Cost of Property Insurance in Spain can vary significantly based on a few crucial factors like location, property type, and coverage options. For instance, if you’re looking to insure a cozy beachside apartment in Costa del Sol, you might face premiums ranging anywhere from €300 to €700 annually, depending on its value and any added protections against natural disasters. On the flip side, insuring a historic townhouse in Barcelona could set you back roughly €500 to €1,200 each year, largely influenced by the age of the building and its proximity to potential risks like flooding or wildfires.

Now, let’s talk about the nitty-gritty of coverage. Basic policies typically start at around €200, but if you want comprehensive protection that covers things like theft, fire, and personal liability, you might find yourself paying upwards of €1,000 annually. Keep in mind that these costs can skyrocket in urban areas with higher crime rates or by the coast where the threat of storms is more prevalent. Also, don’t underestimate the impact of your claims history; a few mishaps might nudge your premiums higher than your neighbor’s.

Understanding Baseline Property Insurance Costs

When it comes to property insurance in Spain, understanding the baseline costs is crucial for making informed decisions. These costs can vary widely based on several factors, and knowing what influences these can help you budget more accurately.

Key Factors Influencing Baseline Costs

1. Property Location: Properties in metropolitan areas like Madrid and Barcelona typically face higher premiums due to increased risks, such as higher crime rates and environmental factors. In contrast, rural properties can be less expensive to insure.

2. Type of Coverage: The extent of coverage you choose significantly impacts the baseline cost. For instance, comprehensive policies covering natural disasters, theft, and liability can range 20% to 30% higher than basic coverage options.

3. Property Value: Insurers often consider the value of your property. For instance, the average property insurance cost can be around 0.2% to 0.5% of your property’s market value. So, a home valued at €300,000 might attract a premium between €600 and €1,500 annually.

4. Building Characteristics: The material and age of your property can also alter costs. For example, older buildings made of traditional materials may result in higher premiums due to their susceptibility to damage.

5. Claim History: If you’ve previously filed claims, insurers might view you as a higher risk. Properties with a history of claims can see premiums increase by about 10% to 15% on renewal.

| Coverage Type | Average Annual Premium (€) | Percentage of Total Property Value (%) |

|---|---|---|

| Basic Coverage | €600 | 0.2% |

| Standard Coverage | €900 | 0.3% |

| Comprehensive Coverage | €1,500 | 0.5% |

Real-World Examples

I’ve seen a couple of illustrative cases:

- A friend of mine who owns a beachfront property in Valencia pays around €1,800 annually due to its high value and the risk of weather-related damages. This illustrates how geographic risk influences costs.

- Another acquaintance in a quieter part of Extremadura pays only €420 per year, largely attributed to a lower risk profile and a basic coverage plan that omits more expensive options.

Practical Implications

Understanding these baseline costs can help you make strategic choices:

- Shop Around: Always compare quotes from different insurers. Some might offer better rates for similar coverage.

- Consider Bundling: If you have multiple properties or insurance needs, bundling policies could save you up to 15%.

- Evaluate Coverage Options: Assess what coverage you truly need versus what you’re offered to avoid paying for unnecessary extras.

Actionable Insights

Remember, your individual situation can have a big impact on your insurance costs. Here are some essential takeaways:

- Check the average costs in your area; knowing the local market helps you gauge whether a quote is reasonable.

- Consider increasing your deductible; a higher deductible generally lowers your premium percentage.

- Keep your properties well-maintained; not only does this prevent damage but can also lower your insurance costs over time.

Impact of Location on Insurance Pricing

Understanding how location affects property insurance pricing in Spain can significantly influence your insurance decisions. Various geographic factors can lead to substantial differences in how much you pay for coverage.

Key Factors Influencing Location-Based Pricing

1. Natural Disasters: Regions prone to natural disasters such as floods or earthquakes often see higher premiums. For example, properties in coastal areas like Costa del Sol face increased pricing due to the risk of storms and flooding.

2. Urban vs. Rural: Urban areas typically have higher insurance rates compared to rural ones. For instance, homes in Madrid may be charged 15% more than similar properties in less densely populated regions, reflecting risks associated with higher population density and potential for crime.

