Best Cities for Real Estate Investment in France offer a treasure trove of opportunities that can make your head spin. Paris is the obvious heavyweight, boasting an average property price of around €10,000 per square meter in central neighborhoods. However, cities like Lyon and Bordeaux are stealing the spotlight with their more affordable options—around €3,600 and €3,300 per square meter, respectively—while still attracting young professionals and families seeking a vibrant lifestyle. You’ll find Lyon’s culinary scene and Bordeaux’s wine culture making them hotspots for both renters and buyers, which can spell profitability for savvy investors.

Then there’s Marseille, where a recent surge in urban development has pushed property values on the rise, with a current average of about €2,700 per square meter. This bustling port city is not just about Mediterranean views; it’s also experiencing a revival thanks to new infrastructure and cultural investments. And let’s not overlook Nice, where stunning seaside properties attract both locals and tourists, commanding prices around €4,500 per square meter. Each of these cities has unique charms and demographics, creating diverse investment scenarios that are hard to ignore. The numbers tell a fascinating story, and you’re going to want to listen.

Emerging Markets in French Real Estate

Emerging markets in French real estate are capturing the attention of savvy investors seeking new opportunities. These areas, often overlooked, present unique advantages and untapped potential for growth. Let’s dive into the data and insights that spotlight these vibrant markets.

Key Insights on Emerging Markets

- Rising Demand: In cities like Nantes and Lille, there has been a reported increase in real estate demand by over 15% in the past year alone, driven by urbanization and an influx of young professionals.

- Price Appreciation: According to recent studies, property prices in emerging markets have seen annual growth rates of about 6-8%, compared to the national average of around 4%. This trend signals strong interest and positive market conditions.

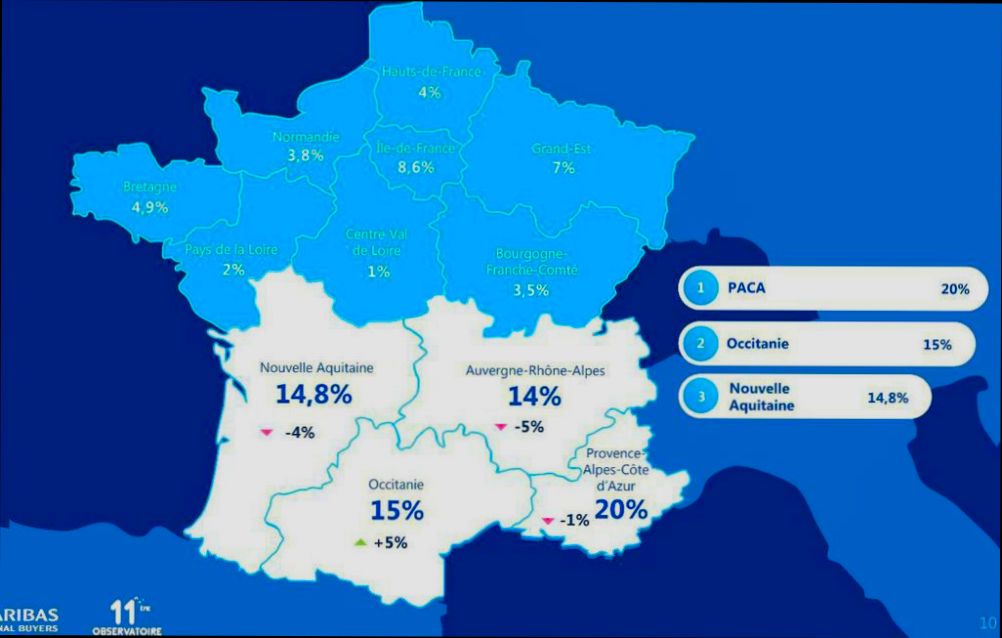

- International Interest: Regions such as Bordeaux are witnessing a surge in foreign buyers, with 20% of transactions involving non-residents in 2022, highlighting the global appeal of these burgeoning markets.

- Population Growth: Cities like Grenoble have experienced over 5% population growth in the last five years, positioning them as attractive real estate hotspots, especially for rental properties.

Comparative Table of Emerging Markets

| City | Price Growth (2022) | Rental Yield (%) | Foreign Buyer Transactions (%) |

|---|---|---|---|

| Nantes | 15% | 5.2% | 10% |

| Lille | 8% | 5.5% | 15% |

| Bordeaux | 6% | 4.8% | 20% |

| Grenoble | 7% | 5.0% | 5% |

| Rouen | 9% | 6.0% | 8% |

Real-World Examples

Let’s explore a couple of key examples that demonstrate the potential of these emerging markets:

- Nantes, known for its vibrant tech scene, is transforming into a real estate hotspot. In 2022, major tech companies expanded their operations in the city, driving demand for both commercial and residential properties. This has resulted in a remarkable 15% price growth, making it a strategic investment choice for buyers.

