helped them invest in research and development, eventually leading to innovations that revolutionized the EV market.

3. Apple’s Early Business Loan of $250,000

- Early in its journey, Apple secured a $250,000 business loan that was instrumental to its initial success. This funding was critical in ramping up production and launching key products, such as the Apple II, laying the groundwork for Apple’s future innovations.

| Company | Amount Loaned | Purpose |

|---|---|---|

| Amazon | $1 Billion | Expansion and enhancement of logistics |

| Tesla | $465 Million | Electric vehicle research and development |

| Apple | $250,000 | Production expansion and product development |

Real-World Financing Implications

- Investing in Growth: Securing substantial financing can be vital for companies with audacious goals. Amazon and Tesla both exemplify how strategic loans can allow businesses to pursue ambitious growth initiatives, innovate, and disrupt their industries.

- Adapting to Challenges: These companies faced significant challenges yet demonstrated adaptability. For example, Tesla encountered numerous production hurdles but leveraged its financing to overcome them, emphasizing resilience in the face of adversity.

- Creating Value through Innovation: Apple’s early investment in product development funded by a business loan shows how financial support can lead to significant innovations. Understanding the importance of financing for R&D can inspire readers to consider different funding options for their entrepreneurial ventures.

Practical Insights for Aspiring Borrowers

- Set Bold Objectives: Just like Musk at Tesla, having an audacious vision can make a strong case for securing financing. Investors and lenders are often willing to back those with exceptional goals.

- Utilize Financial Support Wisely: Learn from Amazon and Apple about the importance of using loans not just for immediate needs, but for long-term strategic goals. Avoid using loans purely for operational quick fixes.

- Surround Yourself with Experts: Following Tesla’s example, building a skilled team can amplify your vision. A talented group can make your case for financing even more compelling to investors.

Actionable Advice

- When seeking a loan, prepare a robust business plan that outlines your goals and how the funding will facilitate achieving them.

- Focus on demonstrating adaptability and innovation in your approach, as these traits can significantly increase your chances of obtaining favorable financing terms.

- Explore various financing options to find the one that aligns with your business goals and growth strategy, whether it be through traditional banks or government loans like those utilized by Tesla.

By learning from these successful financing stories, you can gain valuable insights and strategies for your own financial journey.

Benefits of Homeownership Through Mortgages

Homeownership through mortgages brings numerous advantages that can enrich your life financially and emotionally. From stability and wealth accumulation to tax benefits, these advantages make pursuing a mortgage a compelling option for many homebuyers.

Financial Stability and Predictable Payments

One of the primary benefits of homeownership is the financial stability it offers. When you secure a fixed-rate mortgage, your monthly payments remain constant throughout the life of the loan. This predictability helps you budget effectively, reducing the financial stress that can come with rising rental costs, which have been known to increase by about 3-4% annually in many markets.

Building Equity

Every monthly mortgage payment helps build your equity in the home. Over time, this equity can become a substantial financial resource. Consider this: homeowners typically see their home equity increase as property values appreciate. Nationally, the average homeowner saw a rise in equity of approximately 15% over the past year, highlighting how your investment grows just by owning your home.

Tax Benefits

Homeownership presents significant tax advantages that renting does not. Mortgage interest and property taxes are often deductible on federal income tax returns. For many homeowners, this can translate to thousands of dollars saved annually. In fact, about 75% of mortgage holders claim some form of mortgage interest deduction, significantly reducing their tax liability.

Community Engagement and Stability

Owning a home also fosters deeper community ties. Homeowners are more likely to participate in local initiatives, contributing to neighborhood stability and safety. Research shows that neighborhoods with a higher rate of homeownership experience about a 20% reduction in crime rates, reflecting the community’s vested interest in maintaining property values and safety.

| Benefit | Description | Impact |

|---|---|---|

| Financial Stability | Predictable monthly payments | Reduces budgeting stress |

| Building Equity | Increasing home value over time | Financial resource accumulation |

| Tax Benefits | Deductions on mortgage interest | Significant tax savings |

| Community Engagement | Higher involvement in local initiatives | Safer neighborhoods |

Real-World Examples

To illustrate, a couple in California bought their home through a mortgage five years ago. Initially at $400,000, they’ve seen their property value increase to $480,000. Their equity grew from $40,000 to an impressive $80,000 due to consistent payments and market growth. This not only enhances their financial standing but also provides them stability as they plan for their family’s future.