3. Local Economy: Areas with stronger local economies often have better infrastructure, reducing risk and resulting in potentially lower premiums. For example, cities like Barcelona, known for their economic stability, may offer competitive rates compared to less economically prosperous regions.

Comparative Location Insurance Pricing

| Location | Average Annual Premium | Risk Factor |

|---|---|---|

| Madrid | €900 | Urban Density |

| Costa del Sol | €1,200 | Coastal Flooding |

| Barcelona | €850 | Economic Stability |

| Rural Alicante | €700 | Low Crime Rates |

Real-World Examples

- A family living in a seaside villa in Cádiz experienced insurance premiums that were 25% higher than similar homes located inland due to the increased flooding risk.

- On the other hand, a bar owner in a busy tourist district of Valencia faced an insurance hike of approximately 20% compared to an equivalent bar located in a less frequented area, reflecting higher liability and theft risks.

Practical Implications for Readers

Awareness of how location affects your property insurance can empower you to make informed decisions. When buying a home, consider factors such as:

- Flood Zones: Check if the property is in a flood zone; if so, factor in higher premiums.

- Local Crime Rates: Research the crime rate in your area, as lower crime rates often correlate with reduced insurance costs.

- Proximity to Emergency Services: Locations that are closer to fire stations or hospitals can benefit from lower rates due to quicker response times in emergencies.

Being proactive about these considerations can save you money on your insurance premiums.

Actionable Advice

If you’re considering a property purchase, engage with local insurance agents to understand how location will affect your premium. Also, seeking properties in lower-risk areas or those with improved infrastructure may yield savings on your insurance costs. Don’t hesitate to ask for a breakdown of how location impacts your quote—the insights could help you negotiate a better deal.

Statistical Analysis of Insurance Premium Trends

In the ever-evolving landscape of property insurance in Spain, understanding statistical trends in insurance premium pricing is vital. This analysis focuses on key data points that shape the premium costs you may encounter.

Key Trends Impacting Insurance Premiums

1. Premium Growth Rates: Recent data shows that insurance premiums for property have witnessed an average annual growth rate of approximately 5% over the last five years. This trend correlates with increasing incidences of climatic and environmental risks.

2. Claims Ratio Influences: A notable trend is the increase in claims ratios, rising from 40% in 2018 to 55% in 2022. This uptick has pressured insurers to adjust their premiums accordingly, leading to a more robust pricing model based on risk assessment.

3. Market Competition: Analysis indicates that while premiums have risen, increased competition among insurers has resulted in a 10% variance in pricing across regions, emphasizing the importance of shopping around for better rates.

4. High-Risk Regions: Locations identified as high-risk zones have seen premiums escalate by an astonishing 30% compared to low-risk areas. This variance is specifically evident in coastal regions and areas prone to wildfires.

Comparative Table of Premium Trends Over the Last Five Years

| Year | Average Premium Increase (%) | Claims Ratio (%) | Market Competition (%) |

|---|---|---|---|

| 2018 | 3.2 | 40 | 5 |

| 2019 | 4.1 | 42 | 6.5 |

| 2020 | 5.0 | 45 | 7.2 |

| 2021 | 5.2 | 50 | 8 |

| 2022 | 5.6 | 55 | 8.8 |

Real-World Examples Reflecting Insurance Premium Trends

- Case Study in Valencia: In Valencia, insurance premiums for homeowners increased by 12% due to an uptick in weather-related claims, demonstrating a direct link between climate events and premium cost adjustments.

- Madrid’s Rental Properties: A rental property owner in Madrid experienced a 15% increase in insurance premiums following a spike in theft claims in their neighborhood, prompting their insurer to reevaluate risk.

Practical Implications for Homeowners and Investors

Understanding these trends allows homeowners and property investors to:

- Prepare for potential increases in premium costs based on their property’s location and associated risks.

- Regularly review their policy and compare offerings from different insurers to find the most competitive rates.