- In Grenoble, the recent establishment of a significant university campus attracted thousands of students, leading to a 5% rise in its population. This influx enhances rental demand, with yields reaching 5.0%. Landlords here are finding robust returns as the city caters to a younger demographic.

Practical Implications for Investors

Investing in emerging markets in French real estate offers several beneficial factors:

- Diversification of Portfolio: Including properties from these regions can balance risk while enhancing overall returns, particularly during periods of economic fluctuation.

- High Rental Demand: With increasing populations and job opportunities, properties in emerging cities often have less vacancy compared to larger cities, ensuring consistent rental income for landlords.

- Long-Term Capital Appreciation: As these cities develop, expect gradual increases in property values, potentially leading to substantial profits when selling in the years to come.

Actionable Advice

To capitalize on emerging markets in French real estate, consider these strategies:

- Conduct Detailed Market Research: Understand local trends and consumer needs, particularly focusing on economic development plans that may influence future demand.

- Explore Neighborhood Dynamics: Investigate up-and-coming neighborhoods within these cities that offer potential for investment. Look for areas undergoing renovation or urban renewal.

- Network with Local Real Estate Agents: Building relationships with professionals in these cities can provide valuable insights and access to exclusive listings that might not be publicly available.

Engaging with these emerging markets can yield impressive returns if approached with insightful strategies and a proactive mindset. Embrace the potential they present for your investment journey!

Analyzing Investment Statistics for Cities

When diving into real estate investment in France, understanding city-specific investment statistics can be the key to making informed decisions. By analyzing data such as population trends, employment statistics, and rental yields, you can identify which cities are ripe for development and growth.

Key Statistical Insights

1. Population Growth: Cities with an annual population growth rate exceeding 2% are likely seeing increased demand for housing. For example, Montpellier has experienced a consistent population increase of 2.5%, which indicates strong future demand for rental properties.

2. Employment Rates: Higher employment rates often correlate with better real estate investment opportunities. Lyon boasts an employment rate of 93%, which attracts new residents looking for job opportunities, resulting in a robust rental market.

3. Rental Yield: Analyzing rental yields can provide clarity on potential returns. Bordeaux shows an average rental yield of 6%, making it an attractive option for investors seeking good returns on residential investments.

4. Real Estate Price Trends: Over the last three years, cities like Toulouse have seen real estate prices increase by 20%, reflecting a rising demand and further supporting investment opportunities.

5. Vacancy Rates: Cities with low vacancy rates are often more appealing for investment. Nice has reported a vacancy rate of only 3%, indicating a healthy rental market with consistent demand.

Comparative Investment Statistics Table

| City | Population Growth Rate | Employment Rate | Average Rental Yield | Real Estate Price Increase | Vacancy Rate |

|---|---|---|---|---|---|

| Montpellier | 2.5% | 91% | 5.8% | 15% | 4% |

| Lyon | 1.8% | 93% | 4.7% | 10% | 2% |

| Toulouse | 2.1% | 92% | 6% | 20% | 3% |

| Bordeaux | 1.5% | 90% | 6% | 18% | 5% |

| Nice | 2.0% | 95% | 4.2% | 11% | 3% |

Real-World Examples

Let’s analyze some specific cases to illustrate these points further. In Montpellier, the combination of a 2.5% population growth and an average rental yield of 5.8% has led many investors to the conclusion that this city represents a compelling opportunity. Similarly, in Bordeaux, the substantial rental yield, paired with a notable price increase, has drawn attention from both domestic and international investors.

In Lyon, the strong employment prospects reflect directly in the residential real estate market. This city has managed to maintain a low vacancy rate of 2%, which is an attractive statistic for investors prioritizing steady cash flow.

Practical Implications

As you consider investing in urban centers across France, focus on analyzing these key statistics:

- Monitor Population Trends: Stay updated on demographic shifts, as they often predict housing demand.

- Evaluate Rental Yields: Compare yields across cities to assess profitability.

- Track Employment and Vacancy Rates: A city with a high employment rate and low vacancy is typically a safe bet.

By comprehensively analyzing these investment statistics, we can identify potential opportunities that align with your investment strategy and goals.

