Blog

How to Buy Property in Germany as a Foreigner

How to Buy Property in Germany as a Foreigner doesn't have to be intimidating, especially with the country’s friendly policies towards international investors. Whether you're eyeing a charming apartment in Berlin's trendy Kreuzberg district or a cozy cottage in the Bavarian countryside, understanding the landscape is key. Did you know that around 10% of all property purchases in Germany are made by foreign buyers? This means you’re joining a lively community of expats who’ve found their slice of paradise in this diverse country.

How to Buy Property in Málaga as a Foreigner

How to Buy Property in Málaga as a Foreigner can be an exciting journey, especially if you're dreaming of sun-drenched beaches and charming Andalusian streets. With around 280 days of sunshine a year and a vibrant arts scene, Málaga has become a hotspot for expats. In 2021 alone, nearly 30% of property transactions in the region involved foreign buyers, with Brits, Germans, and Scandinavians leading the pack. With average property prices hovering around €1,800 per square meter, you can find everything from cozy beachfront apartments to stunning villas nestled in the hills.

How to Buy Property in Spain as a Foreigner in 2025

How to Buy Property in Spain as a Foreigner in 2025 can open a world of opportunities for those dreaming of sun-soaked beaches and vibrant cities. With over 12 million international visitors flocking to Spain every year, it’s no wonder that foreigners are keen to invest in this beautiful country. In 2025, the Spanish property market remains enticing, with average home prices in sought-after regions like Costa del Sol hovering around €2,500 per square meter. If you're eyeing a slice of paradise, you’re not alone—foreign purchases accounted for nearly 17% of total property sales in 2024, revealing that more people than ever are ready to dive into this hot market.

How to Buy Property Online in Spain

How to Buy Property Online in Spain can seem like a daunting adventure, especially when you consider that in 2022, foreign buyers made up around 23% of all property sales in the country. Imagine scrolling through beautiful listings on sites like Idealista or Fotocasa, where you can find everything from cozy apartments in bustling Barcelona to stunning villas along the Costa del Sol, all while sipping on a glass of Rioja. The process is not just about finding your dream spot; it's about navigating a vibrant market that offers something for everyone, from retirees looking for sun to investors hunting for high returns.

How to Buy Property Without Intermediaries

How to Buy Property Without Intermediaries opens up a world of opportunity for savvy buyers ready to take the plunge. Imagine skipping the high commissions of real estate agents and diving straight into negotiations with sellers—sounds appealing, right? According to a recent study by the National Association of Realtors, homebuyers who go through agents pay an average of 6% in commissions, which can add up to thousands of dollars on your dream home. By cutting out the middleman, you can leverage those savings towards renovations or your next investment.

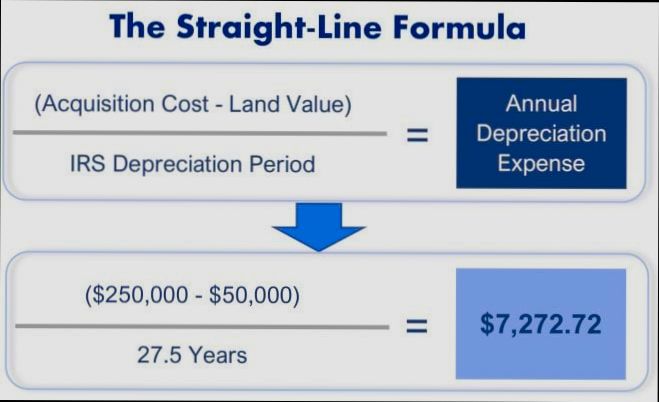

How to Calculate Depreciation on a Rental Property

How to Calculate Depreciation on a Rental Property is a game-changer for landlords looking to maximize their tax benefits. Imagine you bought a rental property for $300,000, and you're eager to figure out how much you can write off for depreciation each year. With the IRS's Residential Rental Property guidelines, most properties can be depreciated over 27.5 years. So, if we break that down, you’re looking at a simple annual deduction of about $10,909. This isn't just number-crunching; it’s actual cash that can help lower your taxable income.

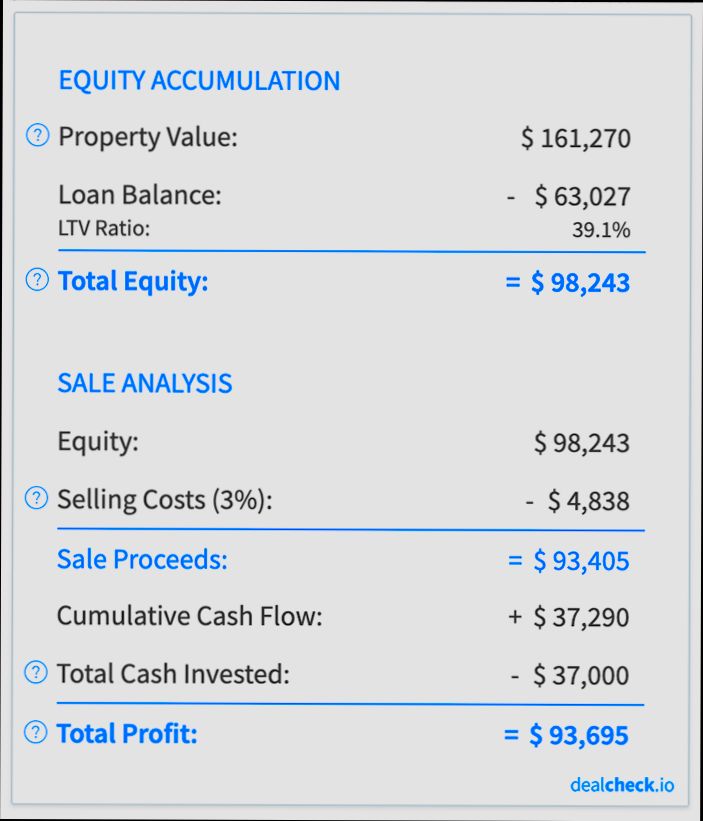

How to Calculate ROI on Rental Property

How to Calculate ROI on Rental Property is a game-changer if you're diving into real estate investment. Imagine you buy a cozy two-bedroom rental for $200,000, and you're able to rent it out for $1,500 a month. That’s $18,000 a year right there. But wait! You also have expenses like property management fees, repairs, and taxes adding up to about $6,000 annually. So, what’s the actual profit? Once you crunch the numbers, it’s essential to see how much you're really pocketing after those costs.

How to Create Wealth Investing in Real Estate

How to Create Wealth Investing in Real Estate starts with understanding the sheer potential of this market. Picture yourself stepping into a world where average returns hover around 8% to 12% annually, while savvy investors have been known to pull off even higher double-digit gains. Let’s take a look at the story of a friend who bought a fixer-upper in a bustling neighborhood for $250,000. After investing another $50,000 in renovations, she sold it for $400,000 just a year later. That’s real profit, right? And with over 7 million rental properties in the U.S., the rental income alone can provide a steady cash flow that can sustain a lifestyle or fuel further investments.

Tags