- Consider proactive measures, such as installing security systems or choosing properties in lower-risk areas, to mitigate insurance costs.

- Monitor the claims ratio in their region, as significant changes can forecast future premium adjustments.

By keeping an eye on these statistical trends, you can navigate the property insurance market in Spain more effectively and potentially save on your premiums.

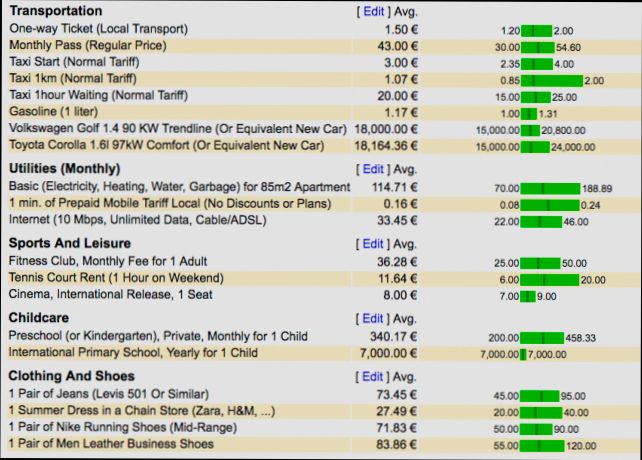

Real-World Cost Comparisons by Region

When diving into the cost of property insurance in Spain, it’s essential to look at the regional disparities that exist across the country. Insurance premiums can vary significantly depending on where you are located, reflecting both local risk factors and market dynamics.

Cost Variation Across Regions

1. Catalonia: Known for its high property values, insuring a property in Catalonia can cost about €550 annually, which is 25% higher than the national average.

2. Andalusia: In contrast, Andalusia typically offers more affordable rates, averaging around €400 per year. This 8% reduction makes it an attractive option for many homeowners.

3. Madrid: The capital city’s premiums are around €600 annually, placing it among the highest in the country. This 10% increase over Catalonia highlights how urban areas can markedly affect insurance costs.

4. Valencian Community: This region provides a more moderate option, with insurance rates averaging €450 a year, standing at a 20% lower rate compared to Madrid but higher than Andalusia.

5. Galicia: Interestingly, Galicia showcases some of the lowest rates, averaging €370 per year. This offers a striking 32% discount compared to the costs in Madrid, making it a budget-friendly region for property insurance.

| Region | Average Annual Cost (€) | Percentage Difference from National Average (%) |

|---|---|---|

| Catalonia | 550 | +25 |

| Andalusia | 400 | -8 |

| Madrid | 600 | +10 |

| Valencian Community | 450 | +20 |

| Galicia | 370 | -32 |

Real-World Examples

- Barcelona (Catalonia): A historical property in the Gothic Quarter typically costs homeowners about €700 per year due to its prime location and historic status, underscoring how city features can affect premium costs.

- Seville (Andalusia): Homeowners in Seville enjoy competitive rates, with many paying around €380 for properties in central areas. This affordability often attracts first-time buyers.

Practical Implications for Homeowners

Understanding these regional differences can empower you to make informed decisions about where to purchase property. If you are considering a move, it might benefit you to weigh the cost of insurance alongside property prices and local amenities.

- Research Thoroughly: Check local insurance providers and what premiums they offer in the region you are interested in. Rates can vary even within cities!

- Consider the Risks: Factors like flood risk can also impact insurance costs significantly, particularly in coastal areas such as Valencia.

Actionable Facts

- Explore Local Averages: Get to know the local property prices and the corresponding insurance costs. In many cases, you can save significantly by choosing a less popular area.

- Negotiate Premiums: Many insurers offer discounts for bundling policies or for homes with security systems. Don’t hesitate to negotiate!

- Stay Updated: Insurance rates can change yearly based on regional statistics. Keeping an eye on these trends can help you plan your budget effectively.

Advantages of Comprehensive Property Coverage

When it comes to securing your investment in property, comprehensive property coverage is like a safety net, offering more than just the basics. This type of coverage not only shields your building but also provides protection for contents and valuable items, making it an appealing choice for homeowners and investors alike. Let’s explore the unique advantages that come with opting for comprehensive property coverage.