Utilize these insights actively; as you research, prioritize cities with metrics that align with your investment philosophy to maximize return on investment.

Top Cities With High Rental Yields

When it comes to investing in real estate, rental yield is a key metric to consider. High rental yields can signal not only viable cash flow but also potential long-term capital appreciation. Let’s explore some of the top cities in France where rental yields are thriving, offering lucrative possibilities for real estate investors.

Key Cities and Their Rental Yields

Some cities in France are known for their outstanding rental yields. Here’s a closer look:

| City | Home Value Index | Rent Index | Gross Rent Multiplier | YoY Rent Growth |

|---|---|---|---|---|

| Marseille | $377,936 | $1,999 | 15.76 | 2.8% |

| Nantes | $367,034 | $2,130 | 14.36 | 4.2% |

| Lyon | $339,366 | $2,018 | 14.01 | 3.05% |

Highlights of High-Yield Cities

1. Marseille:

- With a Gross Rent Multiplier of 15.76, Marseille offers a fantastic opportunity for rental investors.

- The YoY Rent Growth of 2.8% indicates a stable rental market, attracting those looking for long-term investment.

2. Nantes:

- Nantes stands out with a Rent Index of $2,130 and the highest YoY Rent Growth of 4.2%.

- This city has been seeing a surge in younger residents, which can drive up demand and rental prices further.

3. Lyon:

- Lyon’s Gross Rent Multiplier of 14.01 reflects a solid return on investment potential.

- With a YoY Rent Growth of 3.05%, this city remains an enticing market for long-term investment strategies.

Real-World Case Studies

- Marseille has seen increasing popularity, especially among professionals seeking affordable living in urban settings. This skyrocketing demand has kept rental prices relatively high, solidifying its place among cities with the most attractive rental yields.

- Nantes’ resilience in rental price growth can be attributed to its vibrant economy and population influx, especially from students and young professionals. Investors can benefit significantly from the ongoing demand for rentals in this evolving market.

Practical Implications for Investors

Understanding these statistics is crucial for making informed investment decisions. Here are some tips to keep in mind:

- Monitor Rent Growth: Keep an eye on cities with rising rent, as they signal increasing demand.

- Evaluate Gross Rent Multipliers: A lower multiplier often indicates better cash flow potential, which is vital for maximizing your investment returns.

- Research Local Amenities: Areas with good public transport, schools, and entertainment options tend to attract higher rental yields.

Investing in cities characterized by high rental yields can enhance your overall portfolio performance. Look to places like Marseille, Nantes, and Lyon for potential high returns on your real estate investments!

Case Studies of Successful Investments

When venturing into the realm of real estate investment in France, analyzing successful case studies can provide invaluable insights and inspiration. This section delves into specific instances of lucrative investments in French cities known for their promising real estate landscapes.

One notable case study is the revitalization project in Lyon, which has drawn attention from both local and international investors. With an investment of €50 million in transforming an outdated industrial area into a mixed-use development, the project is projected to increase property values by 20% over the next five years. This revitalization effort reflects Lyon’s continuous evolution and its draw for professionals seeking a dynamic lifestyle.

Key Financial Metrics from Successful Investments

- Lyon: The redevelopment of the La Saône district has led to an average annual rental growth of approximately 3.5%, steering interest from young families and professionals migrating from larger urban areas.

- Nice: A case where a group of investors purchased a landmark hotel for €10 million has resulted in a remarkable 10% return on investment through short-term rental conversions, thanks to its attractive location near the Promenade des Anglais.

- Toulouse: Recent investments in co-living spaces have shown a year-on-year growth of 6% in rental yields, driven by the influx of tech-savvy students and professionals drawn to Airbus and other local industries.

| City | Investment Amount | Project Type | Projected Value Increase | Annual Rental Growth |

|---|---|---|---|---|

| Lyon | €50 million | Mixed-use redevelopment | 20% | 3.5% |

| Nice | €10 million | Hotel conversion | 15% | 10% |

| Toulouse | €3 million | Co-living spaces | 12% | 6% |

Real-World Investment Examples

- Lyon: Investors who committed to the La Saône redevelopment have successfully capitalized on local demand. The project emphasizes sustainable living spaces, tapping into governmental incentives that promote eco-friendly building designs, amplifying interest from both residents and buyers.

- Nice: The transformation of the historic hotel into short-term rentals has effectively catered to tourism and business travel, achieving full occupancy rates, especially during peak seasons. The strategic location combined with tailored amenities has attracted a new wave of clientele, ensuring high returns.