In another instance, an individual in Texas was able to deduct more than $10,000 in mortgage interest and property taxes, effectively lowering their taxable income and allowing them to invest more funds into their home and community.

Practical Implications

When considering a mortgage, think about how it can enhance your financial health and overall lifestyle. The long-term advantages of equity building, tax savings, and community connection create a compelling case for homeownership.

Make sure to explore various mortgage types and lender options to ensure you align with your financial goals. Understand that your decision to buy a home can have lasting effects on your financial future, engagement in the community, and overall quality of life.

Investing in homeownership through a mortgage is not just about owning a roof over your head but creating a foundation for personal and financial growth.

Common Pitfalls to Avoid When Applying

Applying for a mortgage loan is a crucial step in homeownership, but it’s fraught with potential missteps. Awareness of common pitfalls can save you time, money, and stress throughout the application process. Let’s dive into several key mistakes that applicants often make, along with actionable steps to sidestep these issues.

Key Mistakes to Watch Out For

- Neglecting to Factor in Additional Costs: Many first-time buyers focus solely on the mortgage payment without considering other costs such as property taxes, homeowner’s insurance, and maintenance. According to research, these additional expenses can add up to 30% of your monthly mortgage payment.

- Inconsistent Financial Habits: Lenders scrutinize your financial behavior leading up to your application. Making large purchases or opening new credit accounts can negatively impact your credit score. Studies show that credit inquiries can lead to a drop of 5-10 points, which could push you out of qualifying for the best rates.

- Not Shopping Around for Rates: Failing to compare mortgage rates from different lenders can be a costly oversight. A study revealed that borrowers who do shop around can save an average of $1,500 over the life of the loan. By not exploring various options, you may end up with a higher interest rate than necessary.

- Ignoring Mortgage Programs and Grants: Many applicants overlook available programs for first-time homebuyers, which can provide down payment assistance or favorable loan terms. It is estimated that approximately 50% of eligible borrowers do not take advantage of these programs, losing out on significant savings.

| Mistake | Impact | Percentage of Borrowers Affected |

|---|---|---|

| Neglecting Additional Costs | Increased monthly payments | 30% |

| Inconsistent Financial Habits | Lower credit score | 10-15% |

| Not Shopping for Rates | Higher interest payments | 50% |

| Ignoring Assistance Programs | Missing out on savings | 50% |

Real-World Case Studies

- Sarah’s Oversight: Sarah was eager to buy her first home and applied quickly without considering additional costs. After moving in, she found herself struggling with higher monthly expenses totaling an extra $400 due to taxes and insurance. If she had budgeted realistically, she could’ve chosen a less expensive property.

- John’s Quick Credit Decisions: John signed up for new credit cards weeks before his mortgage application, thinking it would improve his credit score. Instead, the inquiries hurt his score, resulting in a higher interest rate and increasing his payment by $70 monthly. A simple strategy of refraining from new credit could have saved him money.

- Lisa’s Missed Savings: Lisa didn’t believe she would qualify for first-time homeowner assistance programs. After her friends persuaded her to check, she realized she could access a grant for her down payment, which slashed her initial costs by $15,000.

Practical Implications for Homebuyers

When applying for a mortgage, consider the following actionable steps to avoid major pitfalls:

- Create a Comprehensive Budget: Factor in all costs - mortgage, taxes, insurance, and maintenance. This will enable you to make informed decisions about the price range you should consider.

- Maintain Steady Financial Habits: Avoid any significant transactions that could impact your credit score during the application process. Keep your credit utilization low and make all payments on time.

- Shop Around: Take the time to compare multiple lenders, not just for interest rates but also for fees and available programs. Utilize online calculators to see how different rates can affect your total cost.

- Research Assistance Programs: Familiarize yourself with local homebuyer programs that may help you with down payments or closing costs. You might be surprised by the resources available to you.

Taking these practical steps can ensure that you are well-prepared and informed, allowing you to navigate the mortgage application process with confidence and poise.