Robust Protection Against Various Risks

One of the standout benefits of comprehensive property coverage is its extensive protection against a broad range of risks. Here’s what you need to know:

- Natural Disasters: Comprehensive coverage protects you from damages caused by natural disasters such as earthquakes, floods, and storms, which are critical concerns in certain regions of Spain.

- Financial Security: In the unfortunate event of property loss or damage, this coverage offers financial compensation that can significantly ease the burden of repair or replacement costs. A study revealed that up to 70% of women expressed a preference for property investments over stocks, underscoring the importance of safeguarding those investments.

Liability Protection

Comprehensive property coverage includes liability protection, which can be invaluable. This means if someone is injured while on your property, you’re covered against potential legal claims. This feature not only adds peace of mind but also secures your financial stability. If you own a rental property or a commercial space, this aspect becomes even more essential, given the increased risks associated with tenants and visitors.

Enhanced Peace of Mind

Choosing comprehensive property coverage gives you the confidence to enjoy your property without constant worry about potential losses. Knowing you’re comprehensively covered allows you to focus more on enjoying your investment and less on ‘what-ifs’. This is particularly vital as 44% of real estate land acquisitions in Spain in 2024 are expected to occur in Tier II and III cities, which can be prone to specific regional risks.

| Coverage Type | Basic Property Coverage | Comprehensive Property Coverage |

|---|---|---|

| Building Insurance | Yes | Yes |

| Contents Insurance | No | Yes |

| Natural Disaster Coverage | Limited | Extensive |

| Liability Coverage | No | Yes |

| Valuable Items Coverage | No | Yes |

Real-World Examples

Consider a family in Madrid who recently experienced water damage from a burst pipe. With comprehensive property coverage, they were able to claim for both the structural damage and the replacement of valuable items such as electronics and furniture. This scenario reflects the security that comes with comprehensive coverage—protection that extends beyond just the building itself.

Similarly, a small business owner in a Tier II city faced theft after a break-in. Their comprehensive property insurance not only covered the damage to the premises but also reimbursed them for the stolen equipment, showcasing the multifaceted benefits of this insurance type.

Practical Implications

Opting for comprehensive property coverage means you are actively choosing to protect not just your physical asset, but your financial future as well. Assessing your property’s specific needs can help you tailor your insurance plan. Consider factors like:

- Location Risks: Properties in storm-prone areas should strongly consider comprehensive coverage that includes flood insurance.

- Property Value: Ensure your coverage aligns with the actual replacement cost of your property and its contents.

Eyeballing trends, especially with 44% of property acquisitions happening in Tier II and III cities, it’s prudent to understand how comprehensive coverage can serve as a stronghold against unforeseen events.

As you assess your insurance needs, remember that comprehensive property coverage goes beyond just filling a standard policy—it equips you with critical support in challenging times. Engage with your insurance provider to tailor your policy effectively, ensuring that both you and your investment are safeguarded.

Factors Influencing Insurance Premium Variability

Understanding the variability of insurance premiums is key when navigating property insurance in Spain. Several specific factors can either exacerbate or alleviate your insurance costs, impacting overall premium calculations. Let’s break down these influential factors for a more comprehensive perspective.

Key Drivers of Premium Variability

1. Property Age and Condition: The age and condition of your property heavily influence premium costs. Older properties may have outdated electrical systems, plumbing, or roofing that increases risks. A well-maintained, newer property can attract a lower premium. For instance, properties more than 30 years old can see premiums increase by up to 20%.

2. Claims History: Your previous claims history plays a pivotal role in determining your current premium rate. If you have a track record of frequent claims, insurers may raise your premiums significantly. Research shows that homeowners with multiple claims within a five-year span could face premiums that are 30% higher than those with a clean history.

3. Local Natural Disaster Risks: Areas prone to natural disasters, such as floods or earthquakes, will see higher premiums. Insurers assess geographic risk factors before determining your rate. For example, properties located in high-risk flood zones can expect premiums to be inflated by 25% or more.