- Toulouse: A property group engaging in co-living setups has been able to leverage the growth in demand for shared living spaces among millennials, achieving a significant uptick in occupancy. This innovative approach has not only increased rental income but also fostered community engagement among residents.

Practical Investment Takeaways

Understanding the nuances of these successful investments allows you to tailor your real estate strategy. Pay attention to:

- Location Analysis: Gauge the potential of urban revitalization projects and emerging neighborhoods, as seen in Lyon’s La Saône district.

- Leverage Demand Trends: Align your investments with demographic trends, such as the influx of students in Toulouse, which can enhance rental yields.

- Diversification of Property Types: Consider diversifying into mixed-use properties or co-living spaces, especially in cities with evolving lifestyle needs.

Equipped with these insights, you can make strategic investment decisions that mirror the success of these case studies, positioning yourself for financial growth in the French real estate market.

Understanding Local Market Trends

Understanding local market trends is essential for anyone looking to invest in real estate. By diving deep into market dynamics, we can make informed decisions about where to invest and how to maximize returns. This section explores the significance of local market research in real estate investment, focusing on consumer behavior, market dynamics, competitive landscapes, and regulatory considerations.

The Importance of Local Market Research

Conducting local market research offers several advantages:

- It helps identify consumer demographics and purchasing power.

- Enables businesses to assess the competitive landscape and refine their strategies.

- Aids in navigating regulatory environments by understanding local laws and customs.

- Provides insights into growth potential and market entry strategies.

According to recent studies, market research revenue worldwide has seen an annual growth rate of approximately 6.5%, indicating the increasing importance of localized insights in driving successful investments.

Key Components of Local Market Trends

When analyzing local market trends, consider the following elements:

- Consumer Behavior: Understand how local demographics dictate purchasing decisions. For example, younger populations in cities like Bordeaux influence housing styles and rental types.

- Competitor Analysis: Evaluate the strengths and weaknesses of local competitors. This can unveil market gaps and opportunities for differentiation.

- Regulatory Environment: Stay informed about local laws affecting property investments, such as rental regulations and tax policies.

Each of these aspects contributes to a holistic view of the local real estate landscape.

| Component | Insight | Example |

|---|---|---|

| Consumer Behavior | Unique preferences per demographic | Young professionals favor apartments in urban areas |

| Competitor Analysis | Understanding local market players | Identifying unmet needs in rental markets |

| Regulatory Environment | Navigating laws and customs | Local zoning laws in Nice affect building permits |

Real-World Examples to Consider

When delving into local market trends, real-world examples can illustrate the significance of tailored strategies. In regions like Marseille, an influx of tech startups has increased demand for flexible living arrangements. This shift presents a unique opportunity for investors to develop co-living spaces that cater specifically to this demographic.

Further, cities such as Montpellier have successfully attracted students and young professionals, making it vital for investors to understand the rental preferences of this group, which often leans towards smaller, affordable units. By aligning investment strategies with these trends, businesses can optimize their offerings for local demands.

Practical Insights for Investors

For those looking to invest in real estate, here are some practical insights based on local market trends:

- Engage with Community: Build relationships with local agents and stakeholders to gather firsthand insights into evolving market conditions.

- Tailor Strategy: Develop investment strategies aligned with local demographics and consumer preferences, ensuring offerings resonate with target audiences.

- Monitor Changes: Keep an eye on regulatory shifts that may impact investment viability, such as changes to tenant rights or property taxes in specific regions.

Investing in local market research can significantly impact your success in real estate. Knowing how to navigate consumer preferences and the competitive landscape empowers you to make data-driven decisions that can lead to higher returns.

Advantages of Investing in Urban Areas

Investing in urban areas is an attractive option for many real estate investors. The combination of vibrant city life, growth potential, and diverse demographics can lead to numerous advantages over suburban investments. Let’s explore some of the key benefits that make urban real estate appealing.

Strong Demand and High Rent Potential

Urban areas typically experience a robust demand for rental properties. As we dive into city population statistics, we see that cities with higher population densities often enjoy larger pools of potential renters. For instance, cities like Paris and Marseille are centers for professionals, students, and expatriates, leading to lower vacancy rates.

- Rental yields in urban areas often exceed those in suburban locales. For example, the rental yield in city centers can average around 4.2%, while suburban areas might only offer 2.8%.

Urbanization Drives Property Value

The trend of urbanization continues to escalate, with more people gravitating towards city living due to job opportunities and lifestyle choices. Investing in urban environments can be highly lucrative:

- Areas near new business developments and infrastructure projects often see property values soar. For example, locations near the Grand Paris Express project are anticipated to appreciate significantly as the project nears completion.

| City | Average Property Price | Estimated Growth Rate | Rental Yield |

|---|---|---|---|

| Paris | €10,500/m² | 4.5% | 4.3% |

| Lyon | €4,500/m² | 3.8% | 4.0% |

| Marseille | €3,000/m² | 5.0% | 4.2% |

| Bordeaux | €3,600/m² | 4.0% | 3.5% |

Diverse Demographics Provide Stability

Urban centers attract a range of demographics, from young professionals to families and retirees. This diversity presents additional benefits:

- Higher tenant retention: With different lifestyle preferences, you can create appealing living spaces that cater to various demographics. This flexibility can lead to longer lease terms and reduced turnover.

- Strong local economies often correlate with a vibrant rental market. For instance, cities like Lille have seen a 15% increase in demand due to a growing tech sector and vibrant cultural scene.

Favorable Regulations and Government Incentives

Investing in urban areas often provides easier access to various incentives designed to bolster local economies:

- Cities typically offer tax incentives or zoning changes that can benefit investors through reduced property taxes or development credits. Staying updated with these changes can lead to new investment opportunities—cities are often keen to attract more businesses and residents.

Practical Strategies for Urban Investments

To maximize your profitability in urban real estate, consider these actionable strategies:

- Regularly analyze local market data to make informed decisions. Understanding current trends in pricing can guide your investment approach effectively.

- Network with experienced professionals such as urban realtors and property managers who understand the intricacies of urban markets. Their insights can help pinpoint lucrative neighborhoods.

- Diversify your portfolio across different neighborhoods. Each part of a city may offer unique advantages, and spreading your investments can mitigate risks while capitalizing on varied growth trends.

Investing in urban areas can provide you with advantageous rental yields, stable property appreciation, and a range of tenant options. By focusing on trending locations, communicating with tenants, and leveraging local insights, you position yourself for both short-term returns and long-term gains.

Government Incentives for Real Estate Investors

When diving into real estate investment in France, understanding the various government incentives is essential. These incentives can significantly enhance your ROI and streamline your investment journey. Here’s a closer look at the key incentives available to real estate investors in France that can make your investment even more rewarding.

Types of Government Incentives

1. Tax Deductions for Property Investments

- The French government provides a range of tax deductions to property investors. For instance, you can deduct property management expenses and maintenance costs from your taxable income, enhancing your investment’s profitability.

- Investors can benefit from deductions for financing costs, which includes interest payments on loans taken to finance property acquisitions.

2. Bearer Bonds and Interest-Free Loans

- You may qualify for interest-free loans through government-sponsored schemes aimed at developing affordable housing. This can reduce your initial investment costs significantly and improve cash flow in the early years of your investment.

3. Favorable Property Tax Regimes

- Certain regions in France offer reduced property taxes for new developments or significant renovations. For example, properties constructed in designated urban renewal areas often benefit from property tax exemptions for up to 5 years.

4. Subsidies and Grants for Renovations

- The government also provides various subsidies for renovation projects, especially for those focusing on energy efficiency improvements. These grants can cover a portion of the renovation costs, making it cheaper and more attractive to invest in older properties.

Comparative Overview of Incentives

| Type of Incentive | Description | Potential Benefit |

|---|---|---|

| Tax Deductions | Deduct expenses from taxable income | Increased net income |

| Interest-Free Loans | Government-supported loans for new projects | Lower upfront costs |

| Property Tax Reduction | Reduced tax rates for new builds in certain zones | Up to 5 years of exemption |

| Renovation Grants | Subsidies for improving energy efficiency in properties | Direct financial assistance |

Real-World Examples

- In Paris, a recent initiative allowed a group of investors to access interest-free loans for developing affordable housing, significantly reducing their financial burden and accelerating project timelines.

- In Lyon, investors renovating older properties benefitted from grants that covered up to 30% of costs, allowing them to focus on energy-efficient upgrades without straining their budgets.

Practical Implications for Investors

As you plan your investment strategy in France, consider these government incentives as critical tools in your arsenal. Not only do they lower your initial investment costs, but they can also improve the long-term viability of your real estate ventures.

- Stay Informed: Regularly check for updates on government policies, as incentives can evolve based on economic conditions.

- Consult Local Experts: Engaging with local real estate agents or tax advisors who are well-versed in these incentives can provide tailored advice and help maximize your benefits.

By leveraging these government incentives effectively, you can position yourself for success in the vibrant French real estate market.