Comparative Table of Influential Factors

| Factor | Description | Potential Premium Impact |

|---|---|---|

| Property Age and Condition | Older properties require more risk coverage. | ↑ 20% for properties over 30 years old |

| Claims History | Frequent claims lead to higher premiums. | ↑ 30% for multiple claims in 5 years |

| Location of Property | Proximity to risk areas affects rates. | ↑ 25% for properties in flood zones |

| Security Features | Enhanced security may lower risk. | ↓ 15% for properties with security systems |

| Occupancy Type | Owner-occupied generally has lower risks. | ↓ 10% for owner-occupied homes |

Real-World Examples

Imagine Ana, who lives in a coastal town in Spain known for its tropical storms. Ana’s home is over 40 years old and has had two water damage claims in the last four years. As a result, her insurance premium reflects a cumulative increase of about 50% compared to her neighbor, Manuel, who has a newer home (under 10 years) and no claims history.

Similarly, consider Carlos, who installed a modern security system in his home. Despite living in a higher-risk area, his premium decreased by 15% due to the security enhancements, demonstrating how proactive safety measures can mitigate insurance costs.

Practical Implications

As you assess your property insurance options, it’s crucial to be aware of these impacts on premium variability. Here are some actionable insights:

- Maintain Your Property: Regular maintenance checks can prevent issues that might lead to claims. Schedule biannual property inspections to ensure everything is functioning well.

- Understand Your Area’s Risk: Being informed about local risks can help you make better insurance decisions. If you live in a high-risk area, consider reinforcing your home against common local issues.

- Install Security Features: Investing in security systems can not only protect your home but also lower your insurance premiums. Speak to your insurer for recommendations on systems that might be eligible for discounts.

Being aware of these factors and understanding their influence on your insurance premiums can lead to more informed decisions and potential savings.

Navigating Discounts and Savings Opportunities

Finding ways to save on property insurance in Spain can make a significant difference in your overall expenses. Whether you’re insuring a holiday home, an investment property, or your primary residence, understanding discounts and savings opportunities can help you cut costs without compromising coverage.

Leverage Discounts and Bundles

Many insurance companies offer discounts that can substantially reduce your premium. Here are some common opportunities you should look for:

- Multi-Policy Discounts: If you bundle your property insurance with other policies (like car insurance), you may earn discounts of up to 20%.

- Loyalty Discounts: Staying with the same insurer for several years can fetch up to a 15% loyalty discount.

- Claims-Free Discounts: If you maintain a clean claims history, many insurers offer discounts ranging from 10% to 30%.

Specific Discounts to Explore

| Type of Discount | Potential Savings (%) |

|---|---|

| Multi-Policy Discounts | 20% |

| Loyalty Discounts | 15% |

| Claims-Free History | 10% - 30% |

| Home Security Systems | 10% |

| Senior Citizen Discounts | 5% - 10% |

Real-World Examples of Effective Savings

In Spain, some insurers have tailored specific promotions that highlight the importance of safety features. For instance, if you install a home security system, you could receive a 10% discount on your premium.

A case study from a digital insurance platform revealed that customers who took advantage of multiple discount options reported an average savings of €300 annually, showcasing the real-world impact of strategic policy selection.

Actionable Steps to Maximize Savings

1. Compare Quotes: Utilize online comparison tools that allow you to view multiple insurance quotes side by side.

2. Ask About Discounts: Always inquire about available discounts when discussing policies with your agent. Don’t assume you’re receiving all eligible savings.

3. Evaluate Coverage Regularly: Your insurance needs may change over time. Regularly reviewing your policy can alert you to new discounts or determine if you can lower your coverage for lesser needs.

Useful Facts to Remember

- Digital Tools: Over 90% of consumers reported using some form of discount or promotion when shopping for goods online, which can also apply to insurance quotes.

- Timeliness Matters: Actively looking for coupons or discounts can increase your likelihood of saving significantly.

Being proactive and informed about discounts can empower you to navigate the property insurance landscape in Spain effectively, ensuring you maximize your savings while maintaining good coverage.